Tradingview

TradeCityPro | Bitcoin Daily Analysis #118👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis and key crypto indexes. As usual, in this analysis, I’ll review the futures triggers for the New York session.

⏳ 1-Hour Timeframe

On the 1-hour timeframe, the price remains within the same range box between 108619 and 110256, and it is currently sitting at the bottom of that box.

✔️ Since yesterday, market volume has significantly declined — as you can see, there's practically no real volume in the market.

⭐ On the other hand, it seems the 108619 trigger is about to be activated, and price may move downward. However, personally, as long as market volume stays this low, I prefer not to open any positions.

📊 If we see selling volume entering the market following a break below 108619, I’ll consider opening a short position. But in the current situation, as mentioned, I prefer to stay out of the market.

💥 The RSI oscillator is steadily and gradually declining like a waterfall. This is also due to the lack of volume in the market, which has led to very low price volatility.

⚡️ So for now, it's better not to rely on RSI data because without volume, RSI readings won't be useful.

📈 If the price gets supported at the 108619 level with a good buying volume and starts moving toward 110256, the chance of breaking that level will increase significantly.

👀 If that happens, I’ll personally try to open a long position once 110256 breaks. But I think today, Saturday, and Sunday will remain the same in terms of market conditions, and real volume will likely return starting next week.

👑 BTC.D Analysis

Moving on to Bitcoin Dominance, a descending trendline can be drawn here, which has been tested twice and is now being approached again.

☘️ If BTC dominance gets rejected from this trendline and moves downward, it will likely reach the 65.04 support level. If the trendline breaks, the next resistance will be 65.64.

📅 Total2 Analysis

Looking at Total2, you’ll notice it’s showing more bearishness than Bitcoin and has lost the support it formed at the 1.15 level.

💫 This happened because BTC dominance has been rising since yesterday, which means more money has been flowing into Bitcoin than into altcoins.

🔼 The next support level for Total2 is at 1.13, and a potential downside move may reach this zone. The suitable long trigger remains a break above 1.17.

📅 USDT.D Analysis

Finally, USDT Dominance has exited the range box it had formed and climbed back above the 4.78 level.

🎲 If this upward move continues, the next major resistance will be 4.90. However, if this move turns out to be fake, the short trigger for a bearish reversal will be a break below 4.72..

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

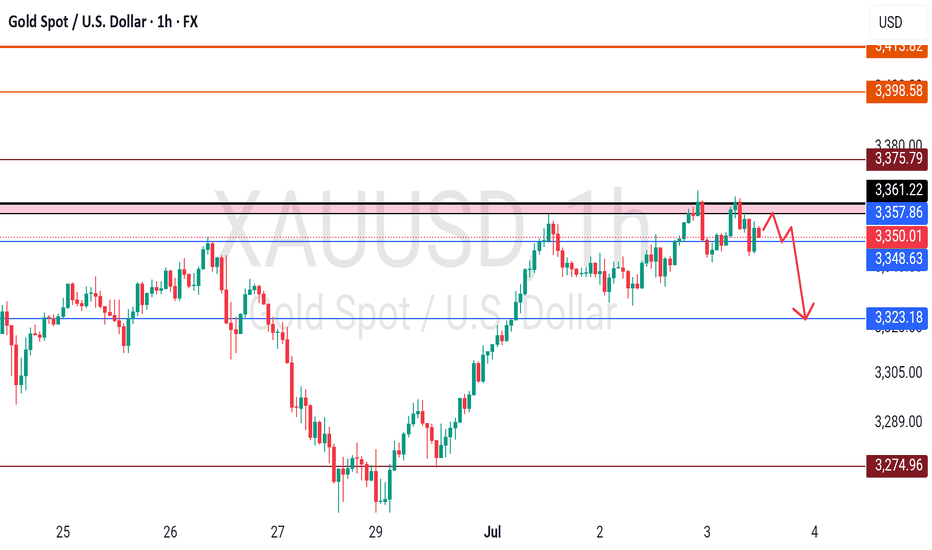

GOLD - at CUT n REVERSE Area? holds or not??#GOLD.. market palced around 3317 18 as day low so far but hour closed above 3323 that was our area.

so keep close our region that is around 3320 to 3323

that is our ultimate region for now and if market hold it in that case we can expect bounce again

NOTE: below 3320 we will go for cut n reverse on confirmation.

good luck

trade wisely

TradeCityPro | VET Battles Key Resistance Amid Buyer Momentum👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the VET coin for you. VET is a Layer1 and RWA project with a market cap of 1.84 billion dollars, currently ranked 44 on CoinMarketCap.

⏳ 4-Hour Timeframe

On the 4-hour timeframe, as you can see, this coin experienced a downtrend and eventually reached the 0.01872 bottom. It then received support from that level and began a bullish move.

✨ Right now, a significant resistance is located at 0.02227, which I’ve marked on the chart as a supply zone. So far, it seems the price has been rejected from this area.

🔍 Price has attempted to break this zone three times already. Each time, although it managed to penetrate further, it still failed to break through and got rejected.

💥 With each rejection, the RSI oscillator has also been rejected from near the 70 level and moved downward. If, in future attempts, the RSI enters the Overbuy area, the probability of breaking 0.02227 will significantly increase.

📊 Currently, market volume favors buyers. The buying volume on green candles has increased noticeably. Meanwhile, during the rejection from the resistance zone, the selling volume was very low, which signals strong buyer control.

⚡️ If the downtrend continues and price fails to form a higher low above 0.02020, we can enter a short position upon the break of 0.02020. A break of 39.35 on the RSI would be a solid momentum confirmation for this setup.

📉 The main short position can be opened upon the break of 0.01872. This would confirm the continuation of the downtrend and could lead to a sharp downward move.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Skeptic | Dogwifhat (WIF): Precision Triggers for Spot & FuturesWelcome, traders, Its Skeptic! 😎 Is Dogwifhat (WIF) the next meme coin rocket or a risky gamble? I’m diving into a pro-level breakdown of WIF, the Solana-based meme coin with a $882.06M market cap, ranked #75 globally. This analysis covers recent performance, ecosystem strengths, and technical triggers for spot and futures trading, grounded in cycle-based strategies. Trade with no FOMO, no hype, just reason. Let’s dissect WIF! 🚖

📰 Recent Performance & Key Events

Dogwifhat (WIF) , a Solana-based meme coin launched in late 2023, trades at 0.886 with a $882.06M market cap, ranking #75 globally. Featuring a Shiba Inu in a pink beanie, it leverages Solana’s high-speed, low-fee blockchain and a deflationary burn mechanism with a 998.9 million token supply. Listed on major exchanges like Binance, KuCoin, and Gate.io, WIF enjoys strong liquidity. In July 2025, it’s up 5.26% in 24 hours and 24.57% over 7 days, with a 24-hour trading volume of $450M. However, it’s down 80.94% from its all-time high of $4.84 (March 31, 2024), reflecting meme coin volatility :)

Technical & Market Position

WIF benefits from Solana’s scalable ecosystem, a hub for DeFi and NFTs, with 160,000+ TPS and low fees, outpacing slower networks. Its community-driven appeal, active on X, Reddit, and Discord, fuels its momentum, with posts highlighting a cult-like following. Compared to Pepe ($4.08B market cap, 456,000+ holders, 37% holding over a year), WIF’s smaller but vocal community shows dedication. However, its lack of real-world utility and reliance on social media hype mirror Pepe’s 25.7% year-to-date drop, raising concerns about sustainability.

Risks : Speculative volatility, pump-and-dump schemes, and dependence on Solana’s performance and social media sentiment make WIF a high-risk bet. Use stop loss to manage swings.

📈 Technical Analysis

Daily Timeframe

The Weekly (HWC) is bearish, entering a major bearish trend after forming a double bottom and breaking support. However, the Daily (MWC) started an uptrend, achieving 350 % growth before correcting to the 0.5 Fibonacci retracement —a healthy correction without breaking the uptrend momentum. Key support zones are $0.635–$0.679 . A break below could resume the Weekly bearish trend, so stay alert.

Spot Trigger (Long): Break above resistance at $ 1.047 , confirmed by a volume surge (ideally 2x the average of the prior 5–7 candles). Volume is critical—technical analysis is an art, not a science, so don’t fixate on exact numbers.

Key Insight: The Daily uptrend holds, but a volume spike is essential to confirm bullish moves and avoid fakeouts.

4-Hour Timeframe (Futures Triggers)

On the 4-hour chart (LWC), for longs:

Trigger: Break of the downward trendline and resistance at $ 0.958 , with volume confirmation (strong volume seen in the prior uptrend leg). Additional confirmation: RSI re-entering overbought.

Shorts: No short trigger currently. Despite the Weekly bearish HWC, the Daily MWC uptrend and strong support at $0.635–$0.679 make shorting illogical. Wait for a support break and MWC turning bearish for a safer short with better R/R.

Pro Tip: Longs are viable with volume and RSI confirmation. Avoid shorts until the MWC aligns bearish to minimize fakeout risk. Always use MAX 1%–2% risk per trade.

Final Vibe Check

This WIF breakdown delivers precise triggers for spot ($1.047) and futures ($0.958 long, no short yet), leveraging cycle-based strategies. With a bearish Weekly but bullish Daily, prioritize volume confirmation to navigate meme coin volatility. Solana’s ecosystem and exchange listings give WIF an edge, but its hype-driven nature demands caution. Want more cycle setups or another pair? Drop it in the comments! If this analysis sharpened your game, hit that boost—it fuels my mission! 😊 Stay disciplined, fam! ✌️

💬 Let’s Talk!

Which WIF trigger are you watching? Share your thoughts in the comments, and let’s crush it together!

Gold (XAUUSD) – July 4: Structure Shift & Short BiasYesterday’s price action (July 3) delivered a crucial structure break that changes our short-term trading outlook.

We were expecting a bullish continuation with a clean break above the 3365 M15 swing high .

Price reached as high as 3364, but failed to break the high — showing early signs of exhaustion.

Then came the PMI news release, triggering a sharp drop that broke the M15 Higher Low and shifted structure.

🔻 Structure Has Shifted

As of today, July 4, the intraday market structure has flipped from bullish to bearish.

✅ M15 trend: Now in a confirmed downtrend

✅ H4 trend: Entering a pullback phase

❌ Previous bullish continuation setup is invalidated

We now adjust our approach to align with the new structure — not the old expectation.

📉 Updated Bias: Short

With M15 and H4 now aligned in pullback, our active bias is bearish.

This means:

• We are not planning any long trades until structure shifts back

• Focus shifts to short setups only, executed with discipline

🔍 Intraday Short Setup Plan – July 4

We are watching for price to retrace into valid M15 POI zones before resuming the downtrend.

🔸 First zone to watch:

• 3348–3352 → M15 POI with strong probability for rejection

🔹 Execution Rule:

→ If price enters this zone

→ And we see M1 confirmation (ChoCh + micro BoS)

→ We will plan a short entry, with structure-based SL and minimum 1:3 RR

🎯 Downside Levels Ahead:

If bearish momentum continues, the next potential reversal/support zone is:

📍 3280–3285

→ This will be a key area to observe for signs of exhaustion or base formation

→ Until then, trend remains valid to the downside

🧭 Final Thoughts:

This shift from bullish to bearish bias is a textbook example of why we follow structure — not predictions .

The market gave a clean BoS at 3358, but failed to follow through.

Instead of forcing the long, we’ve now flipped bias in line with the chart’s reflection.

📖 Let the chart guide your thinking.

Structure reveals the direction.

Confirmation controls the execution.

The chart is the mirror.

📘 Shared by @ChartIsMirror

Author of The Chart Is the Mirror: Mastering Gold with Structure, Stillness, and Price Action

Skeptic | SUI Breakdown: Precision Triggers for Spot & FuturesWelcome, traders, its Skeptic! 😎 Ready to unlock SUI’s next big move? I’m delivering a pro-level breakdown of SUI, the #12 crypto with a $10.4B market cap.This Analysis dives into recent performance, ecosystem growth, and technical triggers for spot and futures trading, all rooted in cycle-based strategies. Trade with no FOMO, no hype, just reason , Let’s conquer SUI! 🚖

Recent Performance & Key Events

SUI , trading at $ 2.98 with a $ 10.4 billion market cap, ranks as the # 12 cryptocurrency globally. A Layer-1 blockchain using the Move programming language, it boasts parallel transaction processing with over 160,000 TPS. In July 2025, SUI showed strong momentum, surging 10% in 24 hours and 12% weekly after bottoming in the $2.30–$2.40 range. However, a 44 million token unlock ($122M) on July 1 introduces potential selling pressure. 📊

Technical & Market Position

SUI’s Total Value Locked ( TVL ) reached $ 2.1 billion in early 2025, ranking it the 8th largest blockchain by TVL. Its DeFi ecosystem is exploding, with stablecoin volume jumping from $ 400M to $ 1.2B . Bitcoin integration and a Microsoft partnership bolster institutional adoption, signaling strong fundamentals despite volatility.

Technical Analysis

Daily Timeframe

The Daily (HWC) is in an uptrend, holding above the upward trendline (marked in blue). The major trend remains bullish unless this trendline breaks. However, the MWC is bearish, with declining volume during recent price rises suggesting a secondary corrective trend rather than a primary bullish trend. As Mark Andrew Lim notes in The Handbook of Technical Analysis, rising prices need increasing volume to confirm trader conviction and bullish momentum. Low volume indicates trend weakness, typical of corrective moves.

Spot Trigger (Long): Break of the downward corrective trendline with consolidation above resistance at $ 3.0408 . The last series breaking this trendline saw 85 % growth, but don’t rush in. Confirm with:

Falling BTC.D (Bitcoin dominance).

Total 3 long triggers (market-wide altcoin signals).

SUI/BTC uptrend, with an initial trigger on breaking its downward trendline and a primary trigger at 0.00003998 resistance.

Key Insight: Volume confirmation is critical. Without a volume surge on breakout, the risk of fakeouts is high.

4-Hour Timeframe (Futures Triggers)

On the 4-hour chart, if price reacts again at resistance $ 3.0890 , you can go long on a breakout, confirmed by RSI entering oversold. If it rejects sharply, the next long trigger is a break of $3.1606. For shorts, a break below support at $2.6593 is a strong trigger, especially with volume confirmation.

Pro Tip: Volume is king for all triggers. Without a volume spike on breakout, fakeout risk is high. Always apply capital management—1%–2% risk per trade to stay safe.

Final Vibe Check

This SUI Analysis equips you with precise triggers for spot ($3.0408) and futures ($3.0890/$3.1606 long, $2.6593 short) trading, leveraging cycle-based strategies. Want more cycle setups or another pair? Drop it in the comments! If this analysis sharpened your edge, hit that boost—it fuels my mission! 😊 Stay disciplined, fam! ✌️

💬 Let’s Talk!

Which SUI trigger are you eyeing? Share your thoughts in the comments, and let’s crush it together!

TradeCityPro | Bitcoin Daily Analysis #117👋 Welcome to TradeCity Pro!

After nearly 20 days of inactivity on this channel, we’re back with our regular analyses. As the first post in this new round, I’ll continue the Bitcoin series and present analysis number 117.

✅As usual, the analysis is done on the 1-hour timeframe to identify potential futures triggers for the New York session.

📰 Before diving into the charts, let’s briefly look at the market fundamentals. Over the past three weeks, we’ve had the news of the conflict between Iran and Israel. Aside from the initial couple of days, it didn’t have a significant impact on the market, and eventually, the market stopped reacting to it. Right now, the two countries have agreed to a ceasefire and seem to be negotiating.

🔍 In my opinion, the market is unlikely to care anymore whether this war continues or not. Whether they reach an agreement or not probably won’t make a big difference to the market.

🔑 The other major event was the Federal Reserve meeting. Everyone was expecting Jerome Powell to provide some clear outlook regarding US monetary policy, but once again, that didn’t happen. Powell didn’t provide any meaningful data.

📊 This uncertainty led to minimal market volatility and prevented any strong legs from forming, with no significant volume entering the market as everyone was waiting for Powell’s remarks. Since that didn’t yield much, the market remains indecisive for now.

💥 We’ll have to wait and see what kind of impactful news comes in the future. Until then, it’s best to remain patient.

⏳ 1-Hour Timeframe

On the 1-hour chart, you can see a bullish move that started from the 105370 zone, and with strong buying volume, price broke through 108619 and reached the top of 110256.

✨ Currently, price has only wicked into 110256 and hasn’t shown a decisive reaction to it yet. If it revisits this zone, we’ll be able to observe its real reaction to the supply level.

🔔 The current support zone is 108619, which has already received a bounce, forming a range box between 108619 and 110256.

📈 If the 110256 level breaks, the upward move could continue with another bullish leg.

🔽 For short positions, the first trigger would be a confirmation below 108619. But for a more reliable short, I would wait for the price to form a lower high and a lower low below that zone before entering.

👑 BTC.D Analysis

Bitcoin dominance is currently hovering around a key support at 65.04. A key resistance sits at 65.64, which would be the first trigger for bullish continuation.

⭐ The main breakout level for starting a new bullish trend in dominance would be 65.97. For bearish confirmation, a break below 65.04 would suffice.

📅 Total2 Analysis

Looking at Total2, a range box has formed between 1.15 and 1.17, with price oscillating in between.

🧩 Momentum is currently bullish, and there’s a high chance of breaking above 1.17. If this level is broken, we could see another bullish leg and a long position would be valid.

📉 For shorts, a break below 1.15 would be the first signal, but I personally prefer to wait for a clearer trend change before entering any short positions.

📅 USDT.D Analysis

USDT dominance is also ranging between 4.72 and 4.78, very similar to Total2.

📊 A break below 4.72 would confirm a bearish move, while a break above 4.78 would indicate bullish continuation for dominance.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

BTC's Situation, A Comprehensive Analysis !!!The situation has become quite strange. Bitcoin is forming deceptive patterns, and altcoins continue their downward trend. Currently, Bitcoin is positioned within two triangles—one symmetrical and the other descending. Now that Bitcoin has reached the top of the triangle and appears ready to break upward, it might actually be hiding yet another trap within the price action.

This market has shown disregard for technical patterns, and every time the price approaches historically significant levels, it reveals its true intentions and disappoints us. This cycle tends to repeat.

In my opinion, we’re likely to see one more drop in Bitcoin’s price. After that, instead of continuing the expected downtrend from the pattern, the price could break the descending formation and experience a strong upward move.

Stay Awesome , CobraVanguard.

CAD/JPYSince my ascending triangle formation has violated its characteristics it is no longer valid. I took this opportunity to revisit this pair and start again. I still believe price is operating from the Double Bottom Formation so I'm still looking for price to go up. Here we have 4 touches on our Trendline & A Expanding Flat Formation (highlighted in blue letters). I have entered a position after the 4hr close but im still looking for a retrace for a better position.

GOLD - at CUT n REVERSE area? Holds or not??#GOLD ... Perfect holdings of our upside resistance area that was actually 3357

And now market just at his current ultimate supporting area, that is 3336-37

Keep close that area and if market thold it in that case we can expect again bounce otherwise not.

NOTE: we will go for cut n reverse below 3336-37

Good luck

Trade wisely

Q3 Could Be Big for #ETH, Breakout Watch ON#ETH bounced exactly from the 0.5 level of Fib Retracement, as expected.

Now it appears to be gearing up for its next breakout move!

After weeks of chopping inside a falling channel, ETH is showing signs of strength. It's reclaiming key levels and slowly pushing toward the breakout zone near $2,520.

A breakout above this resistance could trigger a sharp move toward $2,880 and beyond.

However, bulls need to hold the $2,300 zone, a drop below might delay the pump.

Structure is bullish, just needs confirmation.

IMO, Q3 could be massive for ETH.

Like & retweet for more updates.

#Ethereum

Bitcoin is bullish now & many Traders don't see it !!!I currently expect the price to correct slightly, as indicated on the chart, and then pump by about 6% from the PRZ . This signal is reinforced by strong positive divergence and a wedge pattern. In summary, the PRZ is a solid entry point, derived from the confluence of touchlines and pivots. However, if the price ignores this zone and falls below it, my analysis will be invalidated.

Best regards CobraVanguard.💚

$BTC Consolidating Before the Next Big Move?CRYPTOCAP:BTC consolidating after a strong bounce!

Bitcoin is holding well above the 106K support zone and forming a tight range just below resistance.

After a false breakout above 100K, the price is compressing just below key resistance at 108100.

This consolidation between 106500 and 108100 looks like a pause, not a top.

If BTC breaks 108100, the next targets are 110500 and ATH.

Market structure is still bullish.

A retest of 106500–105650 is possible before liftoff.

Are you positioned for the breakout?

If you find my updates helpful, don’t forget to like and follow for more!

DYOR, NFA

#BitcoinRecovery

Skeptic | PEPE : Spot & Futures Triggers for Maximum EdgeWelcome, traders, its Skeptic! Ready to dissect PEPE’s next moves? I’m diving into a pro-level analysis of PEPE, the #30 crypto and 3rd largest meme coin with a $4.08B market cap. This Analysis delivers a comprehensive breakdown—quick facts, 2025 performance, community strength, and technical triggers for spot and futures trading, all rooted in HWC, MWC, LWC cycles. Trade with no FOMO, no hype, just reason. 🙌 Let’s master PEPE! 🚖

Quick Facts

PEPE, an Ethereum-based meme coin launched in April 2023, is inspired by the Pepe the Frog internet meme. With a 420.69 trillion token supply, it features a deflationary burn mechanism and redistribution rewards for long-term holders. Currently trading at $ 0.00000946 , it ranks as the # 30 cryptocurrency and the 3rd largest meme coin behind Dogecoin and Shiba Inu, with a $ 4.08B market cap. Let’s unpack its 2025 performance and technical setup for actionable trades. 📊

2025 Performance & Community

PEPE has faced significant volatility in 2025, down 25.7% year-to-date and 35% this month. Despite this, its community remains robust with 456,000 + holders, and an impressive 37% haven’t sold in over a year , signaling diamond hands and strong belief in the project. This resilience suggests potential for recovery if market sentiment shifts.

Technical Analysis: Cycle-Based Breakdown

From a cycle perspective, Weekly/Monthly timeframes are range-bound, meaning lower timeframes drive most price action and shape near-term opportunities. Let’s break it down:

Daily Timeframe

After a 100% jump from May 6-22, 2025, PEPE retraced nearly the entire move. Momentum is currently bearish on the Daily, but declining volume during this pullback suggests traders view it as a correction rather than a trend reversal. Interest in heavy trading is low, indicating limited momentum for now.

Key Insight: The Daily is bearish but lacks strong selling pressure, hinting at consolidation. Watch for volume spikes to confirm directional moves.

Triggers for Spot Trading

Long Trigger: Break above resistance at $ 0.00001403 , confirmed by a volume surge during the breakout. For extra confirmation, check PEPE/BTC.

If PEPE/BTC breaks its downtrend line, it signals liquidity inflow and potential for strong growth. The primary trigger is a break of 0.0000000001399 on PEPE/BTC, which could spark explosive rallies for PEPE. Use indicators/oscillators (e.g., RSI) for additional confirmation, as PEPE/BTC volume is fake due to it being a ratio.

Key Insight: A PEPE/BTC breakout is a strong bullish signal, but volume confirmation is critical to avoid fake moves.

4-Hour Timeframe for Futures Triggers

On the 4-hour chart, PEPE has started an uptrend momentum. Should you go long on a break of resistance at $0.00001049? No —the Daily remains bearish, making the first wave risky. First-wave moves against the Daily often face high volatility and fake breakouts, lowering your win rate. Instead:

Long Trigger: Wait for the second uptrend wave after breaking $0.00001049, forming a range ceiling. Confirm with a volume increase, RSI entering overbought, or other oscillators to avoid fake breakouts or stop-loss hunts.

Short Trigger: Break below support at $ 0.00000894 is a strong short trigger, aligning with the bearish Daily. This setup offers favorable R/R ratios, especially if 4-hour momentum turns bearish. Set alarms for this level to catch the move.

Pro Tip: Shorts are safer due to Daily alignment. For longs, skip the first wave, wait for the second, and use tight risk management to navigate volatility.

Final Vibe Check

This PEPE Analysis arms you with precise triggers for spot and futures trading, leveraging cycle-based strategies. With a range-bound Weekly, focus on Daily and 4-hour for opportunities. Short at $0.00000894 aligns with the trend, while longs need second-wave confirmation above $0.00001049 or a PEPE/BTC breakout at 0.0000000001399. Protect your capital—stick to MAX 1%–2% risk per trade. Want more cycle-based setups or another pair? Drop it in the comments! If this analysis sharpened your edge, hit that boost—it fuels my mission! 😊 Stay disciplined, fam! ✌️

💬 Let’s Talk!

Which PEPE trigger are you watching? Share your thoughts in the comments, and let’s crush it together!

Crude Oil Weekly OutlookNYMEX:CL1! NYMEX:MCL1!

With Nasdaq futures hitting all-time highs, our attention now turns to Crude Oil, which has seen a sharp pullback over the past week.

All-time highs in equity indices present a unique challenge:

There are no historical reference points—no prior price or volume data to lean against. Traders typically turn to tools like Fibonacci extensions, measured moves, or rely on market-generated information and emerging intraday levels before making decisions.

What Has the Market Done?

Crude Oil Futures (CL) posted a record drop last week, falling sharply from a Sunday open high of $78.40 to a Monday close low of $64.38—a $14.02 decline.

This sharp sell-off followed developments suggesting a potential Iran–Israel ceasefire and the end of a two-week conflict, prompting markets to rapidly unwind the geopolitical risk premium.

What is it trying to do?

CL Futures have since consolidated around the 2025 mid-range. The market appears to be in a balancing phase, digesting the removal of war-related premiums and recalibrating based on fundamentals.

How Good of a Job Is It Doing?

Having effectively priced out war risk, the market is now refocusing on fundamentals.

The global demand outlook is improving, driven in part by progress in trade deals.

OPEC’s June Monthly Oil Market Report (MOMR) forecasts global oil demand growth of 1.3 mb/d for 2025.

This transition from headline risk to fundamental drivers indicates market maturity and resilience, albeit within a still-volatile regime.

What Is More Likely to Happen From Here?

Today marks the final trading day of the month, and seasonal demand will become increasingly relevant.

Summer weather and travel activity are expected to drive demand for jet fuel and gasoline.

These seasonal tailwinds, if sustained, could help stabilize price action around key technical zones.

Key Levels:

yOpen: 67.65

pHi: 66.09

pIB Hi: 66

2025 mid-range: 65.39

pLow: 64.80

Overnight Low: 64.55

Naked VPOC: 64.50

Scenario 1: Continued Consolidation (Balance Holds)

Crude oil maintains range-bound behavior.

Strategy: “Outside-in” trading—fade moves at range extremes until new directional information emerges.

Scenario 2: Break from Balance

If directional conviction builds, price could break the current consolidation.

Upside target: Yearly open near $67.65.

Downside risk: March 2025 low if $64.40 fails.

All intraday levels noted above should be monitored for structure and participation.

Skeptic| Cycle Mastery Part 1: HWC, MWC, LWC for Smarter TradingUnderstanding Higher Wave Cycle ( HWC ), Minor Wave Cycle ( MWC ), and Low Wave Cycle ( LWC ) is the key to making informed trading decisions, simplifying when to go long , short , or stay out . This Part 1 masterclass introduces these cycles, their relative nature, and how to align them with your strategy for precise entries and effective risk management . Let’s break it down. 📊

The Three Cycles: HWC, MWC, LWC

We trade across three market cycles:

HWC (Higher Wave Cycle) : The big-picture trend, like Bitcoin’s yearly uptrend.

MWC (Minor Wave Cycle): A medium-term trend, often an uptrend or corrective phase within the HWC.

LWC (Low Wave Cycle): The short-term daily trend, which can be range-bound, uptrend, or downtrend.

Knowing these cycles helps you decide when to e nter long, short, or avoid trading altogether, ensuring you align with the market’s rhythm.

Defining Your Cycles: It’s Relative

The main question before diving in: What timeframes are HWC, MWC, and LWC? The answer is relative—it depends on your strategy. Think of it like a temperature scale: 0°C isn’t “no heat” but a reference point (water’s freezing point). Similarly, your cycles are defined by the largest timeframe you analyze:

HWC: Your highest timeframe (e.g., Weekly for long-term traders).

MWC: The next level down (e.g., Daily).

LWC: Your shortest timeframe (e.g., 4-Hour or 1-Hour).

Ask yourself: What’s the largest timeframe I check? Set your HWC there, then scale down for MWC and LWC based on your trading style. This relativity ensures your cycles fit your unique approach.

While shorter cycles (LWC, MWC) form the HWC, the HWC’s power dominates, influencing smaller cycles. Let’s explore how to trade based on these relationships.

Trading Scenarios: When to Act

Scenario 1: HWC Uptrend, MWC Range

When the HWC is in an uptrend and the MWC is range-bound:

Action: Enter a long position on the first MWC wave when the LWC breaks the ceiling of the MWC range (e.g., a box breakout).

Why? The HWC’s bullish power supports the move, likely triggering an MWC uptrend. This makes the first wave a strong, low-risk entry.

Example: If the LWC (e.g., 4-hour) breaks the MWC range ceiling with a strong candle, you can confidently go long, backed by the HWC uptrend.

Scenario 2: HWC Downtrend, MWC Range

When the HWC is in a downtrend and the MWC is range-bound:

Action: Skip the first MWC wave. If the LWC breaks the MWC range ceiling, avoid going long—the bearish HWC could reject the move, resuming its downtrend.

Wait for the Second Wave: Let the MWC return to a range after the first wave. If the LWC breaks the range ceiling again, go long with confidence—the HWC’s influence is less likely to disrupt this second wave.

Risk Management Tips (if you trade the first wave against the HWC):

Reduce Risk: Lower your position size to minimize exposure.

Take Profits Early: Close the position or secure most profits (e.g., scale out) once you hit your R/R target, as volatility is high.

Wider Stop-Loss: Set a larger stop-loss to account for potential HWC-driven reversals, as stop-loss hunts are common in this scenario.

Adjusting Stop-Loss Size Based on Cycles

Aligned Cycles (HWC, MWC, LWC in Same Direction): When all three cycles align (e.g., all uptrend), set a tighter stop-loss relative to market conditions. Gradually scale out profits instead of closing the position, as the trend’s strength supports higher R/R (e.g., 5 or 10).

HWC Against MWC/LWC: If the HWC opposes the other cycles (e.g., HWC downtrend, MWC/LWC uptrend), use a wider stop-loss. The HWC’s power could reverse the LWC, lowering your win rate if stops are too tight. Expect volatility and plan accordingly.

Final Vibe Check

This Cycle Mastery Part 1 equips you to time MWC waves with precision, aligning HWC, MWC, and LWC for smarter entries. By mastering when to trade the first or second wave, you’ll avoid traps and maximize your edge. Part 2 will dive deeper with examples—stay tuned! At Skeptic Lab, we trade with no FOMO, no hype, just reason. Protect your capital—stick to 1%–2% risk per trade. Want Part 2 or another topic? Drop it in the comments! If this guide sharpened your game, hit that boost—it fuels my mission! 😊 Stay disciplined, fam! ✌️

💬 Let’s Talk!

How will you time your MWC waves? Share your thoughts in the comments, and let’s crush it together!

Skeptic | Gold (XAU/USD) Watchlist: Key Triggers for the WeekLast week, our XAU/USD short trigger from the previous watchlist activated cleanly, driving a strong downward move. Now, let’s unpack the Daily and 4-Hour timeframes to pinpoint the Low Wave Cycle (LWC) and lock in new long and short triggers for the week ahead. Here’s the no-nonsense breakdown to keep you ahead of the game. 📊

Daily Timeframe: The Big Picture

On the Daily chart, Gold pulled off an intriguing move last week. After breaking the ceiling of a previous downward channel, I cloned that channel and placed it above the prior one. Price reacted perfectly to the channel’s midline and is now heading toward the channel floor. Overall, the Daily trend is range-bound, likely ranging between 3125 and 3445. However, the Higher Wave Cycle (HWC) on the Weekly timeframe remains uptrend, so we focus on the Low Wave Cycle (LWC) for our setups.

Key Insight: The range-bound Daily suggests consolidation, but the Weekly uptrend keeps the bigger picture bullish. Prioritize LWC for precise entries.

4-Hour Timeframe: Long & Short Triggers

Zooming into the 4-Hour chart, let’s identify the LWC and set our long and short triggers:

Short Trigger: A break below the 4-hour support at 3255.71 could drive price back to the channel floor, potentially re-entering the previous downward channel. This is the safer play, aligning with recent momentum.

Long Trigger: A break above resistance at 3336.81 is the initial trigger, but the primary long trigger is a break of 3396.50 . This is riskier due to the range-bound Daily , so use a tighter stop-loss and take profits quickly to avoid choppy reversals.

Pro Tip: Shorts are stronger given the recent downward momentum. For longs, expect volatility—set conservative stops to dodge stop-loss hunts in the range.

Final Vibe Check

This Gold Watchlist equips you to trade smarter, not harder. With XAU/USD in a Daily range but a Weekly uptrend, patience for clear triggers at 3255.71 (short) and 3396.50 (long) will maximize your edge. I’ll keep you updated daily as the market evolves. Protect your capital—stick to 1%–2% risk per trade, no exceptions. Want more on HWC/LWC strategies or another pair? Drop it in the comments! If this analysis sharpened your game, hit that boost—it fuels my mission! 😊 Stay disciplined, fam! ✌️

💬 Let’s Talk!

Which Gold trigger are you eyeing? Share your thoughts in the comments, and let’s crush it together!