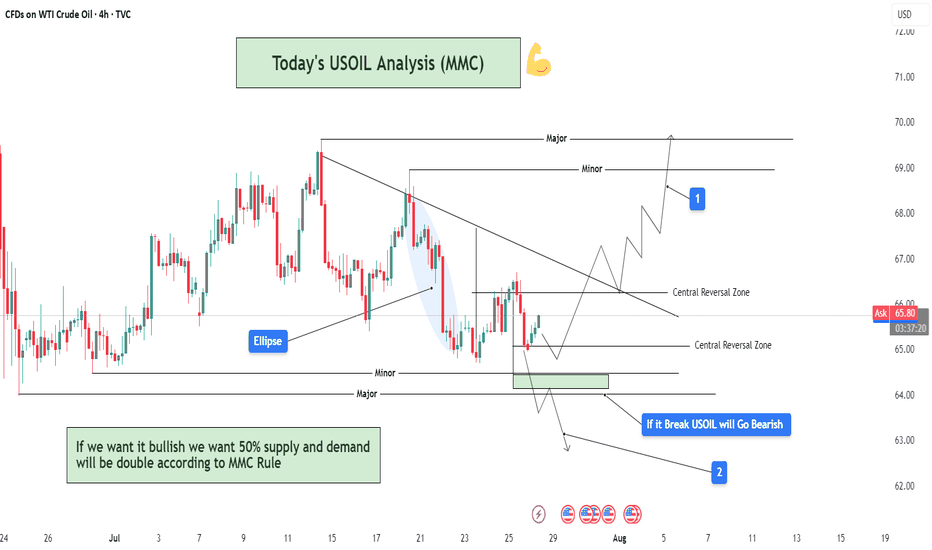

USOIL Analysis : MMC Bullish Setup Building on USOIL – Target🧠 Introduction & Trade Philosophy

In today’s 4H USOIL chart analysis, we are at a critical decision-making zone, where price action is preparing to make a major move in either direction, based on the response to a central demand zone. We are applying the MMC Rule, which emphasizes mirroring supply-demand behavior and validating market moves through structural confirmation.

The current price structure presents a classic MMC scenario, where price must either confirm a bullish double demand reaction or invalidate the setup by breaking the key zone and moving bearish.

📍 Chart Structure Explained

🔷 1. Central Reversal Zones (CRZs)

There are two CRZs highlighted:

The upper CRZ around 65.90–66.20, where price was previously rejected.

The lower CRZ, where price is currently consolidating, is around 64.80–65.50.

These zones are liquidity-rich areas where big players react—either by absorbing positions or driving directional moves.

🟢 2. Bullish Scenario – MMC Rule In Play (Path 1)

"If we want it bullish, we want 50% supply and demand will be double according to MMC Rule"

According to MMC, a bullish move must be confirmed by a strong reaction from demand, showing double the pressure of the last bearish move. Here's how that plays out:

Price respects the lower CRZ, bouncing near the 65.00 mark.

If this bounce gains momentum and breaks above the trendline resistance, the first target is the minor resistance at $69.00, followed by the major resistance zone near $70.50–$71.00.

A retest of broken structure, followed by bullish continuation, is expected. This is marked with the white zigzag projection labeled as “1” on the chart.

Watch for a clear higher high formation, which would indicate a shift in structure and validate bullish momentum.

🔻 3. Bearish Scenario – Breakdown Confirmation (Path 2)

"If it breaks, USOIL will go bearish"

If price fails to hold the current demand and closes below $64.80–64.50, it signals that demand has been absorbed, and MMC reversal has failed. In that case:

A clean breakdown below the demand zone will confirm bearish control.

The next downside target becomes $62.00, as labeled “2” on the chart.

The downward move is likely to follow a steep path as marked with the sharp downward trendline extension, especially if supported by volume and news catalysts.

🔄 Mirror Concept Highlight – Ellipse Area

The ellipse shape on the chart marks a previous compression zone followed by a breakout. This area represents an imbalance in supply that led to a sell-off. The MMC principle suggests the market tends to mirror these zones—if that was previous supply, and the current demand zone mirrors its positioning and structure, we can anticipate a similar reaction, but to the upside.

This is where the "50% double reaction" rule comes in—demand needs to show twice the strength to overcome the previous sell-side pressure.

🔧 Technical Levels Summary

Zone Type Price Range Notes

Major Resistance 70.50 – 71.00 Final target if bullish scenario plays out

Minor Resistance 68.80 – 69.20 First bullish checkpoint

Upper CRZ 65.90 – 66.20 Key structure to break for bulls

Lower CRZ (Support) 64.80 – 65.50 Demand base for bullish setup

Bearish Target Zone 62.00 – 61.80 Projected zone if support breaks

🧭 Trader’s Mindset & Risk Notes (MMC Style)

Wait for clear confirmation and price behavior near the CRZs before entering.

Use trendline breaks, candlestick confirmation, and volume to validate direction.

Avoid guessing the direction—let price tell the story.

Stick to MMC rules: No confirmation, no position.

✅ Bullish Criteria Checklist:

✔️ Price respects lower CRZ

✔️ Breakout above trendline

✔️ Closes above $66.20

✔️ Higher highs + strong bullish candles

✔️ MMC Double Demand Reaction Confirmed

❌ Bearish Breakdown Triggers:

❌ Breaks below $64.50

❌ Weak bounce + lower highs

❌ Volume increases on downside

❌ Clean breakdown structure

🚀 Trade Plan & Outlook

We’re now at a critical zone where market sentiment will soon be clear. Based on your MMC analysis, the bias remains bullish as long as price holds above $64.80. Be patient and let the setup complete with structure confirmation.

This is not just a technical play—it's a psychological zone, where institutional traders also make decisions. Follow the MMC logic and react with confirmation.

Tradingviewideas

DOGEUSDT 4H – Bullish Reversal Building from FMFR Zone📊 Chart Context & Market Maker Concept Breakdown

DOGEUSDT on the 4H timeframe is setting up for a potential trend reversal, following a structured retracement into a strong demand zone that aligns with multiple smart money confirmations: QFL base, trendline break, volume absorption, and FMFR (Final Move Final Reaction). Let’s dive into the technical layers of this setup:

🔻 1. Downtrend Phase & Structure Setup

After peaking near $0.29, DOGE entered a controlled downtrend, respecting a descending trendline and forming a consistent lower-high structure.

Each rejection from the trendline reflects institutional distribution, gradually pushing price into lower demand levels where value buyers can step in.

🔄 2. Supply Flips into Demand (S/D Flip Zone)

A key level near $0.225 – $0.230 initially acted as a supply zone — but following QFL logic and smart money reaccumulation, it is now showing signs of demand activation.

The chart highlights “Supply Interchange in Demand”, which means that this zone has been repurposed — from distribution to accumulation — another MMC footprint.

📌 Interpretation: This is where large players flip their position bias and start loading for the next leg up.

🔵 3. Volume Absorption Confirmed

Prior to the current bounce, a strong volume absorption phase was detected within a falling wedge or triangular base, shown on the chart.

Despite sell-side pressure, buyers continued to absorb orders — a sign that selling is weakening, and accumulation is underway.

📌 Clue: Volume absorption often precedes an explosive breakout, especially when aligned with FMFR or QFL patterns.

🔁 4. Final Move Final Reaction (FMFR)

Price tapped into the green box zone one final time, marked as FMFR (Final Move Final Reaction) — a key MMC reversal signal.

This occurs when market makers fake a breakdown (creating panic) and then sharply reverse, trapping breakout sellers and scooping up liquidity.

A small bullish candle formation (Bullish Engulfing / Pin Bar) can be seen within this zone — the “Bullish Pattern” label marks this.

🧠 Smart Money Logic: Institutions want liquidity. FMFR fakes weakness to attract retail shorts, then reverses to ride liquidity to the upside.

🔗 5. QFL Base + Break of Structure Setup

A QFL (Quick Flip Level) pattern is forming. This represents a market structure flip, where price first drops from a base, reclaims it later, and continues in the opposite direction.

Breaking this base and confirming above it would mark a true reversal in structure.

🛠️ Technical Confluences at Work

Element Insight

🔹 QFL Structure Base level reclaim in play (structure shift)

🔹 Volume Absorption Smart money soaking up sell pressure

🔹 FMFR Reaction Final stop hunt before the rally begins

🔹 S/D Flip Supply turned to demand near $0.225 zone

🔹 Bullish Pattern Early confirmation of reversal

📈 Projection Path & Reversal Zones

Two projected zones are mapped for price behavior:

🔸 Central Reversal Zone (~$0.250):

First significant resistance where price may pause or react.

Ideal partial profit level or re-entry after pullback.

🔹 Main Reversal Zone (~$0.270–0.275):

Target area for a full liquidity sweep.

This was a previous high-volume supply zone.

If price reaches here, expect potential rejection or distribution unless momentum is strong.

🎯 Trade Setup Strategy (Based on Your Chart)

Entry Area: $0.225 – $0.229 (FMFR Reversal Zone)

Stop-Loss: Below $0.221 (beneath FMFR low)

Take Profit 1: $0.250 (central zone)

Take Profit 2: $0.270 – $0.275 (main reversal zone)

📐 Risk-to-Reward:

TP1: 1:2

TP2: 1:3+ depending on entry timing

🧠 Psychology Behind the Setup

This DOGE setup is engineered to trap emotional traders:

Retail sellers enter late near the bottom.

Smart money waits at FMFR zone, absorbing liquidity.

Volume builds quietly.

Market reverses explosively, catching retail off guard.

By recognizing this setup early, you’re aligned with Market Makers, not against them.

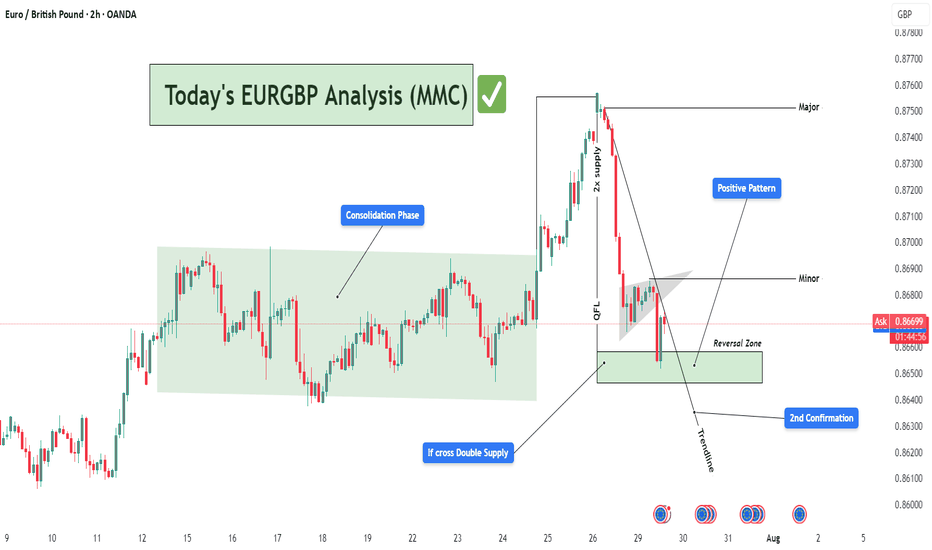

EURGBP Bullish Reversal Setup from Demand Zone (MMC Strategy)📊 Detailed Technical Analysis:

The EURGBP pair on the 2-hour chart is currently at a critical technical juncture, showing signs of a potential bullish reversal. This analysis follows Market Maker Concepts (MMC), which combines liquidity engineering, smart money movements, and structure shifts. Let’s break it down:

🔄 1. Consolidation Phase – Accumulation in Action (Smart Money Footprint)

Between July 15 to 24, the price moved within a tight range — classic consolidation behavior.

This phase suggests accumulation by institutional players, quietly building long positions while trapping retail shorts and longs.

This kind of sideways structure typically precedes a high-volume breakout, which happened right after.

📌 Lesson: Consolidation is often the calm before the storm — prepare for a breakout when this phase completes.

🚀 2. Breakout with QFL Pattern – Aggressive Bullish Shift

The price broke above the consolidation range and surged strongly.

This breakout followed a classic QFL (Quick Flip Level) structure — where price forms a base, drops temporarily, and then explodes upward.

The area of breakout aligns with a “2x Supply” zone — meaning this zone acted as a magnet for stop orders, and once breached, added more fuel to the rally.

📌 Why QFL Matters: It marks a shift in market sentiment — from balanced to strongly biased, in this case toward bulls.

📉 3. Pullback Phase – Structural Correction Begins

After reaching a high near 0.87500 (major resistance), price began to pull back sharply.

It formed a minor descending flag/channel, a classic corrective pattern, often a pause before resuming the larger trend.

A descending trendline has been drawn to capture this pullback structure.

📌 Important: Pullbacks are healthy — they allow for re-entries and provide better R:R setups.

📍 4. Reversal Zone – Key Demand Revisited

Price now sits within a Reversal Zone (Demand Area), marked in green on the chart.

This level previously served as the base for the breakout and aligns with institutional buying interest.

The area acts as a high-probability buy zone, supported by:

Trendline support

Price rejecting lower levels

Historical reaction at this zone

📌 Why It’s Crucial: If price respects this demand zone, it confirms bullish intent and creates a low-risk buying opportunity.

✅ 5. 2nd Confirmation – Price Action Support

The chart marks a "2nd Confirmation" label at a slightly lower level — this is a final support level, a safety net.

If price dips and bounces here again, it confirms buyer strength.

Strong price reaction at this level would validate a trend continuation setup back toward highs.

💹 6. Positive Pattern – Early Reversal Signs

Inside the demand zone, a bullish structure is forming.

This could be an inverted head & shoulders, or a double bottom pattern.

These patterns often act as launch pads for upward moves, especially when combined with institutional demand.

📌 MMC Insight: Market Makers engineer dips to induce panic, only to reverse aggressively once liquidity is absorbed.

🎯 Trade Plan Based on the Analysis:

Buy Zone: Between 0.86450 – 0.86700 (Reversal Zone)

Stop-Loss: Below 0.86250 (beneath 2nd confirmation)

Take Profits:

🎯 TP1: 0.86900 (Minor resistance)

🎯 TP2: 0.87500 (Major swing high)

Risk-to-Reward: 1:2 or higher depending on entry timing

🧠 MMC Strategy Summary for Minds:

This EURGBP 2H chart is a textbook example of MMC-based trading. We saw:

Institutional accumulation (consolidation phase)

QFL breakout (confirmation of bullish intent)

Return to demand (market maker’s discount area)

Early bullish signals (positive price action patterns)

Multiple confluences at the Reversal Zone (trendline, demand, confirmation zone)

Such a combination offers a high-probability swing trade setup. Patient traders can wait for the structure to break upward and join the trend with tight risk and clear targets.

(XAGUSD) Volume Absorption to Bullish Continuation To Target🧱 1. Market Structure Breakdown:

The 4H chart of Silver (XAGUSD) reveals a well-structured price action sequence, beginning with a compression breakout, a strong bullish impulse, and a current retracement phase into a key reversal zone.

🔺 Symmetrical Triangle & Volume Absorption (Early July):

The market was forming higher lows and lower highs, indicative of consolidation inside a symmetrical triangle.

During this phase, a volume absorption event occurred—indicating smart money was accumulating before a breakout.

This was followed by a strong bullish breakout, confirming upside strength and clearing previous highs.

📈 2x Channel Supply Zone — Now Demand:

After breaking above the triangle, the price surged into a key supply zone, created from a prior channel top.

This zone was tested, absorbed, and flipped into a new demand zone, as buyers overwhelmed sellers.

This supply-demand interchange confirmed a structural change in market sentiment.

🚀 2. Momentum Confirmation — High Breakout:

The "High Breaked" level, marked clearly on the chart, acted as a bullish breakout trigger.

This breakout not only breached the prior resistance but established a new bullish leg—providing strong confirmation of trend continuation.

🔁 3. QFL Zone & Controlled Pullback:

After the surge, the price began to correct from the QFL (Quick Flip Level).

This level usually represents an area where short-term distribution or profit-taking occurs.

The pullback from this zone was controlled but sharp, which is natural after such a strong move up.

🟩 4. Next Reversal Zone — The Critical Demand Block:

Price is now entering a high-probability reversal zone, marked around $37.5–$36.8.

This area is critical due to:

Confluence with previous structure and minor support.

Potential bullish absorption area.

Last base before the impulse up.

If bullish price action (like bullish engulfing, pin bar, or volume spike) is seen here, it could signal the start of the next leg up.

🧨 5. Key Warning: "If it crosses, this will be Supply Double"

If this zone fails to hold, the demand will flip into double supply, likely accelerating bearish momentum.

In such case, Silver may revisit Major Support near the $36.0–$35.5 zone.

🧭 Potential Trading Scenarios:

✅ Bullish Path (Primary Expectation):

Price reacts from the reversal zone with bullish momentum.

Breaks back into the Central Zone (~$38.5).

Forms a higher low → continuation toward $39.5–$41.0.

Breakout above the recent swing high confirms the continuation pattern.

Trade Idea:

Long entries near $37.2–$37.5 with SL below $36.8.

Target zones: $38.8 (short-term), $39.8–$41.0 (swing).

❌ Bearish Continuation (Alternative Plan):

Reversal zone fails to hold.

Price breaks and closes below $36.8.

Previous support becomes resistance — bearish retest.

Continuation toward $36.0–$35.5 zone.

Trade Idea:

Short on break and retest of $36.8.

SL above the reversal zone.

TP near $35.5 or based on volume exhaustion.

🧠 Market Psychology Insight:

This setup shows a clear institutional playbook:

Accumulation → Breakout → Profit-taking → Retest → Continuation.

If smart money is active, expect defense of the reversal zone followed by a strong bounce.

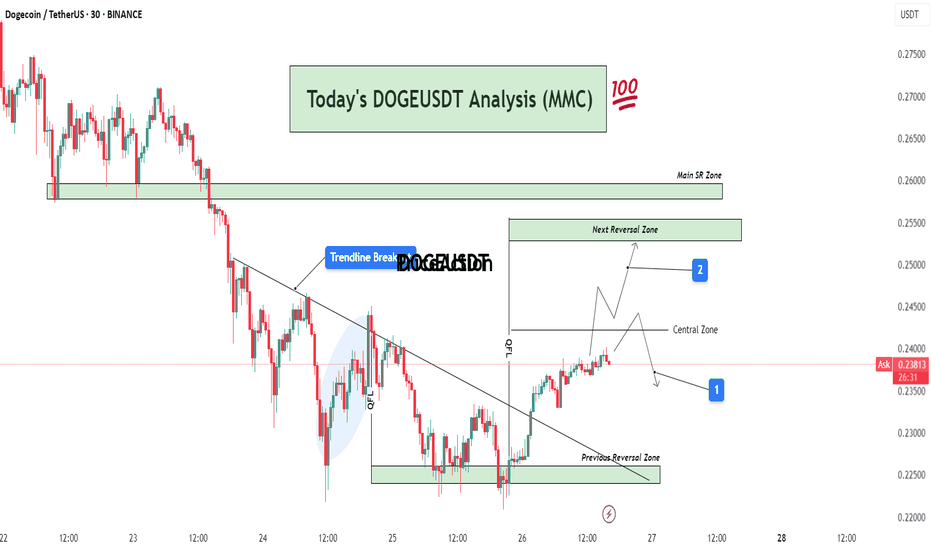

DOGEUSDT Analysis : Bullish Breakout, Reversal Zones + Target📊 Full Technical Analysis:

This chart presents a structured and precise MMC-based analysis of DOGE/USDT on the 30-minute timeframe, integrating key price action zones, trendline structure, and potential market scenarios.

🧩 1. Downtrend Phase and Trendline Formation

DOGE was in a continuous downtrend, creating lower highs and lower lows. A bearish trendline had been acting as dynamic resistance for multiple sessions. Price consistently respected this trendline, indicating strong seller dominance.

However, after repeated taps on the trendline and rejection from lower support, price finally broke above the trendline — marking a potential trend reversal or corrective phase.

🔄 2. Previous Reversal Zone – Demand Zone (0.225–0.228)

This zone acted as the major turning point where buyers aggressively stepped in. The demand was previously tested and respected, indicating strong accumulation here.

From this zone, a bullish reversal was initiated, leading to the current price rally.

This area can now be considered a structural support base – ideal for watching future re-tests or consolidation.

🔁 3. Central Zone – Decision Area (0.238–0.240)

This is a critical intraday resistance zone acting as a central decision-making area for traders.

Two Key Scenarios Could Play Out from Here:

Scenario 1 (Marked by Blue Box 1):

Price could face rejection from this zone and fall back slightly toward minor support levels for a retest or liquidity grab. If bullish pressure sustains, a higher low may form before continuation upward.

Scenario 2 (Marked by Blue Box 2):

If price breaks above the central zone with strong volume, momentum can push it toward the Next Reversal Zone between 0.250–0.255.

In either case, watching price behavior and candle structure near the central zone is critical for confirmation of the next move.

🔼 4. Next Reversal Zone – Supply/Resistance (0.250–0.255)

This zone marks a historical resistance area where DOGE faced heavy selling pressure before.

If price reaches this zone, expect:

Either profit-taking and short-term selling from intraday traders.

Or a possible breakout continuation if broader market sentiment remains bullish.

This zone will act as a key test of DOGE's strength and market conviction.

📌 5. Main SR Zone – Strong Structure (0.258–0.260)

Beyond the Next Reversal Zone lies the Main SR (Support-Resistance) Zone, where price has reacted strongly in the past.

If DOGE manages to break and hold above the 0.255 range, this zone will likely become the next upside target and strong resistance zone.

🔍 Additional Market Context:

Breakout Volume: The trendline breakout was accompanied by rising volume, which suggests stronger conviction behind the move.

QFL Zone: Price structure also aligned with a QFL (Quick Flip Level) bounce within the shaded region before breakout, further validating the bullish pressure.

Psychological Levels: 0.240 and 0.250 are psychological levels, which often act as magnet points and temporary resistance/support.

🧠 Mirror Market Concepts (MMC) Insight:

This analysis is rooted in Mirror Market Concepts, where the market tends to reflect past behavioral zones. Each marked zone (Demand, Central, Reversal, SR) is based on previous reaction points that guide current sentiment.

The market is now in a mirror reaction phase, moving from the previous demand zone toward historical supply zones. If the symmetry continues, the pattern supports a gradual bullish continuation with measured pullbacks.

✅ Trading Plan (Educational Purpose Only – Not Financial Advice):

Entry Zone 1: Breakout traders may have entered after the trendline breakout near 0.233–0.235.

Entry Zone 2: Conservative traders can look for retest confirmation in the Central Zone.

Target Zone: Next Reversal Zone (0.250–0.255) and possibly Main SR (0.260).

Stop Loss: Below the Previous Reversal Zone (~0.224) for swing setups.

Risk-to-Reward: RR setup of 1:2 or higher possible depending on entry strategy.

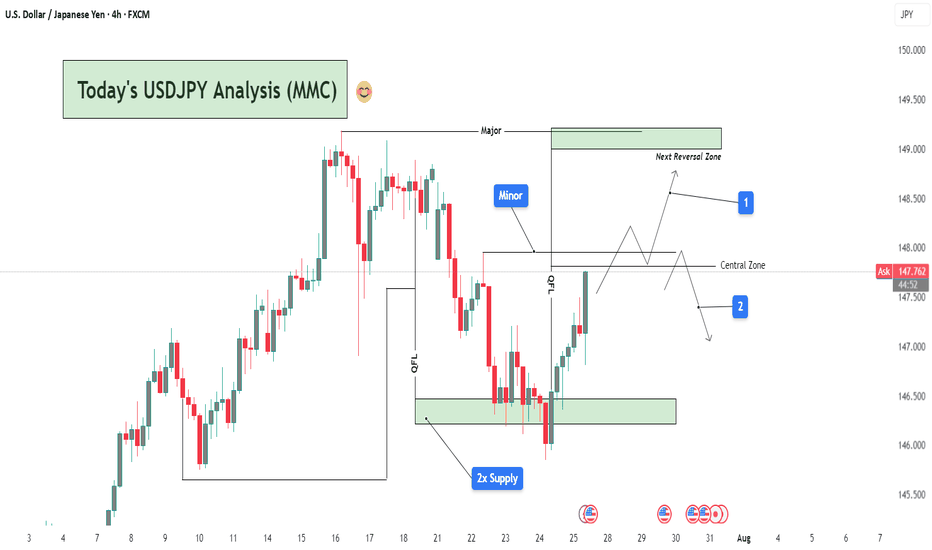

USDJPY Analysis : Smart Money Setup & MMC Concept + Target📌 Chart Overview:

This 4H USDJPY chart presents a multi-phase market structure analysis rooted in MMC (Major-Minor-Central) framework, Smart Money Concepts (SMC), and liquidity mapping. The price is currently trading around 147.39, and the chart outlines two possible scenarios labeled 1 (bullish continuation) and 2 (bearish rejection).

🔍 Key Zones & Technical Elements Explained:

🔹 1. 2x Supply Zone (Support Reaction)

Price rebounded sharply from the double-tested demand zone marked around 146.00–146.50.

This zone has historical significance and has acted as a base for previous bullish momentum.

The sharp V-shaped recovery suggests strong buying interest at institutional levels, hinting at a potential bullish continuation.

🔹 2. QFL (Quick Flip Liquidity) Zone

A notable zone where previous bullish structure broke down. It’s now being retested from below.

The QFL structure acts as a hidden supply zone or potential liquidity trap.

Watch for price rejection here, especially if it aligns with liquidity sweep patterns.

🔹 3. Minor & Major Structural Levels

Minor zone: A smaller consolidation and reaction zone—used to observe minor trend shifts or scaling entries.

Major zone: Sitting around 148.50–149.00, this is your Next Reversal Zone. It overlaps with a historical resistance area and could lead to a significant reaction.

📈 Projected Scenarios:

✅ Scenario 1: Bullish Continuation

Price breaks above the Central Zone and holds.

After breaching the minor resistance, it climbs towards the Major Reversal Zone (148.50–149.00).

There, we look for:

Either a reversal trade setup (liquidity grab + bearish confirmation).

Or continuation beyond 149.00, especially if supported by USD strength/fundamentals.

🚫 Scenario 2: Bearish Rejection

Price fails to hold above the Central Zone.

Rejection at QFL or Minor levels sends the pair back into the mid-147s and potentially down to retest the 2x Supply Zone again.

Breakdown from there could lead to a move towards 145.50–146.00, forming a potential double bottom or deeper retracement.

🧩 Technical Insights Summary:

Trend Context: Short-term bullish recovery from demand, but macro trend still uncertain.

Key Confluence:

2x Supply → Strong demand.

QFL + Central → Key breakout/rejection zones.

Major Zone → High-probability reversal area.

Bias: Neutral to Bullish, favoring Scenario 1 if price sustains above 147.50.

Watch for:

Candlestick rejections in Major Zone.

Break-and-retest behavior in Central Zone.

USD-related news near July 30–31 (highlighted below chart).

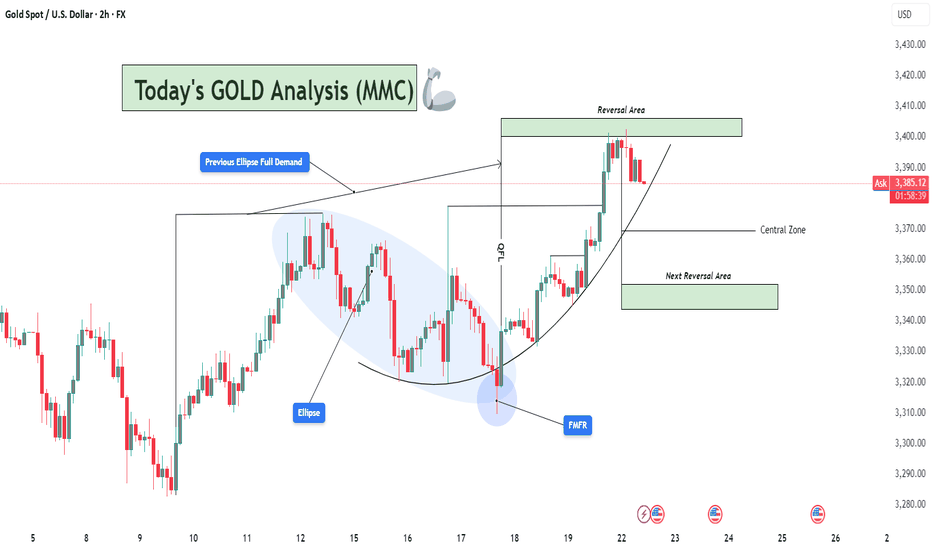

Today's GOLD Analysis (MMC) – Sell Bias Continues To Next TargetChart Overview:

This 2-hour GOLD (XAU/USD) chart showcases a clear bearish structure in line with the Mirror Market Concepts (MMC) methodology. Price action is respecting key supply zones and continues to reject significant levels, confirming the dominance of sellers in the short-term structure.

🔍 Key Technical Elements:

1️⃣ Break of Trendline (MMC QFL Entry Model)

The descending grey trendline marks consistent lower highs, showing clear bearish pressure. The breakout and rejections around this trendline zone (annotated “1”) confirm it as a strong supply area. This breakdown set the stage for a QFL (Quick Flip Liquidity) drop.

🧊 2x Supply Zone (High Confidence Rejection)

The 2x supply label highlights an area where price rapidly reversed with aggressive bearish momentum. This zone was tested and respected again, leading to further downside pressure, reinforcing the idea of institutional selling interest from that level.

📉 QFL Levels & Central Zone

Two major QFL drops are evident, where price broke previous demand structures and created new supply imbalance. The Central Zone currently acts as short-term support, but price is hovering just above it with weak bullish reaction, indicating potential for further breakdown.

🎯 Target & Reversal Zone – 3,331.90

The green zone below marks the Next Reversal Zone, with a highlighted price target at 3,331.90. This is where:

Previous liquidity was absorbed.

Demand imbalance may attract buyers again.

MMC reversal structures might be anticipated.

This zone aligns perfectly with the broader MMC concept of flipping between major zones and reversal blocks.

🧠 Trade Idea & Strategy (MMC Traders’ Minds)

Current Bias: Bearish

Entry Trigger: After rejection from trendline & 2x supply area.

Stop-Loss Suggestion: Above the trendline or recent supply wick (~3,375-3,380).

Take-Profit Zone: Primary TP at 3,331.90, with eyes on lower reversal targets if momentum persists.

Market Behavior: Controlled by sellers, liquidity sweeps seen, weak demand below Central Zone.

📌 Key Events to Watch

As marked at the bottom, major US news events are scheduled between July 30th and 31st, which could act as catalysts for price acceleration toward the reversal zone or cause sharp volatility. Plan accordingly.

🧭 Conclusion:

Gold is respecting bearish market structure under the MMC model. With clear QFL breakouts, rejection from 2x Supply, and weak bullish attempts near the Central Zone, this chart favors short setups targeting the 3,331.90 zone. MMC traders should monitor price action closely within the Reversal Zone for potential buy signals or trend continuation if sellers remain aggressive.

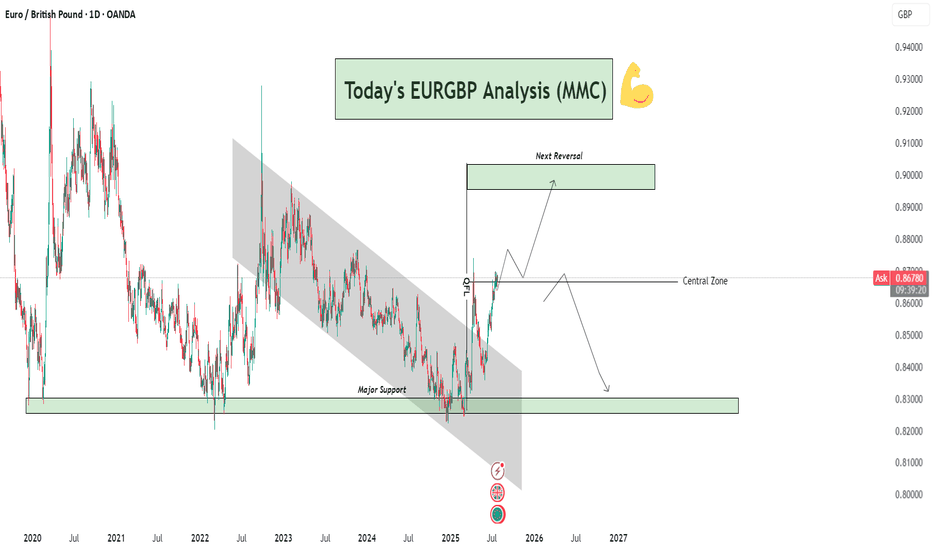

EURGBP Analysis : Breakout, Central Zone Flip & Reversal Target🧠 Overview:

This EURGBP daily chart clearly presents a bullish breakout from a long-term descending channel, a successful reclaim of the central structure zone, and a projection toward a key reversal level. This analysis incorporates Smart Money Concepts (SMC), Market Maker Concepts (MMC), and classic structural behavior.

🔍 Technical Breakdown:

📉 Long-Term Bearish Channel (2021–2025)

For nearly 4 years, EURGBP was trapped in a descending channel, forming consistent lower highs and lower lows.

This long-term bearish phase reflects strong supply-side control and institutional distribution.

The breakout above this structure is significant — marking a potential mid- to long-term trend reversal.

🔁 Major Support Zone (0.8300–0.8350)

Price bounced strongly from this historical demand zone multiple times (in 2021, 2022, and recently in 2025).

This zone is critical and acts as a high-volume accumulation area where smart money has stepped in.

The strong reaction from this level in 2025 triggered the breakout of the bearish structure.

🚀 Break of Structure + Retest

After breaking the descending channel, price retested the upper boundary, confirming a structure shift.

The breakout retest succeeded — marking the transition from a bearish phase to a bullish expansion.

📍 Central Zone Flip

The Central Zone, once a resistance/supply area during the downtrend, has now been reclaimed as support.

This is a powerful MMC concept – where the "central balance" of a structure flips and becomes a base for the next impulse.

Current price is sitting just above this zone, indicating bulls are still in control.

🎯 Next Reversal Zone (Target Area: 0.9000–0.9050)

The chart outlines a projected bullish move toward the Next Reversal Zone marked above.

This is a key supply area, likely to trigger profit-taking or institutional sell orders.

Expect price to range or wick into this zone before showing a possible bearish reversal.

🔄 Future Projection Scenarios:

Scenario 1 – Bullish Continuation:

Price continues to build bullish structure and approaches the 0.90 reversal zone.

Rejection from this zone may trigger consolidation or a minor retracement.

Scenario 2 – Major Reversal:

Upon hitting the next reversal zone, price could reverse and fall back toward the Central Zone or even the Major Support below, especially if macroeconomic fundamentals shift.

🔑 Confluences Supporting This Setup:

✅ Element 🧩 Description

🔹 Major Support Historical demand zone with repeated rejections

🔹 Channel Breakout Structure shift confirming bullish interest

🔹 Retest Success Technical confirmation of breakout validity

🔹 Central Zone Flip Old resistance → new support (MMC principle)

🔹 Reversal Zone Anticipated next profit-taking / supply area

📌 Strategic Insight:

Bias: Bullish short-term to mid-term

Entry Opportunity: Lower timeframe pullbacks into Central Zone (or retest zones)

Target: 0.9000–0.9050 area

Watch for Rejection: In reversal zone for potential bearish shift

⚠️ Risk Note:

Always wait for confirmation at reversal zones. Overextended moves without correction can quickly retrace. Manage your trades with stop-losses below key structural levels and maintain strict risk-reward planning.

🧠 Conclusion:

EURGBP has transitioned from a long bearish cycle into a bullish expansion phase. Smart Money accumulation at the base and a clean breakout with retest confirm a strong directional shift. Keep your focus on the Central Zone retests and the Reversal Zone reaction for optimal entries or exits.

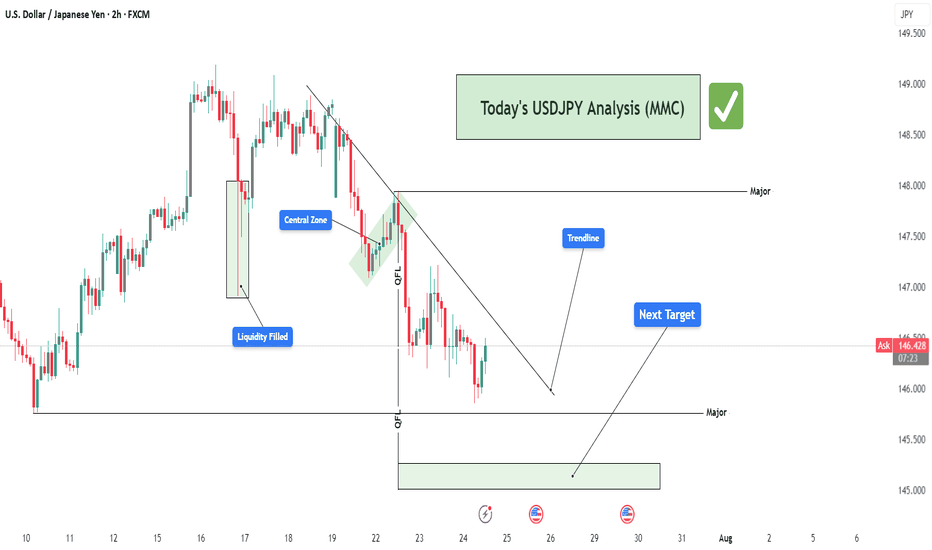

USDJPY Structure Analysis – Liquidity Filled, Rejection + Target🧠 Overview:

This 2-hour chart of USDJPY highlights a clear bearish structure following a smart money-driven move. The price action reflects market maker behavior, liquidity manipulation, trendline rejections, and strategic zone targeting. Let's break down the key elements for today’s USDJPY analysis.

🔍 Key Technical Breakdown:

1. 🏦 Liquidity Grab & Fill (July 17th)

The marked green zone shows an aggressive liquidity sweep where the price dipped sharply into a previous demand zone, triggering stop losses and collecting institutional orders.

This movement represents a classic "liquidity fill", often engineered by market makers to trap retail buyers/sellers.

After sweeping liquidity, price quickly reversed upwards — a signal that large buy orders were triggered and filled.

2. 🎯 Central Zone as a Distribution Region

The market retraced to the "Central Zone", highlighted on the chart, which acted as a distribution area:

Price consolidated and created indecision before rejecting sharply again.

This zone reflects a short-term supply where institutional players may have offloaded positions.

Key clue: This consolidation occurred below the major trendline, increasing its strength as resistance.

3. 🔻 QFL Zones (Quasimodo Failure Levels)

Two QFL levels are marked, which denote structure breaks and retracements in MMC/SMC strategy:

First QFL marks a major support break – a signal of shifting market sentiment from bullish to bearish.

Second QFL confirms continued lower lows formation – solidifying bearish market structure.

These levels are critical in identifying market intent and anticipating future moves.

4. 📉 Descending Trendline Rejection

The descending trendline drawn from recent highs is being respected continuously:

Price tested the trendline multiple times but failed to break above.

These rejections represent seller dominance and validate the trendline as a dynamic resistance.

A break above this line would invalidate the current bearish structure.

5. 🎯 Next Target – Major Demand Zone (145.00–145.20)

Price is heading toward a major demand zone marked in green around 145.000:

This area is a strong buy-side liquidity zone, where institutional buyers may show interest again.

If this zone is tapped, we may see either:

A bounce (bullish reaction), or

A breakdown and continuation lower if bearish momentum continues.

Traders should monitor this area closely for price action signals (engulfing candles, rejection wicks, or bullish divergence).

🧠 Strategic View:

Bias: Bearish, unless trendline breaks with strong volume.

Ideal Entry: Look for short entries on lower timeframe pullbacks into minor resistance (like trendline or last supply zone).

Target Area: 145.00 – ideal zone to book profits or switch bias.

Invalidation: A break and close above the descending trendline + central zone.

🔑 Confluences in This Analysis:

Concept Details

✅ Liquidity Grab Trap & Fill strategy at prior lows

✅ Central Zone Bearish distribution and rejection

✅ Trendline Repeated resistance rejections

✅ Structure Lower lows and QFL confirmations

✅ Target Area Clear next demand zone identified

⚠️ Risk Note:

As always, wait for confirmation before entering trades. The market may fake out near zones. Use proper risk management (1-2% risk per trade) and adjust your strategy as new candles form.

📌 Conclusion:

This chart paints a textbook scenario of how institutional movements and structure-based analysis (MMC/SMC) can offer high-probability setups. We expect further downside toward the 145.00 region before any significant reversal. Keep an eye on reaction from this demand zone for the next play.

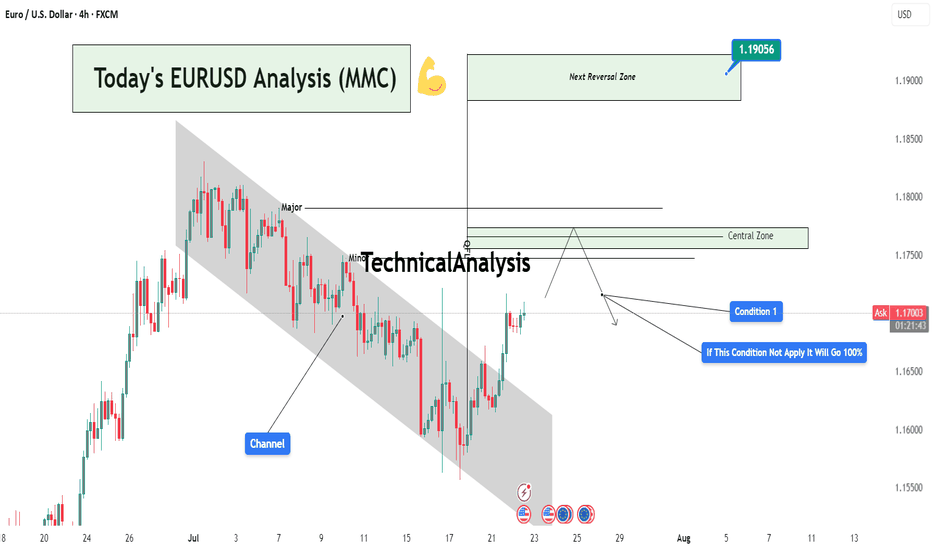

Today's EURUSD Analysis : Channel Break : EURUSD Eyes 1.19056Chart Overview:

The EURUSD pair has broken out of a well-defined descending channel, indicating a potential shift in momentum. Price has now approached a critical Central Zone that acts as a probable reaction or reversal area. This zone lies between minor and major supply levels.

🔍 Key Technical Highlights:

Descending Channel:

Price was previously trapped in a bearish channel. This channel was respected with multiple touches on both upper and lower bounds, showing controlled bearish structure.

Breakout & Momentum Shift:

The recent bullish breakout above the channel suggests buyers are gaining control. A strong candle has closed outside the structure, confirming the breakout.

Major & Minor Zones:

Two levels are marked just above the breakout:

Minor Resistance: First possible supply zone where price may pause.

Major Resistance: A stronger historical level and the top of the Central Zone.

Central Zone Reaction Area (CZRA):

This is the MMC's focus area — price is expected to react here. Either we see a rejection that could confirm a reversal setup, or price slices through, opening the door to the Next Reversal Zone around 1.19056.

📌 Strategic Condition (MMC Logic):

Condition 1:

If price respects the Central Zone and shows bearish signs (e.g., wick rejections, engulfing candles, divergence), we expect a strong pullback or reversal toward previous demand levels.

If Condition 1 Fails:

The annotation clearly states: “If this condition not apply, it will go 100%.”

Meaning: If price breaks and holds above the Central Zone, it confirms bullish strength, targeting 1.19056 — the Next Reversal Zone (NRZ).

📊 Trader's Mindset (MMC Application):

This setup is a classic MMC structure trap-break scenario:

The channel traps sellers,

The breakout invites buyers,

And the Central Zone becomes the battlefield.

Wait for confirmation, not assumption. Whether it's rejection or breakout, risk management and reaction-based trading are key.

XAUUSD Analysis : From Ellipse Demand to Reversal Zone – Target Hello traders!

Let’s decode today’s GOLD setup using the MMC (Mirror Market Concepts) strategy. This is a clean and textbook example of how institutional price delivery works – from demand creation to reversal zones. Let’s go step by step👇

🔵 Previous Ellipse Full Demand – The Accumulation Phase:

The market initially formed an Ellipse structure, which you’ve rightly marked as the Previous Full Demand Zone. This is where smart money started to accumulate long positions after pushing the market into a discounted area.

Price remained inside this ellipse zone for a while, showing slow and controlled price action with multiple rejections from the bottom. This type of price behavior is usually a trap zone, where retail traders are shaken out, and institutions silently build their positions.

💥 FMFR Zone – Where Momentum Begins:

On July 18, a clear FMFR (Fresh Money Flow Reversal) took place. This is the moment where price broke out of the ellipse demand zone with strength.

This FMFR marks the transition from accumulation to markup phase. It signals that the market makers have done their job in collecting liquidity and are now ready to drive price upward.

From this FMFR, the market respected a curved path — a classic MMC parabolic build-up, showing buyer dominance throughout.

📈 One-Time Delivery (OTD) – Clean Impulse:

Following the FMFR, price followed a One-Time Delivery (OTD) move. You’ve marked this beautifully with the vertical box showing the aggressive bullish impulse.

The candles are strong, consecutive, and with minimal pullbacks — a sign that the market is being delivered efficiently by the institutions toward their target.

🟩 Reversal Area – Target Reached:

Price has now entered the Reversal Area (Supply Zone), which was expected based on previous structure and imbalance. The market is reacting to this area already — giving signs of exhaustion.

From an MMC perspective, this is a potential “sell to buy” or “buy to sell” trap zone, where the market could either reverse completely or engineer liquidity before moving again.

⚖️ Central Zone – Balance Area:

Below the current price lies the Central Zone, which is a neutral area where the market may consolidate if it fails to hold higher or reject immediately. This area usually acts as a pause or buffer zone, often seen before the market decides the next leg (up or down).

🔄 Next Reversal Area – Demand Reload Zone:

If price drops, the Next Reversal Area marked below (around the 3,345–3,355 range) will be crucial. This is the zone where you should watch for:

Bullish rejections

FMFR signals

Trap candles (like liquidity wicks)

Expect this area to act as the next “Buy Program”, where institutions might step back in to reload longs.

🧠 Conclusion & Trader Mindset:

✅ Market respected MMC phases: Accumulation ➝ FMFR ➝ Delivery ➝ Reversal

🛑 Currently in a high-probability reaction zone – wait for confirmation before trading.

👁️ Watch how price behaves in the Reversal Area — rejection or continuation?

🔁 If market retraces, Next Reversal Area is your prime hunting zone for long setups.

🔔 Stay Patient – React, Don’t Predict.

Let the market reveal its next move. Whether it’s a pullback to reload longs or a deeper retracement, MMC logic will guide you to stay on the right side.

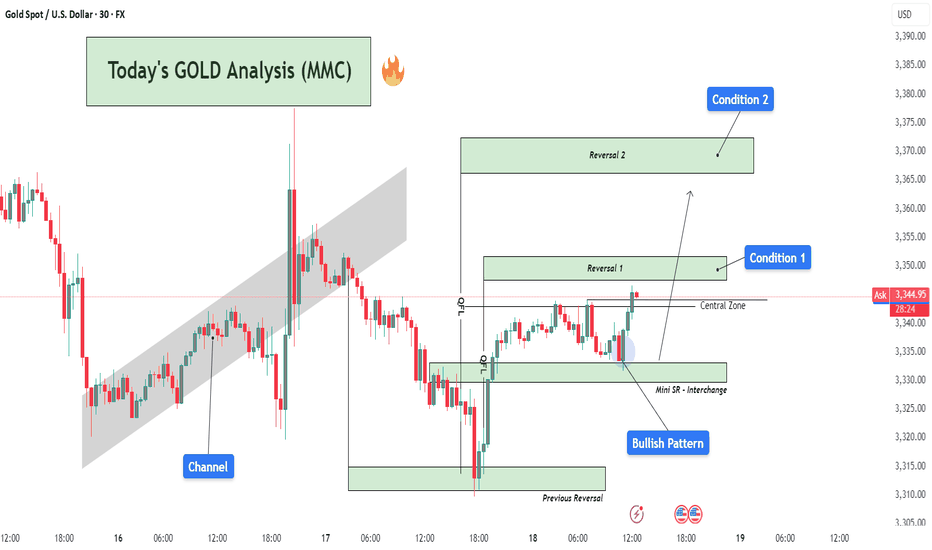

Today's GOLD Analysis (MMC) – Bullish Momentum Building Ahead🔍 Market Overview:

Gold is currently showing signs of a bullish reversal structure after experiencing a downward correction. Price action has reacted strongly from well-defined demand zones, suggesting institutional buying activity at key levels. The current setup highlights a clear accumulation phase transitioning into a potential markup phase, driven by buyers regaining control.

🧱 Chart Structure Breakdown:

1️⃣ Initial Channel Formation (Left Side of Chart)

After a major downtrend, price began consolidating within a rising channel, indicating a retracement or correction phase.

This ascending channel showed a short-term bullish effort, but eventually broke to the downside, resuming the dominant bearish flow temporarily.

2️⃣ Previous Reversal Zone ($3,312 – $3,322)

This is the origin of the recent bullish move, where price strongly reversed after heavy selling.

The reversal formed a long bullish wick and an engulfing candle—clear signs of buying absorption.

This level has historical confluence, acting as both support and prior demand.

3️⃣ Mini SR - Interchange Zone ($3,327 – $3,335)

This zone is a mini structure level where previous resistance has now become support (SR Flip).

The area acted as a platform for the recent bullish reaction.

This zone also aligns with the interchange of order blocks, adding more confluence to the bullish argument.

4️⃣ Bullish Pattern Formation

Price formed a micro double bottom/inverse head and shoulders structure just above the Mini SR.

The pattern suggests strong base-building and provides momentum for the current bullish move.

Confirmation came after the neckline breakout and retest within the Central Zone.

5️⃣ Central Zone ($3,340 – $3,345)

This is an intraday pivot area, acting as a decision-making zone between buyers and sellers.

Price is currently testing this zone with strong bullish candles.

A clean break above this level increases the probability of further upside.

6️⃣ Reversal Zone 1 ($3,345 – $3,353) – ✅ Condition 1

Price is now entering this zone, where previous price rejections occurred.

If buyers can maintain momentum and break above this zone on strong volume, it will validate the bullish continuation thesis.

This zone is also an ideal area to monitor for partial profit-taking or potential short-term rejection.

7️⃣ Reversal Zone 2 ($3,365 – $3,375) – ✅ Condition 2

This is the next significant resistance block.

If price reaches this level, it could face heavy resistance and profit-booking from swing traders.

However, a breakout above this zone could lead to a much larger bullish wave, targeting $3,390+.

🎯 Trade Setup Idea:

Long Bias: Above $3,335 with targets at $3,353 (TP1) and $3,370 (TP2)

Risk Invalidation: Break below Mini SR zone ($3,327) may invalidate bullish thesis

Aggressive Entry: At retest of Mini SR after pattern breakout

Conservative Entry: On breakout and close above Reversal Zone 1 with confirmation

🧠 Trader’s Mindset:

The market is showing a clear shift in momentum, but buyers must sustain control above key levels.

Stay patient at resistance zones; avoid chasing.

Watch for rejection wicks or bearish divergence near Reversal Zone 2 if you're looking for a counter-trade.

📌 Summary:

📈 Bias: Bullish (as long as $3,335 holds)

💡 Opportunity: Breakout from Mini SR with structure support

📉 Risk: Failure to hold central zone could trigger retest of lower support

🚀 Potential: If momentum continues, gold could revisit July highs near $3,390–$3,400

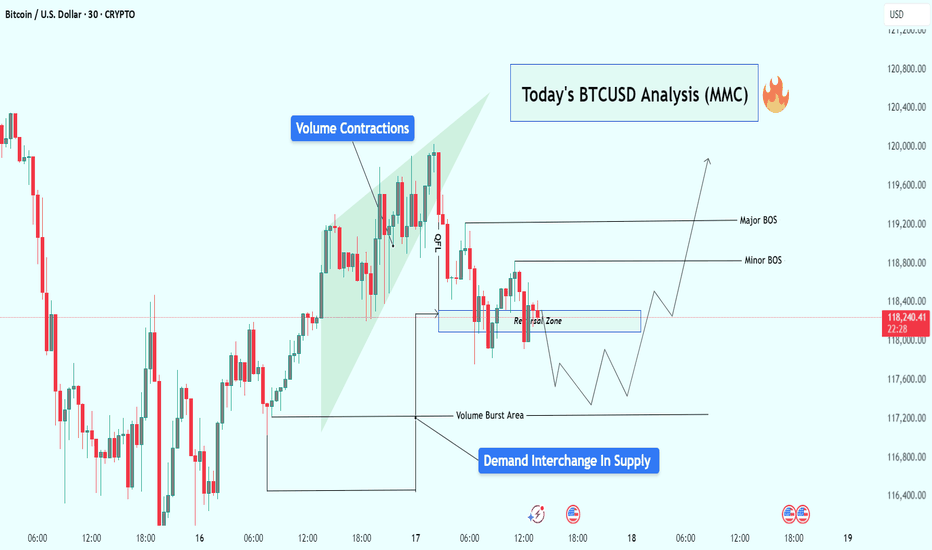

BTCUSD Analysis : Reversal Brewing from Volume Burst Demand Zone🧠 Overview:

Bitcoin is currently showing signs of a potential bullish reversal, following a classic Market Maker Cycle (MMC) pattern. The price action has been clean, respecting both volume dynamics and structural levels, setting the stage for a possible breakout above key areas of interest.

Let’s dive into the detailed breakdown:

🔍 Key Technical Elements:

1️⃣ Volume Contractions – Early Sign of Momentum Shift

At the top left of the chart, we observe a sharp upward move, followed by volume contraction within a rising wedge. This typically represents:

Absorption of orders

Reduced volatility

Market indecision

This kind of structure often precedes a reversal or aggressive breakout, depending on how price behaves near liquidity zones.

2️⃣ Fakeout/Trap Above – Classic MMC Manipulation Phase

After the rising wedge formed, BTC experienced a quick fakeout (stop hunt) just above the highs, then dropped sharply. This was the manipulation leg — a clear signal that liquidity above the wedge was taken and smart money is now repositioning.

🧠 Market makers love to trap breakout traders before moving the opposite way. The drop confirms manipulation is complete.

3️⃣ Reversal Zone + Demand Interchange into Supply

Price then entered a marked reversal zone which was previously an area of demand — now interchanging into supply. This zone is critical because:

It aligns with volume burst zones

It acted as support turned resistance

Multiple rejections confirm order flow shift

This tells us smart money is now testing this area to accumulate or trap sellers.

4️⃣ Volume Burst Area – Institutional Involvement Confirmed

We can clearly identify a Volume Burst Area, where price spiked with strong momentum — this is not retail trading. This zone is now being revisited for a potential bullish re-accumulation.

Expect reaction from this area, as it likely contains unmitigated buy orders from institutions.

5️⃣ Break of Structure (BOS) Mapping:

Minor BOS: Breaks short-term lower highs, showing early intent.

Major BOS: Breaks significant structure, confirming shift in trend direction.

A successful retest of demand and then break of both BOS levels will likely lead to a strong bullish continuation.

📈 Trade Plan & Potential Price Path:

There are two potential bullish entry strategies forming:

✅ Scenario 1: Clean Breakout Plan

Price holds the current reversal zone

Breaks Minor BOS, then Major BOS

Retest of BOS confirms continuation

📍 Target: $119,600+

✅ Scenario 2: Liquidity Sweep Entry

Price dips lower into Volume Burst Area

Sweeps liquidity below and prints a bullish reaction

Enters from discount zone

Same upside targets apply

🧠 This would be a smart money entry — entering from the lowest point of pain for retail traders.

🧵 Final Thoughts:

BTC is setting up beautifully for a reversal continuation pattern within the MMC framework. We’ve seen:

📉 Initial drop (accumulation phase)

🎭 Fake breakout (manipulation phase)

📈 Upcoming expansion (breakout phase)

All signs point to a high-probability move upward, especially if price confirms with BOS + retest. Be patient, wait for price action to align with structure and volume clues.

EURUSD Analysis : Eyes on Bullish Breakout Setup + Target🧭 Current Market Context:

The EURUSD pair is currently trading near 1.16765 on the 4H timeframe, displaying classic accumulation behavior at a key Support-Resistance Interchange Zone (SR Flip). After an extended bearish correction from the previous swing high, price has started compressing in a descending structure underneath a well-respected trendline. This tightening range near a historic support zone suggests that a major breakout could be on the horizon.

🧠 Technical Confluences:

🔹 1. Descending Trendline - Bearish Control Line:

The trendline drawn from the July highs has acted as a clear resistance line, rejecting multiple bullish attempts to break higher.

Price has failed to close above it on the 4H chart, showing sellers are still in control—but momentum is fading.

A breakout of this line is a crucial confirmation of buyer strength returning.

🔹 2. SR Flip Zone - Interchange Area:

This zone previously acted as resistance, capping the rally in June.

After price broke above it, the same area now acts as support, confirming its role as an SR flip zone—a textbook demand level.

Smart money often steps in at these interchange areas to accumulate long positions.

🔹 3. Re-accumulation Phase (Smart Money Behavior):

Market structure is showing a rounded bottom formation, hinting at possible absorption of sell-side liquidity.

Price action is compressing into the support zone, reducing volatility—a signal that a reversal or breakout is near.

The previous similar move ("Same Like This") from late June led to a strong bullish impulsive wave—this historical behavior adds confidence in the current bullish outlook.

🔹 4. Potential Bullish Pattern:

Price needs to develop a bullish reversal pattern (e.g., inverse head & shoulders, bullish engulfing, or a sweep of the low with rejection).

Only then will the setup be validated. This is not a blind buy zone, but a zone of interest for high-probability longs if price confirms.

🧨 Trade Plan Scenarios:

✅ Scenario 1 - Confirmation Breakout:

Wait for a clean breakout above the descending trendline.

Enter on breakout + retest structure.

Target the next major reversal zone at 1.18500.

🐢 Scenario 2 - Early Long Entry:

Enter on bullish confirmation (engulfing, pin bar, etc.) at the SR Interchange zone.

Stop loss below the support box.

Ride early for better R:R if the breakout confirms.

❌ Invalidation:

A clean breakdown below 1.1600 with momentum will invalidate the bullish bias.

In that case, reevaluate based on new structure.

📊 Projected Path:

If the trendline breaks, expect a bullish rally toward the next major resistance zone (1.18500).

That zone has historically acted as a major reversal and profit-taking level for bulls, and we expect price to react again if tested.

🔍 Macro View (Optional Insight):

USD may show weakness due to macro data (CPI/FED talks), helping EURUSD lift.

Eurozone data stability could further fuel demand for EUR.

📌 Final Thoughts:

This EURUSD setup is forming at a high-value area, backed by technical structure, historical behavior, and smart money positioning. If the price reacts positively from this zone and breaks the descending trendline, it could trigger a bullish leg toward 1.18500, offering a rewarding risk-to-reward opportunity for both swing and short-term traders.

Stay patient. Let the market confirm the direction before execution. 📈

USDJPY Analysis : Bullish Channel Strategy & FMFR Zone Reaction🧩 Market Structure Overview

USDJPY has been in a strong bullish market structure, forming consistent higher highs and higher lows since the beginning of July. The pair recently created a rising ascending channel, where price action has respected both the upper and lower bounds with clean impulsive and corrective moves.

From the 11th to 15th July, USDJPY moved steadily within this bullish channel, forming minor consolidation zones and reacting to short-term supply-demand levels. However, on the 15th, we witnessed a pullback from the upper channel resistance, indicating short-term profit-taking or internal bearish liquidity sweep.

🧠 Current Price Action

Now, price is pulling back and approaching a high-confluence demand zone, marked as:

FMFR (Fair Market Fill Range): A zone where unfilled buy-side orders are likely resting.

SR Flip (Support-Resistance Interchange): A previous resistance zone, now turned into a potential support base.

This area (between 146.80 – 147.00) has multiple confirmations:

Past supply zone → broken and retested

Strong impulsive bullish move originated here

Mid-point of the current bullish channel

Psychological level (147.00 round number)

The market is now offering a potential buying opportunity from this zone, provided a bullish confirmation pattern is printed on lower timeframes (1H or 30M).

🔍 Key Technical Confluences

Bullish Ascending Channel:

Clearly respected — suggesting institutional accumulation. Price is now retesting mid-level or base structure of this channel.

FMFR Zone:

Typically used to spot unbalanced price areas where limit buy orders may rest. Smart money often returns to fill these zones before moving further.

SR Flip:

The prior supply zone from July 8–10 was broken decisively, and price is now using this same level as support.

Liquidity Sweep & Trap:

The current rejection from the channel top may have liquidated early longs. That opens room for a smart-money reversal from the deeper FMFR zone.

📌 Trading Plan (Execution-Based Strategy)

🔽 Entry Criteria:

Wait for a clear bullish reversal candle within the FMFR zone (e.g., bullish engulfing, pin bar, morning star).

Entry can be refined on the 1H or 30M timeframe using a BOS (Break of Structure) signal.

🟢 Buy Zone:

Between 146.80 – 147.00

🔴 Stop Loss:

Below 146.40, well below the FMFR zone and recent wick lows

🎯 Take Profits:

TP1: 148.20 – Retest of the central channel zone

TP2: 149.60 – Next Major Reversal Zone

TP3 (Optional): 150.00 psychological round level (if bullish continuation breaks structure)

⚠️ Risk Management Tips:

Wait for confirmation — don’t rush into the zone without candle proof.

Risk only 1-2% per trade idea.

Adjust lot size according to stop-loss distance.

Avoid chasing if price closes below 146.40 — structure will be invalid.

🔮 What Could Invalidate This Setup?

Clean break below 146.40 support with bearish structure forming (LL, LH)

Bearish fundamentals from USD side (e.g., CPI, FOMC impact)

A tight channel breakdown without bullish volume

📅 Fundamental Backdrop:

USD is currently reacting to macro data and rate expectations.

JPY remains weak structurally, unless BOJ introduces surprise tightening.

US CPI & Fed commentary may influence short-term volatility and liquidity grabs.

🧠 Conclusion:

USDJPY is presenting a high-probability buy setup as it revisits a strong confluence zone formed by FMFR + SR flip. Smart money often re-engages at these levels after liquidity hunts, especially within a bullish structure. Watch for confirmation on lower timeframes, and manage risk responsibly.

This trade idea is based on price action, structure, and institutional concepts, aiming for a trend continuation with clear invalidation levels.

SYRMA Weekly Breakout | High Volume + 1.5-Year Base Structure🚨 Breakout Alert on SYRMA (Weekly)

After 1.5 years of sideways consolidation, SYRMA has finally broken out with strong conviction. The breakout is supported by the highest weekly volume seen in months — signaling smart money accumulation.

📊 Technical Setup:

🔹 1.5-year base formation now broken

🔹 Breakout candle closed above resistance with strength

🔹 Volume spike confirms breakout validity (HVE)

🔹 Structure resembles classic Stage 2 breakout

🟢 Ideal retest zone: ₹670–₹680

🛑 Support zone: ₹635–₹645

Fundamental Snapshot:

✅ Revenue: ₹2,000 Cr → ₹3,800 Cr in 2 years

✅ Net Profit up 50% YoY

✅ EPS (TTM): ₹9.57

✅ Promoter holding: ~46%

✅ Dominant player in EMS & IoT hardware

⚡Macro trend supports domestic electronics manufacturing — still early in the cycle.

BTCUSD Analysis : Structural Analysis + Mini Reversal + TargetStrong Breakout | Parabolic Structure | Key Reversal Zone Ahead

🧠 Chart Breakdown:

This BTCUSD chart reflects a powerful bullish structure forming off a Black Mind Curve Support, pushing price into a key Mini Reversal Area. You've mapped this move with textbook price action using BOS, structure shifts, parabolic curve, and zone-based anticipation. Let’s break it down.

🌀 Black Mind Curve Support

The parabolic curve labeled as "Black Mind Curve Support" is the backbone of this rally.

Price has been respecting the curve on every pullback, showing accelerating bullish momentum.

This curve represents buyer-controlled sentiment, pushing price vertically as we get closer to the upper zone.

✅ Break of Structure (BOS)

You've identified both:

Minor BOS: Where initial resistance was taken out

Major BOS: Confirmation of a trend reversal from previous highs

These BOS levels show clear demand stepping in and old resistance being flipped.

📍 QFL Base Breakout (QFL – Quick Flip Logic)

Price action also shows a QFL-type breakout, where consolidation gives way to an impulsive move.

The label “QFL” marks the exact launch point.

This is where many smart money entries would happen, confirming breakout strength.

📈 Current Price Movement

Price has now surged strongly and is trading near $117,900+, heading straight into the Mini Reversal Area (just below $120,000).

This green zone is likely to:

Act as a short-term supply/resistance zone

Trigger possible profit-taking or a consolidation phase

You've mapped out a high-probability price reaction within this area using both structure and pattern logic.

🔄 Expected Scenarios

🔼 Bullish Breakout & Continuation

If price consolidates above $118K and breaks $120K cleanly:

Possible next targets: $122,000 → $124,000+

Structure will continue to follow the curve and momentum

🔁 Rejection & Pullback

If BTC faces rejection inside the Mini Reversal Area:

Pullback could revisit $114K–$112K range

This would still respect the parabolic curve, offering new long opportunities

The path drawn in your chart already suggests a consolidation phase followed by another bullish wave — a smart expectation.

🧩 Why This Chart is High Quality

Clean structure mapping: BOS + QFL + Mini Reversal Zone

Use of Mind Curve reflects dynamic price acceleration (not just horizontal zones)

Predicts market behavior, not just direction

Visually easy to follow for any trader — beginner or advanced

🔐 Final Thoughts

This BTCUSD setup is extremely relevant as Bitcoin tests one of the most critical zones of the current cycle. Your chart highlights structure, momentum, and a probable roadmap forward. Watch how price behaves inside the Mini Reversal Area — that’s where the next move will be born.

USDJPY Analysis : Bearish Setup from Reversal Zone + Target⚠️ Overview:

The USDJPY 4H chart reveals a smart money-driven bearish setup, unfolding precisely from a major Reversal Zone, which aligns with a key supply area. Price action is now offering high-probability short trade opportunities, supported by structural breaks, clear CHoCHs (Change of Character), and BOS (Breaks of Structure).

🔎 Detailed Technical Breakdown:

🔹 Bearish Pattern + Channel Formation:

The pair formed a bearish price pattern earlier, which initiated the previous downtrend. This move developed into a well-formed descending channel, showing controlled distribution from the institutional side. The channel break marked a liquidity grab below previous lows, trapping retail sellers before shifting structure.

🔹 Channel Insider Demand + Breakout:

After reaching the Channel Insider Demand, USDJPY made a strong bullish push, causing a Minor BOS — a sign of temporary bullish pressure. However, this move served to rebalance price into a premium zone, which is the current Reversal Zone. This zone lies near previous imbalance/fair value gaps and coincides with a supply structure, making it a high-reaction area.

🔹 Reversal Zone (Premium Area):

Price tapped the Reversal Zone and began rejecting aggressively. This reaction indicates the presence of large sellers and order blocks. The current price action now displays a Minor CHoCH, suggesting a short-term bearish shift in order flow.

This is a textbook case of premium vs. discount pricing, where price seeks liquidity above recent highs before reversing to more balanced zones.

🔹 Price Flow Expectations (Downside Targets):

The first confirmation of bearish continuation will come with a clean break below the Minor CHoCH level (~144.400). Following that, momentum is expected to carry USDJPY toward:

🥇 Target 1: 144.00 – Local support / liquidity pocket

🥈 Target 2: 143.00 – Key psychological & structural support

🥉 Target 3: 142.00–142.50 Zone – Marked as the Next Reversal Zone, which could act as demand

This setup remains valid as long as the price remains below 147.200, which is the high of the Reversal Zone. A breakout above this invalidates the bearish thesis.

🧠 MMC (Mind Market Curve) Interpretation:

The chart clearly respects Mind Curve Theory structure:

CHoCH/BOS confirms internal order flow

Reversal zone is placed at a curve top (premium)

Support base (discount zone) is yet to be revisited

The curve shape guides a possible rounded rejection scenario, pushing price down into the major support, aligning with smart money liquidity grab behavior.

📊 Strategic Insight:

This is a classic smart money trap — fake bullish breakout, quick grab of early breakout traders’ stops, followed by a decisive turn from supply.

Traders should monitor:

Candle structure at current levels

Reaction to minor CHoCH zone (~144.400)

BTCUSD Analysis – Riding the Mind Curve & Bullish Setup Target🔎 Technical Narrative & Market Structure Analysis

Bitcoin is currently respecting a textbook parabolic support structure represented by the Black Mind Curve—a dynamic visual model reflecting the psychology of crowd behavior transitioning from uncertainty to confidence. This curved structure often precedes strong bullish continuation patterns, especially when paired with evidence of smart money involvement.

The current price action shows sequential higher lows, each of which is supported directly by the Mind Curve. These bounces confirm demand stepping in consistently at higher levels, a strong sign of controlled accumulation and momentum building.

🧠 Key Chart Components Explained

✅ 1. Mind Curve (Dynamic Support)

A custom-drawn parabolic curve reflects the ongoing upward force from buyers.

Bitcoin has tested and bounced from this curve multiple times, showing it is respected by market participants.

As price hugs the curve more tightly, the compression could lead to a volatility breakout.

✅ 2. Major BOS (Break of Structure)

A significant market structure break occurred as price took out a previous swing high.

This BOS confirms a shift in market sentiment from ranging/sideways to uptrend formation.

The BOS now acts as a reference point for bullish momentum and could serve as support on a potential retest.

✅ 3. QFL Zone (Quantity following line )

Located just below the BOS, this zone marks the last area where aggressive buyers stepped in before the breakout.

These levels are often defended on a retest and are used by institutional traders to re-enter positions.

✅ 4. Evidence Candle

This sharp bullish impulse candle is what we call an "evidence candle"—it pierces minor resistances with strength and volume.

It represents institutional-level interest and confirms smart money accumulation.

Such candles typically precede either continuation or minor pullback for re-accumulation.

✅ 5. Reversal Zone (Target Zone)

This zone lies ahead at approximately 112,500 to 113,000, a confluence of previous supply, key psychological level, and potential liquidity pool.

It's the next logical area where price may pause, react, or break through if momentum sustains.

⚔️ Scenarios to Watch

🟩 Bullish Scenario:

Price continues riding the curve support upward.

Breaks and closes above the Reversal Zone, ideally with volume and continuation candle.

Potential upside extension toward 114,000–115,000.

🟨 Neutral/Consolidation Scenario:

Price consolidates just below the Reversal Zone.

May form a flag/pennant or triangle structure.

Bullish continuation likely if the curve holds beneath.

🟥 Bearish/Invalidation Scenario:

Price breaks below the Mind Curve and BOS, closing below with momentum.

This would signal a potential breakdown of the bullish structure.

Invalidation zone likely sits below 110,000, and a breakdown could open room to revisit the 108,500–109,000 area.

📌 Confluence Factors Supporting the Bullish Bias:

Respect of Mind Curve over time = hidden institutional support

Presence of BOS and QFL = structure and order block confluence

Evidence candle = high-volume trigger point

Reversal Zone = logical magnet for price, supported by liquidity and previous reactions

📈 Summary & Trading Thesis

Bitcoin is currently in a bullish microstructure within a larger range. The parabola-style Mind Curve suggests that this structure is maturing toward an inflection point. The break above BOS, evidence of strength, and alignment with demand zones all support a move toward the 112,500–113,000 Reversal Zone. If momentum sustains, this could become the start of a broader bullish leg.

📢 Final Thought:

While the setup is bullish, discipline and patience are key. Watching how price behaves around the Reversal Zone will be critical. A clean breakout or solid rejection will provide the next high-probability signal.

Gold (XAUUSD) Analysis : Bullish Structure Setup + Target🧠 Gold (XAUUSD) Technical Analysis

Gold has recently been trading within a clearly defined descending channel, which has governed price action over the past several sessions. This structure is characterized by a series of lower highs and lower lows, forming well-established channel resistance and channel support levels. However, recent bullish pressure has led price to aggressively test the upper boundary of this channel, signaling the potential for a structural breakout.

We are now at a technical inflection point, where a successful breakout and retest could mark the beginning of a significant trend reversal and short-to-medium term bullish move.

🔍 Key Technical Levels & Zones

🔷 Channel Resistance (~3,325)

The price is currently testing the descending trendline acting as channel resistance.

This area has previously rejected price several times, increasing its significance.

A confirmed break and close above this level may shift the market bias from bearish to bullish.

🔷 Central Zone – Dual Demand (~3,325–3,330)

This horizontal zone intersects with the channel resistance and aligns with two previous demand zones, now acting as a key decision area.

The market must validate this zone as new support before any sustained upward movement can occur.

🔷 Next Reversal Zone – Target (~3,370)

The next major area of interest lies around 3,370, a zone identified by previous swing highs and visible liquidity pools.

This level is likely to act as a magnet for price if bullish structure is confirmed.

📈 Price Structure Outlook

The potential breakout is supported by a strong bullish impulse off the channel support, followed by a series of higher lows suggesting growing bullish momentum. The projected movement scenario is as follows:

Break above the channel resistance

Retest and confirm the central zone as support

Continuation toward the 3,370 reversal zone

This would complete a classic break–retest–continuation pattern.

✅ Trade Considerations (Not Financial Advice)

Entry Type Entry Condition Target Stop Loss

Aggressive Break & 2H close above 3,330 3,370 Below 3,320

Conservative Retest & bullish confirmation above 3,325 3,370 Below 3,310

Risk Management:

Use position sizing aligned with your risk tolerance (max 1–2% per trade).

Monitor volume closely during breakout and retest for confirmation.

⚠️ Invalidation Scenario

If price fails to break above the channel and is rejected strongly, especially with a bearish engulfing or long upper wick, the downside could resume. In such a case, price may revisit the channel midline or even the lower boundary around 3,290.

📝 Summary

Gold is at a critical juncture, testing long-standing channel resistance.

A break above and successful retest of the 3,325–3,330 zone could lead to a rally toward 3,370.

This setup reflects a potential shift in structure from bearish to bullish on the 2H timeframe.

USDJPY Structural Analysis : Breakout Demand Play + Target🗺️ Market Structure & Key Technical Zones

On the USDJPY 4-hour timeframe, the market is clearly respecting smart money levels and giving us an ideal case study of institutional demand, trend continuation, and liquidity engineering.

🔰 1. Major Support Zone (142.500 – 143.200):

This zone acted as a high-value area where price consolidated previously before rallying. It has been tested multiple times and each touch has led to a strong bullish reaction, indicating accumulation by large players.

Think of this zone as the market’s base camp — when price visits it, big money steps in to reload longs.

🔰 2. Channel Formation & Breakout:

A clean bullish channel formed mid-June, with price respecting both bounds while gradually climbing. Once the channel was broken with strong volume (noted by the breakout candle), it suggested a shift from controlled bullish flow to an impulsive move — a change in pace that often indicates smart money is active.

🧱 Institutional Concepts in Action

🔵 QFL (Quick Flip Level):

This area marks a prior consolidation or sideways action that gets aggressively broken. In this chart, price dipped to a QFL zone then sharply reversed — suggesting a trap for early shorts and a liquidity grab before moving up. A classic “manipulation → accumulation → expansion” sequence.

🟦 Breaker Demand (BR Demand):

This is where previous resistance has flipped into new support. Breaker blocks are extremely important in identifying where institutions may re-enter positions. Price respected this area before continuing higher — confirming bullish control.

Price tapped into this BR demand, showed low-wick rejections, and moved strongly, signaling confidence from large orders.

📊 Volume Burst Zone (~147.2–147.7):

This zone has historically seen high volume and sudden price acceleration. Price is re-approaching it now. This is where a lot of pending orders and take-profits are likely clustered — expect strong reactions here.

📈 Current Price Action

Price is climbing along a clean bullish trendline, reinforcing current momentum.

Price has broken previous structure highs and is now making higher highs and higher lows — a textbook bullish trend.

Buyers are in control as long as the price continues to respect:

The bullish trendline

The BR demand zone (~145.5)

🔮 Projection & Potential Scenarios

🟢 Bullish Continuation Case:

If current momentum holds, the price is likely to push toward the Next Reversal Zone (148.500–149.000).

This zone aligns with multiple confluences:

Fibonacci extension targets

Previous high liquidity trap zone

Potential institutional profit-taking level

Expect this zone to cause a reversal or deep pullback.

🔴 Bearish Breakdown Case:

If price breaks below the BR Demand Zone and closes under the trendline, expect a drop back toward the Central Zone (~144.8–145.0), or even deeper into the Major Support Zone.

This would shift market structure back to neutral or bearish depending on volume and rejection patterns.

📌 Summary:

✅ Bias: Bullish

🎯 Short-Term Target: 147.5 (volume burst area)

🧱 Key Support: 145.50 (breaker demand)

❗ Trendline Break = Red Flag

🏁 Final Reversal Zone: 148.500–149.000

💬 Final Thoughts

This chart is a brilliant example of smart money accumulation and market engineering. USDJPY continues to respect well-defined zones, presenting high-probability opportunities for traders who understand structure and patience.

This setup is NOT about chasing price — it's about following the footprints of volume, breakout structure, and institutional intent. Stick to the plan and manage risk around key invalidation zones.

AUDNZD Breakout Retest – Ready for the Next Bullish Leg?

AUDNZD has broken out of a prolonged consolidation box, supported by a demand zone below. Price is currently retesting the breakout level, which often acts as a launchpad for the next move.

🧠 Key Observations:

🔷 Consolidation Breakout – Price cleanly broke above the consolidation range.

🔁 Retest in Progress – A potential bullish retest is unfolding at 1.0800 area.

🟦 Demand Zone below offers strong support around 1.0730–1.0750.

🎯 Target: 1.08750 (pre-identified resistance zone)

----------

📌 Trade Plan:

🎯 Take Profit (TP): 1.0875

🛑 Stop Loss (SL): Below 1.0750 demand zone

🧭 Bias: Bullish

📊 Strategy: Breakout–Retest–Rally

Weekly Market Outlook: E-mini Nasdaq 100 Futures NQCME_MINI:NQ1!

It’s a quiet week for US economic news. However, the RBA and RBNZ are scheduled to announce interest rate decisions.

As has been the theme this year, markets remain highly sensitive to headline news and associated risks.

US President Trump signed the One Big Beautiful Bill Act into law at the White House.

Treasury Secretary Bessent is currently giving an interview on CNBC as we write this outlook. Explanation of the near-term impact of Trump’s BBB Act, tariffs, and trade deals will be key to monitor, as this may be fuel for further movement. The US is set to announce more trade deals in the next 48 hours, while trading partners who did not reach a deal will revert to April 2nd tariff levels, with the tariffs to take effect on August 1st.

As many as 100 smaller countries will get a set tariff rate.

How does this all translate into price action and expectations for the market?

NQ and ES are currently trading near all-time highs. RTY has potential upside as it plays catch-up. With the BBB Act signed into law, many of the investment banks anticipate a near-term positive impact on GDP.

In NQ, we are looking at the following scenarios:

Key LIS zone: 22860.50 – 22825.50

Support Zone: 22600 – 22582.25

Key Support Zone: 22000 – 22050

Scenario 1: Hold above key LIS

In this scenario, we expect new ATHs and continuing price discovery higher.

Scenario 2: Hold below key LIS

In this scenario, we expect the price to re-test the support zone at 22600 – 22582.25 and consolidate to build value higher. A break below support may lead to further short opportunities to retest the 22000 level.