LTC - Bulls Getting Ready!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Long-term, LTC has been overall bullish, trading within the rising channel marked in red.

📍 As it retests the lower bound of the channel — perfectly intersecting with the blue support—I will be looking for medium-term longs.

🚀 For the bulls to take over long-term and initiate the next bullish phase, a breakout above the last major high marked in orange at $97 is needed.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Trend

AUDJPY - Follow The Bears!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈AUDJPY has been bearish trading within the falling channel in red.

Currently, AUDJPY is approaching the upper bound of the channel.

Moreover, it is retesting a strong structure marked in orange.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the structure and upper red trendline.

📚 As per my trading style:

As #AUDJPY is around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPAUD - One More Leg!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPAUD has been overall bullish trading within the rising channel marked in blue.

Moreover, it is retesting a strong structure.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of structure and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #GBPAUD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDUSD - Like a Bow and Arrow!!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈NZDUSD has been overall bullish trading within the rising wedge pattern marked in blue.

Today, NZDUSD is retesting the lower bound of the wedge.

Moreover, it is approaching a strong structure marked in green.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of structure and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #NZDUSD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

K.I.S.S => ETHHello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📉 ETH Market Update – Keeping It Simple 📉

Since breaking below its last major low in December 2024, Ethereum (ETH) has been stuck in a bearish trend.

But don’t lose hope, bulls! 🐂

For the long-awaited altseason to kick off, ETH needs to flip the script and break above its last major high — currently sitting at $2,100.📈

Until then, patience is key. 🧘♂️

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

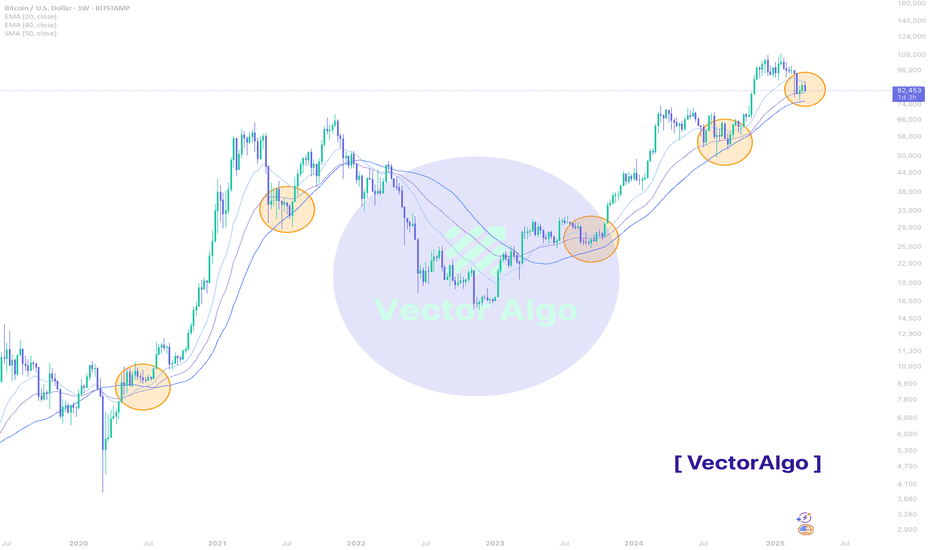

Bitcoin - EMA Support Holding Strong!#BTC/USD #Analysis

Description

---------------------------------------------------------------

BTC/USD – Weekly Chart Analysis

📉 Current Price: $82,239 (-4.47%)

📈 Key Moving Averages:

🔹 EMA 20: 88,143

🔹 EMA 40: 81,116

🔹 SMA 50: 76,230

EMA Support Holds Strong – The chart highlights multiple historical instances where BTC found support at the 20-40 EMA zone (orange circles). This pattern has played out consistently in past market cycles.

- Bullish Trend Continuation – Each time BTC has tested this EMA region on a pullback, it has led to strong recoveries and further bullish momentum.

- Current Market Structure – BTC is once again testing this key EMA support zone. A bounce from here could signal a continuation of the uptrend.

- Historical Patterns Repeat – The blue shaded region and Vector Algo's AI-optimized signals indicate that similar setups have resulted in upward moves.

✅ Bullish Scenario: If BTC holds above the EMA 40 ($81,000) and forms bullish confirmation candles, we could see a move toward previous highs ($96,000) and possibly $100,000+.

❌ Bearish Scenario: A breakdown below $81,000 could lead to further downside towards the 50 SMA ($76,000) and lower demand zones.

Bitcoin remains in a strong uptrend, and the current EMA support test is crucial for trend continuation. Keeping an eye on price action around this zone is key for potential long opportunities!

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights. Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

Speculating Bitcoin's Cycle Top!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📚 Back to basics.

🗓️ This is the BTC monthly log chart.

📊 By applying two simple channels—one short-term (🔴) and one long-term (🔵)—we see both upper bounds aligning right around the 💰 $300,000 mark. A classic case of confluence at a key psychological level 🧠✨

👇 What do you think—are we headed there this cycle, or is it just hopium? Drop your thoughts in the comments!

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Weak US Economic Data Could Drive Prices Higher - 28.03.2025Gold prices have been on a strong upward trend, reaching a high of $3,059. The upcoming US economic data release on March 28, 2025, could provide new momentum for gold, particularly with the following key indicators in focus:

- Core PCE Price Index (MoM)

- Personal Spending (MoM)

- Personal Income (MoM)

Current forecasts suggest a slowdown in inflation and weaker economic activity, which could create a bullish environment for gold.

Economic Data Expectations and Market Implications

The Core PCE Price Index, the Federal Reserve’s preferred measure of inflation, is expected to rise by 0.2%, down from the previous 0.3%. This signals a slowdown in price pressures, increasing the likelihood of the Fed adopting a more dovish stance in the coming months. If inflation continues to decline, expectations for rate cuts could strengthen, which would be supportive of gold prices.

Personal spending is forecasted to increase by 0.3% - 0.5%, a modest recovery from the previous decline of -0.2%. However, this remains a weak rebound, suggesting that consumers are still cautious. Slower spending means less inflationary pressure, which could further encourage the Fed to ease monetary policy.

Personal income is expected to rise by 0.3% - 0.4%, significantly lower than the previous 0.9% increase. A slowdown in income growth could weigh on consumer spending and overall economic activity, reinforcing the case for lower interest rates.

Impact on Gold Prices

The combination of declining inflation, weak spending, and slower income growth increases the likelihood that the Federal Reserve will cut interest rates sooner rather than later. Gold, which tends to perform well in a lower interest rate environment, could see further gains as a result.

Key bullish factors for gold include:

Lower inflation expectations: A weaker Core PCE Price Index supports a more accommodative Fed stance.

Sluggish consumer spending: Less inflationary pressure gives the Fed room to cut rates.

Slower income growth: Weaker earnings could further dampen economic momentum, increasing demand for safe-haven assets like gold.

The main risk to gold prices would be a surprise shift in market sentiment. If the Fed remains cautious and delays rate cuts, gold could face short-term resistance. However, given the current data outlook, the overall trend remains positive.

Trading Idea: Long Position on Gold (XAU/USD)

Given the softer economic data, gold prices could continue their bullish momentum. If inflation shows signs of easing and economic activity slows, traders may start pricing in Fed rate cuts more aggressively, pushing gold higher.

A potential long trade setup could be to enter a buy position around $3,050 - $3,065, targeting $3,080, with an extended upside potential.

To manage risk, a stop-loss below could be placed to account for potential short-term pullbacks.

Conclusion

The upcoming US economic data release suggests a cooling economy, which could lead to increased expectations of Fed rate cuts. This would be a bullish catalyst for gold, reinforcing its role as a hedge against monetary easing.

A long position on gold around $3,065, with targets at $3,080, could be an attractive setup in the short term. Risk management remains key, with a stop-loss set close below.

If economic data confirms a weakening trend, gold could soon test new highs. Stay alert to market reactions and Fed commentary! 🚀

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

EURGBP - Follow The Bears!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURGBP has been bearish trading within the falling channel in blue.

Currently, EURGBP is approaching the upper bound of the channel.

Moreover, it is retesting the upper bound of its range marked in blue.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the range and upper blue trendline.

📚 As per my trading style:

As #EURGBP is around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETH - Will the support hold ?CRYPTO:ETHUSD (1W CHART) Technical Analysis Update

ETH is currently trading at $2007 and showing overall bullish sentiment after hitting the support. We are seeing minor retracement from the support zone. If this support holds we can expect bullish trend and reach the resistance around 4k. New ATH for ETH depends on breaking the resistance around previous ATH.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

ETH - As long as the $1,950 holds...Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈After breaking above the $2,000 level, ETH has been overall bullish trading within the rising orange channel.

Moreover, it is retesting as strong support zone, so we will be looking for longs as long as the $1,950 level holds.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of support and lower orange trendline acting as a non-horizontal support.

📚 As per my trading style:

As #ETH approaches the blue arrow zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

XAUUSD 15 min Chart Long IdeaHello Friends,

Gold had fly today without taking us let's try to catch up again oncenit will take the pullback with better entry positions.

Entry = 3027.42

SL = 3017.98

TP = 3055

We can break even the position after crossing the price 3040.

Please like, share, follow, and comment for more ideas

Thanks

GOLD - Eyeing Two Levels!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 XAUUSD remains overall bullish in both the short and medium term, trading within the rising channels marked in orange and green.

🔍 Here are two key levels I'm watching for potential trend-following long setups:

1️⃣$3,000 – A psychological round number that aligns with the lower orange trendline.

2️⃣$2,950 – A support level that intersects with the lower blue trendline.

Let’s see if the bulls hold the line! 🐂✨

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPUSD - Chasing the Bulls!!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPUSD has been overall bullish trading within the rising channel marked in red.

Moreover, the blue zone is a major daily support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of daily support zone and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #GBPUSD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDCAD - Bulls Steppin in!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈AUDCAD has been overall bullish trading within the rising wedge pattern marked in blue.

Today, AUDCAD is retesting the lower bound of the wedge.

Moreover, it is approaching its previous weekly low.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of weekly low and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #AUDCAD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BTC make or break zone!As per our last BTC analysis, it has been bullish this week, trading within the rising channel marked in red.

For the bulls to take over and start the next impulse toward the $95,000 round number, a break above the last major high at $87,400 is needed.

Meanwhile, if BTC breaks below the last major low marked in red at $81,200, further downside toward the $75,000 support would be expected.

Gold (XAU/USD) on a 4-hour timeframe, showing a potential short Chart Analysis:

Current Price: $3,039.93

Resistance Level: $3,055.47 (marked as a key level where a sell opportunity is identified).

Target Level: $3,000.73 (suggested as the take-profit area).

Support Zone: Highlighted around $2,900.

Trading Idea:

The price is in an uptrend, but a potential reversal is expected at the $3,055.47 resistance level.

If the price fails to break above this resistance, a short position could be considered.

Entry Strategy: Sell near $3,055.47 upon confirmation of rejection.

Target: A drop towards $3,000.73.

Stop Loss: Above the resistance zone to manage risk.

Conclusion:

This is a counter-trend short setup, aiming for a pullback within the broader bullish trend. Traders should monitor price action near resistance before entering a trade.