BTC - Bulls Charging... However!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

As per our last analysis (attached on the chart), BTC rejected the blue trendline support and has been bullish in the medium term. 📈

However, the overall sentiment remains bearish, as BTC is still trading within the falling channel marked in red. 📉

For the bulls to take over long term and initiate the next impulsive wave, a break above the $91,000 major high in blue is needed. 🔵

Meanwhile, BTC may still retest the blue trendline — where we’ll be looking for new short-term longs. 🎯

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Trend

NEAR/USDT is Nearing The Daily TrendHey Traders, in today's trading session we are monitoring NEAR/USDT for a selling opportunity around 2.55 zone, NEAR/USDT is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 2.55 support and resistance area.

Trade safe, Joe.

ETH is falling per Demark’s technical analysis: Target at $988?According to Thomas Demark’s method — when b = a, the next target for ETH is around $988.

📉 Price broke the ascending support

🔻 Wave “a” from $4000 to $2500 has already played out

📏 Wave “b” is projected downward — target aligns with a strong historical support zone

📊 Weekly RSI is nearing oversold territory

Conclusion: The $988 area is critical. A reversal may occur there if selling pressure weakens.

Stay sharp.

#ETH #Demark #CryptoAnalysis #TechnicalAnalysis #Ethereum

Update to Dow Jones Industrials Time At Mode Back in 2015 I had published a chart with annual data for the Dow Jones Industrials. I will provide a link at the bottom.

The research for this patterning is something I did myself by hand using pencil and paper back in the 1980's. These patterns show up in all time frames.

There is plenty of room to enhance the research on this technique and a group of us gather in the chat rooms here at TradingView to discuss new trades that set up and point out when trades expire.

Notice how these two grey boxes (which are both 50% drops in price) that expand wider in time from the 1960's to the 1980's and the 2000-2010's had a multi-year trend, followed by a monster crash (1987 was 40% and 2000 was 37%) and then just two+ years later there was a secondary bear market of 20% in 1990 and 22% in 2022. Keep in mind this is just for the DJ:DJI and not the Nasdaq Composite or S&P500 which were greater corrections.

The 11-year time frame of the 1999-2011 pattern allows for an 11-year rally from 2012 (which was year 1 of the 11-year rally) shows that time expired. As you can see from the 1943-1962 trend, a smaller 5-year mode formed at the end of the 20 year trend and then the market peaked in 1972-1973 when time expired for the second, smaller mode.

I had to reconstruct this chart after the data for the previous chart changed symbol. See the link below to see the original.

I look forward to your additional research onto this pattern and its implications to the idea that we are in a similar period to 1993-1994 with rally years of 1996, 1997, 1998, 1999 and 2000 ahead of us.

All the best,

Tim

October 19, 2024 3:31PM EST

USDCAD - Long-Term Long!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈USDCAD has been overall bullish from a macro perspective trading within the rising blue channel.

This week, USDCAD has been in a correction phase trading within the falling red channel.

Moreover, the green zone is a strong resistance turned support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of support and lower red/blue trendlines acting non-horizontal support.

📚 As per my trading style:

As #USDCAD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BTC | BEARISH Cycle Begins | $71KThere are a few tell signs that BTC has entered the bearish market.

If the price fails to maintain closing daily candles ABOVE the 70k area, there is a likelihood for a nasty Head and Shoulders pattern to form.

A key point to watch are the Bollinger Bands, which gives you an indication of the next possible zone to watch.

_____________________

BINANCE:BTCUSDT

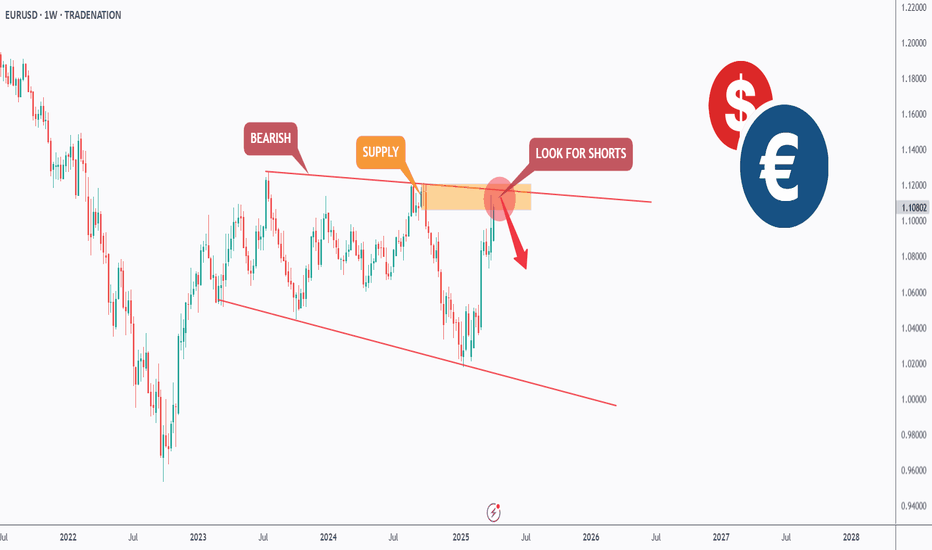

EURUSD - Trade The Impulse!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURUSD has been bearish trading within the falling wedge pattern marked in red.

Currently, EURUSD is retesting the upper bound of the wedge.

Moreover, the $1.12 is a strong weekly supply zone.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper red trendline and supply.

📚 As per my trading style:

As #EURUSD is hovering around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BTC at a Critical Inflection Point – Bulls vs. BearsBitcoin is currently trading around $77,644, sitting right between two major trendlines:

🟢 Long-Term Bullish Support – This green ascending trendline has held since late 2023, providing key support throughout BTC’s macro uptrend.

🔴 Medium-Term Bearish Resistance – The red descending trendline has capped price since the 2025 highs, forming a clear structure of lower highs.

We're now at a pivotal confluence zone where these two trendlines intersect. Price recently bounced off the green support, but it's struggling to decisively break above the red resistance.

🔍 Key Scenarios:

✅ Bullish Breakout:

A strong daily close above the red trendline could confirm bullish continuation.

Targets: $84K, GETTEX:92K , and potentially ATH breakout above $100K.

❌ Bearish Rejection:

Rejection at resistance may lead to a retest of the green trendline (~$74K).

A breakdown from there opens the door to GETTEX:64K –$60K, or even deeper pullbacks.

BTC - One More Leg...Hello TradingView Family / Fellow Traders!

This is Richard, also known as theSignalyst.

📉 BTC has been overall bearish , trading within the falling channel marked in red.

But the big question is — where could the potential bottom be?

👉 I’m watching the $70,000 zone!

Here’s why:

The $70,000 area is a key confluence zone — it aligns with the lower red trendline, horizontal support, a psychological round number, and a potential demand zone.

📚 According to my trading style:

As #BTC approaches the blue circle zone, I’ll be looking for bullish reversal setups — such as a double bottom pattern, trendline break, and more.

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

LONG AMD: Keep it simple trends, time and duration3 Positions in AMD from 2018-2025

Duration of trades: 106 - 1,064 days

Gains: +217% - +917%

Closing in on the trend line, look for a bounce at the line or likely if it goes under, wait for a rally back above the line. This chart is set at the daily timeframe. If you trade on the minor volatility within the major trend, I've found the 2 hour timeframe using a combination of indicators, Relative Trend Index and HH and LL, net favorable results.

LONG SNAP: Ooohhh SNAP Buy @ $8.35 set target for 40% With the exlcusion of double bottoms and minor noise in the trend, snap has risen 5 times from $8.35 to +40% gains with the highest at 114%. It just dropped below $8.35. Buy of it rises above $8.35, set your target at 40% or move up your stops using higher highs/higher lows.

LTC - Bulls Getting Ready!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Long-term, LTC has been overall bullish, trading within the rising channel marked in red.

📍 As it retests the lower bound of the channel — perfectly intersecting with the blue support—I will be looking for medium-term longs.

🚀 For the bulls to take over long-term and initiate the next bullish phase, a breakout above the last major high marked in orange at $97 is needed.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

AUDJPY - Follow The Bears!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈AUDJPY has been bearish trading within the falling channel in red.

Currently, AUDJPY is approaching the upper bound of the channel.

Moreover, it is retesting a strong structure marked in orange.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the structure and upper red trendline.

📚 As per my trading style:

As #AUDJPY is around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPAUD - One More Leg!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPAUD has been overall bullish trading within the rising channel marked in blue.

Moreover, it is retesting a strong structure.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of structure and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #GBPAUD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDUSD - Like a Bow and Arrow!!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈NZDUSD has been overall bullish trading within the rising wedge pattern marked in blue.

Today, NZDUSD is retesting the lower bound of the wedge.

Moreover, it is approaching a strong structure marked in green.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of structure and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #NZDUSD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

K.I.S.S => ETHHello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📉 ETH Market Update – Keeping It Simple 📉

Since breaking below its last major low in December 2024, Ethereum (ETH) has been stuck in a bearish trend.

But don’t lose hope, bulls! 🐂

For the long-awaited altseason to kick off, ETH needs to flip the script and break above its last major high — currently sitting at $2,100.📈

Until then, patience is key. 🧘♂️

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

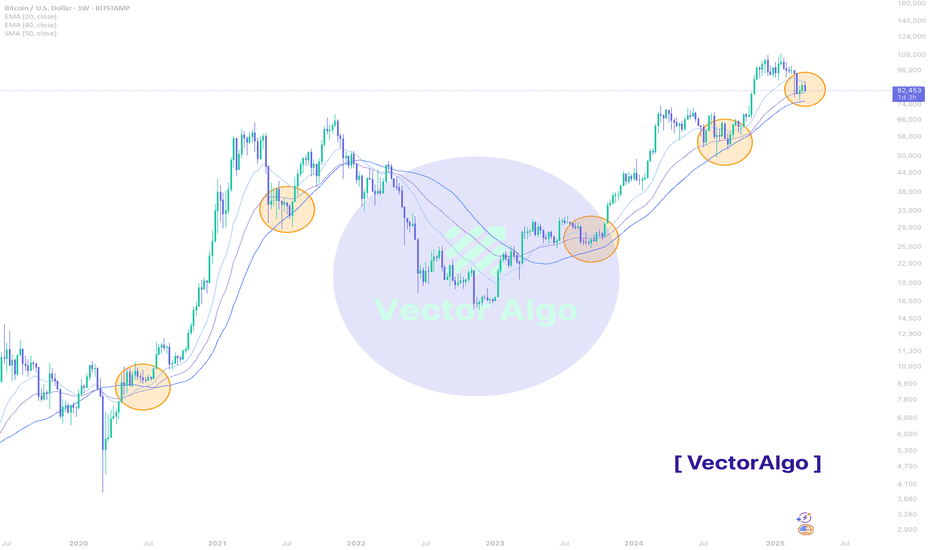

Bitcoin - EMA Support Holding Strong!#BTC/USD #Analysis

Description

---------------------------------------------------------------

BTC/USD – Weekly Chart Analysis

📉 Current Price: $82,239 (-4.47%)

📈 Key Moving Averages:

🔹 EMA 20: 88,143

🔹 EMA 40: 81,116

🔹 SMA 50: 76,230

EMA Support Holds Strong – The chart highlights multiple historical instances where BTC found support at the 20-40 EMA zone (orange circles). This pattern has played out consistently in past market cycles.

- Bullish Trend Continuation – Each time BTC has tested this EMA region on a pullback, it has led to strong recoveries and further bullish momentum.

- Current Market Structure – BTC is once again testing this key EMA support zone. A bounce from here could signal a continuation of the uptrend.

- Historical Patterns Repeat – The blue shaded region and Vector Algo's AI-optimized signals indicate that similar setups have resulted in upward moves.

✅ Bullish Scenario: If BTC holds above the EMA 40 ($81,000) and forms bullish confirmation candles, we could see a move toward previous highs ($96,000) and possibly $100,000+.

❌ Bearish Scenario: A breakdown below $81,000 could lead to further downside towards the 50 SMA ($76,000) and lower demand zones.

Bitcoin remains in a strong uptrend, and the current EMA support test is crucial for trend continuation. Keeping an eye on price action around this zone is key for potential long opportunities!

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights. Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

Speculating Bitcoin's Cycle Top!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📚 Back to basics.

🗓️ This is the BTC monthly log chart.

📊 By applying two simple channels—one short-term (🔴) and one long-term (🔵)—we see both upper bounds aligning right around the 💰 $300,000 mark. A classic case of confluence at a key psychological level 🧠✨

👇 What do you think—are we headed there this cycle, or is it just hopium? Drop your thoughts in the comments!

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich