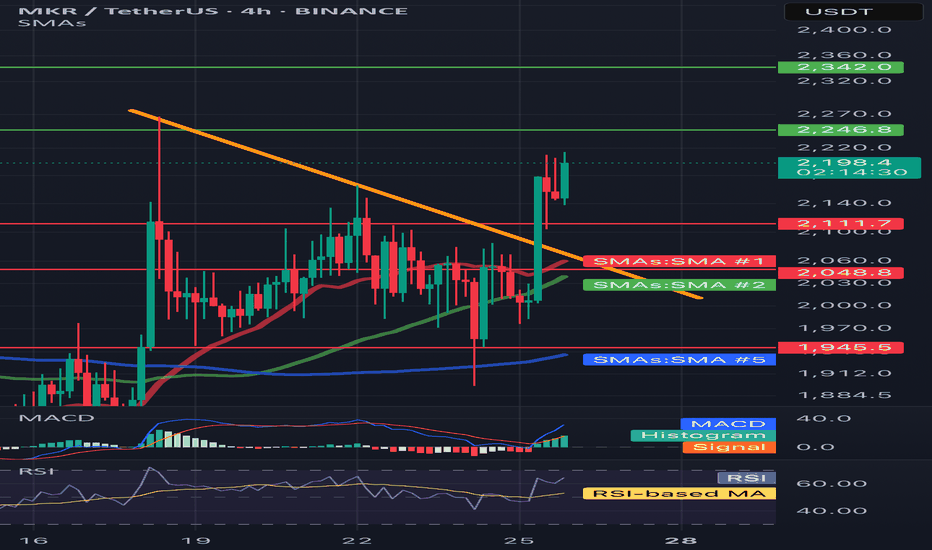

MKR/USDT 4H Chart📉 Short-term situation:

The price is currently trading around 2028 USDT, after a sharp decline from around 2273 USDT (resistance).

The support level around 2000 USDT is currently being tested (coinciding with the SMA 200 – blue line).

A dynamic uptrend line (orange) is also visible, which could act as a key support level in the event of further declines.

🔍 Support and Resistance Levels:

Resistance:

🔴 2188 USDT – recent local high and convergence with the SMA 21.

🟢 2273 USDT – major resistance; previous rebound and point of significant price reaction.

Support:

🔵 1980 USDT – local support + SMA200.

🟠 Uptrend line (~1940–1960 USDT).

🔴 1832 USDT – stronger horizontal support with multiple confirmations.

🔴 1623 USDT – very strong support, from previous lows.

📊 Technical indicators:

RSI (Relative Strength Index):

Current value: ~42, neutral, but approaching the oversold zone (<30).

The RSI is falling rapidly, suggesting selling pressure, but a reaction is possible near current support.

MACD:

Negative signal: signal line crossing from above + descending histogram.

Indicates a continuation of the correction, but we are approaching the potential exhaustion of the downward momentum.

📈 Moving averages:

EMA/SMA 50 and 200:

The price is currently testing the SMA200 – crucial for the medium-term trend.

SMA21 (red) and SMA50 (green) – have reversed downward, which may suggest a weakening of bullish momentum.

🔮 Scenarios:

🟢 Bullish scenario (confirmation of support):

A rebound from 1980–2000 USDT and further upward movement.

Potential target: first ~2180 USDT, then ~2273 USDT.

The condition is a demand response at the current level + an improvement in the RSI/MACD.

🔴 Bearish scenario (breakout of support):

If the 1980 USDT level is broken and the price falls below the uptrend line, a continued decline to 1832 USDT or even lower is possible.

Confirmation will be a strong bearish candle with high volume and a further decline in the RSI/MACD.

Trendanalyse

SOL/USD 4H📉 Price

Current price: approximately $183–$184

We see a decline from the resistance zone around $194.56. The price has broken through support at $187.31 and is heading towards lower support at:

🔴 $183.18 – local support (being tested now),

🔴 $175.58 – key support (potential target if current support breaks).

📊 Market structure

Short-term trend: Downtrend (lower highs and lower lows after a rebound from $194.56).

Volume: Increased volume on bearish candles – confirming supply pressure.

Previous trend: Uptrend with strong momentum from July 18th to July 21st.

🔁 Technical Levels

Resistance:

🟢 USD 187.31 – last broken support, now acting as resistance.

🟢 USD 194.56 – strong resistance (tested twice).

🟢 USD 206.43 – local high, strong resistance level from higher timeframes.

Support:

🔴 USD 183.18 – currently being tested.

🔴 USD 175.58 – stronger support from lower swing highs.

📉 Stochastic RSI

Located in the oversold zone (<20) and pointing down.

No upside crossover yet → no buy signal yet.

If a reversal occurs, a technical rebound is possible.

📌 Conclusions and Scenarios

🔻 Downside scenario (more likely currently):

Breakthrough of support at $183.18 ➜ further decline to $175.58.

Potential entry into a correction of the entire upward movement from July 18-21.

🔺 Upside scenario (alternative):

Support at $183.18 held + Stoch RSI signal ➜ rebound to $187.31.

If buying volume increases, a retest of resistance at $194.56 is possible.

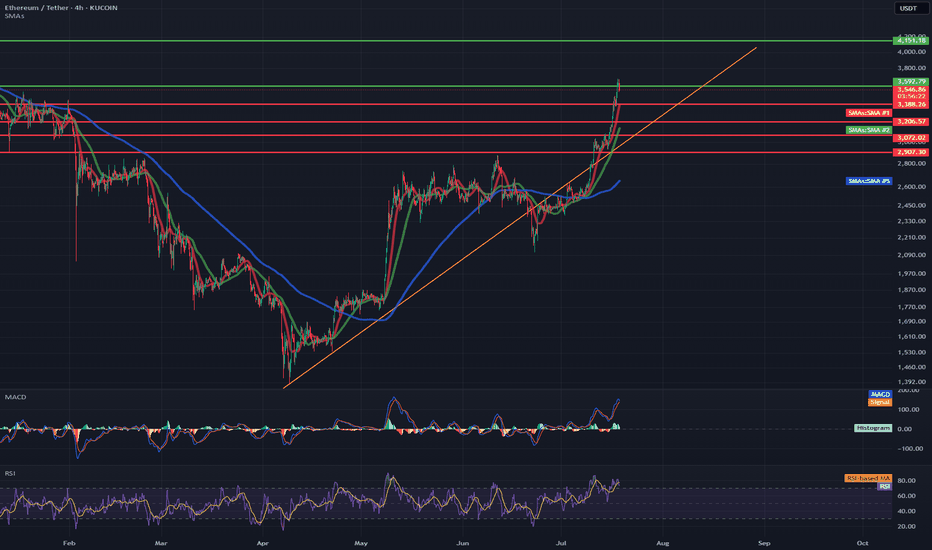

ETH/USDT 4H Chart📊 General Context

Ethereum is rising in a strong short-term uptrend, supported by a rising trendline (orange).

Current price: 3831 USDT

We are approaching a significant resistance level around 3842–3850 USDT (green line).

Technical support is located around 3760 USDT (previous consolidation level and 50/200 SMA).

🔍 Technical Levels

Resistance:

3842–3850 USDT – local high, currently being tested.

4006 USDT – key psychological level and the last local high on the chart.

Support:

3762 USDT – previous resistance, currently turned into support (may be tested in a correction).

3650 USDT – strong technical support, confirmed several times in the past.

SMA50 and SMA200 – currently just below the price, also acting as dynamic support.

📈 Technical Indicators

MACD:

The histogram is rising and positive → bullish momentum.

The MACD line crosses the signal line from below → a buy signal.

RSI (14):

Currently: around 64 → not yet overbought, but close to the overbought zone.

Slightly rising trend, but may suggest impending market overheating with further gains.

🧭 Trend

Short-term: strong uptrend (trend line, green candles, breakout from consolidation).

Medium-term: higher lows and higher highs – the uptrend is maintained.

The price is holding above the 50 and 200 SMAs – confirming bullish sentiment.

⚠️ What to watch next?

A 4-hour candle close above 3842 USDT → confirmation of a breakout, a potential attack on 4000–4010 USDT.

A break of the trend line (orange) → a possible correction to 3760 or even 3650 USDT is possible.

An RSI rise above 70 → an overbought signal, a possible pullback or consolidation.

MKR/USDT 4H📈 Trend and price structure

• The price has just been above the downward trend line (yellow line), which suggests the potential reversal of the trend to the upward.

• Breaking was strong - a candle with a large growth volume and an increase +9.13%, which emphasizes the pressure of buyers.

⸻

🔍 levels of support and resistance

• resistance:

• ~ 2342 USDT - a clear level of resistance (green line) - may be the target for the next upward movement.

• 2246.8 USDT - first resistance to overcome.

• Support:

• 2111.7 USDT - level of local support after struggling (earlier resistance).

• 2048.8 USDT - SMA #1 (red medium), can be support at the back.

• 1945.5 USDT - strong support in the form of long -term SMA (blue line, SMA #5).

⸻

📊 Technical indicators

✅ MacD (below)

• The MacD line cut the signal line up - buy signal.

• The histogram is growing, which confirms the growth moment.

✅ RSI

• RSI has bounced from level 40 and is currently above 60 - it suggests upward momentum, but it is not yet purchased, so there may be room for further growth.

⸻

✅ Medium walking (SMAS)

• The price was pierced by SMA #1 (red) and SMA #2 (green) with impetus, which means a change in sentiment.

• If it stays above these medium - a bull signal.

• SMA 50 (green)> SMA 200 (blue) = potentially a golden cross is formed on a longer TF.

⸻

📌 Summary - technical scenario:

🐂 Bycza scenario:

• If the price lasts above 2111.7 USDT, it may continue to increase to USDTt and further up to $ 2,342.

• Confirmation will be the continuation of growth on MacD and RSI over 60-70.

🐻 Bear scenario (threats):

• If the price drops below 2048 USDT, possible correction up to 1945 USDT.

• RSI returning below 50 and Macd Cross down would be a reversal signal.

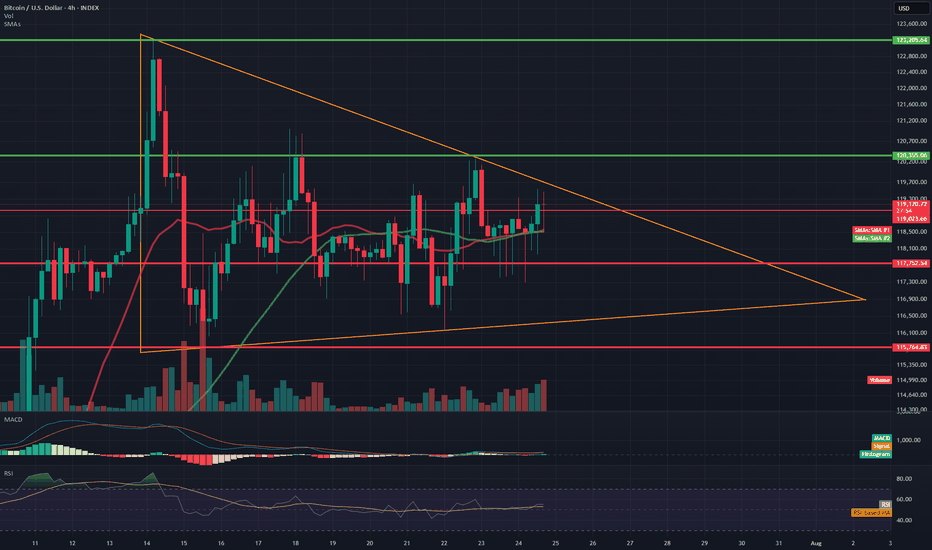

BTC/USD 4H Chart Review📊 Technical Structure (Symmetrical Triangle)

Formation: The symmetrical triangle (orange lines) remains intact—price continues to move within it.

Approaching the apex: The closer to the intersection of the triangle's arms, the greater the probability of a breakout. The current candle is testing the upper boundary of the formation (around $119,300), but has not yet broken it.

Direction: The formation is neutral, but tension is increasing. A breakout of either line (the upper boundary ≈$119,500 or the lower boundary ≈$117,700) could trigger a dynamic move with a range of around $3,000 (the height of the triangle at its widest point).

🧱 Support and Resistance Levels (Red and Green Lines)

Type Level (USD) Description

Resistance 123205 All-Time High – Possible Target After an Upward Breakout

Resistance 120556 Local Resistance – Triangle Breakout Range

Resistance 119200–119300 Currently Tested Level

Support 117752 Lower Triangle Boundary – Critical Defense Line

Support 115764 Next Local Support

📈 Technical Indicators

🔵 RSI (Relative Strength Index)

Currently: ~55 – indicates a neutral situation, having broken down from the overbought level (~74).

Indicates that the market has temporarily cooled down after a previous impulse. There is still room for further upward movement without exceeding 70.

🔵 MACD

The MACD and signal lines are approaching a crossover – if the MACD crosses the signal line upward, it could be a bullish signal.

The histogram is slightly positive – indicating weak but growing bullish momentum.

📊 Volume

Slightly increasing in the last candles – no confirmation of a strong breakout yet, but upward pressure is building.

🧠 Interpretation

Scenario Technical Conditions Movement Objective

🔼 Upward Breakout

Candlestick close above $119,500 USD 122,000–$123,200 USD

🔽 Downward Breakout

Close below 117,750 and confirmed by volume at 115,700, then 114,000 USD

🔄 Consolidation

Inconclusive, continued sideways movement

Between $117,700 and $119,500 USD

✅ Summary

Bitcoin is still in a neutral symmetrical triangle formation but is approaching a turning point.

The RSI has broken out of the overbought range, and the MACD is signaling a potential upside breakout.

Volume confirmation is still lacking, but technical conditions favor the bulls – if it manages to break above 119,500 and hold above, a move towards 122,000–123,000 USD can be expected.

In the event of a rejection, maintaining 117750 will be key; breaking it opens the way to 115700 and below.

EURAUD: Rebound to 1.798 is high probabilityI am watching for a reversal here EURAUD as marked on my chart, expecting a rejection with a upside target at around 1.798.

This are is where it can become a decision point, either price finds support and bounces, or it breaks below, and that’s when we might see the move start to extend lower.

If we get a decisive move upside, my next area of interest is marked as T2. From there we can expect either potential accumulation or another reaction, depending on broader market sentiment at the time.

Just sharing my thoughts for the charts, this isn’t financial advice. Always confirm your setups and manage your risk properly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

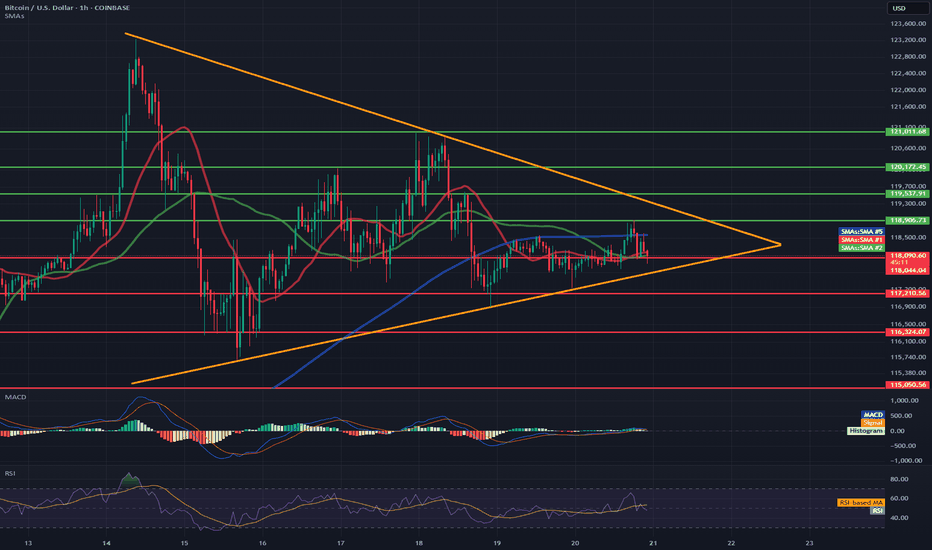

BTC/USD Short-Term🔷 Pattern: Symmetrical Triangle (Consolidation)

The price is inside the triangle formation (orange lines) and is approaching its completion.

An impending breakout (up or down) is highly probable within the next few hours.

📉 Support Levels (red lines):

117.210 – local horizontal support.

116.324 – 115.050 – strong demand zone (potential target in the event of a downward breakout).

📈 Resistance Levels (green lines):

118.900 – 119.700 – local resistance zone.

121.011 – 121.813 – higher target in the event of an upward breakout from the triangle.

📊 Technical indicators:

✅ RSI (Relative Strength Index):

Currently: 69.05 – close to overbought levels, but not yet at an extreme.

Potential for a short-term pullback unless a strong breakout occurs.

✅ MACD:

Signal lines are tightly intertwined, histogram flat → no dominant momentum.

Waiting for a breakout signal (bullish or bearish crossover).

✅ SMA:

Price currently below the 50 and 200 SMA for 1 hour → slight downward momentum.

The 50-SMA (red) is turning down, which may signal a continuation of the sideways or downward trend.

📌 Short-term conclusions (1–6 hours):

Scenario 1: Bullish breakout:

Confirmation: H1 candle close above 118,900.

Targets: 119,700 and potentially 121,000–121,800.

Scenario 2: Bearish breakout:

Confirmation: H1 candle close below 117,200.

Targets: 116,300, then 115,000–115,300.

📍 Watch for:

Breakout of the triangle boundaries with volume.

RSI behavior relative to the 70 level.

MACD crossover and histogram.

ETH/USDT 4H Chart✅ Market Trend and Structure:

Uptrend: The highlighted orange trend line shows continuous growth since mid-April. The price is trading above the 50- and 200-period moving averages (EMA and SMA), confirming bullish sentiment.

Current price: around 3556 USDT – very close to local highs.

Resistance break in the 3200–3300 USDT area, which now acts as support.

📈 Technical Levels:

Resistance (red horizontal lines):

3600–3650 USDT – local resistance resulting from market reaction.

3888 USDT – next historical resistance level.

4133 USDT – established long-term target (green dashed line at the top).

Support:

3300 USDT – strong support after a previous breakout.

3080 USDT – previous high, now the next support level.

3070 / 2900 USDT – key technical support levels in the event of a larger correction.

📊 Indicators:

MACD:

The MACD is in a strongly bullish zone, but:

The histogram is flattening.

A bearish crossover pattern is possible in the following candles – a signal of weakening momentum.

RSI:

RSI ~74 – is in the overbought zone, which often heralds a correction or at least consolidation.

A value above 70 confirms the bullish trend but may suggest that momentum is overheated.

📌 Conclusions and Scenarios:

🔼 Upside Scenario (trend continuation):

If the price remains above 3300–3350 USDT, it could move towards 3888, and then 4133 USDT.

A break above 3650 USDT on heavy volume will be a strong continuation signal.

🔽 Corrective scenario (short-term pullback):

The RSI and MACD suggest a possible correction.

Potential pullback to:

3300 USDT (retest of previous resistance as support).

SMA 200 (~2600 USDT) with a deeper downward move.

BTC/USD 1H ShortTerm🔍 Trend:

The short-term uptrend remains in effect, supported by the orange trendline.

The price has tested dynamic support but has not yet broken it.

🟥 Supports (Important Levels):

🔻 1. 119.550

Key support.

The price is currently testing it. Holding = potential upside rebound.

Breaking = greater downside risk.

🔻 2. 117.260–118.040 USD

Clear demand zone (reinforced by prior consolidation).

If the price breaks below current support, this is the next logical stopping point.

🔻 3. 115.237–115.500 USD

Strong weekly support – very important in the event of a stronger correction.

Historically, it has responded many times.

🟩 Resistance:

🔼 1. USD 121.673

The nearest local resistance – this could pose a problem for further growth.

🔼 2. USD 123.961

The last local high. Breaking it confirms the continuation of the uptrend.

🔼 3. USD 125.785

The next resistance – a potential target after a breakout to the upside.

📈 Technical Indicators:

RSI (classic):

Still below 50, but starting to reverse slightly upward – neutral with a slight potential for a rebound.

Stochastic RSI:

Gives a long signal – the lines have crossed in the oversold zone and are pointing upward.

📊 Scenarios:

🟢 Bullish:

Maintaining the current support zone (119.5–120k).

Breakout above 121.673 → target: 123.961.

Breakout of 123.961 = trend confirmation and target: 125.8k+

🔴 Bearish:

Break of the trend line and support at 119.550 → possible quick decline to 117.2k–118k.

If this doesn't hold, target: 115.2k

✅ Summary:

Decisive moment – tested trend line + support = rebound or breakout point.

The Stochastic RSI indicates a potential upside breakout, but the RSI needs confirmation.

Careful monitoring of volume and reaction to 120k in the coming hours.

MKR/USDT 4H Chart🔍 1. Technical Pattern:

The chart shows a descending wedge (orange lines) that has broken out upward.

The breakout occurred on increasing volume (a signal of bullish strength).

The price is currently trading above a resistance line, which is now acting as support (~1980 USDT).

📊 2. Support and Resistance Levels:

Support (red lines):

1903 USDT – local consolidation support.

1801 USDT – strong support at the previous bottom.

1727 and 1632 USDT – fallback zones in case of strong declines.

Resistance (green and blue lines):

2120 USDT – first target after the breakout.

2168 USDT – another strong resistance from the previous consolidation.

2312 USDT – high resistance, potential target if the uptrend continues.

📈 3. Indicators:

🔹 Stochastic RSI:

Close to the overbought zone, but not yet giving a sell signal.

A short consolidation or correction may occur in the coming hours.

🔹 MACD:

The MACD line is above the signal and the histogram is still rising – a buy signal.

No signs of weakening momentum.

🔹 RSI:

The RSI is rising, but not yet in the overbought zone (>70).

Shows the strength of the trend, but there is room for further upward movement.

🧠 Summary and scenarios:

✅ Bullish scenario:

If the price remains above 1980 USDT, the next targets are:

2120 USDT

2168 USDT

Potentially 2312 USDT with continued demand

⚠️ Bearish scenario (less likely at this time):

If the price returns below 1980 USDT and does not regain this level:

Possible return to 1903 or lower (1801 USDT).

LINK/USDT (Chainlink to Tether) from the 4H interval⚡️ Technical situation – quick overview

✅ Breakout from the descending channel (purple lines)

✅ Resistance zone 14.42 – currently being tested

✅ Target within the breakout range – around 17.73 USDT

⚠️ Stochastic RSI in the overbought zone – local correction possible

🟪 Descending channel – broken!

The descending channel that has been in place since mid-May has been broken upwards.

Such breakouts often signal a change in the local trend.

Theoretical range of movement = channel height (~3.30 USDT) added to the breakout point (around 14.42) = ~17.73 USDT – perfectly aligned with your resistance level.

🟢 Key Resistance Levels (green):

Level Meaning

14.42 USDT Current tested resistance – psychologically significant

15.65 USDT Local high + June price gap

17.73 USDT Potential target after a breakout – range from the formation

🔴 Support Levels (red):

Level Meaning

12.73 USDT Support from the pre-breakout consolidation

11.91 USDT Key defensive level of the uptrend

11.07 / 10.12 USDT Historical support with strong demand reactions

📉 Stochastic RSI (oscillator):

Currently deep in the overbought zone (above 80).

This may indicate local exhaustion of momentum and a short correction before further upward movement.

However: in strong trends, the RSI may remain high for an extended period – it does not automatically provide a sell signal.

📈 Bullish scenario:

Retest of the 14.42 level as support → confirmation of the breakout

Then a move towards:

15.65 – local stop

17.73 – final target from the channel breakout

🟩 Stop-loss: e.g., below 12.73 USDT (loss of key support)

📉 Bearish scenario:

False breakout and decline below 14.42

Loss of the 12.73 level → possible quick decline to 11.91–11.07

🔴 In this case, a new swing low could open the way to 10.12 USDT.

📌 Summary:

Element Rating

Technical Pattern ✅ Breakout from a descending channel (bullish signal)

Current Level ❗ Test of Key Resistance – Decision Point

RSI (Momentum) ⚠️ Overbought – Correction Possible

Upside Potential (Target) 📈 17.73 USDT

Threat ❌ False breakout and return to below 12.73 USDT

🧠 My suggestion (not investment advice):

Observe the price reaction at 14.42 – if it holds above and consolidation forms → a signal to continue.

If the 4H/1D candle closes below, consider caution, as this could be a bull trap.

ETH/USDT 1W Chart📊 Trend structure (Price Action)

Downtrend (historical):

A series of Lower Highs (LH) and Lower Lows (LL) — a classic downtrend.

Confirmed by the orange downtrend line.

A change in structure — a possible beginning of an uptrend:

A Higher Low (HL) has recently been formed after a Lower Low (LL).

Suggests a possible end to the downtrend and an attempt to break out upwards.

Currently:

The price is testing the upper downtrend line.

A breakout above the orange line may confirm a trend change.

🟢 Key Resistance Levels (Green Lines):

Level Meaning

3.058 USDT Potential target after a breakout from consolidation

2.767 USDT Nearest strong resistance - currently being tested

3.427 USDT Deep resistance level from the previous high (HH)

🔴 Key Support Levels (Red Lines):

Level Meaning

2.234 USDT Nearest support - previous breakout

1.883 USDT Early 2023 support

1.507 USDT Local bottom

1.204 USDT Historical support - LL extreme

📉 Stochastic RSI (Momentum Indicator):

Currently in the overbought zone.

This may suggest a short-term correction before an actual breakout.

However, in a strong uptrend, the indicator may "hang out" in the overbought zone for a long time.

📈 Potential scenario:

If the breakout above 2.767 and the orange trendline holds:

A possible move to 3.058 USDT as the first target.

Extended target: 3.427 USDT (HH).

If the breakout fails:

Correction to 2.234 USDT or lower.

There is a risk of returning to a downtrend.

✅ Bullish signals:

Higher Low (HL) formation after Lower Low (LL).

Testing the upper downtrend line with an attempt to breakout.

Volume is increasing (based on candles).

⚠️ Bearish threats:

Stochastic RSI in the overbought zone.

Breakout not confirmed by 100% (needs a weekly closing candle above 2.767).

Resistance at 3,058 could halt the move.

📌 Conclusion:

Ethereum (ETH) could be on the cusp of a new uptrend, but a breakout above 2,767 USDT is needed for confirmation. If it does, a move to 3,058 and then 3,427 is possible. However, the current overbought level on the Stochastic RSI could signal a short-term correction before the trend gains strength.

Is BTC getting ready for a new ATH?🔍 1. Key Support and Resistance Levels (Horizontal Lines):

🟢 Resistances (Green Lines):

114,295.54 — strong resistance resulting from previous highs.

112,767.65

111,009.00

110,685.35 — current key level that price may try to retest after a potential breakout.

🔴 Supports (Red Lines):

108,496.55 — current level being tested, also coinciding with local resistance from the past.

107,687.57

105,888.74

102,909.85

100,848.07

98,208.22 — strong long-term support; in the past, this level was reacted with a strong bounce.

🔶 2. Downtrend channel marked with orange lines:

The upper downtrend line acted as resistance.

The lower uptrend line acted as support.

The price recently broke above the upper line, but is now testing it again - this could be a retrospective retest.

➡️ If the close of the H4 candle is above this line - a possible confirmation of the breakout.

📊 3. Stochastic RSI indicator (at the bottom of the chart):

Currently in the uptrend phase after a bounce from the oversold level (<20).

The %K line (blue) is crossed upwards by the %D line (orange) - a bullish signal.

Still below the overbought zone, which suggests that the potential uptrend still has room to develop.

🧠 4. Market structure and price action:

Price broke above the 108.496 level, but is currently struggling to stay above this zone.

A retest of the broken triangle could be a healthy move, provided that support is maintained in the 108k–107.6k area.

A break below and a close below 107.6k could mean a false breakout and a possible decline towards 105.8k or even 102.9k.

🧭 5. Possible scenarios:

✅ Bullish scenario:

Maintaining the 108.496 level and closing the candle above the upper orange line → continued growth.

The nearest targets are:

110.685 (first resistance),

111.009 and 112.767 next.

❌ Bearish scenario:

The price will not stay above 108k and will fall below 107.687.

Possible return to the previous consolidation range with the target:

105.888,

and then 102.909 or 100.848.

🧮 Summary:

Currently, the decisive moment is underway: a test of support after breaking out of the convergent triangle.

The Stoch RSI indicator gives a bullish signal, but the price must confirm the movement by behaving above 108k.

Retest and bounce - this is a bullish scenario.

A breakdown and return under the trend line - means that the breakout was false.

ETH/USDT 1D🔍 ETH/USDT - technical analysis (1D interval):

📉 Price: 2478 USDT (-4.36%)

🔧 Resistance:

• SMA 200 (green): ~ 2589

• Resistance zone: ~ 2715 → 2880 USDT

• SMA 100 (blue): ~ 2500 (just rejected)

🔧 Support:

• SMA 50 (red): ~ 2434 - currently tested

• Strong support: 2373, 2314, 2223 USDT

📊 indicators:

• MacD: freshly intersected, but the momentum is weakening

• RSI: ~ 45 - neutral/weak, under 50 (no bull strength)

• Trend: Still in the downward channel (yellow trend lines)

⸻

⚠️ Conclusions:

• Price rejected from 2500 (SMA 100) and flies down.

• If 2434 falls, a further discount is possible to 2373–2314.

• Lack of bulls with key resistance - the inheritance scenario dominates.

• Watch behavior at 2434 - this is now a key level.

BNB/USD (4h interval)🔍 1. Chart structure

Instrument: Binance Coin / USD (BNB/USD)

Interval: 4 hours

📐 2. Technical formations

🔸 Breakout from the descending wedge formation

The descending wedge (orange lines) is a bullish formation - it suggests a potential breakout upwards.

The breakout occurred dynamically, with a large breakout candle (confirmation of the formation).

The goal of breaking out of the wedge is usually the height of the entire formation - this is marked with an orange arrow.

📈 Breakout range (target): around $697–710

🟢 Potential next targets:

697.83 (local resistance/projection result)

710.73 (main wedge height projection)

728.12 (strong resistance from history)

📊 3. Supports and resistances

🟥 Support zones (red rectangles):

$648.5–637.5 – previous resistance, now tested as support after the breakout.

$608.5–592.5 – strong support from previous lows.

🔼 Currently, the price has tested the upper support zone (648–637), reacted positively and continues to move up.

🟩 Resistance levels (green horizontal lines):

679.88 USD – local resistance, first target after breaking out of the wedge.

697.83 USD – projected range from the formation.

710.73 USD – full technical range of the breakout.

728.12 USD – strong resistance from history, may be a long-term target.

📉 4. Trends and support lines

Purple upward trend line – currently the price is above, which confirms the short-term upward trend.

Its break may lead to a retest of 648–637 USD.

Only below this zone can a larger correction be considered.

📈 5. Stochastic RSI indicator

Currently in the overbought zone (above 80).

Possible temporary cooling – signal for local correction / consolidation.

It is worth waiting for the indicator to go down to around 20 to re-enter the long.

✅ 6. Scenarios

🔼 Bullish (base) scenario:

Staying above 648–637 USD.

Maintaining the uptrend line.

Continuation to 679.88 → 697.83 → 710.73.

🔽 Bearish scenario:

Breaking the purple trend line.

Returning below 648 USD → going down to the 608–592 zone.

Negation of the breakout from the wedge.

📌 Final conclusions

Breaking out from the descending wedge is a strong pro-growth signal.

The price behaves in accordance with technical analysis, testing the previous resistance as support.

Currently, the retest and consolidation phase is underway – maintaining the trend line and the level of $648 will be key.

The medium-term target is $697–710.

XRP/USD – Technical Analysis (1D)📊 XRP/USD – Technical Analysis (1D)

Current Price:

• Buy: 2.1554 USD

• Sell: 2.1553 USD

⸻

🧭 Trend & Structure

• Price is moving within a rising channel (orange lines).

• It’s currently trading closer to the lower trendline, suggesting potential support.

Resistance Levels (green lines):

• 2.3197

• 2.4404

• 2.5570

• 2.7300 (channel top)

Support Levels (red lines):

• 2.1467

• 2.0461

• 1.8772

• 1.7444 (key support)

⸻

📈 Indicators

RSI (Relative Strength Index)

• Hovering around the 50 level → neutral momentum.

• No strong divergence observed – RSI is moving with price.

Stochastic Oscillator

• %K has crossed %D upward → short-term bullish signal.

• Nearing the overbought zone (above 80) → a pullback could occur soon.

⸻

📌 Interpretation

• Price is testing the 2.15–2.16 zone, which has acted as both support and resistance in the past.

• A break above 2.32 could open the door toward 2.44 and 2.55 USD.

• A drop below 2.04 USD could lead to retesting 1.87 or even 1.74 USD.

• Overall trend: neutral to bullish, supported by the rising channel.

🎯 Trading Ideas

• Long Entry: Break and close above 2.32 USD with volume → targets: 2.44 / 2.55

• Short Entry: Breakdown below 2.04 USD → targets: 1.87 / 1.74

BNB/USDT 1D🕵️♂️ General context

• Steam: BNB/USDT

• Price: 649.52 USDT

• Time: 1D (daily interval)

• Currently, the reflection is underway after the inheritance, but the technical situation remains uncertain.

⸻

📈 Trend and market structure

• You can see a previous strong drop (visible long red candles).

• Currently, reflection is underway to the level of technical resistance (approx. 650–672 USDT).

• A medium -term inheritance trend is still in force - marked with an orange interrupted line of decreasing (inheritance) trend.

⸻

📊 Technical levels

🔹 Opora (green levels):

1. 651.01 USDT - the first tested resistance (current price right next to it).

2. 672.68 USDT - another resistance, above SMA (2), historically strong level of sales.

3. 700.81 USDT - strong psychological and technical level, tested in the past.

🔻 Support (red levels):

1. 636.40 USDT - short -term support (price maintaining just above this level).

2. 625.65 USDT - key support - if it is broken, a possible test of lower levels.

3. 607.62 and 595.27 USDT - subsequent support, where purchases appeared earlier (Long Knoty).

⸻

📉 Technical indicators

🔵 MacD

• Histogram comes out of red - a potential signal of Momentum change to upward.

• The MacD line begins to turn up to the signal line - possible Bullly Crossover soon (buy signal).

🟣 RSI

• RSI oscillates around line 40-50-it is a neutral zone with a slight tilt down, but RSI-Based has a possible reflection.

• Lack of purchase or sale - suggests that traffic can go both ways.

⸻

🔃 Medium walking (SMAS)

• The price is tested by several medium (green, red, blue line):

• SMA (1) and SMA (5) are similar and flat - no clear short -term trend.

• SMA (2) acts as a strong resistance at 672 USDT.

• Need to break out over 672.68 to recognize that the trend can turn around.

⸻

✅ Applications - technical scenarios

🔼 Bullish (upward) scenario:

• Crossing the level 651–672 USDT and closing the daily candle above.

• Confirmation by RSI> 50 and MacD crossover.

• Target: 700–710 USDT.

🔽 Bearish (inheritance) scenario:

• Price rejection with current resistance and descent below 636 → 625 USDT.

• If 625 falls, a possible drop in around 607/595 USDT.

• RSI may then fall into the sale zone.

⸻

🧠 Neutral / swing strategy

• Currently, the market in potential consolidation between 625 and 672 USDT.

• You can consider:

• Buying at the lower consolidation limit (625–636) with a stop-loss below 620.

• Short or Take Profit at the upper limit (670+) until it breaks out.

Eur/Jpy breaks the previous🔍 Key Observations:

Supply Zone (169.713):

Price is approaching a marked supply zone, where sellers previously stepped in with strong momentum. This zone could act as a resistance area, potentially rejecting price downward.

Previous Low Break:

The structure shows that price broke below a previous low, indicating bearish pressure and a possible shift in market sentiment.

Demand Zone Below (~168.700):

There's a strong demand zone marked below the current price, which may serve as a target for short sellers or an area for bullish entries if reached.

Projected Move (Orange Arrows):

The orange path suggests a potential move:

Price may first retest the supply zone around 169.713.

A rejection from that level could trigger a downward move, breaking recent support levels.

The price may bounce slightly midway before continuing the drop toward the demand zone.

RSI Indicator (Relative Strength Index):

Currently at 54.80 (blue line), the RSI is nearing overbought territory but not yet extreme. This leaves room for a bit more upside before a potential reversal, aligning with the idea of testing the supply zone first.

SOL/USD🔹 Trend direction

Current short-term trend: down

Price below key moving averages:

SMA50 (green) ≈ 154.84

SMA200 (blue) ≈ 168.79

Price ≈ 142.49 – below both, confirming weakness.

🔹 Supports and resistances (key levels)

✅ Supports:

142.00–143.50 – current level where price is struggling (multiple price reactions).

131.00 – strong support, last low (June 18).

119.00 / 116.00 / 113.00 – next supports from previous consolidations.

95.61 – deep support if market breaks down.

❌ Resistances:

148.00–150.00 – local resistance, coinciding with the red SMA (short-term resistance).

154.84 – resistance (SMA50).

162.00 – resistance (SMA200).

183.00 – main resistance from the May peak.

218.55 – very strong resistance from March.

🔹 Technical indicators

📉 MACD:

MACD line < signal, negative histogram → bearish signal.

No signs of bullish strength.

📉 RSI:

RSI ≈ 41.31 – close to the oversold zone, but not there yet (below 30).

RSI trend also downward.

🔹 Formations and trend lines

Broken support line after the April-May bullish structure (white trend line).

The previous bearish trend line (yellow) was broken in April, but the momentum did not hold.

A lower high and lower low may be forming now – a classic bearish structure.

🔹 Potential scenarios

🔻 Bearish:

Breakout of 142 → test of 131 → possible drop to 119/116.

Staying below SMA50 and MACD still negative = high chance of continuing declines.

🔼 Bullish:

Recovery of 148–150 needed → only then a chance to test 154 and SMA50.

RSI close to oversold = possible local technical bounce, but not reversing the trend.

📌 Conclusions / Summary

General trend: Bearish (down).

Sentiment: Negative, no confirmed signals of strength.

If level 142 breaks - next test will be at 131.

A strong breakout above 150-154 is needed to talk about a change in structure.

BTC/USD 1D Chart📊 1. Technical formation: Downtrend channel marked with orange lines

Upper trend line (resistance): ~108,200 – 110,000 USD

Lower trend line (support): ~98,455 – 97,000 USD

➡️ Such a formation usually ends with a breakout. The direction of the breakout will be key – currently, the price is testing the upper resistance line.

💵 2. Support and resistance levels

📈 Resistance:

108.202 – currently tested

112.037 – psychological level

114.816 – local top

📉 Support:

105.300 – SMA 50 + local support

103.424 – local lows

100.510 – key psychological support

98.455 – lower edge of the triangle

📉 3. Moving averages (SMA)

SMA 50 (green): currently as dynamic support (~105.300)

SMA 200 (blue): far below the price (~96.000), inactive in the short term

SMA 20 (red): price broke through it upwards – a signal of bullish strength

➡️ A bullish crossover took place between SMA 20 and SMA 50 → bullish signal.

📉 4. MACD (Momentum)

MACD line is approaching the intersection with the signal line from below.

The histogram is becoming less and less red → a potential intersection and a bullish crossover signal may occur any day now.

📉 5. RSI (Relative Strength Index)

Currently: 57.19

RSI is rising and approaching the overbought zone (70), but it is not overheated yet.

Exceeding 60 would be a signal of further bullish strength.

🔍 6. Volume and context

There is no volume marking on the candles, but:

The current bullish candle is strong and breaks through the key averages (SMA 20, 50).

This indicates buyer activity with technical support.

🟢 Bullish scenario (if a breakout occurs up)

A breakout above 108.200 with a close of the daily candle could open the way to:

112.037 (next resistance)

then even 114.816

🔴 Bearish scenario (false breakout)

A rejection from 108.200 and a drop below 105.300 → a possible return to:

103.424 or even 98.455 (lower triangle line)

SoFi Technologies (SOFI, 1D)On the daily chart, SoFi has broken out of its descending trendline, confirmed the breakout with a clean retest of the 0.618 Fibonacci retracement level at $12.33, and is now building upward momentum from this demand zone. This “buy zone” is acting as a launchpad for a potential mid-term move toward higher resistance levels.

Key Fibonacci-based upside targets:

– $13.48 (0.5 retracement)

– $14.64 (0.382 retracement)

– $16.07 (0.236 retracement) — within the defined target zone

– Extended target: $18.37 (1.0 Fibonacci projection)

Technical structure highlights:

– Breakout of multi-month downtrend + successful retest

– Price now trading above key EMAs (50/100/200)

– Volume expansion on bullish candles confirms demand

– Daily momentum favors further continuation toward the $14–$16 zone

– Premium supply zone above $16 may slow initial momentum but offers long-term potential toward $18+

Fundamental context:

SoFi is evolving as a vertically integrated fintech platform with strong brand recognition and growing user engagement across banking, investing, and lending services. As the company narrows losses and strengthens recurring revenue, investor interest in SOFI is growing — particularly as market appetite returns for high-quality fintech with path-to-profitability models.

The technical breakout is confirmed. As long as price remains above the $12.33–$12.50 buy zone, the bullish scenario remains valid with targets toward $14.64 and $16.07. A breakout above $16 would activate the full expansion toward $18.37 in the mid-term.

MKR/USDT (MakerDAO) on the 4H time frame🔷 1. Trend and market structure

🔸 Upward channel:

The price is moving in a wide, ascending channel (orange lines).

The lower line of the channel was last tested on June 22, 2025, which ended with a dynamic upward bounce.

The upper limit of the channel reaches around 2,450 USDT.

🕸️ Market phase:

In the short term, the market was in a downward correction phase within the uptrend.

Currently, we see a strong rebound from support - a new uptrend is possible.

🔷 2. Key horizontal levels (support/resistance)

🟥 Support:

1,637 USDT - local support (the lowest level of the red zone), almost tested at the bottom.

1,717 USDT - very technical support, tested several times.

1,800 USDT – psychological level and local consolidation.

1,901 USDT – last support peak, currently broken upwards.

🟩 Resistances:

2,003 USDT – current price level, currently tested as new resistance.

2,129 USDT – strong resistance from previous peaks.

2,264 USDT – previous swing high.

2,433 USDT – upper boundary of the channel and technical level from historical peaks.

🔷 3. Price and candle behavior

Strong demand reaction at the lower boundary of the channel: long pin bar/bull's embrace at the lower boundary.

The upward movement was dynamic and uniform, which indicates high buyer activity.

If the price stays above 1,901 USDT – further increases are possible.

🔷 4. Technical indicators

🔁 Stochastic RSI (4H):

Currently in the overbought zone, just below the level of 100 - a temporary correction or consolidation may occur.

However, with a strong upward trend, Stoch RSI may "stick" to the upper band - it does not yet give a clear S/S signal.

🔷 5. Technical scenarios

🟢 Bullish scenario (continuation of growth):

Condition: maintaining the level above 1,901 USDT.

Targets:

TP1: 2,129 USDT

TP2: 2,264 USDT

TP3: 2,433 USDT (upper limit of the channel)

Stop-loss: below 1,800 USDT

🔴 Bearish scenario (rejection of resistance):

Condition: strong rejection of 2,003 USDT and return below 1,901

Targets:

TP1: 1,800 USDT

TP2: 1,717 USDT

TP3: 1,637 USDT

SL: return above 2,003 USDT

🔷 6. Final remarks

The current upward movement looks like a "V-shape reversal" reaction - a sharp turnaround with dynamic volume suggests strong buyer interest.

The key will be the reaction to 2,003 USDT - a breakout and retest can give a very good long entry.

Short positions are risky as long as the price is in the lower half of the ascending channel.

LTC/USDT chart technical analysis (1D)🔷 1. Trend and market structure

🔺 Main channels:

The chart is moving in an ascending channel (orange lines), the lower and upper limits of which have been respected since mid-2022.

The current price (around 78.3 USDT) is in the middle range of the channel, with a downward trend in recent weeks.

🔁 Market phase:

The price is in consolidation in a broader uptrend.

The last upward swing did not break through the previous peak (~135 USDT), which may indicate weakening momentum.

🔷 2. Key horizontal levels (support/resistance)

✅ Resistance levels (green lines):

83.46 USDT – the nearest resistance, currently being tested from below.

95.48 USDT – strong resistance from March-April 2024.

105.19 USDT – a level tested many times in the past.

110.00 USDT – a psychological level.

115.83 USDT – a local high from December 2023.

🛑 Support levels (red lines):

78.30 USDT – currently tested support level.

70.98 USDT – a key defensive level for bulls.

52.03 USDT – strong historical support.

39.78 USDT – the last line of defense, consistent with the lows from 2022.

📐 Dynamic support (orange line):

The lower boundary of the ascending channel – currently falls around 65 USDT and increases over time.

🔷 3. Technical indicators

📊 CHOP (Choppiness Index)

Oscillates near the lower values → the market is starting to leave the consolidation phase.

Potential directional movement soon, most likely downward (due to momentum).

📉 RSI (Relative Strength Index)

RSI below 50, currently around 40–45 → supply advantage.

Not oversold yet, but momentum is downward.

🔄 Stochastic

Well below 20, i.e. in the oversold zone.

Potential for a short-term bounce, but it can also go lower with a stronger sell-off wave.

🔷 4. Technical scenarios

🟢 Growth scenario (long):

Condition: Defending the level of 78.3 USDT and a quick return above 83.46.

Targets:

TP1: 95.48

TP2: 105.19

TP3: 115.83 (upper border of the channel)

SL: below 70.98 USDT

🔴 Bearish scenario (short):

Condition: Break 78.3 and retest as resistance.

Targets:

TP1: 70.98

TP2: 65 (lower channel line)

TP3: 52.03 (large accumulation zone)

SL: return above 83.46

🔷 5. Swing strategy proposal

Long

Entry 78.30–79.00

SL < 70.50

TP1 95.50 TP2 105.00 TP3 115.00

Short

Entry < 77.50 (ret.)

SL > 83.50

TP1 71.00 TP2 65.00 TP3 52.00

🔷 6. Additional comments

It is worth observing the price reaction at 70.98 USDT - this could be a capitulation level or a strong rebound.

The formation on the daily chart resembles a head and shoulders (H&S) - a warning signal for bulls.