Trend Analysis

EUR/USD: Risk OnEUR/USD Daily Setup: Riding Risk-Off into the 1.1050 Zone

Chart: Daily (showing 0.146–161.8% Fib extensions, supply/demand zones, trendline)

Analysis & Plan:

Macro Drivers: Fed/ECB rate divergence and yield spread keep USD bid; risk-off bias intact.

Key Levels:

Supply (short zone): 1.1636–1.1750

Invalidation: Daily close above 1.1800

Demand Targets:

1.1278 (100% Fib ext)

1.1056 (161.8% Fib ext + demand confluence)

1.0521 (“strong low” area)

Trigger:

Risk-On Break: Watch for rejection at 1.1589–1.1636; failure confirms fresh sell signal.

Trade Execution:

Enter Short near 1.1589–1.1636 on bearish price action / daily close below 20-day MA.

Stop-Loss: Above 1.1800 supply high.

Take Profits: Scale out at 1.1278, then final at 1.1056.

Rationale: Aligns Fibonacci confluence zones with macro USD strength and trendline support breaks.

Tags:

#EURUSD #Forex #Fibonacci #SupplyDemand #TechnicalAnalysis #TradingVie

SUSDT: trend in daily time frames ((((( Each of these entries can reach the main TARGET)))))

The color levels are very accurate levels of support and resistance in different time frames, and we have to wait for their reaction in these areas.

So, Please pay special attention to the very accurate trend, colored levels, and you must know that SETUP is very sensitive.

Be careful

BEST

MT

#Bitcoin DominanceWhat I said before is that Bitcoin dominance is in a pull back and the "NEW RSI" indicator also shows it on the daily time frame. Probably, considering the Fibonacci levels at 63%, this pull back is over and after the Bitcoin dominance continues to fall, the pump of altcoins like Ethereum and Ripple will continue.

XRPUSDT 4H – Pullback Into Support, But Will This Bounce Stick?XRP has retraced nearly 25% off its local highs after a powerful +90% move in July. Price is now pulling back into a well-defined demand zone around 2.85–2.88, which previously triggered the breakout impulse.

📌 What’s notable:

Clean retest of demand + price hovering above the final bullish structure

EMAs are overhead, but not yet fully bearish — a reclaim could flip short-term bias

The lower demand zone (~2.15–2.25) still stands as a last line of defense from the original rally base

This bounce attempt is key — a strong push from here could send price back toward the $3.30–3.50 region. But if bulls fail to hold, there’s room for a deeper retracement.

Trade Planning Notes:

Aggressive Long: Entry on wick into support with tight invalidation

Conservative Long: Wait for EMA reclaim confirmation

Bearish Case: Breakdown = target $2.25 zone

The path from here decides whether this is a healthy pullback — or the start of a reversal. What’s your play? 👇

Blue Boxes of ConsolidationIt seems the last two major moves on the chart (in the blue boxes) there was heavy consolidation for seven to 10 candlesticks, in this chart seven to ten weeks before a breakout. The bears now have a strong bearish candle but it is still in a consolidation pattern. The Bulls still have a trendline that held from April 2024 where price has not closed below it (please see SMA curve in black on the chart). If you turn on the 50 EMA price is still oscillating around it. And price is still in the Fibonacci golden zone. The bears need a bearish close with follow through below 12.40 and the bulls need a bullish close above 13.65 to hopefully kick off their party. The Bulls have a historical trendline and the Bears have a bearish MACD(Chris Moody) and a Braid filter that just flashed red and a recent strong bearish candle.

XAUUSD Weekly Outlook – August 4–8, 2025

The question isn’t whether gold is strong. The question is — will price expand, or rebalance?

🔸 Macro Overview

Gold begins the week consolidating just below its final HTF supply zone (3439), while USD weakens amid mixed macro data and growing speculation of future rate cuts. Markets await fresh catalysts, and gold’s recent impulsive rally is now facing the big test: break the wick, or pull back?

🔸 Weekly Structure & Bias

Element Observation

🔹 Trend Bullish continuation — clean structure

🔹 Last BOS March 2025 — impulsive, with imbalance below

🔹 Price Action Top wick rejection forming near 3439

🔹 Bias Still bullish, but entering exhaustion zone

🔹 RSI Above 70 — overheated

🔹 EMAs EMA5 > EMA21 > EMA50 > EMA100 — perfect trend

🔸 Key Weekly Levels (Zones + Confluences)

Zone Type Price Range Confluences

🔴 Supply 3350 – 3439 HTF wick supply + FVG + RSI 70+ + liquidity trap

🔵 Demand 3270 – 3215 Weekly OB + FVG + EMA21 support

🔵 Demand 3120 – 3070 Old BOS + deep FVG + psychological level

🟢 Support 3000 zone EMA50 + historical consolidation

🔸 Fibonacci Extensions (Above 3439)

Extension Level Price Target Confluences

1.0 (Swing Full) 3439 Supply wick high

1.272 3505 Next psychological milestone

1.414 3560 Mid-extension + liquidity

1.618 3610 Golden expansion target

2.0 3740 Full trend extension (max)

🔺 These levels serve as potential breakout targets ONLY if we get a confirmed weekly close above 3439 with clean BOS on LTF.

🔸 Weekly Scenarios

🟢 Scenario 1 – Break and Expand

If gold breaks 3439:

Expect clean continuation to 3505 → 3560 → 3610

Best entries come from new OBs on H4/D1 around 3350–3370

Follow momentum — but don’t chase without retrace confirmation

🔻 Scenario 2 – Rejection + Retracement

If price holds below:

Pullback toward 3270 – 3215 expected

EMA21 acts as dynamic support

If selloff gains strength, next demand = 3120 – 3070

🎯 This zone aligns with macro OB + re-entry for long-term bulls.

🔸 Conclusion & Gameplan

Gold is pressing against its final weekly ceiling.

Structure remains bullish, but every sniper knows — at the edge of premium, timing is everything.

✅ Above 3439 → expansion opens to 3505 → 3560 → 3610

🟦 Below 3439 → retracement into 3270 → 3215 → 3070

The best setups will be born from confirmation, not prediction. Let the market decide.

—

What would you do if 3439 rejects hard this week?

Comment your plan, tag your sniper level, and let’s stay ahead together 💬

—

With clarity, confidence, and perfect timing,

GoldFxMinds 💙

Disclosure: Analysis based on Trade Nation (TradingView) chart feed.

TON/USDT – Daily Price Action Analysis🔹 Price has broken a major descending trendline and entered an ascending channel.

🔹 Currently testing the mid-range resistance zone around $3.60 – $3.70.

🔹 If buyers hold above this area, the next targets could be $4.40 – $4.80.

🔹 If rejected, key supports are at $3.20 and $2.90.

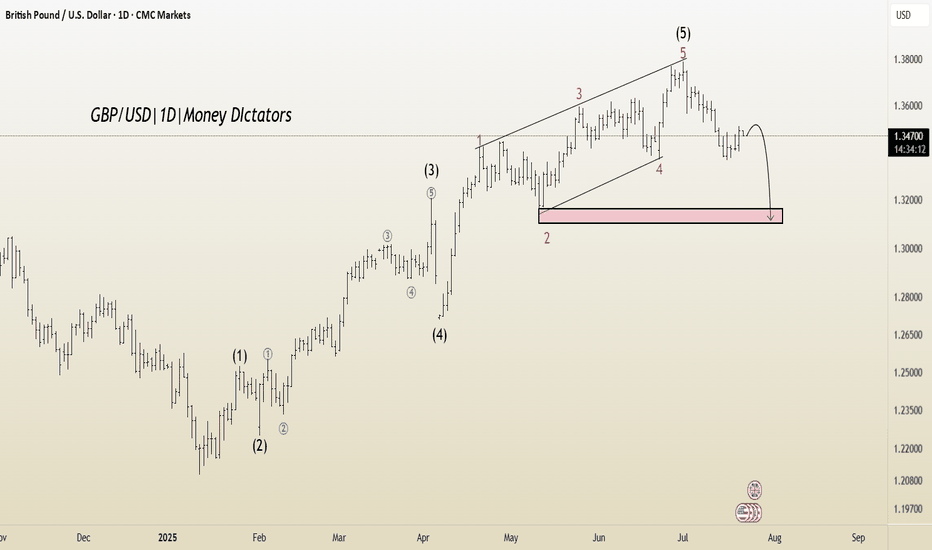

GBP/USD: Post-Impulse Sell Setup from Ending DiagonalThe chart depicts a completed 5-wave impulsive structure, culminating at the top of wave (5). The internal wave structure of the final fifth wave forms a classic ending diagonal pattern, typically signaling a trend reversal or deep correction.

After this extended fifth wave, the price has started rolling over, confirming the start of a corrective decline. The wave count now expects an ABC correction targeting the previous wave 4/2 demand zone, highlighted in red.

Target 1 (T1): 1.33608

Target 2 (T2): 1.32436

Stop Loss (SL): 1.35988

Ending diagonal at the top of wave (5) signals exhaustion of bullish momentum.

Clear bearish divergence (not shown here) is commonly seen with this pattern.

The price has broken the short-term structure and is now forming lower highs.

Target zone aligns with previous wave 2 consolidation – a typical retracement zone for post-impulse corrections.

CAD/CHF: Bearish Trend Resumes After Retest of Downtrend LineCAD/CHF continues to respect its prevailing downtrend, with price reacting from the descending trendline and showing signs of renewed bearish pressure. Fundamentals support further downside as CAD remains weighed by weak domestic data, while CHF holds steady as a safe-haven currency amid global tariff concerns.

Technical Analysis (4H Chart)

Trend: Strong downtrend structure, with repeated rejections from the descending trendline.

Current Level: 0.5829, consolidating after failing to break above 0.5863 resistance.

Key Support Levels:

0.5786 (near-term support and first bearish target).

0.5736 (secondary support and next major target).

Resistance Levels:

0.5863 (immediate resistance at descending trendline).

0.5910 (upper resistance if a breakout occurs).

Projection: Likely pullback toward 0.5863 (retest zone) before continuation to 0.5786 and possibly 0.5736.

Fundamental Analysis

Bias: Bearish.

Key Fundamentals:

CAD: Weak Canadian manufacturing PMI and trade risks from US tariffs limit CAD upside.

CHF: Swiss Franc remains supported by safe-haven demand amid tariff uncertainty.

Oil Prices: Stable oil offers partial CAD support but insufficient to change the broader trend.

Risks:

A sharp rise in oil prices could strengthen CAD.

Global risk-on sentiment could weaken CHF and lift CAD/CHF.

Key Events:

BoC policy updates.

SNB stance and global risk sentiment shifts.

Oil market data.

Leader/Lagger Dynamics

CAD/CHF is a lagger, following CAD’s performance relative to oil and CHF’s safe-haven flows.

Summary: Bias and Watchpoints

CAD/CHF remains bearish, with price respecting the downtrend and targeting 0.5786 initially. A break below this level opens the door to 0.5736. The key watchpoints are oil price fluctuations, global risk sentiment, and potential safe-haven demand for CHF.

127-128k incoming ( altcoins round ? )Hi, Bitcoin seems to have completed its short term Elliott wave 4 correction and the price action analysis also confirms that this time Bitcoin will be able to break the 120-119 resistance, I predict Bitcoin to make a new high around 127-128. Altcoins have not grown that much yet and if the price can make a reliable consolidation above 120k, altcoins will start to rise.

XAUUSD - Daily | More Consolidation??Gold is back in the upper range of this consolidation zone. You can see the high of the range is 3430, and the low is 3240 roughly.

Bulls:

Gold is pulling back into an Inverted FVG. If the price is bullish, then we should clear the gap with ease. Gold has just eliminated 4 days' worth of choppy bearish price action. Look for gold to give clear signs to enter a buy.

**A new daily candle should appear, creating a new FVG showing buyers are winning

Bears:

So with that said... If Gold fails to remain bullish after Friday's (Aug 1st) 700-pip jump, then the iFVG may have the price react bearishly. Watch for gold to give a clear sign of rejection before entering a sell

**Price may drop to cover Friday's gap. Doesn't mean it's bearish

Macro View on EUR/USDMonetary Policy Divergence

The Federal Reserve maintained its target federal funds rate at 4.25 – 4.50 percent, citing a resilient labour market and persistent inflationary pressures (Federal Reserve, 2025).

By contrast, the European Central Bank’s deposit facility rate stands at 2.00 percent, reflecting its earlier tightening cycle and more cautious approach to rate cuts (Federal Reserve Bank of St. Louis, 2025).

Inflation Differential

U.S. headline CPI rose 2.7 percent year-on-year in June 2025, with core CPI at 2.9 percent (U.S. Bureau of Labor Statistics, 2025).

Euro-area inflation was 2.0 percent in June, broadly in line with the ECB’s target (Eurostat, 2025).

Yield Spread

The 10-year U.S. Treasury yield hovered around 4.38 percent, versus roughly 2.4 percent on the bund, underpinning dollar strength (Federal Reserve Bank of St. Louis, 2025).

Growth Outlook

The U.S. economy continues to outperform, supported by robust consumption and a tight labour market.

Advanced-economy growth is projected at 1.4 percent in 2025, with the euro-area likely trailing, given headwinds from energy costs and subdued investment (International Monetary Fund, 2025).

Technical Structure

Downtrend in Place: Recent price action shows a break of the 20-day MA and loss of structure below 1.1700.

Supply Zone near 1.1750–1.1800 offers resistance.

Demand Zones at 1.1100–1.1200 and 1.0750–1.0850 coincide with long-term trendline support (see chart).

Outlook & Scenarios

Near-Term Bearish: Continued USD strength and fading risk appetite may drive EUR/USD toward the 1.1100 demand zone.

Medium-Term Range: If ECB signals a dovish pivot and U.S. data disappoints, expect a bounce into 1.1200–1.1400.

Key Pivot: A sustained break below 1.0750 would open targets toward 1.0200, the “discount” zone from late 2024.

References

European Central Bank. (2025, August 1). ECB deposit facility rate for euro area (ECBDFR) . FRED, Federal Reserve Bank of St. Louis.

Eurostat. (2025, June). Inflation in the euro area . ec.europa.eu

Federal Reserve. (2025, July 30). Federal Reserve issues FOMC statement. www.federalreserve.gov

Federal Reserve Bank of St. Louis. (2025, July 30). Market yield on U.S. Treasury securities at 10-year constant maturity . FRED.

International Monetary Fund. (2025, July). World Economic Outlook Update: July 2025. www.imf.org

U.S. Bureau of Labor Statistics. (2025, July). Consumer Price Index Summary – June 2025. www.bls.gov

EUR/USD Chart Summary (Bearish Setup):Trendline Break: A long-term bullish trendline has been broken.

Price below Ichimoku Cloud: Indicates bearish momentum.

Bearish Retest: Price pulled back to retest the broken trendline and is now forming a bearish continuation pattern.

Double Target Zones Identified:

1st Target Point: ~1.1329

2nd Target Point: ~1.1144

---

🟠 Suggested Trade Setup:

🔹 Entry (Sell):

Around 1.1585 (where price is hovering now; or on a small pullback).

🔻 Take Profit (TP):

🎯 TP1: 1.1329 (short-term target)

🎯 TP2: 1.1144 (main target if bearish momentum continues)

🛑 Stop Loss (SL):

Place above the recent swing high or cloud resistance — around 1.1670

---

📊 Risk-Reward:

TP1 = ~250 pips

TP2 = ~440 pips

SL = ~85 pips

This gives you a favorable risk-reward (1:3+ to TP

S&P 500 Daily Chart Analysis For Week of August 1, 2025Technical Analysis and Outlook:

During the trading activity of the previous week, the S&P 500 Index displayed a predominantly bearish movement after completing our Outer Index Rally target of 6420, as highlighted in the prior week’s Daily Chart Analysis, with the primary objective now being to plug our Mean Support at 6200.

It is essential to recognize that the current price movement may trigger a significant further pullback to the Mean Support level of 6090. Following this downturn, it is expected that the index will resume its upward momentum, aiming for a retest of the Outer Index Rally peak at 6420.

#SOL Update #7 – Aug 02, 2025#SOL Update #7 – Aug 02, 2025

Solana has broken below the low of its last impulsive move, forming a new, deeper bottom. The first area where it may find support is the $158 level. If this fails, the next support level lies at $147. At the moment, Solana is clearly in a downtrend on the 4-hour chart. For Solana to resume its upward movement and confirm a trend reversal, it needs to break above the $206 level with a strong, high-volume candle. Currently, Solana might be considered a cheap opportunity only for those looking to hold spot positions long-term. Otherwise, I don't see it as a suitable option for trading.

USDJPY Is Very Bearish! Sell!

Here is our detailed technical review for USDJPY.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 150.492.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 148.583 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

ITC 1D🔺 Triangle Pattern (likely Symmetrical/Ascending Triangle)

Current Price Zone: ₹416

Pattern Type: Likely Ascending Triangle (if higher lows are forming against a horizontal resistance)

Resistance Level: Around ₹416–420

Breakout Confirmation: Needs a strong bullish candle above resistance with significant volume.

📊 What to Watch:

Volume:

A genuine breakout should happen with above-average volume. Watch the 50-period or 20-period average volumes on daily or 1H chart.

Breakout Candle:

Should close above ₹420 ideally. A breakout without closing above resistance is risky.

Retest Possibility:

Sometimes, price may break out and retest the breakout level before continuing the uptrend. Don’t panic if it slightly dips and holds support near ₹416.

🎯 Target Levels After Breakout:

You can calculate the triangle breakout target like this:

Target = Height of triangle + Breakout point

Let’s assume the base of triangle is from ₹375 to ₹416 = ₹41 range

Breakout Target = ₹416 + ₹41 = ₹457

📌 Extended Target (Momentum-based): ₹475–₹500 zone

📌 If volumes + broader market support: ₹500+ is possible, especially in swing or positional setups.

📉 Invalidation (Risk Management):

If after breakout, price falls below ₹410–408 with volume, it could be a false breakout.

Keep a stop-loss below previous swing lows or support trendline.

🧠 Summary:

✅ Triangle breakout with volume = bullish confirmation

🎯 Targets: ₹457 → ₹475 → ₹500

❗ Risk zone: below ₹410

🔁 Retest is common before upmove continues

Disclaimer: The information provided is for educational and informational purposes only and should not be considered as financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results. Please consult with a certified financial advisor or conduct your own research before making any investment decisions. We are not responsible for any losses incurred as a result of using this information. Stock market investments are subject to market risks; read all related documents carefully.