Is Litecoin finally ready to pop for real this time? 1600% gainAs many of you have been, I'm watching crypto prices closely since the BTC jump to $123k, waiting for the next move. Well, today we see that move and the entire market is blood red, except for...

Litecoin.

The patiently waiting little brother of the "big 3", waiting for his time to grow up and shine. Well today I'm impressed, mr. Litecoin is the only green coin in my entire Watchlist.

Zooming in on the chart: there’s a clean, rounded cup and a crisp handle forming, and that handle looks like it’s already breaking out. If Bitcoin can hold the $112K level, I think this could be the start of some serious moves from LTC.

The perfect bull flag that's formed on the chart has good volume too.

That blue line coming down is a long term trendline, and price is consolidating above it.

Still thinking about that "1600%"?

If you zoom out, there's a massive descending wedge forming since 2014 (11 years!!!). If Litecoin finally breaks out of it, the first fib level (.236) is at .01275BTC, that's 1600% up from here.

We'll see.

Trend Analysis

XAUUSD H4 Update – The Battle Has Moved to 3350

“From deep demand to key supply. The next move is decisive.”

🔸 Sunday Plan Recap

Price was falling aggressively into the HTF demand zone (3265–3240).

The plan anticipated a bounce only if that deep zone held.

Above price, major zones included:

3314 – mid-structure

3330–3345 – supply zone

3368–3380 – final retracement targets

🔸 What Changed?

✅ The deep demand zone worked — H4 CHoCH bullish was confirmed.

✅ Price climbed through 3285 and 3314, confirming a retracement leg.

🔥 Now, price sits at 3349.57, testing the same supply zone marked in Sunday’s plan (3330–3345).

🔸 Current H4 Structure

🔼 Short-term bias = bullish retracement

📍 Price = inside HTF premium zone

📈 EMAs aligned bullish (5/21/50), confirming short-term momentum

💡 RSI = approaching overbought

⚔️ Liquidity above 3355, trapped shorts below 3314

🧠 Today’s Battle Plan (August 1)

🔴 Sell Zone (live) – 3345 to 3355

Price just entered the key H4 supply zone. Watch for rejection signs:

Bearish confirmation needed (e.g. M15/M30 CHoCH or engulfing)

If confirmed → downside targets: 3314 → 3285 → 3265

High RR short only if structure confirms

🔵 Breakout Bullish Case

If 3355 breaks with a clean body + HL at 3340 → bullish continuation active

Next upside target: 3368 → 3380

🧭 Final Thoughts

We’ve reached the exact decision zone from Sunday’s plan.

The market will now reveal: retracement over... or breakout coming?

Patience is key — this is a high RR zone, but only if structure reacts.

💬 Did you catch the move from deep demand? Or waiting for confirmation here at supply?

📈 Share your thoughts in the comments and let’s break it down together.

🔔 Follow for real-time market insights, sniper plans, and structured trading logic you can trust.

❤️ Like if you enjoy clean, actionable updates🚀🚀🚀

🔁 Share with traders who love structure over noise

📉 Price data from Trade Nation feed

NZDJPY Will Go Up! Buy!

Here is our detailed technical review for NZDJPY.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 87.264.

Taking into consideration the structure & trend analysis, I believe that the market will reach 88.444 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Dot/usdtPolkadot (DOT) cryptocurrency is showing potential for growth from around the $3.40 level.

If the price moves upward, it could potentially reach $5.20, $8, and even $12.

This analysis remains valid as long as the support level at $3.10 holds and no lower low is formed.

Please note: This analysis involves risk. Make sure to apply proper risk management.

VIX: From “Calm Tension” to a ReboundWhy does a small uptick matter today… if we’ve already seen 60+ readings four times in the past 17 years?

The first week of August 2025 brought back a familiar market force: volatility.

The VIX, which tracks expected fluctuations in the S&P 500, jumped 21% in just a few days, rising from 17.4 to 20.37, with an intraday high of 21.9 on August 1.

At first glance, the move may seem minor. But it broke through key long-term moving averages (SMA 50 and 200) and exited its recent comfort zone (14–19 pts). That alone is enough to make portfolio managers and traders pay attention again.

🔙 Historical context: when the VIX truly spiked

📅 Date 🔺 VIX intraday 🧨 Trigger

Oct 1, 2008 96.40 Subprime mortgage crisis, Lehman collapse, AIG bailout

Mar 2, 2020 85.47 COVID-19 global spread, border shutdowns

Aug 5, 2024 65.73 Surprise Fed rate hike + overheated jobs data

Apr 7, 2025 60.13 Panic over new U.S. tariffs on global partners

Compared to those moments, today's VIX levels look “mild.” But the technical and macroeconomic signals suggest that volatility may be establishing a new baseline.

1. 📊 Breakdown: First week of August 2025

Weekly increase: from 17.4 → 20.37 (+21%).

Technical breakout: monthly close above both the 50-day and 200-day simple moving averages (SMA 19.25 and 19.45).

MACD on the monthly chart has flipped positive for the first time since March 2023.

Key drivers:

🏛️ The Fed left interest rates unchanged on July 30, but two dissenting votes favored a rate cut.

👷♂️ Softening jobs data: July NFP came in at only +73,000 jobs (vs. +110,000 expected).

🧾 New U.S. tariffs, announced on August 1, reignited inflation concerns.

2. ⚖️ Comparing August 2025 to the August 2024 storm

Factor August 2024 August 2025 (Week 1)

🔺 VIX peak 65.73 21.9

🏛️ Fed stance Surprise 25 bp rate hike Rates unchanged, internal division

👷 Labor market Hot, wage pressures Cooling down

📉 S&P 500 reaction −12% in 3 weeks Approx. −3% decline underway

💧 Market liquidity Very low (pre-market) Normal

Conclusion:

2024 was a systemic shock.

2025 is more of a volatility warning sign—but one that matters for risk management.

3. 📍 Technical signals to monitor

The monthly MACD just turned positive, which historically precedes sustained volatility spikes.

Key short-term range: 18–22 pts. A sustained close above 22 could trigger heavy selling in high-beta stocks.

Options expiration (OPEX, Aug 16) may amplify moves via gamma flows.

4. 🔮 What could move the VIX next?

📅 Date 📌 Event ⚠️ Volatility Risk

Aug 14 Core CPI (July) Reading above 0.3% m/m could reignite hawkish Fed bets

Aug 22–23 Jackson Hole Symposium Powell’s speech could reset the policy outlook

End of Aug Q2 GDP revision Confirm whether slowdown = soft landing or stagflation

📌 Note: The VIX cannot be traded directly. Exposure is typically obtained through futures, options, or ETNs—each with specific risks like contango, low liquidity, and roll decay.

📌 Final thoughts

The VIX doesn’t need to hit 60 to send a message.

The fact that it’s breaking above long-term averages, reacting sharply to macro data, and threatening key levels is enough to suggest that the era of ultra-low volatility may be ending.

History shows us that major VIX spikes come fast and unannounced.

If you remember 2008, 2020, or even April 2025—you know that preparation beats prediction.

CAKEUSDT 1D#CAKE broke above the ascending triangle resistance, but due to Bitcoin's drop, it pulled back inside the triangle.

📌 If you're looking to enter, consider placing a buy order near the support level at $2.439.

In case of a bounce and a breakout above the triangle resistance, the upside targets are:

🎯 $3.106

🎯 $3.581

🎯 $4.186

⚠️ As always, use a tight stop-loss and apply proper risk management.

PI in Full Bear Control as Aroon Down Hits 100%PI continues to flash warning signs as technical indicators lean heavily bearish. Most notably, the Aroon Down Line on the daily chart has surged to a reading of 100%.

For context, the Aroon indicator is designed to identify the strength and duration of a trend, and when the Down Line reaches the 100% mark, it typically signals that a recent low was recorded very recently — often within the past day or two.

This kind of reading reflects an aggressive downtrend, where bearish momentum dominates and sellers are in full control.

Correction will be to 6050-6190, probably the upper limit Now I notice something very important and things and the analyses of many actually coincide. Monthly support from the accumulated volume lies between 6050 and 6170. 4h indicators show a clear reversal. Separately, at these levels are the previous ATH. In my opinion, it is possible to stop even at 6180-6190. We will probably start with a gap on Monday. Now here comes the moment and over the weekend what will take place as conversations and statements in the media, but it is very likely that the minimum could happen as early as Monday night (USA time) or by Tuesday. I agree that this correction was necessary and should have happened as soon as possible because things became difficult even for bulls like me.

JUSDT Short-Term Retrace vs Long-Term UptrendJST is not trading at bottom prices because the low was hit November 2022, but the bigger picture still looks like a long-term consolidation pattern. Sideways for years, this precedes a major bull market.

Good morning my fellow Cryptocurrency trader, I hope you are having a wonderful day.

JSTUSDT is looking weak short-term but we know this to be part of the same process, the one that has been going on for years. Higher lows and higher highs but still no major bullish wave, it is getting closer though because the market can only consolidate for so long.

JST has been rising. The high December last year (2024) hit the highest prices since March 2022, the month when the previous bear market breakdown took place.

The red period is the bear market. Notice how it ends when the downtrend is no more and the market turns blue, sideways. After this period comes green and this is where we are now.

Within the bullish period we also have retraces and corrections. Right now we have a bearish move, short-term, within a wider bullish move, an uptrend long-term. This is the normal and classic market fluctuations; prices moving down and up, up and down, back and forth, every day.

The end of the short-term move will result in the continuation of the bigger move, the uptrend. We should expect a higher low followed by a strong higher high next. The next higher high comes in late 2025, now.

Thank you for reading.

Namaste.

$BTC /USDT – Breakdown from Channel, Bears Gaining ControlBitcoin has broken down from its descending channel on the 4H chart after repeated rejection from the upper trendline. Price is now hovering near key support at $111,785.

Key Technicals:

Rejection from the descending trendline resistance

Breakdown of the mini-channel structure

Current price: $113,637

Support levels:

$111,785 (Immediate)

$106,057

$101,409

$98,398

Bearish continuation is likely if $111,785 breaks with volume

If the $111.7k zone fails to hold, BTC could see further downside toward $106k and even $98k in the coming sessions.

Invalidation: Bullish only on reclaim of $117K+ with strength.

DYOR | Not Financial Advice

$TOTAL at Key SupportThe crypto market cap has just bounced off a strong support zone around $3.67T, right where it aligns with the rising trendline.

This area has held firm before, and it's doing the same now.

If it continues to hold, we could see a nice recovery.

But if it breaks down, there’s a risk of more downside ahead.

Ethereum Short-Term · Trading within Bullish RangeI am looking at Ethereum short-term using the same timeframe I used for Bitcoin, 2h. We have some interesting signals.

Here ETHUSDT is trading within higher lows. This is interesting because Bitcoin produced a lower low recently. The same volume signal is present here, ETHUSDT has been producing lower bearish volume since last month.

The RSI produced a lower low while ETHUSDT produced a higher low. This is called a hidden bullish divergence. Ethereum's bears did not only fail to take out the last low 24-July but also the previous one, and this clearly reveals bullish support.

The RSI being oversold is also a positive condition and can signal a reversal happening soon. Not truly a reversal because we are not in a downtrend, we are still witnessing a small pause after a strong rise; consolidation near resistance. A continuation reads better.

Ethereum's price continues really strong and the short-term signals are pointing to bullish action being favored in the coming days. We can wait easily and patiently because the best is yet to come. Never SHORT in a bull market, the market will surprise you with how fast things can turn. Better wait for support and go LONG.

Namaste.

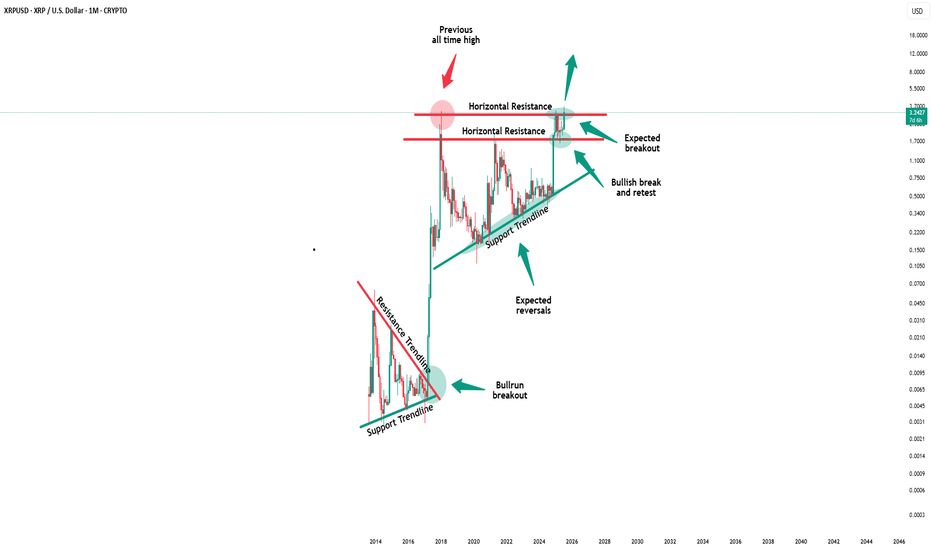

Xrp - This is the bullrun breakout!🔑Xrp ( CRYPTO:XRPUSD ) breaks the triangle now:

🔎Analysis summary:

After the recent bullish break and retest, Xrp managed to already rally another +100%. This is a clear indication that bulls are still totally in control of cryptos and especially Xrp. It all just comes down to the all time breakout, which will then lead to a final parabolic rally.

📝Levels to watch:

$3.0

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

EURUSD BUYING CORRECTION AND SHORTThe price is now at a strong support level and if it can be a double bottom it will retest the descending channel line and reach the orange resistance, but in the general direction the price prefers to fall due to breaking the black uptrend line. We also have a more beautiful scenario, which is if it can break the strong support we will go with the downward trend.

Momentum Continuation after Structural BreakdownHey Candle Fam,

We’re eyeing a clean short setup on SOL after structure broke down and buyers failed to hold key levels. Time to fade the bounce and let the market do the work.

🔥 SOLUSDT.P TRADE IDEA 🔥

Bias: Short

Strategy: Momentum Continuation after Structural Breakdown

Entry: 169.50 – 171.80

Stop Loss: 174.60

Take Profits:

▫️ TP1: 165.10

▫️ TP2: 161.30

▫️ TP3: 158.00 (extension target)

⸻

📊 Rationale:

– HTF structure: Sharp retracement from $215 top, lower highs forming

– LTF structure: Breakdown confirmed, no bullish CHoCH present

– Liquidity targeting: Clean sweep zones below $165 and $160

– Order flow: Sell-side delta dominance, funding positive = longs could unwind

– Volume profile: Imbalance between $172–175 now acting as rejection zone

🎯 Idea: Look for a minor pullback to $170–172, then ride downside liquidity flush. Protect profits fast if market spikes unexpectedly.

⸻

🧠 Stay sharp. Trade smart. Let the market come to us.

Candle Craft | Signal. Structure. Execution.

AMZN: The Battle for Direction at a Critical JunctureThe recent price action for Amazon (AMZN) is currently navigating a critical juncture, having pulled back from a significant resistance level and now consolidating within a pivotal "Deciding Area." A detailed review of the key technical levels reveals the following insights:

Key Resistance ($240): A formidable resistance zone is established around the $240 price point. This level represents a major overhead supply area, where prior selling pressure has been strong enough to halt upward price movements on multiple occasions. A decisive breach of this level on strong volume would be a highly bullish development, signaling a potential move to new highs.

Key Support Level ($200 to $205): A robust support zone is identified between $200 and $205. This level has historically served as a strong price floor, absorbing selling pressure and providing a foundation for subsequent rallies. The integrity of the current uptrend is heavily dependent on the price holding above this critical area.

Market Structure Shift (MSS): The formation of a "Market Structure Shift" earlier in the year was a pivotal technical event. This change in market dynamics marked a significant transition, signaling a potential reversal from a prevailing downtrend to the current bullish phase. The subsequent rally from the lows validates this structural change.

Anchored VWAP: The Anchored Volume-Weighted Average Price (VWAP), anchored from the most recent major low, is serving as a dynamic and trend-defining support level. This indicator reflects the average price paid by investors since the start of the current trend. A sustained close below this line would be an early warning sign of weakening momentum.

Deciding Area: The stock is presently trading within a "Deciding Area" situated just below a previous swing high. This zone represents a period of consolidation and indecision as the market digests the recent pullback from resistance. The outcome of this consolidation will likely dictate the short-term directional bias. A break to the upside would suggest a renewed attempt to challenge the $240 resistance, while a breakdown would likely lead to a retest of the primary support level at $200-$205.

Summary of Outlook: The overall technical picture for AMZN indicates that the stock is at a critical inflection point. The health of the underlying uptrend remains intact as long as the price holds above the key support levels and the Anchored VWAP. A definitive move out of the "Deciding Area" will provide the next clear signal for either a renewed push toward resistance or a deeper pullback to test established support.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

“Exactly What I Saw” promises value and transparency.

In today's analysis, I’ve identified a clear completion of Wave D, securing a 3% ROI across just two trades – all before the move unfolded.

🔍 What’s inside this breakdown?

• Multi-timeframe analysis: Weekly ➝ Daily ➝ 4H ➝ 1H

• Elliott Wave structure with confluence zones

• Trade psychology at key turning points

• Exact entry & exit insights explained

• Risk management for consistent returns

---

⚡ Highlights:

Precise reversal spotted before it was obvious

No indicator clutter – just clean, confident price action

Part of my 100-day breakdown series: real, raw, and repeatable setups

---

👣 Day 7 of 100 is just the beginning.

Tap Follow to stay ahead of the market – one wave at a time.

#EURUSD #ForexAnalysis #ElliottWave #Forex #TradingViewUK #SwingTrading #PriceAction #RiskReward #FXMindset #ForexTradersIndia #ForexEducation