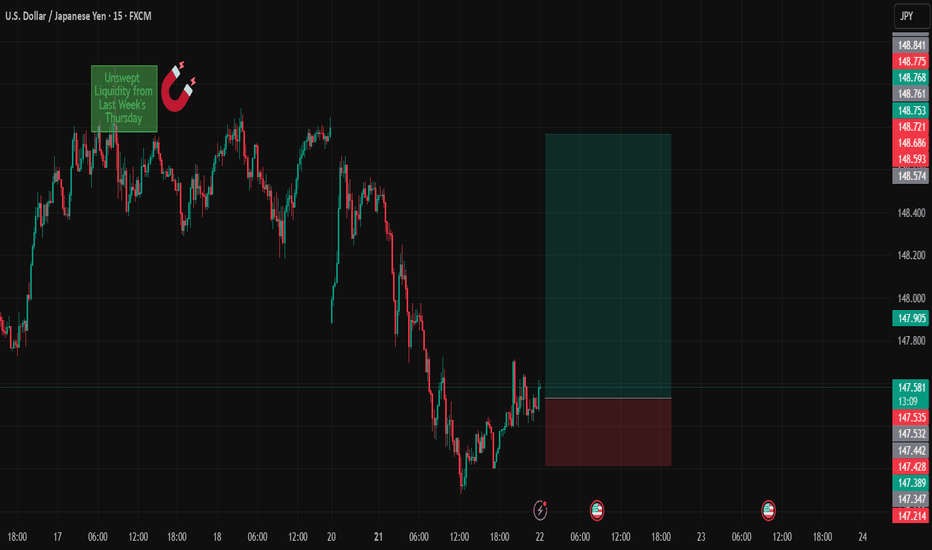

USDJPYDate:

July 22,2025

Session:

Tokyo and London session

Pair:

USDJPY

Bias:

Long

1. Clean liquidity pool left unswept from last week's NYC Open (Thursday).

Took this trade earlier today but looks like price wanted to consolidate in the liquid pool its currently in. I still hold the same idea and think the sweep will definitely take place sometime this week. Now looks like the perfect time to enter. If Asia session cant get it done its up to London and New York session.

Entry:147.534

Stop Loss:147.215

Target:148.768

RR:3.89

Trendanalysisexpalined

ETH/USD: bearish channelEthereum still into this bearish channel from July 2022 that I identify now in Daily timeframe, but now, we see another thing as we see like a pull back that we can to get a long opportunity in Ethereum price, but based in price action, it's speak us a possible bullish continuation until $1,430 USD. And also, we're into this range, what the price doesn't break down any lower low, and the price it's into this ascending triangle in formation, what we can to get this opportunity to long.

Also, I will share the Bitcoin Daily analsyis that I don't see, as another thing it's that Bitcoin invalided all these resistance level and hit $18,500 USD approx. to make a pull back in this descending triangle, what this may be a bullish signal, but the difference here it's that Ethereum give us a early signal than Bitcoin what do, and this could be a long opportunity in Bitcoin price, but Bitcoin doesn't develop any bullish signal for now, what I share my opinion in my previous analysis below.

But I will put a long position in Ethereum price in buy order place in $1,198 USD, Stop Loss in $1,135 USD and take profit to $1,420 USD by Daily perspective. But in H4 and H8 there's not any signal for both sentiment, but in Daily timeframe it's just speak me a change of trend that we can to get an opportunity there.

Good luck!!!

GBP/USD: Review!!!In this little udpate.

So, this was an analysis that I take a better decision to closed up manually as this trade it would have been very good, but in one moment, I remember that I closed up manually this trade with a little earns like 8 pips. But we see a potential short that I'm monitoring right now to look

So, for this kind of trades, there're not any advice to improve. But I'm interesting the direction that make Pound!!!

EURUSD: Review!!!So, as I trade this par, doesn't move much, but we see an interesting data that maybe EUR/USD it's in the distribution zone to sell and the movement it's preparing this consolidation to drop. But well, I'm not bullish, I'm still bearish as I made analysis on this week, as I closed up this short position that I got 1.44% earned in this trade. And before of this 3rd trad, I got in two trades 6.89% loss. But as least as I make a small recover of 1.44% earned. So, I reduce my loss in 5.45%. But this trade was very similar like USD/CAD when I made a review yesterday, I will share the some fell point that I found out into my trading experience.

Now, as I hold up 22.02% in this month, so I will discount 5.45% in the monthly ROI that I have in my hand. that my result still hold up 16.57%

So, first to talk about this trade. When it's suppose that hit my Stop Loss in my first trade, I can to prevent to enter in my 2nd trade and don't trade until analyze very well the analysis as I enter 2 times and those 2 times hitting my Stop Loss and suppose that if I made an analysis in my first trade as my second trade, it's better to wait that this analysis develop their price action until I catch the smart entry. As i my first trade that I enter around $1.0321 USD and hit my Stop Loss in $1.0384 USD

This it's the screenshot in H1 timeframe, also, I can to entry to long until $1.0420 USD and I would gotten like 100 pips. But I can't to entry against the trend when we see in H1 still bullish, but in H4 spoke bearish and weak into the trend. But now, there're will be a lot option, entry to long as my first option or waiting that price action develop and then entry in the smart point to short position if I knew that EUR/USD it's bearish in this point.

And in my second trade that I enter around almost $1.04 USD and put the Stop Loss n $1.0450 USD and then hit again my Stop Loss.

What I most found out in this trade it's be a little more patience when it's talking about the market reverse with some observations that I made in USD/CAD. Also, when talking about when I knew for EUR/USD as USD/CAD that the market will move to the reverse, it's better to wait the formation of price action and be pending of all economic calendar that can to make soundless the movement.

Now, as I see that EUR/USD still bearish, we can to entry in this week and make an analysis to know where to entry in the smart point to short again

This it's all my review here!!! Also ,I share my new Daily outlook that I made!!!

So guys, in few words the only to work a little more analysis that it's about a market reversal it's being a little more patience to catch the smart point and draw the smart point in timeframes to get an excellent analysis and impeccable.

CAD/CHF: Review!!!In this review, this was another analysis that I made in the past week. So, when I knew very good that CAD/CHF was dropping with the case like CAD/JPY, both pars are in dropping. And also, I made a very good analysis what I was shorting from Wednesday, October 26 2022. In the short from $0.7302 CHF and my target fix to $0.7230 CHF. Also, when came the interest rate decision by Bank of Canada, Canada currency drop significantly as I knew very good and only reach $0.7242 CHF, it's was so far to reach my target profit with less 12 pips approximately.

This was a screenshot that I post in my previously CAD/CHF analysis that my technical analysis was driven by fundamental analysis very good in this formation of this bullish channel, what we canto appreciate a bearish rising wedge in the higher point of this bullish channel. So, when the price up, I inevitably closed up this long position got a small loss of 1.16%. When before I was in profit around 46 pips, but if i would have to closed up the short in the $0.7278 CHF. So, I would got 24 pips in profit at least. But after the price go back to the previously level at $0.7310 CHF. I entry in short again with my iPhone, but until I see that bullish rising wedge when I analyze in my laptop, the price was spoke me that it's bullish strong candlestick that it's moment to closed up again a short position, but the small was so diminutive like 0.07%, very near when I open the 2nd trade that I was going to shorten. So, in total of loss in this trade was 1.16% and 0.07% = 1.23%. And to update more, so, I kept in profit in 8.53%.

So guys, I would have to got this profit if only I closed up manually in the pivot of this bottom in this bullish channel. But everything will be a practice.

A widely word that I learn it's the following "The practice make the master"

But well, it's no so bad these trades, but my experience will grow up through this case and process to be very prepared. I don't feel much anxiety or fear to trades. but my perspective I knew it very good. The only to improve in CAD/JPY and CAD/CHF it's only be pending and very update when occur when i have trades and what the price speak us.

So, I have left to analyze USD/CAD, but never goes to my sell order limit, but I see that my perspective was excellent in my another trade that I'm just analyzed. This trade could be another excellent opportunity to take. Anyway, I will analyze making a review to know how the price drop and never goes to my order place when I knew my bearish perspective very well.

So, as I made 8.54% in profit and vs the past week, I made 13.67% in profit during this month. So, I made 22.21% in profit. Only the best trades was GBP/USD and Ethereum during this month.

Now, I'm currently long CAD/CHF from Friday that I decide to run this trade in this week. So, we hope that Forex market open up soon. I will post in the link to related idea my another review and my currently trades.

AUD/JPY: Long position; updateIn this update, I made an analysis in the morning today that I see a potential long position in AUD/JPY to find up long position.

So, I will decide to run this trade until next week. Remember you're early to entry in the long position in AUD/JPY. So, I entry price was $94.58 JPY. Stop Loss to $93.89 JPY (53 pips) and take profit toward $95.60 JPY (Update) (103 pips). So, we have this opportunity in our hand to buy early now and hold this long position until next week. Technically, AUD/JPY forming a bullish channel and after this drop that was this week, we're in the good zone to buy.

Any loss or earn, will be accredited for November, as we're going to start a new month. What I don't make any review in this analysis until closed up one of my two direction, loss or earn.

Good luck!!!

In H1 timeframe look bullish for this side, with a lot potential to continue up.

And in H4, the price still bullish in this range formed, what we see a lot potential to the upside movement.

Ethereum/Bitcoin: Overview correlationEthereum look that has a bearish evolving in weekly timeframe, what it's a moment to sell Ethereum as Ethereum can to make a deep impact in front of U.S. Dollar in front of this bear market what crypto living today.

Also, it's obviously that Bitcoin it's still bearish, one of the best strategy to accumulate Bitcoin using altcoin it's knowing the 3 key points:

1. U.S. Dollar value

2. Ethereum/Bitcoin or Altcoins/Bitcoin

3. Using Bitcoin dominance (to know when Bitcoin it's weak as strong in the trend)

That it's a smart strategy that I ever learned throughout of my crypto-experience since 2018.

So, there're a lot way to accumulate Bitcoin like making trading and find up consistent ROI, hold Bitcoin and using the old strategy that I know when we analyze altcoin in the strong dominance, that will be the case that they rise up in front of Bitcoin value. An also, you can to make trading in some crypto-broker that offer a lot instruments in the financial market like Forex, stocks, crypto or commodities and the benefit of them it's when we see a U.S. Dollar strong, a Bitcoin strong, an Ethereum strong, we could to change it for the convertibility to fiat to Bitcoin or Ethereum, or Bitcoin to Ethereum, and more.

A good broker called Prime XBT offer it to trade this thing.

But well, more later I will deepen this theme about Bitcoin and altcoins

Technically, we see that Ethereum/Bitcoin look in this bearish side, as Ethereum look more weak in front of Bitcoin value, I hope a drop in the Ethereum in front of Bitcoin value that could to reach down toward 0.038 BTC in the next month, it's a good chance to buy Ethereum later to accumulate a lot quantity of Bitcoin or an smart strategy it's making trading and starting to buy Bitcoin now and find up a goal like 20% monthly and each month re-buy more Bitcoin and then successively. Because as right now Bitcoin and Ethereum down, later of this bear market, I look that Bitcoin could to take more influence in front of Ethereum and altcoins giving us a clue of what the dominance could stand up after that Bitcoin repeat the same cycle in 2019 when Bitcoin dominance climb and altcoin weak in front of Bitcoin value. But for that, its essential to know every situation of each altcoin as I prefer that Bitcoin goes climb and Ethereum still more weak in the next month, and also a fix target could be 0.023 BTC for Ethereum/Bitcoin.

So guys, this it's a fundament and vital information if you want to know where to invest your own money later of this bear market. First starting to buy Bitcoin and accumulate Bitcoin and keep away of Altcoins for now and starting to accumulate Bitcoin for now and learn to make trading if you want to grow up your Bitcoin assets. Until the U.S. Dollar still more stronger, it's a way to apply it and change Bitcoin or Altcoins for Dollar when Bitcoin/Dollar may to weak and then, you must to re-buy Bitcoin in the deep and hold it. It's very hard to understand it, but if you have an ability, you can to get success in crypto-markets .

I hope that this information support for you. A lot content like this will be created very soon!!!

Keep update!!!

USD/JPY: Review!!!U.S. Dollar/Yen Japanese was a trade that I was longing, but I closed up this trade in the past week. And also, it's my 2nd time that I closed up a trade when I knew that U.S. Dollar has a bullish perspective by fundamental news, that I believe that I will to be a little more patience and disciplined to trade and don't closed up when the fundamental analysis lead the Dollar bullish.

That it's my only mistake that I found out, the same as USD/CAD that pass the same like USD/JPY in the past week.

The movement was bulish as I knew it as perspective that Dollar goes strengthen in this week. But I don't earn much as loss much, what this trade was neutral to consider any earned or loss. But this could be a pretty good this trade if I only keep holding to long when I knew it when I was in long in $137.47 JPY and putting this order place in the good zone to bought.

But nothing, in Forex for that, I make a review to fix any analysis what I do and take evaluation of it.

MichFX | EURCHF can possibly dive into a deep bearish movement

EURCHF is actually on a very critical support level which it didn't reach it since January 2015. Breaking this level and rejecting a pull back will open up the opportunity to take new short positions.

Share your opinion in the comments and support the idea with like.

EUR/JPY: bearish trend continuationEuro/Yen Japanese it's look bearish from this point with high chance to short in this right direction.

Remember that in macrotrend we're bullish, but right now in medium term we see a break in the trend.

What I see a bearish setup in EUR/JPY that could to find down like 150 pips. I entry around $141.37 JPY, Stop Loss to $142.03 JPY (64 pips) and target to $139.88 JPY (151 pips)

I hope that this idea support you

EUR/GBP: Manipulation key to watchEuro/Great Britain Pound show us a good point that you would need to know for possible long position that I feel.

To know more deep, in H1 we forming a little symmetric triangle flag, but that generally could be reversal as continuation of the trend.

But you would need to pay attention the key point in H4 and Daily timeframe that I will enfocous in these analysis here.

In H4 I mark by yellows circle the exaclty point that you must to watch and also I draw a finite red line that you can to understand it how this manipulation work.

And finally, this it's my Daily analyssi that I show you fundamentally the key point to look.

So, Euro could to hit 0.8384 GBP as chance to find up good position but I prefer to take profit in my exactly red line target to 0.8365 GBP.

Also, I see a long position right now as that it's key manipulation to watch. I entry around 0.8284 GBP and SL to 0.8260 GBP (24 pips) and target to 0.8365 GBP (81 pips)

ADA/USD: Bought in the Dip!!!I buy Cardano spot contract as I use this Fibonacci analyze with confluence that in this level $2.40 USD it's show us a good support.

Cardano formed a bearish rising wedge in the higher zone between $2.90-$3.10 USD, And today, Cardano drop over 22%, that was incredible voaltile movement what Cardano do.

Now, I look that I mark Fibonacci retrocement from $1.24 USD to $3.10 USD and show us that make support in the 0.382% of Fibonacci meanwhile I mark another fibonacci retracement in H8 timeframe from $1.86 USD to $3.10 USD and we look that make support in the 0.618% of Fibonacci.

Now, I buy Cardano in the dip to hold this position toward $4 dollar. Now, I see that this it's a confluence what Fibonacci make. I put in long position in ADA buying in the DIP.

ADA/USD: Break Out inminent!!!Cardano break out the ascending triangle. So, I move my break even to $1.30 USD to protect my earnings in Cardano!!!

This it's the H4 timeframe and we see that Cardano it's starting to up above of $1.40 USD. So, my next forecast it's that Cardano it's leading to the $1.54 USD. I hold this Cardano trade until $2.55 USD. So, my potentail earning will be 0.86 ETH to accumulate Ethereum in my trading app

ENJ/ETH: Possible formaton of ascending triangleThe market it;s like neutral in Daily timeframe. Enjin Coin and Ethereum are bullish in the same time. But this it's the relationship the ratio Enjin Coin vs. Ethereum.

s3.tradingview.com

Now, the weekly timeframe, it's look bullish with this bullish envolving candlestick. Now, I'm bullish in Enjin Coin vs. U.S. Dollar and Bitcoin ratio. For that, it's not any doubt that Enjin Coin it's bullish agains with Ethereum.

BTC/USD: Bitcoin could be into the bear market; Beware!!!At the moment, I analyze the 3 Daily chart and I want to share you each timeframe to analyze Bitcoin and some altcoin like Ethreum. Now, this could be a real perspective how I see Bitcoin in the next days to weeks. In short term like in Hourly timeframe, Bitcoin it's look more bearish than bullish. But that, it's my theory to be prepare if Bitcoin continue down. Now, I put that Bitcoin could to exit in the re-distributtion zone to continue suffer more. for that, you will need to be prepare in investment and trading. I know that during the month of May, I get more loss in cryptocurrency for that extremely drop from $64,000 USD to $30,000 USD. For that, I wil going to study it using the bar replay to analyze the past on Bitcoin to studing their bearish movement to learn in my personal opinion. I'd never trade Bitcoin to bear market, did you know bullish market I did traded as I have less of half one year making trading in cryptocurrency and before to make trading in cryptocurrency, I made trading in Forex. I don't have more of 2 years of experience making trading, but yes knowledge. But, I interesting to take the past and anayze how Bitcoin made their movement to study it very well and be practicing.

ETH/USD: Bullish Rising Wedge; update!!!At the moment analyzing Ethereum in my trade, Im in profit around of $1,900 USD that was entry price level to long position, we're ok. Just that today, Etheruem forming a bullish rising wedge, for that, Ethereum could to continue up to $2,400 USD. i'm in profit and I move the SL at $1,827 USD.

ADA/USD: Cardano testing in the weekly zoneThe only information that I have in my hand it's that Cardano it's in the same consolidation too as Bitcoin too, but the difference it's that Cardano make testing in the weekly zone, in the esactly higher zone where Cardano break out the rally to continue to $2 dollar and down. But now, I have so clear that Cardano it's bullish, just waiting or use Cardano to invest in the smart cryptocurrency..

s3.tradingview.com

But now, Cardano could to forming a bullish rising wedge, but now, I do not going to trade Cardano as Cardano in another way, could to be more influenced by Bitcoin. As Bitcoin and Cardano it's not clear to trade. For that, I consider this like neutral, but with bullish expectative to investment!!! Just I believe that Cardano testing in the weekly zone.