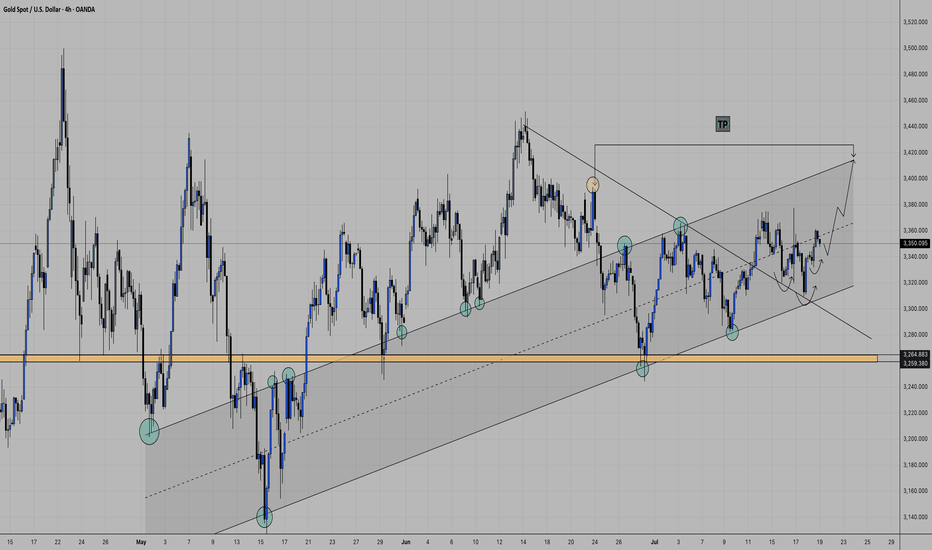

XAUUSDgold has played over a week and finally took a long as we know it will fly on wednesday but trap with seller.. i am looking for continue long on gold, as i have drw simple line reason is clear w pattern,, and the (bos) .. lets see is it flying without fvg, or lit a bit to fill the fuel..what are your thought let me know in the comment.

Trendfollowing

EURGBP - Follow The Bulls!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURGBP has been overall bullish trading within the rising channel marked in blue. And it is currently retesting the lower bound of the channel.

Moreover, the orange zone is a strong daily support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower blue trendline and support.

📚 As per my trading style:

As #EURGBP approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

The Power of Confluence: Building Trade Setups Using 3 Indicator🔵 INTRODUCTION

Many traders fall into the trap of relying on a single indicator to make trading decisions. While one tool might work occasionally, it often leads to inconsistent results. The key to consistency lies in confluence — the strategic combination of multiple indicators that confirm each other.

In this article, you'll learn how to build high-probability trade setups by combining three essential components: trend , momentum , and volume .

🔵 WHY CONFLUENCE MATTERS

Confluence refers to multiple signals pointing in the same direction. When different indicators agree, your trade idea becomes much stronger. It helps reduce noise, avoid false signals, and increase confidence in your entries.

Think of it like crossing a busy road: you wait for the green light, check both sides, and make sure no cars are coming. The more confirmations you have, the safer your move.

🔵 WHAT IS CONFLUENCE IN TRADING?

Confluence means agreement. In trading, it’s when different methods, indicators, or tools all point toward the same outcome.

Think of it like this:

One green light? Maybe.

Two green lights? Worth watching.

Three green lights? That’s a trade worth considering.

Imagine you're planning a road trip. You check the weather forecast (trend), Google Maps traffic (momentum), and ask a local for advice (volume). If all three say “go,” you’re more confident in your decision. Trading works the same way — using multiple tools to validate a setup reduces risk and removes guesswork.

Important: Confluence is NOT about cramming 10 indicators onto your chart. It’s about using a few that each offer different types of information — and only acting when they align.

🔵 THE 3-STEP CONFLUENCE SETUP

1️⃣ Identify the Trend (Using EMAs)

Before entering any trade, you need to know the market direction. You can use:

Moving Averages (e.g., 21 EMA and 50 EMA crossover)

Structure-based analysis (e.g., higher highs = uptrend)

Trade only in the direction of the prevailing trend.

2️⃣ Check Momentum (Using RSI, MACD, or Stochastic)

Momentum tells you whether the market supports the current trend or if it's weakening.

RSI above 50 → Bullish momentum

MACD histogram rising → Acceleration

Stochastic crossing above 20 or 80 → Momentum shifts

Avoid entering when momentum is fading or diverging from price.

3️⃣ Confirm with Volume (To Validate Participation)

Volume reveals the strength behind the move. A breakout or trend continuation is more reliable when it's backed by volume.

Look for:

Volume spikes at breakout points

Increasing volume in the direction of the trend

Volume confirmation after pullbacks or retests

No volume = no conviction. Watch how the market "votes" with actual participation.

🔵 EXAMPLE TRADE SETUP

Let’s say you spot a bullish trend with 21 EMA above 50 EMA. RSI is above 50 and rising. A pullback forms, and volume picks up as price starts to push higher again.

That’s trend + momentum + volume lining up = a confluence-based opportunity.

🔵 BONUS: HOW TO ENHANCE CONFLUENCE

Add price action patterns (flags, wedges, breakouts)

Use support/resistance zones for cleaner entries

Combine with higher timeframe confirmation

Wait for retests after breakouts instead of chasing

Confluence doesn't mean complexity — it means clarity.

🔵 CONCLUSION

The best traders don’t guess. They wait for the market to align. By combining trend, momentum, and volume, you filter out weak setups and focus only on the highest-probability trades.

Start testing confluence-based setups in your strategy. You’ll likely find more consistency, fewer fakeouts, and greater confidence in your execution.

Do you trade with confluence? What’s your favorite trio of indicators? Let’s talk in the comments.

$BTC Daily Outlook BYBIT:BTCUSDT.P

Macro Picture

Weekly Chart

Both Bias & Momentum aligned bullish

Moving towards 111968.0 vLevel (HH) - ATH

Be careful with Weekly FA from that Level

More upside room from here

vLevels Range between 111968.0 - 77083.5

Daily Chart

Both Bias & Momentum aligned Bullish

Failed Auction at 102000.0

Validated from Volume Footprint Charts - Selling Delta trapped on this Failed Auction - POC & Value Area at Wick Lows

vLevels Range between 111968.0 - 102000.0

More Upside room from here, but overall consolidation for now as we are inside a High Volume Node

A pullback would be ideal to look for entries

10-Hour Chart

Price is currently inside an Inside Bar Range between 109740.9 - 107134.7

Overall momentum from the Intraweek Chart (10-Hour) is bearish due to a Failed Auction around 109740.9

Need to wait for confirmation for New Failed Auction Today.

vLevels zone around 105335.0 - 104567.0

Would be nice to have a pullback towards this zone, in which we can start looking for rejections for Intra-Week Longs

Nice zone to look for longs is also IB Range Low 107134.7

Intraday Picture

1-Hour Chart

No outlook for now, waiting for Intra-Week Chart Confirmation

No shorts from here, as HTF bias & momentum remain bullish

Patience - Overall range, don't want to get chopped here.

10-Minute Chart

No Outlook for now, waiting for MTFs and HTFs confirmation

Bitcoin Outlook — Narrative Recap

On the higher time-frames the picture is straightforward: both weekly and daily bias and momentum are in sync to the upside. Price is grinding toward the prior all-time high vLevel at 111 968 USD. Treat that level with respect, if a weekly failed auction (FA) forms there, it could mark the next inflection, but for now there is still air between price and that resistance. The broader weekly value range spans from 111 968 USD down to 77 083 USD.

The daily chart reinforces the bullish thesis. A failed auction printed at 102 000 USD, and volume-footprint data show sell-side delta trapped at those wick lows; the point of control and value area also sit there. 102 k is now strong support. Price is chopping inside a high-volume node, so a healthy pullback toward 102 k (or at least into value) would be the ideal place to reload longs before the next push higher.

Drop to the 10-hour “intra-week” view and momentum tilts short-term bearish. Price is boxed inside an inside-bar range between 109 741 USD and 107 135 USD after a failed auction at the range high. The preferred play is patience: let price drift into either the IB low at 107 135 USD or, even better, the deeper vLevel cluster at 105 335 USD – 104 567 USD. There we’ll watch for a fresh failed auction or obvious seller exhaustion to trigger new longs targeting the ATH zone.

On the 1-hour and 10-minute intraday charts there is no edge yet, conditions are choppy and hostage to the intra-week setup to align with the Higher Timeframes. With higher-time-frame bias still firmly bullish, fading strength makes little sense; stand aside until the 10-hour chart confirms a pullback and reversal.

Bottom line: stay bullish, stalk a pullback, and look to join strength from 107 k or 105–104 k. A decisive daily close back below 102 k would force a rethink; until then, patience is the edge.

Gold (XAUUSD) – Bias for July 2Yesterday, price broke above the key H4 Lower High zone (3348–3350) with strong bullish momentum.

This breakout suggests a possible shift in the higher timeframe structure — indicating that the market may now be building toward a larger uptrend.

But we don’t chase breakouts — we prepare for the pullback phase .

🔍 What to Watch:

At present, M15 remains in a clean uptrend , fully in sync with the new H4 structure.

This multi-timeframe alignment gives us a clear bullish bias — but not an entry by itself.

We now need to see how price develops the pullback.

The best trades come when structure retraces with clarity — and confirms before continuation.

📍 Key M15 Level to Track:

• 3302 – Current M15 Higher Low

→ If this level holds, we may see a continuation of the uptrend from here.

→ If it breaks, the next potential reversal zone is around 3290 , where demand may reappear.

🎯 Execution Plan:

The trend is now clearly bullish across HTF and LTF.

We will only look for long setups , and only where structure confirms — either at the current HL or at deeper demand zones.

No confirmation = No trade.

No alignment = No edge.

Let price come to you. Our job is not to anticipate, but to align.

📖 From the Mirror Philosophy:

“In trend-following, the edge lies in waiting — not in chasing.

The market will reflect your patience back at you.”

📘 Shared by @ChartIsMirror

Author of The Chart Is The Mirror — a structure-first, mindset-grounded book for traders

SPY Price Projection: Mid-2025 TargetRevealing Market Trends: Logarithmic Regression Analysis Indicates Bullish Path for SPY

In the ever-evolving realm of financial analysis, the search for reliable predictions remains ongoing. Logarithmic scale regression analysis, coupled with potent indicators, has emerged as a promising tool for discerning trends, particularly regarding assets like the SPY.

This analysis delves into the utilization of logarithmic scale regression alongside two robust indicators, offering insights into the potential trajectory of the SPY's price movement. It's essential to note that the interpretations and predictions presented are based on my analysis alone and should not be construed as financial advice. As with any market analysis, uncertainties persist, and actual outcomes may diverge from projections.

Logarithmic scale regression accounts for the exponential nature of price movements, providing a nuanced perspective on long-term trends. When combined with indicators such as moving averages or momentum oscillators, the analysis gains depth, revealing not only the direction but also the strength of the trend.

After meticulous examination of historical data and the application of analytical tools, our analysis suggests a bullish trajectory for the SPY, with a projected price nearing 620 EUR by mid-2025. This projection implies a significant uptrend from the current date, with a potential increase of approximately 20% over the specified timeframe.

However, it's crucial to approach such forecasts with caution, recognizing the inherent risks associated with financial markets. While our analysis indicates a positive outlook, market conditions can change rapidly, leading to deviations from expected trends.

In summary, logarithmic scale regression analysis, supported by robust indicators, offers valuable insights into market trends and potential price movements. While our analysis suggests a bullish sentiment for the SPY, investors should conduct thorough research and seek professional advice before making investment decisions.

Disclaimer: The analysis provided is based on personal interpretation and should not be considered financial advice. Investing in financial markets carries risks, and actual outcomes may differ. Readers are encouraged to conduct their own research and consult with financial professionals before making investment decisions.

Gold (XAU/USD) Technical Analysis – Triangle Breakout & Bullish Overview of the Chart

This chart presents a daily timeframe (1D) analysis of Gold (XAU/USD) and highlights a well-defined bullish trend supported by a breakout from a triangle pattern. The overall price action suggests a strong uptrend continuation, with clearly marked support and resistance levels, trendlines, and potential trade setups.

Gold has been consistently respecting key technical levels, forming higher highs and higher lows, which is a classic indicator of a strong bullish market. Traders can use this analysis to identify entry points, stop-loss levels, and profit targets for a strategic trading approach.

Key Technical Components in the Chart

1. Triangle Pattern Formation – The Setup for Breakout

One of the most crucial formations in this chart is the triangle pattern, which acts as a continuation pattern.

The triangle pattern (highlighted in green) represents a period of consolidation where price action was squeezing between higher lows and lower highs before a breakout occurred.

This pattern suggests that buyers and sellers were in equilibrium, building up momentum before gold made a decisive move to the upside.

The breakout above the upper boundary of the triangle confirms the bullish continuation, leading to a strong rally.

📌 Technical Significance: Triangle patterns are a reliable technical structure used by traders to anticipate breakouts. The breakout direction (upward in this case) determines the next trend phase.

2. Trendline Analysis – Defining Market Structure

The dashed black trendline represents the primary ascending trendline, which has been respected multiple times, indicating that the market remains in an uptrend.

Several minor support levels (highlighted in blue) have acted as strong demand zones, preventing price breakdowns and helping sustain the bullish momentum.

A major support zone (highlighted in beige at $2,300-$2,400) serves as the base of the uptrend, where price action historically reversed strongly, indicating heavy institutional buying.

📌 Technical Significance: As long as the price remains above these support levels, the uptrend remains intact.

3. Breakout & Price Action Structure – Momentum Confirmation

The breakout from the triangle pattern signaled the beginning of a new bullish impulse wave, and the price action structure confirms this move.

Higher Highs & Higher Lows: The black zig-zag pattern represents a strong bullish structure where each retracement finds support before continuing higher.

Price Movement Post-Breakout:

After breaking above the triangle’s resistance, gold started forming higher highs at an accelerated pace.

Minor pullbacks are bouncing off key support levels, providing re-entry opportunities for traders.

📌 Technical Significance: A breakout followed by sustained higher highs and strong buying pressure is a key bullish signal.

Trading Plan & Strategy

1. Entry Strategy – Ideal Buying Zones

Buy on Pullbacks:

Enter near minor support levels to take advantage of retracements.

This improves the risk-to-reward ratio and reduces exposure to sudden reversals.

Confirmation Signals:

Look for bullish candlestick patterns (bullish engulfing, pin bars, hammer candles).

Increased trading volume on bullish moves supports trend continuation.

2. Stop-Loss & Risk Management

📍 Stop-Loss: $2,661

Placed below the most recent minor support level to protect against downside risk.

If price breaks below this level, it may signal a trend shift or deeper correction.

📍 Why this Stop-Loss Level?

It ensures a tight risk control while allowing room for natural price fluctuations.

3. Take-Profit & Target Projection

📍 Target Price: $3,170

The measured move projection from the triangle breakout suggests a target near $3,170, which aligns with historical resistance.

If the price approaches $3,100-$3,170, traders should monitor for potential reversals or further breakouts.

4. Key Factors Supporting the Bullish Bias

✅ Uptrend Structure: The market is making higher highs and higher lows, which is a textbook sign of bullish momentum.

✅ Breakout Confirmation: The price has broken out of the triangle pattern and is sustaining higher levels.

✅ Support Levels Holding: Each pullback is being absorbed by buyers at well-defined support zones.

✅ Momentum & Volume: Increased volume and strong buying pressure indicate that the bullish trend is likely to continue.

5. Risk Management & Market Conditions

Market Sentiment:

If gold continues to hold above the support zones, further upside momentum is likely.

If price starts breaking below key support levels, it may signal a trend reversal or deeper correction.

Geopolitical & Economic Factors:

Gold prices are often affected by inflation data, interest rate changes, and global uncertainties.

Traders should monitor economic news that could impact gold’s trend.

Conclusion – A High-Probability Trade Setup

This analysis confirms that gold (XAU/USD) is in a strong bullish uptrend following a successful triangle breakout.

🚀 Trade Setup Summary:

✅ Entry: Buy on pullbacks at minor support levels

✅ Stop-Loss: $2,661 (Below support)

✅ Target Price: $3,170 (Next resistance level)

✅ Risk-Reward Ratio: Favorable setup with strong trend confirmation

🔹 Final Verdict: As long as gold remains above the minor support levels, the bullish bias remains strong, making this a high-probability long trade setup.

Would you like to add any additional indicators (RSI, MACD) for confirmation? 📈

EUR/JPY Bullish Continuation in an Ascending Channel

This EUR/JPY 4-hour chart shows a strong bullish trend within an ascending channel, indicating a potential continuation of upward momentum.

Key Highlights:

✅ Ascending Channel – Price is trading within a well-defined upward channel, showing steady bullish movement.

✅ Support Zones – Two key support areas marked, which could act as potential entry zones on a retracement.

✅ Target Level – The projected target is around 165.831, aligning with previous resistance zones.

✅ Price Action Expectation – A pullback to the support level within the channel before another bullish impulse toward the target.

Trading Plan:

📌 Bullish Bias: Wait for a retracement toward the marked support zones for a potential long entry.

📌 Invalidation: A strong break below the channel and support zones would invalidate the bullish setup.

Momentum Trading Strategies Across AssetsMomentum trading is a strategy that seeks to capitalize on the continuation of existing trends in asset prices. By identifying and following assets exhibiting strong recent performance—either upward or downward—traders aim to profit from the persistence of these price movements.

**Key Components of Momentum Trading:**

1. **Trend Identification:** The foundation of momentum trading lies in recognizing assets with significant recent price movements. This involves analyzing historical price data to detect upward or downward trends.

2. **Diversification:** Implementing momentum strategies across various asset classes—such as equities, commodities, currencies, and bonds—can enhance risk-adjusted returns. Diversification helps mitigate the impact of adverse movements in any single market segment.

3. **Risk Management:** Effective risk management is crucial in momentum trading. Techniques such as setting stop-loss orders, position sizing, and continuous monitoring of market conditions are employed to protect against significant losses.

4. **Backtesting:** Before deploying a momentum strategy, backtesting it against historical data is essential. This process helps assess the strategy's potential performance and identify possible weaknesses.

5. **Continuous Refinement:** Financial markets are dynamic, necessitating ongoing evaluation and adjustment of trading strategies. Regularly refining a momentum strategy ensures its continued effectiveness amid changing market conditions.

**Tools and Indicators:**

- **Relative Strength Index (RSI):** This momentum oscillator measures the speed and change of price movements, aiding traders in identifying overbought or oversold conditions.

- **Moving Averages:** Utilizing short-term and long-term moving averages helps in smoothing out price data, making it easier to spot trends and potential reversal points.

**Common Pitfalls to Avoid:**

- **Overtrading:** Excessive trading can lead to increased transaction costs and potential losses. It's vital to adhere to a well-defined strategy and avoid impulsive decisions.

- **Ignoring Market Conditions:** Momentum strategies may underperform during sideways or choppy markets. Recognizing the broader market environment is essential to adjust strategies accordingly.

By understanding and implementing these components, traders can develop robust momentum trading strategies tailored to various asset classes, thereby enhancing their potential for consistent returns.

Source: digitalninjasystems.wordpress.com

Donchian Channel Strategy like The Turtles TradersThe Turtle Traders strategy is a legendary trend-following system developed by Richard Dennis and William Eckhardt in the 1980s to prove that trading could be taught systematically to novices. Dennis, a successful commodities trader, bet Eckhardt that he could train a group of beginners—nicknamed "Turtles"—to trade profitably using strict rules. The experiment worked, with the Turtles reportedly earning over $100 million collectively. Here’s a detailed breakdown of their strategy, focusing on the core components as documented in public sources like Curtis Faith’s Way of the Turtle and other accounts from the era.

Core Philosophy

Trend Following: The Turtles aimed to capture large price trends in any direction (up or down) across diverse markets—commodities, currencies, bonds, and later stocks.

Systematic Rules: Every decision—entry, exit, position size—was predefined. No discretion allowed.

Volatility-Based: Risk and position sizing adjusted to each market’s volatility, not fixed dollar amounts.

Long-Term Focus: They targeted multi-month trends, ignoring short-term noise.

Two Trading Systems

The Turtles used two complementary breakout systems—System 1 (shorter-term) and System 2 (longer-term). They’d trade both simultaneously across a portfolio of markets.

System 1: Shorter-Term Breakout

Entry:

Buy when the price breaks above the 20-day high (highest high of the past 20 days).

Sell short when the price breaks below the 20-day low.

Skip the trade if the prior breakout (within 20 days) was profitable—avoid whipsaws after a winning move.

Initial Stop Loss:

Exit longs if the price drops 2N below entry (N = 20-day Average True Range, a volatility measure).

Exit shorts if the price rises 2N above entry.

Example: Entry at $100, N = $2, stop at $96 for a long.

Trailing Stop:

Exit longs if the price breaks below the 10-day low.

Exit shorts if the price breaks above the 10-day high.

Time Frame: Aimed for trends lasting weeks to a couple of months.

System 2: Longer-Term Breakout

Entry:

Buy when the price breaks above the 55-day high.

Sell short when the price breaks below the 55-day low.

No skip rule—take every breakout, even after a winner.

Initial Stop Loss:

Same as System 1: 2N below entry for longs, 2N above for shorts.

Trailing Stop:

Exit longs if the price breaks below the 20-day low.

Exit shorts if the price breaks above the 20-day high.

Time Frame: Targeted trends lasting several months (e.g., 6-12 months).

Position Sizing

Volatility (N): N, or “noise,” was the 20-day Average True Range (ATR)—the average daily price movement. It normalized risk across markets.

Unit Size:

Risk 1% of account equity per trade, adjusted by N.

Formula: Units = (1% of Account) / (N × Dollar Value per Point).

Example: $1M account, 1% = $10,000. Corn N = 0.5 cents, $50 per point. Units = $10,000 / (0.5 × $50) = 400 contracts.

Scaling In: Add positions as the trend confirms:

Long: Add 1 unit every ½N above entry (e.g., entry $100, N = $2, add at $101, $102, etc.).

Short: Add every ½N below entry.

Max 4 units per breakout, 12 units total per market across systems.

Risk Management

Portfolio Limits:

Max 4 units in a single market (e.g., corn).

Max 10 units in closely correlated markets (e.g., grains).

Max 12 units in one direction (long or short) across all markets.

Stop Loss: The 2N stop capped risk per unit. If N widened after entry, the stop stayed fixed unless manually adjusted (rare).

Drawdown Rule: If account dropped 10%, cut position sizes by 20% until recovery.

Markets Traded

Commodities: Corn, soybeans, wheat, coffee, cocoa, sugar, cotton, crude oil, heating oil, unleaded gas.

Currencies: Swiss franc, Deutschmark, British pound, yen.

Bonds: U.S. Treasury bonds, 90-day T-bills.

Metals: Gold, silver, copper.

Diversification across 20-30 markets ensured uncorrelated trends.

FNV to new ATHFNV looks good for a break to new ATH. We had that nice long 3 year distribution like schematic, we broke down, got lots of people short, re-accumulated long stops at all those consolidation lows and have had multiple clear breaks to the upside. People interpreting the schematic as a distribution, are gonna be shorting every supply zone between here and ATH's. That coupled with the stops that have already built up above the highs will create the clouds of liquidity that will fuel these uptrends

Look at the fractal re-accumulation that occured once we started breaking back up to the topside.

Sure looks familiar

AUD/USD - Bullish Intent Locked InMarket’s got the vibe, just waiting for the right pullback to strike.

4H:

Bullish intent is clear, but no IDM sweep or order block mitigation yet. Patience building up the perfect play.

30M:

Structure still holding strong with the bulls. Waiting for IDM liquidity to get swept and that order block to get hit before making my move.

Execution’s coming soon. I’ll let the market show its hand first — then I’m in.

Bless Trading!

Short re-test and "Buy re-test" signals allow to trade the trendI am a huge fan of buying pullbacks in an uptrending market and shorting pullback in a down trending markets. This is why I always try to code algos that look for those continuation setups.

That Impulse Master Indicator haunts for those buyable and shortable setups

Transform Your Trading with WiseOwl - Free Edition! Take a look at Hedera's chart—and YES, this was spotted with WiseOwl Free Edition ! 🎯

🔍 What makes it powerful?

🔥 **Entry signals** that help time the market for you

🟢 **Bullish/Bearish backgrounds** for instant clarity

📊 **EMAs** to analyze trends like a pro

👉 Check out the WiseOwl Free Edition now and start spotting opportunities like this!

XRP $3.00 - 25% Within HoursRipple / XRP is currently one of the coins with the most momentum. As we all know, this is very important for trend following models. As you can see, XRP holds the current trend line and repeats a pattern it already did two times within this short bullish trend. As $3 is a very important mark (and a round number too) I assume we will see a 25% move within hours (at max. a few days).

I’d love to hear your thoughts and predictions. Where do you see XRP heading in the next hours to days? Let’s discuss below!

Breaks Out of a Bullish Flag: Key Levels and What to Watch NextWillis Towers Watson NASDAQ:WTW is breaking out of a classic flag pattern, reclaiming key resistance with strong volume.

The price action suggests solid momentum, and the breakout above 321$ could pave the way for further upside. The high-volume also support this move and shows strong buyer interest, making it a setup interesting.

As long as the price holds these levels, the breakout could continue driving bullish sentiment.

SNEK: Adapted tools for Regime filtering & SystematisationYou should never rely solely on one tool when trading, think of trading as putting together a jigsaw.

You are looking to form a picture.

The more tools at your disposal allow you to form this jigsaw and make better, more informed decisions.

Understand these concepts:

- Orderflow

- Momentum

- Trend-following

- Volatility

- Time

- Price

Here's the #SNEK SNEK/USDT chart leveraging a few of my tools:

- Momentum (Adapted RSI w/ Multi-Crypto Regime Detection)

- Trend-following (SMA RF)

- Volatility, Time, Momentum, & Trend are packaged in a third strategy with the long/short signals...

Systematising our trading.

Believe in something.

Cardano ADA - 200D SMA Bull Regime DetectionTo view script:

Understanding the chart

Bullish Regime:

The price is currently above the 200D SMA, indicating a bullish regime and a regime duration of 16 bars.

Strong Momentum:

Large distance from price to both SMAs (119.62% and 141.38%) suggests powerful upward momentum

Historical Price Action

Long Bear Market (2022-2023):

Extended period below 200 SMA

Multiple failed attempts to break above

Declining 200 SMA indicating strong bearish trend

Accumulation Phase (Mid-2023):

Price consolidated around 200 SMA

Reduced volatility

Built base for current move

Recent Breakout:

Clean break above 200D SMA

Sharp increase in volume and momentum

Walmart in weeklyHello,

A quick look at the action of the famous US channel.

My algo, signals me a price higher than 41% on its "Price Action".

What bothers me a little is the acceleration marked with the yellow arrow on the graph.

The blue line is the right price according to my algo.

What do you think?

Make your opinion, before placing an order.

► Thank you for boosting, commenting, subscribing!