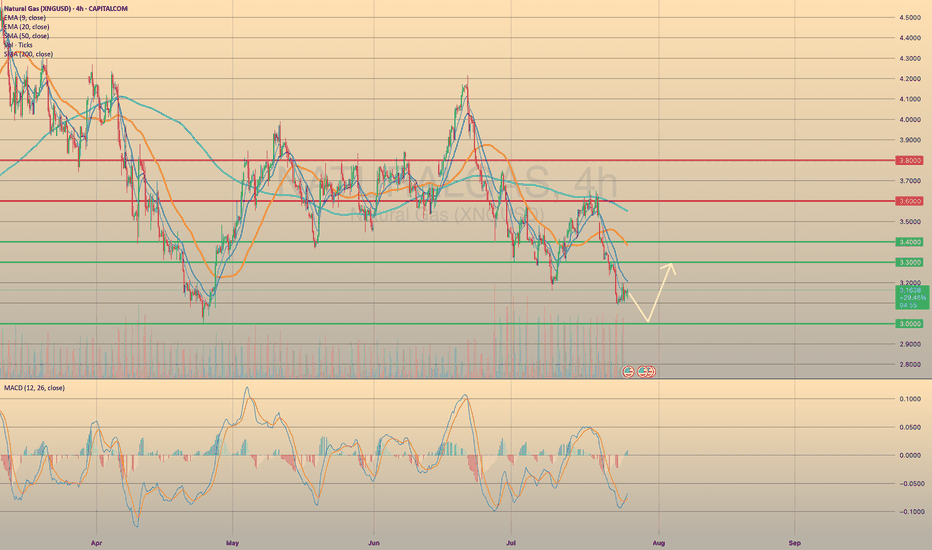

XNGUSD CONTINUES ITS DOWNWARD TREND. FOR HOW LONG?XNGUSD CONTINUES ITS DOWNWARD TREND. FOR HOW LONG?

Recent bearish impulse started at the beginning of this week may come to an end soon. Yesterday the U.S. Natural Gas Storage report came out. Numbers appeared to be lower than expected and lower than previous. (23b vs 28b vs 46b). This is bullish signal for the market participants. Minutes after the report came out, market reacted bullish, however, soon price went sideways.

Right now gas prices continue to decline. Still, the opportunity for short-sellers here is quite limited. Not so far below there is a level of 3.0000, form where I expect the price to rebound, supposedly to a 3.3000.

Trendlineanalysis

Massive Move Loading? $SOL Prepping for a BreakoutSolana is showing real strength here.

CRYPTOCAP:SOL consistently taking support from the long-term rising trendline, a sign that buyers are defending key levels. We're also approaching a critical resistance zone, which was the previous ATH area.

If SOL manages to close above this zone, we could witness a strong rally towards $500 and beyond. Until then, it’s a crucial level to watch, a breakout here could set the stage for the next leg up.

DYOR, NFA

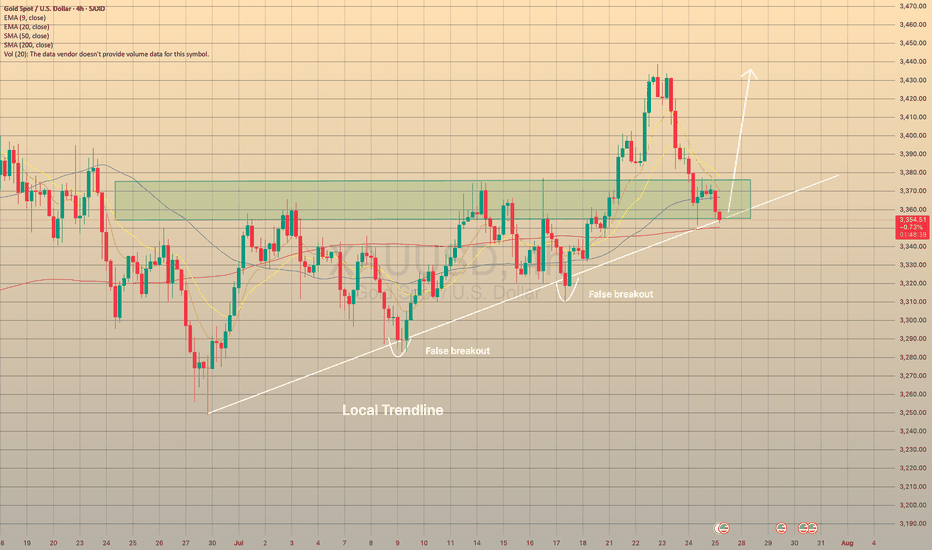

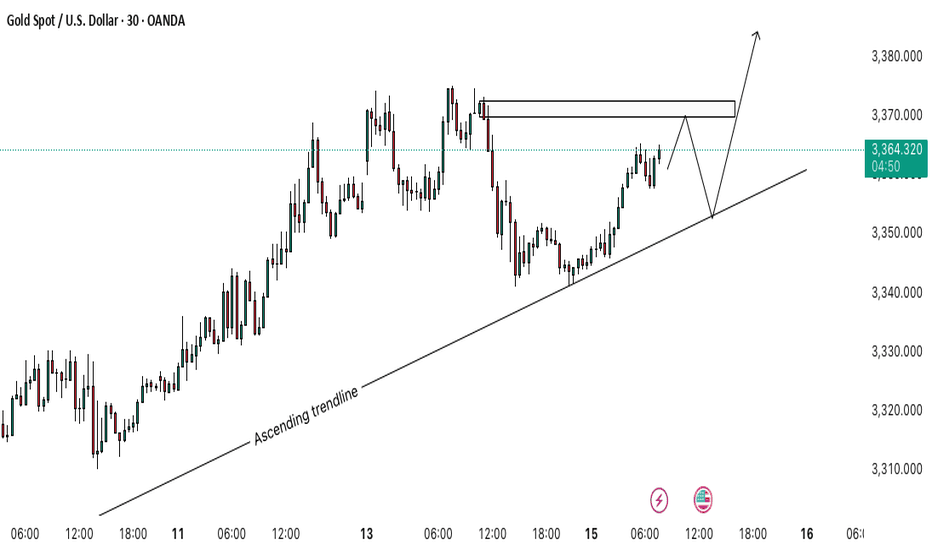

XAUUSD REACHED THE LOCAL TRENDLINEXAUUSD REACHED THE LOCAL TRENDLINE

On July 24 the U.S. Manufacturing PMI report came out way below forecasted (49.5 actual vs 52.6 forecasted). A number below 50 causes concerns among investors and could be a sign of an overall economic slowdown or recession. So, as a result, it could lead to an increase in demand for safe assets like gold.

However, today the price, despite the recent rebound from the trendline after report, came to the trendline once again. There is a high possibility that the price will rebound in nearest future: besides the local trendline we may observe the sma200 on 4-h chart. Additionally, we entered the price zone of 3,350.00-3,375.00, which used to be a resistance zone, now may play out as a support. In case of rebound, the price may go to local highs of 3,440.00 at least.

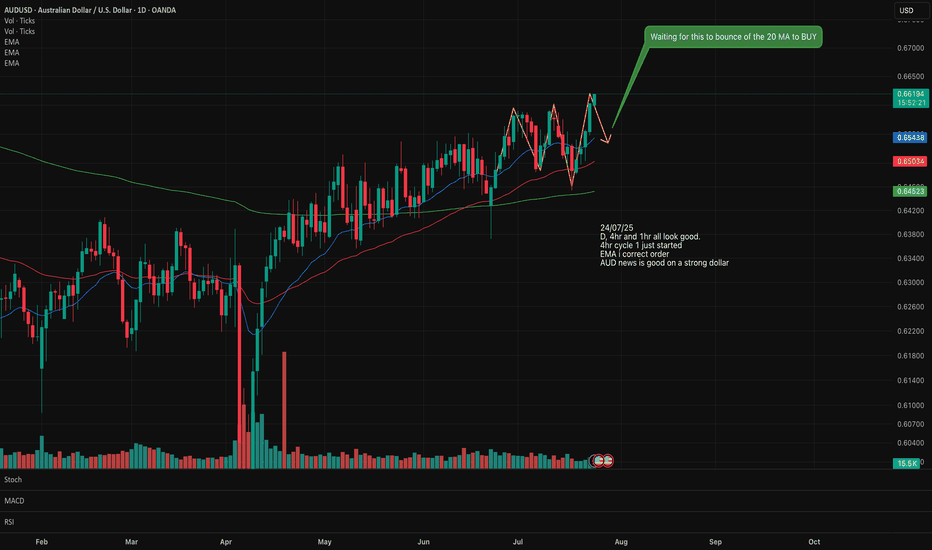

AUS/USD Long/Buy setting upLooking at AUS/USD for a potential Buy setting up on the Daily and 4 hr.

EMA has lined up in the correct stacking order.

An upward trend can be observed. The 20 has crossed over the 50.

We are starting a new Cycle 1 on the upward so I will wait for the pull back to the 20MA which will form the Cycle 2 then wait for the new Cycle 1 on the upward to start again before I buy in.

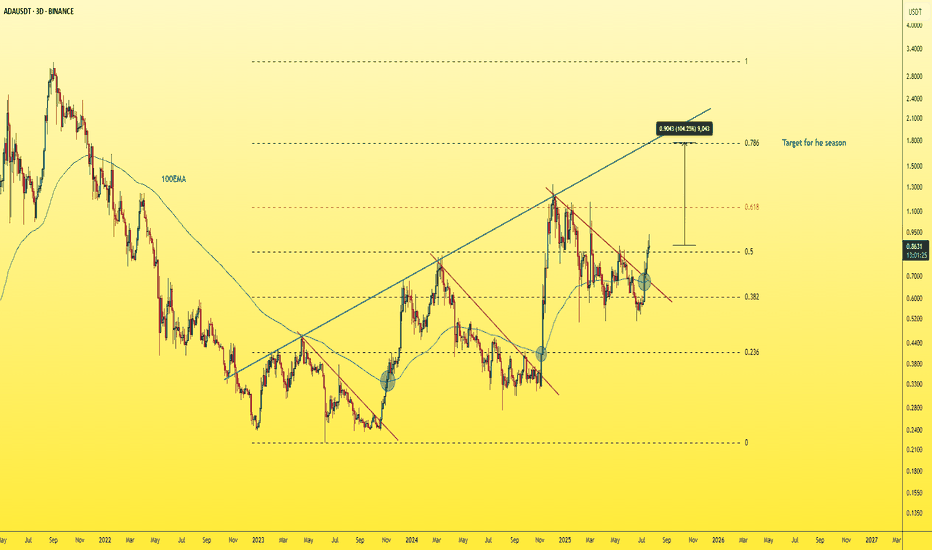

ADAUSDT - Buy or Regret!As clear and simple as the chart is… the target is just as clear and reliable.

ADA is showing strong bullish structure on the 3-day chart — breaking above the red trendline with a successful retest, and also breaking above the 100 EMA.

The blue trendline represents a strong hidden resistance level that many traders are overlooking.

The upside move is likely to end around the 0.786 Fibonacci level, which intersects with this blue trendline — in the $1.50–$1.70 range.

A strong project. A fundamentally sound coin that respects technical analysis.

A logical and high-probability target.

Best regards Ceciliones🎯

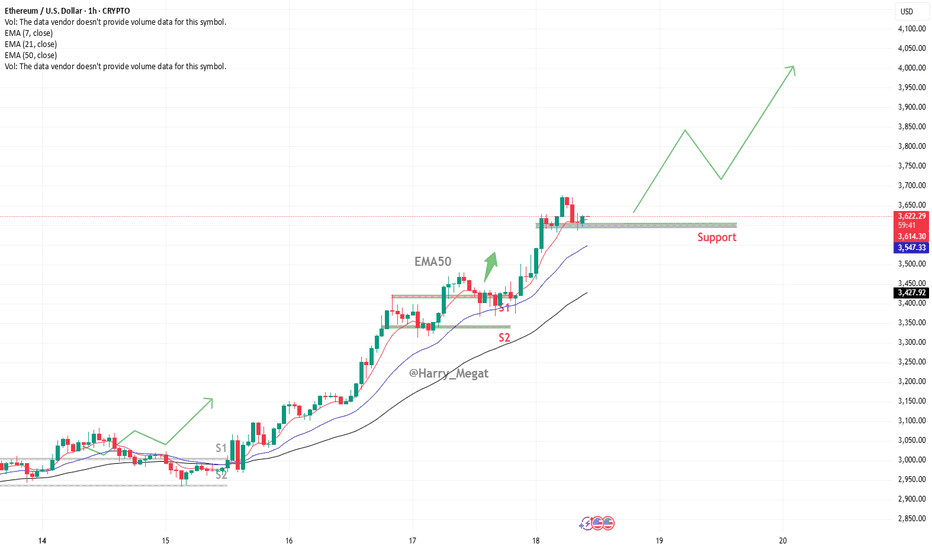

Ethereum (ETH/USD) Chart AnalysisEthereum (ETH/USD) Chart Analysis

**Trend Overview:**Ethereum (ETH/USD) Chart Analysis

* The chart shows **strong bullish momentum**, with Ethereum maintaining an upward trend of **higher highs and higher lows**.

* The price is currently around **\$3,618**, well above the key moving averages:

* **EMA(7): \$3,610**

* **EMA(21): \$3,539**

* **EMA(50): \$3,419**

**Support Levels:**

* The recent pullback found support at the **\$3,570–\$3,600 zone**, which is now acting as a **key horizontal support**.

* Below this, **EMA 21 (\$3,539)** and **EMA 50 (\$3,419)** offer additional dynamic support zones.

* Marked support areas **S1 and S2** also highlight previous breakout zones that could act as strong demand levels if retested.

**Bullish Outlook:**

* As long as ETH stays **above the support zone**, the bullish trend is likely to continue.

* A bounce from the current level could lead to a **retest of \$3,740**, followed by a move toward the **\$4,000 target** shown by the projected green path on the chart.

**Indicators & Sentiment:**

* Price respecting the EMA lines confirms **strong buyer interest** on pullbacks.

* No visible bearish divergence, and the chart structure favors **trend continuation**.

**Conclusion:**

Ethereum remains in a **bullish structure**, with strong support around \$3,570–\$3,600. As long as it holds above this zone, the next upside targets are \$3,740 and potentially \$4,000. A break below the EMAs would signal weakness, but for now, momentum supports continued gains.

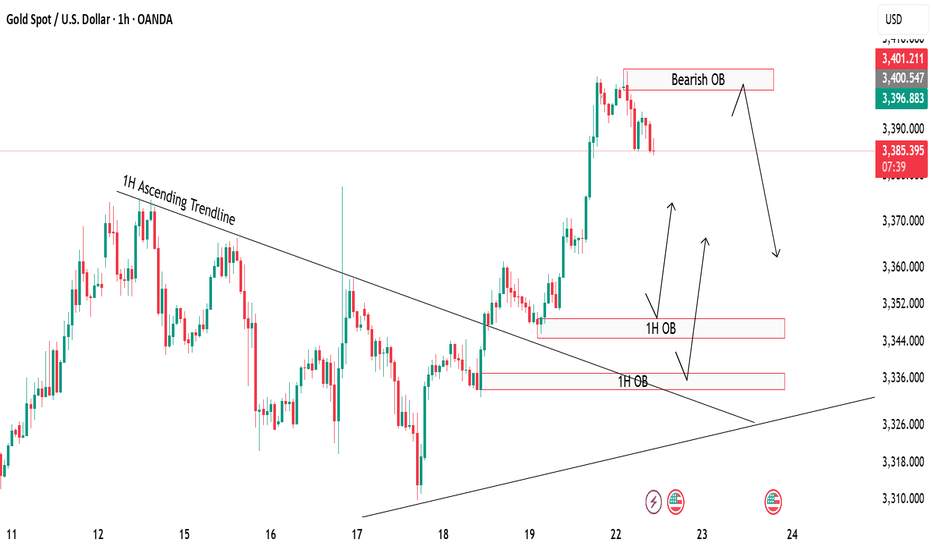

Gold Rejection & Retest Zones AnalysisGold has recently broken out of the 1H ascending trendline with a strong bullish push 🚀. After this breakout, we are now watching key supply and demand zones for the next move.

🔴 Bearish OB (3398-3404):

Price is currently hovering around the bearish order block, which could trigger some short-term rejection or pullback from this zone.

🟢 Bullish OB Zones (3350 & 3330):

If gold decides to correct lower, we have two important bullish OBs below, perfectly lining up with the previous trendline retest ✅. These zones can offer high-probability buy setups if price respects them.

🎯 Focus is on watching for possible rejections from the top OB, or waiting for a deeper retracement towards the bullish zones for buy confirmations

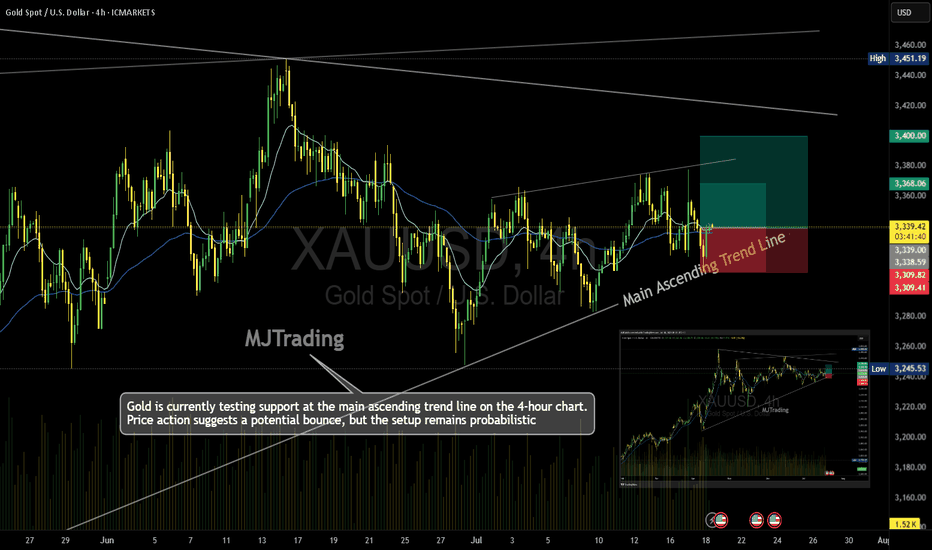

Gold (XAU/USD) – 4H Time Frame Trade Idea📈MJTrading:

Gold is currently testing support at the main ascending trend line on the 4-hour chart. Price action suggests a potential bounce, but the setup remains probabilistic—ideal for traders who operate on higher time frames and manage risk with discipline.

🔹 Trade Setup

Entry: 3340

Stop Loss: 3309

Take Profit 1: 3368

Take Profit 2: 3400

🔍 Technical Context

Price is respecting the long-standing trend line, hinting at bullish continuation.

Risk-reward ratio is favorable, especially for swing traders.

A break below the trend line invalidates the setup—hence the tight SL.

⚠️ Note: While the trend supports upside potential, failure to hold the trend line could trigger deeper retracement. Trade the probabilities, not the certainties.

In case it's not shown properly on your monitor because of different resolutions:

Psychology Always Maters:

#MJTrading #Gold #XAUUSD #Trend #Trendline #Forex #Chart #ChartAnalysis #Buy #Long

Gold 15-Min Chart Analysis Alert!Gold has successfully broken above the descending trendline, showing early signs of bullish momentum. Price has reclaimed structure and is now trading above the breakout level.

📌 Retest Zone:

We can expect a possible pullback towards the marked zone for a healthy retest before continuing the upward move.

🎯 Bullish Target:

As long as price holds above the support area, the bullish bias remains intact with targets around 3351+.

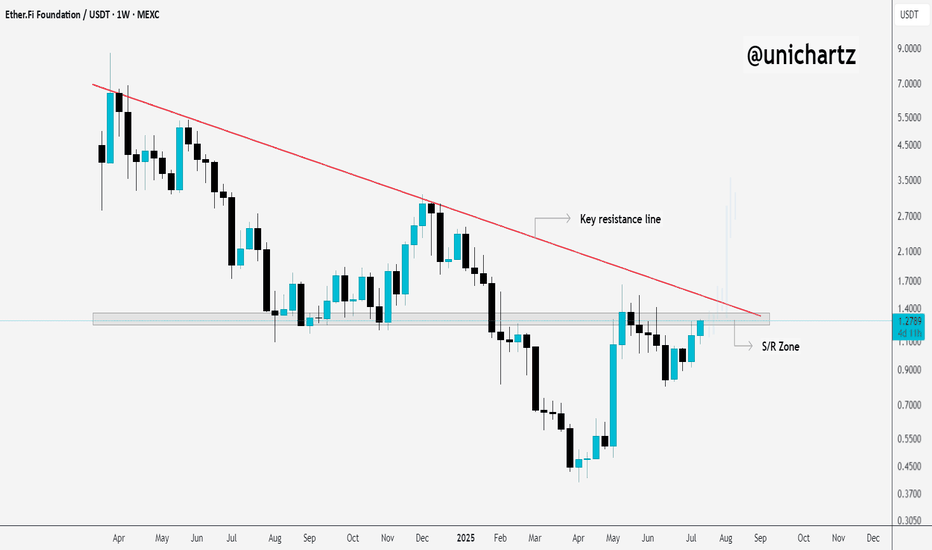

ETHFI Bulls Need to Flip This Level for Upside ContinuationCRYPTOCAP:ETHFI is still hovering around the key S/R zone and trading just below the major trendline resistance on the weekly timeframe.

This area has been a strong rejection point in the past, so it’s a crucial level to watch.

If we get a clean breakout and weekly close above this zone, it could trigger a breakout from the long-term downtrend, potentially kicking off a fresh bullish move.

Keep a close eye. A decisive move is coming.

DYOR, NFA

Gold (XAU/USD) – Bullish Continuation SetupGold is moving within an ascending trendline, showing strong bullish momentum. Price is approaching a Bearish Order Block near 3,370, which may trigger a short-term pullback 📉.

If price rejects from this zone and retests the trendline (around 3,355), it could offer a high-probability long setup for a continuation move toward 3,380+ 📈🚀.

🔍 Key Levels:

Resistance: 3,368–3,370 (Bearish Order Block)

Support: 3,355 (Trendline area)

💡 Trading Idea:

Look for price action confirmation near the trendline for potential buys. Break above the order block could fuel further upside.

BTC/USD 1H chart short-term🔻 Trend:

• Currently visible inheritance channel - confirmed by the yellow inheritance trend (decreasing peaks).

• The price tests resistance in the area 117.564 - possible to break out, but requires confirmation of the volume.

⸻

📊 levels of support and resistance:

• resistance:

• 117,564 (here we are now - resistance test)

• 117,939

• 118,206 (key level - potential breaking from the channel)

• Support:

• 117,205 - a recent hole, valid short -term

• 116,905

• 116,680 - deeper support, possible target with further decline

⸻

📉 Macd:

• The histogram begins to decrease, but the MacD line and the signal line still below zero → still weakness.

• Possibility to build a base for reversing the trend, but there is no clear signal intersection.

⸻

📉 RSI (Relative Strength Index):

• RSI below 50, but it starts to reflect slightly.

• MA RSI is still falling → no strong growth dynamics.

⸻

🔍 Applications:

• The downward trend still dominates, but the price is trying to pierce local resistance (117.564).

• If it breaks above 117,939–118,206 and persists, a possible change in the direction at a short interval.

• If he rejects the resistance - a quick descend to 117.205 or lower (116,900-116,680).

⸻

⚠️ Signals for observation:

• Closing the candle 1h above 118.206 - Bullly Breakout.

• Rejection of level 117.564 and descent below 117,200 - confirmation of further decline.

• MacD and RSI - 50 - potential change of direction.

US100 rises sharply, with further upside target of 23,000At this stage, US100 continues to ride a dominant ascending channel structure, maintaining a consistent bullish structure supported by strong fundamentals as well as technical positioning.

The current price action reflects a high-confidence trend environment, underpinned by steady economic resilience in the U.S. tech sector and growing investor optimism surrounding AI-driven growth and corporate earnings. This alignment between structure and sentiment reinforces the strength of the current trend.

What’s especially encouraging is how the price has remained in the upper half of the ascending channel. Every corrective move has been shallow and absorbed quickly as well. This kind of behavior is exactly what you want to see in a strong trend.

From a structural perspective, the recent break of the prior swing high confirmed a bullish break of structure (BOS), reinforcing the broader uptrend. That’s a meaningful move, not just technically, but also psychologically, as it validates that bullish momentum remains intact and market participants are still positioning for higher levels.

No signs of weakness are showing up yet. If anything, the structure is intact and there’s no evidence of a shift in momentum. This makes it a good opportunity for traders who are "late to the party" to consider entering, as the trend still looks strong and continuation is likely.

As for upside targets, the 23,000 level is a natural extension. It aligns with the middle of the channel and fits within the current rate of expansion. If we don’t see any warning signs (like impulsive bearish candles), this target remains both technically justified and psychologically relevant.

Just sharing my thoughts on support and resistance, this isn’t financial advice. Always confirm your setups and manage your risk properly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD forecast For my forecast we see market should be make a structure .in this structure my observation is Market make today buy side liquidity 3366 and other side also make sell side liquidity 3311 but is not fixed because day was not close if market price hunt liquidity strong bearish mode than we found new lower low otherwise we saw bullish correction if market price mitigated recent FVG than target will be hunting buy side liquidity its my thought .

golden trend linegold price peaked on intraday h1 chart on 3450 level despite shocking war news

opposite to crowd consensus price came down last two week until crowd give up buying war news

but price was falling like text book from trend line

test bounce then new lower low

(price now testing h4 support 3245)

Broadcom - This was just the first all time high!Broadcom - NASDAQ:AVGO - just created new highs:

(click chart above to see the in depth analysis👆🏻)

Over the course of the past three months, Broadcom has been rallying an impressive +80%. However looking at market structure, all of the previous "dump and pump" was not unexpected. Following this recent bullish strength, Broadcom is likely to channel a lot higher.

Levels to watch: $250, $400

Keep your long term vision!

Philip (BasicTrading)

Nvidia - 100% new all time highs!Nvidia - NASDAQ:NVDA - is just too bullish now:

(click chart above to see the in depth analysis👆🏻)

Honestly it was not unexpected that Nvidia is now the most valuable company in the world. The chart is just so strong and perfectly following structure; it seems to be just a matter of days until Nvidia will create a new all time high. If this happens, a breakout rally will follow.

Levels to watch: $150

Keep your long term vision!

Philip (BasicTrading)