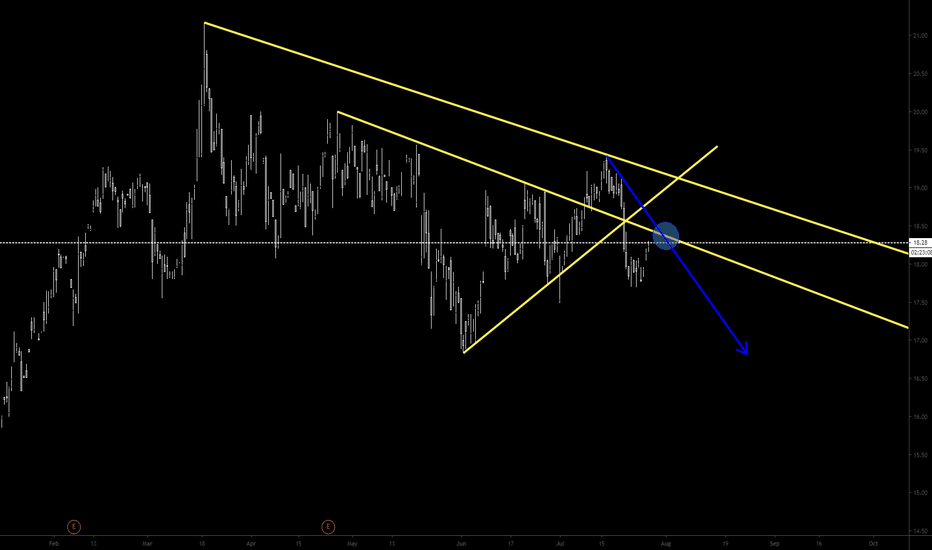

USD/JPY multi time frame analysis, WILL BE UPDATED STAY TUNED !Will be Updated During the next days for possible trade opportunity Stay Tuned (BE SURE THAT FOLLOW ME TO GET NOTIFICATION)

If like this and if help you with your trading Please Like, Share, Follow and comment that give me motivation to make another Market analysis and trading ideas

If you have some suggestion, comment or other opinion feel free to write it in comment

Wish you succesfull and consistent trading with profits!

This is not an investment advice.

"CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money."

Trendlinestructure

(4h) The eventual recovery of the monthly fractal support (1764)OANDA:XAUUSD

Gold, now trading below the major support forged at 1764 and approaching the bullish butterfly pattern completion point projected at 1711.

The pattern, if formed, will suggest a bounce towards the daily fractal resistance positioned at 1816 - the 38% fib (+6.15%)

GBP/USD To reach 1.40 For GBP/USD we are currently sitting on a very strong support level and we do expect the price to reject it and continue it's move to the upside and reach the 1.40 Price. We have a Daily ascending channel and we will target the upper trendline for our long position and then we can look for other opportunities afterward. For the time being from a COT data perspective we can clearly see that GBP is getting very strong and that long order have been filled and we should expect this momentum to continue and reach our target or even more.

Now if you enjoyed this analysis smash that like button and share. If you have a different opinion please leave a comment below as I would love to get more insights and ideas. I also linked my previous idea about this asset.

Trade safe !!!

The S&P 500 remains in a bullish trend - but beware

Quick comments in this analysis.

I tend to find just looking at the direction the ema ribbon, or red 20dma is an easy way to tell the underlying trend. Clearly it is still bullish.

I was wrong in the latest TA on the S&P 500 I posted. I foresaw a drop through that ema ribbon that did not materialize. That next week I closed that short for a loss, as once the price bounced off that ema ribbon which was historically a setup, it was evident shorting a bull market would have made the loss much worse.

I however did not chase the price as it went up higher, nor am I recommending longing here. I do however think while the price can continue higher, frankly I even am expecting it as the price appears very bullish and the financials XLF continue to rise towards historical resistance - there is not a clear setup for longing with the price this far from the mean and so overextended. If the price were to fall to support within the channel, & tag and confirm support off a pivot point to the right of the chart then I would consider longing.

If we have a significant drop I will seek to get back into equities. Till then I am stuck spectating, stock picking, and continuing to ride the Bitcoin/Eth bull market up its own wall of worry.

Some interesting trend lines holding... I have a definite short bias at this point, right back down to the weekly ema 12 around 22,000 - 23,000 would be lovely but lets see. Hopefully a short will setup, maybe the break and retest of that long trendline that it's kept above since 30th Dec and retested on the latest dip.

The dollar is very bearish and continues to sell offWe are seeing other currencies, and cryptocurrency especially rise against the dollar, but when looking at the USD outright we see a very bearish picture. I would imagine targeting that $89 point as we see nice confluence with other indicators as outlined in the chart.

EurCad Currently, price action is at the support zone on the 4hr tf. If we look to the Daily, we can see that the market structure is in uptrend.

If we look left on the 4hr tf, we see that this support zone has not been broken/still respects the zone.

If price breaks and retest then the support has becomes a resistance zone . This means price action will be short untill the support of the trendline .

Wait and see how price reacts to that level to determine buy or sell. I personally looks for confirmation patterns/candle to determine my entry.

I would love to hear some feedbacks.

NIFTY50 - Trendline Breakout StrategyWhenever i see a trend-line break , but not a follow-through move, i draw a parallel Trend line to the new low made.

And if the price break this new trend-line, then the chances of price follow through becomes high.

Hence nifty is sell below 8980 levels.

Do not follow blindly, please do your own research.

USDCAD Technical Analysis - Trend Lines & Candlestick PatternsThe USDCAD give us an opportunity to get in the market as sellers.

Do not open any position if the price doesn't closed below the previous candlestick (body and spike), we will be in a better position if this candlestick closed lower and it have a spike at the top.

I will be happy to talk about this technical analysis with other traders.

Bearish Idea for Solar WindsBased on these trend lines, and retesting of previous levels, I have bearish sentiment for this market.

GBPJPY... Decision Time .. Can the USDJPY make more headway

GBPJPY... Decision Time .. Can the USDJPY make more headway with the Falling stocks.

Actual Charts are within the links provided below...

i.imgur.com

GBPJPY Daily - 151 looks solid for now.. However a break can dent the Up Trend it is trying to form in..

i.imgur.com

GBPJPY 4 hr - Clearer highlight on the 151 handle as must hold zone - Else a systematic drop down to 147 handle would be attractive tgt.

Last but not the least the Weekly which I had it on display on few occasion past few weeks.

i.imgur.com

GBPJPY Weekly --

Close link preview

GOLD Short positions in playShorting FX_IDC:XAUUSD till major support line at 1307. After a breakout of CTL, which has been running since 25th August we can see shorting positions coming into play. You can also see the 9 Day EMA has risen above the latest bar therefore showing bearish momentum.

Happy Shorting ;)