Silver (XAG/USD) – Rising Wedge Breakdown & Bearish Setup📌 Overview

This 1-hour chart of Silver (XAG/USD) presents a textbook Rising Wedge pattern, which is known as a bearish reversal signal. The price was in a strong uptrend but started showing signs of buyer exhaustion, leading to a breakdown from the wedge formation.

The chart clearly identifies:

✅ A Rising Wedge formation

✅ Resistance Level where price faced multiple rejections

✅ Breakdown Confirmation and shift in trend direction

✅ Projected Target & Stop Loss Zones

This setup suggests a strong potential for further downside movement in silver prices. Now, let’s break it down step by step like a professional trader.

🔹 Key Technical Analysis Breakdown

1️⃣ Rising Wedge Pattern – The Bearish Setup

The Rising Wedge is a bearish reversal pattern that forms when price action moves higher within two converging trendlines. The slope of the lower trendline is steeper than the upper trendline, meaning that buyers are getting weaker.

This pattern suggests that even though the price is rising, bullish momentum is fading.

Once the price breaks below the wedge, it confirms a bearish trend.

🔸 Characteristics of this Wedge:

📌 Multiple Higher Highs & Higher Lows – But with decreasing strength

📌 Narrowing Price Action – Indicates weaker buying power

📌 Breakdown Below Support Line – Confirms the bearish move

2️⃣ Resistance Level – Key Price Rejection Zone

The price tested the Resistance Level multiple times before breaking down. This area is where sellers overpowered buyers, preventing further upside movement.

The resistance zone was a liquidity area, meaning large institutional traders likely placed sell orders here.

The price attempted to push higher but failed, showing that demand was exhausted.

Once rejection happened, selling pressure increased, and the breakdown followed.

3️⃣ Breakdown Confirmation – Bearish Momentum Kicks In

After the wedge broke down, the price started moving in a structured downtrend, forming lower highs and lower lows. This confirms that the breakdown was valid and that the trend has shifted.

🔹 Signs of Breakdown Strength:

✅ Strong Bearish Candles – Indicating aggressive selling

✅ No Immediate Recovery – Suggests sellers are in control

✅ Lower Highs Forming – Bearish trend structure confirmed

4️⃣ Risk Management – Stop Loss & Target Zones

A well-planned trade must include a Stop Loss and a Target to manage risk effectively.

📌 Stop Loss Placement (33.95)

Placing a Stop Loss just above the resistance level protects against false breakouts.

If the price goes back above 33.95, it would invalidate the bearish setup.

📌 Profit Target (31.96)

The target is based on the measured move projection, meaning the expected price drop is equal to the height of the wedge at its widest point.

If the price reaches 31.96, traders can lock in profits.

📌 Risk-Reward Ratio (RRR)

The setup offers a favorable risk-to-reward ratio, making it a high-probability trade.

5️⃣ Expected Price Movement – Bearish Outlook

From here, we can expect the following price movement:

📉 Scenario 1: Continuation of Downtrend (High Probability)

The price will likely form lower highs and lower lows on its way to 31.96.

Each small rally should be met with selling pressure.

📈 Scenario 2: False Breakdown (Low Probability but Possible)

If the price moves back above 33.95, the wedge breakdown will be invalid.

This could lead to a bullish reversal instead.

6️⃣ Final Thoughts – How to Trade This Setup?

This Rising Wedge Breakdown provides an excellent short-selling opportunity. Here’s how a professional trader would approach it:

✅ 🔹 Entry Strategy:

Short after a retest of the broken wedge support

Confirmation of lower highs ensures trend continuation

✅ 🔹 Risk Management:

Place Stop Loss above 33.95

Take profits around 31.96

✅ 🔹 Confirmation Signals to Watch:

Lower highs forming after breakdown

Increased selling volume on bearish candles

Price respecting the downtrend structure

🔔 Conclusion – Bearish Bias Confirmed

🔻 Trend Shift: The breakdown signals a potential trend reversal in silver.

🔻 Bearish Targets: The price is expected to fall toward 31.96 in the coming sessions.

🔻 High-Probability Trade: Strong technical reasons support a bearish outlook.

🚨 Watch for further confirmations and manage risk effectively! 📊💰

Trendreversal

EUR/USD Technical Analysis – Double Top Pattern & Bearish MoveThis EUR/USD 1-hour chart presents a clear Double Top pattern, signaling a potential trend reversal. The chart displays key technical elements, including support and resistance levels, trendlines, a stop-loss placement, and a take-profit target. Let’s go through an in-depth professional breakdown of this trading setup.

1. Market Structure and Trend Analysis

Before identifying the pattern, it’s crucial to analyze the market structure:

✔ The price had been in an uptrend initially, making higher highs and higher lows.

✔ However, the trend began to weaken after hitting resistance at the 1.0950 zone.

✔ This failure to break higher created a double top, which is a strong bearish reversal signal.

A double top forms when the price reaches a high twice, fails to break above resistance, and then declines past the neckline (support level), confirming trend reversal.

2. Double Top Pattern Breakdown

🔹 First Peak (Top 1):

The price surged upwards, hitting the resistance zone at 1.0950, but faced selling pressure.

The rejection resulted in a pullback to the neckline (support level at 1.0800-1.0820).

🔹 Second Peak (Top 2):

The price attempted another rally but failed at the same resistance zone, confirming seller dominance.

The second rejection suggests a lack of bullish strength, signaling a potential shift in momentum.

🔹 Neckline (Support Breakdown):

The key support zone around 1.0800 acted as a pivot level.

Once this level was breached, it confirmed bearish continuation.

3. Key Technical Levels & Price Action Signals

🟢 Resistance Level – 1.0950 Zone

This level has acted as a strong supply zone where sellers stepped in to push prices lower. The two failed breakout attempts indicate that buyers lost control.

🔵 Support Level (Neckline) – 1.0800-1.0820 Zone

Initially, this area provided buyer support, but once broken, it became a resistance level (previous support turns into new resistance).

⚡ Stop-Loss Placement – 1.09190

A well-placed stop-loss above the resistance zone protects against false breakouts.

If the price rises above this level, it invalidates the bearish structure.

🎯 Take-Profit Target – 1.06916

The projected target aligns with the measured move (the distance from the resistance to the neckline).

The price may find support at this level, where traders should look for a potential reversal or continuation.

4. Confirmation of Bearish Breakdown

For a high-confidence short trade, multiple confluences support the bearish bias:

✔ Break & Retest of the Neckline – After breaking support, the price attempted a retest and failed, confirming resistance.

✔ Trendline Break – The trendline supporting the previous uptrend has been decisively broken.

✔ Bearish Price Action – The formation of strong red candles and lower highs suggests sustained selling pressure.

✔ Momentum Shift – Increased bearish volume further confirms the reversal strength.

5. Trading Strategy & Execution Plan

✅ Entry Criteria

Sell after the retest rejection at the previous support (now resistance).

Look for a strong bearish candle formation as a confirmation signal.

📉 Risk Management

Stop-Loss: Placed slightly above 1.09190, ensuring the pattern remains valid.

Take-Profit: Target set at 1.06916, aligning with previous structure support.

💰 Risk-Reward Ratio

The setup offers an attractive risk-to-reward ratio, making it a high-probability trade.

6. Alternative Scenarios & Market Considerations

Although the bearish bias is dominant, traders should be prepared for alternative outcomes:

🔸 Fakeout Risk: If price closes above 1.09190, it could indicate a failed breakdown, invalidating the trade.

🔸 Bounce from 1.06916: If the price reaches the target support zone, buyers might step in, leading to a potential reversal.

🔸 Fundamental Influence: News events (such as FOMC, ECB statements, or US inflation data) can increase volatility and impact price direction.

7. Conclusion – A High-Probability Short Trade

This Double Top pattern setup presents a textbook bearish reversal, offering an excellent short-selling opportunity. The combination of technical confirmations, price action signals, and a well-structured risk-reward ratio makes this trade highly reliable.

Final Takeaways:

✔ Bearish Confirmation – Double Top breakdown with a retest rejection.

✔ Sell Setup Validity – Below 1.0800 support.

✔ Stop-Loss & Target Defined – Risk-controlled strategy execution.

📊 Verdict: Bearish trade setup with downside potential toward 1.06916. Traders should monitor price action for further confirmations! 🚀

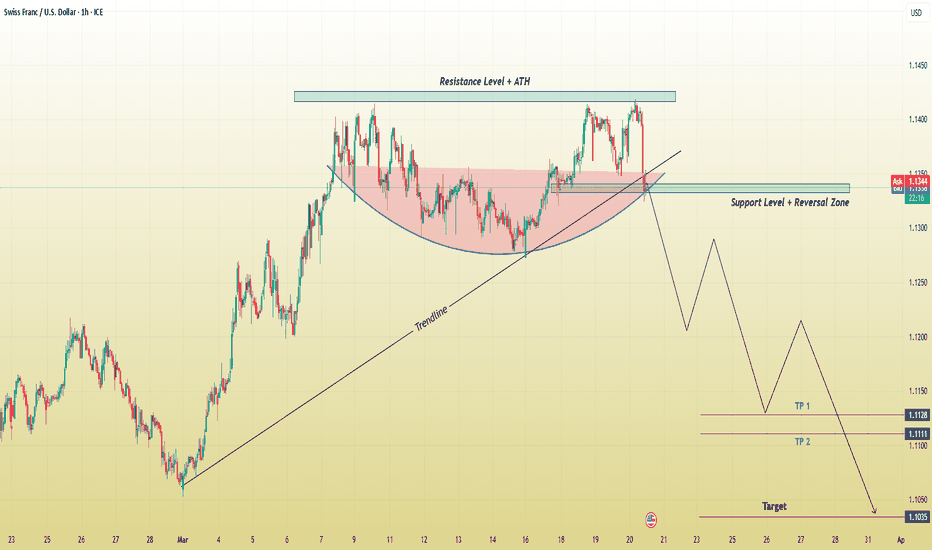

CHF/USD Bearish Reversal: Trendline Break Strong Sell-Off!his CHF/USD (Swiss Franc/U.S. Dollar) 1-hour chart showcases a bearish trading setup, signaling a potential downside move after a failed breakout at a key resistance level. Below is a comprehensive breakdown of the chart, highlighting key technical elements, potential trade setups, and risk management considerations.

1. Identified Chart Pattern – Cup & Handle (Failed Breakout)

The chart initially formed a Cup and Handle pattern, a bullish continuation setup where:

The rounded bottom (cup) indicated accumulation and a gradual shift in trend from bearish to bullish.

The handle consolidation represented a minor pullback before a potential breakout.

However, the pattern failed to hold its bullish momentum. Instead of continuing higher, the price was rejected at the resistance level (ATH – All-Time High), signaling a shift in sentiment.

2. Key Technical Levels

Resistance Level + ATH (All-Time High)

The price reached a significant resistance zone (marked in blue), aligning with an all-time high (ATH) level.

Multiple rejections at this level indicate strong selling pressure, making it a potential distribution area where smart money is offloading positions.

Support Level + Reversal Zone

After rejection from the resistance, the price retraced to a critical support zone, previously acting as a demand area (buyers stepping in).

A break below this level confirms bearish momentum, increasing the likelihood of further downside movement.

Trendline Break – Bearish Confirmation

The trendline (marked in black) represents the primary uptrend support that guided price movement.

The break below this trendline signals a loss of bullish strength, increasing the probability of a trend reversal rather than a continuation.

3. Projected Price Movement – Bearish Scenario

Given the trendline break and rejection from resistance, the chart suggests a bearish wave with the following expectations:

A retest of the broken trendline and support zone before continuing downward.

Lower highs and lower lows formation – confirming a new downtrend.

A potential drop towards key downside targets (marked as TP1, TP2, and the final target).

Take Profit (TP) Targets:

✅ TP1 (1.1128): A minor support level where price may find temporary buying interest.

✅ TP2 (1.1111): A more significant support area that previously acted as demand.

✅ Final Target (1.1035): The ultimate downside objective, aligning with a major support zone and historical price action levels.

Stop-Loss Placement (SL):

📍 Above the broken trendline OR the recent swing high, ensuring protection against false breakouts or retracements.

4. Trade Execution & Risk Management

Entry Strategy (For Short Positions)

🔹 Aggressive Entry: Enter short immediately after the support zone break.

🔹 Conservative Entry: Wait for a retest of the support-turned-resistance area for confirmation before shorting.

Risk-Reward Ratio Consideration:

A properly placed stop-loss above resistance ensures a favorable risk-to-reward ratio.

Ideal ratio: 1:2 or better, meaning potential reward should be at least twice the risk.

5. Market Sentiment & Possible Alternative Scenario

While the primary outlook is bearish, traders must remain flexible and monitor price action closely:

If price reclaims the support zone and breaks above resistance, it invalidates the bearish setup, shifting momentum back to bullish.

A sustained close above the trendline could trap early sellers, leading to a short squeeze rally back toward resistance.

6. Final Thoughts

🔹 Bearish Bias: This setup favors downside movement due to trendline break, resistance rejection, and market structure shift.

🔹 Key Levels to Watch: Support zone retest, trendline confirmation, and target levels.

🔹 Risk Management is Essential: Using stop-loss protection and proper trade sizing to mitigate potential losses.

Conclusion: High-Probability Bearish Setup

🚀 The CHF/USD pair has shifted to a bearish structure after failing to break its ATH resistance. The breakdown of the trendline and key support level suggests a strong sell-off towards the 1.1035 target. Traders should look for short opportunities on pullbacks while managing risk effectively.

Would you like me to refine or simplify any part of this analysis for your TradingView post? 📉🔥

NASDAQ 100 - Is the Downtrend Losing Steam? The market has been in a clear bearish trend, forming a descending channel with lower highs and lower lows. However, we are now witnessing signs of stabilization as price action begins to consolidate at a critical level.

🔍 Key Observations:

- The price has tested resistance twice around 20,800, failing to break higher. This signals strong selling pressure at this level.

- At the same time, the market has established a short-term support around 20,000, holding the price from making new lows.

- The structure suggests a possible double top formation, which could indicate another rejection and continuation of the bearish trend.

Possible Scenarios:

1️⃣ Bullish Breakout: If the price manages to break above resistance, we could see a trend reversal, leading to a potential recovery towards 21,000+.

2️⃣ Bearish Rejection: If resistance holds strong, another drop could follow, with price targeting the previous support zone or even lower lows.

3️⃣ Range Formation: If the market continues to test this zone without clear direction, we might enter a sideways consolidation phase before the next major move.

What do you think? Will NASDAQ break resistance or head lower?

#NASDAQ #Trading #MarketAnalysis #DoubleTop #BearishOrBullish

$COIN Spinning Stop Candle in Downtrend; ReversalWe have 7 days of straight beating, assault, slaughter and murder. Do I think this thing reverses 10 fold? No but do I expect a bounce into the mid 220’s? Yes. RSI is relatively low (sold) for its name, it fundamentally smashed earnings and the candle here that closed on the daily is known as a spinning stop with a green closure. Expect a volatile move soon - tomorrow or and into Friday. NASDAQ:MSTR held up well today. This is always a craps shoot, no matter the trade, no matter the look of the chart and all the indicators we use. It just creates an edge. Good luck. I’m going to look at calls here for a bounce.

Wall Street Loser.

China stocks ready to go? #DeepSeek another reason..This is a chart of the benchmark index for Hong Kong - HK50

It's up on Monday, while Nvidia is down 10+%

If funds are flowing out of Nvidia - China (home of DeepSeek) could be one place they end up.

The Hang Seng is a perfect example of how long a trend can take to reverse.

How many times would traders have tried to go long this index only to see it slump right back towards the bottom?

Now while this trend reversal might be delayed further - and might fail altogether - we think there is enough evidence to suggest a reversal is happening.

The price is above a rising weekly 30 week SMA

A long term trendline has broken

Crucially - the price made a double bottom pattern around 15,000

DAILY CHART

On the daily chart we see the strong surge in buying interest from September has given way to a long multi-month correction.

We are looking for a breakout above the down trendline to demonstrate the correction has finished and a new up-leg is beginning.

The final confirmation would come from a break of resistance (not drawn) from the November and December highs at 21,350.

Should the price turn lower and make a new fractal low under 19,650 then we’ll have to wait a bit longer for the Hang Seng trend reversal.

But - as always - that’s just how the team and I are seeing things, what do you think?

Share your ideas with us - OR - send us a request!

TOSHI/USD Bearish Phase is Over! Is a Bullish Breakout Coming?After a prolonged bearish correction, TOSHI/USD is flashing signals of a potential breakout. If you're still stuck in a bearish mindset, you might be missing the next big move!

🔥 Key Bullish Signals:

✅ Higher Lows Forming – Buyers stepping in at stronger levels.

✅ Volume Surge

💡 Trading Idea:

🎯 Long Entry: Look for confirmation above with strong volume.

📢 Final Takeaway: If TOSHI/USD holds key support and breaks resistance, we could see a strong rally. Stay alert and trade smart!

💬 What’s your outlook on TOSHI? Drop your thoughts below! 👇

#TOSHIUSD #CryptoTrading #BullishBreakout #TradingIdeas #TrendReversal #Altcoins #CryptoMarket

EUR/GBP Collapses Bearish Breakout SetupThis chart shows a short trade setup based on the price action and trendline analysis of the EUR/GBP pair on the 2-hour timeframe. The price was moving within an ascending channel, defined by two parallel white trendlines. The ascending channel suggests a temporary bullish trend where the price consistently made higher highs and higher lows.

At the top of the channel, the price experienced resistance, which led to a breakdown below the lower trendline. This breakdown signals a potential reversal of the bullish trend and marks the start of bearish momentum. The break of the lower trendline is the key signal for the short entry.

The breakdown also aligns with a shift in market sentiment, as the price failed to maintain its position within the channel. The sell-off that followed confirmed the validity of the breakout. The price is now trending downward toward a lower level, which could act as a support area.

The key levels to watch include the recent breakout point, which could act as resistance if the price attempts a pullback, and the lower support level near 0.82856. This support level aligns with a previous price range and serves as the potential target for the short position.

The descending movement following the channel break suggests strong selling pressure. To confirm the continuation of the bearish trend, the price should not re-enter the ascending channel. A retest of the lower trendline could provide further confirmation of the breakdown, while a failure to hold below it could invalidate the bearish bias. This setup reflects a clear trend reversal strategy focusing on trading the breakout of an ascending pattern.

#GOAT/USDT Short-Term Rally or Wave 5 Decline ?#GOAT/USDT is currently forming a descending channel with a 5-wave Elliott Wave structure. The price shows potential for a short-term upside move toward $0.69, which acts as a crucial resistance level at the upper boundary of the channel. If rejected at this level, the price may continue its downtrend toward $0.32, aligning with the lower channel boundary and Wave (5) target. Traders should watch for a breakout or rejection at $0.69, as it will determine the next significant move. A breakout could signal further bullish momentum, while rejection would confirm the continuation of the bearish trend. BYBIT:GOATUSDT.P

$AMD Forms Another Double Bottom – Will History Repeat Itself?I wanted to share an interesting setup I’ve noticed on NASDAQ:AMD daily chart. The stock just completed what looks like a classic double bottom pattern—something it’s done before with impressive results.

What I’m Seeing:

Double Bottom Revisited:

We can see that AMD has formed another “W” shaped bottom, where price tested a support zone twice and successfully bounced.

Historical Precedent:

The last time AMD completed a double bottom, the subsequent breakout and follow-through rally were significant. After the neckline breakout, price continued to move higher, rewarding patient traders and confirming the pattern’s bullish nature.

Volume & Confirmation:

It’s worth looking closely at volume to confirm the pattern. In many textbook double bottoms, volume often increases on the breakout, signaling that buyers are stepping in. If we see heavier trading volumes as AMD breaks through the neckline, it could be an indication that a similar move might unfold.

Potential Price Target:

A common way to project a double bottom target is to measure the height of the “W” and add it to the breakout point. If this pattern performs similarly to the last one, we could see a significant upside move. Of course, there are no guarantees, but patterns like these give traders a framework to manage risk and set objectives.

What to Watch For:

Neckline Break: A clean move above the neckline (resistance area) would be a key bullish signal.

Volume Expansion: Higher volume on the breakout adds conviction.

Market Conditions: Broader market health and sentiment can affect whether the pattern plays out as expected.

AMD has shown us before that this pattern can precede major rallies. As always, manage your risk appropriately—no matter how promising a setup looks, it’s wise to confirm with price action and volume before jumping in.

Forex Trade Planning: USD Dominance and Potential CorrectionToday's trade planning session highlighted the USD as the strongest currency on the daily Currency Strength Index (CSI), while the EUR emerged as the weakest.

General CSI Overview:

Buy pairs: USD, CHF, GBP, JPY, AUD

Sell pairs: CAD, NZD, EUR

In our H1 timeframe market analysis, we anticipate a deeper correction in existing trends. The wave structure for major pairs versus the USD has reached momentum high and momentum low 5. From this level, a correction of the trend is expected.

It is important to note that significant effort and time are required for a trend reversal. Nevertheless, there has been a notable decline, breaking key structures in USDJPY, which could indicate a more substantial downturn for the USD and potentially lead to a larger secondary trend.

Trade carefully and happy trading!

Gold Long Term Analysis Nov 15I published some trend analysis using the adaptive trend finder 2 weeks ago. I wanted to revisit this given the eventful couple of weeks we've had.

The previous analysis highlighted an ultra-strong uptrend over the previous 20 weeks on the weekly chart. Prior to the election, the rally in gold the price showed little sign of slowing down. In the last two weeks we've seen a fall in the gold price of 1.9% and 4.5% (the largest drop since 2021). Apart from the obvious, there appears to be several factors leading to the drop.

Donal trump's emphatic win and a number of his stated policies that could see interest rates stay higher for longer (think tarrifs, tax cuts)

Economic data that came in inline with expectations

A rate cut that had already been fully priced in

Essentially, the gold price is being weighed down by expectations on policies that are potentially months aways and stronger than exepected economic data. Jerome Powell also indicated in his speech that the Fed sees the pace of rate cuts slowing down in the near future.

Whilst higher inflation is typically seen as a positive for the gold price (gold as an 'inflation hedge'). Higher inflation is accompanied by higher interest rates which act as a negative for the non-yielding asset.

Last week's close broke the established 20 week price trend there is, however, a longer term trend that can be observed over the last 60 weeks. Last week's closing price respects this trend. Whilst the expectation of a technical correction hadn't eventuated, we may find that this is the bottom of the dip as long as there is not further negative news for gold. Central Bank and ETF demand is still strong. A shift from gold to risk assets following the Trump election does remain a risk for the short-term gold price.

There are a couple of key resistance points to watch this week to understand whether this is the bottom of the dip. I'll explore this in another post.

EURUSD: Intraday Trend Reversal PatternFollowing the low established on Wednesday, 6th November 2024, we have observed a completed bullish wave structure. Subsequently, the price traded the low at 1.0682, forming a bearish completed wave pattern. Based on this price information, a bullish phase is anticipated in the next movement.

We are entering a buy position, anticipating increased buying momentum at 1.0682, which could propel the price past the nearest internal momentum high of 1.0727. If this trade materializes, 1.0824 will serve as our momentum high target.

Stop Loss: 1.0676

Happy Trading!

Meme Magic on BRETT: Don’t Miss This Bullish Trend!THIS IS A MUST BUY! 🚀 As most memes are currently flipping bullish, this one just fired a bullish signal right off the lows.

What’s to like? This is just the beginning of the weekly trend. Sure, it might seem a bit late, but if everything aligns, the swing is safe to take.

I can’t see a chart more bullish than this at weekly prices. Price targets are indicated by the boxes, so adjust your risk and go long now! 📈

Grab It Now, Cash In by November!💰📈

Gold reached all-time high and hit weekly targetHello traders,

As you can see gold reached all time high time record.And reached the weekly target as anticipated, so the analysis went to our favor and gave us a Great trade. After gold broke the fourr hour level, it Made a break and a retest and made a rebound on the one hour time frame at exactly 2673 The bullish momentum took place againand buyers.Took control of the market and pushed gold higher and higher until reached the weekly target.

After this long run making a tree leg extension as you can see on the chart, there is a high probability that the market will reverse.And we might see a huge sell off of gold in order to breathe until.Buyers and bullish momentum comes back again and takes the gold market higher again because this is very normal. After a long run being bulish or bearish.There should always be a big.Correction. Remember.After every long run there is a steep pullback and that's what we gonna see in the coming days. So guys.Be prepared for selling gold, but not this week, probably next week or the following week.

WBA Sing Trade UnderwayWBA seems to have completed the breakout of the Inverse HS bottoming and trend reversal pattern I discussed last week.

If entry point was at close yesterday, gains are 6+%

Take profits as you feel comfortable.

Ultimate target upon completion of pattern yields a price target of approx. 10.50.

If trend reversal is a long term chance of character move, reaching the 200DMA for a gain of 50-85% is not out of the question.

Taking half positions off the table is not a bad idea.

Please watch for details

Is Gold ready to retrace?Gold has experienced a significant appreciation of 48.18% since 6 October 2023. This remarkable increase can be attributed to rising global uncertainties, including the ongoing conflict in Ukraine, escalating tensions in the Middle East, and the impending US presidential elections.

New Highs and Market Indicators

From a technical standpoint, gold is currently trading at historic highs, placing it in uncharted territory with no established resistance levels on the daily chart. The Relative Strength Index (RSI) indicated a reading of 77.26 on 26 September, suggesting that gold may be in an overbought condition. Generally, RSI readings above 70 signal potential exhaustion of buying momentum.

The price has also been trading above the 200-period Average for 254 candles, which tends to show a potentially ageing upward trend on the daily chart. The longer the price remains on the same side of a Moving Average, the more prone it is to a retraction.

So, considering these elements:

1. High appreciation of more than 48% in Gold prices over the past 12 months,

2. Recent RSI reading at 77.26, indicating overbought conditions

3. Potentially ageing uptrend, with 254 candles above the SMA200,

Given these factors, there is a possibility that gold may experience a slightly stronger pullback if it manages to break below the uptrend line drawn on the chart between 5 August and 10 October. Such a movement could lead to a decline toward the 2480.00 level within a few days.

The Influence of Political Uncertainty

On the other hand, gold is often viewed as a safe haven during uncertain times. As recent US election polls indicate a technical tie between Donald Trump and Kamala Harris, it is plausible that a more definitive movement in gold prices may not occur until after the election results are announced.

Navigating the Gold Market

In conclusion, while the current indicators suggest a potential for price retraction, gold's status as a haven and the upcoming political landscape may heavily influence future price actions. Traders should remain vigilant and consider these elements in their market strategies.

Disclaimer:

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK.

Bandhan Bank - Magic Waiting to Happen !!Magic Waiting to Happen: Bandhan Bank's Weekly Chart Overview

- The downtrend line since 2020 has been a key resistance level.

- ₹250 and ₹200 have served as a consolidating range's upper and lower boundaries.

- You can now access our structured charts for all Nifty 500 companies . Check the signature column below for more info.

- Recent base formation suggests accumulation, supported by a surge in volume.

- The stock has gained momentum following the RBI's nod for a change in MD, CEO.

Bandhan Bank is currently coiling up for what looks like a significant breakout. With the downtrend line as the final hurdle and volume picking up, the chart suggests that magic is waiting to happen. A break above the resistance zones could trigger a bullish trend reversal, so it's worth keeping a close watch on this stock in the coming weeks.

DISCLAIMER: The information provided here is for educational purposes only and does not constitute financial advice or a recommendation to buy, sell, or hold any security. Stock market investments carry risk, and you should consult with a qualified financial advisor before making any trading decisions. Past performance is not indicative of future results.

Swing Trade Opportunity - LONG WBAWBA has broken a long term downtrend line, creating a potential inverse HS in the process.

This company is due for a bounce at the very least.

Best case for longs is a longer term bottom and reversal being put in that can take us to the 200DMA or above.

See video for details

Intel - Back To A Bullish Market!Intel ( NASDAQ:INTC ) perfectly rejected a major previous support:

Click chart above to see the detailed analysis👆🏻

After being cut in half multiple times over the past couple of months, Intel finally managed to reverse at a strong previous support level. However market structure is still clearly not bullish and Intel has to break above the next resistance to start creating a new overall uptrend.

Levels to watch: $26, $20

Keep your long term vision,

Philip (BasicTrading)