Trendshiftindicator

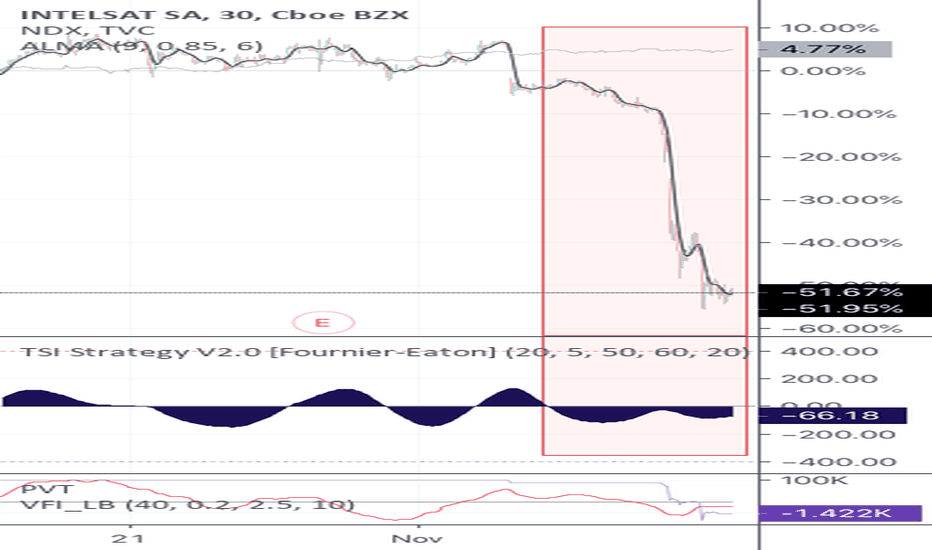

The unwinding of frothy speculation and the start of valuation. Trend Shift Indicator saved me from the worst of today with two weird peaks and a precipitous indicator drop that seemed scary enough to make me sell prior to the worst.

Despite the very short upswing TSI is still hanging low. Volumes aren't great and the volatility is likely not over.

We are exiting the speculation phase of sentiment-is-all and moving to the phase where adoption of currencies are manipulated politically and some semblance of valuation can begin in earnest. This is good for Bitcoin but likely bad for short term speculation.

Gamestop Reckoning Part 1. VolumeAs the community of traders reckons with many a crazed new-comer and their love of gamestop GME and AMC we have to be glad that people are being more and more interested in trading. However, for many of us, trading isn't to make a statement: it isn't to make a point, to stick it to someone or to prove how resolute you are.

For me at least, trading is the end result of an exciting process of creative research, imaginative planning and positioning, using algorithms that I've written to try to get a well-timed entry, and the satisfaction of not worrying about each pricepoint thereafter -- knowing that

I like the stock because of the sub-industry position in our future as a society

I like the stock because of the particular company's financials relative to any similar sub-industry member

I feel that management, both based on metrics and intuition from listening to the researchers, COO, CEO, CTOs at the company actually believe in what they are doing.

I feel that the timing is right from a technical perspective, relative to events, from an industry-cyclic standpoint, and broader market threats.

Thus, in summary, my "advice" to anyone would be: buy a stock because you find it compelling, you can imagine what they do 5 years from now and its more than what they do now, you know the company is healthy, there aren't many threats, and you wouldn't be upset if it lost 10% because you are confident in its future. .

If you feel this way about GME, then that's great. But its unlikely that you will make it through the above points without a bit of heartburn -- especially given the following: EARNINGS COME NEXT WEEK . This is a time to ask yourself the following question: what is a fair price? Did 100% gain exceed your fair price? How about 500%? I'll leave that to you.

Today lets look at GME's Volume using the OBV Correlation Indicator.

The OBV Correlation Indicator can be set to correlate with any reference. I've chosen QQQ

Secondarily the direction of chart stock's OBV is encoded with color: So if the histogram is negative AND red this means the correlation is negative and the obv direction is downward for GME.

Lastly price correlation is encoded with a line, and price direction with color. Thus a negative red line means the price directions are also anti-correlated and price is downward.

In the case of GameStop we see the natural pre-earnings pattern.

A lower price correlation than usual to the broader market

A lower volume correlation than usual to the broader market.

But we see something else here. We see accelerating negative correlation in Obv of GME and the index as well as obv oscillator decreasing at an increasing rate.

This is all one moment in time. However we have to remember earnings are about rectification: rectifying the price with perception, rectifying expectation with guidance, and also rectifying expectation with position --- i.e., a time to take profits.

Ask yourself this: Do you see whatever will be said by management as being something to sustain a 1,000% increase in price? Do you imagine a buyout would be offered at 1,000% its price at last earnings?

This week: Watch the relative volumes, watch the decoupling of volume and price using this indicator (OBV correlation indicator), and if you are holding GME, consider looking like a genius and selling now.

Almost time... but not yetTrend shift indicator (v2.0) histogram— along with other volume metrics —has this still weak. Wait for momentum and cross above 0 on TSI

TREND SHIFT INDICATOR: MAJOR UPDATE --- early warning lineNice performance of TSI Update on AYX reversal

Major Update to TSI: Please Read update on script

Strategy version available: "trend shift indicator strategy V2.0"

Early Warning: TSI and EARS indicator performanceGood performance by the EARS (Early Reversal Signal) and TSI (Trend Shift Indicator).

EARS signals early potential shift

Downward trend in TSI likewise

EARS: Early Reversal Signal Indicator BETA [Fournier-Eaton]EARS: Early Reversal Signal Indicator.

NOTE: THIS IS A BETA VERSION

This script allows you to get timely reversal indications. The script upon which this is based leads. However, EARS is meant to confidently lag so as to signal optimal trading times.

This particular version is optimized to suit the 1 month, 30min chart. Feel free to adjust the parameters to suit your needs.

More information on the parent script (Trend Shift Indicator) can be found here

Early Exit / Reduction... Trend Shift Heiken While the Trend Shift Indicator and Trend Shift Heinki are barely still "green"...

we can see a shift to decreasing values and a

the stock neared the 180 caution on TSI/TSH

traders are likely to favor taking some profits.

Time for a brief pause.

Feedback Appreciated.

Hold Alteryx (with some skepticism)Based on the accuracy of TSI Heikin Ashi, it is strong.

Ayx looks like it needs a breather. Wait for TSI HA.

Early Warnings: using Trend Shift Indicator divergence.The attached chart has much of the explanation.

Here are the highlights:

TSI gives early sell warning via high values (near 170), relative highs, or in rare cases an "x" signal.

Divergence with price is also a key indicator of future action.

Examine the divergence illustrated during the price drop and the (still red) TSI values.

I hope this is helpful. Feedback appreciated.

Lead time test: Trend Shift Indicator v2.0This is a simple , single , test of the Trend Shift Indicator's lead time.

5 day chart.

Lead time = signal time - directional shift time

Warning sign: upper line on TSI trending down while price trending up

End of warning: price shift in accordance with TSI direction.

Results :

Optimal Lead time = 1.25 days (of 5D)

Practical lead time= 1 day (of 5D)

Notes:

* This is simply one of many tests and is not indicative of constant performance -- as always use other confirmation indicators

* This is using version 2.0 of TSI, however the exact parameters and outcomes apply. It simply looks a bit different.