ETH Targets $12,500 With Potential Ascending Triangle BreakoutThis post updates my earlier post and revises the previous prediction upwards.

Pattern

As we can see on the 3-Month ETH/USD log chart, ETH price compresses within an Ascending Triangle formed by trendlines set at the candle bodies (not wicks). The upper trendline is almost perfectly horizontal and sits at $3600. ETH is currently attempting breakout, but would need a 3-Month close (end of Q3) above the upper trendline at $3600 to confirm the new uptrend.

Target Price

As someone new to Technical Analysis, my original chart used the linear layout, which I have come to learn is less well suited for charting patterns on long timeframes. The updated chart here shows a much more reliable pattern, but also suggests a much higher, yet still conservative, price target of $12,500. I am unsure of the timeline for which ETH could achieve this price, but I assume it would occur this cycle, which is consistent with other bullish ETH predictions, such as Tom Lee's recent call for $10k - 15k.

Method

Ascending Triangles are bullish continuation patterns. The breakout price target is obtained by measuring the percentage distance from the widest part of the triangle and projecting that same percentage above the upper trendline.

Please feel free to offer your criticisms and observations. This is not financial advice.

Trianglepatternbreakout

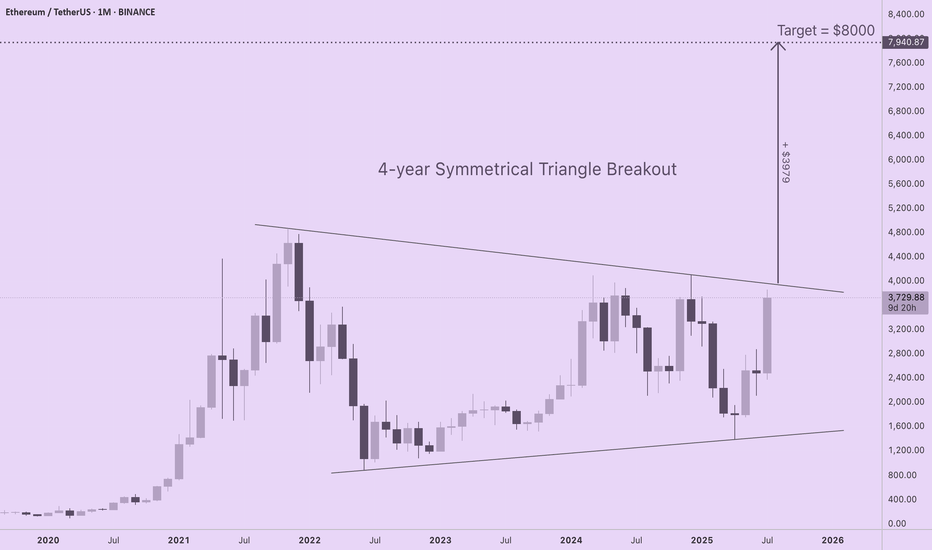

ETH Targets $8000 with 4-Year Symmetrical Triangle BreakoutIf you are seeking realistic ETH price targets based upon solid long-term market structure, check out this 4-year symmetrical triangle forming on the ETH/USD monthly chart. ETH is coiling for a major move to $8000, yet none of the CT "influencers" I follow are talking about this. I am new to technical analysis, so I am interested in learning your thoughts about this pattern and which tools or indicators you prefer for setting price discovery targets.

For those of you new to technical analysis, symmetrical triangle patterns can form on long timeframes (weeks, months, or years), indicating indecision between bulls and bears as price compresses within a continually narrowing range. A breakout from a symmetrical triangle typically follows the direction that preceded their formation, and the longer the consolidation period, the stronger the move.

The chart shows a strong euphoric phase in 2021 followed by a bear market low. Subsequent failure to reach previous ATHs is balanced by a pattern of higher lows. Since ETH was in an uptrend prior to triangle formation, odds are this is a continuation pattern, especially given profound shifts in capital flows and sentiment for the asset over the last several weeks.

With trendlines set at the price extremes, the height of the triangle is roughly $3980. If a breakout occurs at a price of $3960, ETH will target a price of $7940 (height of triangle + breakout price). A more conservative price target of $7000 is obtained by resetting the trendlines at the monthly opening and closing prices (omitting the wicks).

Regardless of the specific method for drawing the triangle, ETH is primed for a major move to the upside that has been four years in the making.

APP Earnings Triangle BreakoutWith APP breaking key resistance to the upside. There is a possibility for an aggressive move to the upside. This will NOT be a straight line up, but does show the possibility of the measured move. If I were to enter this, todays candle would be my entry and my stop loss would be an aggressive close back under the trendline.

Let's see what happens.

Triangle Chart Patterns: How to Identify and Trade ThemTriangle Chart Patterns: How to Identify and Trade Them

Triangle chart patterns are essential tools in technical analysis, helping traders identify potential trend continuations. These formations build as the price consolidates between converging trendlines, signalling an upcoming move in the market. In this article, we’ll explore the three types of triangle patterns—symmetrical, ascending, and descending—and how traders use them to analyse price movements.

What Are Triangle Chart Patterns?

Triangle chart patterns are a common tool used to understand price movements in the market. These patterns form when the price of an asset moves within two converging trendlines, creating a triangle shape on a chart. The lines represent support and resistance levels, and as they get closer together, it signals a potential breakout in one direction.

Symmetrical, ascending, and descending are three types of triangle patterns. Each of these patterns reflects a different market sentiment, with symmetrical triangles showing indecision, ascending triangles suggesting a bullish bias, and descending triangles hinting at bearish momentum. These formations are useful because they help traders spot potential breakouts, where the price might move sharply up or down after a period of consolidation.

It’s important to note that triangles and wedge patterns are similar but not the same. Both patterns involve converging trendlines, but wedges tend to slope upward or downward. Triangles, on the other hand, either feature one horizontal trendline and a sloping trendline or two sloping trendlines at roughly the same angle.

Below, we’ll cover the three triangle types. If you’d like to follow along, head over to FXOpen and TradingView to get started with real-time charts.

Symmetrical Triangle

The symmetrical triangle is a popular chart pattern that shows up when the price of an asset starts consolidating within a tighter range. Unlike other triangle patterns, it doesn’t lean heavily in either direction—bullish or bearish—making it a neutral signal. It forms when buyers and sellers are in a bit of a standoff, with no clear trend in sight. However, this period of indecision often leads to a significant move once the price breaks out of the pattern.

What Does It Look Like?

- Two converging trendlines;

- One sloping down from the highs (resistance);

- One sloping up from the lows (support);

- The price oscillates between these two lines, forming lower highs and higher lows;

- The formation narrows as the lines get closer together, creating a point of breakout.

What Does It Indicate?

A symmetrical triangle pattern indicates a period of indecision in the market. Buyers and sellers are evenly matched, causing the price to move within a narrowing range. As it gets smaller, the pressure builds, and the price is likely to break out either up or down. Since the formation is neutral, the breakout could occur in either direction, and traders wait for this moment to see where the market is heading.

How Do Traders Use It?

Traders typically watch for a breakout from the symmetrical triangle to signal the next significant price movement. They often look for an increase in trading volume alongside the breakout, as this can confirm the strength of the move. In most cases, it’s used as a signal for potential price continuation. However, some traders see it as a reversal indicator, depending on what the preceding trend looks like.

Ascending Triangle

An ascending triangle is a bullish triangle pattern that’s often looked for when analysing potential price breakouts. It usually forms during an uptrend but may also appear in a downtrend. It suggests that buyers are becoming more aggressive, while sellers are struggling to push the price lower, creating a situation where the market might break upwards.

What Does It Look Like?

- A horizontal resistance line at the top (price struggles to break above this level);

A rising trendline at the bottom, connecting higher lows (buyers are stepping in earlier each time);

- The price moves between these two lines, creating a triangle shape;

- The formation narrows over time, putting pressure on the resistance level.

What Does It Indicate?

An ascending triangle pattern signals that buyers are gaining control. While the price keeps hitting a ceiling (resistance), the higher lows show that the market’s buying pressure is increasing. This often leads to a breakout above the resistance level, where the price can make a significant upward move. Traders usually see this formation as a sign that the market is primed for a continuation of the current uptrend. However, sometimes it can appear in a downtrend and signal a trend reversal.

How Do Traders Use It?

Traders typically use the ascending triangle to spot potential breakouts above the resistance level. When the price finally moves and closes above this line, it’s seen as confirmation that the upward trend is continuing. Many also pay close attention to the trading volume during this breakout—rising volume can confirm that the breakout is genuine.

In some cases, the price may break through the resistance quickly, while in others, it could take time before the upward move happens. There may also be false breakouts before the true bullish move occurs, with the price typically closing below resistance.

Descending Triangle

A descending triangle is a bearish chart pattern that signals potential downward movement in the market. It typically forms during a downtrend but can also appear in an uptrend. It shows that sellers are becoming more dominant, while buyers are struggling to push the price higher, which could lead to a breakdown below a key support level.

What Does It Look Like?

- A horizontal support line at the bottom (price struggles to break below this level);

- A descending trendline at the top, connecting lower highs (sellers are pushing the price down);

- The price moves between these two lines, creating a triangle shape;

- The formation narrows over time, with the pressure building on the support level.

What Does It Indicate?

A descending triangle chart pattern suggests that sellers are in control. While the price holds at the support level, the series of lower highs shows that selling pressure is increasing. This often leads to a breakdown below the support line, where the price might experience a sharp decline. Traders see the formation as a bearish signal, indicating that the market could continue its downward trend.

How Do Traders Use It?

Traders typically use the descending triangle to identify potential breakdowns below the support level. When the price falls and closes below this line, it’s considered confirmation that the sellers have taken over and that further downside movement could follow.

Similar to other triangle patterns, it’s common to watch for a rise in trading volume during the breakdown, as it can confirm the strength of the move. It’s also possible to see false breakouts below the support level when the price closes back inside the pattern almost immediately.

How Traders Use Triangle Patterns in Technical Analysis

These patterns are just one piece of the puzzle in technical analysis, but they can offer us valuable insights when used correctly.

Triangle Pattern Trading: Entry, Stop-Loss, and Profit Targets

Entry Points

Traders typically wait for a confirmed breakout from the triangle formation’s boundaries before entering a trade. For ascending triangles, this means watching for the price to break above the upper trendline (resistance), while for descending triangles, they look for a breakdown below the lower trendline (support). In a symmetrical triangle, the breakout may be in either direction, usually informed by the broader market trend.

The entry is often confirmed by a closing candle above or below these key levels to reduce the risk of false breakouts.

Stop-Loss Placement

Stop-loss orders are crucial here. For ascending triangles, stop losses might be placed just below the last swing low, while for descending triangles, they might be set just above the recent swing high. In the case of symmetrical triangles, traders often place the stop-loss just outside the formation’s apex.

Profit Targets

To set profit targets, traders typically use the triangle's height (the distance between the highest and lowest points). This height is then projected from the breakout point, offering a realistic target for the trade. For example, if a triangle stock pattern’s height is $10 and the breakout occurs at $50, the target would be $60 for a bullish move.

Combining with Market Context

Triangles may become more reliable when considered in the context of the broader market environment. Traders don’t just look at the pattern in isolation—they analyse the prevailing trend, market sentiment, and even macroeconomic factors to gauge whether a breakout aligns with the larger market movement. For instance, an ascending formation in a strong uptrend adds confidence to the idea of a bullish breakout.

Using Other Indicators for Confirmation

While triangles provide a useful framework, they’re usually combined with other technical indicators for confirmation. Traders often align triangles with volumes, moving averages, or momentum indicators to assess whether the breakout has strong support behind it. For instance, a breakout confirmed by high volume or a moving average crossover might add confluence to the trade.

Limitations and Considerations of Triangle Patterns

Triangles are useful tools in technical analysis, but they come with limitations and important considerations. While they can signal potential breakouts, it’s essential to approach them cautiously.

- False Breakouts: Triangles often experience false breakouts, where the price briefly moves beyond the trendline but quickly reverses. This may trap traders in unfavourable positions.

- Subjectivity: These formations are open to interpretation. Different people may draw trendlines slightly differently, leading to varying conclusions about where the breakout occurs.

- Need for Confirmation: Relying solely on patterns can be risky. They may work better when combined with other indicators, such as volume or moving averages, to confirm the trend direction.

- Market Conditions: In volatile or news-driven markets, chart patterns may not behave as expected, reducing their reliability. They may provide false signals or lose significance in these situations.

The Bottom Line

Triangle chart patterns are popular tools among those looking to analyse market movements and potential breakouts. Whether it’s a symmetrical, ascending, or descending triangle, these patterns provide valuable insights into price consolidation and future trends. While no pattern guarantees a winning trade, combining triangles with other indicators may improve market analysis.

Ready to apply your knowledge? Open an FXOpen account to explore chart patterns in more than 700 live markets and take advantage of our low-cost, high-speed trading environment backed by advanced trading platforms.

FAQ

What Is a Triangle Chart Pattern?

A triangle chart is a pattern in technical analysis that forms when the price of an asset moves between converging trendlines, creating a triangle shape on a price chart. They typically signal a period of consolidation before a strong potential breakout in price.

What Are the Patterns of Triangles?

There are three main types of triangles in chart patterns: symmetrical, ascending, and descending. Symmetrical triangles indicate indecision in the market while ascending triangles are often bullish, and descending triangles tend to be bearish.

How to Trade a Triangle?

Traders typically wait for a confirmed breakout from the triangle’s trendlines. According to theory, entry points are based on a breakout above resistance or below support, with stop-loss orders placed just outside the triangle. Profit targets are often set based on the height (the distance between the highest and lowest points) of the pattern.

What Is the Triangle Pattern Strategy?

The triangle pattern strategy involves waiting for a breakout and using the formation’s height to set profit targets. It’s combined with tools like volume, moving averages, and momentum indicators to confirm the move and avoid false breakouts.

Is the Triangle Pattern Bullish or Bearish?

They can be both bullish and bearish. Ascending triangles are generally seen before a bullish movement, descending triangles are bearish, and symmetrical triangles can be either.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XAUUSD – Symmetrical Triangle Breakout or Breakdown?Gold (XAUUSD) is currently coiling within a symmetrical triangle on the 1H timeframe, indicating that a high-probability breakout or breakdown is imminent. Price is consolidating after a strong bullish trend, but volatility is compressing—typically a precursor to explosive movement.

📊 Technical Analysis

1. Symmetrical Triangle Formation

Price has been tightening within a symmetrical triangle, marked by lower highs and higher lows.

These patterns typically resolve in the direction of the preceding trend—but can also serve as reversal zones, especially at key highs.

2. Dual Scenarios Mapped Out

Bullish Breakout: If price breaks above the triangle, bulls may push toward the psychological resistance and Fibonacci extension target near 3,101.642, continuing the trend.

Bearish Breakdown: A rejection at triangle resistance and clean break below the support line could send gold down to the demand zone around 2,929, a 2.6% potential move, aligning with previous structure support.

3. Key Support Zone

The highlighted yellow block shows a strong demand zone, previously respected during a mid-March consolidation.

Price could seek this level if the triangle resolves to the downside.

🧠 Trade Setup Ideas

Bullish Bias: Break and hold above 3,020, potential long entry with TP around 3,101

Bearish Bias: Breakdown and close below 3,000, targeting the 2,930–2,915 zone

Invalidation Levels: Above 3,035 for bearish, below 2,995 for bullish

Gold Forming Triangle Pattern in Wave IV - Potential BreakoutXAU/USD is currently displaying a textbook triangle consolidation pattern as part of what appears to be wave IV in its Elliott Wave sequence. This corrective structure is developing after a strong upward move and shows clear converging trendlines with alternating A-B-C swings.

Technical Analysis:

Price consolidating near $3,044 level with minor bearish bias labelled wave ((D))

A-B-C internal wave structure visible inside consolidation

Potential wave ((iii)) price target at $3082.37

Triangle patterns typically represent consolidation before continuation of the primary trend. If this pattern completes as expected, we could see a final wave V impulse in the coming sessions.

Watch for a breakout from this triangle formation - volume should increase to confirm the validity of the move. Target exit or adjust stops based on the direction of the breakout.

Ascending Triangle Pattern Tutorial: 3/8 Bullish PatternsAscending Triangle Pattern Tutorial: 3/8 Bullish Patterns

An ascending triangle is a bullish continuation chart pattern that signals the potential for an upward breakout. Here's how it forms:

Flat Upper Trendline: The upper trendline is flat, indicating a resistance level where the price consistently faces selling pressure and fails to move higher.

Rising Lower Trendline: The lower trendline is ascending, showing higher lows as buyers step in at increasingly higher prices.

Price Convergence: The price action gets squeezed between the two trendlines, leading to a tightening range.

Breakout: Eventually, the price breaks above the resistance level, indicating a continuation of the upward trend. This breakout is typically accompanied by a surge in volume.

Ascending triangles are popular among traders because they offer clear entry and exit points. The height of the triangle, measured from the base to the horizontal resistance, can be used to estimate the potential price target following the breakout.

LIKE l FOLLOW l SHARE

BAJAJFINSV BREAKOUT ?Weekly Breakout possible .

Triangle Pattern.

Good for Long term.

Do Like ,Comment , Follow for regular Updates...

Disclaimer : This is not a Buy or Sell recommendation. I am not SEBI Registered. Please consult your financial advisor before making any investments . This is for Educational purpose only.

A continuation triangle?The price has triangulated its direction and now goes to the test of the upper level, to be valid it must respect some parameters including volumes and time. Here we have everything to have a valid triangle, we just need a breakout with above-average volumes. We are in 3/4 of the time calculated from the first retracement to the hypothetical summit, it has been a while since we have seen these very evident figures on the btcusd chart. I decided to write and publish it because looking around I saw that many are following this pattern, which represents the market's intentions and not the future. Certainly this continuation graphic formation gives us hope, given that the trend is bullish. Perhaps the price could give us another important movement before the retracement on the intermediate which will be the moment in which having liquidity to buy or mediate will make the difference on the final results of the trades, because holding without doing anything is easy, taking the corrections by selling and then buying back lower is difficult, but remains the objective of the majority of traders.

FXS Expanding T-Pattern Analysis: Potential Breakout and Grow?!🍣📈This analysis examines the expanding triangle pattern formation and assesses the potential for a breakout and subsequent price growth.

📈Expanding Triangle Pattern:

An expanding triangle pattern has been identified, characterized by rising highs and falling lows.

This pattern indicates a buildup of market indecision and uncertainty.

📉🔺Breakout and Resistance Levels:

A breakout above the daily resistance level could signal a bullish trend reversal and potential for further price appreciation.

The next daily resistance level would then become the target for the upward movement.

📊🔺RSI Confirmation and Volume:

A break above the RSI trendline would provide additional confirmation of the bullish breakout.

Increasing trading volume alongside the breakout would indicate strong momentum and support the upward trend.

⛔Important Considerations:

False breakouts are a possibility with expanding triangle patterns, and traders should exercise caution.

🔽Additional technical indicators and market sentiment analysis can help validate the breakout and provide trade entry and exit signals.

🚫This analysis is for educational purposes only and should not be construed as financial advice. Always conduct your own research and employ sound risk management practices before trading.🚫

MAZDOCK Breakout ReadyMazagon Dock Ship Builders Ltd. recently announced that the company will pay dividend to its shareholders for which the record date has been set at November 20, 2023. This will be the highest dividend the company has ever paid till date. We have previously seen the company pay dividend to its shareholders in the past so it has a good track record of giving growth & revenue to its shareholders. The company has a strong order book which gives it a fundamental boost to be a good pick for the long term.

Coming to the charts, the stock has formed a triangle pattern that can give an aggressive breakout in the days to come. The daily RSI is trending around 50 which can give it a boost as its a sign that the momentum of the stock has not yet exhausted. The stock is also outperforming NIFTY which makes it a favorable pick.

Engineers India Swing Trade OpportunityThe stock is very strong in Monthly, weekly, Daily, has been on a very strong uptrend.

On the daily time frame it has moved out of 1 month old consolidation zone.

So one can look to enter the stock at the demand levels marked for a quick move till the supply zone of 180.

A good 10% opportunity exists.

Trade at your own risk.

Happy trading!

Liberty Shoes Swing Trade Monthly is moving out of 4 months old consolidation period.

Weekly shows a triangle chart pattern compression BO.

One may consider an immediate swing trade for a target till the supply levels marked, 280 range. Quick 5 to 10% move is seen.

And if the price sustains above 180 then the stock may move to 350.

Happy trading!

Kotak BankKotak bank broke out of triangle pattern on 30 min TF with good volumes & facing multiple resistance zone of 1780-1785 which got rejected multiple times in recent past, fortunately todays its trading above this zone from past 30 mins, which is highest time spent in these zone.

Could be bought with mentioned stoploss & target.

HDFCHDFC broke out of triangle pattern on 30 min TF with decent volumes.

Could be bought with mentioned stoploss & target.