Not Even Gold Escaped the Volatility of Liberation DayWe finally saw the shakeout on gold I was expecting around $3000. This clearly changes things for gold traders over the near-term, even though the fundamentals remain in place for bulls. I highlight key levels for gold and take a look at the devastation left across key assets on Thursday.

Matt Simpson, Market Analyst at City Index and Forex.com

Trump

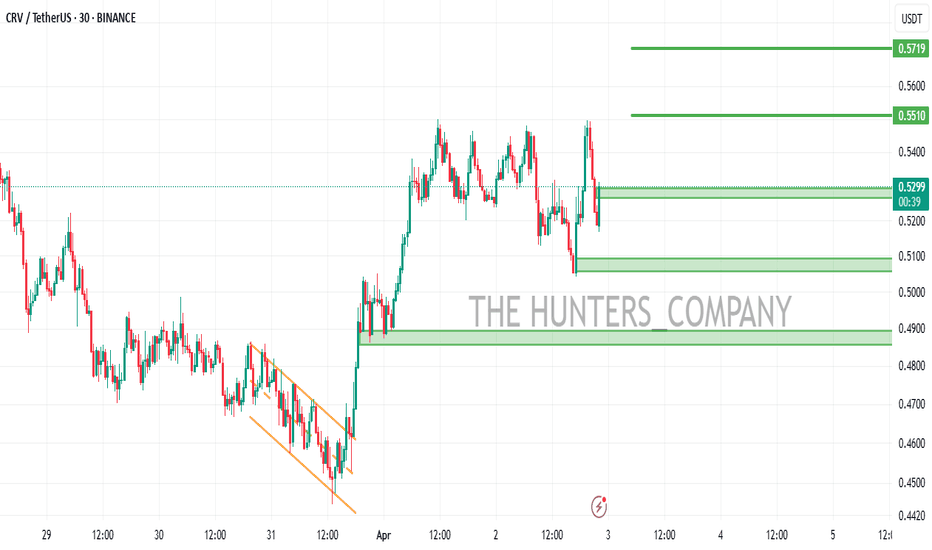

DOGE/USDT:BUY...Hello dear friends

Given the price drop we had in the specified support range, considering the price growth indicates the entry of buyers.

Now, given the good support of buyers for the price, we can buy in steps with capital and risk management and move towards the specified goals.

*Trade safely with us*

The Trade War Strikes Back: Market Reeling from Trump’s Tariff MThe markets are not taking Trump’s new round of tariffs lightly.

As the S&P 500 dips sharply, investors are reacting to the growing tension between the U.S. and China over trade policy. The new tariffs have ignited fears of a prolonged trade war, sending shockwaves through tech-heavy sectors and dragging major names like NASDAQ:NVDA , NASDAQ:MSFT , NASDAQ:AAPL , and NASDAQ:AMZN deep into the red.

📉 What we're seeing:

SP500 is breaking recent support with heavy volume.

Tech sector is leading the sell-off, especially chipmakers and global exporters.

Uncertainty is pushing investors toward safety, further increasing volatility.

🧠 Key takeaway: This is more than a dip—it’s policy risk priced in real time. Until there's clarity, traders should prepare for more erratic moves. Short-term sentiment has clearly flipped bearish.

💬 Are you buying the fear or staying out of the storm?

EDUCATION: The $5 Drop: How Trump’s Tariffs Sent Oil TumblingOil markets don’t move in a vacuum. Politics, trade wars, and global economic shifts all play a role in price action. Case in point: the recent $5 drop in oil prices following Trump’s latest tariff announcement.

What Happened?

Markets reacted swiftly to Trump’s renewed push for tariffs, targeting key trading partners. The result? A ripple effect that sent oil prices tumbling as traders anticipated lower global demand. The logic is simple—higher tariffs slow trade, slowing trade weakens economies, and weaker economies use less oil.

Why It Matters to Traders

For traders, this kind of volatility is both an opportunity and a risk. Sharp price drops like this shake out weak hands while rewarding those who position themselves with clear strategies. If you trade crude oil, understanding the macro picture—beyond just supply and demand—can make or break your positions.

The Next Move

Is this just a knee-jerk reaction, or the start of a larger trend? Smart traders are watching key levels, tracking institutional order flow, and looking for confirmation before making their next move.

How do you react when headlines move the market? Do you panic, or do you position yourself with a plan? Drop a comment and let’s talk strategy.

Trump's Tariff Wars : What To Expect And How To Trade Them.I promised all of you I would create a Trump's Tariff Wars video and try to relate that is happening through the global economy into a rational explanation of HOW and WHY you need to be keenly away of the opportunities presented by the new Trump administration.

Like Trump or not. I don't care.

He is going to try to enact policies and efforts to move in a direction to support the US consumer, worker, business, and economy.

He made that very clear while campaigning and while running for office (again).

This video looks at the "free and fair" global tariffs imposed on US manufacturers and exports by global nations over the past 3+ decades.

For more than 30+ years, global nations have imposed extreme tariffs on US goods/exports in order to try to protect and grow their economies. The purpose of these tariffs on US good was to protect THEIR workers/population, to protect THEIR business/economy, to protect THEIR manufacturing/products.

Yes, the tariffs they imposed on US goods was directly responsible for THEIR economic growth over the past 30-50+ years and helped them build new manufacturing, distribution, consumer engagement, banking, wealth, and more.

The entire purpose of their tariffs on US goods was to create an unfair advantage for their population to BUILD, MANUFACTURE, and BUY locally made products - avoiding US products as much as possible.

As I suggested, that is why Apple, and many other US manufacturers moved to Asia and overseas. They could not compete in the US with China charging 67% tariffs on US goods. So they had to move to China to manufacture products because importing Chinese-made products into the US was cheaper than importing US-made products into China.

Get it?

The current foreign Tariffs create an incredibly unfair global marketplace/economy - and that has to STOP (or at least be re-negotiated so it is more fair for everyone).

And I believe THAT is why Trump is raising tariffs on foreign nations.

Ultimately, this will likely be resolved as I suggest in this video (unless many foreign nations continue to raise tariff levels trying to combat US tariffs).

If other foreign nation simply say, "I won't stand for this, I'm raising my tariff levels to combat the new US tariffs", then we end up where we started - a grossly unfair global marketplace.

This is the 21st century, not the 18th century.

Step up to the table and realize we are not in the 1850s or 1950s any longer.

We are in 2025. Many global economies are competing at levels nearly equal to the US economy in terms of population, GDP, manufacturing, and more.

It's time to create a FREE and FAIR global economy, not some tariff-driven false economy on the backs of the US consumers. That has to end.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

EURUSD Surges to 1.10 levels post-Trump Tariffs: BUY or SELL?Current Situation:

EUR/USD spiked to 1.10 levels(up sharply) following Trump’s tariff announcement, defying initial expectations of short-term USD strength. This suggests markets are pricing in long-term risks to the USD (growth fears, retaliatory tariffs) faster than anticipated.

Key Drivers Behind the Move:

1. Tariff Backfire Risk: Investors may fear tariffs will hurt U.S. growth more than Europe’s, weakening the USD.

2. ECB vs. Fed Policy Shift: Bets that the **Fed could cut rates sooner** if tariffs slow U.S. inflation/growth, while the ECB delays cuts.

3. Retaliation Bets: Expectations of aggressive EU countermeasures (e.g., tariffs on U.S. tech/agriculture) boosting EUR sentiment.

---

Technical Analysis (EUR/USD Daily Chart)

- ✅ Breakout Confirmed : Price surged till 2024's resistance, now testing 1.10 levels (psychological levels).

- RSI: Overbought, suggesting short-term pullback risk.

#EURUSD #TrumpTariffs #ForexTrading #Breakout #USDweakness

BTC 4H Technical & Fundamental AnalysisTRUMP EFFECT & RESISTANCE DENIAL

CRYPTOCAP:BTC 4H Technical & Fundamental Analysis

As we expected, Bitcoin reached the upper band of the falling channel (approximately $88,000), touched the red resistance circle and then experienced a strong rejection. The timing of this technical rejection is no coincidence.

Last night, former US President Donald Trump's announcement that he would impose new customs duties on all countries of the world created a risk-off mood in the markets . In particular, global uncertainty and protectionist policies triggered selling pressure in risk assets such as Bitcoin.

Technically:

🔸RSI still has no obvious negative mismatch.

🔸However, since the price cannot break the upper band of the falling channel, this region continues to work as a selling zone for now.

If this retracement movement deepens, the first major support level of $73.777 , followed by the $69.000 line may come to the agenda.

On the other hand, if the price manages to regain strength and break this zone in volume, there may be a rapid movement to the GETTEX:92K - $95K band.

In short, Technical resistance + Trump news effect combined, we can say that the market has stepped back for now. From now on, volume and news flow will be directional.

#btc #Bitcoin #crypto #cryptocurrency

S&P 500 Index Hits 2025 Low Following Trump's TariffS&P 500 Index Hits 2025 Low Following Trump's Tariff Announcement

As shown on the S&P 500 Index (US SPX 500 mini on FXOpen) chart, the benchmark US stock index dropped below 5,450 points for the first time in 2025. This decline reflects the US stock market’s reaction to the tariffs imposed by the White House on international trade.

According to Reuters:

→ President Donald Trump announced a 10% tariff on most goods imported into the United States, with Asian countries being hit the hardest.

→ This move escalates the global trade war. "The consequences will be devastating for millions of people worldwide," said European Commission President Ursula von der Leyen, adding that the 27-member EU bloc is preparing to retaliate if negotiations with Washington fail.

Financial Markets’ Reaction to Trump’s Tariffs

→ Stock markets in Beijing and Tokyo fell to multi-month lows.

→ Gold hit a new all-time high, surpassing $3,160.

→ The US dollar weakened against other major currencies.

The S&P 500 Index (US SPX 500 mini on FXOpen) is now trading at levels last seen in September 2024, before Trump's election victory.

Investor sentiment appears to have turned bearish, with growing concerns over the impact of Trump's tariffs, as fears mount that they could slow down the US economy and fuel inflation.

Technical Analysis of the S&P 500 Index (US SPX 500 mini on FXOpen)

The bearish momentum seen yesterday signals a continued correction, which we first identified in our 17 March analysis.

At that time, we mapped out a rising channel (blue) that began in 2024, suggesting that selling pressure might ease near its lower boundary. However, Trump's policy decision has reinforced bearish confidence, and now the price may continue fluctuating within the two downward-sloping red lines. This suggests that the long-term blue growth channel is losing its relevance.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USD/JPY Stands Firm, But Volatility ExpectedVolatility has receded with less than 20-hours to go until Trump's tariffs are officially implemented, with traders now clearly in watch-and-wait mode. So while headline risks around tariffs remain in place, moves could remain limited unless traders are treated to any last-minute negotiations.

Typically, risk has benefitted when it has been expected that tariffs have been watered down. If that turns out to be the case by Trump's speech at 4pm ET Wednesday, indices could rise alongside the US dollar and the yen weaken.

Bit of course, the opposite is true. And that could weigh on USD/JPY. Rightly or wrongly, I'm feeling optimistic and now seeing a bounce on USD/JPY.

Two bullish pinbars found support and close above the 20-day SMA and monthly pivot point. The bias remains bullish while prices remain above Monday's low, and a break above 150 brings the 200-day SMA, February VPOPC and 152 handle into focus.

Matt Simpson, Market Analyst at City Index and Forex.com

Australian dollar rally continues, Trump tariffs loomThe Australian dollar has posted strong gains for a second straight day. In the European session, AUD/USD is trading at 0.6306, up 0.47% on the day.

The Reserve Bank of Australia maintained the cash rate at 4.10% on Tuesday, in a move that was widely expected by markets. Still, the Australian dollar reacted positively, gaining 0.48% on Tuesday.

The RBA statement noted that underlying inflation continued to ease in line with the Bank's forecast, but the Board "needs to be confident that this progress will continue" so that inflation remains sustainable at the midpoint of the 2%-3% target band. The statement said there was "significant" uncertainty over global trade developments, pointing to the threat of further US tariffs and possible counter-tariffs from targeted countries.

The central bank's decision was made in the midst of a hotly contested election campaign, and a rate cut would likely have been attacked by the opposition parties as political interference.

In a press conference after the meeting, Governor Michele Bullock acknowledged the uncertainty over the global outlook due to US trade policy but sought to assure the markets by saying that Australia was "well placed" to weather the potential storm of a global trade war.

US President Trump has not specifically targeted Australia with any tariffs but China is Australia's number one trading partner and a US-China trade war would inflict damage on Australia's economy.

The new US tariffs are expected to be announced later today and take effect on Thursday. The financial markets remain volatile as investors look for some clarity from Washington about the tariffs, as it remains unclear which countries will be targeted and the extent of the tariff rates.

March Was Boring. April Could BiteMarch Was Boring. April Could Bite | SPX Analysis 02 April 2025

At the risk of sounding like a scratched CD (or whatever the Spotify kids call repetition), yes – I’m still bearish.

Some might say I’m stubborn.

I say I just know a pattern when I see one.

And while March was about as exciting as watching paint dry in slow motion on a frozen chart... April's already teased a shift. Tuesday’s 0-DTE win added a bit of grease to the gears – finally. Movement. Profit. Action.

But I’m not celebrating yet.

My stance is clear: bullish above 5700, bearish below. Until we break out, I’m scanning for pulse bar setups, especially if price cracks below 5500 – that’s where things get spicy.

And with Friday’s NFP looming on the calendar, the market may be about to wake up and pick a direction.

I know which way I’m leaning.

Bear slippers are still on.

---

Why April Could Be a Whole New Beast

Here’s the rundown:

March = sideways snoozefest.

April = already triggered a 0-DTE win.

My trigger line for flipping bull remains 5700 – it’s the GEX flip, flag failure, and no-go zone.

I’m watching for bearish pulse bars, ideally on:

Morning setups

Under 5500

With volatility in play

Should we crack those levels with strong momentum, I’ll look to compound into existing bear swings, leaning on the mechanical setups that’ve done the job before.

This week’s X-factor?

Friday’s Non-Farm Payroll report.

Could be a nothing-burger.

Could be the matchstick that lights the whole thing up.

Either way, I’ll be ready.

---

Expert Insights – Don’t Let Boredom Trade for You

One of the most common trader traps?

Forcing trades when the market isn’t doing anything.

Here’s how to avoid it:

✅ Patience is a position.

Waiting for clarity is a valid strategy.

I didn’t force anything through March – and I’m better for it.

✅ Setups still work – just less frequently.

Your system isn’t broken… the market was just asleep.

✅ The pros aren’t hunting trades every day – they’re waiting for the ones worth taking.

That’s how the SPX Income System works – clear triggers, no second-guessing.

---

Fun Fact - April: Historically Strong… Unless March Fails First

The month of April is historically one of the strongest for the S&P 500, averaging gains of 1.5% since 1950.

But guess what?

Most of that strength happens after a strong March.

When March is slow or bearish… April tends to flip the script.

So don’t be surprised if volatility roars back this week – just be ready.

---

Video & Audio Podcast

Coming Soon on main blog...

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

---

p.s. Ready to stop scratching your head and start stacking profits?

If you want to trade with clarity – not confusion – then it’s time to get serious about structure.

Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1's

Or watch the free training to see the SPX Income System in action.

No fluff. Just profits, pulse bars, and patterns that actually work.

Links In Bio

Gold Prices Hover Near Record Highs Ahead of Trump’s TariffGold Prices Hover Near Record Highs Ahead of Trump’s Tariff Announcement

As shown on the XAU/USD chart today, gold prices are fluctuating near their all-time high, set when the price of an ounce surpassed $3,140 for the first time in history.

Gold has risen by approximately 19% in the first three months of 2025.

Why Is Gold Rising?

On 2 April, traders' sentiment is driving gold prices higher in anticipation of US President Trump’s tariff announcements, expected later this evening.

This event enhances gold’s appeal as a safe-haven asset, as concerns grow that Trump’s aggressive trade policies could slow global economic growth and fuel inflation.

Additionally, media reports highlight strong demand for gold from central banks, while exchange-traded funds linked to the precious metal are seeing capital inflows from investors concerned about geopolitical uncertainty.

Technical Analysis of XAU/USD

Gold price movements have formed two ascending channels in 2025: a broader blue channel and a steeper purple channel.

Notably, gold is currently trading near the midpoints of both channels, indicating that supply and demand may have reached equilibrium after buyers broke through resistance around $3,088 (marked by an arrow).

It is likely that XAU/USD will exhibit low volatility until news about Trump’s tariffs emerges. This could trigger sharp price movements, with a potential test of the purple channel’s boundaries in the near future.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Japan's Business Sentiment Mixed, Yen StrengthensThe Japanese yen has gained ground on Tuesday. In the North American session, USD/JPY is trading at 149.27, down 0.47% on the day.

The yen was red-hot in the fourth quarter of 2024, gaining a massive 9.5% against the US dollar, but has reversed directions in Q1, declining 4.7%.

The Manufacturing Tankan index indicated that confidence among manufacturers eased to 12 in Q1 2025, down from 14 in the previous quarter. This was the lowest level in a year, reflective of growing concern among Japanese manufacturers over US tariff policy.

The Non-manufacturing Tankan index, meanwhile, moved in the opposite direction, climbing to 35 in Q1, up from 33 in the Q4 2024 release. This was the fastest pace of growth since August 1991, as companies are increasingly passing on costs to consumers.

The mixed Tankan report is unlikely to change the cautious stance of the Bank of Japan, which has expressed concerns about the uncertainty caused by the threat of additional US tariffs. The BoJ held rates steady in March and the next meeting is on May 1, with the markets projecting another hold.

US President Donald Trump has threatened to impose wide-ranging tariffs on April 2, leaving US trading partners and the financial markets highly anxious ahead of what Trump has declared "Liberation Day".

It is unclear which countries will be targeted or what the tariff rates will be, which has only added to financial market jitters. If Trump goes ahead with the tariffs and targeted countries retaliate with counter-tariffs, we will be one step closer to a global trade war.

USD/JPY has pushed below support at 149.65. Below, there is support at 149.02

There is resistance at 150.59 and 151.22

USD/CAD breaks out of falling wedgeUSD/CAD closed higher for a fourth day on Monday, on the even of Trump's liberation day. It also accelerated away from its 50-day EMA after establishing support around its 100-day EMA last week.

This has also seen USD/CAD break trend resistance, and a falling wedge pattern now appears to be in play. This suggests an upside target near the 1.4550 cycle highs.

Bulls could seek dips towards the 50-day EMA and retain a bullish bias while prices remain above last week's low.

Matt Simpson, Market Analyst at City Index and Forex.com

INVERSE CUP AND HANDLE $TSLA TO $120 The inverted cup and handle, also known as the upside-down cup and handle pattern, is a bearish chart formation that can occur in both uptrends and downtrends. Unlike the traditional bullish cup and handle pattern, this inverse pattern features two key components: the "cup," which forms an inverted U-shape, and the "handle," a brief upward retracement following the cup.

Sell NASDAQ:TSLA right now with fact check:

brand reputation risk, high competition, loss of EV market leadership, cyber truck/ product recalls, declining sales with lower margin, stock volatility concern, insider selling, investors buy it based on expected future earnings rather than its current profitability.

+ Head and shoulder/ inverse cup and handle, P/E ratio 79.8-161.23 (overpriced), falling knife, dead cat bounce, the lowest target estimate stands at $120.00, below the 50-day, 100-day, and 200-day moving averages, MACD indicator is -19.8, bearish signals.

+ potential stagflation, tariff war, slow economic growth, inflation, rising public debt, geopolitical tensions, ai bubble, and more

Bitcoin - Where will Bitcoin go?!Bitcoin is trading below the EMA50 and EMA200 on the four-hour timeframe and is trading in its descending channel. The continuation of Bitcoin’s downward trend and its placement in the demand zone will provide us with the opportunity to buy it again.

The continued rise of Bitcoin will also lead to testing of selling transactions from the supply zone. It should be noted that there is a possibility of heavy fluctuations and shadows due to the movement of whales in the market and compliance with capital management in the cryptocurrency market will be more important. If the downward trend continues, we can buy in the demand range.

Since March 14, inflows into spot Bitcoin ETFs have maintained a positive trend. For seven consecutive days, these ETFs have recorded net capital inflows without any outflows. This marks the first instance in 2025 of such a consistent streak of inflows into Bitcoin ETFs.

The assets under management (AUM) of actively managed ETFs in the United States have surged over the past two years, surpassing $1 trillion—a more than threefold increase. This remarkable growth indicates a rising investor interest in strategies beyond index-based funds.

Bitcoin had an overall positive week, whereas the S&P 500 and global equity markets suffered declines due to ongoing concerns over tariffs and persistent inflation. The S&P 500 closed the week lower, dropping to $5,580—just 1.2% above its recent low from March 13. Meanwhile, despite experiencing pullbacks, Bitcoin remains 9.3% above its previous low of $77,000, recorded on March 10.

Strategy, following its latest acquisition, now holds 2.41% of the total global Bitcoin supply.Given that a significant portion of Bitcoin has either been lost or remains dormant in wallets, this stake represents nearly 4% of the actively circulating supply.

About a month and a half ago, Eric Trump, son of former President Donald Trump, tweeted that it was the perfect time to buy Ethereum. Since that tweet, however, Ethereum’s price has dropped by approximately 35%. This highlights the risk of making investment decisions solely based on endorsements from well-known individuals.

Trump Media & Technology Group, owned by U.S. President Donald Trump, has announced a partnership with the cryptocurrency exchange Crypto.com to launch a range of exchange-traded products (ETPs) and exchange-traded funds (ETFs). This includes a multi-crypto ETF (the first of its kind) and ETPs comprising digital assets and securities from various sectors, including the energy industry. Crypto.com will provide the underlying technology, custodial solutions, and crypto asset management services.

In the second half of March, the cryptocurrency market experienced a significant rebound, reigniting optimism among traders. However, historical analysis suggests that the crypto market often moves contrary to mainstream expectations. When bullish sentiment—such as the phrase “To the Moon”—becomes widespread on social media, it may signal an impending price drop. Conversely, when negative sentiments like “Crypto is dead” or “Bitcoin is a scam” become dominant, this could indicate a potential price surge.

Therefore, investors should pay close attention to market sentiment and exercise caution in their decision-making. Recognizing that markets may move against the prevailing consensus can help in formulating more strategic investment approaches.

NAS100 - Stock market still in a downtrend?!The index is trading below the EMA200 and EMA50 on the 4-hour timeframe and is trading in its descending channel. If the index moves down, it will be clear that it is heading for further moves. At the channel ceiling, I could be close to the next sell-off.

As the new US tariffs are set to take effect on April 2, new evidence suggests that they may be less than the markets had expected. According to a recent report in the Toronto Star, Canada is likely to face the lowest level of tariffs, while Mexico, another member of the US trade agreement, is likely to face a similar situation. In addition, Trump’s recent statements about significant progress in controlling fentanyl (an industrial drug), are seen as a positive sign for improving trade relations.

In this regard, CNBC reported that VAT and non-tariff barriers will not be taken into account in calculating the tariff rate, or at least not fully. The main concern is that by threatening to impose a 25% tariff, Trump is actually preparing Canada and Mexico to accept higher rates than the current conditions. It seems that his goal is to impose the highest possible tariff level. This decision could be an incentive to increase tariff revenue to reduce taxes. Of course, such an approach is associated with high risks, since any level of tariffs can lead to retaliatory measures from trading partners.

In the case of Europe, tariffs imposed on American goods are higher than in other countries, but a large part of them relate to the automotive industry. Europe has previously announced that it is ready to reduce these tariffs. The question now is whether the EU will take a different approach than Mexico and Canada? That is, first impose higher tariffs and then negotiate to reduce them.

This scenario could ultimately benefit the US economy, as the bulk of its trade is with Mexico and Canada. Meanwhile, China remains a complex challenge, as it is the main target of Trump’s tariff policies. In addition, the US president recently proposed imposing tariffs on Venezuela, which could be a pretext for intensifying trade pressure on China. Polls show that 50% of the market expects new tariffs on China, which indicates the level of investor concern.

The European Union has reacted to the Trump administration’s decision to impose new tariffs on imported cars and expressed regret over the move. European Commission President Ursula von der Leyen has said the bloc will seek a negotiated solution to ease tensions, but she has also stressed that Europe’s economic interests will be protected against US trade policies.

The US credit rating has risen to a new low, according to a new report from Moody’s, which warns that tax cuts and trade tariffs could widen the country’s budget deficit.

Analysts at Goldman Sachs and Deutsche Bank say investors expect the effective tariff rate on all imports to be between 9% and 10%, although some analysts at Goldman Sachs have suggested a rate of 18%. However, inflation and exchange rate expectations point to lower figures.

If Trump’s promise of “reciprocal tariffs” is implemented, the effective tariff rate could be even lower than 5 percent, although this depends on whether the agricultural sector is also subject to tariffs. Some reports also suggest that non-tariff barriers may be completely ignored.

According to Deutsche Bank, it is very difficult to determine market expectations precisely. But if the tariff rate ultimately falls between 5 and 7.5 percent, markets are likely to react with more confidence. Otherwise, more volatility and turbulence in financial markets are expected.

At the beginning of the year, markets were in a positive and optimistic mood. The Republican victory in the election, the continuation of tax breaks and the possibility of new support packages were among the factors that reinforced this optimism.

However, factors such as the high US budget deficit, the deadlock in Congress and the high inflation rate have now challenged this optimism. Meanwhile, two important support tools that were effective in the past may no longer be as effective:

1. During Trump’s first term, the stock market was of particular importance to him. Even during the COVID-19 crisis, he constantly talked about the stock market and considered it part of his successes.

The term “Put Trump” meant that even if he made harsh statements, he ultimately acted in the market’s favor.

2. But now, in Trump’s second administration, he talks about “short-term pain” and “economic detoxification.” Tariff threats, reduced investment and policy uncertainty have caused the S&P 500 to fall 10% since February. Trump still considers the market important, but he is no longer as staunchly supportive of it as he used to be.

In addition, this week will include the release of a series of key economic data. Including:

• Tuesday: ISM Manufacturing PMI and JOLTS.

• Wednesday: ADP Private Employment Report

•Thursday: ISM services index and weekly jobless claims.

One of the big risks to the markets is that economic data remains weak while the ISM price sub-indices rise. Such a situation could signal a deflationary tailwind. In such a situation, even if the Federal Reserve moves to lower interest rates, it will still be difficult for the stock market to grow.

GOLD PoV - SHORT 3.125$The price of gold has recently reached a historic high, surpassing the $3,100 per ounce mark, driven by uncertainty stemming from U.S. tariff policies under President Donald Trump and concerns about potential geopolitical conflicts.

This increase underscores gold’s role as a safe haven asset, with investors seeking stability amid growing economic and political instability.

Trade tensions, particularly the tariff policies proposed by the Trump administration, have contributed to economic uncertainty, prompting investors to seek security in gold.

Additionally, concerns about potential conflicts, such as recent escalations in the Middle East, have further strengthened demand for gold as protection against geopolitical risks.

Central banks have played a significant role in this scenario, increasing their gold reserves. In the third quarter of 2023, reserves increased by 337 tons, bringing the total for the first nine months of the year to 800 tons, about a third of the global mine production for the same period.

This accumulation by central banks has helped sustain the price of gold, highlighting its status as a safe asset.

Regarding investment strategies, some analysts suggest that gold's price may undergo a correction after its recent rally. For example, technical analysis indicates a potential short entry at $3,125 per ounce, with a profit target of $2,925, anticipating a retracement of about $200.

However, it is important to consider that gold price forecasts can be influenced by various unpredictable factors, such as economic policies, geopolitical developments, and market dynamics.

In summary, gold has benefited from a significant increase in value due to the uncertainty arising from trade policies and concerns about geopolitical conflicts. Its nature as a safe-haven asset has attracted investments from both institutional investors and central banks. However, trading strategies, such as short positions, should be evaluated cautiously, considering the volatility and uncertainty that characterize the gold market.

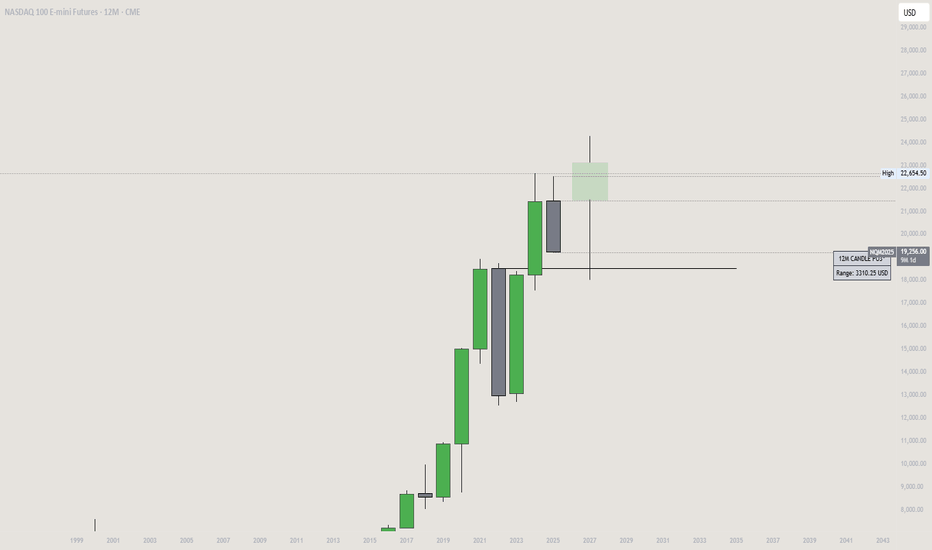

Yearly Candle on NQ 2025I believe what we're seeing right now is simply the market printing the “open low” of the yearly candle. The recent dip seems driven by short-term fear surrounding the new tariffs, but in my view, this is just noise. Long-term, this sets up a bullish scenario.

Businesses won’t adjust overnight—it takes time to shift operations away from high-tariff regions. But as that transition unfolds, we’ll likely see improved margins and stronger fundamentals emerge.

From a technical standpoint, I’m watching for a key reversal after price revisits the order block. If we get that reaction, it could mark the beginning of a broader move higher. This looks like manipulation, not distribution.

OLHC

- Gavin

NFA, DYOR

TRUMP Ready for PUMP or what ?Do you think this will happen, or do you see TRUMP below $9.5 in the future?

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!