SPX short analysisLike I wrote in my EUR/USD analysis you never know what could happened.

USA bombed Iran!

This could have huge impact on the US market next week.

My guess is temporarily short... At least to close this gap in spot price of SPX.

Since we're still in bearish market, until we see new highs, and this could be catalyst for another sell off. So the jump could be even bigger and we could see new ATH this year.

For now, I'm seeking a position to short tomorrow after market is open.

This is my entry mark.

There will be higher volatility. However, I expect US market to open in the red, close the gap and to sell off again.

We shall see!

Trade safe this one :)

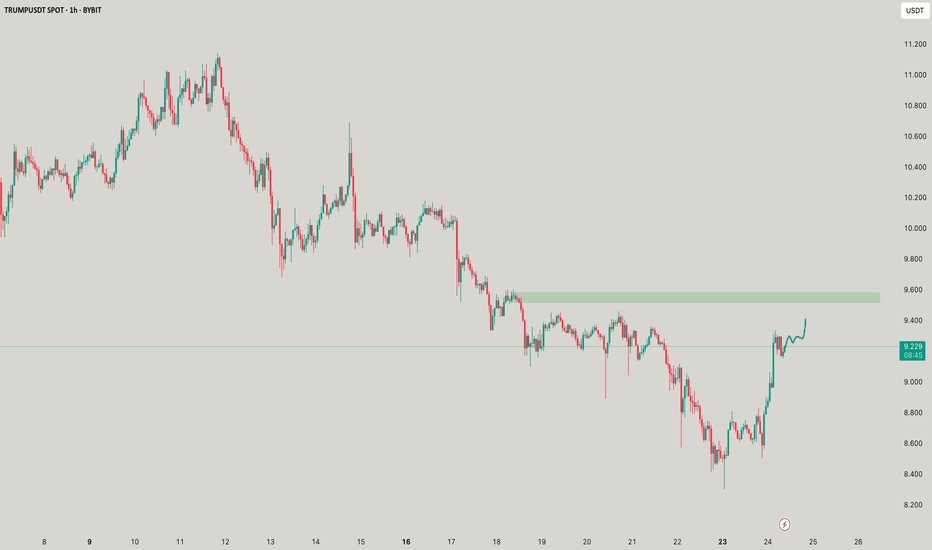

Trump

S&P 500 (SPX) 1M next week?The S&P 500 is pulling back from a key resistance after completing a bearish AB=CD pattern on the monthly chart. Price action suggests a potential correction toward the 4662–4700 zone, aligning with the 0.618 Fibonacci retracement level, which may serve as a key area for bullish reaccumulation. Momentum indicators show bearish divergence, hinting at a cooling rally.

Fundamentally, the index remains supported by strong earnings in tech and AI sectors, but risks persist from elevated interest rates, sticky inflation, and potential Fed policy shifts. A pullback into the 4662–4700 zone may offer a medium-term setup for continuation toward 5198 and potentially 5338. A breakdown below 4662 would invalidate the bullish structure and shift focus to lower Fibonacci levels.

AUDUSD SHORT FORECAST Q2 W26 D24 Y25AUDUSD SHORT FORECAST Q2 W26 D24 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Daily order block

✅1H Order block

✅Intraday breaks of structure

✅4H Order block

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Is the oil market signalling de-escalation?After an initial 6% spike at the open, U.S. crude oil futures reversed sharply—falling into negative territory—as markets priced in the possibility that Iran's latest retaliation may be more symbolic than escalatory.

According to President Donald Trump, Iran gave advance notice before launching missiles at a U.S. base in Qatar, allowing defences to intercept the attack and resulting in no reported casualties.

While Tehran publicly described the strike as “devastating and powerful,” the lack of impact on the ground and the pre-warning have fuelled speculation that Iran was aiming to save face without triggering a broader conflict.

The swift reversal in oil prices reflects that sentiment. For now, the market appears to be signaling that escalation may pause here.

USDJPY H2 Best Level to SHORT/HOLD TP +100/+200 pips🏆USDJPY H2 Market Update H2 chart

📊 Technical Outlook

🔸trading in well defined range

🔸trading near range highs now

🔸range highs set 148.40/148.80

🔸range lows set at 140.80/141.40

🔸strategy: SHORT SELL from resistance

🔸SL 60 pips TP1 +100 pips TP2 +200 pips

🔸swing trade setup for patient traders

🌍 FX Market Snapshot — June 2025

🇪🇺 EUR/USD (~1.1500)

Euro climbs near 1.15 as eurozone inflation cools and ECB turns more dovish.

Stable German sentiment provides support, but softer CPI could limit gains.

🔑 Support: 1.1445 | Resistance: 1.1550

🇬🇧 GBP/USD (~1.3435)

Pound slips toward 1.34 after recent highs, as UK data remains mixed.

Manufacturing picks up, but falling inflation boosts BoE rate cut bets.

🔑 Support: 1.3400–1.3420 | Resistance: 1.3500

🇺🇸 DXY (US Dollar Index, ~99.14)

Dollar edges higher as investors seek safety amid geopolitical tensions.

Mixed US economic signals; eyes on upcoming job data.

🔑 Support: 98.80 | Resistance: 100.00

🇯🇵 USD/JPY (~147.4)

Dollar rallies above 147 as yen weakens; BOJ stays ultra-loose.

Oil price spikes add extra pressure on JPY.

🔑 Support: 145.0 | Resistance: 148.5

📊 Quick View

Pair Rate Support Resistance Key Theme

🇪🇺 EUR/USD ~1.1500 1.1445 1.1550 Dovish ECB, soft CPI

🇬🇧 GBP/USD ~1.3435 1.3400–1.3420 1.3500 Mixed UK data

🇯🇵 USD/JPY ~147.4 145.0 148.5 Yen weakness

🇺🇸 DXY ~99.14 98.80 100.00 Geopolitical risks

Bitcoin at Risk: Will Geopolitical Tensions Push BTC Below $90K?By analyzing the #Bitcoin chart on the weekly timeframe, we can see that the price continued its correction amid rising tensions and conflict between Iran and Israel, dropping to as low as $98,000. Currently, Bitcoin is trading around $101,000, and if these tensions escalate further — especially if Iran decides to close the Strait of Hormuz — it could significantly impact global markets, and Bitcoin would not be an exception.

If BTC fails to hold above $100,000 by the end of the week, a continuation of the drop toward $90,000 is possible.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

AI Algo Systems vs. Manual Trading: Which Delivers Real Results?AI Algo Systems vs. Manual Trading: Which Delivers Real Results? ⚖️

________________________________________

Introduction

With the explosive rise of artificial intelligence (AI) in financial markets, traders everywhere are asking the million-dollar question:

Should I trust my trades to automation, or keep my hands on the wheel? 🧠🤖

This guide offers a real-world, side-by-side comparison between AI-powered algorithmic trading systems and traditional manual trading. We’ll highlight where each method dominates, when they fail, and how you can combine both to build a system that outperforms the rest. 💡

What Are AI Algo Systems? 🤖

AI trading systems use advanced machine learning models to:

• Analyze huge volumes of historical and real-time data 📈

• Detect patterns and trading opportunities faster than any human

• Automatically execute trades using coded logic, without emotion

🔬 Real-World Examples:

• Neural networks (LSTM, CNN): Predicting EUR/USD direction based on years of tick data

• Reinforcement learning agents: Managing position sizing dynamically in crypto scalping

• Predictive classifiers: Spotting likely trend reversals on S&P 500 based on 20+ indicators

Key Benefits:

• 🔄 Emotionless execution: No fear, no greed, just rules

• ⏱️ Lightning-fast trades: React to price action instantly

• 📊 Pattern recognition: Finds subtle correlations people miss

________________________________________

What Is Manual Trading? 👤

Manual trading is powered by human intelligence and judgment. Traders use:

• Price action and SMC/ICT techniques (e.g., order blocks, BOS)

• Fundamental analysis: News, sentiment, macro reports

• Intuition and experience: Reading between the lines the way only humans can

🧑💼 Real-World Examples:

• A trader spots an untested order block on GBP/JPY and waits for liquidity sweep before entering

• Reading a dovish tone in FOMC minutes and fading the initial spike on DXY

• Using “market structure shifts” after a big news event to catch a reversal

Key Benefits:

• 🔍 Contextual awareness: Understand the full market story

• 🎯 Real-time adaptability: Adjust plans on the fly

• 🧠 Creative edge: Find setups no algorithm can code for

________________________________________

Side-by-Side Comparison Table 📋

Feature AI Algo Trading 🤖 Manual Trading 👤

Execution Speed Instant Slower, can lag

Emotions Involved None Prone to fear/greed

Adaptability Limited (needs retrain) High

Learning Curve High (coding/tech) Medium (market logic)

Strategy Flexibility Pre-coded only Unlimited creativity

Backtesting Automated Manual/semi-auto

Session Monitoring 24/5 via server Human-limited hours

________________________________________

When AI Algo Systems Work Best 💾

AI is unbeatable when you need:

• Scalability: Watching 10, 20, or even 100+ pairs 24/5

• High-frequency execution: Entering/exiting trades within milliseconds

• Repetitive strategies: Like mean reversion, breakout scalps, or arbitrage

📈 Example:

• Strategy: EUR/USD London open breakout

• Process: AI model detects volume and volatility spike, enters trade with 0.3% risk, targets FVG

• Results: 60% win rate, 1.8R average reward over 3 months

________________________________________

When Manual Trading Wins 🧠

Manual skills shine when you need:

• Discretionary entries: Especially with complex SMC/ICT structures

• Adapting to breaking news: Sudden CPI, FOMC shocks, geopolitical headlines

• Making sense of market narrative: When volatility is off the charts and AI gets confused

🗞️ Example:

• News: Surprise ECB rate hike

• Setup: Price sweeps liquidity and forms new order block

• Action: Trader enters based on confluence of structure, sentiment, and news

• Why AI fails: Model trained on normal volatility might get stopped out or miss entry entirely

________________________________________

Hybrid Strategy: The Best of Both Worlds 🌐

Elite traders combine the power of AI with human oversight.

Hybrid Workflow:

1. AI scans markets: Flags setups (order blocks, FVGs, volume spikes)

2. You review: Confirm bias with news, sentiment, or higher time frame

3. Entry:

o Manual (you pull the trigger)

o Semi-automated (AI suggests, you approve)

🔁 You save time, avoid missing setups, but keep critical discretion and control.

________________________________________

Risk Management: Algo vs. Manual 📊

AI:

• Stops, lot size, SL/TP are auto-calculated

• Consistent, never emotional

• Example: EA manages all USD pairs with 0.5% fixed risk per trade

Manual:

• Trader might override risk plan

• Discipline needed—easy to “revenge trade” after a loss

• Example: You up your risk size after a losing streak, breaking your rules

Best Practice:

📌 Let AI calculate risk size. Manually approve or override the entry. Double safety net.

________________________________________

Trader Case Study 👤

Name: Ray – $100K funded prop trader

Style: Hybrid (AI scanner + manual ICT confirmations)

Process:

• Sets HTF bias each morning

• AI scans for OB/BOS setups during NY session

• Manual review before entry

Performance:

• Win rate: 63%

• Avg R: 2.5

• Monthly gain: 9.7%

Ray’s Words:

“AI catches what I can’t see. I catch what it can’t understand.”

________________________________________

Mistakes to Avoid ❌

• 🚫 Blindly trusting black-box AI: Always verify signals

• 🚫 Micromanaging every tick: Let automation work, don’t over-interfere

• 🚫 Running AI during high-impact news: Most bots aren’t built for chaos

• 🚫 Ignoring psychology: Even if AI executes, your mindset impacts risk and management

________________________________________

Conclusion ✅

There’s no one-size-fits-all answer. The best traders in 2025 master both worlds. Here’s the winning formula:

• Harness AI’s speed and pattern recognition

• Lean on manual judgment for narrative and nuance

• Blend them with intention and structure for a trading system that’s fast, flexible, and resilient.

💥 Don’t pick sides. Master both.

That’s how the top 1% trade today—and win. 🚀⚙️📊

Trump:New update(don't miss it)hello friends👋

This time we came with the analysis of Trump's famous coin meme, which you requested a lot.

Well, as you can see, by making a double floor, the price has broken its downward channel and has grown well.

After the price growth, we saw the price suffering and then the price correction, which caused the formation of an upward pattern.

Now, according to the successful formation of this ascending pattern, it should be seen whether the buyers support the price in the specified support areas or not...

Pay attention that our trend is upward and the pattern made also shows an upward trend, that's why we have identified the support areas for you to enter the transaction step by step with risk and capital management.

🔥Follow us for more signals🔥

*Trade safely with us*

Forex and Gold Market Highlights June 21 2025Forex & Gold Market Highlights – June 21, 2025

🕒 Key Events This Week:

• 🏦 Fed officials signaling possible rate cuts vs. cautious economic tone

• 🌍 Escalating Israel–Iran tensions boosting safe-haven flows

• 🏭 Mixed U.S. macro data (retail sales, Philly Fed, housing) shaping Fed expectations

________________________________________

💶 EUR/USD Nears 1.1520 on Safe-Haven Flows

EUR/USD edged up to about 1.1520 amid weakness in the U.S. dollar, driven by global risk-off sentiment. Mixed signals from the Fed kept traders cautious.

________________________________________

💷 GBP/USD Hovering Around 1.3500 on USD Strength

GBP/USD remains near 1.3500, slipping slightly off highs after weaker UK retail data. The pair faces resistance in the 1.3550–1.3600 zone.

________________________________________

💴 USD/JPY Eyeballing 146 Resistance

USD/JPY climbed toward 146.00, driven by risk-averse USD demand and dovish BOJ stance. The pair is testing key retracement resistance near 146.76.

________________________________________

🥇 Gold Pulls Back but Holds Ground

Spot gold slid to around $3,334 3,381 this week, under pressure from a stronger dollar and diminished Fed rate-cut hopes. Still, geopolitical jitters kept it from falling hard.

• Weekly drop of ~2.5%, trading in a $3,330–$3,400 range.

________________________________________

📈 DXY Index Rallies on Risk Aversion

The U.S. Dollar Index rose ~0.45%, marking its strongest weekly gain in over a month due to heightened safe-haven flows amid Middle East tensions.

________________________________________

📌 Market Outlook:

• EUR/USD: Mixed bias. May test 1.1550–1.1600 if risk-off continues; downside risk near 1.1400 if U.S. data surprises.

• GBP/USD: Expected to stay in the 1.3450–1.3550 range; UK economic data and USD momentum will be key.

• USD/JPY: Bullish tilt remains toward 146.76, but any BOJ hints of policy tightening could shake it.

• Gold: Pressure from a firm dollar is likely to persist. Watch for geopolitical developments and upcoming Fed signals for reversal clues.

Can Crude Oil Spike to 150 USD / bbl ? Scenario Analysis.With Mid East tensions rising and overall unpredictable

situation around Strait of Hormuz, let's review potential

scenarios for the Crude Oil Prices. I've outlined three

scenarios with projected oil prices for each scenario below.

🚨 Market Alert: Israel-Iran Conflict Impact Forecast 📈

🔴 Worst-Case Scenario: Regional War + U.S. Military Involvement

🚢 Oil (Brent): Soars to $150–$200+ if Strait of Hormuz closes

🥇 Gold: Skyrockets to $4,500–$5,000 (safe-haven rush)

₿ Bitcoin: Initial volatility; settles at $80k–$100k

📉 SPX: Crashes to 4,000–4,500

💻 NDX: Drops sharply to 15,000–16,000

🟠 Base-Case Scenario: Protracted Tension, No Major Disruption

🛢 Oil: Stabilizes at elevated $75–$95, occasional spikes

🥇 Gold: Moves higher, trading $3,500–$3,800

₿ Bitcoin: Trades steady, $90k–$110k range

📊 SPX: Pullback moderate, around 5,200–5,500

💻 NDX: Moderately lower, 18,000–19,000 range

🟢 Best-Case Scenario: Diplomatic De-Escalation

🌊 Oil: Eases down to $65–$75

🥇 Gold: Mild decline, holds at $3,300–$3,500

₿ Bitcoin: Positive sentiment, lifts to $100k–$120k

📈 SPX: Slight dip; stays strong near 5,800–6,200

💻 NDX: Minor correction, remains high at 20,000–22,000

EURUSD SHORT FORECAST Q2 W25 D20 Y25EURUSD SHORT FORECAST Q2 W25 D20 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅15' order block

✅4 hour order block identified

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Gold Market Update: Bulls Will target 3750 USD after 3500 USD🏆 Gold Market Mid-Term Update (June 19, 2025)

📊 Price & Technical Outlook

Current Spot Price: ~$3,365

Technical Setup

Inverted H&S pattern forming/completed on higher timeframes — confirms bullish reversal structure.

Reload (buy) zone: $3,250–$3,275 (ideal accumulation range for bulls if price pulls back).

Swing trade setup: Entry: $3,250–$3,275 (reload zone)

Take Profit (TP): $3,750

Support: Major at $3,250–$3,275 (break below = reassess bullish bias).

Resistance: $3,450–$3,500 ; next major resistance: $3,600, then $3,750.

Price consolidating above $3,250–$3,350 is technically healthy — maintaining bullish structure.

🏆 Bull Market Overview

The pullback appears complete; uptrend resumes amid strong macro/geopolitical drivers (inflation, rates, safe haven flows).

Key Levels: $3,000 (macro support), $3,250 (bulls must defend), $3,500 (breakout zone), $3,750 (swing TP).

Short-term dips = buying opportunities — “Buy the Dip” remains favored as long as support holds. Upside targets: Immediate: $3,600 Swing target: $3,750

Summary:

Gold remains in a bullish mid-term structure, with the inverted H&S pattern pointing to higher prices ahead. Bulls look to reload at $3,250–$3,275, targeting $3,750 for swing trades. As long as $3,180–$3,200 holds, buying dips is the play. A sustained breakout above $3,400–$3,600 opens the door for new all-time highs.

EURUSD H2 Best Levels to BUY/SELL and Market Update🏆 EURUSD Market Update m20 short-term trade

📊 Technical Outlook

🔸Short-term: BEARS 1275

🔸1500/1540 short sell rips/rallies

🔸Mid-Term outlook: BULLS 1750

🔸bulls buy low 1250/1275 reload

🔸bulls exit at 1750 swing trade

🔸Price Target Bears: 1250/1275

🔸Price Target Bulls: 1750

🌍 Macro & Political Drivers

U.S. tax & spending concerns: The Congressional Budget Office now projects President Trump's tax‑and‑spending bill will raise deficits by about $2.8 trillion over the next decade. This massive debt addition is pressuring the U.S. dollar, as rising Treasury issuance and weaker fiscal confidence weigh on demand.

Geopolitical tensions: Escalation in the Israel–Iran conflict is pushing investors toward the safe-haven U.S. dollar. The DXY jumped to around 98.80 as President Trump’s remarks on Iran sent the EUR/USD down to approximately 1.1484.

EU developments: ECB officials, including Christine Lagarde, are doubling down on strengthening Europe’s financial infrastructure to elevate the euro as a viable alternative to the dollar — calling this a “global euro moment.”

Key resistance is around 1.1550–1.1575; downside support zones near 1.1450 and broader range 1.1360–1.1420 remain intact, though current levels suggest consolidation above the lower range. Strength from safe-haven flows could stall upward momentum.

📊 ECB Policy & Inflation Signals

The ECB cut rates by 25 bp last week to 2.0%, reinforcing the message that inflation remains subdued (1.9% in May) and prompting a data-driven, meeting-by-meeting decision approach.

ECB speakers stress “agile pragmatism” given global uncertainties, citing the euro’s ~10% rally year-to-date but cautioning amid rising oil prices and geopolitical risks.

⚡ What to Watch Next

Catalyst Outlook

U.S. yields & bond auctions More issuance tied to tax plans could steepen the curve and support the USD.

Middle East headlines Escalation may continue to offer dollar safe-haven benefits, pressuring EUR/USD.

EU economic data Inflation softness (e.g., France) could weaken ECB’s stance, re-pressuring the euro.

Technical levels Watch 1.1450 support—holds for possible rebound; resistance 1.1550–1.1575 for upside pressure.

✅ Summary

Current: EUR/USD around 1.1484, with bearish tilt amid risk aversion.

Bull case: Ongoing U.S. fiscal weakness, delayed tariffs, and ECB support for euro could cap downside.

Bear case: Safe-haven demand from geopolitical tensions, Fed‑ECB divergence, and technical breakdown through 1.1450 could push toward 1.1360.

GBPUSD H1 compression BUY/HOLD TP1 +100 TP2 +200 pips low risk🏆 GBPUSD Market Update

📊 Technical Outlook

Short-term: BULLS active; resistance forming mid‑1.3600s, consolidation below 1.3600s

Mid-term: Neutral to slight bullish bias; bulls seek 1.3600–1.3700/1.3730 zone

Status: Narrow trading range (tight band) ahead of key UK CPI, Fed & BoE meetings

🔥 Latest Forex Updates

GBP/USD is consolidating in a narrow range around the mid‑1.3500s ahead of this week’s UK CPI and central bank meetings.

The pair holds defensive below 1.3600, with dovish BoE bets capping gains while the Fed is expected to stand pat.

GBP/USD sits near a 40‑month high (~1.3600), boosted by geopolitical risk tone, but lacking momentum to break much higher.

GBP/USD hit ~1.3600 after rebounding from 1.3515 amid renewed Middle East tensions and a weaker US dollar.

Live charts show a mild bullish tilt, awaiting central bank outcomes.

💡 Trade Recommendation

Buy GBPUSD at 1.3530 (recommended entry near 1.3530)

Take Profit at 1.3730 → +200 pips profit target

Stop Loss: 50 pips (around 1.3480)

This trade aligns with the current structure: shallow dip followed by rebound, positioning ahead of central bank catalysts. Momentum above resistance could propel GBP/USD toward 1.3730.

📌 Market Overview

Metric Details

Current Price ~1.3565–1.3600

24H Range 1.3515–1.3600

Central Event Risks UK CPI (Wed), US Retail Sales & Fed (Wed), BoE (Thu)

Geopolitical Middle East tension supports USD weakness, aiding GBP

📈 Forecast Highlights

Support Levels: ~1.3530 (100‑period SMA), ~1.3460, ~1.3425

Resistance Levels: 1.3600, 1.3630 static ceiling, followed by ~1.3700–1.3730 for bulls

🧭 Final Take

GBP/USD sits in a tight range, awaiting central bank clarity. The recommended long trade at 1.3530 aims to capitalize on upside momentum toward 1.3730, supported by technical confluence and a softer USD. Manage risk with a 50‑pip stop loss.

Bitcoin - Will Bitcoin Reach Previous ATH?!Bitcoin is above EMA50 and EMA200 on the four-hour timeframe and is in its short-term descending channel. We can look for Bitcoin short positions from the specified supply range. If this range is broken, the path to the rise and a new ATH for Bitcoin will be presented.

It should be noted that there is a possibility of heavy fluctuations and shadows due to the movement of whales in the market and capital management in the cryptocurrency market is required, more than we would like. If the downtrend continues, I can buy in the desired range.

Bitcoin is now approaching its all-time high, yet unlike previous bullish cycles, we have not seen widespread profit-taking so far. The market’s whales currently seem uninterested in large-scale selling at these levels and appear to be waiting for higher price targets.

Since the start of January 2024, cumulative inflows of over $60 billion have poured into crypto-related investment products in the U.S., including ETPs and ETFs. In addition, retail investor futures trading volumes have recently surpassed their one-year average. Indicators of retail activity suggest that a significant number of smaller investors have become active in the futures markets.

The total assets under management by crypto investment funds surged to an unprecedented $167 billion in May. This impressive growth was fueled by net inflows of more than $7 billion into these funds. Meanwhile, global equity funds recorded $5.9 billion in outflows, and gold funds, for the first time in 15 months, also saw capital leaving.

The year 2025 could turn out to be the most dangerous year yet for cryptocurrency holders. Already, more than 25 incidents involving physical attacks on crypto owners have been reported, and the year isn’t even over. These attacks have targeted individuals whose digital asset information or identities were compromised, leading to thefts, kidnappings, physical threats, or assaults.

On another front, the total value of circulating stablecoins has surpassed $250 billion, more than doubling from its mid-2023 low of $123 billion. USDT remains the market leader with a 62% share, followed by USDC at 24%, while other stablecoins such as USDe, DAI, and BUIDL are also expanding their presence.

It is worth noting that average spot trading volumes on centralized exchanges have dropped to their lowest levels since October 2020.This kind of pattern typically precedes a significant price move—whether that’s a sharp rally or a deep correction. It’s also possible that this phase of uncertainty could persist for several more weeks.

TRUMPUSDT In my opinion, we could still see a further 10% drop, considering the market’s cyclical nature — though it does feel like we’re near the bottom at this point.

Based on the indicators below, MACD and CCI are also showing signs of compression, similar to what we're seeing in the technical analysis.

Overall, I think by June 20th we’ll have a clearer picture of where the breakout from these triangle formations is headed

USDCHF LONG FORECAST Q2 W24 D13 Y25USDCHF LONG FORECAST Q2 W24 D13 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation & breaks of structure.

Let’s see what price action is telling us today! 🔥

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Iran tensions rise: a setup brewing for gold and oil Geopolitical tensions surrounding Iran might fuel safe-haven demand for gold.

A break above $3,403 might open the door for a test of the May high at $3,437. However, price action over the last two sessions potentially indicates that buyers are reluctant to drive spot prices above $3,400.

At the same time, analysts are suggesting that oil could climb toward $120 if Israel takes military action against Iran. “I don’t want to say it’s imminent, but it looks like something that could very well happen,” President Trump said during a White House event.

Meanwhile, cooler-than-expected US CPI and PPI prints have potentially strengthened expectations that the Federal Reserve could begin cutting interest rates by September, with a second cut possibly following before year-end.

EURUSD SHORT FORECAST Q2 W24 D12 Y25EURUSD SHORT FORECAST Q2 W24 D12 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block

✅15' order block

✅4 hour order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

DXY Ready to Reload? Eyes on 99.100 as Tariff Tensions Ease!!Hey Traders, In tomorrow's trading session, we're closely monitoring the DXY for a potential buying opportunity around the 99.100 zone. After trending lower for a while, the dollar index has successfully broken out of its downtrend and is now entering a corrective phase.

We’re watching the 99.100 support/resistance area closely, as it aligns with a key retracement level making it a strong candidate for a bullish reaction.

On the fundamental side, Friday's NFP data came in slightly above expectations, which is typically USD-positive. In addition, recent Trump-led de-escalation in U.S.-China tariff tensions is another supportive factor for the dollar.

Trade safe, Joe.

Crude Oil Surges on Summer Demand and Trade OptimismOn the weekly chart, crude oil trades above the mid-range of a descending channel that has been in place since the 2022 highs. The RSI remains just below the neutral zone, suggesting a cautiously bullish-to-neutral outlook while prices hover near the $65 resistance level.

From a daily perspective, oil prices are breaking out above the $65 resistance, and a firm hold could pave the way toward $66 and potentially retest the $71 and $73 levels.

On the downside, the psychological support at $60 remains critical. A break below $60—and more critically, below the $58 moving average—could reintroduce long term bullish positioning from $55 and $49.

- Razan Hilal, CMT