Jul 20 | Crypto-market reviewNew Crypto-Sunday market review video, where I share my current analysis on the trend structures of BTC, ETH, SOL, XRP, HYPE and other alt- and mem-coins of interest to my, highlighting key support and resistance zones to watch in the coming sessions.

Charts featured in the video

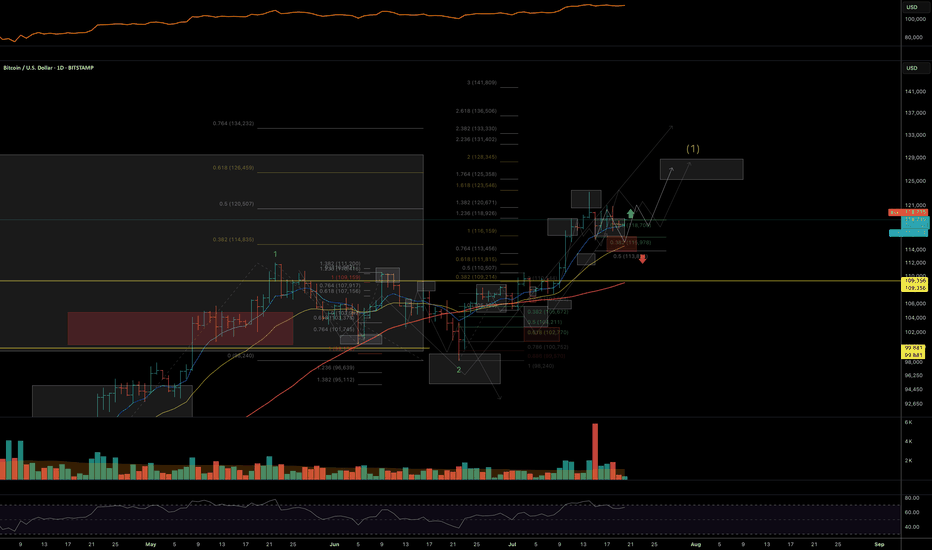

BTC

ETH

XRP

(!) SOL

(!) HYPE

(!) TRUMP

BRETT

(!) FET

RENDER (Weekly)

(!) DOG

(!) MOG

Thank you for your attention and I wish you happy Sunday and great trading week!

If you’d like to hear my take on any other coin you’re tracking — feel free to ask in the comments (just don’t forget to boost the idea first 😉)

Trumpcoin

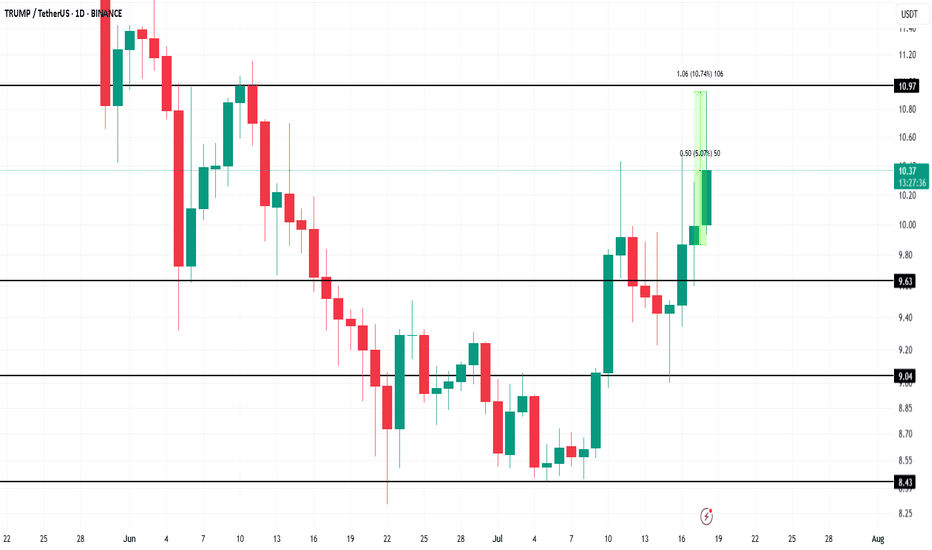

TRUMP Token's $950 Million Unlock Sparks Short-Lived Price RallyBINANCE:TRUMPUSDT recently saw its first major token unlock in six months, which flooded the market with fresh supply. The 90 million TRUMP tokens unlocked today are much smaller than the previous unlock in January, yet they still increased liquidity significantly.

However, the lack of response to the unlock, despite the substantial capital entering the market, further indicates a cooling of investor enthusiasm around the meme coin

BINANCE:TRUMPUSDT price rose by 5% today, trading at $10.39 at the time of writing. It briefly surged by 10% during the intraday high , but the rally was short-lived, and the price retraced.

If BINANCE:TRUMPUSDT fails to breach the $10.97 resistance level again, the coin could face potential corrections to $9.63 , making recovery difficult. The token will need strong demand to push past this resistance and secure more gains.

However, should BINANCE:TRUMPUSDT capitalize on broader market bullish momentum, it could break past $10.97 and reach $11.00 . This would likely invalidate the current bearish outlook and provide an opportunity for a further rise to $12.18.

OFFICIAL TRUMP Main trend. 16 05 2025Logarithm. Time frame 3 days. After a super pump and a drive of "stupid money", a descending channel was formed on a natural dump. The price came out of it. Now a triangle is forming. The price is clamped. The reversal zones and percentages to the key support/resistance levels are shown extremely accurately according to TA.

If there is no aggressive exit in the medium term, then there will be consolidation and, as a consequence, the formation of a horizontal channel "sholtai / chattai", its key zones are shown.

Now, this "cryptocurrency" is now on 16 05 2025 in 41st place by capitalization.

Reductions from the price highs are about -90%.

From the liquid zone about -84%.

These are not the minimum values of the decline of such hype cryptocurrencies. Just take this into account in your money management. For clarity, the level zones and the % of potential decline if the trend breaks again are shown on the chart (pull the chart down).

Even with such a decline, the price is now at a huge profit. I am not speaking for the creators of the cryptocurrency, but for the first speculators and "investors" who may not have sold everything on the hype.

For the creators of the cryptocurrency, perhaps these are manipulators close to the Trump family, for them, any sale is super profit. But in order to sell, you need to maintain liquidity, and from time to time make interest in speculation and asset retention by investors, that is, do pumps and hype. Use this, and do not be greedy...

Levels and zones, pump/dump, which the price will "feel" are shown in advance. Click "play" on the chart and move the chart up. With a high degree of probability, the hype and pumping of the price of this cryptocurrency will be repeated, given the hype and the long term of the political figure whose name this cryptocurrency bears. Now it is a Trump dump, in the future it will become a Trump pump for some time.

Do not forget to sell on the next hype. If you understand that you are very greedy, and the news background affects you, then sell in parts, or use stop losses to protect profits.

There is no need to guess the minimums and maximums. It is important to know these zones, and have an acceptable average price, from the position of the trend, and its potential. It is regulated by the distributed entry volume (in advance) at potential reversal zones.

Trump's signalHello friends🙌

🔊Given the good growth we had, you can see that the price has hit resistance and you can see that the upward waves are getting weaker, which indicates that we are likely to have a correction until the support areas are identified...

You can buy in the identified support areas in steps and with capital management and move with it to the specified targets.

🔥Join us for more signals🔥

*Trade safely with us*

TRUMP BUY ???Hello friends🙌

🔊As you can see in the picture, we have brought you two Trump charts:

1_TRUMP/USDT, in which we see an upward trend.

2_TRUMP/BTC, in which we see a downward trend.

✔Now what is the conclusion? When this negative divergence occurs, it means that money flows from Bit to Tether, and we can expect good growth from it to the specified targets, given the price reaching important support and its return📈

🔥Join us for more signals🔥

Trade safely with us.

Trump:New update(don't miss it)hello friends👋

This time we came with the analysis of Trump's famous coin meme, which you requested a lot.

Well, as you can see, by making a double floor, the price has broken its downward channel and has grown well.

After the price growth, we saw the price suffering and then the price correction, which caused the formation of an upward pattern.

Now, according to the successful formation of this ascending pattern, it should be seen whether the buyers support the price in the specified support areas or not...

Pay attention that our trend is upward and the pattern made also shows an upward trend, that's why we have identified the support areas for you to enter the transaction step by step with risk and capital management.

🔥Follow us for more signals🔥

*Trade safely with us*

TRUMPUSDT In my opinion, we could still see a further 10% drop, considering the market’s cyclical nature — though it does feel like we’re near the bottom at this point.

Based on the indicators below, MACD and CCI are also showing signs of compression, similar to what we're seeing in the technical analysis.

Overall, I think by June 20th we’ll have a clearer picture of where the breakout from these triangle formations is headed

TRUMP to $100? Code 144 and Trump's Birthday I want to share my unique hypothesis, which no one has discussed before. I noticed an interesting pattern: on the 144th day after listing, a pump began for meme tokens like SHIB, PEPE, DOGE, FLOKI, and BABYDOGE.

I call this "Code 144" — and I believe the same scenario could repeat with the TRUMP token, especially considering June 14th is Donald Trump's birthday. This is the perfect media opportunity to trigger a FOMO wave, especially if it coincides with this critical 144th day.

📌 What’s important:

The same pump pattern on these coins' charts (possibly controlled by the same market maker);

TRUMP is currently in an accumulation phase;

The US election hype could amplify the effect;

I expect a pump near June 14th, as part of the "Code 144."

The target for TRUMP, based on this scenario, is $100 as a short-term spike due to the hype.

⛔ This is not financial advice, but my personal idea based on observing past cycles of meme tokens. I’m sharing it to document the hypothesis and check it against time.

TRUMPUSDT price analysis✊ It seems that the price of $Trump will only skyrocket when #Trump is impeached!

And we're keeping our fingers crossed that this happens as soon as possible... Mr. #Musk, you have nothing to lose — spill the beans!

As a Ukrainian classic wrote: “I gave birth to you — I will kill you.”

🕯 As for the price of OKX:TRUMPUSDT , it is moving very harmoniously and according to the canons of TA, regardless of who makes some “news throws” and does it on time or not.

And this is not surprising, as the crypto market titan Justin Sun has invested in it. His reputation is controversial, but he knows how to defend his “creations” and investments, pump them up, and make money on them.

So, it's purely hypothetical to assume that the price of $Trump will continue to rise, but this is by no means a call to invest in the red-haired jerk's coin. ✊

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

#TRUMP/USDT#TRUMP

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 9.53, acting as strong support from which the price can rebound.

Entry price: 9.70

First target: 10.07

Second target: 10.40

Third target: 10.70

THESE ALTS can +100% | ALTSEASON PART2️⃣Altseason usually happens when BTC trades close towards a new ATH, as it is doing now, and takes some time to stall/trade sideways

Now this season is working a little differently. Usually ETH makes its way towards new highs, but we haven't seen that just yet. Ethereum has HUGE upside potential still.

It's hard to say just how high Ethereum can go, but what we do know is that it's still 88% away from the previous ATH, and due for a new one...

ENA is another alt with big upside potential, from it's previous peak its more than 200% away:

Solana has made a strong V-shaped recovery and if ETH is primed for new ATH, SOL is sure to follow:

TRUMPcoin may be memecoin, but the again so is PEPE! Still big upside after a long while of range trading here:

World Liberty Financial STABLECOIN | Everything YOU Need to KnowWorld Liberty Financial (WLFI), a DeFi lending protocol launched in 2024 and notably associated with the Trump family, is currently executing a key operational test for its new stablecoin, USD1.

This U.S. dollar-pegged stablecoin was introduced in March 2025 and backed by Treasuries and cash equivalents. It has already seen rapid adoption, surpassing $2.1 billion in circulation.

To validate their on-chain distribution systems ahead of a wider rollout, WLFI is conducting a test airdrop, proposing to send a small and fixed amount of USD1 to all existing $WLFI token holders on the Ethereum Mainnet. A governance vote on this proposal, set to conclude this Wednesday, May 14th shows overwhelming community support, with over 99.9% approval which is signalling confidence in the initiative's technical goals and community reward aspect.

Investors should note that while the vote seems assured, critical details like the exact USD1 amount per wallet and the precise airdrop date are yet to be announced, pending the vote's finalization. Also, WLFI retains discretion to modify or cancel this test distribution. This operational step occurs against a backdrop of significant scrutiny surrounding WLFI, stemming from its high-profile political connections, reported investigations, and potential conflicts of interest highlighted in various media outlet.

this test airdrop represents a practical infrastructure check and a community engagement tactic for WLFI as it builds out the ecosystem for its rapidly growing USD1 stablecoin. For current $WLFI holders, it presents a small token distribution contingent on final details announced after May 14th. For prospective investors, it's an operational milestone to observe, weighing the technical progress and market adoption of USD1 against the unique regulatory and political risks associated with the World Liberty Financial project.

____________

BYBIT:WLFUSDT

A bet on US geopolitical power I lomged trump some time ago. I won't say at what price but i think this will pump a bit today as the dinner snapshot approaches. Some normie influenzas are convincing their followers to short it into the snapshot but i think except for some minor corrections there will be no major crash to $8 or whatever. This token is slowly and steadily going to creep back up to $100 price. whenever trump solves global conflicts such as india-pakistan, ukraine- israel etc. It'll positively influence the price of this token. A bet on $trump is a bet on $trump's presidency. Whether he will prove to be a good president or not is upto you. Regardless, keks will be had.

$TRUMPUSDT Breakout Alert!$TRUMP has officially broken above its descending trendline after holding firm support around $11.8. The price also reclaims the 100 EMA (orange line), signaling strength and potential for a trend reversal.

📈 Technical Highlights:

Downtrend breakout confirmed ✅

Retest of resistance turned support around $13.3 ✅

Targets in sight:

• TP1: $16.52

• TP2: $21.04

• TP3: $26.35

This breakout setup remains valid as long as TRUMPUSDT holds above $13.3. A clean trendline flip often leads to explosive follow-throughs.

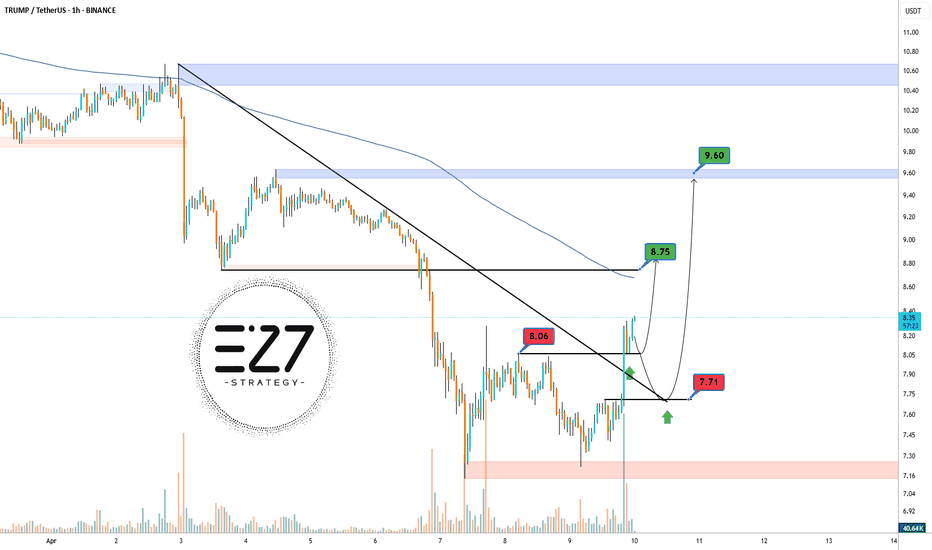

Trump token bullishKey Levels: The main resistance is at 10.40 dollars , and the main support is at 7.71 dollars . The descending trendline keeps the price below it, and the 200-period moving average above the price confirms the bearish trend .

Closer Zones: A nearby resistance is observed at 8.06 dollars, overlapping with the trendline. The closer support is at 7.71 dollars. A break above 8.06 dollars could push the price toward 9.60 dollars .

Intermediate Level: On the way up, the 8.25 dollars level acts as an intermediate resistance.

Target: Based on the previous move of 2.50 dollars, the potential upside target is around 9.60 dollars .

Conclusion: A breakout above the nearby resistance could signal a weakening bearish trend and the start of an upward move .

BTC/USDTBINANCE:BTCUSDT

CRYPTOCAP:BTC is respecting my levels perfectly 📈 88K target hit ✅

We’ve just tapped into a major resistance zone—so a short-term pullback could be on the table 📉⚠️

#Altcoins might see a bit of cooling off too, but if BTC manages a clean retest around the 85K–85.5K range, that’d be a bullish confirmation 📍

"Disclaimer : Not Financial Advice"

$TRUMP token Crumbles as Major Support Breaks, Is an ATL Next? TRUMP, the meme token inspired by former President Donald Trump, is currently priced at $7.52. The token has gained 5.03% in the last 24 hours. Its market capitalization stands at $1.5 billion, with a daily trading volume of $415.5 million, a drop of nearly 60.12% in the last 24 hours.

TRUMP was launched to commemorate Trump’s viral "FIGHT FIGHT FIGHT" moment in July 2024. That day, he survived a deadly incident and raised his fist in defiance. The moment triggered a movement that birthed this meme token. It symbolizes resilience and leadership, attracting thousands to its growing community. The token is now freely tradable on the blockchain, with increasing interest in both trading and long-term holding.

Technical Analysis: Price Faces Trendline Rejection and Heavy Resistance

TRUMP has been in a strong downtrend since reaching highs at $77. A descending trendline continues to cap upward moves, with the price breaking below key support at$12. Resistance is seen around the descending trendline and the horizontal support at $12. This level was previously a support and is now acting as a ceiling for price recovery. The daily RSI is currently at 27.19 indicating oversold conditions. This could trigger a short-term bounce toward $10–$12.

However, the trend remains bearish. The price has failed multiple times to break above the downtrend line. If the price breaks below $7 with volume, further drop could follow. A successful bounce might lead to a retest of $12.

TRUMP & MELANIA Collapse - Sh*tcoin Reality CheckIf you had bought BINANCE:TRUMPUSDT or BINANCE:MELANIAUSDT.P at any point during the last three months, you’d likely be deep in loss within just days. These tokens, despite using the names of major political figures, followed a typical memecoin pattern:

🚀 Launch hype → 💰 Speculation → 📉 Massive dump

But here’s what traders need to remember:

🔁 These types of tokens can pump again. All it takes is a tweet, a trending news event, or a post from an influencer or celebrity—think Elon Musk. A spark like that could fuel a rally.

⚠️ However, the risk is extremely high. These projects often lack fundamentals, and the price action is driven mostly by hype and speculation. If you choose to trade them, know your risk tolerance and never overexpose your portfolio.

💡 This is the reality of memecoins. Recognize the pattern, protect your capital, and stay sober in the market.

📊 Follow for grounded insights and market wisdom—no hype, just facts. 🔔

#TRUMPUSDT — Breakdown or Reversal Confirmation🚀 BYBIT:TRUMPUSDT.P — Breakdown or Reversal Confirmation? Full Breakdown on 1H & 4H!

Let’s start by analyzing the charts on different timeframes:

✅ On the 1H chart , we clearly see a reversal pattern — Inverted Head & Shoulders — and the neckline breakout has already occurred. The volume on the breakout is high, which confirms the strength of the signal.

➡️ The target for this pattern is around $10.75–$10.80, which also aligns with the upper VPOC level from the previous range.

➡️ The POC level for BYBIT:TRUMPUSDT.P is $10.159, which may now act as support — this can be a potential entry zone.

➡️ Nearest resistance is at $10.40. A breakout above this level could trigger an impulse move towards $10.75–$10.80.

✅ On the 4H chart , a bearish flag is forming, which could potentially push the price lower — but this scenario hasn't played out yet.

➡️ There's also a local double bottom, confirmed by a price bounce. A retest of the flag’s lower boundary will be a key moment.

Let’s break down the patterns:

✅ 1. Inverted Head & Shoulders (1H) – A classic bottom reversal formation.

➡️ The neckline breakout occurred on increased volume — a key confirmation for a long setup.

✅ 2. Volume (Volume Profile & Bars) – Strong volume spike during the breakout confirms buyer interest.

✅ 3. Price broke out of consolidation – We’ve seen an impulsive breakout and the price is holding above the neckline.

✅ 4. Local Market Structure Break (MSB) – A shift from local downtrend to an emerging uptrend.

📍 Key Point: If the price holds above $10.40, this confirms a breakout from the descending channel, increasing the chance of reaching $10.75–$11.00.

📍 Price must also stay above $10.15 and not fall back into the previous range. A retest and bounce from this level would serve as further confirmation.

📢 If the price drops back below $10.15 and breaks $9.87, the “Inverted Head & Shoulders” pattern will be invalidated. In that case, a bearish trend will likely resume and a short toward $9.50–$9.00 could be considered.

📢 On the 4H chart, the risk of the bearish flag playing out still remains. We are monitoring the structure closely — a sharp pullback is possible.

📢 The volume zone around $10.15–$10.20 is key. As long as the price stays above it — the long scenario remains dominant.

🚀 As of now, BYBIT:TRUMPUSDT.P has strong technical reasons to support a long bias, especially if it holds above $10.40 — that would open the door to $10.75–$11.00.

Risks remain — particularly around the 4H bearish flag — but for now, bullish momentum prevails.

🚀 BYBIT:TRUMPUSDT.P still holds upside reversal potential — LONG scenario remains the priority!

Official Trump price analysis$Trump coin will probably only go off when and if Trump wins the Nobel Peace Prize. And for this to happen, his activities and rhetoric must change completely... at the moment, it looks "on the verge of fantasy."

Meanwhile: A major investor lost money on TRUMP again - this time $3.3m, he sold 743,947 TRUMP for $7.92m, but did so at a loss.

The irony is that at the very beginning of trading this token, he earned $11.82 million. However, a series of unsuccessful trades resulted in serious losses - now his total loss on $TRUMP has reached $15.7 million.

1️⃣ If by some miracle OKX:TRUMPUSDT manages to break out above the trend price, then we can dream of $14.26 and $17.36

2️⃣ А if, again, he writes, or says, or does something stupid, which is more likely for this personality.... then #Trump at $7-7.2, why not.

Ten times less than the highs... that's where the success is!)

Breaking: $TRUMP Token Dips 10% Reverting to $10 ZoneThe price of OFFICIAL TRUMP coin ($TRUMP) tanked 10% today, falling back to the $10 region. The asset ever since peaking to an all time high of $76, faced insane selling pressure losing about 80% of total value together with its compatriot $MELANIA coin.

For Weeks now, $TRUMP has been circumventing in the $10- $12 zone albeit the crypto market was most of the time in a bloodbath season. For $TRUMP coin, should the bulls push the token above the 38.2% Fibonacci retracement point, that may be the catalyst the token needs to spark a bullish renaissance as hinted by the Relative Strength Index (RSI) at 30- pointing at the disparity $TRUMP has to capitalise and make a bullish move.

Similarly, the 1-month low is serving as support point for $TRUMP should extreme selling pressure push the token lower.

OFFICIAL TRUMP Price Live Data

The live OFFICIAL TRUMP price today is $10.21 USD with a 24-hour trading volume of $517,239,338 USD. OFFICIAL TRUMP is down 8.71% in the last 24 hours. The current CoinMarketCap ranking is #45, with a live market cap of $2,041,294,317 USD. It has a circulating supply of 199,999,430 TRUMP coins and a max. supply of 999,999,993 TRUMP coins.