Tesla Motors (TSLA)

Tesla Shares Tumble 7%+ Following Cybertruck Quality ComplaintsTesla Inc. (NASDAQ: NASDAQ:TSLA ) faced another sharp sell-off on Thursday 10th. The stock dropped 7.27% to close at $252.40, down $19.80 for the day. However, volume was high, reaching 399.04 million shares.

The fall followed reports of build quality issues in Tesla’s Cybertruck. Owners posted complaints on the Cybertruck Owners Club forum. Several noted that the vehicle’s metal panels had detached.

Additionally, videos showing Cybertruck damage in cold weather gained attention on social media site X. These reports raised concerns over production quality.

Tesla had been recovering before the recent plunge. However, concerns about product reliability appear to have paused the rebound.

Technical Analysis

The 3-day chart shows Tesla in a strong downtrend. The stock broke below $290, triggering a drop to around $220 before bouncing back to $252. Price recently respected a key support near $190m, which may act as a floor for future declines. High volume near support signals buyer interest. If Tesla breaks above $290, it could retest $300. That zone acts as resistance and aligns with the 50- and 100-day moving averages at $252 and $232, respectively.

The longer-term target is near $488, but the price must clear $290 first. A failure to hold support near $220 could send the stock back toward $180. The RSI is at 42.77, slightly above oversold. Momentum is weak but may shift if price builds support above $250. Tesla’s next move depends on how it manages both technical resistance and consumer concerns.

Tesla (TSLA) Shares Jump Approximately 22% in a Single DayTesla (TSLA) Shares Jump Approximately 22% in a Single Day

Tesla was among the standout performers in the stock market rally that followed President Trump’s decision to delay, by 90 days, the implementation of new international trade tariffs — with the notable exception of China. According to the charts, Tesla (TSLA) shares surged by approximately 22%.

Why Did TSLA Shares Soar?

Some insight comes from Cathie Wood, CEO of asset management firm ARK Invest.

In an interview with Barron’s on Wednesday, she noted the following:

→ Tesla plans to launch a new, more affordable vehicle this quarter, likely priced at around $30,000 — roughly half the cost of the base Model Y.

→ The upcoming release of Tesla’s robotaxi service could also lower the need for large upfront vehicle purchases, offering consumers a more economical alternative.

→ Tesla sources more components from North America than most other US carmakers, meaning it is less exposed to tariff-related costs.

And there’s another reason TSLA may have jumped — one that can be found in the chart.

Technical Analysis of TSLA

Take note: the March and April lows (marked with arrows) are both around the $220 level. Meanwhile, the S&P 500 (US SPX 500 mini on FXOpen) posted a significantly lower low in April compared to March. This suggests that, in early April, TSLA was outperforming the broader market. Why?

One possible explanation is that there has been — and perhaps still is — a strong accumulation interest in TSLA. Buyers may have been quietly scooping up available shares amid recession fears. When yesterday’s news suddenly shifted market sentiment, the “spring” uncoiled, catapulting TSLA’s share price upward.

However, the overall downtrend remains intact. If bullish momentum continues, the price may encounter resistance around the psychologically significant $300 level — which coincides with the upper boundary of the downward channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

TSLA in the coming monthsBased on my analysis using three-month candlestick charts, TSLA is not in a bear market yet. It may test the 202 level and possibly even dip to the 168 area. However, as long as it holds above that range, the outlook remains positive.

The market may be choppy in the coming months, which could present some solid trading opportunities.

Good luck to us all!

TSLA 45M chart - BULL flag Coiling for Breakout!www.tradingview.com

🚀 TSLA 45m – Bull Flag Coiling for Breakout

NASDAQ:TSLA TSLA ripped from $214 → $276 📈 and is now forming a bull flag just under resistance at $276.87.

🔹 Strong volume on the pole, cooling off during flag 🧊

🔹 RSI ~74 — strong, but not overheated 💪

🔹 MACD crossover 🔄 + momentum building 📊

🔹 Above all key EMAs (20/50/100/200) 🟢

🔹 OBV trending up — smart money is loading 💼📦

⚠️ Breakout above $277 = launch toward $293–$300, with extended target of $310–$330 if trend continues.

❌ Invalidation below $263.

📌 Watching for a breakout + retest entry 🔁

Let it cook. 🔥

Tesla Taps the Golden Zone – Is the Launch Sequence Engaged?Tesla (TSLA) has shown textbook precision by respecting the golden zone after a significant sweep of previous highs. Rather than violating the last HTF low—which would’ve hinted at deeper downside—price instead retraced cleanly into the OTE (Optimal Trade Entry) range and reacted with strong bullish intent.

This move indicates a healthy retracement rather than weakness, suggesting a continuation to the upside. Confirmation of this potential bullish leg would be a sustained close above the 272–300 level, which aligns with previous buyside liquidity zones and Fibonacci confluence.

Key Observations:

- Golden Zone respected: Price bounced cleanly between the 62–79% fib levels.

- HTF low protected: No violation of higher timeframe bullish structure.

- Volume spike supports the reversal move.

Targets:

- Short-term: 300.61

- Mid-term: 416.67

- Long-term swing: 861.17 (over 255% potential gain)

Conclusion:

Tesla looks set for lift-off 🚀. The reaction at the golden zone and the preservation of structure give high confluence for a potential explosive move higher. Wait for confirmation via price continuation and structure integrity.

As always — DYOR (Do Your Own Research).

TSLA Best Level to BUY/HOLD 100% bounce🔸Hello traders, today let's review daily chart for TSLA. we are

looking at a 67% correction, almost complete now, another 67%

recent correction presented on the right.

🔸Most of the bad news already price in and we are getting

oversold, expecting a bottom in weeks now not months.

🔸Recommended strategy bulls: BUY/HOLD once 67% correction

completes at/near strong horizontal S/R 140/150 USD, TP bulls

is 280/300 USD, which is 100% unleveraged gain.

**Tesla (TSLA) Market Update – April 9, 2025**

📉 **Stock Decline:** TSLA closed at $221.86, down 4.9%, amid new tariffs and CEO Elon Musk's political involvement

**Analyst Downgrades:*

Wedbush's Dan Ives cut the price target by 43% to $315, citing a "brand crisis"

Wells Fargo's Colin Langan set a target at $130, anticipating a potential 50% drop

📊 **Delivery Shortfall:** Q1 deliveries fell 13% year-over-year to 336,000 vehicles, missing expectations by about 40,000 unis.

🌍 **Tariff Impact:** President Trump's new tariffs are expected to increase costs and disrupt Tesla's supply chain, especially concerning Chinese operatins.

💡 **Investor Sentiment:** Analysts express concern over Musk's political ties affecting Tesla's brand and sales, particularly in China.

[TSLA] Bear Market to $15: Musk’s Empire at Risk?Tesla’s market cap now surpasses the combined market cap of all major automobile producers. Elon Musk is undeniably a genius, yet this staggering valuation owes much to a robust bull market and post-COVID hype. If Tesla were valued using the same earnings and revenue multiples as the average automaker, its stock price would hover between $15 and $20 per share.

TECHNICAL ANALYSIS

Tesla’s chart is one of the most striking I’ve ever seen. It reflects a powerful bull market that has completed an Elliott Wave five-wave structure, signaling that a bear market is likely next.

Wave 4 formed a running triangle—a pattern typical in strong trends—and was followed by a short Wave 5, exactly as expected. Running triangles paired with a brief Wave 5 often indicate distribution. Indeed, Tesla’s chart reveals a beautiful four-year distribution phase (2021–2025). During this period, the stock struggled to climb higher due to persistent selling pressure. Strong hands have now offloaded their shares to weaker hands, setting the stage for a bear market.

A triple divergence on the monthly RSI further confirms extreme overbought conditions and reinforces the case for selling. There’s no significant support until the $15–$20 range.

If my prediction of a 2008-style crash in the S&P 500 (see related ideas) holds true, Tesla could bottom out around $15—a level that, intriguingly, aligns with its COVID-era low.

"Bull market geniuses turn into bear market fools."

Elon Musk net worth derives value mostly from Tesla and SpaceX as other companies are illiquid and very speculative.

Current Musk's Tesla stake is worth around $100 billion if the price falls down to $15 it would be worth $6 billion, all other things being equal that alone would put a significant dent in his net worth.

Musk is widely recognized as someone who leverages his Tesla shares and SpaceX to fund other ventures and lifestyle.

It is not clear at what price level his margin calls are and what arrangements he has with banks but if crash of this magnitude happens all his Tesla shares could be wiped out with possible full blown bankruptcy.

I wish him well and hope he does well, but this scenario is not unlikely and interesting to ponder.

Tesla: bounce expected at $200 Support?NASDAQ:TSLA is currently approaching an important support zone, an area where the price has previously shown bullish reactions. This level aligns closely with the psychological $200 mark, which tends to carry added weight in the market .

The recent momentum suggests that buyers could step in and drive the price higher. A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would increase the probability of a bounce from this level. If I'm right and buyers regain control, the price could move toward the 260.00 level.

However, a breakout below this support would invalidate the bullish outlook, potentially leading to more downside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

TESLA Always Pay YOURSELF! Tsla Stock were you PAID? GOLD Lesson

⭐️I want to go into depth regarding the this topic but it is a long one with PROS & CONS for doing and not doing it.

Every trader must choose what's best for them but you will SEE when I finally get to the write up that MANY OF THE PROS are NOT FINANCIAL but PSYCHOLOGICAL❗️

Another of 🟢SeekingPips🟢 KEY RULES!

⚠️ Always Pay YOURSELF.⚠️

I know some of you chose to HOLD ONTO EVERYTHING and place your STOP at the base of the WEEKLY CANDLE we entered on or the week priors base.

If you did that and it was in your plan GREAT but... if it was NOT that is a TRADING MISTAKE and You need to UPDATE YOUR JOURNAL NOW.

You need to note EVERYTHING. What you wanted to see before your exit, explain why not taking anything was justified to you, were there EARLY exit signals that you did not act on. EVERYTHING.

🟢SeekingPips🟢 ALWAYS SAYS THE BEST TRADING BOOK YOU WILL EVER READ WILL BE YOUR COMPLETE & HONEST TRADING JOURNAL ⚠️

📉When you read it in black amd white you will have YOUR OWN RECORD of your BEST trades and TRADING TRIUMPHS and your WORST TRADES and TRADING ERRORS.📈

✅️ KEEPING an UPTO DATE JOURNAL is STEP ONE.

STUDYING IT IS JUST AS IMPORTANT👍

⭐️🌟⭐️🌟⭐️A sneak peek of the LESSON after will be HOW & WHEN TO ENTER WHEN THE OPEN BAR IS GOING THE OPPOSITE WAY OF YOUR IDEA.👌

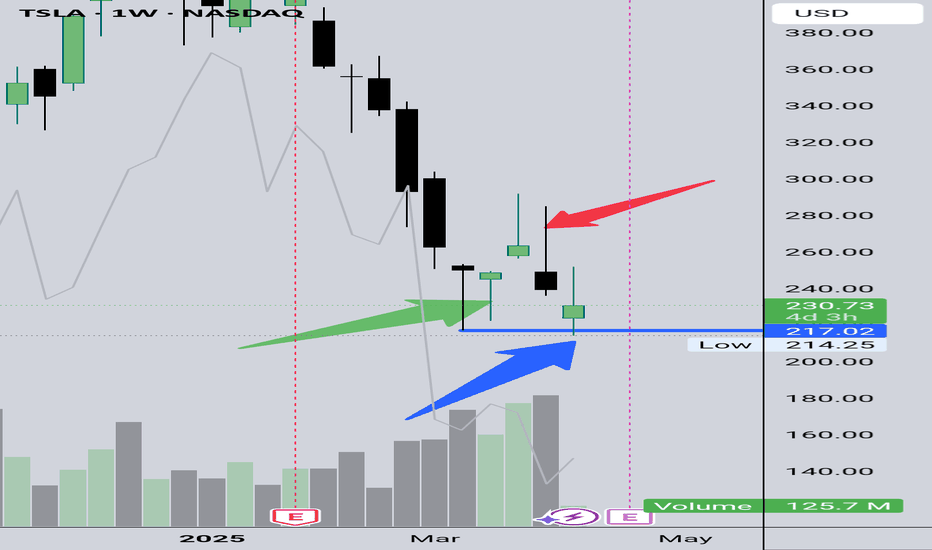

🚥Looking at the TESLA CHART ABOVE you will see that we were interested in being a BUYER when the weekly bar was BEARISH (GREEN ARROW) and we started to consider TAKE PROFITS and EXITS when the (RED ARROW) Weekly bar was still BULLISH.🚥

First let's go down a little more and then retest broken supportFifth Elliott wave is forming. This wave may possibly extend to $160.

It is likely to test the support it broke later around $250.

* The purpose of my graphic drawings is purely educational.

* What i write here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose your money.

Tesla (TSLA) Long-Term Analysis: Retesting Key SupportHello traders! Let’s dive into a long-term analysis of Tesla (TSLA) on the monthly chart to understand where the stock might be headed next. I’ll walk you through my thought process, focusing on a comparison between the recent correction and a similar setup in 2020, while also analyzing the current correction’s alignment with the triangle formation from the 2021–2024 consolidation. My goal is to help you see the context of this setup and make an informed decision if you’re considering a trade.

Step 1: Understanding the Big Picture and Historical Context

Tesla has been in a strong uptrend since 2013, as evidenced by the ascending channel (highlighted in blue). This channel has guided the stock’s long-term trajectory, with the lower trendline providing support during pullbacks and the upper trendline acting as resistance during peaks. Within this uptrend, Tesla has experienced significant breakouts followed by corrections, and I’ve identified a compelling similarity between the current price action and a setup from 2020, alongside a key technical level from the recent consolidation.

Step 2: Comparing the Recent Correction to 2020

In 2020, Tesla consolidated in a range between $12 and $24 (labeled "Consolidation 1" on the chart). It then broke out, rallying to a high of $64.60—a gain of about 169% from the upper end of the consolidation range. Following this breakout, Tesla experienced a sharp pullback, dropping to $23.37, which represents a 63.8% correction from the $64.60 high. After finding support at this level, Tesla resumed its upward trajectory, soaring to $166.71—a 613% increase from the pullback low. Now, let’s look at the current situation: Tesla broke out of "Consolidation 2" (around 2021–2024), rallying from $212.11 to a high of $488.54—a 130% increase. It has since corrected by 51%, dropping to the current price of $239.43. This 51% pullback is slightly less severe than the 63.8% correction in 2020, but the structure is similar: both followed significant breakouts from consolidation zones.

Step 3: Current Price Action and the Triangle Retest

Tesla is currently trading at $239.43, down 55% from its recent high of $488.54. If the correction deepens to around 60%, it would bring the price to approximately $195.42 (calculated as $488.54 × (1 - 0.60) = $195.42), which aligns perfectly with the upper trendline of the triangle formation from "Consolidation 2" and the "Retest support?" zone around $170–$200. This confluence suggests that the current correction could be setting the stage for a significant bounce, just as the 2020 correction did. If this $170–$200 level fails to hold, I’m watching for a deeper pullback to the "Retest support" zone around $138–$150, which aligns with the lower trendline of the ascending channel and has acted as support during previous pullbacks (e.g., in 2023).

Step 4: My Prediction and Trade Idea

Here’s where I put myself in your shoes: if I were trading Tesla, I’d be watching for a retest of the $170–$200 support zone as a potential buying opportunity, drawing from both the 2020 playbook and the current technical setup. Why? In 2020, Tesla found support at $23.37 after a 63.8% correction, which set the stage for a 613% rally to $166.71. Similarly, a 60% correction now would bring Tesla to the upper trendline of the Consolidation 2 triangle at $170–$200, a level that could act as a springboard for the next leg up. If Tesla holds this support, I expect a move back toward the $300–$339 range, where it faced resistance before the recent drop. A break above $339 could signal a continuation toward $488.54, retesting the recent high.

Profit Targets and Stop Loss

Entry: Consider buying around $170–$200 if the price retests this support and shows signs of reversal (e.g., a bullish candlestick pattern or increased volume).

Profit Target 1: $300 (a conservative target based on recent resistance).

Profit Target 2: $339 (a more aggressive target at the prior resistance zone).

Stop Loss: Place a stop below $160 to protect against a breakdown of the $170–$200 support zone. This gives the trade a risk-reward ratio of up to 13:1 for the first target.

Risks to Consider

If Tesla fails to hold the $170–$200 support, we could see a deeper correction toward $138–$150, and potentially even $64–$90, another historical support level. Additionally, keep an eye on broader market conditions, as Tesla is sensitive to macroeconomic factors like interest rates and consumer sentiment in the EV sector. While the 2020 setup and the triangle retest provide a historical and technical parallel, the current 55% drop suggests heightened volatility, so be prepared for potential whipsaws around these key levels.

Conclusion

Tesla’s recent 55% correction from $488.54 to $239.43 echoes the 63.8% pullback in 2020 after the breakout from "Consolidation 1." If the correction deepens to 60%, it would retest the upper trendline of the Consolidation 2 triangle at $170–$200, suggesting a potential opportunity for a high-probability trade with clear profit targets and a defined stop loss. This setup could mirror the 2020 recovery, where Tesla rallied 613% after finding support. What do you think of this setup? Let me know in the comments—I’d love to hear your thoughts!

S&P 500 Records Largest Weekly Decline Since 2020The S&P 500 Index has suffered its steepest two-day drop since the pandemic crash in March 2020. On April 4th, 2025, the benchmark index closed at 5,074.08, down 322.44 points (5.97%). This marks a loss of $5.4 trillion in market value across just two sessions.

The sell-off followed comments from Federal Reserve Chair Jerome Powell. He warned that President Donald Trump’s new tariffs could lead to persistently higher inflation. All 11 sectors in the S&P 500 closed in the red. Only 14 stocks remained positive as Nvidia and Apple fell more than 7%, while Tesla dropped 10%.

The Nasdaq 100 Index plunged 6.1%, confirming a bear market after losing over 20% from its February peak. The rapid decline mirrors the speed seen during the 2020 COVID crash and the 2000 dot-com bust.

President Trump announced sweeping tariffs on U.S. imports on Wednesday. These include a 10% general tariff and higher rates on dozens of countries. China responded by imposing a 34% levy on American goods. The tit-for-tat measures triggered fears of a full-scale global trade war.

Global markets reacted sharply. Investors pulled out of stocks and moved into safer assets like government bonds. The two-day loss of $5 trillion on the S&P 500 set a new record, surpassing the $3.3 trillion loss during March 2020.

Rick Meckler, of Cherry Lane Investments, said the escalation is now deeper than many investors expected. The initial belief that tariffs were a negotiation tactic has now given way to serious market concerns.

Technical Analysis: Price Approaching Key Support Zones. Will They Hold?

The S&P 500 has shown a bearish trend since early 2025. Several weekly candles have closed bearish, confirming a strong downtrend. Currently, the index is trading lower toward a key ascending trendline near $4,930.

The $4,930 support level may offer short-term support. A bounce from here could see a brief recovery. However, the sentiment remains bearish without strong economic data or policy changes.

Further Downside Risk If Support Fails

Another horizontal support sits at $4,780. If both support levels fail, the index may fall toward the $4,500 psychological zone. This level is crucial as it marks a long-term support and potential reversal point.

At present, bearish momentum dominates, with much strength coming from trade war fears. Unless data shifts investor sentiment, the downtrend may persist.

TESLA: Will Keep Growing! Here is Why:

Balance of buyers and sellers on the TESLA pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the buyers, therefore is it only natural that we go long on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

$TSLA $160-180? I think..."Technical bounce on NASDAQ:TSLA at 160-180? – Possible long???"

📉 Nasty drop on TSLA, broke below the $250 level.

🎯 Potential short setup now, with a target around $160-180.

That’s where I’ll start buying—if we get a daily or weekly reversal candle, with a stop just below support.

👉 Follow me for more updates on stocks and futures.

TSLA Weekly Chart Analysis-Bearish Scenario. NFATSLA Weekly Chart Analysis-Bearish Scenario. NFA

-Weekly structure making bearish rising wedge

-This week's candle closed below 200Days SMA and also EMA9/21 cross down on weekly.

-Price rejected from weekly resistance zone(Red iFVG-W rectangle)

- if market continues to drop next week I am expecting Sellside($138ish) as next target

nazis arent from south africawhat do u want me to say...

weekly chart here w/ weekly trendlines (aggressive & conservative- dashed)

earnings report on the 22nd line up at 200$ for Q1. awfully close at the 173/169 dollar too.

what does the FOMC have to say on the 9th???

i have an alert at 200, i'll buy @ 175$ (wait n see a week or two)

the Left losing their minds!!!!!!!