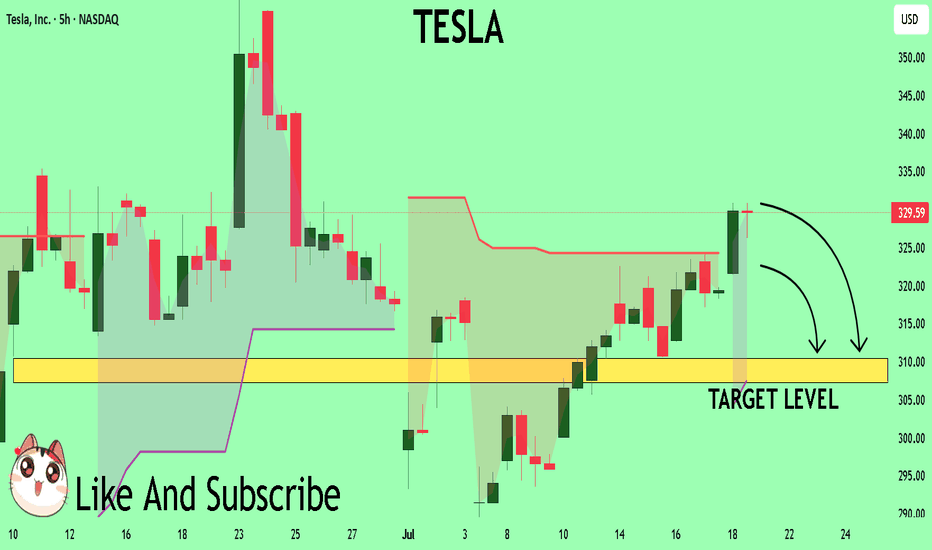

TESLA My Opinion! SELL!

My dear subscribers,

My technical analysis for TESLA is below:

The price is coiling around a solid key level -329.59

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 310.44

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

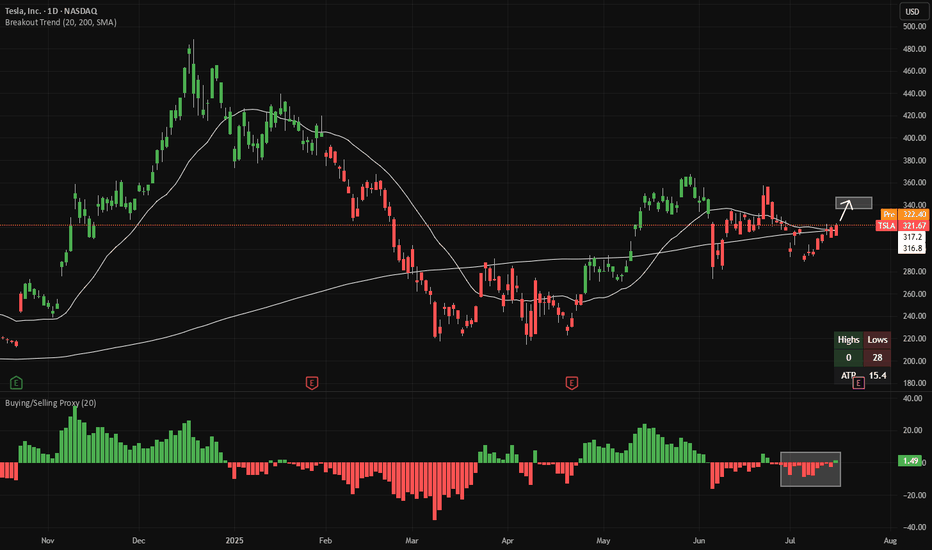

Tesla Motors (TSLA)

Long TSLA - buyers almost have controlThe buying/selling proxy (bottom panel) is showing signs of net-buying in TSLA. This makes 20-day highs (area indicated in the main chart) more likely to come next. That's around $349.

There is good risk/reward to buy TSLA here, with a stop-loss if the buying/selling proxy flips back to net-selling (red bars). If a 20-day high is made, the candles will change color from red to green.

Both indicators (Breakout Trend and Buying/Selling Proxy) are available for free on TradingView.

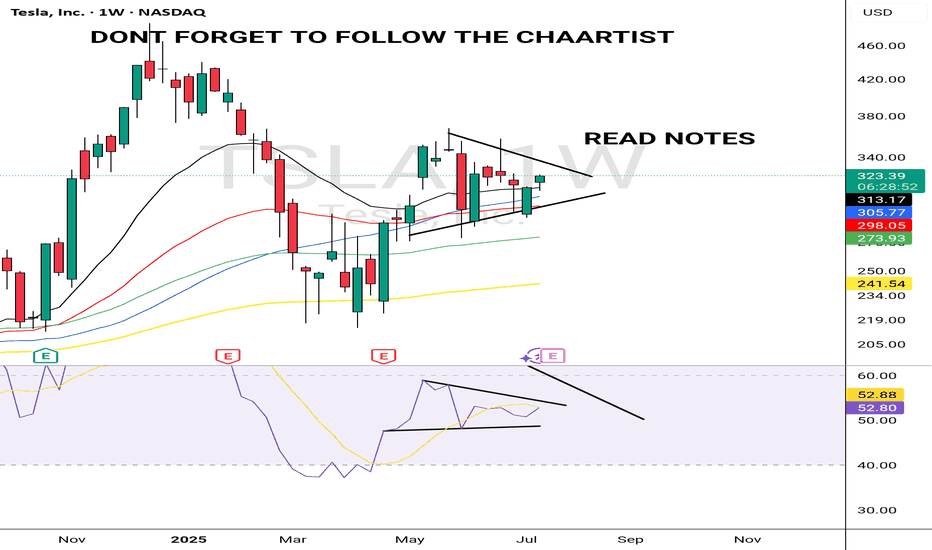

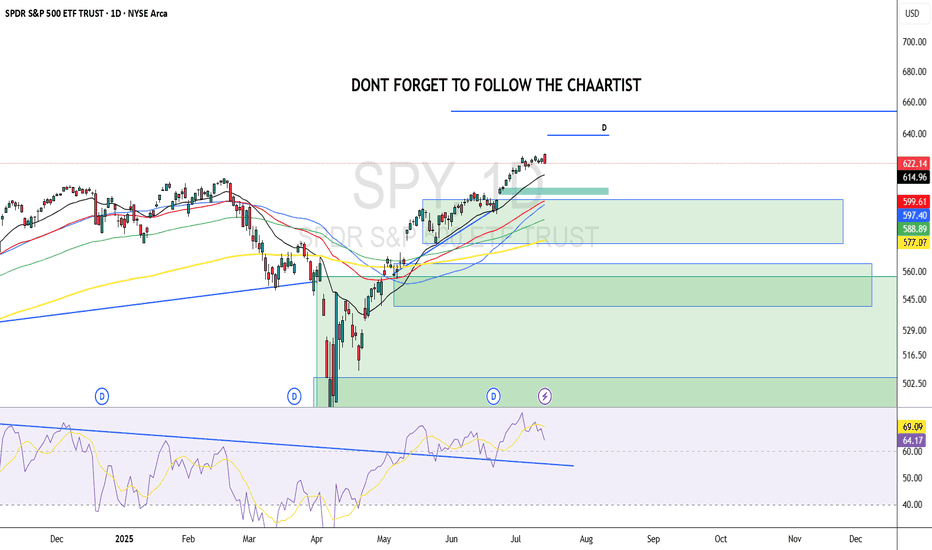

Is the BullRun over? I don't think so. $TSLAYesterday we saw a somewhat heavy fall in Indexes, and it probably scared alot of retail Bulls outs.

However, it seems we've fallen straight into potential medium term supports across multiple stocks in the markets.

I'm convinced we will get a good economic data print today.

This would open the door to new ATHs, again, in the Indexes.

For this to play out, the local bottoms established over night need to hold.

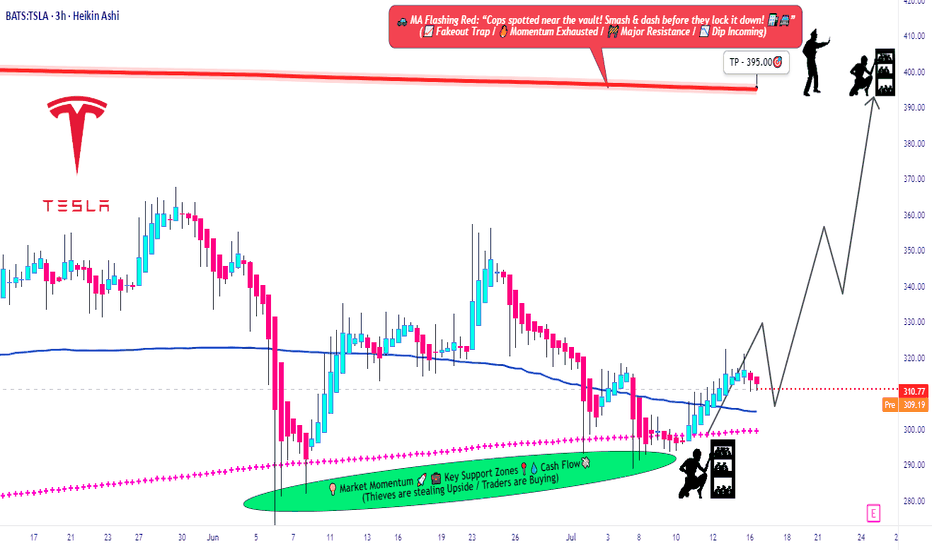

Tesla Bulls Assemble: It’s Time for a Clean Robbery🚨🔥TESLA STOCK ROBBERY BLUEPRINT: Thief Trading Heist Plan v2.0🔥🚨

(Swing & Day Traders, Scalpers — Welcome to the Ultimate Market Raid)

🌍 Greetings, Money Makers & Market Bandits!

Hola! Ola! Bonjour! Hallo! Marhaba! Salute from the global Thief Squad! 💰💸🕶️

Today, we’re unleashing a bold market raid on NASDAQ:TSLA (Tesla Inc.), using our signature Thief Trading Strategy™ — a fusion of technical precision, smart risk, and fundamental power. This is not your average trade idea — this is a robbery plan, tailor-made for those ready to outsmart the market with elite tactics.

🎯 The Mission: Steal the Bullish Breakout Before the Bears Wake Up!

Market Status:

Tesla is showing early signs of bullish strength — short-term consolidation with a potential breakout toward the upper red zone. However, that red zone is where the “Police” (resistance + short sellers) wait to ambush — so we enter with strategy, not emotion.

🟢 Entry Zone – "Vault is Open, Thieves Assemble!"

We’re looking for a long entry anywhere inside the most recent pullback zones (use 15m / 30m candles). Place layered buy-limit orders like a DCA thief stacking charges, targeting the swing low or support wick.

🔑 Pro Tip: Be patient. Let the pullback bless your orders. We rob smarter, not harder.

🛑 Stop Loss – "Escape Route Planned"

Stop Loss = Placed under swing low (3H TF). Current suggested SL: $280.00 (adjust for risk profile).

💬 Thief Note: Your SL depends on position size, number of entries, and account leverage. Never risk your life savings on one job. 😉

🎯 Target Zone – "The Big Loot"

Main Target 🎯: $395.00

Optional Exit: Trail your SL and escape early with bags full of gains. Exit before the trap if heat rises. 🔥

👀 Scalpers – "Fast Hands Get First Cash"

Stick to the long side only. Shorting this train is standing in front of a robbery truck. Use trailing SLs and grab those quick gains.

If you're a small account thief — no worries — ride with the swing crew. We share the loot.

📊 Why the Heist Now?

TSLA's move is supported by:

🔍 Fundamental strength & positive sentiment

🌐 Macro tailwinds & sector rotation favoring EV/Tech

🧠 Intermarket & index alignment

📰 Bullish outlook from recent positioning and COT data

🧨 Consolidation base forming an explosive setup

⚠️ Caution Tape – News Alert Zone

🚨Stay Clear of Major News Releases!

Avoid opening fresh entries during high-impact news. Use trailing SLs to protect your gains. Market heat can go nuclear — be alert, not emotional.

💖 Support the Heist – Smash That BOOST Button!

If you love this Thief Strategy, hit the BOOST 💥

Help us reach more robbers, dreamers, and money makers across TradingView. Let’s build the biggest, smartest, most strategic trading crew ever.

📌 Disclaimer (We're Thieves, Not Financial Advisors)

This is not financial advice — it’s a strategic idea shared for educational purposes. Adjust based on your own risk profile. Never enter a robbery without a plan. 🧠💼

🔥 Stay locked in. Another market heist blueprint is coming soon.

Until then — keep your charts clean, your entries smart, and your exits legendary.

💸Rob the Market — The Thief Way™

🐱👤🎯📈🚀

Tesla -> The all time high breakout!🚗Tesla ( NASDAQ:TSLA ) prepares a major breakout:

🔎Analysis summary:

Not long ago Tesla perfectly retested the major support trendline of the ascending triangle pattern. So far we witnessed a nice rejection of about +50%, following the overall uptrend. There is actually a quite high chance that Tesla will eventually create a new all time high breakout.

📝Levels to watch:

$400

🙏🏻#LONGTERMVISION

Philip - Swing Trader

Nvidia (NVDA) 2025+ Catalysts & Risks: Analyst Views🚀 Nvidia (NVDA) 2025+ Catalysts & Risks: Analyst Views

🔑 Key Catalysts Driving Nvidia’s Stock Growth (2025+)

1. 🏆 AI Chip Dominance

Nvidia maintains >90% market share in data-center AI chips (Blackwell, Hopper, Rubin). Its CUDA ecosystem and relentless innovation keep it as the “default” supplier for advanced AI, giving NVDA massive pricing power.

2. 🏗️ Surging Data Center Demand

Cloud and enterprise AI spending remains white-hot. Tech giants (Meta, Microsoft, Amazon, Google) are collectively pouring $300B+ into 2025 AI CapEx. Data center revenues are at all-time highs; analysts expect this uptrend to extend through 2026 as “AI infrastructure arms race” persists.

3. 🌐 Mainstream AI Adoption

AI is now integrated in nearly every industry—healthcare, finance, logistics, manufacturing, retail. As companies embed AI at scale, NVDA’s hardware/software sales rise, with “AI everywhere” tailwinds supporting 15–25% annual growth.

4. 🤝 Strategic Partnerships

Big wins: Deals with Snowflake, ServiceNow, and massive sovereign/international AI collaborations (e.g., $B+ Saudi Arabia/“Humain” order for Blackwell superchips; UAE, India, and Southeast Asia ramping up AI infrastructure using Nvidia).

5. 🚗 Automotive/Autonomous Vehicles

NVDA’s automotive AI segment is now its fastest-growing “new” business line, powering next-gen vehicles (Jaguar Land Rover, Mercedes, BYD, NIO, Lucid) and expected to surpass $1B+ annual run rate by late 2025.

6. 🧑💻 Expanding Software Ecosystem

Nvidia’s “full stack” software (CUDA, AI Enterprise, DGX Cloud) is now a sticky, recurring-revenue engine. Over 4M devs are building on Nvidia’s AI SDKs. Enterprise AI subscriptions add high-margin growth on top of hardware.

7. 🌎 Omniverse & Digital Twins

Industrial metaverse and simulation/digital twin momentum is building (major partnerships with Ansys, Siemens, SAP, Schneider Electric). Omniverse becoming the industry standard for 3D AI/simulation, unlocking new GPU/software demand.

8. 🛠️ Relentless Innovation

Blackwell Ultra GPUs debuting in late 2025, “Rubin” architecture in 2026. Fast-paced, aggressive product roadmap sustains Nvidia’s tech lead and triggers constant upgrade cycles for data centers and cloud providers.

9. 📦 Full-Stack Platform Expansion

Grace CPUs, BlueField DPUs, and Spectrum-X networking mean Nvidia is now a “one-stop shop” for AI infrastructure—capturing more value per system and displacing legacy CPU/network vendors.

10. 🌏 Global AI Infrastructure Buildout

Recent US export rule rollbacks are a huge tailwind, opening up new high-volume markets (Middle East, India, LatAm). Nvidia remains the “go-to” AI chip supplier for sovereign and enterprise supercomputers outside the US, supporting continued global growth.

________________________________________

📈 Latest Analyst Recommendations (July 2025)

•Street Consensus: Overwhelmingly bullish—~85% of analysts rate NVDA as “Buy/Overweight” (rest “Hold”), with target prices often in the $140–$165 range (post-split, as applicable).

•Target Price Range: Median 12-month PT: $150–$160 (representing ~20% upside from July 2025 levels).

•Key Bullish Arguments: Unmatched AI chip lead, accelerating enterprise AI adoption, deep software moat, and a robust international/sovereign AI order pipeline.

•Cautious/Bearish Notes: Valuation premium (45–50x P/E), high expectations priced in, geopolitical and supply chain risks.

________________________________________

⚠️ Key Negative Drivers & Risks

1. 🇨🇳 US–China Tech War / Chip Export Restrictions

• US restrictions: While the Biden administration eased some export bans in May 2025 (allowing more AI chip exports to Gulf/Asia partners), China remains subject to severe curbs on advanced NVDA AI chips.

• Workarounds: Nvidia is selling modified “China-compliant” chips (H20, L20, A800/H800), but at lower margins and lower performance.

• Risk: If US tightens controls again (post-election), China sales could fall further. Chinese firms (Huawei, SMIC, Biren) are also racing to build their own AI chips—posing long-term competitive risk.

2. 🏛️ Political/Regulatory Risk

• Election year: A US policy shift (e.g., harder tech stance after Nov 2025 election) could re-restrict exports, limit new markets, or disrupt supply chains (especially TSMC foundry reliance).

3. 🏷️ Valuation Risk

• NVDA trades at a substantial premium to tech/semiconductor peers (45–50x fwd earnings). Any AI “spending pause” or earnings miss could trigger sharp volatility.

4. 🏭 Supply Chain & Capacity Constraints

• As AI chip demand soars, there’s ongoing risk of supply/delivery bottlenecks (memory, HBM, advanced packaging), which could cap near-term revenue upside.

5. 🏁 Competitive Threats

• AMD, Intel, and custom in-house AI chips (by Google, Amazon, Microsoft, Tesla, etc.) are scaling up fast. Loss of a hyperscaler account or a successful open-source software alternative (vs CUDA) could erode Nvidia’s dominance.

6. 💵 Customer Concentration

• A small handful of cloud giants account for >35% of revenue. Delays or pullbacks in their AI spending would materially impact results.

________________________________________

📝 Summary Outlook (July 2025):

Nvidia’s AI chip monopoly, software moat, and global AI arms race create a powerful multi-year growth setup, but the stock’s high valuation and US-China chip tension are real risks. Analyst consensus remains strongly positive, with most seeing more upside as data-center and enterprise AI demand persists—but with increased focus on geopolitical headlines and potential supply chain hiccups.

________________________________________

TESLA My Opinion! SELL!

My dear friends,

Please, find my technical outlook for TESLA below:

The price is coiling around a solid key level - 313.47

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 303.67

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

TESLA: Bearish Forecast & Bearish Scenario

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to sell TESLA.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Ethereum’s Next Fair Value Gap is $3.8K — And the Road to $26K 🚀 Ethereum’s Next Fair Value Gap is $3.8K — And the Road to $26K Remains On Track

Ethereum ( CRYPTOCAP:ETH ) just reclaimed key structure — and despite a temporary pullback, all signals remain aligned for a parabolic breakout toward $26,000 this cycle.

Here’s why the next Fair Value Gap (FVG) sits near $3.8K, and why the Schiff Pitchfork structure still implies Ethereum is coiling for exponential upside in the coming months.

🔹 The $3.8K FVG: ETH’s Next Magnet

Looking at the daily chart:

The $3.8K zone is a clear untapped FVG (Fair Value Gap) from late 2021, created by a sharp breakdown candle that never got properly filled.

ETH is currently consolidating just below the $3.1K resistance band, and once that breaks, liquidity will naturally gravitate toward the next inefficiency — at $3,800–3,900.

This gap aligns with a previous supply zone and intersects with the upper resistance trendline from late 2021, creating a powerful magnet for price once momentum returns.

🔹 All-Time Schiff Pitchfork Still Intact

The Schiff Pitchfork structure drawn from Ethereum’s 2018 low through its COVID crash low and 2021 all-time high paints a highly disciplined range:

ETH is respecting the midline of the lower channel and recently bounced off the support of the median zone, with price now grinding higher within the ascending structure.

The upper band of the pitchfork intersects with price in late 2025 near the $26,000–28,000 zone, forming a natural cycle top target.

Historically, Ethereum has respected this long-term structure remarkably well — and this current move is no different.

🔹 Moving Averages & Bullish Market Structure

ETH recently flashed a Golden Cross — the 50-day SMA crossing above the 200-day SMA — which historically front-runs explosive upside in post-halving years.

All major SMAs (20/50/100/200) are now curling upward, creating a supportive launchpad.

Price is breaking out of the consolidation wedge that defined Q2 2025 — and has room to run toward $3.8K before meeting major overhead resistance.

🔹 Post-Halving Explosiveness

Let’s not forget: we’re in a post-halving year — and ETH has a consistent pattern of multiplying 5x–10x in the 9–12 months following Bitcoin halving events:

In 2017 (after 2016 halving): ETH went from ~$8 to $1,400 — nearly 175x.

In 2021 (after 2020 halving): ETH went from ~$120 to $4,800 — roughly 40x.

A move from the current ~$3K level to $26,000 is just an 8.5x — well within historical precedent.

🔹 Macro Tailwinds: ETH ETFs & Institutional Flows

BlackRock, Fidelity, and other asset managers are positioning Ethereum ETFs for approval, which would unlock billions in institutional inflows.

A staking ETF would dramatically compress supply — Ethereum already has over 27% of its supply locked — amplifying upside through supply-demand squeeze.

Meanwhile, stablecoin settlement volume is growing faster than Visa — all powered by Ethereum infrastructure.

🔹 Timing the Move: August to December Explosion?

The verticals on your chart highlight key windows:

A breakout window between early August and mid-September coincides with both macro liquidity injections and historical altseason patterns.

If ETH hits $3.8K by August, the runway to $8K–$14K opens by October, with $26K still well within reach by December 2025, in line with your pitchfork’s top boundary.

🟣 Summary: Ethereum’s Next Stop Is $3.8K — Then Moon

✅ Untapped FVG magnet at $3.8K

✅ Schiff Pitchfork upper boundary intersects near $26K

✅ Post-halving year + Golden Cross = Explosive setup

✅ ETH ETF narrative just beginning

✅ Structural breakout from consolidation wedge

Ethereum is no longer just the base layer of DeFi — it’s becoming the base layer of global financial infrastructure. And price hasn’t yet priced that in.

"If the internet had a price, it would be Ethereum."

Don’t fade this breakout. We’re still early.

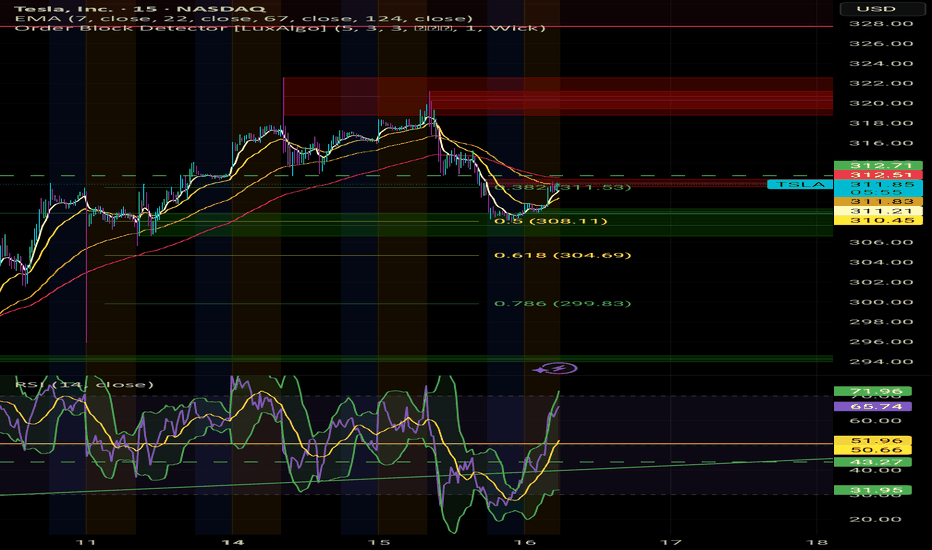

TSLA Short Setup – Fading the July 7 Gap FillTSLA Short Setup – Fading the July 7 Gap Fill 📉

This short idea on TSLA builds off a key gap fill from Monday, July 7 , combined with a strong local volume profile and risk-reward alignment on the 15-minute chart.

Entry: $312.76

Stop Loss: $314.81 (above gap resistance and local high)

Target: $299.89 (gap base and volume shelf)

RR: ~6.3R

Why I'm shorting here:

TSLA has just filled the July 7 gap , which often acts as a technical resistance zone on retest.

Price stalled right as it completed the fill — with visible hesitation and selling pressure stepping in.

VRVP shows low liquidity above, suggesting diminished reward for upside continuation.

Below, there's a clean volume shelf around $294–$300 that could attract price if weakness confirms.

Trade Logic:

This is a classic fade-the-gap-fill setup, targeting the lower edge of the volume cluster for a potential bounce or reversal zone.

As always: size accordingly, stick to the stop, and don’t chase if the entry’s already gone.

Thoughts? Anyone else watching this gap level?

Tesla (TSLA) Market UpdateTesla NASDAQ:TSLA shares dropped nearly 7% after Elon Musk dismissed analyst Dan Ives' suggestion to scale back his political activities. Musk also proposed a new pay package, raising concerns among investors about potential distractions from Tesla’s core business.

📊 Upcoming Catalyst:

Tesla is set to report its Q2 earnings on July 23, with investors eagerly awaiting updates on the company’s financial performance and the newly launched robo-taxi service in Austin, Texas.

⚠️ Sentiment:

Recent bearish headlines include:

Concerns over potential Robotaxi issues

The ongoing Trump/Elon Musk political drama

📈 Trading Opportunity (Long Setup):

Despite the negative sentiment, this dip could offer a solid long entry opportunity:

Entry Zone: $275–$270

Take Profit Targets:

TP1: $315

TP2: $335

Stop Loss: Close below $265

Long TESLATrading Fam,

Today my indicator has signaled a BUY on $TSLA. The technicals align. M pattern looks to have completed at strong support (RED TL) and is bouncing upwards inside of a solid liquidity block. Buyers are stepping in. I'm in at $315 and will shoot for $430 (probably taking some profit along the way). My SL is currently $241 but will trail as we enter profit.

Best,

Stew

TESLA (TSLA) ARE WE HEADING TO 336? Morning Folks

It appears we are trying to break the highs of 304 and if we are successful a nice range up to 327-336 makes sense. However be careful if sink back down under 289 which then can see levels of 259 getting hit.

What are your thoughts on Tesla? Put in the comments section below

Kris Mindbloome Exchange

Trade Smarter Live Better

Why Ethereum’s Will 10×🚀 Ethereum’s Next 10×: Why bank-grade adoption + the stable-coin avalanche make a moonshot look conservative

Big banks are building on-chain right now. JPMorgan & Bank of America began 2025 pilots for dollar-backed tokens that settle on Ethereum, while Societe Generale just unveiled its USD CoinVertible stable-coin on main-net.

Stable-coins already move more money than Visa + Mastercard combined. $27.6 trillion flowed through stable-coins in 2024—most of it routed over Ethereum block-space.

Ethereum clears four-fifths of that stable-coin volume. More than 80 % of all stable-coin transactions occur on ETH or its L2s, locking in network effects that rivals can’t match.

ETF wall-of-money is already hitting the gate. 2025 Ethereum ETFs posted a record $743 million month of inflows—the strongest vote of institutional confidence to date.

ETH supply keeps shrinking while demand spikes. Post-Merge burn has removed roughly 332 k ETH, flipping issuance negative; base-line inflation is now < –1.3 %/yr.

30 million ETH is locked in staking, slicing liquid float by 25 %. The yield engine tightens supply just as banks and ETFs need inventory.

Real-world assets are going token-native. Tokenized bond issuance jumped 260 % in 2024 to €3 billion, and virtually every pilot settles on ERC-standards.

Layer-2 roll-ups slashed average gas fees to <$4. Cheaper block-space makes day-to-day payments viable, driving still more stable-coin throughput (and fee burn).

User base is exploding toward mass scale. Active ETH wallets hit 127 million—up 22 % YoY—showing that retail, devs, and institutions are onboarding together.

Energy-efficient PoS removes the last ESG roadblock. With > 99 % less energy use than PoW chains, Ethereum checks the sustainability box that banks and asset managers need for wide-open deployment.

Bottom line: when TradFi giants plug directly into Ethereum rails and stable-coins dwarf legacy payment rails, every transfer torches a little more supply. Add the ETF flywheel and a vanishing float, and a 10× move shifts from “moon-boy” to math.

OTHER EXAMPLES

TSLA

www.tradingview.com

Total 2

www.tradingview.com

MartyBoots here—trading for 17 years, and I would like to hear YOUR take!

👉 Can Ethereum really 10× from here? Drop your best argument below, hit the 👍 if you learned something, and smash that Follow to stay in the loop on every crypto deep-dive I post.

Important Volatility Period: Around August 21

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(TSLA 1D chart)

The medium-term trend is maintaining an uptrend.

However, if the price falls below the M-Signal indicator on the 1M chart and maintains, there is a possibility of a downtrend, so caution is required.

The support zone is

1st: 222.15-235.59

2nd: 172.16

Around the 1st and 2nd above.

The 268.07-311.48 zone is an important support and resistance zone.

If the price is maintained above this zone, there is a high possibility that a full-scale upward trend will continue.

However, since a resistance zone is formed in the 347.21-382.40 zone, we need to look at how this zone is broken upward.

-

When it falls to the 172.16-234.59 zone, we need to find a time to buy.

If not, we need to buy when it shows support in the 268.07-311.48 zone.

It would be better to buy at a lower price, but since the investment period will inevitably be longer, I think it is better to buy when an upward trend is detected.

-

The important volatility period is around August 21st, but before that, we need to check the movement around July 25th.

If it falls below 268.07 after August 21st, it could lead to further decline.

If it rises above 311.48 and maintains the price during the movement around July 25th, it could lead to further increase and it seems likely to create a trend after the volatility period around August 21st.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

$TSLA: Battleground stock. There’re better way to make money. In this bull market where almost all the stocks are working, NASDAQ:TSLA seems to be still in the penalty box. When NASDAQ:NVDA , NASDAQ:MSFT are at ATH and most of the Mag7 are near to the ATH. NASDAQ:TSLA is still 33% below its ATH of 484 $. And the price action is not particularly bullish. This week NASDAQ:AVGO crossed NASDAQ:TSLA with a larger Market Cap cos. May be NASDAQ:AVGO should replace NASDAQ:TSLA in MAG7. A food for thought.

With such poor price action and the price stuck within the 0.618 and 0.382 Fib retracement levels the stock has not looked bullish recently. IN this recent market reversal all the speculative sectors like Quantum, Space stocks and Drone stocks are working, NASDAQ:TSLA is still searching for direction. In my opinion NASDAQ:TSLA has a great future with a visionary leader, but it might end up being a good company but not a good stock. With controversy surrounding the leadership it has become a battle ground stock. There are many large cap liquid stocks where the positive momentum is working. Until the stock breaks out of this consolidating pattern it’s better to make money somewhere else.

Verdict: Stay on sidelines for NASDAQ:TSLA stock. Accumulate if you need to. Buy it above 400 $ once momentum is back.

Tesla on the Edge – Key Support or Deeper Drop?📉 Tesla on the Edge – Key Support or Deeper Drop? 🔥🔍

Tesla is in freefall, dropping nearly 9% today. The stock has plummeted from its highs near $500, now testing the critical $220-$200 support zone.

📊 Key Levels to Watch:

📌 Holding $220 could trigger a relief bounce towards $275+.

📌 A breakdown below $200 could open doors to $160-$180, or worse.

🔎 What’s Happening?

Tesla, along with X and SpaceX, is under intense scrutiny amid political pressure, regulatory battles, and even cyberattacks. This aligns with the broader market uncertainty, as Bitcoin struggles to reclaim $79,478.

👀 Elon Musk is in the spotlight, facing global resistance, from social media wars to business challenges. Could this spell opportunity or more downside for Tesla?

⚡️ Will TSLA rebound, or is it heading even lower? Let me know your thoughts below!

One Love,

The FXPROFESSOR 💙

#Tesla #TSLA #ElonMusk #StockMarket #Trading #TechStocks

Tesla (TSLA) Leads Declines in the Equity MarketTesla (TSLA) Leads Declines in the Equity Market

Yesterday, President Trump announced that letters had been sent to the United States’ trading partners regarding the imposition of new tariffs — for instance, a 25% tariff on goods from Japan and South Korea. This marks a return to “trade diplomacy” under the America First strategy. The tariffs are scheduled to take effect on 1 August, though the date remains subject to revision.

As we highlighted yesterday, bearish signals had begun to emerge in the US equity market. In response to the fresh wave of tariff-related headlines, the major indices moved lower. Leading the decline — and posting the worst performance among S&P 500 constituents — were shares of Tesla (TSLA). The sell-off followed news of a new initiative by Elon Musk, who now appears serious about launching a political “America Party” to challenge both the Republicans and Democrats.

Trump criticised his former ally’s move on his Truth Social platform, and investors are increasingly concerned about the potential impact on Tesla’s business. Tesla shares (TSLA) fell by more than 6.5% yesterday, accompanied by a broad bearish gap.

Technical Analysis of Tesla (TSLA) Stock Chart

On 2 July, our technical outlook for TSLA anticipated the formation of a broad contracting triangle in the near term. Yesterday’s price action appears to confirm this scenario:

→ The sharp move highlighted the lower boundary of the triangle (marked in red);

→ The $317 level — where the previously rising channel (marked in blue) was broken — acted as resistance.

It is worth noting that during yesterday’s session, TSLA did not fall further following the gap down. In other words, the bears were unable to extend the sell-off, suggesting that the stock may attempt a recovery towards the $317 level. This area could potentially act as a central axis within the developing triangle pattern.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.