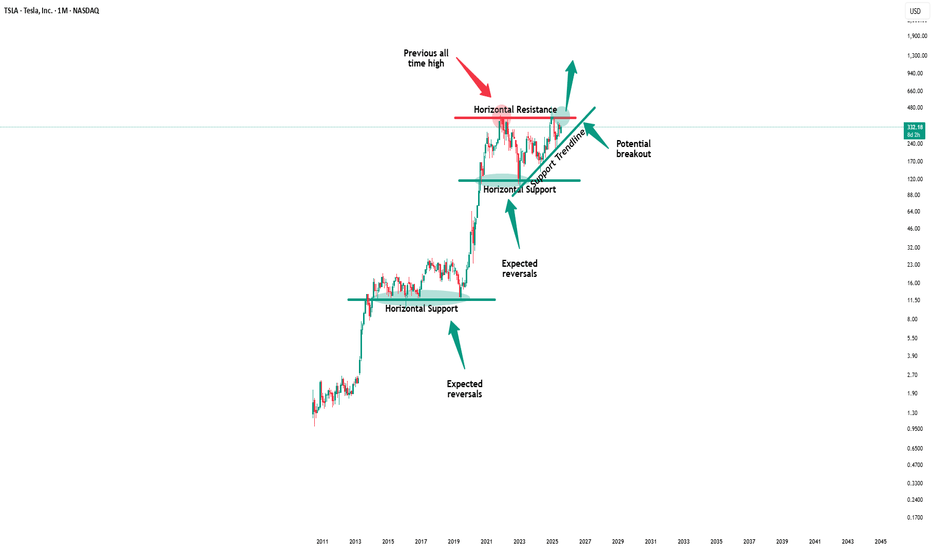

Tesla - The all time high breakout!🚗Tesla ( NASDAQ:TSLA ) will break out soon:

🔎Analysis summary:

For the past five years Tesla has overall been consolidating between support and resistance. But following the recent bullish break and retest, bulls are slowly taking over control. It is actually quite likely that Tesla will soon break above the previous all time highs.

📝Levels to watch:

$400

🙏🏻#LONGTERMVISION

SwingTraderPhil

Tslaanalysis

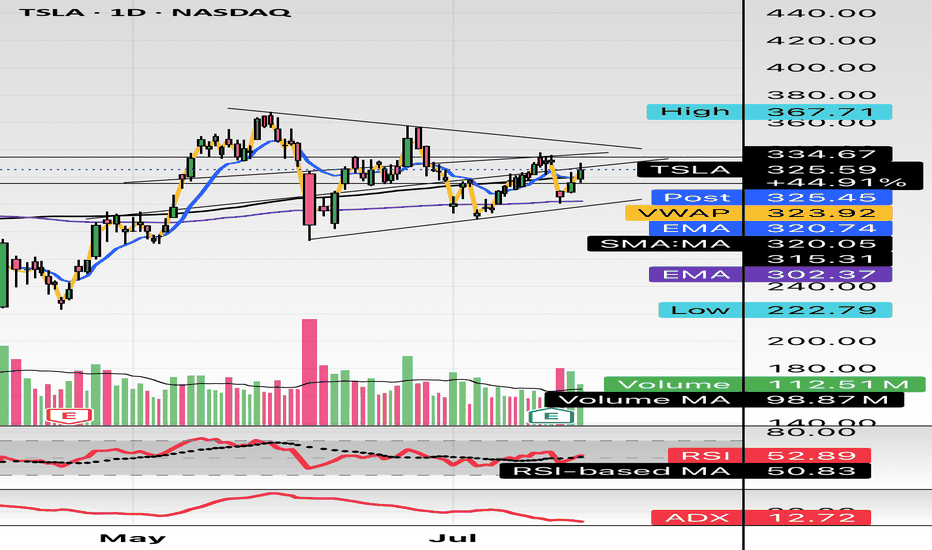

TESLA ANALYSIS CAN WE HIT 380? Evening everyone

Here is the analysis on Tesla currently:

Thesis For Bullish: If we break the highs of 336 then we can hit levels of 380 or higher

Thesis for Bearish: If we break the low at 298 then a drop down to 291 then 275 makes sense

Trade Smarter Live Better

Kris/Mindbloome Exchange

Tesla Builds Toward Fair Value GapFenzoFx—Tesla (#TSLA) bounced from the ascending trendline and closed yesterday's session at the volume point of interest, the $322.3 mark. This level is above the monthly VWAP, meaning bulls are gaining, and bears are losing money.

That said, we expect the uptick in momentum to resume, targeting $338.9, and if this level is breached, the stock will likely aim to fill the Fair Value Gap at $350.0.

SLA Moderate Bullish Setup – Weekly Play for 08/01 Expiry

## ⚡ TSLA Moderate Bullish Setup – Weekly Play for 08/01 Expiry

🎯 *"Volume confirms it. RSI supports it. Time to strike—or stand by."*

---

### 🔍 Market Intelligence Snapshot:

📊 **Consensus**: Moderately Bullish

📈 **Weekly RSI**: Rising

📉 **Daily RSI**: Still Neutral (momentum building)

📉 **VIX**: Low → Great environment for call buying

📦 **Volume**: Strong institutional activity across models

---

### ✅ Recommended Trade Setup:

**TSLA \$340 CALL (Exp: Aug 1)**

💰 *Entry*: \~\$0.88

📈 *Target*: \$1.38

🛑 *Stop*: \$0.35

📆 *DTE*: 3 Days

🎯 *Entry*: Market Open

⚖️ *Confidence*: 65%

---

### 🔧 Model Blended Strategy Notes:

* Meta & Anthropic: Suggest ATM/ITM (\$327.50–\$330) → safer, higher cost

* Google & xAI: Prefer \$340–\$342.50 for a better risk/reward

* DeepSeek: Targets \$320 but with heavier premium

🧠 *Takeaway*: \$340 offers a balanced shot — affordable, but still responsive to upside flow.

---

### ⚠️ Risk Notes:

* ⏳ Time Decay → Quick exits = better outcomes

* 📰 External news or earnings reactions = watch for sudden volatility

* 🎯 Position size = keep light due to only 3 DTE

---

### 📊 TRADE SNAPSHOT (JSON):

```json

{

"instrument": "TSLA",

"direction": "call",

"strike": 340.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 1.38,

"stop_loss": 0.35,

"size": 1,

"entry_price": 0.88,

"entry_timing": "open",

"signal_publish_time": "2025-07-29 10:16:14 UTC-04:00"

}

```

---

### 🧠 Quick Captions for Social:

* “TSLA bulls waking up? \$340C looks lit for the week 📈🔥”

* “Call volume surging. RSI rising. Low VIX. This \ NASDAQ:TSLA 340C might run 💥”

* “Risk-managed breakout shot — in and out fast 🎯”

$TSLA either one big flag or massive short setting upHello,

Just some browsing, NASDAQ:TSLA hasn’t had any major moves prior to early May - June IMO. This is on my watch for a short swing setup. This is bull flagging but I see a short here. I’m conflicted. I do see the higher low but we are in a pitchfork and this has been consolidating in this $290-$340 area for about a month and half. There’s also a lower high. Just posting for some free dialogue and open ideas. Talk to me. Let me know what you see and think. We aren’t too far from 200EMA and 200SMA. It’s just curling above the 50 as well. Maybe we consolidate for another week or two? A massive move is brewing here I think. I’m talking $100 in a week up or down soon.

WSL

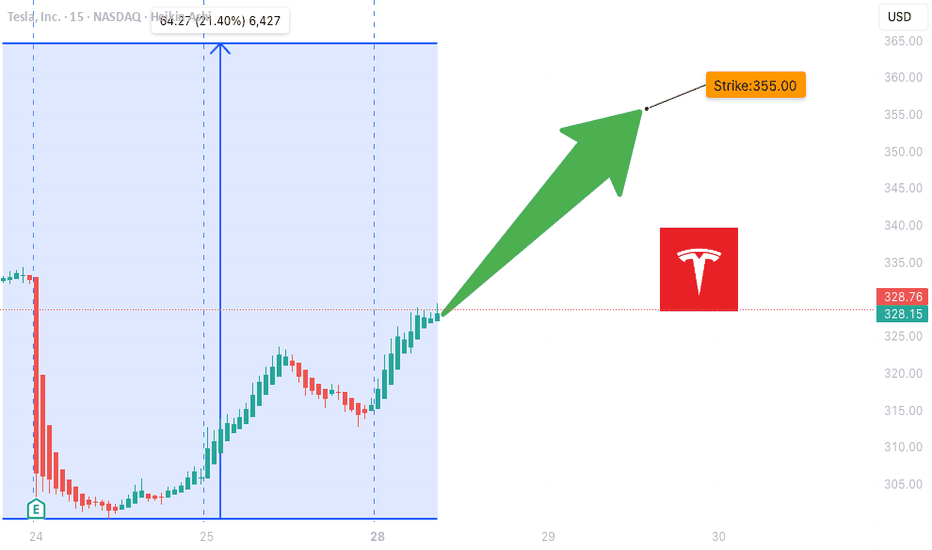

TSLA WEEKLY OPTIONS SETUP

### 🚗 TSLA WEEKLY OPTIONS SETUP (2025-07-28)

**Big Call Flow. Low VIX. Can Bulls Hold \$325?**

---

📊 **Momentum Overview:**

* **Daily RSI:** 48.2 🔻 → *Neutral-to-Weak*

* **Weekly RSI:** 57.1 🔻 → *Still bullish zone, but falling*

⚠️ **Interpretation:** Momentum is softening, trend in question.

📉 **Volume Context:**

* **Volume Ratio:** 1.3x ⬆️ (vs. last week)

* **Price Change:** -0.77% despite that volume

🔍 *Distribution Alert:* Institutions may be selling into strength.

📈 **Options Flow:**

* **Call/Put Ratio:** **1.70** = 🚨 *Bullish flow confirmed*

* **Volatility (VIX):** 15.16 🟢 Favorable for directional plays

✅ Strong setup for options traders riding short-term momentum

---

### 🧠 **Weekly Sentiment Scorecard:**

* ✅ **Bullish Signals (2):** Options Flow, Volatility

* ⚠️ **Neutral Signals (2):** Daily & Weekly RSI

* ❌ **Bearish Signal (1):** Volume pattern = distribution risk

**Overall Bias:** 🟢 *Moderate Bullish*

---

### 🔥 **TRADE SETUP IDEA:**

🎯 **Strategy:** Long Call Option

* 📌 **Instrument:** TSLA

* 💵 **Strike:** \$355C

* 📅 **Expiry:** Aug 1, 2025

* 💸 **Entry:** \~\$0.75

* 🎯 **Profit Target:** \$1.50

* 🛑 **Stop Loss:** \$0.45

* 🔒 **Key Support to Watch:** \$327.50 — lose that = exit fast

📈 **Confidence Level:** 65%

⚠️ **Gamma Risk:** High → trade small, manage tight.

---

### 📦 TRADE\_DETAILS (JSON Format for Algo/Backtest):

```json

{

"instrument": "TSLA",

"direction": "call",

"strike": 355.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 1.50,

"stop_loss": 0.45,

"size": 1,

"entry_price": 0.75,

"entry_timing": "open",

"signal_publish_time": "2025-08-01 09:30:00 UTC-04:00"

}

```

---

### 🧭 **Quick Notes for Traders:**

* ✅ Bulls have short-term edge — but **momentum is fading**

* ⚠️ If TSLA breaks below **\$325**, exit fast.

* 🔍 Watch for fakeouts: options flow is bullish, but volume says “not so fast.”

---

📊 TSLA \$355C → Risk \$0.75 to potentially double 📈

💬 Will this hold, or is it a bull trap before a dump? 👀

Comment below ⬇️ and follow for Monday updates!

---

**#TSLA #OptionsFlow #WeeklyTrade #TradingSetup #GammaRisk #AITrading #TeslaStock #UnusualOptionsActivity #SmartMoneyMoves**

Tesla in the waiting room as revenue slidesTesla is a global innovator that is changing the world. As a general rule, many investors have a saying: Never bet against Elon. They're not wrong. Elon delivers. But the short term is messy.

The stock is hovering around its 200-day moving average, a critical test. Break lower and we could see $290, maybe $260. That’s not panic, it's just price catching up to reality.

The auto business is deep in a downcycle. Q2 deliveries fell 14%, with revenue down 12%. Profits squeezed. Classic cyclical move. Nothing new here. But it’s weighing on momentum.

The upside isn’t about cars, it's autonomy, robotaxis, AI (Grok in cars). That’s where Tesla becomes a $2 trillion company. Musk knows it and is building for the future (100,000 GPU super cluster). He’s already shifting the story.

But that future is 6–12 months out, maybe longer.

In the meantime, we sit in the waiting room. Auto volumes need to stabilise. Robotaxi needs scale. Optimus requires proof and some definitive timeframes to get the market excited. That creates a 3–6 month narrative gap. Markets hate gaps.

Earnings last week were among the softest (though expected). EPS fell 23%. Free cash flow almost vanished. No real catalysts until next quarter. If the broader market sells off, which looks likely, Tesla takes more heat.

But let’s not lose the plot. Tesla is still Tesla. Long-term vision remains. Musk’s execution record is unmatched. Bet against him and you lose, eventually.

Short term, expect weakness. Patience required. If the stock breaks $315 with conviction, we’d expect further weakness before the real upside re-emerges.

Wait, watch, then pounce.

The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

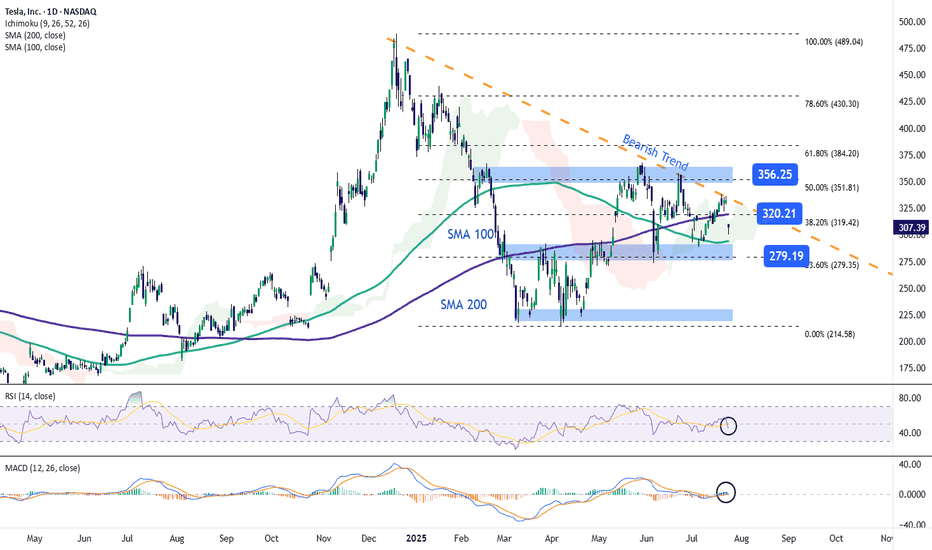

Tesla Stock Returns to the $300 ZoneShortly after reporting earnings, Tesla stock fell more than 9% in the final hours of trading. This new bearish move is mainly due to the company’s earnings per share (EPS) of $0.40, which missed expectations of $0.43, and revenue of $22.5 billion, below the projected $22.74 billion. These figures indicate that Tesla failed to meet market expectations, triggering a sustained downward trend in the stock. This move could extend further unless new catalysts emerge to restore investor confidence.

Downtrend Remains Intact

Recent price action has been clearly bearish and continues to reinforce a downtrend that began forming in late December. So far, there has been no significant bullish correction to challenge this structure, making the bearish pattern the dominant technical setup in the short term.

Technical Indicators

RSI: The indicator remains below the neutral 50 level, suggesting that selling momentum continues to build. If the downward path persists, bearish pressure may grow stronger in upcoming sessions.

MACD: The MACD histogram is currently hovering around the zero line, showing signs of technical indecision. However, if it crosses clearly below zero, it would confirm a more sustained bearish momentum.

Key Levels to Watch:

$356 – Major Resistance:

This level corresponds to the 50% Fibonacci retracement. A break above this zone could threaten the current downtrend.

$320 – Nearby Resistance:

Aligned with the 200-period simple moving average and the 38.2% Fibonacci level, a close above this point could reignite bullish sentiment and trigger a short-term upward move.

$280 – Key Support:

This is a critical support level, aligned with the 23.6% Fibonacci retracement. A breakdown here could extend the ongoing bearish trend.

Written by Julian Pineda, CFA – Market Analyst

Tesla Shares (TSLA) Drop Following Earnings ReportTesla Shares (TSLA) Drop Following Earnings Report

Yesterday, after the close of the main trading session on the stock market, Tesla released its quarterly earnings report. While both earnings per share (EPS) and gross profit slightly exceeded analysts’ expectations, the results reflected a negative trend driven by declining sales. This decline is being influenced by intensifying competition from Chinese EV manufacturers as well as Elon Musk’s political activity.

According to Elon Musk:

→ The company is facing “a few tough quarters” due to the withdrawal of electric vehicle incentives in the US;

→ The more affordable Tesla model (mass production expected in the second half of 2025) will resemble the Model Y;

→ By the end of next year, Tesla's financials should become "highly compelling".

Tesla’s share price (TSLA) fell by approximately 4.5% in after-hours trading, clearly reflecting the market’s reaction to the report. Today, the stock is likely to open around the $317 level, down from over $330 just the day before.

Technical Analysis of TSLA Stock Chart

In our analysis of TSLA charts dated 2 July and 8 July, we outlined a scenario in which the stock price could form a broad contracting triangle, with its axis around the $317 level.

The new candlesticks that have appeared on the chart since then have reinforced the relevance of this triangle, as the price rebounded from the lower boundary (as indicated by the arrow) and headed towards the upper boundary. However, yesterday’s earnings report disrupted this upward move.

Thus, while the broader stock market is trending higher (with the S&P 500 reaching a historic high yesterday), TSLA may remain "stuck" in a consolidation phase, fluctuating around the $317 level—at least until new fundamental drivers shift market sentiment.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

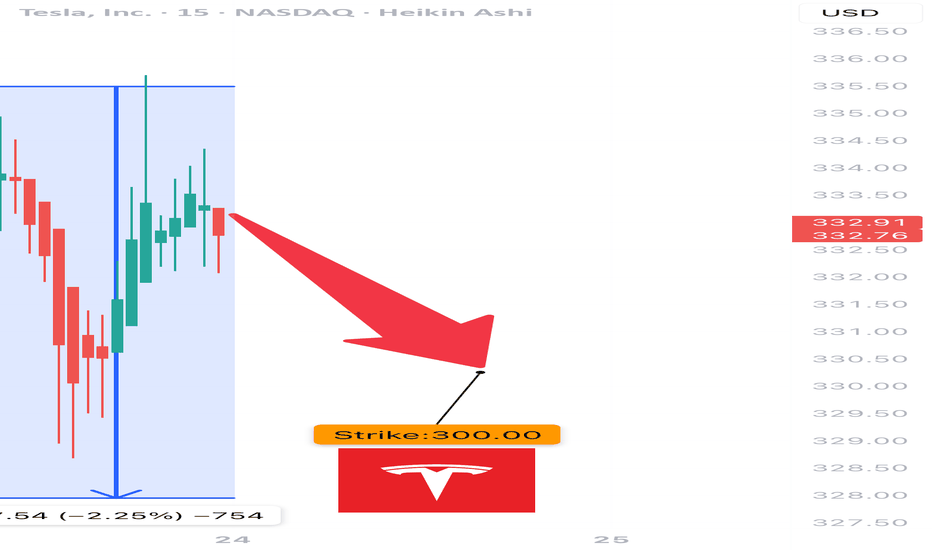

TSLA Earnings Play (Bearish Bias)

🚨 TSLA Earnings Play (Bearish Bias) 🚨

Earnings Date: July 23, 2025 (AMC)

🧠 Confidence: 75% Bearish | 🎯 Target Move: -10%

⸻

🔍 Key Takeaways:

• 📉 TTM Revenue Growth: -9.2% → EV demand weakness

• 🧾 Margins Under Pressure: Gross 17.7%, Operating 2.5%, Net 6.4%

• ❌ EPS Beat Rate: Only 25% in last 8 quarters

• 🐻 Options Flow: High put volume at $330 strike

• 🧊 Low Volume Drift: Trading above 20/50MA but losing steam

• 📉 Sector Macro: EV competition + cyclical headwinds

⸻

🧨 Earnings Trade Setup:

{

"instrument": "TSLA",

"direction": "put",

"strike": 300,

"expiry": "2025-07-25",

"entry_price": 2.02,

"confidence": 75,

"profit_target": 6.06,

"stop_loss": 1.01,

"entry_timing": "pre_earnings_close",

"expected_move": 7.1,

"iv_rank": 0.75

}

⸻

🛠️ Trade Details:

Parameter Value

🎯 Strike Price $300 PUT

💰 Premium Paid $2.02

📅 Expiry Date 2025-07-25

🛑 Stop Loss $1.01

🚀 Profit Target $6.06

📏 Size 1 Contract

⏱ Entry Timing Pre-Earnings

📊 IV Rank 75%

🕒 Signal Time 7/23 @ 14:14 EDT

⸻

📈 Strategy Notes:

• 🧯 IV Crush Risk: Exit within 2 hours post-earnings

• 🎲 Risk/Reward: 1:3 setup | Max Loss: $202 | Max Gain: $606+

• 🧭 Volume Weakness & put/call skew signal downside

• 🧩 Macro + Tech + Flow Alignment = Tactical bearish play

⸻

🧠 “Not all dips are worth buying — this might be one to short.”

📢 Drop your thoughts — would you take the trade or fade it?

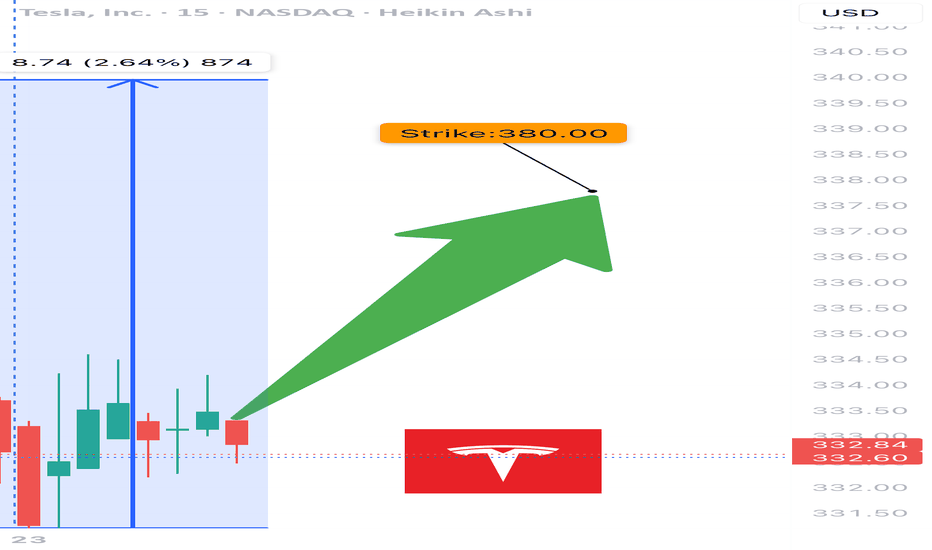

TSLA WEEKLY CALL SETUP — 07/23/2025

🚀 TSLA WEEKLY CALL SETUP — 07/23/2025

📈 AI Consensus Signals 🔥 Bullish Move Incoming

⸻

🔍 SENTIMENT SNAPSHOT

5 AI Models (Grok, Gemini, Claude, Meta, DeepSeek) =

✅ MODERATE BULLISH BIAS

➡️ Why?

• ✅ RSI Momentum (Daily + Weekly = UP)

• ✅ Bullish VIX sentiment

• ⚠️ Weak volume + neutral options flow

• 🧠 No model signals bearish direction

⸻

🎯 TRADE IDEA — CALL OPTION PLAY

{

"instrument": "TSLA",

"direction": "CALL",

"strike": 380,

"entry_price": 0.88,

"profit_target": 1.76,

"stop_loss": 0.44,

"expiry": "2025-07-25",

"confidence": 65%,

"entry_timing": "Open",

"size": 1 contract

}

⸻

📊 TRADE PLAN

🔹 🔸

🎯 Strike 380 CALL

💵 Entry Price 0.88

🎯 Target 1.76 (2× gain)

🛑 Stop Loss 0.44

📅 Expiry July 25, 2025

📈 Confidence 65%

⏰ Entry Market Open

⚠️ Risk High gamma / low time (2DTE)

⸻

📉 MODEL CONSENSUS

🧠 Grok – Bullish RSI, cautious due to volume

🧠 Gemini – Momentum confirmed, weekly strength

🧠 Claude – RSI + VIX = green light

🧠 Meta – 3 bullish signals, minor risk caution

🧠 DeepSeek – RSI + volatility favorable, careful on size

⸻

💬 Drop a 🟢 if you’re in

📈 Drop a ⚡ if you’re watching this flip

🚀 TSLA 380C looks primed if we break resistance near $376

#TSLA #OptionsTrading #CallOptions #WeeklySetup #AIPowered #MomentumTrade #TeslaTrade #GammaRisk #ZeroDTEReady

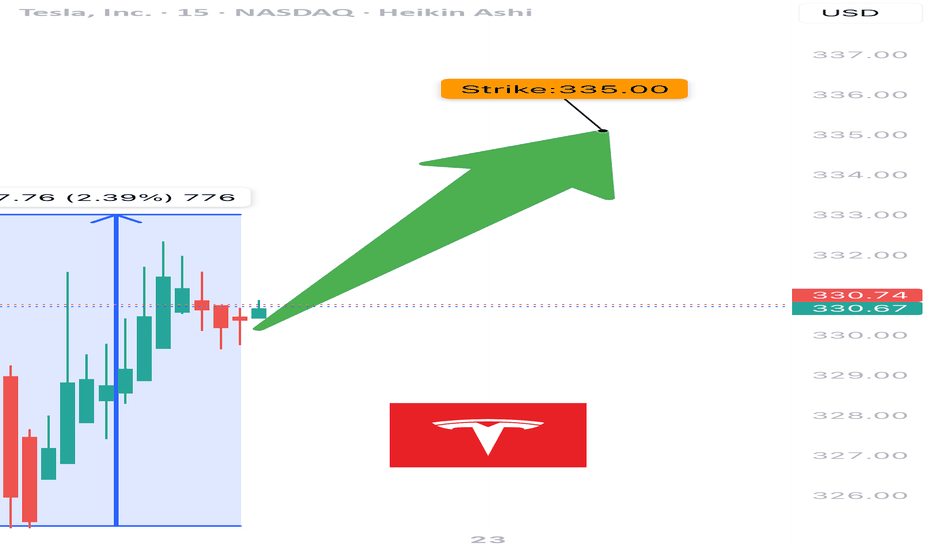

$TSLA Weekly Call Play – 07/22/25

🚀 NASDAQ:TSLA Weekly Call Play – 07/22/25

RSI Bullish 📈 | Options Flow Strong 🔁 | Volume Weak 💤 | 3DTE Tactical Entry

⸻

📊 Market Snapshot

• Price: ~$332–335 (spot near strike)

• Call/Put Ratio: 🔁 1.24 – Bullish Flow

• Daily RSI: ✅ 57.6 – Rising momentum

• Weekly RSI: ⚠️ 54.8 – Neutral / flattening

• Volume: ❌ Weak – Institutional absence

• Gamma Risk: ⚠️ Moderate (DTE = 3)

• VIX: ✅ Favorable

⸻

🧠 Trade Setup

{

"Instrument": "TSLA",

"Direction": "CALL",

"Strike": 335.00,

"Entry": 9.90,

"Profit Target": 15.00,

"Stop Loss": 6.00,

"Expiry": "2025-07-25",

"Confidence": 0.65,

"Size": 1,

"Entry Timing": "Open"

}

⸻

🔬 Sentiment Breakdown

Indicator Signal

📈 Daily RSI ✅ Bullish – confirms entry

📉 Weekly RSI ⚠️ Flat – no long-term edge

🔊 Volume ❌ Weak – no institutional bid

🔁 Options Flow ✅ Bullish (C/P = 1.24)

💨 VIX ✅ Favorable for upside trades

⏳ Gamma Decay ⚠️ High risk (3DTE)

⸻

📍 Chart Focus

• Support Zone: $328–$330

• Breakout Watch: $335+

• Target Zone: $340–$345

• ⚠️ Risk Watch: Volume divergence + gamma decay on low move

⸻

📢 Viral Caption / Hook (for TradingView, X, Discord):

“ NASDAQ:TSLA bulls flash 335C with confidence, but volume’s asleep. RSI’s in, gamma’s ticking. 3DTE lotto with caution tape.” 💥📉

💵 Entry: $9.90 | 🎯 Target: $15.00+ | 📉 Stop: $6.00 | ⚖️ Confidence: 65%

⸻

⚠️ Who This Trade Is For:

• 🔁 Options traders chasing short-term call flows

• 📈 Momentum scalpers riding RSI pop

• 🧠 Disciplined risk managers eyeing 3DTE setups

⸻

💬 Want a safer bull call spread (e.g., 330/340) or risk-defined iron fly for theta control?

Just ask — I’ll build and optimize it for you.

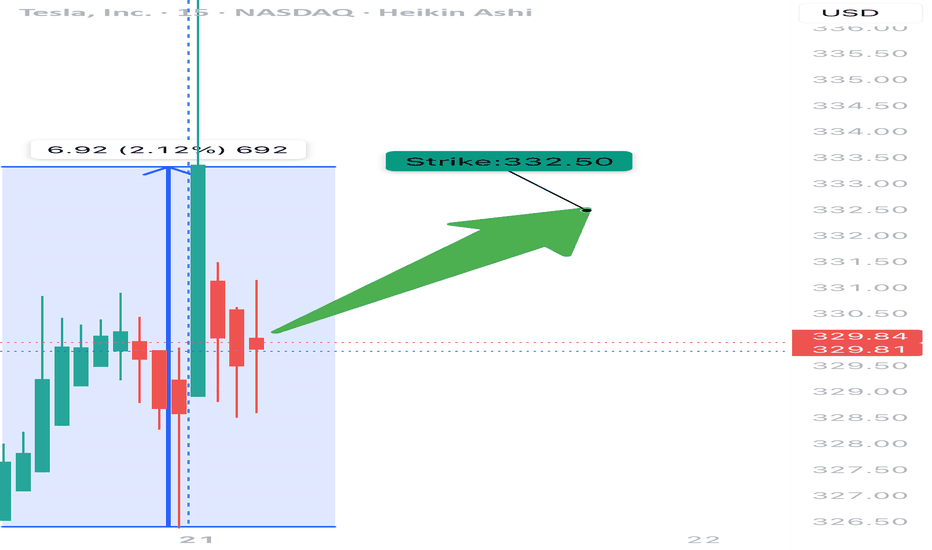

TSLA WEEKLY TRADE IDEA – JULY 21, 2025

🚀 TSLA WEEKLY TRADE IDEA – JULY 21, 2025 🚀

🔔 Bullish Play, But Handle With Caution 🔔

Models split, but momentum wins (for now)…

⸻

📈 Trade Setup

🟢 Call Option – Strike: $332.50

📆 Expiry: July 25, 2025 (Weekly)

💰 Entry: $11.05

🎯 Target: $22.11 (100% Gain)

🛑 Stop: $5.53 (50% Loss)

🕰️ Entry Time: Monday Open

📊 Confidence: 65% (Moderate)

⸻

🧠 Why This Trade?

✅ RSI trending bullish on both daily + weekly

⚠️ Weak volume & bearish options flow (C/P ratio > 1)

📉 Institutions may be hedging into earnings

🌪️ Earnings risk looms – volatility expected

📉 Some models say no trade – we say: controlled risk, tight leash

⸻

🧨 Strategy:

🔹 Single-leg naked call only

🔹 Avoid spreads due to IV & potential gap risk

🔹 Scale out if gain >30% early-week

🔹 CUT FAST if volume + price diverge

⸻

🔥 Quick Verdict:

Momentum > fear, but don’t ignore the smoke.

TSLA 332.5C — Risk 1 to Make 2+

Ready? Let’s ride the wave 📊⚡

#TSLA #OptionsTrading #CallOption #TradingSetup #WeeklyTrade #EarningsSeason #MomentumPlay #TradingViewIdeas #SwingTrade #SmartMoneyMoves

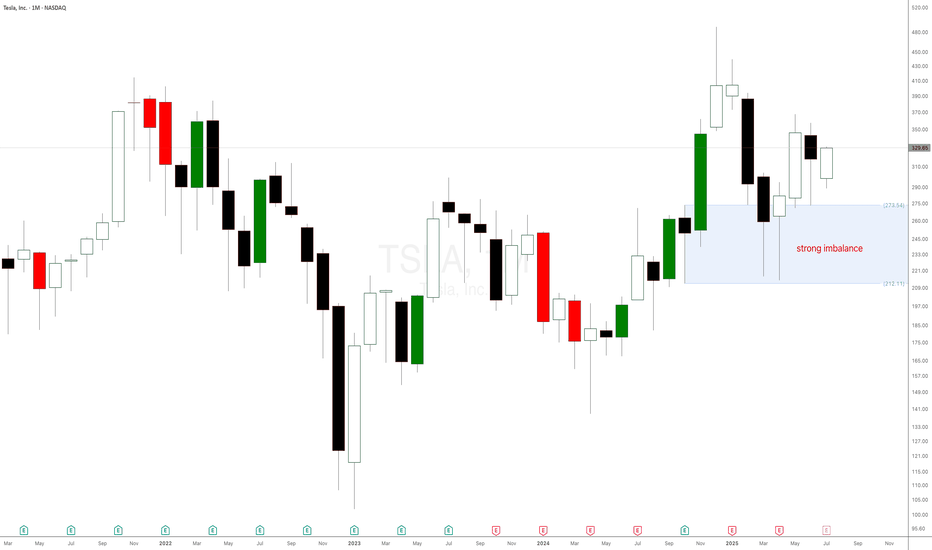

Don’t Listen to Elon Musk – Tesla Stock Chart Tells the REAL StoTesla Stock Set to Break Records: The Power of Monthly and Weekly Demand Imbalances at $273 and $298. Welcome back, traders! In today’s supply and demand breakdown, we’re diving deep into Tesla Inc. (NASDAQ: TSLA) — not from the noisy headlines or what Elon Musk just tweeted, but strictly from raw price action, demand imbalances, and the truth on the charts. Forget the fundamentals, forget the hype, because that’s already been priced in.

This is all about supply and demand, price action, and the power of patience.

The $273 Monthly Demand Imbalance: The Big Fish Made Their Move

A few weeks ago, Tesla stock pulled back to a significant monthly demand imbalance at $273. This level wasn’t just any zone—it was carved out by a strong impulsive move made of large-bodied bullish candlesticks, the kind that only institutions and whales create when they're loading up.

What happened next?

Boom. The market reacted exactly as expected, validating that monthly imbalance and setting the stage for higher prices. This is why we always trust the bigger timeframes—they hold the truth of what the smart money is doing.

The $273 Monthly Demand Imbalance: The Big Fish Made Their Move

A few weeks ago, Tesla stock pulled back to a significant monthly demand imbalance at $273. This level wasn’t just any zone—it was carved out by a strong impulsive move made of large-bodied bullish candlesticks, the kind that only institutions and whales create when they're loading up.

What happened next?

Boom. The market reacted exactly as expected, validating that monthly imbalance and setting the stage for higher prices. This is why we always trust the bigger timeframes—they hold the truth of what the smart money is doing.

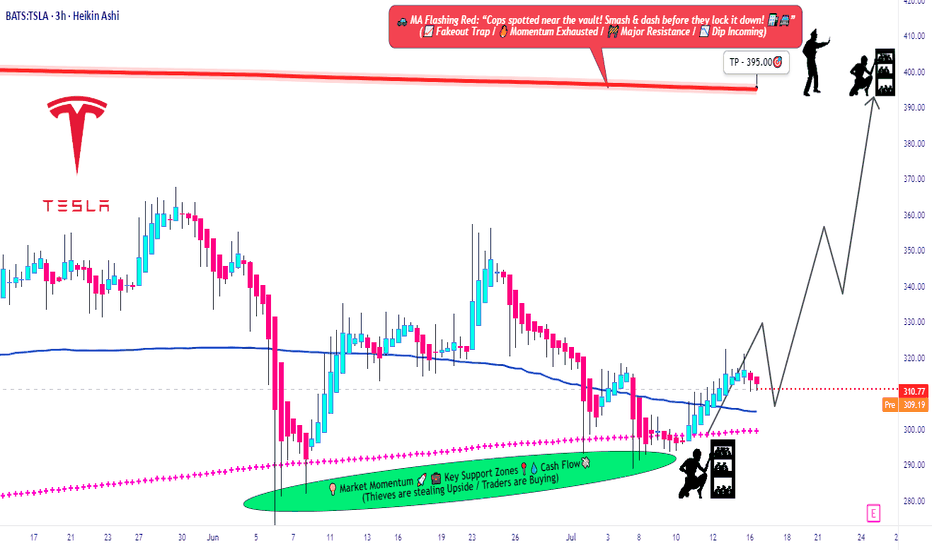

Tesla Bulls Assemble: It’s Time for a Clean Robbery🚨🔥TESLA STOCK ROBBERY BLUEPRINT: Thief Trading Heist Plan v2.0🔥🚨

(Swing & Day Traders, Scalpers — Welcome to the Ultimate Market Raid)

🌍 Greetings, Money Makers & Market Bandits!

Hola! Ola! Bonjour! Hallo! Marhaba! Salute from the global Thief Squad! 💰💸🕶️

Today, we’re unleashing a bold market raid on NASDAQ:TSLA (Tesla Inc.), using our signature Thief Trading Strategy™ — a fusion of technical precision, smart risk, and fundamental power. This is not your average trade idea — this is a robbery plan, tailor-made for those ready to outsmart the market with elite tactics.

🎯 The Mission: Steal the Bullish Breakout Before the Bears Wake Up!

Market Status:

Tesla is showing early signs of bullish strength — short-term consolidation with a potential breakout toward the upper red zone. However, that red zone is where the “Police” (resistance + short sellers) wait to ambush — so we enter with strategy, not emotion.

🟢 Entry Zone – "Vault is Open, Thieves Assemble!"

We’re looking for a long entry anywhere inside the most recent pullback zones (use 15m / 30m candles). Place layered buy-limit orders like a DCA thief stacking charges, targeting the swing low or support wick.

🔑 Pro Tip: Be patient. Let the pullback bless your orders. We rob smarter, not harder.

🛑 Stop Loss – "Escape Route Planned"

Stop Loss = Placed under swing low (3H TF). Current suggested SL: $280.00 (adjust for risk profile).

💬 Thief Note: Your SL depends on position size, number of entries, and account leverage. Never risk your life savings on one job. 😉

🎯 Target Zone – "The Big Loot"

Main Target 🎯: $395.00

Optional Exit: Trail your SL and escape early with bags full of gains. Exit before the trap if heat rises. 🔥

👀 Scalpers – "Fast Hands Get First Cash"

Stick to the long side only. Shorting this train is standing in front of a robbery truck. Use trailing SLs and grab those quick gains.

If you're a small account thief — no worries — ride with the swing crew. We share the loot.

📊 Why the Heist Now?

TSLA's move is supported by:

🔍 Fundamental strength & positive sentiment

🌐 Macro tailwinds & sector rotation favoring EV/Tech

🧠 Intermarket & index alignment

📰 Bullish outlook from recent positioning and COT data

🧨 Consolidation base forming an explosive setup

⚠️ Caution Tape – News Alert Zone

🚨Stay Clear of Major News Releases!

Avoid opening fresh entries during high-impact news. Use trailing SLs to protect your gains. Market heat can go nuclear — be alert, not emotional.

💖 Support the Heist – Smash That BOOST Button!

If you love this Thief Strategy, hit the BOOST 💥

Help us reach more robbers, dreamers, and money makers across TradingView. Let’s build the biggest, smartest, most strategic trading crew ever.

📌 Disclaimer (We're Thieves, Not Financial Advisors)

This is not financial advice — it’s a strategic idea shared for educational purposes. Adjust based on your own risk profile. Never enter a robbery without a plan. 🧠💼

🔥 Stay locked in. Another market heist blueprint is coming soon.

Until then — keep your charts clean, your entries smart, and your exits legendary.

💸Rob the Market — The Thief Way™

🐱👤🎯📈🚀

Tesla -> The all time high breakout!🚗Tesla ( NASDAQ:TSLA ) prepares a major breakout:

🔎Analysis summary:

Not long ago Tesla perfectly retested the major support trendline of the ascending triangle pattern. So far we witnessed a nice rejection of about +50%, following the overall uptrend. There is actually a quite high chance that Tesla will eventually create a new all time high breakout.

📝Levels to watch:

$400

🙏🏻#LONGTERMVISION

Philip - Swing Trader

Long TESLATrading Fam,

Today my indicator has signaled a BUY on $TSLA. The technicals align. M pattern looks to have completed at strong support (RED TL) and is bouncing upwards inside of a solid liquidity block. Buyers are stepping in. I'm in at $315 and will shoot for $430 (probably taking some profit along the way). My SL is currently $241 but will trail as we enter profit.

Best,

Stew

Tesla (TSLA) Leads Declines in the Equity MarketTesla (TSLA) Leads Declines in the Equity Market

Yesterday, President Trump announced that letters had been sent to the United States’ trading partners regarding the imposition of new tariffs — for instance, a 25% tariff on goods from Japan and South Korea. This marks a return to “trade diplomacy” under the America First strategy. The tariffs are scheduled to take effect on 1 August, though the date remains subject to revision.

As we highlighted yesterday, bearish signals had begun to emerge in the US equity market. In response to the fresh wave of tariff-related headlines, the major indices moved lower. Leading the decline — and posting the worst performance among S&P 500 constituents — were shares of Tesla (TSLA). The sell-off followed news of a new initiative by Elon Musk, who now appears serious about launching a political “America Party” to challenge both the Republicans and Democrats.

Trump criticised his former ally’s move on his Truth Social platform, and investors are increasingly concerned about the potential impact on Tesla’s business. Tesla shares (TSLA) fell by more than 6.5% yesterday, accompanied by a broad bearish gap.

Technical Analysis of Tesla (TSLA) Stock Chart

On 2 July, our technical outlook for TSLA anticipated the formation of a broad contracting triangle in the near term. Yesterday’s price action appears to confirm this scenario:

→ The sharp move highlighted the lower boundary of the triangle (marked in red);

→ The $317 level — where the previously rising channel (marked in blue) was broken — acted as resistance.

It is worth noting that during yesterday’s session, TSLA did not fall further following the gap down. In other words, the bears were unable to extend the sell-off, suggesting that the stock may attempt a recovery towards the $317 level. This area could potentially act as a central axis within the developing triangle pattern.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Tesla - This bullish break and retest!Tesla - NASDAQ:TSLA - confirmed the bullish reversal:

(click chart above to see the in depth analysis👆🏻)

Tesla recently created a very bullish break and retest. Therefore together with the monthly bullish price action, the recent rally was totally expected. But despite the short term volatility, Tesla remains bullish, is heading higher and will soon create new highs.

Levels to watch: $400

Keep your long term vision!

Philip (BasicTrading)

Tesla Bullish Breakout Setup: Entry at $295.54 Targeting $488.87Entry Point (Buy Zone): Around $295.54

Stop Loss: Between $272.94 – $295.54 (lower purple support zone)

Target (TP): $488.87

Current Price: $315.33 (as of the latest candle)

📈 Strategy Summary:

Setup Type: Long (Buy)

Risk-Reward Setup:

Reward: ~$193.33 per share (from $295.54 to $488.87)

Risk: ~$22.60 per share (from $295.54 to $272.94)

Reward:Risk Ratio ≈ 8.6:1 — a high potential payoff if the trade works out.

📊 Technical Context:

Support Zone: Price recently bounced off the support region (marked in purple).

Moving Averages:

Red Line (Short-Term MA): Price just crossed back above.

Blue Line (Long-Term MA): Price reclaimed this level — bullish signal.

Price Action: After a corrective phase, a possible reversal is forming at support, confirming bullish interest.

✅ Bullish Signals:

Bounce from support zone with a strong bullish candle.

Price closing above the 200-day MA (bullish trend resumption).

High reward-to-risk trade setup with clear stop loss.

⚠️ Considerations:

Confirmation with volume or a second bullish candle would add confidence.

Watch for earnings or macro events that could disrupt the trend.

Tight stop is essential to avoid drawdowns if the setup fails.

🔚 Conclusion

This is a well-structured long setup with a high potential reward. If price maintains above the entry zone and breaks recent highs, a push toward the $488.87 target is plausible.

Musk-Trump Feud Sends Tesla (TSLA) Shares DownRenewed Feud Between Musk and Trump Drags Tesla (TSLA) Share Price Lower

The US Senate yesterday narrowly approved Trump’s so-called “big, beautiful budget bill.”

Elon Musk, who had previously criticised the bill for potentially adding $3.3 trillion to the national debt, warned that Republican lawmakers who supported it would face political consequences. In a post on X, Musk wrote:

“Every member of Congress who campaigned on reducing government spending and then immediately voted for the biggest debt increase in history should hang their head in shame! And they will lose their primary next year if it is the last thing I do on this Earth.”

He also reiterated his intention to establish a third political force under the name “America Party.”

In response, President Trump issued sharp threats:

→ to apply federal pressure on Musk’s companies by revisiting existing subsidies and government contracts (estimated by The Washington Post at $38 billion);

→ to deport Musk back to South Africa.

The market responded immediately to this renewed escalation in the Trump–Musk conflict. Tesla (TSLA) shares fell by over 5% yesterday, forming a significant bearish gap.

Technical Analysis of TSLA Stock Chart

Eight days ago, we analysed the TSLA price chart, continuing to observe price action within the context of an ascending channel (indicated in blue). At that point:

→ In mid-June, when the initial Musk–Trump tensions surfaced, TSLA managed to hold within the channel. However, as of yesterday, the price broke below the lower boundary, casting doubt on the sustainability of the uptrend that had been in place since March–April;

→ The price breached the lower channel limit near the $315 level — a zone that previously acted as support. This suggests that $315 may now serve as a resistance level.

As a result, optimism related to the late-June launch of Tesla’s robotaxi initiative has been eclipsed by concerns that the Musk–Trump confrontation may have broader implications.

If the former allies refrain from further escalation, TSLA may consolidate into a broadening contracting triangle (its upper boundary marked in red) in the near term, ahead of Tesla’s Q2 earnings release scheduled for 29 July.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.