Tesla Shares (TSLA) Drop Following Earnings ReportTesla Shares (TSLA) Drop Following Earnings Report

Yesterday, after the close of the main trading session on the stock market, Tesla released its quarterly earnings report. While both earnings per share (EPS) and gross profit slightly exceeded analysts’ expectations, the results reflected a negative trend driven by declining sales. This decline is being influenced by intensifying competition from Chinese EV manufacturers as well as Elon Musk’s political activity.

According to Elon Musk:

→ The company is facing “a few tough quarters” due to the withdrawal of electric vehicle incentives in the US;

→ The more affordable Tesla model (mass production expected in the second half of 2025) will resemble the Model Y;

→ By the end of next year, Tesla's financials should become "highly compelling".

Tesla’s share price (TSLA) fell by approximately 4.5% in after-hours trading, clearly reflecting the market’s reaction to the report. Today, the stock is likely to open around the $317 level, down from over $330 just the day before.

Technical Analysis of TSLA Stock Chart

In our analysis of TSLA charts dated 2 July and 8 July, we outlined a scenario in which the stock price could form a broad contracting triangle, with its axis around the $317 level.

The new candlesticks that have appeared on the chart since then have reinforced the relevance of this triangle, as the price rebounded from the lower boundary (as indicated by the arrow) and headed towards the upper boundary. However, yesterday’s earnings report disrupted this upward move.

Thus, while the broader stock market is trending higher (with the S&P 500 reaching a historic high yesterday), TSLA may remain "stuck" in a consolidation phase, fluctuating around the $317 level—at least until new fundamental drivers shift market sentiment.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Tslachart

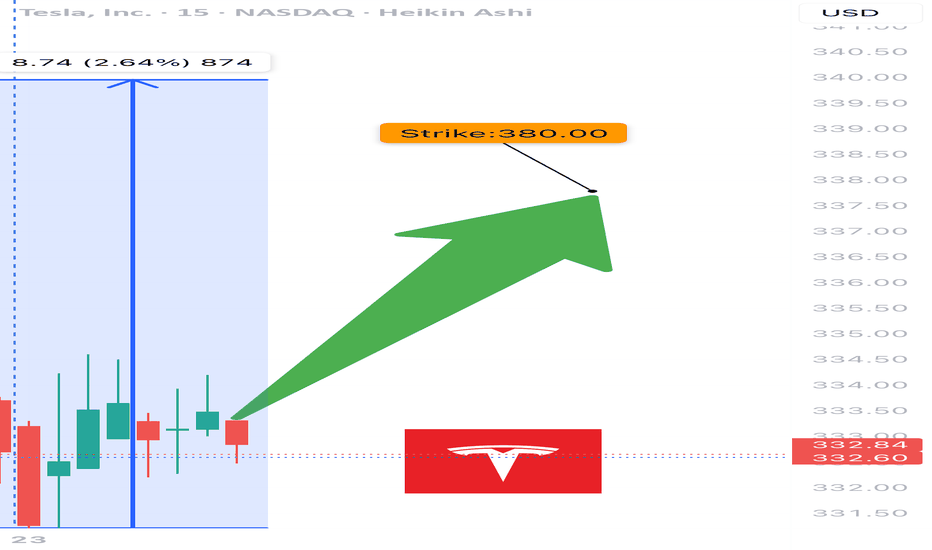

TSLA WEEKLY CALL SETUP — 07/23/2025

🚀 TSLA WEEKLY CALL SETUP — 07/23/2025

📈 AI Consensus Signals 🔥 Bullish Move Incoming

⸻

🔍 SENTIMENT SNAPSHOT

5 AI Models (Grok, Gemini, Claude, Meta, DeepSeek) =

✅ MODERATE BULLISH BIAS

➡️ Why?

• ✅ RSI Momentum (Daily + Weekly = UP)

• ✅ Bullish VIX sentiment

• ⚠️ Weak volume + neutral options flow

• 🧠 No model signals bearish direction

⸻

🎯 TRADE IDEA — CALL OPTION PLAY

{

"instrument": "TSLA",

"direction": "CALL",

"strike": 380,

"entry_price": 0.88,

"profit_target": 1.76,

"stop_loss": 0.44,

"expiry": "2025-07-25",

"confidence": 65%,

"entry_timing": "Open",

"size": 1 contract

}

⸻

📊 TRADE PLAN

🔹 🔸

🎯 Strike 380 CALL

💵 Entry Price 0.88

🎯 Target 1.76 (2× gain)

🛑 Stop Loss 0.44

📅 Expiry July 25, 2025

📈 Confidence 65%

⏰ Entry Market Open

⚠️ Risk High gamma / low time (2DTE)

⸻

📉 MODEL CONSENSUS

🧠 Grok – Bullish RSI, cautious due to volume

🧠 Gemini – Momentum confirmed, weekly strength

🧠 Claude – RSI + VIX = green light

🧠 Meta – 3 bullish signals, minor risk caution

🧠 DeepSeek – RSI + volatility favorable, careful on size

⸻

💬 Drop a 🟢 if you’re in

📈 Drop a ⚡ if you’re watching this flip

🚀 TSLA 380C looks primed if we break resistance near $376

#TSLA #OptionsTrading #CallOptions #WeeklySetup #AIPowered #MomentumTrade #TeslaTrade #GammaRisk #ZeroDTEReady

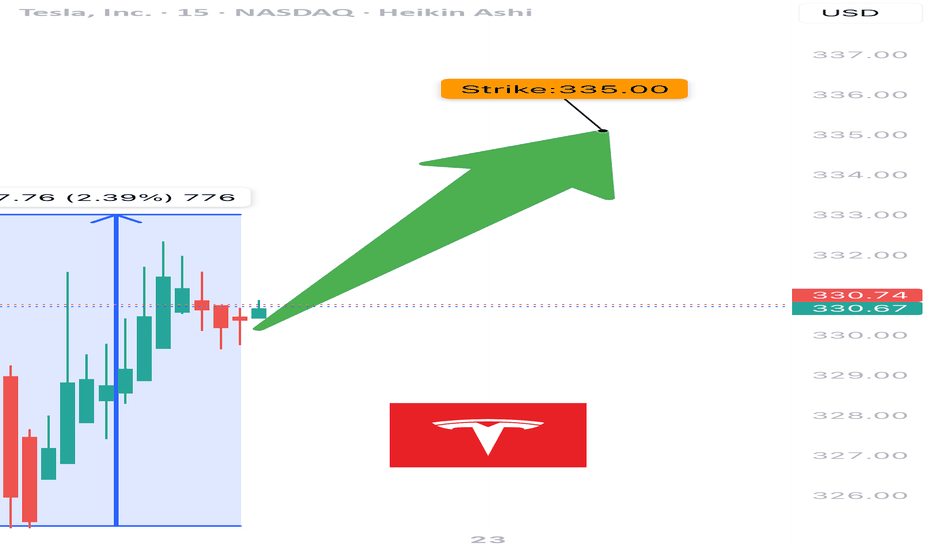

$TSLA Weekly Call Play – 07/22/25

🚀 NASDAQ:TSLA Weekly Call Play – 07/22/25

RSI Bullish 📈 | Options Flow Strong 🔁 | Volume Weak 💤 | 3DTE Tactical Entry

⸻

📊 Market Snapshot

• Price: ~$332–335 (spot near strike)

• Call/Put Ratio: 🔁 1.24 – Bullish Flow

• Daily RSI: ✅ 57.6 – Rising momentum

• Weekly RSI: ⚠️ 54.8 – Neutral / flattening

• Volume: ❌ Weak – Institutional absence

• Gamma Risk: ⚠️ Moderate (DTE = 3)

• VIX: ✅ Favorable

⸻

🧠 Trade Setup

{

"Instrument": "TSLA",

"Direction": "CALL",

"Strike": 335.00,

"Entry": 9.90,

"Profit Target": 15.00,

"Stop Loss": 6.00,

"Expiry": "2025-07-25",

"Confidence": 0.65,

"Size": 1,

"Entry Timing": "Open"

}

⸻

🔬 Sentiment Breakdown

Indicator Signal

📈 Daily RSI ✅ Bullish – confirms entry

📉 Weekly RSI ⚠️ Flat – no long-term edge

🔊 Volume ❌ Weak – no institutional bid

🔁 Options Flow ✅ Bullish (C/P = 1.24)

💨 VIX ✅ Favorable for upside trades

⏳ Gamma Decay ⚠️ High risk (3DTE)

⸻

📍 Chart Focus

• Support Zone: $328–$330

• Breakout Watch: $335+

• Target Zone: $340–$345

• ⚠️ Risk Watch: Volume divergence + gamma decay on low move

⸻

📢 Viral Caption / Hook (for TradingView, X, Discord):

“ NASDAQ:TSLA bulls flash 335C with confidence, but volume’s asleep. RSI’s in, gamma’s ticking. 3DTE lotto with caution tape.” 💥📉

💵 Entry: $9.90 | 🎯 Target: $15.00+ | 📉 Stop: $6.00 | ⚖️ Confidence: 65%

⸻

⚠️ Who This Trade Is For:

• 🔁 Options traders chasing short-term call flows

• 📈 Momentum scalpers riding RSI pop

• 🧠 Disciplined risk managers eyeing 3DTE setups

⸻

💬 Want a safer bull call spread (e.g., 330/340) or risk-defined iron fly for theta control?

Just ask — I’ll build and optimize it for you.

Tisk Tisk TSLAShort thoughts on a neutral area. TSLA broke out of what appears to be bear flag to me. I also see an inverse cup & handle. We may attempt to retest and/or regain the channel. If we fail, 225-220 is my target. Demand zone marked. More journal notes this week to stay focused on the trade(s).

Bear Flag:

www.bapital.com

Cup & Handle:

www.investopedia.com

Inverse Cup & Handle ( from our very own Trading View):

youtu.be

Tesla (TSLA) Shares Among the Biggest Losers AgainTesla (TSLA) Shares Among the Biggest Losers Again

As the chart shows, Tesla (TSLA) shares opened yesterday’s trading session with a bearish gap and closed more than 5% lower than the previous day’s close. Meanwhile, the S&P 500 index (US SPX 500 mini on FXOpen) also declined, but by only around 1%.

Why Tesla (TSLA) Shares Fell

The recent two-day decline may be part of a broader downtrend. As we noted earlier in March, one of the key bearish factors could be Elon Musk’s political involvement in the Trump administration. For investors, this may imply that:

→ A significant number of potential Tesla customers may be put off by Musk’s political stance, slowing sales.

→ The CEO may not be paying enough attention to the company at a time of intense competition. Notably, Chinese EV manufacturer BYD Co. (CN:002594) has announced the launch of its Super e-Platform, which can charge a vehicle with a 400-kilometre range in just five minutes.

This sentiment is reflected in analysts’ decisions, as they continue to lower their target prices for TSLA shares, further fuelling negative sentiment.

TSLA Price Forecast

According to MarketWatch, RBC Capital Markets has cut Tesla’s target price from $440 to $320 due to a worsening outlook for the company’s robotaxi programme and autonomous driving software.

However, RBC analyst Tom Narayan maintained a “Buy” rating on Tesla (TSLA) shares, stating that concerns over a sharp sales drop in Europe and China are “overblown.”

Technical Analysis of Tesla (TSLA) Chart

The previously identified downward channel (marked in red) remains relevant. However, price action suggests that selling pressure may be easing:

→ The decline on 10 March (marked by arrow One) was much more aggressive, but the downward momentum has since slowed (also marked by arrow One).

→ During yesterday’s session, the price closed only slightly below the opening level, suggesting that bears are hesitating near the yearly low.

This could potentially lead to a bullish Double Bottom pattern, increasing the likelihood of an attempt to break above the current resistance around the psychological level of $250.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

TESLA: 4 Hour DOWN TO THE 5 MINUTE MUST WATCH FOR WHATS NEXTMORNING TRADERS

currently this video is an extension of my last Tesla video I did we are are still trying to go to: will be break up and hit our 272 target or will need a bit more correcting to do before we can try our hands at the long trades.

I break this video down for you to give you the best insight into the best levels to look for if you trying to trade Tesla and why

Enjoy

MB Trader

Happy Trading

TSLA (Tesla) Technical Analysis and Trade Idea Upon analyzing TSLA (Tesla), we can see that it has been in a sustained downward trend. Notably, price has entered a critical support zone, exhibiting a double bottom pattern on the chart. Additionally, there has been a downward move beneath this double bottom, tapping into liquidity.

Given the significance of this support zone, I anticipate a reaction, potentially leading to a substantial retracement. Another noteworthy aspect is the imbalance above the current price range, which could serve as a target. Furthermore, I acknowledge the influence of seasonality in stock markets, a topic I delve into within the accompanying video. In the video, we explore trends, price action, market structure, and other essential elements of technical analysis.

TSLA Rebounds from $164.76 Support LevelMy TSLA forecast has been one of my most accurate predictions so far, and TSLA has reached the $164.76 price target discussed in my previous updates. NASDAQ:TSLA initially dipped below the $164.76 support level, but had a bullish rebound at the support line. TSLA is red today, but could be forming a bullish retest of the $164.76 support line. I would keep an eye on the $164.76 support level on the way down to see if it holds or whether TSLA loses support here.

TSLA Technical Analysis and Trade IdeaMarket Observations: #TSLA has experienced downward pressure as evidenced by the distinct pattern of lower highs/lows on the daily chart, signaling a clear downtrend. A significant price gap exists above the current trading range. This setup suggests a potential stop run above the range to clear liquidity, providing an opportunity for larger institutions to fill short orders.

Trade Strategy: Target a short entry on a potential stop run above the range. Aim for an initial profit target at the previous daily low, with a secondary target at the 165 level, which aligns with a prior daily low. Manage risk with a strategically placed stop-loss order.

Disclaimer: This analysis reflects my personal opinion and does not constitute financial advice. Always conduct your own comprehensive research and risk assessment before executing any trades.

TSLA after the earningsTSLA is in its downtrend channel but below the main support rising channel, which was tested several times from below - bearish action.

We were looking for an expected volatility move after the earnings of +/-7%. So far the price is down over 7% and still sliding.

Looking for a gap fill next at minimum, which sits at 193.17

$TSLA Trending Towards $180 Support LevelTSLA had a strong rejection at the yellow resistance line, and has been dropping straight down several support levels over the past few weeks. The $240 orange support line was immediately lost, and TSLA just lost support at the $207.50 green support line. There is a lot of pessimistic news surrounding the sustainability of EVs, and TSLA had a poor earnings report that further hurt investor's future outlook. The $180 light blue support level is the next key price to monitor for a potential bounce. There has been strong support here in the past.

TSLA bear channel + I.B.Simple 4h Inside bar pattern with a supporting 10m bear channel with previous days reacting similarly you can expect a strong bearish move into the lows but nothing is ever 100% in the market. First low is a majority trim, Second low is a remainder close runners up to you but I wouldnt due to the macro position of TSLA as it sits right above a weekly level.

TESLA An opportunity to buyHi, according to my analysis of Tesla stock, there is a great long-term investment opportunity. Especially with a downward channel break. With a very green positive candle on the daily timeframe. outside the parallel channel. good luck for everbody .Note: If you like this analysis, please give your opinion on it. in the comments. I will be happy to share ideas. Like and click to get free content. Thank you

TSLA $200's ResistanceTSLA opening above $198.5 should go up towards $204 gap fill possibly $206 retracement ...

resistance @ $$199.5-200.5 then $204 (2 sigma weekly Move)

If Fed is Dovish today with a 25bp hike this will help to push bullish narrative

Fed with 25bps and Hawkish rhetoric can stop the bull run.

Below $194, we could see Tesla go for Gap fill below and settle around $190 to finish the week

This Feels like a Bull Trap set-up- just my opinion

I bought back in @ 175

Since I plan on taking Profits for this week I will look into selling $200-$205 calls against my $175 price positions *** this is a profit taking options position,

I would not sell calls if I did not own shares at that lower price.

$TSLA bulls keeping the TSLA alive!$TSLA holding it own this morning, keeping the momentum up just above $200 level. tesla must stay above the $190 to $200

to continue its momentum to upside. no new catalyst for tesla except the anticipation of the new tesla model 3 which still no

further announcement. also Elon Musk face class action lawsuit from shareholders, overstating the effectiveness and safety of

the company's autopilot and full self driving technologies.

below is the price level I'm looking for $TSLA:

TGT average price move per day is $7-12 per day depending on market volatility and catalyst.

Below is the price level I'm looking for entry and exit for TSLA:

Buy call above 209.26 and sell at 211.73+ or above

Buy puts below 204.17 and sell at 201.52 or below

make sure that you set up alerts on those key level so you wont miss the move.

and always to take your profits as you see one.

TSLA setting up for a pull back?$TSLA slightly pulls back after soaring for couple of weeks. this pulls back is expected and it might setting up for another pulls back or consolidate

if needs to cools off. TSLA bulls needs to hold the 190 level or bears might gain some momentum here to break below 190.

no majors news to push the TSLA except the analyst upgrade to buy rating.

TSLA average price move per day is $7-$13 per day depending on market volatility and catalyst.

Below is the price level I'm looking for entries and exit for TSLA:

Buy call above 203.31 and sell at 205.90+ or above

Buy puts below 196.61 and sell at 194.50 or below

make sure that you set up alerts on those key level so you wont miss the move.

and always to take your profits as you see one.

TSLA REBOUNDS OF 105!!!!TSLA having a massive buy presence in the premarket this morning. Could this be a sign good things are coming? I think not, over the last 5 trading sessions TSLA dropped a eye watering 21% !!!

Here are some factors of why TSLA has declined a MASSIVE 72% this year :

Inflation -> Fed tightening -> Risk-off assets looking more attractive

Elon has sold $23bn worth this year alone to finance the twitter acquisition. If advertisers continue to flee, he will need to sell more to finance debt payments from LBO.

He has pledged not to sell anymore till 2024

There have been large concerns from major investors around Elon's time commitments as CEO given Twitter acquisition.

Fears of a global recession next year are causing concerns around luxury car demand. Consumers will be reluctant to spend $80,000 on a new car with used car prices tanking.

No $30,000 Tesla car yet.

Concerns about Chinese demand given COVID cases and lockdowns hurting demand for luxury vehicles.

No wide FSD rollout, No Cybertruck

Ouch......

TSLA at Critical Level - Could Go Either WayTSLA is at a critical point with the volume shelf and other factors that could mean either direction.

Bull Case:

Retesting Breakout Level

Falling Wedge on Daily/65m

Bullish Divergence on 65m

Some Bollinger Band squeezing on 65m

Bear Case:

Net Premium flow favors puts heavily

Bearish Engulfing Candle on Weekly

MACD crossing down on Daily

Hidden Bearish Divergence on Daily that may not have completely played out

May be slightly below volume shelf - next shelf at $912

Diminishing Volume on Daily

So:

If Bulls Win... (price breaks $1,037)

PT1 - $1,045

PT2 - $1,065

PT3 - $1,087

If Bears Win... (price breaks $1,021)

PT1 - $1,011

PT2 - $1,000

PT3 - $1,090

Is Tesla still plugged into Bitcoin?The prices of cryptocurrencies including Bitcoin, the most popular of the lot, have been highly volatile in recent months due to conflicting regulatory signs and rising interest rates.

Despite the massive sell-off of digital tokens, Tesla (NASDAQ:TSLA) CEO Elon Musk is among those who are still bullish on digital currencies. As such, the recently reminted $1 trillion dollar company is caught in the crosshairs of movements in the cryptocurrency market.

Bitcoin price crash

After reaching an all-time high of $67.5K in November, the price of Bitcoin is now hovering around $40K since the start of the year. The crash is partly due to remarks from the US Federal Reserve about launching its own digital currency similar to China’s e-renminbi and US President Joe Biden’s recent order directing government agencies to coordinate on a regulatory framework for digital currencies.

While the regulatory forces mentioned above have helped to suppress any upside in digital assets, the largest contributor in the price crash of Bitcoin is the about-face that Musk, and by association Tesla, pulled for its support of Bitcoin. In a way, those cryptocurrency crosshairs are attached to the rifle wielded at times by Musk and Tesla.

Tesla’s $1.5 billion Bitcoin stash

Last year, Tesla revealed that it invested a total of $1.5 billion in Bitcoin and hinted that it may acquire and hold digital assets “from time to time or long-term.” Since that announcement in February 2021, the company has had no additional Bitcoin purchases.

Tesla disclosed in its 2021 annual report that it still held around $1.26 billion worth of digital assets and incurred $101 million of impairment losses on its digital assets.

At the same time, the EV leader also reiterated its confidence in the long-term potential of digital assets both as an investment and as a liquid alternative to cash. However, the carmaker warned, in an ambiguous statement, that it may boost or reduce its digital asset holdings based on its business needs and on its view of market conditions. However, knowing Tesla dependency on Musk as its “product architect and social media manager”, as quoted by Bloomberg, the company’s position on digital currency’s may be far closer aligned with his own personal view than the above statement suggests.

Over a month after the company’s disclosure, Musk on Twitter said he still owns and “won’t sell” his own personal Bitcoin, Ethereum or Dodge holdings, stressing that “it is generally better to own physical things like a home or stock in companies you think make good products, than dollars when inflation is high.”