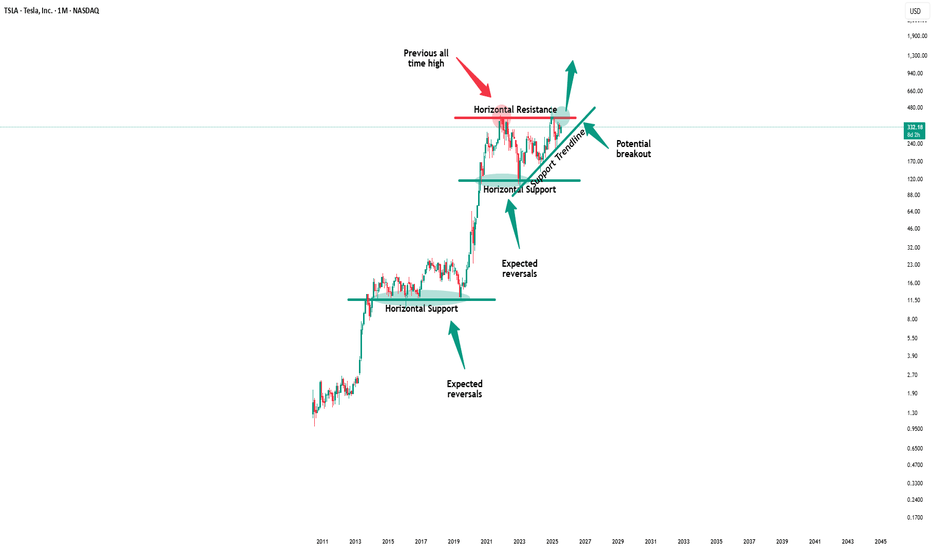

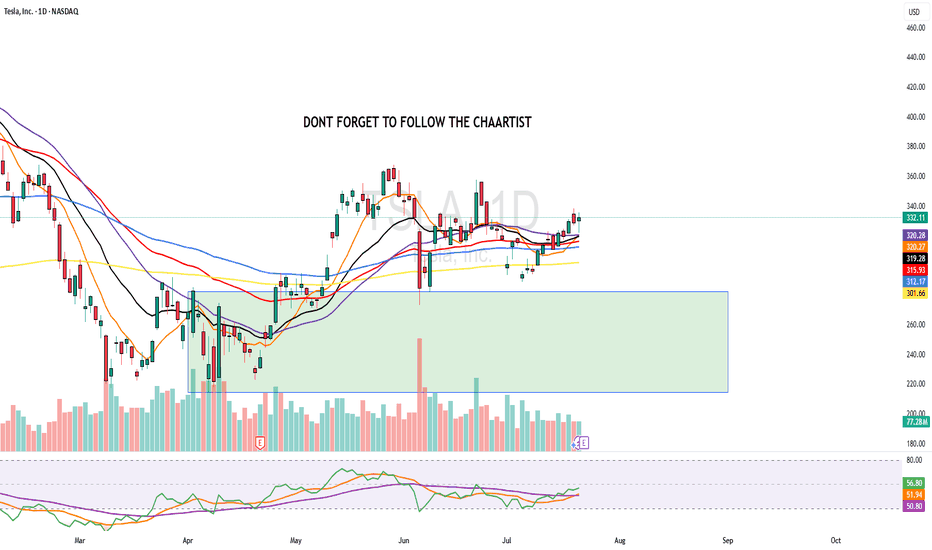

Tesla - The all time high breakout!🚗Tesla ( NASDAQ:TSLA ) will break out soon:

🔎Analysis summary:

For the past five years Tesla has overall been consolidating between support and resistance. But following the recent bullish break and retest, bulls are slowly taking over control. It is actually quite likely that Tesla will soon break above the previous all time highs.

📝Levels to watch:

$400

🙏🏻#LONGTERMVISION

SwingTraderPhil

Tslalong

SLA Moderate Bullish Setup – Weekly Play for 08/01 Expiry

## ⚡ TSLA Moderate Bullish Setup – Weekly Play for 08/01 Expiry

🎯 *"Volume confirms it. RSI supports it. Time to strike—or stand by."*

---

### 🔍 Market Intelligence Snapshot:

📊 **Consensus**: Moderately Bullish

📈 **Weekly RSI**: Rising

📉 **Daily RSI**: Still Neutral (momentum building)

📉 **VIX**: Low → Great environment for call buying

📦 **Volume**: Strong institutional activity across models

---

### ✅ Recommended Trade Setup:

**TSLA \$340 CALL (Exp: Aug 1)**

💰 *Entry*: \~\$0.88

📈 *Target*: \$1.38

🛑 *Stop*: \$0.35

📆 *DTE*: 3 Days

🎯 *Entry*: Market Open

⚖️ *Confidence*: 65%

---

### 🔧 Model Blended Strategy Notes:

* Meta & Anthropic: Suggest ATM/ITM (\$327.50–\$330) → safer, higher cost

* Google & xAI: Prefer \$340–\$342.50 for a better risk/reward

* DeepSeek: Targets \$320 but with heavier premium

🧠 *Takeaway*: \$340 offers a balanced shot — affordable, but still responsive to upside flow.

---

### ⚠️ Risk Notes:

* ⏳ Time Decay → Quick exits = better outcomes

* 📰 External news or earnings reactions = watch for sudden volatility

* 🎯 Position size = keep light due to only 3 DTE

---

### 📊 TRADE SNAPSHOT (JSON):

```json

{

"instrument": "TSLA",

"direction": "call",

"strike": 340.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 1.38,

"stop_loss": 0.35,

"size": 1,

"entry_price": 0.88,

"entry_timing": "open",

"signal_publish_time": "2025-07-29 10:16:14 UTC-04:00"

}

```

---

### 🧠 Quick Captions for Social:

* “TSLA bulls waking up? \$340C looks lit for the week 📈🔥”

* “Call volume surging. RSI rising. Low VIX. This \ NASDAQ:TSLA 340C might run 💥”

* “Risk-managed breakout shot — in and out fast 🎯”

TSLA WEEKLY OPTIONS SETUP

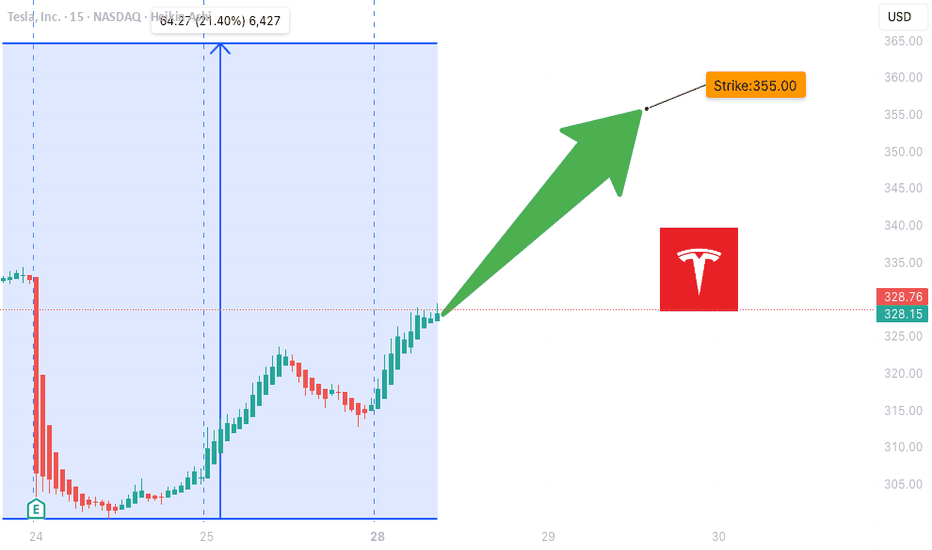

### 🚗 TSLA WEEKLY OPTIONS SETUP (2025-07-28)

**Big Call Flow. Low VIX. Can Bulls Hold \$325?**

---

📊 **Momentum Overview:**

* **Daily RSI:** 48.2 🔻 → *Neutral-to-Weak*

* **Weekly RSI:** 57.1 🔻 → *Still bullish zone, but falling*

⚠️ **Interpretation:** Momentum is softening, trend in question.

📉 **Volume Context:**

* **Volume Ratio:** 1.3x ⬆️ (vs. last week)

* **Price Change:** -0.77% despite that volume

🔍 *Distribution Alert:* Institutions may be selling into strength.

📈 **Options Flow:**

* **Call/Put Ratio:** **1.70** = 🚨 *Bullish flow confirmed*

* **Volatility (VIX):** 15.16 🟢 Favorable for directional plays

✅ Strong setup for options traders riding short-term momentum

---

### 🧠 **Weekly Sentiment Scorecard:**

* ✅ **Bullish Signals (2):** Options Flow, Volatility

* ⚠️ **Neutral Signals (2):** Daily & Weekly RSI

* ❌ **Bearish Signal (1):** Volume pattern = distribution risk

**Overall Bias:** 🟢 *Moderate Bullish*

---

### 🔥 **TRADE SETUP IDEA:**

🎯 **Strategy:** Long Call Option

* 📌 **Instrument:** TSLA

* 💵 **Strike:** \$355C

* 📅 **Expiry:** Aug 1, 2025

* 💸 **Entry:** \~\$0.75

* 🎯 **Profit Target:** \$1.50

* 🛑 **Stop Loss:** \$0.45

* 🔒 **Key Support to Watch:** \$327.50 — lose that = exit fast

📈 **Confidence Level:** 65%

⚠️ **Gamma Risk:** High → trade small, manage tight.

---

### 📦 TRADE\_DETAILS (JSON Format for Algo/Backtest):

```json

{

"instrument": "TSLA",

"direction": "call",

"strike": 355.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 1.50,

"stop_loss": 0.45,

"size": 1,

"entry_price": 0.75,

"entry_timing": "open",

"signal_publish_time": "2025-08-01 09:30:00 UTC-04:00"

}

```

---

### 🧭 **Quick Notes for Traders:**

* ✅ Bulls have short-term edge — but **momentum is fading**

* ⚠️ If TSLA breaks below **\$325**, exit fast.

* 🔍 Watch for fakeouts: options flow is bullish, but volume says “not so fast.”

---

📊 TSLA \$355C → Risk \$0.75 to potentially double 📈

💬 Will this hold, or is it a bull trap before a dump? 👀

Comment below ⬇️ and follow for Monday updates!

---

**#TSLA #OptionsFlow #WeeklyTrade #TradingSetup #GammaRisk #AITrading #TeslaStock #UnusualOptionsActivity #SmartMoneyMoves**

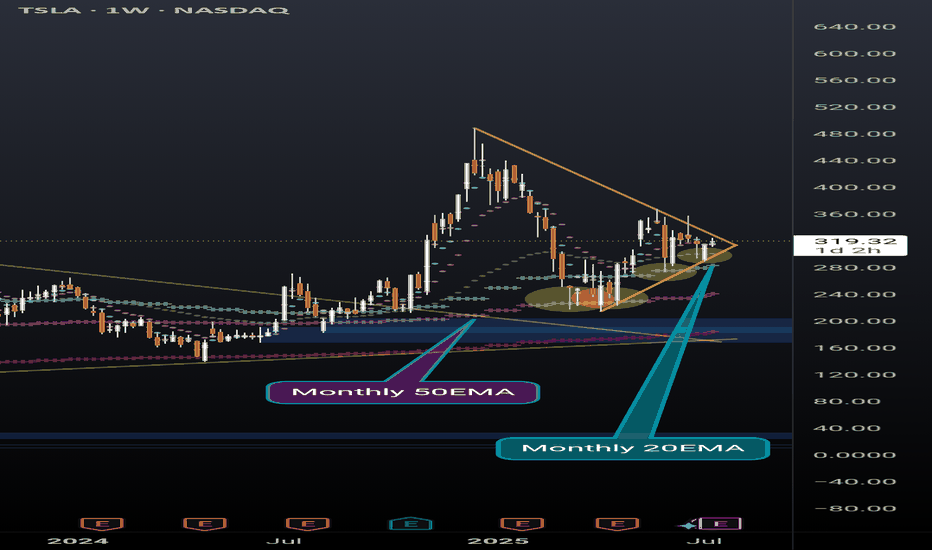

TSLA weekly coiling into something powerfulNever doubt the power of TSLA. Recently broke out of a huge pennant, and now nearing the end of another pennant while simultaneously holding support above the daily 20EMA(overlayed on this weekly chart).

Also recently found support off of the monthly 20EMA (overlayed on this weekly chart) and took 2 direct hits on the monthly 50EMA (overlayed on this weekly chart) before that and rallied up. It will take a lot to crush this setup but anything can happen. Possibly a longer pennant formation.

I'm just a cat not a financial advisor.

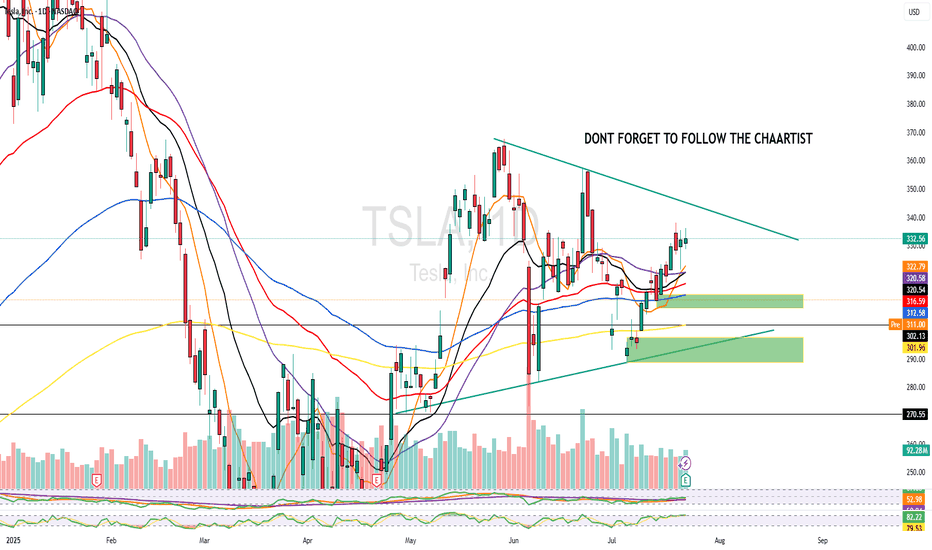

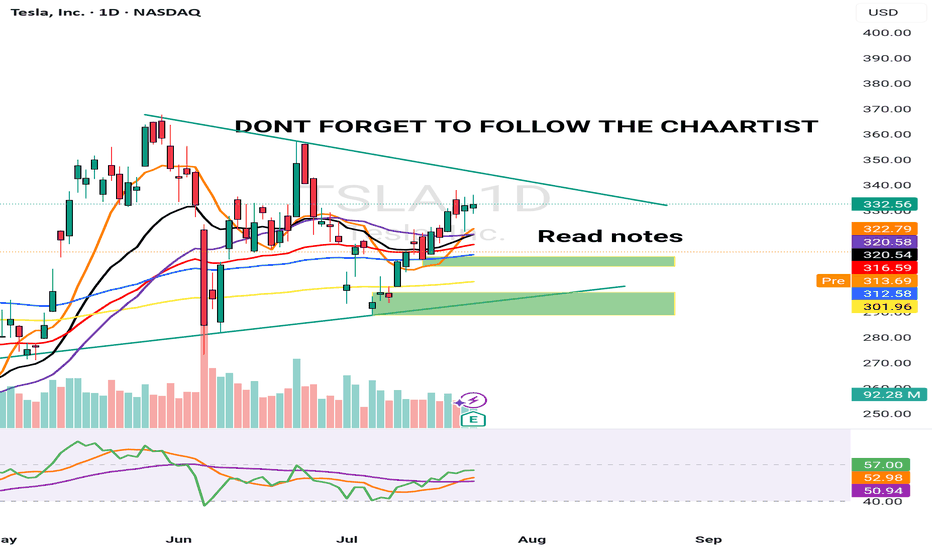

TSLA 24 JULY 2025I have marked 2 levels in green boxes. Price is inside this box pre market and TSLA is down -8.5% from the highs of $338 post market till $310 & -7.5% down from yesterday's close

A better level is the lower demand zone but its not the best. Price has not hit any major resistance.

My job is to read the data & trade. I am still bullish & 10% up down move is normal for Tesla &

This could be a "BEAR TRAP".

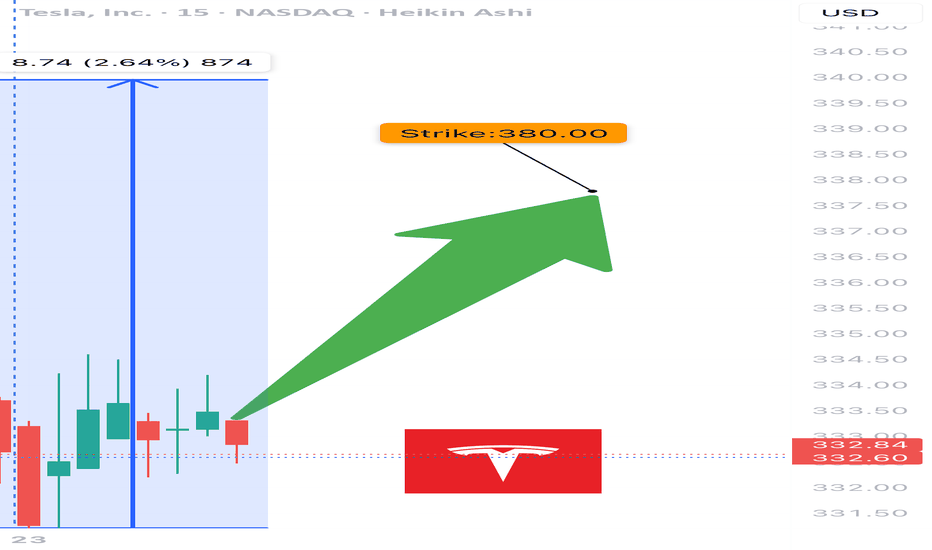

TSLA WEEKLY CALL SETUP — 07/23/2025

🚀 TSLA WEEKLY CALL SETUP — 07/23/2025

📈 AI Consensus Signals 🔥 Bullish Move Incoming

⸻

🔍 SENTIMENT SNAPSHOT

5 AI Models (Grok, Gemini, Claude, Meta, DeepSeek) =

✅ MODERATE BULLISH BIAS

➡️ Why?

• ✅ RSI Momentum (Daily + Weekly = UP)

• ✅ Bullish VIX sentiment

• ⚠️ Weak volume + neutral options flow

• 🧠 No model signals bearish direction

⸻

🎯 TRADE IDEA — CALL OPTION PLAY

{

"instrument": "TSLA",

"direction": "CALL",

"strike": 380,

"entry_price": 0.88,

"profit_target": 1.76,

"stop_loss": 0.44,

"expiry": "2025-07-25",

"confidence": 65%,

"entry_timing": "Open",

"size": 1 contract

}

⸻

📊 TRADE PLAN

🔹 🔸

🎯 Strike 380 CALL

💵 Entry Price 0.88

🎯 Target 1.76 (2× gain)

🛑 Stop Loss 0.44

📅 Expiry July 25, 2025

📈 Confidence 65%

⏰ Entry Market Open

⚠️ Risk High gamma / low time (2DTE)

⸻

📉 MODEL CONSENSUS

🧠 Grok – Bullish RSI, cautious due to volume

🧠 Gemini – Momentum confirmed, weekly strength

🧠 Claude – RSI + VIX = green light

🧠 Meta – 3 bullish signals, minor risk caution

🧠 DeepSeek – RSI + volatility favorable, careful on size

⸻

💬 Drop a 🟢 if you’re in

📈 Drop a ⚡ if you’re watching this flip

🚀 TSLA 380C looks primed if we break resistance near $376

#TSLA #OptionsTrading #CallOptions #WeeklySetup #AIPowered #MomentumTrade #TeslaTrade #GammaRisk #ZeroDTEReady

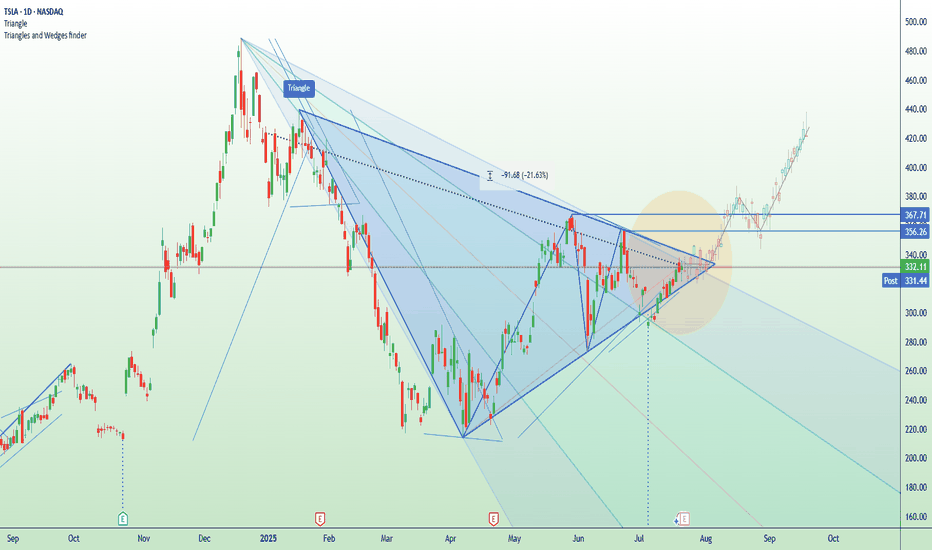

TSLA squeezes into resistance ahead of earnings Tesla is set to report Q2 earnings after the closing bell on Wednesday, covering the quarter ending June 2025.

The stock has been highly volatile this year, amid concerns about tariffs, Elon Musk’s politics (and nazi salutes), and his public clashes with President Donald Trump.

Tesla bulls Wedbush think, “We are at a 'positive crossroads' in the Tesla story,” suggesting that investors will look past the current numbers and focus on Tesla’s long-term AI potential.

Technically, Tesla is now testing a major descending trendline that’s capped every rally since December. The current price action resembles an ascending triangle pattern — a bullish structure — with resistance around $356 and a series of higher lows from May through July. This tightening formation suggests building pressure ahead of the earnings release.

$TSLA Weekly Call Play – 07/22/25

🚀 NASDAQ:TSLA Weekly Call Play – 07/22/25

RSI Bullish 📈 | Options Flow Strong 🔁 | Volume Weak 💤 | 3DTE Tactical Entry

⸻

📊 Market Snapshot

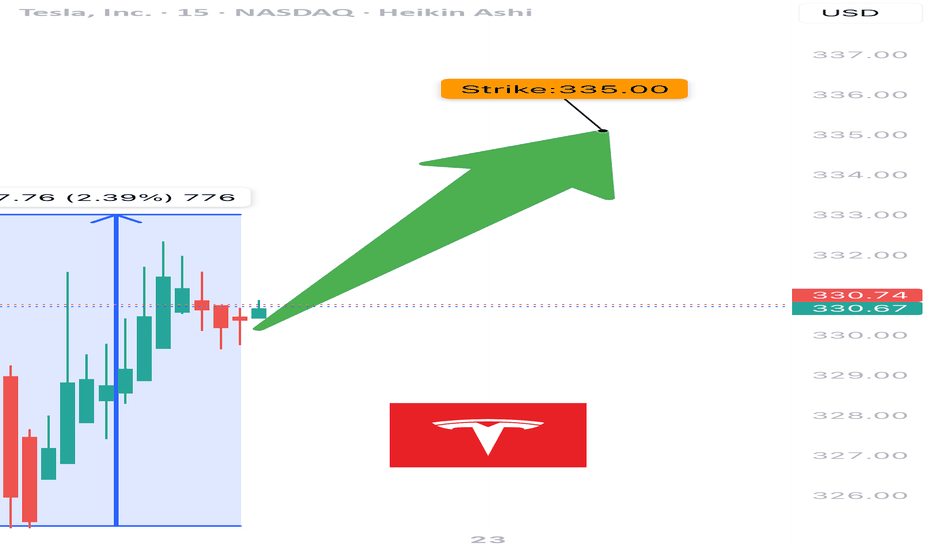

• Price: ~$332–335 (spot near strike)

• Call/Put Ratio: 🔁 1.24 – Bullish Flow

• Daily RSI: ✅ 57.6 – Rising momentum

• Weekly RSI: ⚠️ 54.8 – Neutral / flattening

• Volume: ❌ Weak – Institutional absence

• Gamma Risk: ⚠️ Moderate (DTE = 3)

• VIX: ✅ Favorable

⸻

🧠 Trade Setup

{

"Instrument": "TSLA",

"Direction": "CALL",

"Strike": 335.00,

"Entry": 9.90,

"Profit Target": 15.00,

"Stop Loss": 6.00,

"Expiry": "2025-07-25",

"Confidence": 0.65,

"Size": 1,

"Entry Timing": "Open"

}

⸻

🔬 Sentiment Breakdown

Indicator Signal

📈 Daily RSI ✅ Bullish – confirms entry

📉 Weekly RSI ⚠️ Flat – no long-term edge

🔊 Volume ❌ Weak – no institutional bid

🔁 Options Flow ✅ Bullish (C/P = 1.24)

💨 VIX ✅ Favorable for upside trades

⏳ Gamma Decay ⚠️ High risk (3DTE)

⸻

📍 Chart Focus

• Support Zone: $328–$330

• Breakout Watch: $335+

• Target Zone: $340–$345

• ⚠️ Risk Watch: Volume divergence + gamma decay on low move

⸻

📢 Viral Caption / Hook (for TradingView, X, Discord):

“ NASDAQ:TSLA bulls flash 335C with confidence, but volume’s asleep. RSI’s in, gamma’s ticking. 3DTE lotto with caution tape.” 💥📉

💵 Entry: $9.90 | 🎯 Target: $15.00+ | 📉 Stop: $6.00 | ⚖️ Confidence: 65%

⸻

⚠️ Who This Trade Is For:

• 🔁 Options traders chasing short-term call flows

• 📈 Momentum scalpers riding RSI pop

• 🧠 Disciplined risk managers eyeing 3DTE setups

⸻

💬 Want a safer bull call spread (e.g., 330/340) or risk-defined iron fly for theta control?

Just ask — I’ll build and optimize it for you.

TSLA WEEKLY TRADE IDEA – JULY 21, 2025

🚀 TSLA WEEKLY TRADE IDEA – JULY 21, 2025 🚀

🔔 Bullish Play, But Handle With Caution 🔔

Models split, but momentum wins (for now)…

⸻

📈 Trade Setup

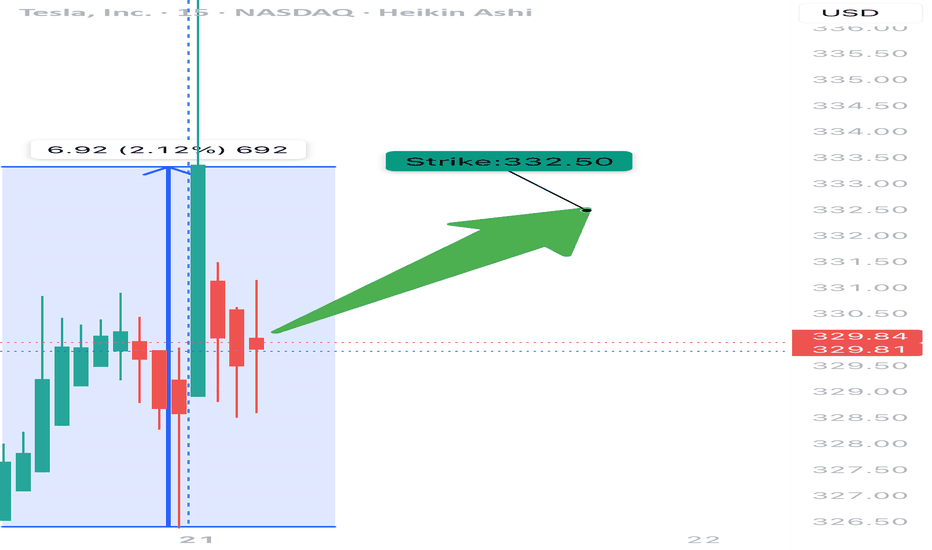

🟢 Call Option – Strike: $332.50

📆 Expiry: July 25, 2025 (Weekly)

💰 Entry: $11.05

🎯 Target: $22.11 (100% Gain)

🛑 Stop: $5.53 (50% Loss)

🕰️ Entry Time: Monday Open

📊 Confidence: 65% (Moderate)

⸻

🧠 Why This Trade?

✅ RSI trending bullish on both daily + weekly

⚠️ Weak volume & bearish options flow (C/P ratio > 1)

📉 Institutions may be hedging into earnings

🌪️ Earnings risk looms – volatility expected

📉 Some models say no trade – we say: controlled risk, tight leash

⸻

🧨 Strategy:

🔹 Single-leg naked call only

🔹 Avoid spreads due to IV & potential gap risk

🔹 Scale out if gain >30% early-week

🔹 CUT FAST if volume + price diverge

⸻

🔥 Quick Verdict:

Momentum > fear, but don’t ignore the smoke.

TSLA 332.5C — Risk 1 to Make 2+

Ready? Let’s ride the wave 📊⚡

#TSLA #OptionsTrading #CallOption #TradingSetup #WeeklyTrade #EarningsSeason #MomentumPlay #TradingViewIdeas #SwingTrade #SmartMoneyMoves

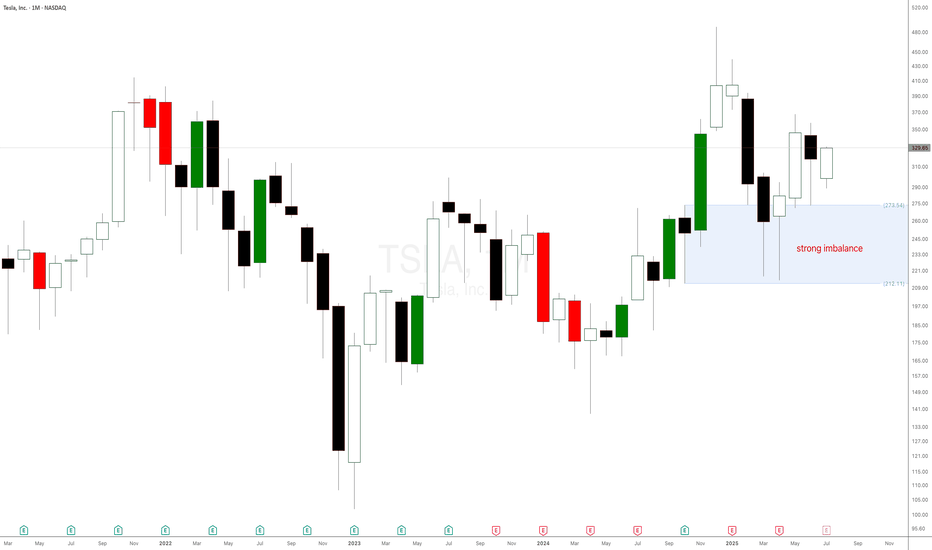

Don’t Listen to Elon Musk – Tesla Stock Chart Tells the REAL StoTesla Stock Set to Break Records: The Power of Monthly and Weekly Demand Imbalances at $273 and $298. Welcome back, traders! In today’s supply and demand breakdown, we’re diving deep into Tesla Inc. (NASDAQ: TSLA) — not from the noisy headlines or what Elon Musk just tweeted, but strictly from raw price action, demand imbalances, and the truth on the charts. Forget the fundamentals, forget the hype, because that’s already been priced in.

This is all about supply and demand, price action, and the power of patience.

The $273 Monthly Demand Imbalance: The Big Fish Made Their Move

A few weeks ago, Tesla stock pulled back to a significant monthly demand imbalance at $273. This level wasn’t just any zone—it was carved out by a strong impulsive move made of large-bodied bullish candlesticks, the kind that only institutions and whales create when they're loading up.

What happened next?

Boom. The market reacted exactly as expected, validating that monthly imbalance and setting the stage for higher prices. This is why we always trust the bigger timeframes—they hold the truth of what the smart money is doing.

The $273 Monthly Demand Imbalance: The Big Fish Made Their Move

A few weeks ago, Tesla stock pulled back to a significant monthly demand imbalance at $273. This level wasn’t just any zone—it was carved out by a strong impulsive move made of large-bodied bullish candlesticks, the kind that only institutions and whales create when they're loading up.

What happened next?

Boom. The market reacted exactly as expected, validating that monthly imbalance and setting the stage for higher prices. This is why we always trust the bigger timeframes—they hold the truth of what the smart money is doing.

TSLA: Don't Sleep on the PullbackTesla’s bullish momentum is still in control – the weekly chart shows we’re still in an uptrend, and the trend is still our best friend. After a strong bounce from support a couple weeks ago, price is now rejecting off a weak resistance zone. Ideally, this pulls it back into my entry zone to retest the bottom or the 50% mark of the current swing. I’m using trend lines for guidance and expecting the next swing to push up into that confluence area. My golden zone is set between $367–$390, with partial profits be taken at $367 (top of the channel) and the rest near $390, where we meet the trend line. Stop loss is placed at $241, just below the level where momentum would likely shift.

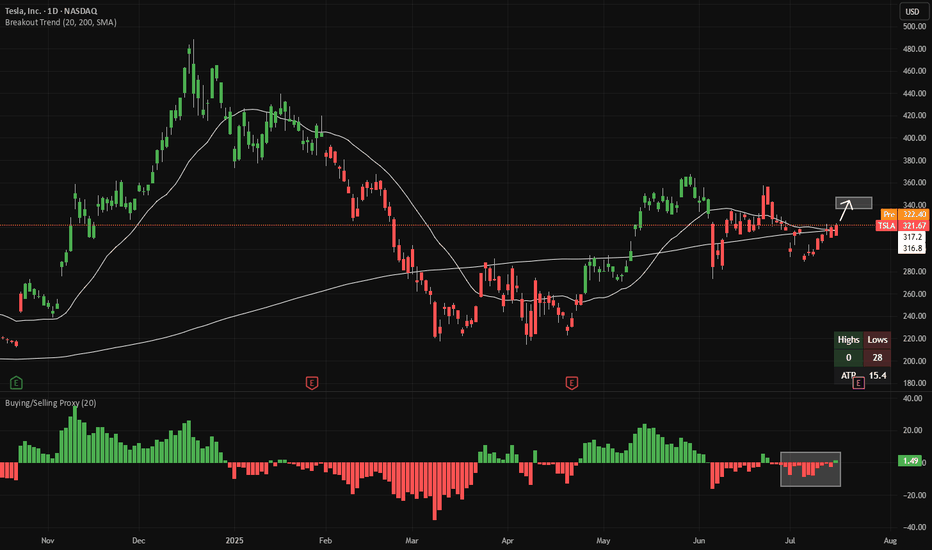

Long TSLA - buyers almost have controlThe buying/selling proxy (bottom panel) is showing signs of net-buying in TSLA. This makes 20-day highs (area indicated in the main chart) more likely to come next. That's around $349.

There is good risk/reward to buy TSLA here, with a stop-loss if the buying/selling proxy flips back to net-selling (red bars). If a 20-day high is made, the candles will change color from red to green.

Both indicators (Breakout Trend and Buying/Selling Proxy) are available for free on TradingView.

Tesla -> The all time high breakout!🚗Tesla ( NASDAQ:TSLA ) prepares a major breakout:

🔎Analysis summary:

Not long ago Tesla perfectly retested the major support trendline of the ascending triangle pattern. So far we witnessed a nice rejection of about +50%, following the overall uptrend. There is actually a quite high chance that Tesla will eventually create a new all time high breakout.

📝Levels to watch:

$400

🙏🏻#LONGTERMVISION

Philip - Swing Trader

TSLA, Long, 1D✅ TSLA has just broken out of a clear symmetrical triangle pattern, signaling a potential bullish continuation.

Yesterday’s daily candle was a white Marubozu, indicating strong buying pressure and clear dominance by the bulls.

LONG 📈

✅ Like and subscribe to never miss a new technical analysis! ✅

Long TESLATrading Fam,

Today my indicator has signaled a BUY on $TSLA. The technicals align. M pattern looks to have completed at strong support (RED TL) and is bouncing upwards inside of a solid liquidity block. Buyers are stepping in. I'm in at $315 and will shoot for $430 (probably taking some profit along the way). My SL is currently $241 but will trail as we enter profit.

Best,

Stew

TSLA – Calm Before the Storm or Just Another Dip Buy?Tesla (TSLA) is trading around $315, bouncing off recent lows, but this isn’t just a clean technical setup. With Elon Musk’s political drama escalating (hello, “America Party”) and ongoing tension with Trump, TSLA is becoming a battleground stock with serious volatility.

As swing traders, that’s exactly where we thrive.

📍 Entry Plan

✅ Entry #1 – $315

✅ Entry #2 – $300

• Previous breakout zone — ideal for dip buyers

✅ Entry #3 – $265

• Strong macro support; only activated if market correction deepens.

🎯 Profit Targets

• TP1: $335

• TP2: $355

• TP3: 400+ – if sentiment + volume align with narrative momentum (think: Robotaxi or AI catalyst)

If $265 gets hit, I’m not panicking, I’m preparing for high-reward setups.

⚠️ Disclaimer: This is not financial advice. I’m just sharing my plan and technical zones. Always do your own research and manage your risk.

📌 Follow for more ideas based on price, narrative, and timing. Trade smart — not loud. 🧭📈

Tesla - This bullish break and retest!Tesla - NASDAQ:TSLA - confirmed the bullish reversal:

(click chart above to see the in depth analysis👆🏻)

Tesla recently created a very bullish break and retest. Therefore together with the monthly bullish price action, the recent rally was totally expected. But despite the short term volatility, Tesla remains bullish, is heading higher and will soon create new highs.

Levels to watch: $400

Keep your long term vision!

Philip (BasicTrading)

Tesla Bullish Breakout Setup: Entry at $295.54 Targeting $488.87Entry Point (Buy Zone): Around $295.54

Stop Loss: Between $272.94 – $295.54 (lower purple support zone)

Target (TP): $488.87

Current Price: $315.33 (as of the latest candle)

📈 Strategy Summary:

Setup Type: Long (Buy)

Risk-Reward Setup:

Reward: ~$193.33 per share (from $295.54 to $488.87)

Risk: ~$22.60 per share (from $295.54 to $272.94)

Reward:Risk Ratio ≈ 8.6:1 — a high potential payoff if the trade works out.

📊 Technical Context:

Support Zone: Price recently bounced off the support region (marked in purple).

Moving Averages:

Red Line (Short-Term MA): Price just crossed back above.

Blue Line (Long-Term MA): Price reclaimed this level — bullish signal.

Price Action: After a corrective phase, a possible reversal is forming at support, confirming bullish interest.

✅ Bullish Signals:

Bounce from support zone with a strong bullish candle.

Price closing above the 200-day MA (bullish trend resumption).

High reward-to-risk trade setup with clear stop loss.

⚠️ Considerations:

Confirmation with volume or a second bullish candle would add confidence.

Watch for earnings or macro events that could disrupt the trend.

Tight stop is essential to avoid drawdowns if the setup fails.

🔚 Conclusion

This is a well-structured long setup with a high potential reward. If price maintains above the entry zone and breaks recent highs, a push toward the $488.87 target is plausible.

TSLA JUNE 20 2025 READ NOTESThis is momentum based price targeting & Tesla can easily do $390 but before that 342 is a solid resistance. From there we can get a dip and then price can continue the up move further

ANY NEWS IS TO BE AVOIDED

Now price action which is way superior is clearly suggesting the same up move.

I fact RSI is saying $400++ can come but it would be super dafe to exit around $390

If you nave any doubts then you can leave a comment.