Turbo

TURBO/USDT - H4 - Wedge Breakout (29.06.2025)The TURBO/USDT pair on the H4 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Wedge Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming Days.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 0.005173

2nd Resistance – 0.005994

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

#TURBO/USDT#TURBO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.005170.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.005466

First target: 0.005592

Second target: 0.005746

Third target: 0.005962

turboThere is a 50% selling pressure area against it that is likely to be allowed to enter the red box to stimulate buyers and this is if the green lines do not disappear

After that I think it can ......

Although there is a visible pattern for the price to increase

But I do not accept the risk of that area very much

TURBO price analysisWell, admit it, at least someone took a chance / was lucky enough to buy #TURBO at $0.0014-0.0015 with a pending limit order that they forgot about ?)

The price of OKX:TURBOUSDT rebounded well, now it would be a "blessing lucky" to buy this #memcoin at $0.0029-$0.0033

With the prospect of #Turbo continuing to grow at least to $0.010

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

TURBO long-term outlookAfter completing its first cycle TURBO seems to stabilize around the 0.0010-0.0020$ region which marks the last ATH from 2023. What's interesting here is that TURBO follows the DOGE coin pattern levels almost to a T, in speedrun mode. It is absolutely not the same structure but it respects the same trading ranges and shows a lot of similarities, which is quite remarkable.

Watch out for this yearly trendline in the TURBO chart and expect some volatility for the next months. Breaking under 0.0010$ could potentially confirm a longer downtrend if we don't see a big impulsive bounce to the upside in the near future.

#TURBO/USDT#TURBO

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.003600

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the Moving Average 100

Entry price 0.003623

First target 0.003758

Second target 0.003845

Third target 0.003950

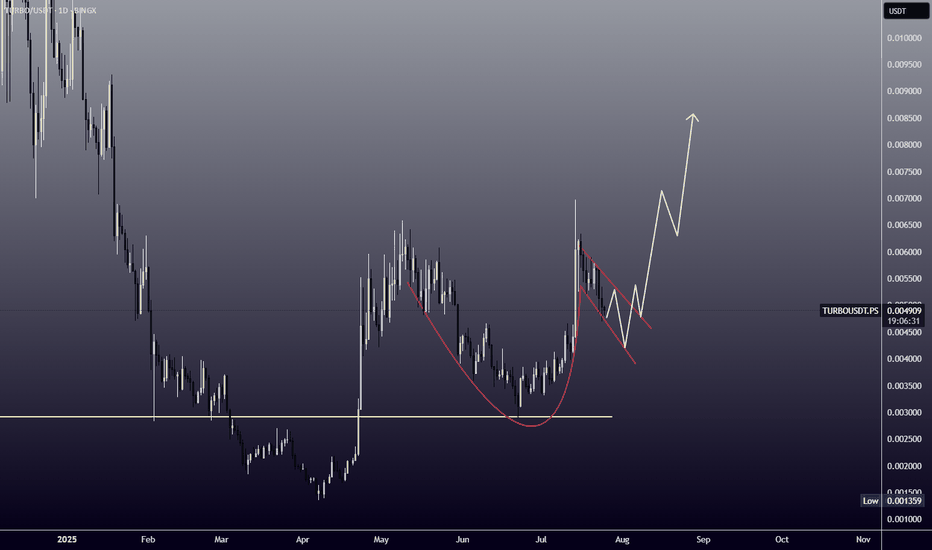

TURBO IS STILL ON TRACK FOR TAKE OFF !!! (PACK YOUR BAGS) If you have been following my trade trends on Turbo, from the Beginning "TRIPPLE BULL FLAG ON TURBO", well since then we have had both TRUMP coin and DEEP SEEK remove Liquidity from the entire market and pushing the trend into a descending bear flag, Scary times!

But our friend TURBO refused to postpone take off for too long, having broken the bear flag is now heading back into position for TAKE OFF ! ..

TIME FRAME IS LISTED BELOW ! PACK YOUR BAGS ! NEXT STOP 1.5-2 Cents !

I am not a professional trader, I just enjoy technical analysis if you understand the charts than hopefully you can see the same pattern emerging.

TURBO to 1.4 - 2.2 cents by FEBUARY 16th 2025 <---- MY PREDICTION

Will TURBOUSD Explode Higher? Or Are We Facing a Fakeout?Yello, Paradisers! Have you noticed how TURBOUSD has bounced from its minor support zone recently, hinting at a potential bullish reversal? The bullish I-CHoCH (Internal Change of Character) on the charts certainly has us paying close attention—but is this the real deal or just another trap? Let’s break it down.

💎Currently, TURBOUSD is trading within a resistance trendline that’s giving it a triangle-like pattern. This setup signals a decisive move ahead. If the price manages to break above the trendline and close a strong candle above it, the bullish probability will increase significantly, paving the way for a potential rally.

💎But let’s not forget about the risks here. If the market faces more retracement or panic selling, we could see TURBOUSD dip further to take out the below inducement level. In that scenario, it would be crucial to monitor the lower timeframes for another bullish I-CHoCH to confirm a possible bounce.

💎On the flip side, if the price breaks down and closes a candle below the key support zone, the entire bullish setup will be invalidated. In such a case, staying patient and waiting for stronger price action will be the smart move.

🎖As always, Paradisers, the key is to stay disciplined and let the market reveal its hand. Whether this triangle pattern resolves to the upside or downside, remember: consistency and patience will always win over impulsive decisions. Stay sharp and trade smart—this is the only way to make it long-term in the crypto game.

MyCryptoParadise

iFeel the success🌴

TURBOUSDT: Fresh Deman Zone ResearchTURBOUSDT: Fresh Deman Zone Research 🔍

The price has lingered too long in intermediate zones, which I don't prefer. Instead of getting lost in such areas, I choose fresh demand zones for better opportunities. The blue box marks a fresh demand region.

When trading the blue box, I rely on tools such as CDV, liquidity heatmaps, volume profiles, and volume footprints, alongside market structure breaks on lower time frames for confirmation.

📌 Stay focused, and don't let intermediate price action mislead you. Remember, fresh zones often yield cleaner reactions.

Disclaimer: Manage your risk accordingly; markets remain volatile.

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis (the list is long but I think it's kinda good : )

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

TURBOUSDT: Promising Setup for Short- to Mid-Term GainsI spend time researching and finding the best entries and setups, so make sure to boost and follow for more.

Turbo ( OKX:TURBOUSDT ): Promising Setup for Short- to Mid-Term Gains

Trade Setup:

- Entry Price: $0.0096522

- Stop-Loss: $0.0063183

- Take-Profit Targets:

- TP1: $0.0150133

- TP2: $0.0230523

Fundamental Analysis:

Turbo ( OKX:TURBOUSDT ) is a meme-inspired cryptocurrency that continues to thrive due to its active community and strong engagement. MYX:TURBO has carved out a niche in the competitive crypto market, leveraging its branding and community dynamics to attract a loyal following. With the recent bullish momentum across meme coins, MYX:TURBO is well-positioned for a potential rally.

Technical Analysis (4-Hour Timeframe):

- Current Price: $0.0096522

- Moving Averages:

- 50-EMA: $0.0092000

- 200-EMA: $0.0085000

- Relative Strength Index (RSI): Currently at 58, signalling growing bullish sentiment.

- Support and Resistance Levels:

- Support: $0.0090000

- Resistance: $0.0110000

The 4-hour chart shows OKX:TURBOUSDT forming higher lows, indicating a strengthening trend. If OKX:TURBOUSDT breaks above the immediate resistance at $0.0110000, it could quickly move toward TP1 and beyond.

Market Sentiment:

Market sentiment for OKX:TURBOUSDT remains positive, driven by increasing trading volumes and renewed interest in meme coins. The broader crypto market recovery provides a supportive backdrop for this move.

Risk Management:

A stop-loss at $0.0063183 ensures manageable downside risk, while the take-profit targets provide excellent risk-reward ratios. TP1 offers a potential gain of **55%**, and TP2 offers a gain of **139%,** making this setup ideal for swing traders.

Key Takeaways:

- OKX:TURBOUSDT shows strong technical and market momentum, making it a compelling short- to mid-term trade.

- The trade setup offers attractive risk-to-reward ratios for traders seeking to capture the upside potential of meme coin rallies.

- Disciplined adherence to stop-loss and target levels is critical in navigating the volatility of this market.

When the Market’s Call, We Stand Tall. Bull or Bear, We’ll Brave It All!

*Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Traders should conduct their own due diligence before making investment decisions.*

FLAVIA ready for fly , Similar to turboIt behaves exactly like turbo coin, the big holders accumulated a lot in the last two months, it seems that it can experience a significant growth.

$TURBO/USDT: Market Sentiment and Trade Analysis $TURBO/USDT: 24-Hour Market Sentiment and Trade Analysis

I spend time researching and finding the best entries and setups, so make sure to boost and follow for more.

Market Overview (Last 24 Hours):

- TURBO/USDT is trading near 0.0080982, showing bullish potential. The pair has gained traction due to increased retail interest and speculation.

- Market sentiment around $TURBO/USDT is driven by broader crypto momentum, with altcoins showing renewed strength as Bitcoin and Ethereum maintain stability.

Technical Overview:

- Support Levels: 0.0065000

- Resistance Levels: 0.0159817 (TP1), 0.0239840 (TP2)

- Indicators: RSI is trending upward but remains below overbought levels, indicating room for growth. MACD shows bullish crossover, confirming positive momentum.

Fundamental Catalysts:

- On-Chain Metrics: Increased wallet activity and trading volume suggest heightened interest in TURBO.

- Tokenomics Overview: TURBO’s token supply and burn mechanisms are creating scarcity, driving demand.

- Community Sentiment: TURBO is gaining traction on social platforms like Twitter and Discord, reflecting strong retail enthusiasm.

- Liquidity: Elevated trading volume supports the potential for large price movements.

Scenario Planning:

- Bullish Scenario: If buying momentum persists, the price could achieve TP1 ($0.0159817) and extend to TP2 ($0.0239840).

- Risk Scenario: If liquidity diminishes or BTC dominance rises, the price could fall toward SL at $0.0045605.

Trade Setup:

- Entry Price: $0.0080982

- Stop-Loss: $0.0045605

- Take-Profit Targets:

- TP1: $0.0159817

- TP2: $0.0239840

When the Market’s Call, We Stand Tall. Bull or Bear, We’ll Brave It All!

Disclaimer:

This analysis is for informational purposes only and does not constitute financial advice. Traders should conduct their own due diligence before making investment decisions.