>1%Hello everyone

Today I want to discuss with you a serious issue of risk management.

Surely each of you has heard about the 1% rule: do not risk more than 1% of your capital in one transaction.

The rule is well-known and quite useful, it is better to lose 1% than the entire capital.

Beginners, although they know this rule, rarely follow it and this is a big problem.

I think this is the main problem of beginners, people think that the problem is strategy, but FOREX trading is a game of probability.

The Probability Game

Not every trader understands what probability is.

Most are afraid to study this question because they are afraid of long mathematical formulas.

Do not be afraid, you need to study!

And even if you don't want to do it, there is an easier way.

In simple words: probability is something that happens more often than usual, but not always.

Not clear?

Let's take any pattern. By the method of research and observations, experienced traders decided that this pattern is often found on the market and it can be traded, while trading this pattern does not promise 100% results.

This means that if you trade this pattern infinitely many times, you will be in the black at a distance.

At a distance…

We're getting close.

Distance is a series of transactions.

Whatever pattern you choose, whatever strategy you have, you need distance, you need to make a series of trades so that the pattern works out in order to understand whether this strategy is really profitable.

But if you risk everything or almost everything in one trade, what distance will you have?

Exactly.

Without a series of trades, you will not be able to profit from the pattern, without risk management and following the 1% rule, you will not be able to make a series of trades, because your capital will disappear very quickly.

Do you think that 1% is too little?

Professional traders risk an even smaller percentage in transactions.

The goal is to stay in the game as long as possible and that's when you'll be super profitable.

Traders who risk less than 1% in transactions get huge profits at a distance, so don't worry about profits, think about losses, how to reduce and avoid them.

Demo account

The biggest advantage of a demo account, in my opinion, is that it is free and every trader can train to follow risk management for free and as much as he wants.

I advise you to set aside a month for trading on a demo account with the right risk management.

Set a goal not to open trades with a risk of more than 1%.

And no matter what your strategy is, just follow the rule.

I assure you, you will see the difference.

Analyze, study, train and victory will find you.

good luck!

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Tutorial

Stability In Forex TradingWhy so few traders manage to bring their trading to the level of stable earnings, when trading becomes a source of income, and not a source of constant disappointment?

Because before you start to get the "easy" money that everyone comes to this industry, you will have to go a long way to make a lot of mistakes, each of which will cost you money. To fall down many times and get up more times, to lose money at the same time without losing the motivation to move forward, to learn yourself and change your attitude to trading. In addition to all of this, the difficulty is that no trader knows how much time it will take him. And the truth is that 95% don't have the strength and patience to do it.

I can point out 3 main criteria for stable trading:

The right attitude to losing trades.

Confidence in your strategy.

Availability of trading rules and most importantly the desire to follow them.

1. Accepting losses.

To survive in this field, a trader has to learn to properly deal with losses, without that he will not be able to make a profit in the long run. Just like in sports, first you learn how to fall properly, then everything else.

The thirst for quick money, which is present in almost everyone at the initial stage, generates fixation on profits. With this attitude the trader becomes highly vulnerable and morally unprepared to accept and tolerate losses. Nobody likes making mistakes and losing money. And large losses cause a lot of stress, which can lead to emotional burnout, depression and even deprive the strength to continue trading.

Trader's dependence on the expectations of the result of each deal will invariably make him experience emotions. And emotions will push him to make erroneous actions. These constant emotional swings take away the trader's strength and leave him with no opportunity to improve his trading. He's busy just trying to keep his mental balance somehow.

How do most traders try to solve this problem? They try to avoid losses and fight their emotions.

But that's impossible, you, see? This is a vicious circle.

What you can and should do is to shift your attention from the result of each trade to the result of a time period (for example, a month). It is very important to understand and accept that: in any sequence of trades, there is a random distribution of profitable and losing trades.

This will help reduce the emotional component of trading. When you do not expect any result from a trade, the result of the trade ceases to matter and causes emotions that push you to take the wrong actions. The trader's job is to make his trading as psychologically comfortable as possible.

2. Strategy

A strategy is a method. Most traders, having suffered another failure, begin to change their trading strategy or look for another one. They sincerely believe that the problem is in it. That it is the strategy which does not let them to earn profit. But there are no profitable or unprofitable strategies. Traders make them so.

In fact, a strategy is not supposed to provide a trader with profit. It has only one function. It should provide trader's understanding of WHAT, WHERE and WHEN to trade. And the sooner the trader stops shifting responsibility from himself and his actions to his strategy, the faster he will learn.

It will take time for you to feel confident in your strategy. Time to adjust the method to yourself, to your understanding of the market. You can take any strategy you like as a basis and taking into account your weaknesses and strengths determine how and what you will trade.

3. Compliance with rules

The third and perhaps the most important criterion for stable trading is the presence and observance of rules. This is what will bring the trader profit in the end.

Trading rules have only two functions:

To provide a trading strategy with a positive mathematical expectation.

Provide correct models of trader's behavior in different trading situations.

So that it is possible to control emotions and not to leave the psychological comfort zone.

When successful traders are asked what is most important to achieve success none of them focuses on their strategy, they do not talk about the magic money management or special knowledge. But all of them say that it's important to follow their rules in a disciplined manner.

All traders who make money fanatically follow their rules. Because they know that strict adherence to trading rules is what makes them profitable. The market pays us money for our disciplined actions. We pay it for experience and it pays us for discipline. Most traders are mainly busy analyzing their trades and forget about their own behavior and trading mindset.

The desire to follow the rules arises only when you realize that they reduce your losses, which automatically increases your profitability.

Unfortunately, there is no ready algorithm for creating rules. They are individual, and that is the difficulty of learning to trade. The only guideline in their creation is that they must LIMIT your losses. Everything else is up to you.

Learn to listen to yourself by methodically and persistently striving to improve your trading. If you give yourself time to learn first, setting aside the desire for instant results, you will definitely come to have your own trading system sooner or later. An individual system which will bring you money.

ETH/USD Main trend. Accumulation/Distribution. Pivot pointsThe chart shows the main trend (most of it) of this cryptocurrency. The timeframe is 1 week.

Most people "trade" and do not understand the profit values of the price from the real set zones (not hamsters).

Also shown are the recruitment zones (horizontal channel) and partial reset zones (until the triangle decoupling) of previously gained positions of large market participants.

The last video explained this in detail and showed it on the example of this coin.

Even taking into account that this triangle (1.5 years) is a position reset. That doesn't mean that this formation must necessarily break down. But, this is something to keep in mind, especially the +3600%.

Volatility narrowing, that is, the end of triangle formation is a “doubt zone”—the “market fuel” (small and medium market participants) for the impulse is clamped down. That is, the decoupling of the triangle and the direction of further trend development.

The price is clamped into a triangle. A formation of this magnitude will only unravel due to future world shocks, especially financial ones. Who knows, maybe this time there will be no correlation at all, as the time of "coming out of the shadows" approaches.

Always trade within your working range (for example 1 day), always understand where the price is in the main trend. Based on this understanding, limit the risks, and make a decision about reducing (partial liquidation) or, on the contrary, about adding to the position.

Locally on the 1-day timeframe a wedge is formed on the decline.

I've shown all the decoupling options for this trading situation in detail in this trading idea, as well as in the video.

ETH/USDT Local trend. Channel. Wedge. Pivot zones.

Under idea fixed my previous trading as well as training/trading ideas where I accompanied the price in updates for quite a long period. Note the exact values and more. You can use the material in them as educational, based on reality.

Remember, the basis of trading is not guessing (that's what everyone wants to do), but your trading strategy and risk management based on your knowledge and experience.

Those who want to guess tend to lose money. Do not be such characters in the market, that is, its fuel. I wish all smart people a big profit, and wish all stupid people to wake up from the dream of stupidity.

Winning Trader is Patient TraderHello friends, like every forex trader on Earth, I sometimes ask myself what are my strengths and weaknesses? How have I changed, and what qualities have I developed in myself? Today we're going to talk about how you can develop it. How susceptible are you to impatience?

Impatience in ordinary life.

But what does it mean to be able to "delay making a decision"? For me, it means handling things calmly and being disciplined. I don't have to do rash things right away and can bide my time for action. This is equally true for trading as it is for real life.

Wait until you get a good discount for something you've wanted to buy for a long period of time. After all, there are many things that seem to be needed, but their purchase may well have to wait until the seasonal sale.

This behavior, also called "delayed gratification," protects me from making hasty and emotional decisions. I would not be satisfied if I bought something recklessly, only to get the thing right away but pay a high price for it. My focus is on the risk/reward ratio. So, the risk of making a bad decision is relatively low.

I think it's not easy to just wait it out these days. The sensitivity to consumption and the wide variety of offerings makes it difficult to refrain from buying something right away without waiting out the right situation. Due to the ability to pay in installments, people are able to buy expensive items right away. Many people spend money on rash decisions and get into debt just because they can't wait.

Several years ago, I read Daniel Goleman's book “Emotional Intelligence”. Among others, he described long-term experiments with children who became particularly successful and incorruptible if they learned at an early age about delayed decision-making.

The essence of the experiment was this: a child was offered a candy and told that he could eat it now, and if he didn't eat the candy right away, but waited twenty minutes, he would get two candies. So, those children who agreed to wait, then in adulthood were much more successful than fans of "fast" candy.

What does this mean for the trade?

I think delayed gratification has several positive effects on trading.

You have to wait out the right situation and you have to refrain from recklessly entering the market.

You must wait for the perfect set-up that will execute according to all the rules.

You should not take profits too early, and should calmly wait and close a position only when your rules allow you to do so.

You must be firmly aware of when you should not trade and when your individual trading strategy will not be profitable.

You must control your risks to stay in the game.

You must know that you can only succeed in trading in the long run and that you cannot get rich quickly.

Nowadays, I have begun to notice that I am primarily looking for reasons NOT to enter the market. It is only when there is no reason to trade that I open a position. The market no longer pressures me, and I try not to be influenced by my emotions. I have to wait for the right setup and the right conditions. The emphasis is on first-class odds, not second-class and beyond. All you have to do is wait it out.

Another point that is never talked about. It's pushing through situations. Here's an example: you have an open position and it has reached a stop loss. You want to win back, and at the next signal you enter the market with bigger lot position. Again, you take a loss. You follow your emotions and open in the same direction with an even bigger lots, without even waiting for your strategy signal. You probably already know the end of the story. This is a push-pull situation, when you're trying to have some kind of impact on something you can't influence.

Exercise

Instead of describing any self-evident conclusions from the above, I offer you a simple exercise, which allows you to understand whether you have developed the skill of waiting or not.

Take an hourglass, for 3-5 minutes (no less), turn it upside down, and just watch the grains of sand pile down into the empty half of it. Your task is to wait until the last grain of sand falls down. Do not try to control your thoughts.

So, after you've completed the task, remember what thoughts and emotions you had while you were watching the sand? If you were starting to get mad at how slowly the sand is falling away, you were trying to figure out how much time is left, you were cursing to yourself about this "stupid task" that doesn't let you see pictures of cats, you were remembering how many important things you have to do today, or even failed to wait until the sand falls to the other half of the hour congratulations. You have a problem with patience. But if you calmly waited for the last grain of sand, you had no desire to speed up the process in any way, you just watched the sand until the very end without emotion or irritation. You don't have a problem with patience, at least not obviously.

Bites Of Trading Knowledge For New TOP Traders #15 (short read)Bites Of Trading Knowledge For New TOP Traders #15

----------------------------------------------------------------

What is an Interest Rate Differential? -

An interest rate differential is a change in the interest rates between the currencies of two countries. It is a measure of how money from two countries compares to each other.

What is the Carry Trade? -

The carry trade is where an investor borrows in a currency where the interest rate is low and converts those funds into a currency where the interest rate is higher.

For example, if one currency has an interest rate of 5% and the other has a rate of 1%, it has a 4% interest rate differential. If you were to buy the currency that pays 5% against one that pays 1%, you would be paid on the difference with daily interest payments.

RISKS AND OPPORTUNITIES FOR CORPORATES AND INDIVIDUAL INVESTORS -

Common application of financial market instruments for managing risk and opportunities.

Diversification: Portfolio Risk Using FX Futures

Portfolio diversification is the process of investing your money in different asset classes and securities in order to minimize the overall risk of the portfolio.

For both corporate and individual investors, having access to markets that enable the building of a diversified portfolio is an important consideration when managing futures focused accounts.

Similar to managing risk, the market to trade would be a key variable to clearly state and support with reasons for trading or investing. Reasons for selecting one market over another could include price volatility, liquidity, daily volume traded, size of the minimum price increment, and value of the minimum price increment. Comparing these variables between markets will help decide the suitability and/or risk of each.

For example, the parameters for a price driven strategy may be designed to be applied to any market whether it be index equity futures or forex futures. However, the signals for entry may not always trigger if a trader were just to focus on a single index equity futures. Having access to markets such as the Micro MSCI USA Index futures could add diversification to a portfolio in an efficient manner.

Having access to other futures markets to apply the strategy to allow for the creation of a diversified portfolio with varying entry and exit points or the ability for more trading oriented investors increased opportunities to execute price driven strategies more often across a range of futures markets.

TRADDICTIV · Research Team

--------

Disclaimer:

We do not provide investment advice, nor provide any personalized investment recommendations and/or advice in making a decision to trade. Before you start trading, please make sure you have considered your entire financial situation, including financial commitments and you understand that trading is highly speculative and that you could sustain significant losses.

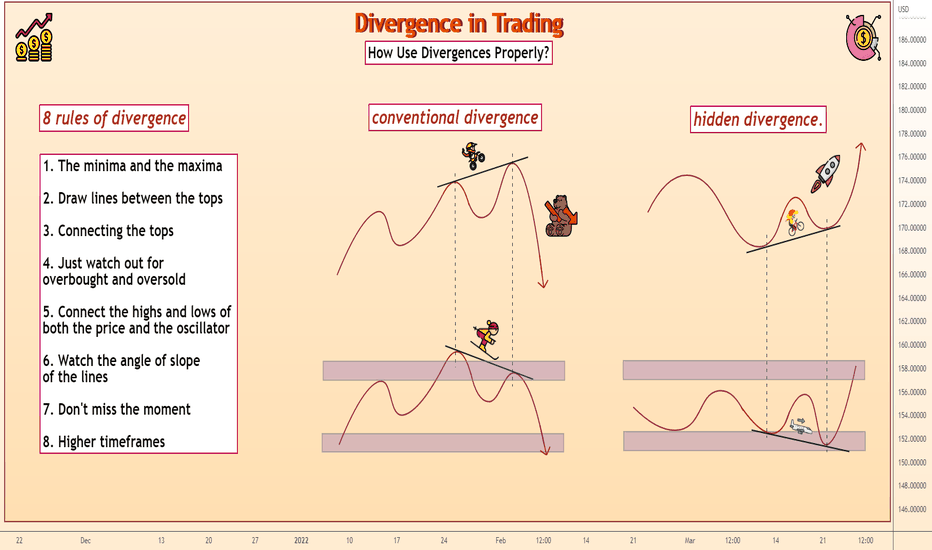

Divergence in TradingThe essence of divergence is very simple: The divergence of price and indicator movements.

When price updates higher highs and the oscillator updates lower highs, it is divergence in its classic form. It could be stochastic, RSI, MACD, CCI and hundreds of other oscillators. Some traders believe divergence is the only oscillatory signal worth looking at.

From stochastics creator George Lane to Alexander Elder, hundreds of professional traders have described divergence in their books.

What is the essence of the divergence?

When the price reaches its maximum value, the oscillator should reach it too. The same is true for the minimum values. This is how it works in a normal situation. If the oscillator and price decide to mark different values - we're talking about divergence.

It can be used in two main cases:

conventional divergence;

hidden divergence.

Let us now analyze them.

The classic divergence

The simplest and clearest signal, which hints at a future trend reversal. If price makes a lower low and the oscillator makes a higher low, we have a traditional bullish divergence. In other words, if the oscillator is up and the price is down, that is a hint of a reversal of the price in the direction of the oscillator.

The opposite situation is also true. The trend is going upward and the price is updating the maximums and if the oscillator is not then it’s a divergence.

The optimal use of divergence is on the maximum and minimum values of the price. This is the easiest way to find the reversal zone. The oscillator directly indicates that the momentum is changing and although the price keeps updating levels, it will not last.

We have considered the conventional divergence, now let's look at its evil cousin, the hidden divergence. It is not so secret that it is just a divergence hidden within the trend.

Hidden divergence

A divergence does not always indicate a trend reversal. Sometimes it is, on the contrary, a clear indication that the trend will continue. Remember, you should be friends with the trend, so any signal that the trend will continue is a good signal.

Hidden divergence is quite simple. The price updates the upper low and the oscillator updates the lower low. It is easy to see. When the price has updated the maximum, check if the oscillator has done the same. If it doesn't and goes in the opposite direction, it's a divergence.

And there is the hidden bearish divergence. The price updates lower highs on a downward move and the oscillator, on the other hand, it is trending upwards and updating the higher highs. If the general trend is downward, it is an indication that this trend will continue and quite possibly double its efforts.

How Use Divergences Properly?

Divergences are a great tool. However, it often raises the question of when exactly to open the trade so that it does not happen that the trade is opened too early or too late. For this purpose, we need a confirmation: some method allowing us to filter the false entries in the divergence. We will consider several such methods.

Oscillator crossing

The first thing we usually look at is a trivial crossing of oscillator lines, say, stochastics. This is an additional indication that the trend may soon change. Therefore, when the price approaches the upper or lower zone, the crossing can give a good signal.

Patience and confirmation of signals are the main qualities of a trader. Divergence is a great tool, but you need to confirm it with additional tools to achieve really good results.

Oscillator exits the overbought/oversold zone

Well, we took our time and waited for additional confirmations of the divergence. Strong enough to indicate a reversal of the trend. Which ones? Remember the basics of technical analysis. A trend line would show that the trend is steadily descending and it is too early to enter the reversal.

This technique is very valuable for finding a reversal or breakdown of a trend line. If the price bounces from the trend line, draw it for the oscillator as well.

8 rules of divergence

To use divergence successfully, it is advisable to adhere to the following rules.

1. The minima and the maxima

The following conditions are necessary for divergence

price updates higher highs or lower lows;

a double top;

double bottom.

When the price updates these highs and lows, there is a trend and this is the feeding ground for divergence. If there is no trend and all you see is a consolidation, the divergence can be missed.

2. Draw lines between the tops

The price is in only two states: trend or consolidation. Connect its tops with lines in order to figure out what is going on. If one peak is lower or higher than the other, it is trending and the market is sweet and available for trades. If there are no clear new highs and lows, it means that there is a consolidation, and divergences do not play a significant role in it.

3. Connecting the tops

Let's be more specific. The price reached the new maximums? Connect the tops. If it made lower lows, connect them. And don't get confused. A very common mistake the price makes new highs and the trader connects the previous lows for some reason.

4. Just watch out for overbought and oversold.

We have connected the tops with trend lines. Now we study the oscillator readings. Remember we are only comparing highs and lows. It doesn't matter what the MACD or stochastic is showing in the middle of the chart. What difference does it make? It makes no difference. We are only interested in their boundary values.

5. Connect the highs and lows of both the price and the oscillator

If we have connected the highs/minimums of the price, we have to do the same for the oscillator. And not somewhere, but for the current values.

6. Watch the angle of slope of the lines.

Divergence when the angle of lines for the price and the oscillator is different. The more this difference, the better. The line can be upward, downward or flat.

7. Don't miss the moment

If you notice the divergence too late and the price reverses, it means the train has already left. The divergence has worked out, it will not be relevant forever. The one who missed it is too late. Wait for the next price divergence with the oscillator and a new divergence will not keep you waiting.

8. Longer timeframes

Divergence works better on higher timeframes. Simply because there are fewer false signals. That's why it's recommended to use them on 1-hour charts or more. Yes, some people like 5- and 15-minute charts, but in these timeframes, divergences often lead to false ones.

These are the rules for dealing with divergence. It's a cool tool. If you specialize on it, it is one of the most powerful methods of technical analysis. Certainly, you will need practice and a bottle of good wine to understand all its peculiarities.

Trading on a demo accountHello everyone!

Today I want to discuss a topic that worries everyone: to trade or not to trade on a demo account.

The demo account itself is a useful tool, but it also has a couple of disadvantages.

Let's deal with everything in order.

Advantages of a demo account

Perhaps the most important plus is that you do not need to deposit your money into the account.

The demo account is created for training, and you can use it for free! There are no risks and you will not lose your money.

The ability to test your strategies. Thanks to a demo account, you can try to trade your strategy in real time on a real market and understand whether it works or not and whether you are able to follow the rules.

The experience is priceless, and you can get it thanks to a demo account. You can open demo accounts as much as you want and trade all day long, filling your hand on the real market.

Thanks to the demo account, you can try all the free indicators and understand which ones are suitable for you and which ones do not work at all.

Disadvantages of a demo account

Perhaps the most important disadvantage is that you will definitely behave differently than on a real account. Psychology is not to do anywhere and when trading for real money, you will immediately notice it. There is no tension on demo accounts, because you will not lose your money, but as soon as the question concerns your real money, you lose your head.

In addition, transactions are executed instantly on a demo account, this is not always possible on a real account, because there is slippage. Because of this, strategies that were profitable on a demo account may be unprofitable on a real one.

On demo accounts, traders choose the maximum deposit and trade the maximum lots . With an infinite deposit, it's hard to lose all the money. In real trading, the account is usually always smaller and therefore you need to trade a smaller lot, which is not so easy.

Spread. A narrow spread on a demo account is a feature of brokers trying to attract as many clients as possible. In real trading, this parameter will be wider.

The number of transactions. On demo accounts, traders tend to execute a much larger number of orders than they actually need. This habit is transferred to real money. But it is much more important to approach the evaluation of each transaction carefully and chase not the number of orders, but their quality.

Conclusion

A demo account is certainly a very useful tool for a trader.

But you need to approach the matter wisely and understand the difference between a demo and a real account.

Practice trading on a demo account the same way as if you were managing real money and then the benefits will be much greater.

Good luck!

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

📖 STEP 4 to MASTER TRADING: Focus on One Pattern 📖

"I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times." - Bruce Lee

We, traders, have a natural passion for learning and that’s really great and helps us build that foundation for trading. However, a moment comes when enough is enough and it’s time to focus on something more specific. But very often, we can make the unconscious mistake of trying to learn as much as possible, without even questioning if we really need it at the moment.

🟩 TOO MUCH INFORMATION

For anyone eager to learn, the information is there. In fact, too much information, and naturally, it can be hard to stop learning. Sometimes we just feel we need to learn about one more pattern, one more strategy, one more approach. And it may seem that more knowledge will bring quality. And that’s true when you just start trading, however, later in your career, it makes sense to think and ask yourself: “Do I really need one more strategy which I know on an average level, or should I maybe focus on one strategy, or one pattern of any given strategy - and really master it, and refine it to the very deep level of understanding?”

🟩 IT’S UNCOMFORTABLE TO LET GO

This part can be discussed for a long time, but based on what was said before, it’s literally uncomfortable for traders to let go of this habit of trying to trade multiple patterns, and learn more patterns in between. I’m not sure why this is so, there must be some psychological reasoning for this, but in simple words, every new trading pattern can be treated by us as a new opportunity to make profits in the market. And so when we stop learning more patterns - it can feel like we’re missing something.

And it may seem that the more we trade, the more patterns we can use - the more profit we can bank because we can enter into the market based on different patterns. And while that may be true to some genius traders, for most of us it doesn’t work that well. More importantly - we don’t need to do it. It’s enough to master 1-2 patterns of a given system we believe in and tested, and so have confidence in it.

I propose you consider “cutting off” 90% of your trading knowledge and focus only on executing 1-2 patterns max. Think about it. If you’re like me, you should feel really uncomfortable or even scared to do this. It may even seem stupid. Because it means you should let go of all the time you dedicated to learning, and maybe even trading with some systems before. But it’s an illusion because that time and effort - they are not lost, you can’t lose them, they are part of you now, part of your experience, something that led you to finally choose something you will work with really closely. But if you will attach to everything you learned before – this will confuse you and spray your focus all over the place, making it much harder to become a specialized, professional trader.

🟩 FOCUS ON YOUR BEST PATTERN ONLY

When the time comes, and you’ve tried several strategies, it now makes sense to stop exploring additional systems and just focus on one system and learn everything about it. For example, if you’re trading head and shoulders, then stop trading double tops and bottoms, break and retest, and diamond patterns. Why? Because head and shoulders are not just 5 lines on the chart, it has numerous variations in how it plays out in the market, in different markets, sessions, and contexts. And you have to know it, see it, test it, and refine it. Become a master of head and shoulders, or any other specific pattern and trading approach, and be profitable with it. And if profitability is there - you can move on to another pattern, but at that stage, you will not need it probably.

🟩 HINDSIGHT TEST, BACKTEST, FORWARDTEST, REFINE

It’s a great practice to have a “hindsight journal” and your backtesting journal, that will only be about that pattern you chose to trade. And there could be several reasons for choosing some particular pattern. But usually, it comes from your mentor or anyone else that you saw who reached sustainable profitability with it, and you believed in this pattern. But that would not be enough. You can’t tell your brain - believe in this. You need to actually show and prove it to your brain and to yourself.

So you need to backtest this pattern, and only this pattern for at least 150 trades. This will help you to develop real confidence in the system.

🟩 YES, IT CAN BE HARD TO FIND “YOUR” SYSTEM

I spent almost 3 years before I really found something I was willing to stick to long-term. Not sure if there’s actually good advice on how to find the system for yourself. It depends on your personality, your lifestyle, etc. Based on my experience, I would say just continue to learn and listen to yourself. Most likely you’ll find some trader or a mentor and you’ll like his trading style. Try to replicate it, and stick to his system. With time, and during journaling and live testing, it will all develop into your own system. Yes, it may look similar to your mentor’s but it will be your system.

And once again, a trading system can have different kinds of entry confirmations, but it makes big sense to choose 1 or 2 confirmations and master them.

🎁 For those who are still reading :), thank you, and here’s BONUS trading hack for you. Next time during your trading day, when you'll feel something is wrong, maybe you're frustrated or just feel like your discipline starts to slip away, or maybe even you catch yourself thinking about entering without entry pattern or risk more than usual - realize that's your "monkey brain" stepping in. It's very hard to control, but easy to trick. Here's what you should do. Say to yourself: "Ok, I'll do whatever I like, place any kind of trade with the risk of half of the account if I want, BUT after 20 min. pass." Then you just start a timer (you can google "timer 20 min.") and do whatever you like after that 20 minutes. Usually what happens is you calm down and don't do stupid things. It very simple but effective technique.

🚀Thanks for your BOOSTS and support🚀

💬Send your comments and questions below, I'll be glad to talk to you💬

Dima

Environment Dictates PerformanceHello, fellow Forex traders! Successful trading on the currency market is not only about having a trading strategy that suits you, emotional composure and risk control. Your work environment, where and how you trade, also plays an important role. So, what should be a trader's workplace?

A computer

You don't need super powerful hardware for the trading terminal. But when all of your programs, including the terminal, work quickly, nothing hangs and the computer does not "freeze", if you suddenly decide to take your mind off the charts and watch videos with cats on youtube, it's quite pleasant and comfortable. And it does not disturb your emotional state. And you still need nerves. If you trade on a desktop PC, I advise you to keep a laptop nearby. Since the electricity can theoretically cut out at any time, and the laptop runs on battery power - at least to close the position you will have enough charge.

Monitor

It is better if it will be large. 19-24 inches. It's just more comfortable. A lot of monitors, as in the movies about cool traders, you do not need, believe me. At least it will not make you trade better directly. But you will be able to watch a movie, play a game and trade Forex at the same time.

Internet

The faster, the better. Also, you need to think about what you will do if it suddenly turns off. "Backup plan" can be either pre-internet from another provider (just pay every month for 2 networks), or a 3g modem, or a modern smartphone, such as iPhone, with a modem function (more than once helped me out).

Chair

The spine is directly related to brain function, headaches and overall human health. So do not skimp on normal computer chair. You will get a hundredfold return of the money spent and you'll save your health.

Printer

Printer/scanner/copier. You probably saw these hybrid devices at offices of different companies. Buy one of these and you can print out charts, use pens to draw on them, scan them back into your computer, make yourself important data posters, etc. Printed out charts with examples of difficult situations, tables with lot sizes for positions, examples of shapes, new rules to implement in the TS are very helpful in your work. Try it.

But most importantly, try not to mix work and personal life. If possible, it is better to allocate a separate room for trade, or even rent an office (for those who do not have problems with money). This way you will not be distracted by anything, and you will not disturb anyone.

YOU SHOULD KNOW THISYOU SHOULD KNOW THIS

Hello everyone!

Today I would like to remind you of a couple of things, the understanding of which will definitely take you to a new level.

Let's go!

1. 99% of newbies come to trading with a desire to make quick money and that's the problem. Trading is a long game. It's worth understanding right away and remembering. In trading, it is impossible to consistently make a double-digit increase in capital and at the same time follow reasonable risk management.

2. Without reasonable risk management, sooner or later you will lose ALL your capital. All professional traders follow risk management and as a rule do not risk more than 1% of the capital in one transaction.

3. Small capital will be a problem. As a rule, 90% of small capitals are burned in the forex market in the first week. All because it is difficult to follow the rules of risk management with a small account, largely because the profit will be scanty, and the time spent will be too much. Over time, you will get tired of wasting time and getting nothing in return, and you will start taking risks, thereby bringing your account to $ 0.

4. You will not be able to correctly predict the exact direction of the market every time. If you think it's possible, the market will kill you. No one can know the future and nitko cannot predict all market movements. But the good news is, you don't have to be right in every trade.

5. The right risk-to-profit ratio will take you to the top. In the market, it is enough to be right in 40% of cases if your RR in transactions is equal to 1:4. Only 4 deals out of 10 will help your account grow steadily. And the higher the RR, the better for your score, but don't flirt.

Understand these principles now, and your trading will become more profitable today.

Good luck.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Strong Trading Strategy, Do not trust all the pin barsThe pin bar pattern is one of the best signals on any market for predicting the next move. But should you trust all pin bars? In my humble opinion, NO, and I’m explaining this idea below and the approach I take to distinguish valid pin bars from invalid ones.

I suppose you already know what is a pin bar, so I’ll not explain its basic details here. If you don’t know please, do a search and read its basics first.

I have 3 filters for my pin bars. Find them below and boost the idea if you liked it :)

1- What should it look like?

In my opinion, having a candle with a shadow (wick) longer than the other and a small body is not the only factor to call it a pin bar. I filter pin bars by expecting some pre-defined proportions and ratios between body size and shadow lengths. Here are my rules:

The body must be at least 2% of the candle height.

The long shadow must be at least 4 times bigger than the body.

The long shadow must be at least 2 times bigger than the short shadow.

I know you are rightly thinking about how to calculate them, but do not! There is a simple indicator that does this calculation and highlights the pin bars for you, the Abnormal Pin Bar indicator . You just need to set it up with your values. You can even set up an alert to let you know when a pin bar is shaped.

These are my rules and values that fit my strategy, you can use them. Also you can do your own tests to find the values that fit your psychology and your strategy. You can say you prefer a pin bar that has a bigger body than yours! it’s okay, just do your own tests to make sure it works for you.

2- What is behind that?

Always inspect the smaller timeframe to check if the sub-candles that shaped the pin bar confirm its bearishness or bullishness. Yes, you should always see the big picture but remember, all the moves start from smaller timeframes. You shouldn't expect too much from a movement with bad groundwork.

For a bullish pin bar, its bullish sub-candles must overcome the price action and volumes of its bearish ones, and on the other hand, for a bearish pin bar, its bearish sub-candles must surpass the price action and volumes of its bullish sub-candles.

It would be nice to write a long and detailed article about bearish and bullish sub-candles competition and when they overcome each other. It's not something you decide just by comparing the number of bullish and bearish sub-candles! Long story short, it’s all Price Action and Volume Analysis. and my favorite one is when the volume of sub-candles in one direction surpasses the volume of the candles in the opposite direction. Or you can look for volume and price anomalies.

What is the volume and price anomaly?

The volume and price anomaly is a simple pattern that occurs in two consecutive candles. Assuming two descending candles or two ascending candles in a row, if the body of one candle is bigger than the other one, we expect its volume to be larger, or if the body of one of them is smaller, we expect its volume to be small. Now, if this pattern is not observed for two consecutive candles, we call it a volume and price anomaly.

For example, a candle has a larger body than the previous candle, but its volume is smaller than the previous candle. Or a candle that has a smaller body than the previous candle, but its volume is greater than the volume of the previous candle!

Anomaly Confirmation Candle:

In most cases, after the volume anomaly, I wait for a confirmation candle. This candle will be a bearish candle for a bullish anomaly and will be a bullish candle for a bearish anomaly. The volume of the confirmation candle is very important in anomaly, and in addition to its shape and size, you should also pay attention to its volume.

I just explained the anomaly here to give you a point of view and perspective. I don't want to make this idea overlong so I do not go into more details. Maybe it would be a subject for another idea ;)

In which timeframe should the inspection be done?

You will understand which timeframe you should choose to inspect a pin bar sub-candles by experiencing it over time, but I personally consider two things:

1- The timeframe must be well-known and be used by not only me but also by most traders.

2- It must contain at least 4 sub-candles. e.g. for a daily pin bar, 12h reveals only 2 sub-candles while 4h reveals 6.

For example, for a closed daily pin bar, it would be a good check to inspect candles for the 4h timeframe. or after a weekly pin bar close, you can check the candles of the last 7 days.

Consider this instruction and practice on the chart to see the result.

If one of the pin bars in sub-candles is also a pin bar, do the same inspection for it.

3- On there any key level around?

A pin bar is an important pattern but one that touches a trend line or any important level is leading! The combination of a key level and a valid pin bar is something very valuable and instructive. It's definitely not to be missed, provided you do your own analyses.

Prioritising trend lines and important levels always makes my decision easier when a pin bar spawns near to more than one significant level.

Check twice if you face a pin bar in peaks, troughs, resistance or support areas, supply and demand zones, or as a rejection from a trend line.

You can use the Trend Key Point indicator to highlight important levels. Additionally, there is a guide about its usage .

Bonus Tips:

Pin bars on bigger timeframes are more reliable.

If there are lots of pin bars shaped on a chart, think twice, select a bigger timeframe, or do not use this strategy on that specific asset.

For two valid pin bars in a row, the one with a bigger volume is more important to me.

Check twice if the volume of a pin bar is bigger than the volume average.

Check twice if the volume of a pin bar is bigger than the volume of its previous candle.

Do you have any questions? ask in the comments.

Do not hesitate to write your opinion about this idea.

I'd appreciate if you share this idea with your network.

ARE YOU A GAMBLER OR ARE YOU A TRADER?Hello everyone

Today we will touch on a serious topic, at the end of which you will be able to determine who you are in the market.

Let's go!

Two types of people

There are a large number of people in the forex market and they are all different.

But, even considering the diversity, there are still common features by which people can be divided.

Some come with a desire to earn quickly, while spending not much time and effort.

Others come to the market as a job.

The first are simple players, mostly they lose money and eventually leave with nothing.

The second are professionals. They know how to trade, they follow the rules and their discipline is at the highest level.

How to determine which group you belong to?

There are a couple of factors that distinguish an ordinary player from a real trader:

1. Risk management. The player, as a rule, does not follow the rules of risk management. The player's risk is equal to his capital. That is why players lose all their capital.

Real traders rarely risk more than 1% of the capital. Such traders follow the rules of risk management in EACH position. Therefore, they never lose all their capital.

2. Trading plan. Players have not tested strategies and rarely study them to the end. They superficially learn new trading methods and run to the market to use them and therefore lose everything. Professionals know everything about their strategy, when to open, when to close, why and how much. A professional will have an answer to all questions and will have a plan.

3. Emotions and money. Do you trade for emotions? Do you like roller coasters at the market? If the answer is yes, then you are a player. Players come to the market to experience the full range of emotions and the market gives them this, but takes money in return. Professionals do not experience emotions, they are here to earn a living. Chasing emotions is not for them.

4. What do you want or what do you see? The player trades what he wants from the market. A player may see something on the street or some news and now he wants to open long positions without paying attention to the context of the market. A professional is not set up to trade long or short, he is set up to trade what the market is trying to show. If the market shows signs of growth, a professional will open long and vice versa. There are no desires here, there is only a plan, strategy and discipline.

Conclusion

Everyone should answer these questions to understand who they are in the market.

Having defined yourself, you will be able to improve yourself, admitting mistakes is already half the case.

This article also indicates the further path that will help you from an ordinary player to become a professional trader.

Good luck!

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Dietary Supplements For TradersLong sitting at the computer, constant stress, bad ecology in the cities, unbalanced nutrition all this is detrimental to the health of forex trader, as well as any intellectual worker.

Today is not going to be a typical post. We're going to talk about supplements that help improve mental and physical vitality under emotional pressure from the market. I will share with you those remedies that I myself use.

What are dietary supplements?

Nutritional supplements are supplements, usually based on natural ingredients. They are not medicines, but act similarly to vitamins. There are universal nutritional supplements, and there are specialized ones for bones, brain, heart, etc. Consider dietary supplements not as something magical, but as a kind of bonus, "+1 to HP", if we put it in computer game terms.

There are opponents of supplements, there are supporters. Personally, I have tried various supplements for many years, and below is a list of what I think are the best. Of course, it all depends on the individual, for example, I have problems with the stomach and cervical spine, so, let's say, joint supplements for the average person needs less than I do. Try to try everything on your body, diseases (if any) and preferences. My experience is just my experience, not the fact that what works for you is what works for me.

Omega Fatty Acids

Omega-3, omega-6, omega-7, and omega-9. These are all varieties of fatty acids found in foods such as fish, nuts, some fruits and vegetables.

Omega's are healthy bones, immune system, breasts, cardiovascular system, intestines and pancreas as well as improve memory and brain function. I recommend unconditionally to all. I myself have been drinking for many years. Omega-7 is generally rare, and here it is in a complex, perfectly balanced, also containing astaxanthin - the most powerful antioxidant in the world.

Cordyceps

I use it when I need a lot of energy. When flights, busy days. This is a parasitic fungus that sucks the life juices out of insects that it encounters: grasshoppers, ants, etc. In China, cordyceps has been used medicinally for 5000 years.

In addition to energy, it stimulates brain activity by improving blood circulation, strengthens the walls of blood vessels, as well as the immune system.

Unfortunately, there are a lot of fakes, be careful. One rule of thumb - cordyceps can't be cheap, as very little of it is extracted.

Ginseng

Ginseng has long been known for its healing powers. Unlike cordyceps, it gives a deeper energy, not so pronounced, the effect is noticeable a little later. In addition to physical energy helps with mental fatigue.

In dietary supplements is usually used artificially grown ginseng, as it is cheaper. Wild ginseng is considered more powerful, I can't recommend any particular supplement, so please try it. If you feel the effect, it means that it is suitable for you. Now I take this one.

Ginkgo Biloba

Ginkgo Biloba is the plant whose leaf extract is closest to those "NZT pills" from the famous movie " Limitless ".

It nourishes the brain, improves memory, attention, mental performance, and slows the aging process of the brain. Result is not instant; miracles is not going to happen.

Garlic.

Garlic kills a lot of pathogens inside the body, a couple of times a year I take a course.

What is interesting, everyone knows about the properties of garlic as an anti-cold and immune boosting agent, but it also helps to reduce cholesterol and improve male potency. Garlic is a dietary supplement in a concentrated form and in large quantities. This will not make your breath stink.

Hyaluronic Acid

Hyaluronic acid is a constituent of many tissues in our body. Hyaluronic acid is commonly advertised as an anti-wrinkle cosmetic, for younger looking skin, etc. But it is also excellent for joints, muscles and ligaments. Scientists are predicting that in the future, this acid will form the basis of cancer fighting agents.

In this way, it is an excellent remedy for the mobility of the joints and has an aesthetic effect on the skin.

Blueberries

Although modern monitors don't strain our eyes as much, there's still nothing good for vision in the glowing screens of laptops, cell phones and tablets that we all often look at. And it doesn't hurt to take preventive care.

Blueberries are very good for vision. And in combination with the substance Lutein, the effect is enhanced. I try to remember to take a course of blueberry extract with lutein once a year to prevent good vision.

Calm

You also need to drink a soothing magnesium-based mixture. It promotes better sleep and relieves stress, of which there is so much in a trader's job. I drink it at night.

How to use supplements?

The most important rule is not to overdo it. Make sure that you do not overdose on any components/vitamins. For example, if you drink something with vitamin E, you should not take a supplement at the same time, where vitamin E is also present, albeit as an auxiliary component.

Also, watch your own well-being. What works for one person won't necessarily work for another.

Conclusion

Various supplements help, but they are not a panacea. If you have, God forbid, any diseases, be sure to see a doctor. Also, supplements work many times better when you combine them with physical activity. Yes, that's right: you have to get off the couch and go to the gym. Choose what you like: yoga, aerobics, tennis. It's your business, but physical activity has to be, without it there is no way.

ATOM We accumulate large positions and get profit without risks.ATOM/BTC Everything is shown and painted on the graph. On the chart, the main trend of this cryptocurrency. This coin of the second group is suitable for accumulating large positions. This technological solution has great potential, especially when ETH goes green, then a small ATOM will turn into a big COSMOS. Accumulation is an increase in the number of coins (output to profit) through trading and working with a complex%, and not by the "hamster" method of re-buying at the expense of new funds.

Coin at Coenmarket: Cosmos (ATOM)

A local situation on a larger scale on this trading instrument.

My previous trading idea for this trading pair.

ATOM / BTC Mid-term work. Potential rising flag

Allocation of funds / positions in work.

An example of work for less experienced traders with small deposits.

1) 60-70% in work in the main direction. Increases the "working volume body" due to the complex% summation of transactions. Your working amount will grow steadily.

a) From each purchase from the bottom of the channel, 10% -30% coins to the upper orders or wallet.

b) From each sale near the resistance of the channel, transfer 10% -30% of money (BTC, USDT) into an "safety cushion".

It is worth noting that if you are sure that there will be an exit from the channel in the near future, the percentage in the upper orders is higher, if you are more inclined to the fact that the accumulation will continue, then it will be lower. This is logical.

In this way, you accumulate coins and at the same time increase the part of the position (coins) that is not involved in the work, as well as the "airbag" itself (money).

"Safety cushion" (accumulation of money) initially 10-30% in money. In this example, BTC acts like money (its price against the dollar shouldn't bother you too much). Additional profit from working with compound interest at a distance of several local trends more than covers all fluctuations in the price of BTC. While these fluctuations can be exploited, inexperienced traders are better off not complicating their work. An easier way is to work in the same way with alt / dollar pairs.

PS. For experienced traders.

All the same + partial or full influence on the price. As the position grows, your potential influence on the price will also grow, it is rational to help the price move in a local direction favorable to you.

When increasing a position, consider the liquidity of the instrument. Remember that when the coin is pumped, it decreases several times, therefore, the probability of entering the market at reasonable prices without falling prices will not be possible. Hence, adequate position sizing matters.

If you are more experienced and play the "trading games", you should under no circumstances work against the general direction of the market. This is irrational and unprofitable. The market is pouring - take this chance. Use panic to your advantage. Market down - load the glass from above, unload from the bottom. Market growth is a mirror image.

Also remember that your large orders controlling price movements should always be protected by small orders given the liquidity and volatility of the instrument.

Make fake sets and dumps to guide the price and draw charts where it is rational, the volume should be adequate. It makes no sense to draw a large volume at a narrow price value on a small liquid instrument. There are people who have not yet forgotten how to think and adequately analyze the "imprint of actions on the chart." Do it wisely and remember to follow the beautiful realistic buying / selling history during this action.

Also, you should always remember. If you are earning too much compared to other market participants, it is very likely that you will run into problems up to the banning of your account (the name of the exchange does not matter). The less liquid the exchange is, the less the “critical amount” of earnings, and vice versa. Exchanges greet those who are losing money and are unhappy with those who are making money. This does not apply to small amounts, but if you multiply a large amount several times in a short period of time, you are likely to run into problems. Therefore, if the trade is going very well, do not forget to withdraw profits.

Below I have attached all my trading and training / trading ideas for almost 2 years.

Pump your mind and improve your experience - it will reward you.

Winrate and risk reward ratioHi everyone. In the pursuit of success in forex, traders tend to focus on finding a strategy that gives the highest accuracy of entry. The pursuit of perfectionism in trading blinds their eyes and does not let them see the "forest for the trees". So, what are you missing out on? What important detail is missing from your trading plan?

The profit/risk ratio is your advantage.

In this article, we will look at how you should calculate your risk-to-profit ratio for your working trading system. A Forex trading system should include a well-defined equity management system that is easy to follow. Money management is one of the most important aspects of any trading strategy (TS) today, but most traders neglect the whole concept of money management in their trading. Most forex traders want to focus on the entry points provided to them by their trading systems. Their dream is to find a TS that gives a buy entry signal at the lowest point on the chart and a sell signal at the very top!

The entry point is undoubtedly important. But do not forget that at the moment of entry, we can create an advantage not only in the exact entry into the trade, but also in creating a favorable statistical expectation. Specifically, by putting a good profit to risk ratio into the trade. Trading is a game of probability. We know that in N% of trades we will lose and that in X% of trades we will win. But we need to remember that we can easily improve our stats by simply ignoring trades where the profit potential does not exceed the potential loss by at least a factor of two.

It is the presence of money management in your trading strategy that reduces your losses and makes you hold on as a winner. I say "makes you" because you have built into your trading system a certain percentage of profitable trades, the knowledge of which will screen out your emotions in the process of trading.

Applying this simple money management system will give you a general idea of how to propel your trading exponentially forward and in a positive way. In this article, I will explain how, by developing your trading system, you will determine the size of a position before you open it. Please remember that these are the basics to help you think properly. The exact calculations, specifically for your strategy, you will need to do on your own.

"We've all heard the famous trading axiom: cut your losses, and let the profits run. This is the aspect of money management in your trading system that produces big winners. Money management puts aside the subjective feelings that are present in people. "

Richard Dennis

“I'll say it again: I never made my money by trading; I made my big money by waiting and letting my profits grow."

Jesse Livermore

The first aspect we have to understand about our trading system is that our system gives us a positive expectation. We can only do that by testing, but sometimes testing can give a negative result if you forget to set a profit to risk ratio for each trade of at least 1:1.5 in the rules of the strategy. All beginners say that a forex trading system without 90% of profitable trades sucks, and they will surely develop their own holy grail to the envy of others. They are wrong, of course.

In Pursuit of Perfection

For all the trading systems really working in the Forex market, it is important to note that:

- Professional traders are looking for performance, while novice traders are looking for perfection.

- Beginner traders are looking for quick profits.

Most novice traders get hung up on the number (percentage) of successful trades rather than total profits. They all buy into a system that is advertised as 90% winning. The question is, "What good is a system that provides 90% winning trades with an average win of 12 pips if you have to tolerate 60 pips of risk to achieve a win?" Do you see where I'm going with this? It's like your best friend after taking 3 karate classes is ready to fight 6 muzzleloaders in an alleyway. He's obviously going to lose)

Probability of bankruptcy of a trading account as a function of the percentage of profitable trades and the profit to risk ratio.

The table above shows the dependence of the probability of "losing" the deposit on the percentage of profitable trades in your trading system and the profit/risk ratio in each trade. Thus, we can see that even if your strategy works 60% of the time but the profit/risk ratio is kept at least at 1.5:1, you can already be sure that you will not lose all your money. But if the ratio of profit to risk is 1:1 with the same 60% of profitable trades, the probability of losing the deposit in a series of losing trades is 12%.

A profit/risk ratio of 1.5:1 or more is the right way to think about trading. The minimum characteristics of a profitable strategy is 40% of winning trades with a profit/loss ratio of 2:1 (see the table above). According to this table, if you make 100 trades (each one following the same rules) and you have a 40% winning trade with a 2:1 profit/loss ratio, your risk of ruin would be about 14%. This is the minimum point from which the system can be considered working.

What is the most important piece of information regarding risk of loss?

Let me help you out. Having a high winning percentage is not an indication that you'll come out a clear winner. If you have 55% winning trades with a 1:1 risk to profit ratio, then your risk of going broke will be in the neighborhood of 27%. So, if you're trading in a similar way, in addition to that it's better to have fewer positions with higher profits!

Overall, 42% winning trades with a 1.6:1 profit to risk ratio would also be a good option. That means you would take 1.60 pips out of the market for every 1 pip you risk. For example, by risking 40 pips, you get 64 pips. If the market turns against you (when volatility occurs), you adjust your stop up or down.

If your stop-losses and take-profits vary from trade to trade, try skipping trades where the profit/risk ratio is less than 1.5:1. And you'll see how your overall trading statistics will improve.

Conclusion

I hope this article will help you in forming and optimizing your own trading strategy. Don't get hung up on perfection, but search for and work through profitable trading patterns and profit will come to you.

Bites Of Trading Knowledge For New TOP Traders #14 (short read)Bites Of Trading Knowledge For New TOP Traders #14

----------------------------------------------------------------

What defines a Bear Market? -

A bear market is when a market or even individual securities experiences extended price declines. The condition observed in the equity markets is where securities prices fall 20% or more from recent highs triggered by negative investor sentiment and/or overall pessimism in the markets.

What defines a Bull Market? -

A bull market is the condition seen in a financial market or individual security in which prices are rising and/or are expected to rise. Commonly the rise in price is observed over an extended period of time and can last months or years.

What is Inflation? -

Inflation is a rise in prices and is often expressed as a percentage change over a period of time. Inflation could also be interpreted as a decline of purchasing power over time, meaning that a unit of currency buys less than it did in prior periods.

RISKS AND OPPORTUNITIES FOR CORPORATES AND INDIVIDUAL INVESTORS -

Common application of financial market instruments for managing risk and opportunities.

Diversification: Portfolio Risk Using FX Futures

Individual investors taking a portfolio approach with managed futures and spot foreign exchange could be entering into emerging market currency positions including for example Hong Kong Dollar, Singapore Dollar or South Korean Won.

Depending on the view of each of the currencies in the portfolio, it could be constructed to eliminate exposure to the U.S. Dollar. However, there may be a time during which investors would like to introduce U.S. Dollar exposure and they could do so by using Mini US Dollar Index ® Futures with a contract value of $10,000. For example, the U.S. Dollar Index ® may be observed to be in a medium term uptrend and an investor may want to consider entering into a long position in the Mini US Dollar Index ® Futures based on their strategy of choice and exit the position when either their profit target is achieved or their loss limits are triggered.

TRADDICTIV · Research Team

--------

Disclaimer:

We do not provide investment advice, nor provide any personalized investment recommendations and/or advice in making a decision to trade. Before you start trading, please make sure you have considered your entire financial situation, including financial commitments and you understand that trading is highly speculative and that you could sustain significant losses.

How To Lose ProperlyOne of the few aspects of forex trading where you can experience some certainty is that you will have losses. Losses are a part of trading, and one of the key differences between successful traders and the rest is not how much they lose, but how they handle those losses. Being able to lose is key to being a winner in the long run.

How are you currently coping with your losses in trading? How do they affect you? What effect do they have on your performance and trading results?

Let's break down three steps that can help you better manage your Forex trading losses.

Step 1: Reduce losses

The first step in effectively dealing with losses is " Reducing losses". It is a key aspect because if you get this step right, you will have to use step 2 and 3 less in the future. The first step can be seen as a kind of "disease prevention".

There are three aspects that will help you reduce your trading losses and have an impact on how you deal with them.

1. Reduce your losses

When I talk about reducing your losses, I do not mean trying to reduce your losses per se, as it is not realistic, I mean focusing on your trading strategy, maintaining trading discipline and reducing loss-making trades that, for example, arise from trading that is not part of your strategy and that you can therefore avoid.

Losses that occur as a result of orderly trading are nothing more than losing trades that are part of the trade. Losses incurred from opening trades that go against your trading strategy, when "something seemed there" to you, can be seen as bad trading or something else that could have been avoided. In short, don't be fooled. Follow your forex strategy.

2. Reduce the value of your losses.

Obviously, it all comes down to risk management again. It's important to recognize that large losses have a significant impact on our emotional state, and can often have an impact on our trading behavior, usually not in the best way, such as trying to "get back at the market. Never increase the lot size after a losing trade.

3. Reduce the mental and emotional impact these losses have on you

Your reaction to losses is a factor in how you got those losses (whether you followed your strategy strictly or not), their magnitude, as well as your perception and belief about those losses. If you don't like to suffer losses, and feel that you shouldn't have losing trades or dealing with a trade where losing trades are possible, then your reaction will be very different from those people whose thinking is more realistic and who realize that losses are an inevitable part of trading, that results are probabilistic and that not every trade is a winning trade.

Are you fully aware of the fact that losses are a part of trading?

Are you fully aware of the fact that every trade is not lossless and has a probabilistic outcome?

Step 2: Reacting to losing trades

Knowing how to lose is the key to becoming a winner.

This step comes down to how you actually handle yourself the moment you realize that you may have to accept a loss. Dealing with loss is extremely difficult, it has to do with factors such as our ego, our desire to win and our human nature of aversion to loss, and that is why the "loss reduction" phase is so important. However, even that one step in terms of accepting losses can still be difficult, even more so if we have had losses or losses before. Because of this, it would be helpful to have some strategies that could help you stay calm, focused and disciplined while in the heat.

Many people are stopped or taken out of the trade by feelings of anxiety or anger. Their behavior begins to be driven by the emotions they are feeling in that moment, causing them to lose control and discipline. The whole point is to be able to manage your emotional state in real time and keep your mental faculties open to trading, as well as to be able to own yourself and keep a tight discipline.

The only quick and easy way to learn how to manage your emotional state is to learn how to manage your breathing. When you are stressed, your breathing usually changes. It becomes ten times more frequent and intermittent, so you need to breathe deeper and longer. This will help you overcome the stress response and keep yourself calm, composed and, most importantly, disciplined.

It also helps me to connect the palms of my hands using my fingers. This is a simple ancient Indian technique for calming the nerves.

Also, taking the cognitive aspect, keep your sanity in these situations. What thoughts usually visit you the moment you execute a losing trade? "The market always goes against me." "It shouldn't have happened," etc. ...

These are unhelpful thoughts because they only increase your stress level. A better question to ask yourself is the following: "What would a successful trader say to himself in a situation like this?" This may help you to direct your thinking in the right direction, and as a result affect your feelings and lead to more positive behavior.

Another way to manage your mindset is to actually create some affirmations, phrases that you can repeat to yourself when you are in a situation that will probably bring you a loss, and channel your thoughts, feelings and emotions and override any unconscious and habitual reactions that you might have developed in yourself. Remember that what you focus your attention on will determine your emotional state and discipline.

It can be very helpful to focus on phrases that help you concentrate on your trading process and do the right things (which is probably not easy) at the right times and for the right reasons; for example: "I'm a winner because I follow my trading plan."

Step 3: Recovering from losses

It's helpful to have some strategies that can help you stay calm, focused and disciplined while in the heat.

At the end of your trade, take stock of your losses today. What can you do to do this?

1.Evaluate your state of mind

How do you feel? On a scale of 10, evaluate your overall trading condition, with 10 being the other end of the scale, and 1 being the other end. Where are you now?

2. Evaluate and analyze the cause of your losses.

What type of loss occurred - a losing trade or a bad trade? Can you learn a lesson from the trade? Is there anything you can do about it in the future?

Evaluate and analyze the cause of the loss. What lesson can you learn from it?

3. Control your reactions.

There are a number of ways in which you can manage your reactions to losses.

On a cognitive level, you want to be fully accountable for your thoughts, your perceptions, and the meaning you give to your losses. Your losses have the meaning you give them. Loss does not mean, for example, that you are a loser. You can take a different perspective by looking at things more broadly, what lesson can I learn from this? How will I feel about it at the end of the day, at the end of the week, at the end of the month, after 6 months, after a year, after 5 years?

On a behavioral level, you could use a breathing or relaxation technique, go for a walk, or do some physical exercise to help you deal with feelings of loss.

Sometimes it's just a matter of time. One trading session or day can often be enough to help you get rid of some emotions, regain some perspective, and be ready to start trading again.

4. Get it together.

Come back and be ready to start trading forex again emotionally and strategically. Remember your trading plan, focus on your breathing, and then act.

Bottom line.

If you want to learn to lose like a winner, and develop skills that will help you improve your chances of becoming a successful Forex trader in the long run, remember:

- Reduce your losses: develop the ability to avoid strong reactions to losing trades, by reducing avoidable losses and bad trades; by managing position size and trade outcomes; and by developing a mindset that has a more positive view of losses.

- Properly respond to your losses by directing your thoughts and focusing your attention on controlling your breathing to create a state that will enable you to conduct yourself in the proper manner necessary for orderly trading.

- Learn to recover from your losses by assessing your condition, analyzing, controlling your reactions, and focusing on trading again.

Margin callWhen there are not enough available funds in your account to meet margin requirements, the broker issues you a warning, which is called a Margin Call.

Your broker automatically sends a margin call when your free margin reaches $0 and your margin level reaches 100%. From now on, it will be impossible to open new positions.

Thanks to leverage, traders get leverage that allows them to open positions that are several times larger than the size of their trading account. This helps to earn much more, but losses are also growing. It is at such moments, when you hold too large a position and the market goes against you, that you can get a margin call. This will trigger the automatic closing of all stop-out positions if the market continues to move against you.

An example of a margin call.

You open a forex trading deposit of $4000 and use a leverage of 1:100. As we know, the lot size on forex is equal to 100,000 units of the base currency ($ 100,000). When using the leverage of 1:100, you must deposit $ 1000 of your money as collateral for each open transaction in the amount of one lot.

After analyzing the EUR/USD currency pair, you decide that the price will rise. You open a long position for two standard lots at EUR/USD. This means that you are using $2,000 of your funds as collateral. At the same time, the free margin will also be $ 2000. The cost of one item when trading one lot of software will be equal to $ 10. This means that if the price drops by 200 points, the free margin will reach $ 0, the equity level will be equal to the margin used, and you get a margin call.

How can margin calls be avoided?

To avoid margin calls, you need to follow the rules of risk management. Before opening positions, you need to know where your stop loss will be and how much it will equal as a percentage of capital. The distance from your entry point to your stop loss should determine the size of your position and, accordingly, your risk level. Do not do the opposite: the size of your position should not determine the size of the stop loss.

You may have heard that it is not worth risking more than 5% of the capital in one transaction. Trading according to this rule is, of course, better than trading without rules, but an experienced trader will still say that it is too dangerous to risk 5%. Using the 5% rule, you can lose 20% of your capital in just 4 trades, which is too much.