Tutorial Bullish Zone & Map (84% Easy Target Short-Term)Today TUTUSDT (Tutorial) has a combination of bullish signals.

It is moving above three strong support levels that were formally resistance. The red zone has been flipped, resistance turned support. The green and blue zones are yet a work in process. The action is happening above but the confirmation only comes ones the daily candle (session) closes above. That is, if today closes above 0.04387, this final resistance level has been flipped support.

Above 0.5 Fib. extension or 0.03951 is the bullish zone. TUTUSDT is now strongly bullish.

Today we have a full green candle and this is great, with rising volume. The highest volume since 1-June with room of course for it to go higher. We can easily see higher prices in the coming weeks and months.

Notice that this is a young chart, but if we couple marketwide action with short-term action, we can predict the next move. This is using the assumption that the market is one; what one does, the rest follows.

It is tricky but with practice you can predict how the market will move as well.

Thanks a lot for your continued support.

The next target stands at 0.08086. That's the main target short-term. An easy target I should say. Potential sits around 84% right now.

Namaste.

TUTUSDT

TUTUSDT Forming Bullish BreakoutTUTUSDT is currently showing a bullish breakout from a falling wedge pattern on the daily chart—a highly reliable reversal setup often signaling the end of a downtrend and the beginning of an upward move. This breakout is accompanied by a healthy increase in volume, adding further confirmation to the move. Falling wedges are generally considered powerful patterns, especially when followed by strong bullish candles as seen here. This setup is attracting both technical traders and market watchers who are closely monitoring the next leg up.

The potential for a 40% to 50% gain is clearly visible on the chart, with projection targets well-defined and aligned with recent price action. The momentum is building, and TUTUSDT seems to be gearing up for a strong continuation rally. A sustained move above the wedge resistance and current local highs could pave the way for a retest of key resistance zones from previous price spikes.

This breakout comes at a time when broader market sentiment is slowly shifting toward optimism. As the altcoin space regains traction, tokens with solid technical setups like TUTUSDT become prime candidates for short- to mid-term investment. Additionally, the relatively low market cap and increasing investor interest in this project add further fuel to its upside potential.

For traders seeking early-stage breakouts with strong technical structure and positive sentiment, TUTUSDT offers an attractive opportunity. Keep an eye on volume continuity and market-wide conditions as confirmation for a full rally toward the upper targets mentioned in this setup.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

TUT Analysis (2H)From the point marked as "start" on the chart, the TUT correction has begun.

It appears to be an ABC correction, and we are currently in wave B of this ABC.

Wave B seems to be a complex correction, possibly a triangle or a diametric, and we are currently in wave c of B.

Wave c of B itself appears to be forming a symmetrical pattern.

It is expected to move toward the red box while maintaining the green zone.

The targets are indicated on the chart.

A daily candle closing below the invalidation level would invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

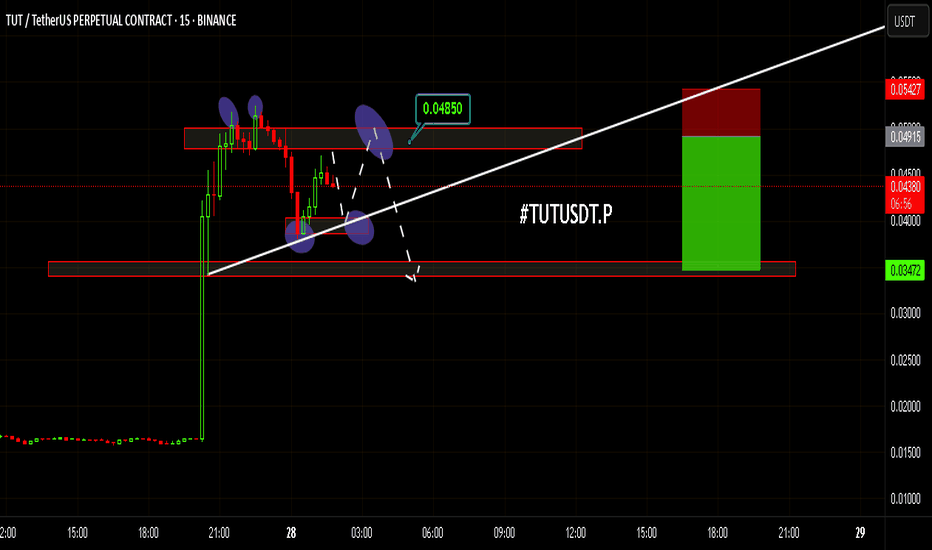

#TUTUSDT.P | Is the Drop Deepening?#TUTUSDT.P

Looking at the chart, I expect the price to hover within a range for a while before making sharp downward moves. As shown in the visual, I anticipate the price to fluctuate between $0.043 - $0.038, then break the $0.037 - $0.037 levels and quickly test $0.032 and $0.027 levels.

However, before the major drop, I believe the price will give us another opportunity to enter a short position. Therefore, I have set my short position target at $0.038 after opening it at $0.043.

May our trades be profitable, friends! 🚀📊💰🔍⚡⏳

Manage your risk, stay in the game! 🎯🔥

#AlyAnaliz #TradeSmart #CryptoVision #TUTUSDT #Binanciega

Will the Classic Formation Repeat ?Hey friends, here's the next analysis for today on #TUTUSDT.P. Lately, I believe this classic pattern we’re familiar with will repeat itself, just like it has with other coins. 🚀📊

The price initially makes a sharp correction, pulling back to the Fibo 0.382 level 🔄. At this point, it finds strong buyers and pushes itself back up. During the decline, it tests the lower point of a small double top it broke earlier, then rebounds and, as it approaches the 0.382 level, it finds strong buyers again, preventing the price from dropping further. It creates the impression of a double bottom during the drop and rise. Then, the price breaks the neckline of the double bottom pattern and hangs around there for a while before the inevitable sharp drop with large bearish candles. 📉🔥

We’ve pretty much memorized this formation by now, right? 😅 I’ll leave you with that, and now I’m off to sleep! 😴

#TUTUSDT.P is looking like it's following the same path again. Therefore, I recommend getting into positions gradually. The price should first reach around the $0.040 level, then push towards $0.048-0.049, where it will likely make a final stop loss hunt 🔪. I think it’s a great position with a 1:3 risk ratio! 💰

By the way, due to the Funding Rate situation, I recommend not opening a short position and going to sleep 💤. Also, keep leverage at a minimum and pay attention to the Funding Rate "tax hours." ⏳

Stay green, friends! 🍀💚

Manage your risk, stay in the game! 🎯🔥

#AlyAnaliz #TradeSmart #CryptoVision #TUTUSDT #Binanciega

TUT ANALYSIS (1H)It seems that wave A has completed, and this token has entered wave B, which is bearish. The wave B structure appears to be symmetrical.

In the green zone, the price may sweep the liquidity pool and bounce upward.

Targets are marked on the chart. A 4-hour candle closing below the invalidation level will invalidate this analysis.

invalidation level: 0.015680$

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You