Ather’s Affordable EV Announcement Triggers Market Rally...Technical Analysis:

Ather Energy has successfully broken above the key resistance level of ₹330 and is currently trading around ₹340. This breakout is supported by a noticeable surge in volume, confirming bullish momentum. The ₹330 level, which previously acted as a strong resistance, may now serve as a potential support in the event of a retest. Traders and investors can look for buying opportunities on dips near ₹330, while those already holding the stock are advised to continue holding for further upside.

Fundamental Analysis:

From a fundamental standpoint, Ather’s maiden quarterly results have been encouraging. The company reported a one-third increase in revenue, while its EBITDA loss narrowed to ₹172 crore, down from ₹239 crore in the same quarter last year. This marks a significant step towards operational efficiency and profitability.

Adding to the positive sentiment, Ather recently announced that it will unveil its new EL EV platform and upcoming concept models in August 2025. The highlight of this announcement is that the new scooter will be Ather’s most affordable offering, signaling a strategic push to expand market penetration and compete in the mass segment of the EV market.

Conclusion:

The breakout at ₹330, supported by improving financial performance and strong product pipeline news, suggests a bullish outlook for Ather Energy in the near term. Investors should monitor the ₹330 level for price retest and accumulation opportunities. Holding is recommended for existing investors, while fresh entries can be considered on technical confirmation around support zones.

Note: Due to ongoing global uncertainties, market conditions may remain volatile. Investors are advised to exercise caution and manage risk accordingly.

Twowheeler

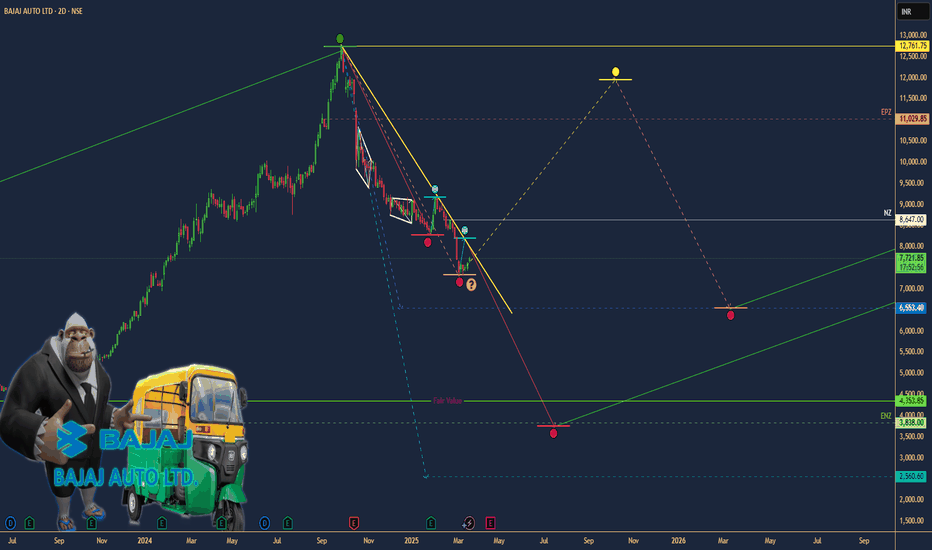

$BAJAJAUTO: Bajaj Auto – Wheeling to Wealth or Spinning Out?(1/9)

Good afternoon, everyone! ☀️ $BAJAJAUTO: Bajaj Auto – Wheeling to Wealth or Spinning Out?

With BAJAJAUTO at ₹7,711.25 post-CEO nod and ₹1,500 crore boost, is this two-wheeler titan revving up or stalling? Let’s ride into it! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 7,711.25 as of Mar 19, 2025 💰

• Recent Move: Up 1.64% on news, below $12,774 high, per data 📏

• Sector Trend: Auto sector steady, with two-wheeler demand in focus 🌟

It’s a smooth ride—value might be in gear! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx ₹2.12 lakh crore (web ID: 6) 🏆

• Operations: Two-wheelers, financing via subsidiary ⏰

• Trend: Leadership stability, credit growth, per data 🎯

Firm in its lane, with expansion in sight! 🚴♂️

(4/9) – KEY DEVELOPMENTS 🔑

• CEO Re-appointment: Rajiv Bajaj for 5 yrs from Apr 1, per data 🌍

• Investment: ₹1,500 crore into Bajaj Auto Credit Ltd., per data 📋

• Market Reaction: Stock up, signaling confidence 💡

Revving up leadership and capital! 🛵

(5/9) – RISKS IN FOCUS ⚡

• Market Volatility: Trade tensions, economic shifts 🔍

• Competition: Hero MotoCorp, TVS pressure sales 📉

• Rates: Rising costs could hit demand ❄️

It’s a twisty road—watch the turns! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Brand Power: Two-wheeler leader in India 🥇

• Subsidiary Growth: Credit arm expansion, per data 📊

• Dividend: Steady payouts attract income fans 🔧

Got horsepower to spare! 🏍️

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Below peak, macro risks 📉

• Opportunities: Two-wheeler demand, financing growth 📈

Can it accelerate or hit a bump? 🤔

(8/9) – POLL TIME! 📢

BAJAJAUTO at ₹7,711.25—your take? 🗳️

• Bullish: ₹9,000+ soon, growth kicks in 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: ₹7,000 looms, market stalls 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

BAJAJAUTO’s ₹7,711.25 price reflects confidence 📈, but volatility’s in the air 🌿. Dips are our DCA fuel 💰—buy low, ride high! Gem or bust?

The Wizard with a Magic Wand !!! - Ward Wizard MobilityWardwizard Innovations & Mobility Limited is a publicly-held electric vehicle manufacturing company based in India. It is engaged in manufacturing eco-friendly electric scooters and vehicles. It operates in the electric vehicle manufacturing sector in multiple countries, including India, Uganda, and Nepal

IPO began in 2015 with the initial price around Rs. 2 - Given the focus on Electric Vehicles the price skyrocketed to over Rs. 100 / share within 7 years - literally 50x. Later it started a Flag pattern consolidation on weekly and price fell around 30-35 levels before taking a Bullish Reversal

India is leading in the Renewable Energy space and even till date the # of 2 wheelers in India is multiple times higher than 4 wheelers. EV Boost has even aggravated the Electric 2wheeler space. Though this stock does not have much history on charts - this is a Multi-bagger stock which is set to Write its own History

Technicals:

The initial call was given around 40 Levels and today it trades 82+ - a staggering 105% in a matter of 6 months.

Currently the price has completed a Rounding Bottom BO above 78 and today's 13% increase accompanied by significant volume accumulation for the past 15-20 weeks is a strong confirmation of BO.

Target: 95, 120, 140++

Disclaimer:

Stocks-n-Trends is NOT a SEBI registered company. We do not provide Buy / Sell recommendations - rather we provide detailed analysis of how to review a chart, explain multi--timeframe views purely for Educational Purposes. We strongly suggest our followers to "Learn to Ride the Tide" and consult your Financial Advisors before taking any positions.

If you like our detailed analysis, please do rate us with your Likes, Boost and share your comments

-Team Stocks-n-Trends