Twitter / Important Levels and ForecastGood morning traders, welcome to the last day of this 2020. Today, we bring you a stock that we consider to have great upside potential if certain conditions are met.

🔸Well, the first thing to detail is that we can see that from historical highs to the current moment, the price has a parable behavior, where a downtrend is generated, then the price finds a bottom, and the subsequent recovery begins.

🔸Theoretically, this movement leads us to see the price in the historical highs again in the short term.

What should we expect in the short term?

🔸At this moment, the price is facing a strong resistance zone. So first of all, we need this zone to be penetrated to the upside.

🔸Once this happens, two scenarios can occur. First, that the price generates a retest to the broken zone and then continues the upward movement, and the other option is that it is a direct movement towards highs.

🔸What we will necessarily wait for is that correction and retesting to the broken zone, to have a good risk-benefit ratio, and a safe place to position the stop loss.

TWTR

TWTR | Rolling over?Twitter rolling, down to horizontal support?

Interesting to note:

(1) downtrend resistance on the RSI and

(2) negative divergence between RSI and Brown Composite Index*

(3) looking back, lots of similar historical price-action compared with now

* Derivative of RSI (and no range-constraint)

Thoughts welcomed.

$TWTR accumulation pattern complete, new Bullish ERA comingSince IPO

$TWTR hasn't broken out,

Instead, it range traded then dumped from $50 to $13 and back to $50

The outcome?

An accumulation pattern, a very bullish one.

The same structure can be observed on $FB

Just before it broke out from $70 to $274

That's right folks,

a %1000 bullish move since $FB cracked that accumulation pattern.

Targets for $TWTR

$67

$82

$124

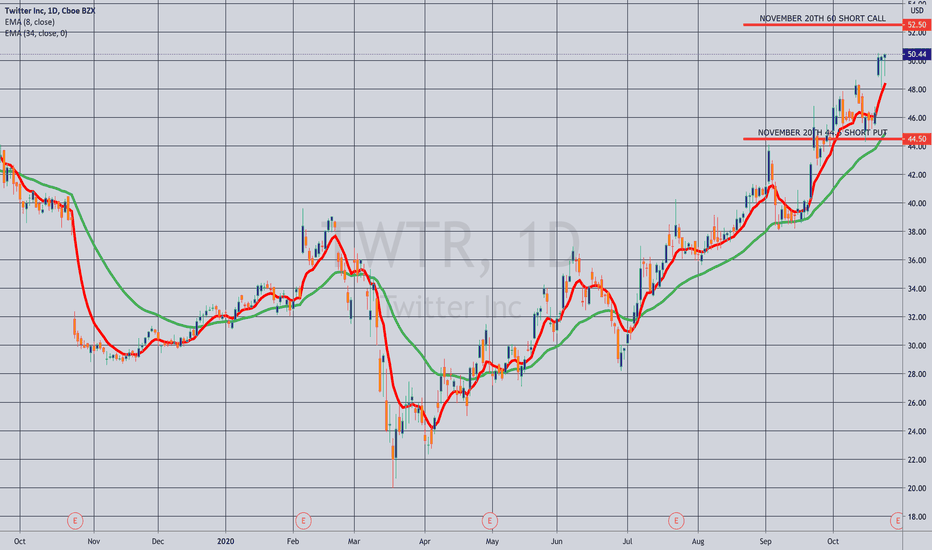

THE WEEK AHEAD: TWTR, MGM, AMD EARNINGS; JETS, XOP, GDXJEARNINGS:

If you like to play earnings for volatility contraction, there are a ton this coming week. Here are the ones that made my cut for volatility contraction plays based on options liquidity and bang for your buck as a function of stock price:

TWTR (49/73/15.9%),* announcing Thursday after market close.

MGM (16/69/15.2%), announcing Thursday before market open.

JBLU (22/73/14.6%), announcing Tuesday before market open.

TECK (20/64/14.1%), announcing Tuesday before market open.

AMD (30/62/14.0%), announcing Tuesday after market close.

BA (19/59/12.4%), announcing Wednesday after market close.

FB (47/52/11.1%), announcing Thursday after market closes.

Honorable Mentions:

AMZN (63/51/11.2%), announces Thursday after market close. (Option illiquid).

AAPL (36/47/9.8%), announces Thursday after market close. (November 20th short straddle paying less than 10% of stock price).

GOOG/GOOGL (40/40/8.6%), announce Thursday after market close. (Options illiquid).

MSFT (32/40/8.2%), announces Tuesday after market close. (November 20th short straddle paying less than 10% of stock price).

Pictured here is a TWTR short strangle in the November 20th expiry (26 days) with the short options camped out at the 22 delta. Paying 2.72 at the mid price as of Friday close, it has -.55/10.56 delta/theta metrics and break evens wide of 2 times the expected move on the call side, between the expected and 2x on the put.

For those of a defined risk bent, the uneven winged** November 20th 40/44.5/60/65 iron condor pays 1.50, has delta/theta metrics of 2.53/3.43, and has a 2x expected move break even on the call side and an expected move break even on the put.

MGM: Short straddle or iron fly with risk one to make one metrics; 25% of credit received take profit.

JBLU: Short straddle or iron fly with risk one to make one metrics; 25% of credit received take profit.

TECK: Short straddle or iron fly with risk one to make one metrics; 25% of credit received take profit.

AMD: Short strangle with 2 x expected move metrics; iron condor paying one-third the width of the wings; 50% of credit received take profit.

BA: Short strangle with 2 x expected move metrics; iron condor paying one-third the width of the wings; 50% of credit received take profit.

FB: Short strangle with 2 x expected move metrics; iron condor paying one-third the width of the wings; 50% of credit received take profit.

EXCHANGE-TRADED FUNDS RANKED BY BANG FOR YOUR BUCK AND SCREENED FOR THE DECEMBER AT-THE-MONEY SHORT STRADDLE PAYING >10% OF STOCK PRICE:

JETS (12/50/16.1%)

XOP (15/56/16.0%)

GDXJ (17/49/15.1%)

SLV (36/48/13.9%)

EWZ (17/43/13.3%)

XLE (26/44/12.6%)

GDX (16/40/12.6%)

XBI (30/41/11.6%)

SMH (21/35/10.3%)

EWW (23/35/10.0%)

I threw JETS in here due to continued high implied volatility in airlines which is sticking in there even for names that have already announced "earnings" (or lack thereof) (e.g., DAL (63.5%), UAL (80.7%), AAL (106.6%)).

BROAD MARKET:

QQQ (30/34.9.7%)

IWM (29/33/9.0%)

SPY (23/27/7.6%)

EFA (23/24/6.3%)

IRA DIVIDEND-PAYERS SCREENED FOR THE DECEMBER AT-THE-MONEY SHORT STRADDLE PAYING >10% OF STOCK PRICE:

KRE (25/45/13.3%)

XLE (26/44/12.6%)

EWZ (17/43/13.3%)

* -- The first metric is the implied volatility rank (where 30-day implied volatility is relative to where it's been over the past 52 weeks); the second, implied volatility in expiry nearest 30 days until expiry; and the third -- for earnings: what the November at-the=money short straddle is paying as a function of stock price; for exchange-traded funds, broad market, and IRA dividend-payers, what the December at-the-money short straddle is paying as a function of stock price. For lack of a better term, I've dubbed this last metric as the "bang for your buck".

** -- Only 5-wides are available on the call side.

TWTR about to go further up to $52-$53Congratulations to those who followed my linked idea. We got in nicely around $46.

My main target still stands around $53, there is a possible 2nd target around $52 as there is a weekly resistance there.

I believe we will go up after yesterdays very bullish hammer. It dropped hard but got bought back very well and even ended positive.

$TWTR At Turning PointSince the March low Twitter has been trading within a channel that it is currently trying to break out from.

Additionally $ NYSE:TWTR TWTR is currently making new 52week highs, which is always a good setup for a long position.

With the earnings in mind it will be interesting to oberserve whether we can break out of the channel and continue the bullish momentum $SNAP earnings brought to us,

or if we fill the gap and retest the trendline within the channel.

If we dont fill the gap, there is not much resistance up ahead, except major levels that go back all the way to 2015/14 (3 red lines).

If Twitter will outperform earnings expectations we might even be able to fill the gap all the way back from February 2014 (red box).

Tell me your opinion in the comments!

Twitter [TWTR] breaking through a 6 year trendline Twitter has recently broken through the 6-year trendline as seen in the chart. This week it has successfully retested the trendline as support as well.

The Twitter train is about to get wings and fly upwards.

Target 1 would be 50

Target 2 would be 53.48

I believe the move up will start next week.

This is not financial advice, do your own research.