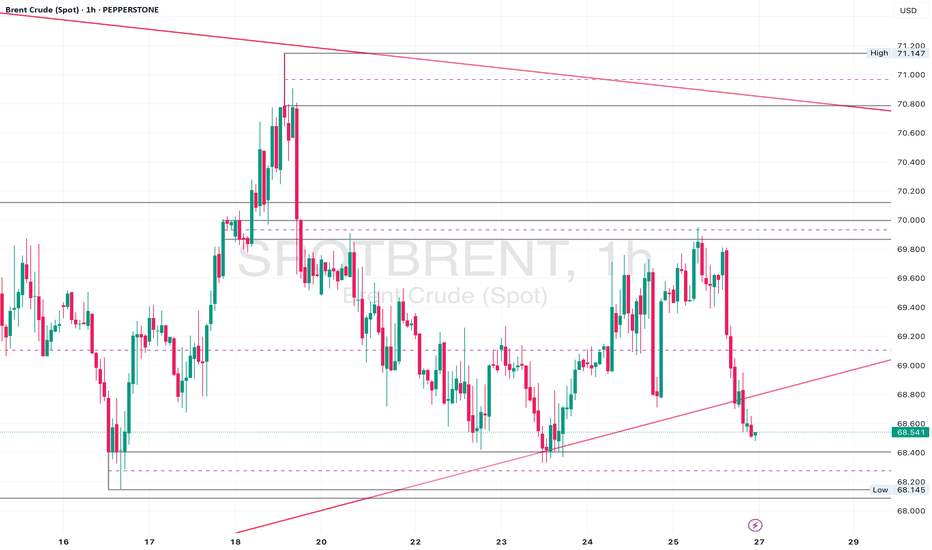

Brent Crude Sitting at Key Support – 69.20 Hold for a Rebound?Daily Analysis:

Price is holding above the ascending trendline and forming higher lows. Multiple rejections from the 68.00 region suggest strong demand. As long as we remain above the trendline, bulls stay in control.

4H Analysis:

Pullback after rejecting 71.00. Now sitting inside the 69.60–69.20 demand area. Bullish channel is still valid unless we break below 68.50.

1H Analysis:

Price broke the rising channel but is now hovering near key support. Bullish re-entry possible if lower timeframe aligns around 69.60.

Confirmation & Entry:

If we see bullish engulfing or pin bar at 69.60–69.20, this could signal a long setup back to 71.00. Invalidated on clean break below 68.50.

Crude Oil Brent

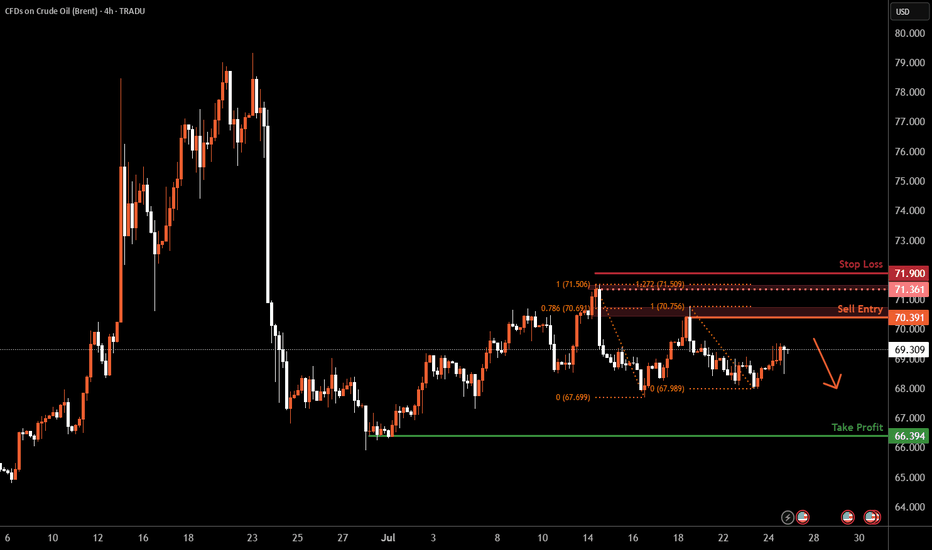

Brent Oil H4 | Heading into a swing-high resistanceBrent oil (UKOIL) is rising towards a swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 70.39 which is a swing-high resistance that aligns closely with the 78.6% Fibonacci retracement.

Stop loss is at 71.90 which is a level that sits above the 127.2% Fibonacci extension and a swing-high resistance.

Take profit is at 66.39 which is a swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

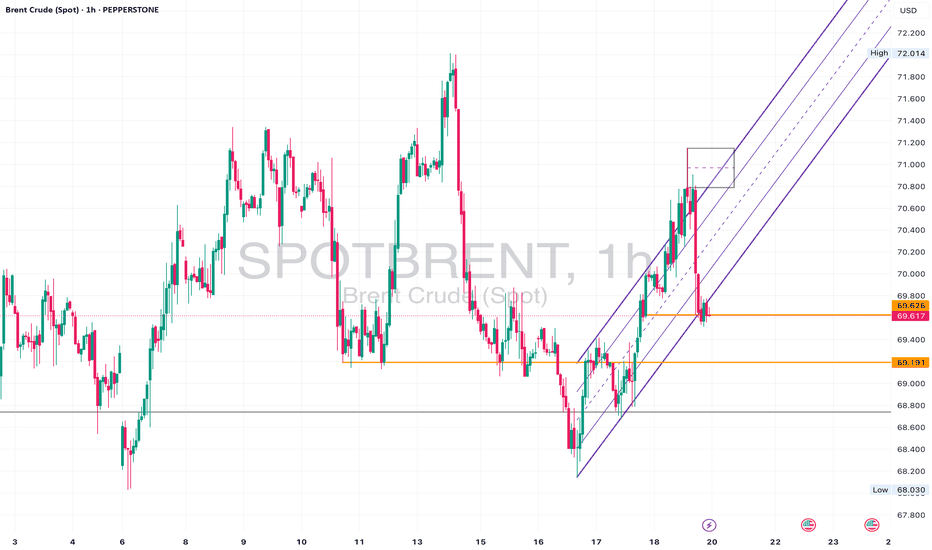

Brent UKOil - Neutral Slightly Bearish • Daily: Price is sitting above long-term trendline support, but momentum is waning.

• 4H: Structure looks indecisive with constant failures near 71.00.

• 1H: Recent break of the upward channel. Now retesting that zone from below.

⚠️ Watch For:

• Retest of 69.60–70.00 as resistance.

• Break and close below 69.20 could signal deeper downside.

• If it holds above 70.20 again, bullish bias resumes.

"UK Oil/Brent Heist Plan: Thief Style Breakout Strategy"🛢️💣 "BRENT Energy Heist Plan 💸: The Thief Trader's Playbook to Rob the UK Oil Market!" 🔫📈

🚫 This is a creative and educational overview of a market strategy. It does not encourage illegal activity. Please trade responsibly and within your own risk tolerance.

🌍 Hola! Bonjour! Marhaba! Hello, Money Makers & Market Thieves! 🤑💰📊

Welcome to the Thief Trading Style — a unique, bold, and tactical approach to trading the UK Oil Spot (Brent) market like a pro bandit on Wall Street. We don’t chase the market… we set the trap, wait, and strike like skilled robbers at the vault. 🔓💼

🧠💡Game Plan Summary:

📌 Asset: UK Oil Spot / Brent

📌 Style: Day Trade / Scalping

📌 Bias: Bullish Breakout

📌 Thief’s Method: Layered DCA Entries, Breakout Setup, Swing-Based SL, Aggressive TP

🎯 ENTRY - “The Vault Break”

🚨 Codename: Break & Retest Mission

Wait for a clean breakout above the Moving Average Wall (around 70.500) followed by a retest confirmation. That’s your green light!

✅ Buy Stop Entry: Above 70.500 after a clean candle close & retest.

✅ Buy Limit (Pullback): Near recent swing low or 15–30 min timeframe zones. Use DCA or order layering to reduce risk.

📌 Tip: Set up alerts at the breakout level — never miss the move.

🛑 STOP LOSS - “Escape Route”

🎙️ "Yo, Thief Rule #1: Plan the exit before the entry."

📍 SL suggestion: Swing Low @ 64.000 (based on 2H structure).

🧠 Risk management is key – consider your lot size, margin, and how many layered orders you're stacking.

📢 Optional: Trail that SL once price moves in your favor — lock your loot!

💸 TAKE PROFIT - “The Clean Getaway”

🎯 Target: 72.200 — but don’t be greedy. If the market gets shaky, exit before the cops (sellers) show up!

📌 Be ready to close manually if you smell reversal.

🔍 Fundamentals & Macro View

UK Oil is experiencing strong bullish momentum, driven by:

📰 Geopolitical tensions

🛢️ Supply-demand imbalances

📊 Positive sentiment & institutional flow (Check COT, Macro Outlooks, and Sentiment Reports)

👉 Stay updated with news drops and macro data that can flip the script — set economic calendar alerts.

⚠️ News Release Survival Tips

❌ Avoid new entries during high-impact news.

✅ Use trailing SL to protect running trades.

🔄 Monitor position sizing — volatile swings can eat your equity.

💥 SUPPORT THE CREW!

If you’re vibing with this Heist-Style Trading Analysis, smash that ❤️ Boost Button on TradingView and join the growing crew of market robbers making money with precision and attitude! 🏆💰📈

🚨 More Heist Plans coming soon — follow for real-time setups & updates!

📌 DISCLAIMER:

This analysis is educational and based on personal trading style. Always DYOR (Do Your Own Research), and tailor trades to your own risk profile. Markets change fast — stay agile and sharp! 🧠💼

WTI Crude Oil: Double Engulf + H&S Breakdown Points to $40Hello guys! Let's dive into WTI!

The weekly chart of WTI Crude Oil reveals a bearish Head & Shoulders pattern playing out over a long-term descending channel. Price recently got rejected from the upper trendline, showing weakness despite a short-term bounce.

- Engulfed 1 & 2:

Two major engulfing zones failed to hold as support, turning into strong resistance.

- Bearish Scenario in Play:

After the recent upside move into resistance, price is likely to follow one of two paths:

- Continuation Within the Channel:

Rejection from the upper bound of the descending channel leads to a stair-step decline toward the $47–52 zone.

- Final Rejection from Supply Zone ($83–89):

A larger corrective push could test this area before a full collapse toward the long-term demand zone.

Main Target:

The blue shaded region ($36–47) stands out as a strong long-term demand zone, where buyers may finally step in.

____________________

Invalidation point:

Unless crude oil breaks above the $89 zone with strong volume, all signs point to further downside.

The chart structure favors a slow bleed with temporary bounces, ultimately targeting the $40s.

Crude oil $ukoil - Final falling oil has been a barometer of the financial market for the last decades.

I look at the formations and I see that we will see a renewal of the bottom in the coming months, I will not say the reasons, you just need to wait a little.

I've been talking about the fall for a long time, but it's not over yet.

After the final fall, I expect a renewal of the highs, due to the worsening situation in the Middle East, this will be after September

Best Regards EXCAVO

DIESEL OIL GOES 'STILL-RUNNING', AND IT IS NOT A MEME AGAINDiesel Oil NY Harbor ULSD December 2025 futures contracts are trading around $2.25/gallon, once again above its 52-week average, with recent technical ratings indicating a strong buy.

The market has shown a 4.50% rise in the past 5-Day time span, reflecting bullish momentum.

Fundamental Perspective

Supply: Distillate inventories are 20% below the five-year seasonal average, the lowest since 2022. Refinery utilization is high at 94.7%, leaving little buffer for disruptions.

Demand: Distillate consumption has risen to 3.794 million barrels per day, up 260,000 b/d year-over-year, driven by robust industrial activity and summer travel.

Geopolitics: A U.S.-brokered ceasefire in the Middle East has reduced immediate supply risks, but the situation remains fragile and could quickly change.

Macroeconomic Risks: While fundamentals are bullish, potential U.S. recession risks and data reporting delays add uncertainty. Monitoring GDP growth and manufacturing PMIs is crucial.

Summary

ULSD futures are technically strong and fundamentally supported by tight inventories and robust demand, but traders should remain vigilant for macroeconomic and geopolitical shifts.

--

Best wishes,

@PandorraResearch Team 😎

Brent Oil Robbery: The Thief’s Guide to Energy Market Profits! 🚨💰 THE OIL VAULT HEIST: UK OIL SPOT/BRENT TRADING STRATEGY 💸🔫

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers 🤑💰💸✈️

Based on our 🔥Thief Trading style analysis🔥 (both technical and fundamental), here’s the master plan to heist the UK Oil Spot/Brent Energy Market. Follow the blueprint carefully—this strategy focuses on long entries, with a daring escape planned near the high-risk RED MA Zone where bearish robbers and consolidation traps await. 🏆💸 Take your profit and treat yourself, fellow traders—you earned it! 💪🏆🎉

🕵️♂️ Entry 📈

💥 The vault is wide open! Time to swipe that bullish loot—heist is on!

Place buy limit orders within the 15 or 30-minute timeframe, near swing lows/highs for pullback entries.

🛑 Stop Loss 🛑

📍 Thief’s SL—recent swing low and below the moving average (4H timeframe) for day/swing trades.

📍 Adjust SL based on risk, lot size, and number of orders.

🎯 Target

🏴☠️💥 70.800 (Aim for the big loot!) OR escape before the target

🔥 Market Heist Overview

The UK Oil Spot/Brent market is currently showing bullishness 🐂, driven by key factors—perfect for a day/scalping trade robbery! ☝☝☝

📰 Additional Tools & Analysis

📊 Get the Fundamental, Macro, COT Report, Quantitative Analysis, Sentiment Outlook, Intermarket Analysis, Future Targets—check our bi0 liinks 👉👉👉🔗🔗

⚠️ Trading Alert: News Releases & Position Management

📰 News can rattle the vault! 💥

✅ Avoid new trades during news releases.

✅ Use trailing stop-loss orders to protect profits.

💖 Supporting our heist plan?

💥 Smash the Boost Button 💥 to empower the robbery team.

Let’s make money every day in this market with the Thief Trading Style! 🏆💪🤝❤️🎉🚀

👀 Stay tuned for the next robbery plan, thieves! 🤑🐱👤🤗🤩

Brent Oil Breakout Heist – Bullish Robbery in Progress!🕶️ Brent Oil Job in Motion – Market Robbery Blueprint by The Chart Bandits 💼💸

What’s up, gang? 👋 Hola, Ola, Bonjour, Hallo, Marhaba! 🌍

Calling all market robbers, trend thieves, and slick profit snatchers! 🤑💰💥

We’ve got eyes on the UK Oil Spot / Brent Energy Market – and this time, it’s a clean breakout job. According to our Thief Trading Code (yeah, that’s the street manual we use), the setup’s lit and the vault’s wide open. Here’s the drill:

📈 Entry Plan – The Break-In Point:

The score begins above MA level 65.400. When that line cracks, it’s time to move.

You can either:

🔹 Set buy stop orders just above the breakout zone

🔹 Or wait for a pullback to a 15m or 30m swing low/high and enter with style

🚨 Pro tip: Set your alerts. Real thieves don’t sleep on breakouts.

🛑 Stop Loss – Safety First, Bandits:

Let the breakout breathe. Don’t slam the SL too early.

Once it confirms, tuck your SL near the 4H swing low – around 64.000.

Lot size, risk appetite, number of positions – all play into where you hide your exit door.

Just don’t blame the crew if you jump in blind. ⚠️

🎯 Take Profit – The Escape Route:

Target set at 70.000 – hit it, grab the bags, and disappear before the bears sniff us out. 🏃♂️💨

📊 Why This Heist Works:

The market’s lookin’ bullish – real heat from fundamentals like:

Macro setups

COT positioning

Intermarket analysis

Sentiment vibes

Storage & inventory updates

🔍 Want the full blueprint? Fundamentals, charts, deep dives – check my profille for the linkss 🔗👀

⚠️ Heads-Up – News Drops Can Wreck the Getaway:

Don’t enter during high-impact news

Protect profits with a trailing SL

Always expect the unexpected, robbers 🚧📉

💥 Smash the Boost Button if you’re part of the Thief Crew!

We’re not just trading – we’re executing blueprints and stealing clean gains.

Stay tuned for the next setup. You know what time it is...

🕶️ Trade smart, loot fast, vanish smooth. 🐱👤💸🚀

Brent Oil – Bearish Break or Bounce from Long-Term Support?Brent Oil is hovering just above critical support near 66.00, with a clear bearish structure visible across timeframes:

🔎 15m & 1h:

Price action is consolidating near the ascending support trendline drawn from early June lows. Short-term price structure shows lower highs and lower lows, suggesting continued downside pressure.

📉 4h & 1D:

The recent sell-off from above 78.00 has pushed Brent back into the lower region of the broad descending channel. Daily and 4h charts show price testing confluence between the horizontal support at ~66.00 and a long-term rising trendline. A confirmed close below this level could accelerate bearish momentum towards 64.00 or even 62.00.

⚠️ Key Levels:

• Support: 66.00, 64.00, 62.00

• Resistance: 67.00, 69.00

• Bias: Bearish – price remains in a clear downtrend unless buyers reclaim above 67.50 with strong volume.

📌 Outlook:

As long as Brent holds below 67.00 and the descending trendline caps rallies, my bias is bearish. A breakdown of 66.00 on higher timeframes would open the door for a move towards lower channel support levels. However, if buyers defend and push back above 67.50, we could see a short-term relief rally.

Brent Oil Breakdown – Rejection & Freefall From Channel HighsBrent Oil delivered a textbook reversal last week.

After weeks of climbing within a rising channel, price printed a strong rejection wick at the upper boundary (~$79.45), then followed through with a violent sell-off, slicing through structure and breaking the channel cleanly.

🔍 Key Levels:

• Rejection High: $79.45

• Structure Break: $74.89 (former support, now resistance)

• 4H Demand Zone: $66.00–$69.00

• Daily Demand Confluence: Aligned with 4H zone

On the 1H and 23min, we’re now seeing price trying to stabilise above $69.80 — right on top of the 4H and daily zone confluence.

📉 Bias:

Currently bearish below $74.89.

A clean retest of that level could offer continuation entries.

However, price is now in a high-probability reaction zone, so intraday longs are possible if price shows strength above $70.

⛽ Watch For:

• Bullish price action around $68.50–$70.00

• Weak retracements into $72–$73 for potential short entries

• Break below $66.00 could open floodgates back toward $63 and $60.00

Brent Crude Oil's Defining Moments: Analyzing the Top 5 MovesThe oil market has experienced unprecedented volatility over the past two years, with five pivotal moments generating the most significant price movements in Brent crude.

The Top 5 Market Movers:

1. June 13, 2025 (+7.02%): Israeli airstrikes on Iranian nuclear and oil facilities triggered the largest single-day surge to $74.23/barrel, demonstrating how geopolitical events can instantly drive supply disruption fears.

2. April 8, 2025 (-15.67% over 5 days): Trump's tariff escalation and US-China trade war intensification caused the most severe multi-day decline, ending at $62.82/barrel as traders priced in global economic slowdown.

3. October 7, 2024 (+12.76% over 5 days): Escalating Israel-Iran tensions drove a significant rally to $80.93/barrel as markets built in geopolitical risk premiums ahead of expected retaliatory strikes.

4. September 3, 2024 (-6.41%): Libya's oil dispute resolution combined with weak global demand outlook caused a sharp drop to $73.75/barrel, showing how supply resolutions can trigger selloffs.

5. October 6, 2023 (-11% weekly crash): The end of driving season combined with demand concerns and interest rate fears triggered the biggest weekly decline since March 2023, with Brent falling to $84.07/barrel as gasoline demand hit yearly lows.

Current Fundamental Landscape and Path Forward

The EIA forecasts Brent averaging $66/barrel in 2025 and $59/barrel in 2026, below recent levels due to trade uncertainties and slower growth. Three key factors will drive future prices: US-China trade resolution, Middle East geopolitical risks, and OPEC+'s production strategy. Recent volatility shows that while fundamental supply-demand dynamics remain important, geopolitical events, trade policies, and seasonal demand patterns can generate dramatic price swings that overwhelm traditional market forces.

Can Crude Oil Spike to 150 USD / bbl ? Scenario Analysis.With Mid East tensions rising and overall unpredictable

situation around Strait of Hormuz, let's review potential

scenarios for the Crude Oil Prices. I've outlined three

scenarios with projected oil prices for each scenario below.

🚨 Market Alert: Israel-Iran Conflict Impact Forecast 📈

🔴 Worst-Case Scenario: Regional War + U.S. Military Involvement

🚢 Oil (Brent): Soars to $150–$200+ if Strait of Hormuz closes

🥇 Gold: Skyrockets to $4,500–$5,000 (safe-haven rush)

₿ Bitcoin: Initial volatility; settles at $80k–$100k

📉 SPX: Crashes to 4,000–4,500

💻 NDX: Drops sharply to 15,000–16,000

🟠 Base-Case Scenario: Protracted Tension, No Major Disruption

🛢 Oil: Stabilizes at elevated $75–$95, occasional spikes

🥇 Gold: Moves higher, trading $3,500–$3,800

₿ Bitcoin: Trades steady, $90k–$110k range

📊 SPX: Pullback moderate, around 5,200–5,500

💻 NDX: Moderately lower, 18,000–19,000 range

🟢 Best-Case Scenario: Diplomatic De-Escalation

🌊 Oil: Eases down to $65–$75

🥇 Gold: Mild decline, holds at $3,300–$3,500

₿ Bitcoin: Positive sentiment, lifts to $100k–$120k

📈 SPX: Slight dip; stays strong near 5,800–6,200

💻 NDX: Minor correction, remains high at 20,000–22,000

Time for a Rise in Oil Prices $$$When analyzing the recent movements in oil prices through the lens of Elliott Wave Theory, it appears that the current structure is completing an ABC corrective formation.

Initially, the A wave has developed as a strong upward 1-5 impulse structure.

The B wave evolved through a classic ABC correction, pushing prices down to the support area marked as (B).

Following this correction, early signals indicate the initiation of the C wave.

In this context, the technical structure suggests a potential new upward momentum in oil prices with the activation of the C wave. The target zone for the C wave should be monitored in consideration of the existing trendlines and historical resistance levels.

Nevertheless, under the current market conditions characterized by high volatility, it is critical to monitor volume and momentum indicators to confirm the C wave and ensure key support levels are maintained.

Brent Crude Hits Key Supply Zone After BreakoutPrice has aggressively broken out from the descending wedge and reached a strong 4H & 1D resistance zone between 74.50–76.00.

• 1D Chart: Sharp breakout from long-term descending trendline. Approaching resistance from Feb-April supply area.

• 4H Chart: Bullish structure confirmed by higher lows and breakout of ascending channel.

• 1H & 23m Chart: Consolidating beneath resistance, forming a triangle structure.

Key Zones:

• Support: 71.50–72.00

• Resistance: 74.50–76.00

Bias: Neutral short-term (range). Bullish if 76 is broken and held.

Potential Decline of Brent Oil Price to $50 in the Near Future.Brief Overview of Events and News Explaining the Potential Decline of Brent Oil Price to $50 in the Near Future.

➖ Increased OPEC+ Production:

On April 3, 2025, eight OPEC+ countries unexpectedly decided to accelerate production increases, adding 411,000 barrels per day starting in May. This decision triggered a price drop, with Brent falling 6.42% to $70.14 per barrel at the time.

Analysts like Amrita Sen from Energy Aspects noted that this move pressures “lagging” countries to meet quotas, but the market interpreted it as an oversupply signal.

Source: OilPrice.com, "OPEC+ to Raise Oil Production by More Than Expected in May," April 3, 2025 (oilprice.com)

➖ Decreased Demand Due to Economic Challenges:

On April 14, 2025, OPEC revised its 2025 oil demand growth forecast downward by 150,000 barrels per day to 1.3 million barrels per day, citing trade tensions and weak economic indicators. JPMorgan also raised the likelihood of a global recession to 60%.

Source: OilPrice.com, "OPEC Lowers 2025 Oil Demand Forecast on Trade Tensions," April 14, 2025 (oilprice.com)

➖ Trade Tariffs and Global Instability:

On April 3, 2025, U.S. President Donald Trump announced new tariffs on trading partners, heightening recession fears. Fitch Ratings described this as the highest level of U.S. import tariffs since 1910. Brent dropped 4% immediately following the announcement.

Source: OilPrice.com, "OPEC+ to Raise Oil Production by More Than Expected in May," April 3, 2025 (oilprice.com)

➖ Geopolitical De-escalation:

On April 25, 2025, reports emerged of progress in U.S.-Russia talks on Ukraine, as well as Iran’s openness to nuclear negotiations. This reduces geopolitical risks and increases the likelihood of higher oil supply on the market.

Source: OilPrice.com, "Oil Set For Weekly Loss on OPEC+ Supply Rumors," April 25, 2025 (oilprice.com)

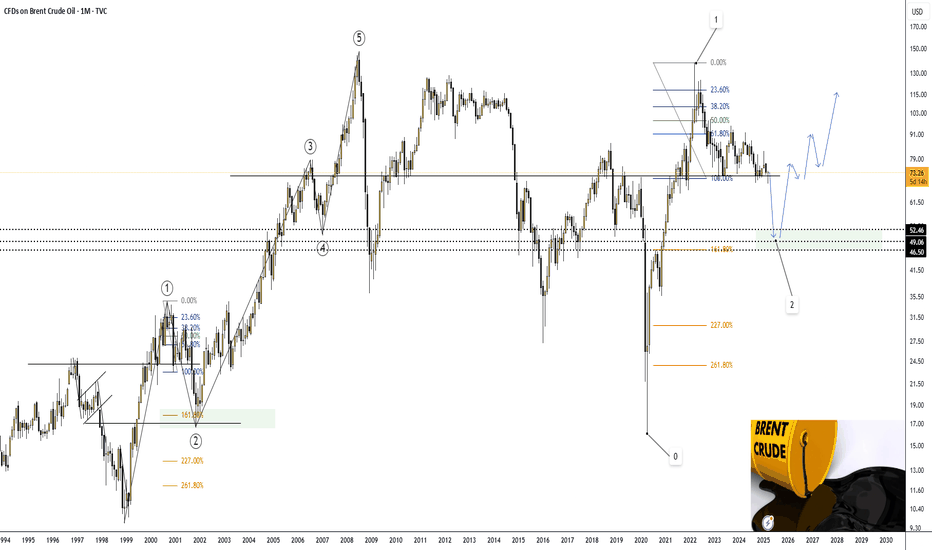

Technical Analysis Section:

The monthly chart shows similarities between the 1999–2002 and 2020–2025 periods: an initial impulse, followed by a correction, and then a 6-year upward trend.

Nearest entry point targets at the 161.8% Fibonacci level:

• $52,46

• $49,06

• $46,50

Growth Potential

Medium-term:

• $138,00

Long-term:

• $500,00

Once the price of oil UKOIL reaches $52.46, a review for the entry point will be prepared.

Charts:

•

•

Analysis of the BRENT chart with expectations for 2025-2026◽️Technically, all conditions for the completion of the second wave correction have been met, and now quotes can be safely reversed up. However, current events in the global economy do not yet provide grounds for confidently asserting this. Locally, the price may still be driven down to $50 per barrel and even slightly lower. One way or another, it is important to understand a simple thing: everything below $70 per barrel should be seen as an opportunity to buy oil and everything related to it cheaply.

◽️According to my estimates, there is probably still time for deliberation on purchases until the end of spring. But further, from the beginning of summer, I expect a sharp rise in prices amid the escalation in the Middle East. From above, in the $100-150 range, growth will likely be contained for some time, which will be interpreted as the formation of sub-waves (i)-(ii), where after sharp rise in the first sub-wave from approximately $50-60 to $120-130, a local correction will follow within the second sub-wave.

◽️The growth period may take 3-6 months, and the correction to it another 2-4 quarters, and then a breakout of the $120-150 resistance zone and further "to the moon" in the third waves is expected.

🙏 Thank you for your attention and 🚀 for the idea.

☘️ Good luck, take care!

📟 See you later.

#BRENT Gold/Oil Ratio, Stocks/Oil RatioOn chart I tried to fit three instruments at once:

1️⃣ Bottom (white) chart: Gold to Oil Ratio.

2️⃣ Middle (red) chart: BRENT crude oil price.

3️⃣ Top (blue) chart: Dow Jones Industrial Average to Oil Price Ratio.

1️⃣ The first thing to pay attention to is the white chart: GOLD/OIL Ratio , specifically where this ratio is today. Over the last 75 years of observation, the ratio has reached unprecedented levels. The spread is once again testing the record values of the COVID-19 hysteria of 2020, when panic caused oil prices to plummet sharply. At the current moment, the ⚖️Gold to Oil Ratio is around the 50 mark, meaning that one ounce of gold can buy as much as 50 barrels of oil. Over the last century, when the spread exceeded 25 barrels per ounce, it was interpreted as a moment of cheap oil relative to gold. Today, against the backdrop of the chaos reigning in the world, the GOLD/OIL Ratio is entering what can be called the " MAGA Mega Cheap Oil Zone" if it is again valued in gold, and not in fiat green piece of paper. Further, we should expect at least a return to its average values, and here three scenarios are possible:

1. First Scenario. Let's assume that today's price of $60-70 per barrel of oil is "fair" and this is where it belongs. In this case, gold is currently strongly overvalued, and it's time for a correction from $3300 to the $2500-2800 range.

2. Second Scenario. Everything is fine with gold, and it will continue to rise without correction. In this case, oil is severely undervalued relative to gold, and it's time for it to catch up so that the spread of 50 returns to its average values in the 10-25 range.

3. Third Scenario suggests that both oil is significantly undervalued and gold has risen too sharply, and now it's time for a correction in gold and a rise in oil prices.

In any of the three scenarios described above, the GOLD/OIL Ratio will sooner or later return to its normal values of the last century, that is, to the range of 10-25 barrels per ounce of gold. And most likely, we will see the third scenario unfold this year, where against the backdrop of a stock market crash, problems with liquidity in the global financial system, the entry of Western economies into recession, as well as the start of a full-scale war in the Middle East this summer, all of this together will provoke a correction in gold and an explosive growth in oil prices, and consequently, a return of the gold to oil ratio to its historical averages.

2️⃣ On the second (red) linear chart of BRENT crude oil prices , everything looks quite ordinary. If we briefly describe the chart for the last twenty years in simple terms, it's worth saying the following: since 2008, they have been trying in every possible way to keep the oil price below $130 per barrel, and as soon as the price approaches the $120-150 zone, some "invisible hand of the market" throws it down. The first test of this resistance zone occurred during the GFC global financial crisis of 2008, the second test with prolonged trading took place during the Eurozone debt crisis of 2011-2014 (culminating in the Greek default), and the third test was in 2022, as a consequence of the monetary madness of 2020 (global lockdown, unlimited QE, and as a result: a wave of monetary + structural inflation worldwide). One way or another, from the fourth or fifth time, the $120-150 per barrel boundary will be finally broken. And then the price above, like a samurai, "has no destination, only the path," and this path is upwards, "to the moon"🚀

3️⃣ Now it remains to consider the last (blue) chart at the top, the ⚖️Dow Jones Industrial Average to Oil Price Ratio . This chart should be understood as a long-term trend indicator of cycle changes in financial markets. When it rises, it implies a 10 or even 20-year growth cycle in the stock market, and accordingly, corrections in the commodity market. And when it falls, then vice versa, the cycle changes to growth in the commodities market and a correction in the risky stock market, which also lasts one or even two decades. Today, it can be said with certainty that since 2020, the cyclicality has changed, and we are just entering a ten or even twenty-year growth trend in the commodity sector, which portends a change from the "eternally" growing trend in the American stock market to a fall or at least a multi-year sideways movement a la the 1970s.

🙏 Thank you for your attention and 🚀 for the idea.

☘️ Good luck, take care!

📟 See you later.

"UK oil / Brent" Energy Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "UK oil / Brent" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (65.500) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (61.500) Scalping/Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 70.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸🛢"UK oil / Brent" Energy Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets & Overall Score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CRUDE OIL (WTI): Important Support Clusters to Watch

On a today's live stream, we discussed potentially significant

historic supports on WTI Crude Oil to watch.

Support 1: 57.0 - 59.0 area

Support 2: 52.5 - 54.6 area

Support 3: 48.8 - 50.4 area

Support 4: 40.6 - 43.7 area

The price is currently testing a lower boundary of Support 1.

It perfectly matches with a completion point of a harmonic ABCD pattern.

It looks like we may see some pullback soon.

❤️Please, support my work with like, thank you!❤️

Trump Goes "The Peacemaker", as Crude Oil Turns Gradually LowerThe notion that crude oil prices might decrease due to an abatement of the Ukraine's war not seems to be counterintuitive, as the conflict has historically led to increased oil prices due to supply disruptions and geopolitical tensions.

There are several factors that could contribute to a decrease in oil prices if tensions were to ease.

Factors Contributing to Decreased Oil Prices:

Easing of Sanctions on Russia: If tensions between the U.S. and Ukraine were to ease, it might lead to a relaxation of sanctions on Russia, potentially allowing more Russian oil to enter the global market. This increase in supply could help reduce prices.

Market Perception of Reduced Conflict: The market might perceive a decrease in conflict as a sign of reduced risk to global oil supplies, leading to lower prices. This perception could be influenced by expectations of increased oil availability from Russia and other regions.

OPEC Production Increases: If OPEC decides to increase production, as it has recently done, this could add more oil to the market, further pressuring prices downward.

Global Economic Concerns: Economic slowdowns or concerns about global growth can reduce demand for oil, leading to lower prices. The Ukraine conflict has contributed to economic uncertainty, and its abatement might not necessarily increase demand if global economic concerns persist.

Fundamental considerations

Well, in early March 2025, oil prices fell due to a combination of factors, including tensions between the U.S. and Ukraine and OPEC's decision to gradually increase output. Brent crude fell to around $71.08 per barrel, and WTI to about $68.01 per barrel.

Impact of Sanctions: Despite sanctions not directly targeting Russian oil, they have affected its exports by limiting financing and causing some buyers to avoid Russian crude. Easing these sanctions could increase Russian oil exports, potentially lowering global prices.

Market Dynamics: The war in Ukraine initially caused oil prices to surge due to supply concerns. However, if the conflict were to abate, market dynamics could shift, leading to decreased prices as supply risks diminish and global economic factors come into play.

Post war challenge

Crude oil and gasoline prices today are moderately lower, but crude oil tends to breakthrough a long-term 3 - to - 4 years low.

Crude oil prices are under pressure as US tariff uncertainty weighs on the outlook for energy demand.

Also, ramped-up Russian oil exports boost global supplies and are negative for prices.

In addition, crude prices have some negative carryover from Wednesday when weekly EIA crude inventories rose more than expected to a 7-month high.

Conclusion

In summary, while the Ukrainian war has historically driven oil prices up due to supply disruptions and geopolitical tensions, an easing of tensions could lead to decreased prices through increased supply, reduced market risk, and global economic factors.

--

Best 'Peacemaking' wishes,

@PandorraResearch Team 😎

"BRENT/UK Crude Oil" Energy Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "BRENT/UK Crude Oil" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (74.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 3H timeframe (72.000) Day / swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 78.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢🔥"BRENT/UK Crude Oil" Energy Market Heist Plan (Day/Swing Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

A major correction in Brent crude oil (UKOIL).A major correction in Brent crude oil (UKOIL).

- This idea is invalidated if the price exceeds $73.755.

On the monthly chart, it shows that we are forming a 50% Fibonacci correction from wave 1, from where we will further expect growth toward the $115 area, and possibly even a new all-time high due to a military conflict in the Middle East.

I’ve marked potential downside targets on the chart at $46.50, $49.06, and $52.46, from where we will look for entry points for long positions lasting 2 years or more.