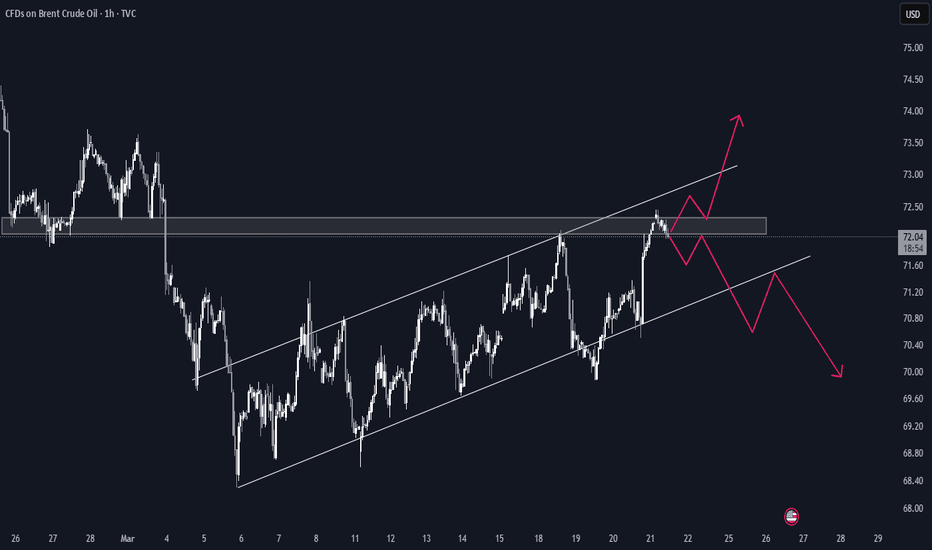

Ukoilshort

USOIL is about to fall sharply, prepare to shortFrom a technical perspective, usoil currently has a large short-selling opportunity.

The overall price of usoil has successfully stabilized at the 70 mark, and on this basis, it has ushered in a correction market with a volatile rebound. In the afternoon European session, oil prices rose slightly, pierced the 71.2 mark, and then closed in a volatile state. From the daily K-line pattern analysis, it finally closed with a volatile rebound cross K-line.

Although the short-term price stabilized and rebounded after gaining support at the 70 mark, from a comprehensive consideration at the daily level, usoil is still in a weak volatile pattern, limited by the 10-day moving average and below the 5-day moving average. For the short-term trend, the 73 mark is the key dividing line for short weakness. At the daily level, as long as usoil fails to effectively break through and stabilize the 73 mark, any pullback can be regarded as an excellent short-selling opportunity.

usoil short-selling trading plan:

Sell: 71.55, take profit 70.5; stop loss 72.3

TVC:UKOIL TVC:USOIL

"UKOILSPOT / BRENT Crude Oil" Energy Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "UKOILSPOT / BRENT Crude Oil" Energy market. Please adhere to the strategy I've outlined in the chart, which emphasizes long & Short entry. 👀 Be wealthy and safe trade 💪🏆🎉

Entry 📈 : You can enter a Bull or Bear trade at any point after the breakout.

Buy entry above 77.500

Sell Entry below 75.500

Stop Loss 🛑: Using the 2H period, the recent / nearest Pullbacks.

Goal 🎯: Bullish Robbers TP 81.500 (or) Escape Before the Target

Bearish Robbers TP 72.500 (or) Escape Before the Target

📰🗞️Fundamental, Macro, Sentimental Outlook:

The "UKOILSPOT / BRENT Crude Oil" Energy market is expected to move in a bearish direction, driven by several key factors.

🟠Macroeconomic Factors:

1. Global Economic Slowdown: A slowdown in global economic growth, particularly in China, may decrease demand for crude oil, putting downward pressure on prices.

2. US-China Trade Tensions: Escalating trade tensions between the US and China may lead to a decline in global economic growth, negatively impacting oil demand.

3. Strong US Dollar: A strong US dollar may make crude oil more expensive for foreign buyers, reducing demand and putting downward pressure on prices.

🔴Fundamental Factors:

1. Increasing US Shale Oil Production: Rising US shale oil production may lead to a surplus in global oil supply, putting downward pressure on prices.

2. High Oil Inventory Levels: Elevated oil inventory levels in the US and other countries may indicate a surplus in global oil supply, negatively impacting prices.

3. OPEC+ Compliance Issues: Non-compliance by OPEC+ members with production cuts may lead to a surplus in global oil supply, putting downward pressure on prices.

🟢Trader/Market Sentimental Analysis:

1. Bearish Trader Sentiment: The CoT report shows that speculative traders are net short crude oil, indicating a bearish sentiment.

2. Market Sentiment: The market sentiment is bearish, with many analysts expecting crude oil prices to decline due to the supply surplus.

3. Technical Analysis: The technical analysis shows that crude oil is in a downtrend, with a bearish breakdown below the $70 level.

🟡Sentimental Outlook:

Bearish Sentiment: 55%

Bullish Sentiment: 30%

Neutral Sentiment: 15%

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

🚨Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

🚨Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

"BRENT / UK OIL SPOT" Energy Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "BRENT / UK OIL SPOT" Energy market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (74.500) then make your move - Bearish profits await!"

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high or low level should be in retest.

Stop Loss 🛑: Thief SL placed at 78.800 (swing Trade) Using the 4H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many orders you have to take.

Target 🎯: 71.000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

"BRENT / UK OIL SPOT" Energy market is currently experiencing a Neutral trend (there is a higher chance for Bearish)., driven by several key factors.

🟠Corporate Traders:

Fundamental Analysis: Bullish, citing growing demand for oil and supply constraints.

Macro Economics: Bullish, expecting a global economic recovery to drive oil demand.

Sentimental Analysis: Bullish, with 58% of corporate traders holding long positions.

COT Report: Bullish, with corporate traders holding 100,219 long contracts.

🔴Investor Traders:

- Fundamental Analysis: Neutral, citing uncertainty around global oil demand and supply.

- Macro Economics: Neutral, expecting a slow global economic recovery to impact oil demand.

- Sentimental Analysis: Neutral, with 50% of investor traders holding long positions and 50% holding short positions.

- COT Report: Neutral, with investor traders holding 40,109 long contracts and 35,219 short contracts.

🟤Hedge Fund Traders:

- Fundamental Analysis: Bearish, citing rising US oil production and global supply concerns.

- Macro Economics: Bearish, expecting a global economic slowdown to impact oil demand.

- Sentimental Analysis: Bearish, with 60% of hedge fund traders holding short positions.

COT Report: Bearish, with hedge fund traders holding 80,109 short contracts.

🟢Institutional Traders:

- Fundamental Analysis: Bearish, citing rising US oil production and global supply concerns.

- Macro Economics: Bearish, expecting a global economic slowdown to impact oil demand.

- Sentimental Analysis: Bearish, with 62% of institutional traders holding short positions.

COT Report: Bearish, with institutional traders holding 120,000 short contracts.

🟡Overall Outlook:

- Bearish: 55%

- Bullish: 25%

- Neutral: 20%

Based on the comprehensive analysis, the outlook for Brent UKOIL Spot Commodity CFD is bearish, with a target price of around $62-$65 per barrel.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤗

UKOIL/Brent Crude Oil Energies Market Heist Plan on Bearish SideOla! Ola! My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist UKOIL / Brent Crude Oil Energies Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Near the Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry 👇 📉: Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe, Recent / Nearest High Point entry should be in pullback.

Stop Loss 🛑: Recent Swing High using 1H timeframe

Attention for Scalpers : Focus to scalp only on Short side, If you've got a money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

Brent Crude (UK Oil) moving lower this week**Monthly Chart**

Brent Crude (spot) - UKOil, last month's candle closed lower after testing the previous month's key reversal, this indicated that UKOil is going to continue its move lower. This month's candle which is still active, has opened from the bearish closed candle of May and started moving lower. However, the pair is moving within a long-term range as per the monthly timeframe.

**Weekly Chart**

Last week candle opened lower. However, it paused around the 77 level, the previous demand zone then moved higher to the 82 level (round number) and rejected it. Therefore, the expectation as per the weekly chart that the move will be bearish for this week. The next target to be tested is the monthly low around the 72 level.

**Daily Chart**

As per the daily, the price tested the relative equal lows on the daily and started moving higher. However, due to NFP last Friday, the price started moving lower after testing the FVG (or IPA) candle around 82 level and then started moving lower.

For this week, I would like to see more price action to provide a good setup to sell this UKOil and move it to test the 72 level given the change in market structure in the lower timeframes.

UKOIL potential downtrendThere is a possibility that the UKOIL, a trading instrument representing the price of crude oil in the United Kingdom, might experience a downward trend. The recommended take-profit (TP) level is at 77.2, while the suggested stop-loss (SL) level stands at 84.25. However, it's crucial to emphasize that engaging in any financial trading activity carries inherent risks. The TP and SL levels provided are merely speculative and based on an analytical idea or forecast.

The volatility and unpredictability of the commodities market, especially concerning oil prices, are influenced by multifaceted factors such as geopolitical tensions, global demand-supply dynamics, economic indicators, geopolitical events, and unforeseen natural disasters, among others. This inherently complex and dynamic nature of the market renders any predictions subject to change or deviation.

Investors and traders should conduct thorough research, employ risk management strategies, and exercise caution when making financial decisions. It's advisable to consider various sources of information, consult with financial advisors or experts, and assess one's risk tolerance and financial objectives before executing any trade based on speculative forecasts or trading ideas.

Moreover, the terms TP and SL denote the take-profit and stop-loss levels, respectively, indicating the targeted price at which a trader aims to close a position to secure profits or limit potential losses. These levels serve as guiding markers, aiding traders in managing their risk exposure and ensuring disciplined trading practices. Nevertheless, it's essential to remain vigilant and adaptable in response to market fluctuations and unexpected developments that might impact the price movements of UKOIL.

In conclusion, the forecast suggesting a potential downward movement in UKOIL with specified TP and SL levels should be regarded as a trading idea rather than a definitive prediction. Engaging in financial markets demands informed decision-making, risk awareness, and a comprehensive understanding of the intricate dynamics driving commodity prices. Traders are encouraged to exercise prudence, stay updated with market trends, and use analytical tools while acknowledging the inherent uncertainties associated with trading.

UKOil Brent Technical Analysis And Trade IdeaIn this video, we embark on a comprehensive analysis of UKOil, with a specific focus on the prevalent bearish sentiment observed in the 1-month (1M) and 1-week (1W) timeframes. Notably, our charts reveal that Brent has approached a critical support level, a pivotal juncture. Throughout this presentation, we delve into the fundamental tenets of technical analysis, encompassing essential components such as evaluating the current market trend, price dynamics, market structure, and other indispensable aspects of technical analysis. As we progress through the video, we meticulously scrutinize a potential trading opportunity in Brent Oil.

It is imperative to stress that the insights shared in this content are exclusively intended for educational purposes and should not be misconstrued as financial advice. Participating in the foreign exchange market trading carries a significant level of risk. Therefore, it is vital to prudently incorporate robust risk management strategies into your trading plan to navigate these challenges effectively.

UKOIL Enters Slippery SlopeUnfortunately my last UKOIL prediction didn’t fair too well but using the science of Elliott Wave I think I’ve been able to identify previous mistakes and also a way forward.

I expect the $90-$91 range to send UKOIL back to $25 over the next 3 years or so. Based on what news? Who knows. We’ll see when it comes but the chart is always the first indicator :)

BRENT OIL ( UK OIL ) LONG term Trade AnalysisHello Traders

In This Chart UK OIL HOURLY Forex Forecast By Forex Planet

today UKOIL analysis 👆

🟢This Chart includes_ (UKOIL market update)

🟢What is The Next Opportunity on UKOIL Market

🟢how to Enter to the Valid Entry With Assurance Profit

This Video is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts.

DeGRAM | UKOIL pullback against trendUKOIL broke through the major support level at 80.00 then dropped.

The price is consolidating after the sell-off.

The oil market bounced off the support level at 72.00. It's pulled back against the bearish trend.

We anticipate a bearish continuation trade.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

BCOUSD Potential for Bearish Drop | 20th February 2023Looking at the H4 chart, my overall bias for BCOUSD is bearish due to the current price being below the Ichimoku cloud , indicating a bearish market.

Looking for a pullback sell entry at 8392.4, where the 38.2% Fibonacci line and overlap resistance is. Stop loss will be at 8673.5, where the recent swing high is. Take profit will be at 7902.9, where the previous swing low is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

UKOIL: Short from ResistanceAs evident on 4Hr Time-Frame with formation of Bearish Cypher harmonic pattern UKOIL a reversal is possible.

Seasonal Analysis shows JXY & DXY remain Bullish in January over 60% which have negative correlation with Oil. CXY on the other hand remain Bearish in January over 70% of times which indicates a low price of Oil.

TPs can be set as per Fib Lvls identified on chart and stop Loss on or above Point D of Cypher. It is my expectation that price action will retrace to 61.8% Fib level.

Manage your risk accordingly.

UKOIL: Bearish Reversal IdeaBearish Indications

• Resistance Zone at 85.26

• AB=CD where the D point is at 85.93 which indicates a reversal

• Gartley’s XABCD indicates 85.73 Area

• Seasonal Analysis Shows DXY remains Bearish at over 80% in December month

Bullish Indications

• Three White Soldiers

• Significant Support Zone at 0.68329

• Resistance Broken at 0.68629

• Support Zone at 84.23

• Seasonal Analysis shows UKOIL remains Bullish in December Month.

Biased: Short

Entry Short: 84.52 (Fib Level 78.6%)

TP1: 0.68236 (Fib Level 61.8%%)

TP2: 0.68085 (Fib Level 38.2%)

Stop Loss: 86.20

Risk/Reward: 1:1.6

DeGRAM | UKOIL reversal pattern at resistanceUKOIL broke through the descending channel .

The price action tested the trendline and closed below it.

It failed to make a higher high, resulting in an H&S pattern.

The market is making a pullback on the larger scale of the bearish trend .

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

OIL, What's next?As the CPI numbers and the inflation numbers starts to slow and decrease, and banks are saying that 2023 inflation will drop even more.

The oil is facing more down moves.

The Saudi Arabia, needs a $75 per barrel to cover the government budget.

but what if the decrease production to keep prices high, will be enough to cover the budget ?!

In this chart, we are seeing too possible buys, with two possible scenarios.

the first buy at $75.00 per barrel and the second one at $50.00

Always manage your risk in trading be for you enter the market.

Regards.

DeGRAM | UKOIL short opportunityUKOIL is trading in the ascending channel.

The market is heading to confluence zone where there are resistance and global trendline.

The price action has bounced off the trendline several times before.

If the resistance level rejects the price, then we can look for selling opportunities.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!