SoFi's Surge: Unveiling 2023 and What Lies Ahead in 2024Technical Analysis Overview

Current Price : $10.34, a 3.77% increase.

Weekly Trend : Showing a positive trend with a 5.35% increase over the last five days.

1-Month Trend : A significant increase of 51.96%, indicating strong bullish sentiment.

6-Month and Yearly Trends : A 17.04% increase over the last six months and a 124.51% increase year to date, highlighting a robust bullish trend.

Advanced Technical Indicators

Relative Strength Index (RSI) : 70.41 - Indicating that SOFI is nearing overbought territory, which could lead to a potential reversal or consolidation in the short term.

Moving Average Convergence Divergence (MACD) : 0.63 - Suggesting bullish momentum, indicating a strong buying trend.

Other Indicators : STOCH (83.28), STOCHRSI (84.02), ADX (37.09), Williams %R (-8.57), CCI (104.63), ATR (0.46), Ultimate Oscillator (54.76), and ROC (24.66) all contribute to a picture of current bullish momentum but with potential for short-term volatility or pullback.

Market Sentiment and External Factors

Market Capitalization : $9.904B USD.

Trading Volume Analysis : A high trading volume of 35,199,288, suggesting active market participation and interest in the stock.

Recent News Coverage Impacting SOFI

Bullish Outlook for 2024 : Analysts predict SOFI stock could continue its rally in the new year, benefiting from expected interest-rate cuts. A notable analyst has set a high price target of $14 for SOFI stock, implying significant upside potential ( InvestorPlace ).

Focus on Non-Lending Businesses : Analysts appreciate SoFi's shift towards non-lending businesses, improving earnings quality despite a higher-for-longer interest-rate policy.

Central Bank Policy Changes : Potential interest rate cuts in 2024 could benefit SoFi's lending business, as lower rates tend to spur borrowing and lending activity.

Conclusion

SOFI's stock shows strong bullish signs in the medium to long term, but the current overbought condition warrants caution for short-term traders.

The recent news and analyst predictions provide a positive outlook for 2024, making SOFI an interesting stock for both traders and long-term investors.

Undervalued

UNH bear flag and gapsUNH has been top of my radar for a bullish reversal. With 2 major gaps to fill after the epic collapse in share price this ticker has a lot of potential. Currently sitting in what appears to be a bear flag, it is holding above the monthly 200EMA (overlayed on this 4H chart). However price recently rejected off the daily 21ema (overlayed on this 4H chart) and if the bear flag is any indicator price may head lower for another liquidity sweep before the inevitable bullish reversal.

A side note: insiders have been buying $millions since the share price collapsed which is always a good indicator of what's to come.

A BULLISH SNAPCHAT ANALYSIS SNAPCHAT has a neat chart setup long term. Here is a bullish look. I use a metric called NJT which analyzes total user hours available.

From a technical standpoint, there are gaps up to $70, and it could soar much higher. Think longer term investment, with short term jump potential.

Here is my summarized view with a little help from Grok (X).

"Overview of Snap Inc.'s Assets and Valuation

Snap Inc., the parent company of Snapchat, is a publicly traded technology company listed on the NYSE under the ticker SNAP. Founded in 2011 by Evan Spiegel, Bobby Murphy, and Reggie Brown, it focuses on multimedia messaging, augmented reality (AR), and related products. Below, I outline Snap Inc.'s key assets, estimate their valuation based on available data, and apply the NJT (Net Joint Time) metric to contextualize its user engagement in the competitive landscape of 2025-2026. The NJT metric, defined as monthly active users (MAUs) × average time spent per user per month, is used to assess user hours, with the global pool estimated at 285.6 billion user hours per month (9.52 billion hours/day × 30 days).

Key Assets of Snap Inc.

Snap Inc. owns several products and services, with Snapchat being the flagship. Here’s a breakdown of its primary assets as of June 2025:

Snapchat (Core Multimedia Messaging App)

Description: Snapchat is a visual messaging app allowing users to send ephemeral photos and videos, with features like Stories, Snap Map, Discover, and AR Lenses. It generates most of Snap’s revenue through advertising, particularly AR ads and Snap Ads.

User Metrics: Approximately 900 million MAUs and 453 million daily active users (DAUs) as of Q4 2024, with users spending an estimated 30 minutes daily (15 hours/month).

NJT Calculation:

MAUs: 900 million

Average time spent: 15 hours/month

NJT = 900 million × 15 = 13.5 billion user hours/month

Valuation Estimate: Snapchat accounts for ~98% of Snap’s revenue ($5.26 billion of $5.36 billion in 2024). Assuming the company’s current market cap of $14.18 billion (June 2025) is primarily driven by Snapchat, we allocate ~98% of the market cap to this asset:

Value: $13.9 billion

Spectacles (AR Smart Glasses)

Description: Wearable sunglasses that capture Snaps and integrate with Snapchat, featuring GPS-powered AR lenses and hand-tracking capabilities. Launched in 2016, Spectacles have not gained widespread popularity but remain part of Snap’s AR vision.

User Metrics: Limited user data; estimated <1 million users with minimal time spent (assumed 1 hour/month for valuation purposes).

NJT Calculation:

MAUs: ~1 million (conservative estimate)

Average time spent: 1 hour/month

NJT = 1 million × 1 = 1 million user hours/month

Valuation Estimate: Spectacles contribute ~2% of revenue ($100 million in 2024). Using the same revenue-to-market-cap ratio as Snapchat, we estimate:

Value: $0.28 billion ($280 million)

Bitmoji (Personalized Avatar Platform)

Description: Acquired in 2016 for ~$64 million, Bitmoji allows users to create personalized avatars integrated into Snapchat and other platforms. It enhances user engagement but is not a direct revenue driver.

User Metrics: Assumed to align with Snapchat’s user base (900 million MAUs) but with lower engagement (estimated 2 hours/month).

NJT Calculation:

MAUs: 900 million

Average time spent: 2 hours/month

NJT = 900 million × 2 = 1.8 billion user hours/month

Valuation Estimate: As a feature enhancing Snapchat’s ecosystem, we estimate its value based on acquisition cost adjusted for inflation and integration (5% annual growth since 2016):

Value: ~$100 million

Snap Camera (Desktop Application)

Description: Launched in 2018, Snap Camera allows users to apply Snapchat filters during video calls on platforms like Zoom. It has niche usage, primarily for streaming and virtual meetings.

User Metrics: Limited data; estimated 10 million MAUs with 1 hour/month usage.

NJT Calculation:

MAUs: 10 million

Average time spent: 1 hour/month

NJT = 10 million × 1 = 10 million user hours/month

Valuation Estimate: Minimal direct revenue; valued as a brand enhancer at ~1% of Snapchat’s value:

Value: $140 million

Zenly (Location-Sharing App, Discontinued)

Description: Acquired in 2017 for an undisclosed amount (estimated $200-$300 million), Zenly was shut down in 2023, but its location-sharing features were integrated into Snap Map.

User Metrics: No independent users post-shutdown; value absorbed into Snapchat.

NJT Calculation: Not applicable (integrated into Snapchat’s NJT).

Valuation Estimate: Residual value in Snap Map enhancements, estimated at acquisition cost:

Value: ~$250 million

Other Assets (Content Partnerships, Snapchat+, R&D)

Description: Includes partnerships with NBCUniversal, Disney, and others for Snapchat Originals, the Snapchat+ subscription service (7 million subscribers in March 2024), and ongoing AR R&D. Snapchat-Az These contribute to revenue and engagement but are not separately quantified.

User Metrics: Snapchat+ has ~7 million users; other assets are part of Snapchat’s ecosystem.

NJT Calculation: Included in Snapchat’s NJT (13.5 billion hours/month).

Valuation Estimate: Snapchat+ and content partnerships generate ~$100 million annually (estimated); R&D is a cost center. Valued at ~2% of market cap:

Value: $280 million

Total NJT and Market Cap Projection

Total NJT:

Snapchat: 13.5 billion hours/month

Bitmoji: 1.8 billion hours/month

Snap Camera: 10 million hours/month

Spectacles: 1 million hours/month

Total: ~15.311 billion hours/month

Market Share: 15.311 ÷ 285.6 ≈ 5.36% of the global pool (285.6 billion hours/month).

Current Market Cap (June 2025): $14.18 billion

Projected Market Cap Using NJT: Assuming the total market cap of 45 companies (~$10 trillion) is distributed proportionally to NJT shares (as in prior conversations), Snap’s 5.36% share yields:

Projected Market Cap: $536 billion

Comparison: Significantly higher than the current $14.18 billion, suggesting Snap is undervalued based on user engagement.

Breakdown of Valuation by Asset

Asset

NJT (Billion Hours/Month)

Estimated Value ($B)

% of Total Value

Snapchat

13.5

13.9

98.0%

Spectacles

0.001

0.28

2.0%

Bitmoji

1.8

0.10

0.7%

Snap Camera

0.01

0.14

1.0%

Zenly (integrated)

-

0.25

1.8%

Other (Snapchat+, R&D)

-

0.28

2.0%

Total

15.311

14.18

100%

Key Insights

Snapchat Dominance: Snapchat accounts for 98% of Snap’s value and 88% of its NJT, driven by its 900 million MAUs and strong engagement among younger users.

Undervaluation: The projected market cap of $536 billion (based on NJT share) is significantly higher than the current $14.18 billion, suggesting Snap’s user engagement is not fully reflected in its stock price, possibly due to ongoing losses ($1.4 billion in 2022).

AR and Innovation: Investments in AR (Spectacles, Lenses) and Snapchat+ position Snap for growth in 2025-2026, particularly as AR advertising and immersive experiences gain traction.

Challenges: Competition from TikTok and Instagram Reels, privacy changes (e.g., Apple’s iOS updates), and macroeconomic swings in ad spending could limit growth.

Conclusion

Snap Inc.’s primary asset, Snapchat, drives its value and user engagement, with a projected market cap of $536 billion based on NJT, far exceeding its current $14.18 billion. This suggests significant undervaluation, driven by its strong user base and AR innovations, despite profitability challenges. Spectacles, Bitmoji, and other assets play smaller roles but enhance Snap’s ecosystem, positioning it as a top contender for 2025-2026.

Key Citations

Snap Inc. - Wikipedia

Who Owns Snapchat? - Famoid

Snapchat Revenue and Usage Statistics (2025) - Business of Apps

Snap (SNAP) - Market Capitalization - CompaniesMarketCap

Snapchat - Wikipedia

SNAP Intrinsic Valuation and Fundamental Analysis - Alpha Spread

Snap Inc. Announces Fourth Quarter and Full Year 2024 Financial Results - Snap Inc."

- GROK

HERTZ (HTZ) Rental Company Bullish Today Despite Tariff FearsHertz (HTZ) was up +12% before falling slightly before closing. It appears the rental company, known for their rental cars may be keeping investors interested even with President Trump's "Liberation Day". Could this be a bullish pick for 2025?

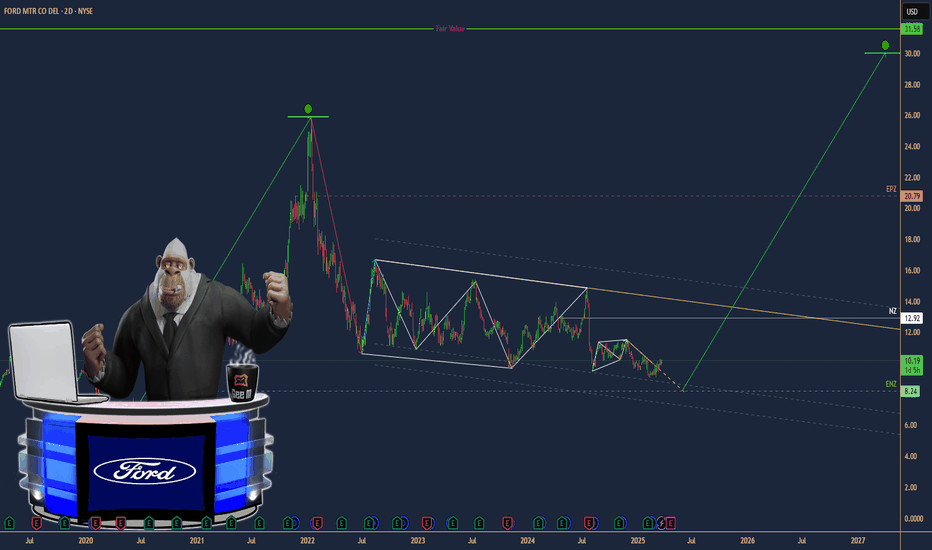

$F: Ford Motor Company – Driving Profits or Stalling Out?(1/9)

Good afternoon, everyone! ☀️ NYSE:F : Ford Motor Company – Driving Profits or Stalling Out?

With F at $10.18, is this auto giant revving up with EVs or sputtering in the market? Let’s shift gears and find out! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 10.18 as of Mar 18, 2025 💰

• Recent Move: Slight uptick in March, per data 📏

• Sector Trend: Auto sector mixed, EV demand growing 🌟

It’s a road with twists—let’s see where it leads! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $45B (4.4B shares) 🏆

• Operations: Global auto manufacturer, focusing on EVs ⏰

• Trend: EV push with F-150 Lightning, per data 🎯

Firm in its lane, with electric acceleration! 🚗

(4/9) – KEY DEVELOPMENTS 🔑

• Q1 2025 Earnings: Expected soon, EV sales in focus 🌍

• EV Sales: F-150 Lightning gaining traction, per data 📋

• Market Reaction: Stock reflects cautious optimism 💡

Shifting to electric, eyes on the horizon! ⚡

(5/9) – RISKS IN FOCUS ⚡

• Economic Slowdown: Impact on auto sales 📉

• Competition: Tesla, GM, VW in EV race ❄️

• Supply Chain: Geopolitical tensions affecting parts 🛑

It’s a competitive race—buckle up! 🚦

(6/9) – SWOT: STRENGTHS 💪

• Brand Power: Iconic auto brand 🥇

• EV Strategy: F-150 Lightning leading the charge 📊

• Undervalued: Low P/E ratio, strong cash flow 🔧

Got the engine to roar! 🏁

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Traditional auto sales vulnerable to economic shifts 📉

• Opportunities: Growing EV market, new models 📈

Can it charge ahead or run out of juice? 🤔

(8/9) – POLL TIME! 📢

F at $10.18—your take? 🗳️

• Bullish: $12+ soon, EV boom drives growth 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $9 looms, market stalls 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

F’s $10.18 price tags potential value 📈, but volatility’s in the air 🌿. Dips are our DCA fuel 💰—buy low, ride high! Gem or bust?

$MAGS: Magnificent Seven ETF – Tech Titan or Overhyped?(1/9)

Good afternoon, everyone! ☀️ CBOE:MAGS : Magnificent Seven ETF – Tech Titan or Overhyped?

With MAGS at $46.85, is this ETF a powerhouse of tech giants or just another bubble waiting to burst? Let’s decode the code! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 46.85 as of Mar 18, 2025 💰

• Recent Move: Likely up, reflecting tech sector strength, per data 📏

• Sector Trend: Tech stocks soaring with AI and cloud hype 🌟

It’s a tech fest—let’s see if it’s worth the buzz! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $1.87B (assuming 40M shares) 🏆

• Operations: Tracks Apple, Microsoft, Amazon, Alphabet, Meta, Tesla, Nvidia ⏰

• Trend: Dominant players in tech, driving innovation and market trends 🎯

Firm in the heart of Silicon Valley! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Tech Rally: Magnificent Seven companies hit new highs, per data 🌍

• Earnings Season: Strong Q4 results from underlying firms, per posts on X 📋

• Market Reaction: MAGS up, reflecting sector momentum 💡

Navigating through tech’s highs and lows! 🛢️

(5/9) – RISKS IN FOCUS ⚡

• Regulatory Scrutiny: Antitrust concerns for big tech players 🔍

• Market Volatility: Tech stocks prone to swings due to innovation and competition 📉

• Economic Factors: Interest rates and global economic conditions impact growth ❄️

It’s a risky ride—buckle up! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Industry Leaders: The Magnificent Seven are pioneers in their fields 🥇

• Growth Potential: AI, cloud computing, and other tech trends fuel expansion 📊

• Dividend Payouts: Some companies offer dividends, adding income potential 🔧

Got the best of both worlds! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: High valuations, potential for overinvestment 📉

• Opportunities: Emerging technologies like quantum computing, biotech integration, per strategy 📈

Can they stay ahead of the curve? 🤔

(8/9) – POLL TIME! 📢

MAGS at $46.85—your take? 🗳️

• Bullish: $50+ soon, tech’s unstoppable 🐂

• Neutral: Steady, risks balance gains ⚖️

• Bearish: $40 looms, overhyped and due for correction 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

MAGS’s $46.85 price reflects the dynamism of the tech sector 📈, but with risks from valuations and regulatory pressures 🌿. DCA-on-dips could be a strategy to manage volatility. Gem or bust?

$FMC: FMC Corporation – Crop Cash or Weed Woes?(1/9)

Good morning, everyone! ☀️ NYSE:FMC : FMC Corporation – Crop Cash or Weed Woes?

With FMC at $42.96, is this agro giant sprouting profits or wilting away? Let’s dig into the dirt! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 42.96 as of Mar 18, 2025 💰

• Recent Move: Up 14.5% from $37.52 on Mar 3, per data 📏

• Sector Trend: Agri sector volatile with commodity swings 🌟

It’s a wild harvest—value might be budding! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $5.36B (124.84M shares) 🏆

• Operations: Crop protection in N. America, LatAm, Asia ⏰

• Trend: Q4 2024 earnings beat, per data 🎯

Firm in agro sciences, weathering the storm! 🚜

(4/9) – KEY DEVELOPMENTS 🔑

• Q4 2024 Earnings: EPS $1.79 beat $1.60 estimate, per data 🌍

• Revenue: Steady despite agri volatility, per reports 📋

• Market Reaction: Price reflects cautious optimism 💡

Growing roots in a tough field! 🌱

(5/9) – RISKS IN FOCUS ⚡

• Commodity Prices: Grain price drops hit demand 🔍

• Economic Slowdown: Reduced grower budgets, per data 📉

• Regulation: Pesticide rules tighten globally ❄️

It’s a risky plot—watch the yield! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Product Portfolio: Insecticides, herbicides, fungicides 🥇

• Global Reach: Ops across continents, per data 📊

• Dividend: ~5% yield draws income seekers 🔧

Got fertile ground to grow! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Volatility, regulatory pressures 📉

• Opportunities: Agri demand rebound, new products 📈

Can it bloom or just mulch? 🤔

(8/9) – POLL TIME! 📢

FMC at $42.96—your take? 🗳️

• Bullish: $50+ soon, agro recovery 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $35 looms, sector woes 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

FMC’s $42.96 price hints at value 📈, but agro risks loom 🌿. Dips are our DCA harvest 💰—buy low, ride high! Gem or bust?

$APA: APA Corporation – Oil’s Wild Ride or Steady Bet?(1/9)

Good afternoon, everyone! ☀️

NASDAQ:APA : APA Corporation – Oil’s Wild Ride or Steady Bet?

With APA at $19.70, is this energy titan a fuel for profit or a risky barrel? Let’s drill down! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 19.70 as of Mar 17, 2025 💰

• Recent Move: Down from higher levels, reflecting oil price volatility 📏

• Sector Trend: Energy sector volatile amid economic uncertainties 🌟

It’s a rollercoaster—hold tight! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $6.1B (310M shares outstanding) 🏆

• Operations: Oil and gas exploration in key regions like U.S., Egypt ⏰

• Trend: Vulnerable to oil price swings, but diversified operations offer stability 🎯

Firm in its niche, but subject to market winds! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Oil Price Dynamics: Recent drops impact revenue and earnings 🌍

• Company Strategies: Focus on cost management and strategic investments 📋

• Market Reaction: Stock price reflects current market sentiments 💡

Navigating through turbulent waters! 💪

(5/9) – RISKS IN FOCUS ⚡

• Oil Price Volatility: Primary driver of performance 🔍

• Regulatory Changes: Environmental regulations and transition to renewables 📉

• Geopolitical Tensions: Impact on supply chains and prices ❄️

It’s a risky venture—stay alert! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Established Presence: Key oil-producing regions like Permian Basin 🥇

• Diversified Portfolio: Operations across multiple geographies 📊

• Financial Stability: Strong balance sheet, per historical data 🔧

Got solid foundations! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Vulnerable to oil price drops, regulatory risks 📉

• Opportunities: Expansion into new markets, M&A activities, potential oil price rebound 📈

Can it weather the storm and shine again? 🤔

(8/9) – POLL TIME! 📢

APA at $19.70—your take? 🗳️

• Bullish: $25+ soon, oil prices rebound 🐂

• Neutral: Steady, risks and opportunities balance out ⚖️

• Bearish: $15 looms, further downturn ahead 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

APA’s $19.70 price reflects current market challenges 📈, but its long-term potential remains. DCA-on-dips could be a strategy to average in over time. Gem or bust?

Pfizer ($PFE): Undervalued Pharma Giant with Growth Potential?(1/9)

Good afternoon, everyone! 😊

Pfizer ( NYSE:PFE ): Undervalued Pharma Giant with Growth Potential?

With PFE at $25.90, is this the time to buy into this pharmaceutical powerhouse? Let’s dive in! 😎

(2/9) – PRICE PERFORMANCE

• Current Price: $25.90 as of March 12, 2025 😏

• Recent Moves: Trading within a range of $24 to $28, currently near the middle 😬

• Sector Vibe: Pharma sector remains stable, with new drug approvals driving growth 📈

Short commentary: The stock seems to be consolidating. Is this a good entry point? 🤔

(3/9) – MARKET POSITION

• Market Cap: Approximately $147.2 billion (assuming 5.67 billion shares outstanding) 💰

• Operations: Global pharmaceutical company with a diverse product portfolio 🛡️

• Trend: Strong Q4 2024 earnings and reaffirmed 2025 guidance 🚀

Short commentary: Pfizer’s fundamentals are solid, with consistent revenue and earnings projections. 😉

(4/9) – KEY DEVELOPMENTS

• Reaffirmed 2025 revenue guidance of $61-64 billion and EPS of $2.80-3.00 📈

• Continued focus on new drug developments and expanding into emerging markets 🌐

• Achieved cost savings goals and ongoing optimization programs for improved margins 💡

Short commentary: The company is managing its costs effectively and looking to future growth. Let’s watch closely. 👀

(5/9) – RISKS IN FOCUS

• Legal challenges related to past products ⚙️

• Competition from generic manufacturers and patent expirations 📉

• Economic conditions affecting healthcare spending ⚠️

Short commentary: These risks are known, but Pfizer’s diverse portfolio should help mitigate them. Stay vigilant! 🕵️

(6/9) – SWOT: STRENGTHS

• Diverse product portfolio across multiple therapeutic areas 🏆

• Strong R&D capabilities and pipeline of new drugs 🌈

• Global presence and distribution network 🌟

Short commentary: Pfizer’s strengths position it well for long-term growth. Keep up the good work! 👍

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Dependence on key products, legal issues ⚠️

• Opportunities: New drug approvals, expanding into emerging markets 🌐

Short commentary: Opportunities abound, but weaknesses need to be monitored. Let’s hope they nail it! 📈

(8/9) – PFE at $25.90 – what’s your call? 🗳️

• Bullish: Price could rise to $30+ if it breaks above $28 🚀

• Neutral: Price remains between $24 and $28 😐

• Bearish: Price could drop to $22 if it breaks below $24 📉

Drop your pick below! 💬

(9/9) – FINAL TAKEAWAY

Pfizer’s $25.90 stance shows a company with solid fundamentals and a fair valuation at a P/E of approximately 8.93. With a strong pipeline and cost management, it’s an attractive option for value investors. Keep an eye on resistance at $28 for potential upside movement. Snag low, hold long!

S&P500 is OVERSOLD!CME_MINI:ES1! NASDAQ:NVDA NASDAQ:AAPL NASDAQ:AMZN NASDAQ:META NASDAQ:MSFT NASDAQ:GOOGL NASDAQ:COIN

BUY OPPORTUNITY on CME_MINI:ES1!

The chart shows a strong bullish setup. A well-defined wave structure is visible along with a key Fibonacci retracement level marking the pullback. A divergence in momentum has been noted, and the price action has bounced off the 52-week EMA, suggesting that buyers are stepping in.

Fundamentally, the outlook remains positive. Recent macroeconomic data points to solid consumer spending and steady industrial production, while bank earnings and statements from major financial institutions have added to market confidence. These positive signals help support the S&P 500’s broader resilience, reinforcing the potential for further gains.

That said, caution is advised. Uncertainties such as shifting monetary policy, potential geopolitical tensions, and any unforeseen changes in economic data could introduce volatility. Traders should consider tight risk management and stop-loss strategies to mitigate downside risks.

Not Financial Advice

BERKSHIRE HATHAWAY ($BRK.A) Q4—INSURANCE & CASH SHINEBERKSHIRE HATHAWAY ( NYSE:BRK.A ) Q4—INSURANCE & CASH SHINE

(1/9)

Good afternoon, TradingView! Berkshire Hathaway ( NYSE:BRK.A ) is humming—Q4 operating earnings soared 71% to $ 14.5B 📈🔥. Insurance and a record cash pile spark buzz—let’s unpack this titan! 🚀

(2/9) – EARNINGS SURGE

• Q4 Ops: $ 14.5B—up from $ 8.5B last year 💥

• Full ‘24: Insurance jumps 51%—key driver 📊

• Net: $ 19.7B Q4—profit stays juicy

NYSE:BRK.A ’s flexing—steady as she goes!

(3/9) – BIG MOVES

• Cash Hoard: $ 334B—up from $ 270B mid-year 🌍

• No Buybacks: Q4 skips—$ 7B spent earlier 🚗

• Apple Trim: Half sold off—cash king 🌟

Buffett’s stacking bucks—ready for action!

(4/9) – SECTOR SNAP

• Market Cap: ~$ 1.075T—top tier 📈

• P/B: 1.55—vs. JPM’s 1.9, Allstate’s 1.3

• Outrun: 25.5% ‘24 vs. S&P’s 25% 🌍

NYSE:BRK.A ’s a beast—value or peak?

(5/9) – RISKS IN SIGHT

• Stocks: Apple, Chevron swings—volatility nips ⚠️

• Succession: Buffett’s exit looms—jitters? 🏛️

• Economy: Rail, retail soften if cash tightens 📉

Solid, but not ironclad—watch out!

(6/9) – SWOT: STRENGTHS

• Diverse: Insurance leads—51% growth 🌟

• Cash: $ 334B—ultimate cushion 🔍

• Track: 19.8% CAGR—beats S&P’s 10.2% 🚦

NYSE:BRK.A ’s a fortress—built tough!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Insurance lean, cash sits 💸

• Opportunities: Deals, yields lift—$ 14.5B zing 🌍

Can NYSE:BRK.A zap the next big win?

(8/9) – NYSE:BRK.A ’s Q4 surge—what’s your vibe?

1️⃣ Bullish—Cash rules, value shines.

2️⃣ Neutral—Solid, risks balance.

3️⃣ Bearish—Growth stalls, succession bites.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NYSE:BRK.A ’s $ 14.5B Q4 and $ 334B cash spark zing—insurance flexes 🌍. Premium P/B, but steady wins—champ or chill?

Buy the Dip: TEM is a Resilient AI Healthcare Pick for 2025Tempus AI NASDAQ:TEM is presenting a compelling investment opportunity as we move into 2025. This health tech company, focused on leveraging AI for precision medicine, has weathered a recent downturn and is showing strong signs of recovery. After a 4 week correction that presented a chance to buy at a discount, TEM has finally shown the ability to rally.

This recovery makes it a particularly interesting prospect for several reasons:

1. AI's Continued Rise: The field of artificial intelligence is advancing at breakneck speed, and Tempus is at the forefront of applying these advancements to healthcare. Their work in areas like genomic sequencing and data analysis for personalized treatment plans positions them exceptionally well to capitalize on this megatrend.

2. Weathering the Political Storm: Tempus's core business is less vulnerable to possible tariffs that may be introduced by incoming President Trump. Healthcare, particularly innovative approaches to disease treatment, remains a critical sector regardless of the political landscape. Furthermore, Tempus' customers being mostly internal U.S. customers provides further resilience in the face of possible tariffs.

3. Technical Rebound: As the attached chart illustrates, TEM is in the midst of a technical bounce back. The recent price action suggests that the sell-off may be overdone, and the stock is finding support at current levels. The upward sloping support and resistance lines indicate a potential 40-80% gain if TEM can continue to show resilience in the face of selling pressure. The stock currently trades below it's 20 day EMA, but the recent rally shows that it could potentially find support along this average before continuing to trend upwards.

In Conclusion:

Tempus AI offers a unique combination of growth potential in a rapidly expanding sector, resilience to potential political headwinds, and a technically attractive entry point. While all investments carry risk, TEM's current profile suggests it's a stock worth serious consideration for gaining exposure to the intersection of AI and healthcare in 2025, especially at these highly discounted prices.

Disclaimer: This is not financial advice. Conduct your own research before making any investment decisions.

Remember,

Patience is Paramount.

$MU getting accumulated with PT $140-220- NASDAQ:MU GAAP eps is growing substantially in 2025 and 2026 but market hasn't rewarded NASDAQ:MU

- It appears that whales are accumulating the stock and/or suspicious of NASDAQ:MU future demand.

- If analyst expectation and company's projection is true then this stock is grossly undervalued.

Based on the fundamentals:

Year | 2025 | 2026 | 2027

Gaap EPS | 6.32 | 9.65 | 11.27

EPS growth | 730.48% | 52.72% | 16.80%

Bear case ( for. p/e = 15 ) | $94.8 | $144.75 | $169.05

Base case ( for. p/e = 20) | $126 | $193 | $225

Base case ( for. p/e = 25 ) | $158 | $241 | $281.75

Bull Case ( for p/e = 35 ) | $189 | $289 | $338

$BP’S COMEBACK? ELLIOTT’S STAKE & UNDERVALUATION BUZZBP’S COMEBACK? ELLIOTT’S STAKE & UNDERVALUATION BUZZ

1/7

BP ( NYSE:BP ) just got a jolt of activist energy ⚡️ as Elliott Management took a significant stake. Shares surged 7% to 464.75 pence—the highest since August. Are we witnessing the start of a big turnaround? Let’s break down the numbers.

2/7 – REVENUE RUNDOWN

• 12-month revenue (ending Sept 2024): $199.1B (↓13.72% YoY)

• Big contrast to 2022’s 51.58% revenue jump

• Post-pandemic swings? The energy rollercoaster keeps rolling. 🎢

3/7 – EARNINGS HIGHLIGHTS

• Q4 2023 net income: $371M vs. $10.8B the previous year 🤯

• Lower refining margins + weaker oil & gas production = big dent

• Still holding a “GOOD” Financial Health score—some resilience under the hood.

4/7 – ELLIOTT’S INVOLVEMENT

• BP’s 2023 performance: -16%—underperforming Shell (-4%) & ExxonMobil (+8%)

• Elliott sees untapped value? Activists typically target companies trading below intrinsic worth

• Market loves it: 7% daily pop signals new optimism. 🚀

5/7 – VALUATION SNAPSHOT

• TTM P/E ratio at 7.89—notably below Shell & Exxon’s multiples

• Some analysts call BP “undervalued” and point to further upside potential

• If Elliott drives restructuring or divestitures, could we see a sustained rally?

6/7 Is BP primed for a major comeback with Elliott on board?

1️⃣ Yes—Activists will unlock hidden value!

2️⃣ No—BP’s challenges run too deep.

3️⃣ Maybe—Need more clarity on strategy.

Vote below! 🗳️👇

7/7 – RISK FACTORS

• Commodity Volatility: Oil & gas prices can swing hard

• Regulatory & ESG Pressure: Green-energy pivot demands big $$

• Debt Levels: ~$20.9B net debt could limit agility

• Competition: Shell, Chevron, & Exxon aren’t standing still. ⛽️

IOTA on the verge of…Inverted chart. Inverted head and shoulders is clearly seen. After a failed attempt for breaking the shoulder looks like FWB:IOTA wants to try again. So two scenarios can happen:

1- Price will reach 0.50$, after that it will face a rejection, so the second attempt fails and in that case IOTA can touch its previous ATL again.

2_ Bulls are turnt enough to break the shoulder, price stays above 0.50$, and the previous ATH can be touched.

Before anything, FWB:IOTA should break the $0.42 resistance. If that doesn’t happen the price can reach $0.20 but it’s really unlikely to happen, I’m still thinking that IOTA will try to break the shoulder with another attempt.

So it’s either

$0.42 is broken >>> $0.50 is broken >> previous ATH or even a new High.

Or

The price is rejected at $0.42 >>> $0.20 can be touched >> then either the previous ATL will be touched if things get bearish or a again, another try for breaking $0.50 can happen from there.

Harsha engineering good swing pick?Harsha engineering from fundamental pov company is debt free and has delivered a good cagr return

Now stock is at good value looks like in mid of Jan month it will pop up with good volume

Risk traders can accumulate at cmp keeping sl at 475 almost 8% while safe trader can accumulate at 485-515

Tgt 562 598 676 720

Only for educational purposes

Ask your financial advisor and broker before buying

Symbotic Hypergrowth? $850 Price TargetOverview

Symbotic Inc. is an A.I. and robotics automation company based in Wilmington, Massachusetts that is looking to increase the ability for companies to keep up with growing demand. To do this, they utilize artificial intelligence software to maintain records and warehouse organization with the assistance of SKU numbers. Autonomous robots then account for, store, and retrieve items in a fraction of the time that it would take a human being. Symbotic's mission is to increase supply capabilities through the symbiotic relationship of artificial intelligence and robots. Its origins trace back to 2007, before it was known as Symbotic, and the company went public in 2022 ( NASDAQ:SYM ).

Call it FOMO, but I think Symbotic Inc. has the potential of becoming a hypergrowth stock. I built my own fundamentals tracker to get a pulse on the tech company's vitals and, while it still is not a profitable company, it looks like it's in the early stages of becoming so. The fundamentals for Symbotic provide me the confidence to invest despite the presence of red flags which led me to performing a deep dive. My price target for Symbotic Inc. is $850 with a projected timeline before 2030.

What I Don't Like

SYM has lost nearly 60% in value since July 2023 from a high of $64.15 to its current share price of $26.87. If you look up Symbotic Inc. on a search engine then you will also see that there are numerous law firms attempting to build class action lawsuits. The headlines can't help but to sow distrust by utilizing strong statements such as "misleading investors" and "inflated revenue" within their subjects. Within the last few weeks Symbotic had to file a delayed annual report due to self-identified accounting errors within their balance sheets. Also, if you dig through their filings, you will find that Symbotic Inc. was born from a deal with SVF Investment Corp which, according to the filings, was headquartered in the Cayman Islands.

I can only assume that the business dealings with SVF Investment Corp were to facilitate equity financing and an expedited public launch for SYM. From my findings, SoftBank Group Corp ( TSE:9984 ) is an investment conglomerate and the parent company to multiple subsidiaries. You guessed it, it is affiliated with SVF Investment Corp which functions as a "blank check company" for SoftBank. In my limited knowledge, this translates as a way for SoftBank to inject a substantial investment into the company that is now known as Symbotic Inc. No matter how savvy they may have been to launch Symbotic Inc., business deals that originate in the Cayman Islands typically raise one's eyebrows.

What I Do Like

Symbotic Inc. seems to have a pretty solid vision for global expansion and has attracted some significant institutional investors such as SoftBank, Vanguard, BlackRock, and Morgan Stanley to name a few. In fact, according to the NASDAQ site, 282 institutional investors hold 82% of Symbotic Inc.'s Class A Common Stock. Symbotic Inc. was founded by Richard "Rick" Cohen who currently serves as the CEO and is a legacy to the Cohen family who founded C&S Wholesale Grocers. Symbotic's technology is used by C&S Wholesale Grocers which is one of the largest privately held companies in the United States.

Symbotic and SoftBank have partnered on a separate venture known as GreenBox which is meant to deliver automated warehouses made possible by Symbotic's hardware and software. According to the company's site, GreenBox is supplying warehouses as a service to consumers. With an increase in online shopping, I believe that Symbotic is both seeing and filling a need in an industry that its founder is very familiar with. I can also envision Symbotic spreading its reach internationally which helps fuel my massive price target. Megacap stocks need to have a global influence and extend across industries, which Symbotic appears to be preparing for.

Fundamentals

Right now, Symbotic Inc. is in its early stages and is bringing in a negative income which makes it a risky investment. However, the company's total revenue has increased by 200% from 2022-Q4 to 2024-Q4; the gross profit has also increased by 147% in the same timeframe. Symbotic's net income has revealed consistent losses since 2022, but the 2024 annual report had the smallest loss on record at a negative $84.7M which is a 39% improvement from 2022 and a 59% improvement from 2023. No matter which way you cut it, the company is still absorbing annual losses so it will be important to keep an eye on improvements and deficiencies to identify any consistent trends.

NASDAQ:SYM has 585,963,959 total outstanding shares according to the 2024 Annual Report published at the beginning of December. This is a far cry from the 106M outstanding shares reported on some financial websites and even here on TradingView. From my findings, around 100M of Symbotic's shares are Class A Common Stocks and the remaining 485M are Class V Common Stocks. My focus is on the market capitalization which is a tool that I like to use when establishing long-term price targets. For Symbotic, which has the potential for global reach and use across multiple industries, I think it's reasonable to achieve a market capitalization of $500B.

Price Target

With the current number of outstanding shares at a market cap of $500B, this would place Symbotic's share price at $853. This type of growth would turn a $1,000 investment today into $31,710 at the projected target price; a whopping 3,000% return. HOWEVER, a lot has to happen to make this come to fruition. One thing I would like to see, in addition to profitability, is for Symbotic to begin buying back its own stock.

It's become my investing philosophy that companies who believe they are undervalued will buyback their shares while companies that believe they are overvalued will issue new shares. Symbotic's total outstanding shares have increased by 5.8% since its annual report at the end of 2022. I think that my philosophy is best tailored to established companies so it is possible that Symbotic could be an exception. Because the company is so new, it may need to issue more shares to generate enough capital to stay afloat while its roots set.

BELUSDT – Deeper Insights for a Stronger Conviction With BEL’s technical breakout in full swing, deeper insights into its fundamental and market-driven aspects help solidify the case for a massive rally. Let’s explore how BEL stands out in the crypto landscape, and why this breakout is primed for sustainable growth.

🔍 DeFi Adoption: The Catalyst for BEL's Growth

Bella Protocol (BEL) is part of the rapidly growing DeFi ecosystem, offering smart DeFi services and user-friendly tools like automated yield farming and optimized wallet management. As DeFi continues to expand, BEL is uniquely positioned to capture demand for simpler and more efficient decentralized finance solutions.

BEL's Role in the DeFi Market

1️⃣ Yield Optimization: BEL's protocols focus on maximizing returns for users while reducing gas fees—a significant pain point in DeFi.

2️⃣ Simplified UX: Bella Protocol offers one-click solutions that cater to non-technical users, enabling mainstream adoption.

3️⃣ Staking and Lending Integration: With BEL's staking and lending functionalities, users earn rewards while participating in a secure ecosystem.

💡 Growth Stat: According to DeFiLlama, the total value locked (TVL) in DeFi has grown to over $60 billion as of late 2024, with smaller-cap projects like BEL set to benefit from the renewed inflow of capital into the sector.

🛠️ Market Cap Insights – Undervalued Gem?

Current Market Cap vs. Potential Upside

BEL’s current market cap is ~ FWB:40M , making it a low-cap gem with room to grow significantly in the next bull cycle.

For perspective:

If BEL achieves a $400M market cap (10x growth), it would still rank lower than many mid-tier DeFi projects, suggesting plenty of upside remains.

BEL reaching the $2.00-$3.00 target range would place its valuation closer to competitors like SushiSwap or PancakeSwap, which have multi-billion dollar valuations during peak cycles.

Market Efficiency & Price Exploration

The breakout from multi-year lows is a signal that smart money is positioning ahead of BEL’s fundamental improvements and ecosystem growth.

Small-cap projects like BEL often see exaggerated price moves once volume increases, as liquidity is concentrated into fewer trades, amplifying volatility in favor of buyers.

💡 Key Insight: BEL’s lower valuation compared to larger DeFi competitors means it has greater room for exponential growth, especially in a bull market where investors chase undervalued gems.

📈 Tokenomics Breakdown – What Fuels BEL?

1️⃣ Circulating Supply:

BEL has a maximum supply of 100 million tokens, with over 60% already in circulation.

This healthy ratio reduces inflationary pressure compared to tokens with lower circulating percentages.

2️⃣ Staking Rewards:

BEL holders can stake their tokens and earn rewards, providing long-term holders with passive income while reducing market supply.

3️⃣ Ecosystem Usage:

BEL tokens are used for transaction fees, governance voting, and ecosystem development, tying token value directly to Bella Protocol’s growth.

4️⃣ Burn Mechanism:

BEL periodically burns tokens, creating a deflationary effect that supports price appreciation as demand increases.

💡 Stat to Watch: Bella Protocol’s staking APY and total staked tokens have steadily increased over the last 12 months, indicating rising interest in the platform.

📊 Broader Crypto Market Trends Supporting BEL

1️⃣ Altcoin Season Potential

As Bitcoin dominance (BTC.D) begins to decline, capital often flows into altcoins and mid-cap projects. BEL fits perfectly into this trend as a low-market-cap altcoin.

2️⃣ Increasing DeFi Activity

With growing uncertainty in traditional finance, DeFi continues to attract users, and protocols like BEL are perfectly placed to capture this flow.

3️⃣ Positive Regulatory Developments

Regulatory clarity around crypto has boosted sentiment for legitimate DeFi projects, including Bella Protocol, which complies with decentralized finance standards.

📊 Technical Insights Supporting the Bullish Case:

1️⃣ Historical Price Action

BEL previously surged to $3.00 during its last bull cycle, making this a key area to watch for price action.

The recent breakout suggests a revisit of these highs, especially as altcoin markets recover.

2️⃣ Bullish Market Sentiment

The crypto market is showing signs of renewed optimism, with increasing activity in mid-cap altcoins like BEL.

BEL’s triangle breakout aligns perfectly with the broader trend of altcoins gaining momentum, signaling that the market is gearing up for a strong move.

3️⃣ Fibonacci Confluence

The 0.618 Fibonacci retracement level aligns with the breakout zone at $0.75-$0.85, making it a high-probability entry point.

Extensions point to $2.00 and $3.00 as logical upside targets based on historical price behavior.

🔥 Final Verdict – BEL as a Must-Watch Altcoin

BEL has all the hallmarks of a strong breakout trade and long-term hold, with technical, fundamental, and market-driven factors aligning for a potential multi-fold rally. Its undervalued position in the DeFi sector, combined with its technical breakout and growing adoption, makes it one of the most compelling altcoin opportunities heading into 2025.

Subaru is Cheap!FUJHY is cheap by several metrics and warrants a multiple expansion!

- TTM GAAP PE is 71% below sector median

- FWD GAAP PE is 70% below sector median and 53% below its 5 year average.

-EV/EBITDA TTM and FWD are 92 and 94% below sector media; both are about 72% its 5 year avg

-P/S, P/FCF, P/B all are substantially below sector median and its 5 year avg

-DCF based on FCF and 7% discount rate implies a margin of safety at 89.1%

-Shiller PE is 8.34, during the past 10 years, Subaru's highest Shiller PE Ratio was 31.54. The lowest was 6.70. And the median was 10.74. Subaru's shiller PE is ranked better than 84% of 739 companies in the vehicle and parts industry.

-Technically, FUJHY is sitting near the bottom of a long term uptrend and appears to be finding a bottom within a flat channel and starting to trend up.

Subaru has been able to recover to its 2017-2018 profitability and net income range while projecting FWD growth. Given these considerations Subaru appears to be very cheap on several time frames and metrics.