UnitedHealth: Deeply oversold but worth a closer lookUnitedHealth (UNH) is the largest private healthcare company in America. Eight million Medicare Advantage members. Optum’s network reaches tens of millions more. It has the data, the reach, and the pricing power. At today’s valuation, it’s worth adding to your watchlist. Forward P/E at 11× versus a five-year average of 14×. Price-to-sales at 0.6×. RSI at levels not seen in decades. Oversold. Under-owned.

Mispriced? Potentially. We must make it very clear that there could be more downside. But upside is also worth considering.

The AI angle is real. UNH’s health data trove is unmatched. AI can strip billions in waste, automating claims, flagging fraud, predicting costly illnesses before they happen. This isn’t science fiction. It’s execution. Done right, it builds margins and widens the moat. Few can play at this scale. UNH can.

Healthcare as a sector trades 20-30% cheaper than the S&P 500. Aging demographics and chronic care demand are long-term tailwinds. A re-rating here could be swift and brutal for anyone short.

Now, the problems. Medical costs are spiking. Medicare Advantage margins are squeezed. Guidance was pulled, and that spooked the market. Leadership turnover added uncertainty.

These are real headwinds. But they’re fixable.

Premium hikes are already being set for 2026. Stephen Hemsley, the architect of UNH’s prior growth, is back. He’s cutting, reviewing, and bringing in outside talent.

Price implications? The market is pricing in permanent damage. That’s why you can buy a market leader at a crisis multiple. If margins recover and AI efficiencies kick in, this stock doesn’t just bounce, it re-rates. The gap from 11× to 14× earnings on UNH’s scale is tens of billions in market cap.

The bear pit is noisy. The bull case is quiet. But it’s there, and it’s strong. Stop losses are important to manage more downside risk.

The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

Unitedhealth

Entering UNH HereTrading Fam,

I'm not going to go into a long exposé about how great the technicals are here because, truthfully, they are not great. In fact, there is relatively little that supports any kind of entry here other than the fact that this stock is extremely oversold. Really, the only reason I even considered an entry here is that my indicator has given me a buy. If you have been following me for any length of time, you know that this thing is knocking it out of the park in stocks. But to keep it safe, I am entering a 1:2 long rrr, shooting for $327 with a $217 SL. Let's see if my little indicator can keep its amazing win streak going even without a lot of technicals to support it.

✌️Stew

United Health - The perfect time to buy!⛑️United Health ( NYSE:UNH ) finished its massive drop:

🔎Analysis summary:

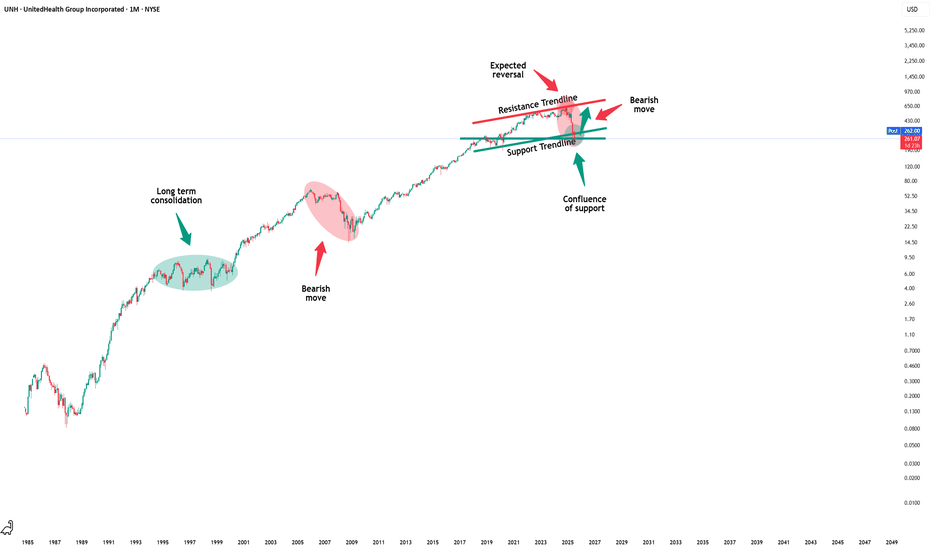

Over the past couple of months, United Health managed to drop an incredible -60%. This drop however was not unexpected and just the result of a retest of a massive resistance trendline. Considering the confluence of support though, a bullish reversal will emerge quite soon.

📝Levels to watch:

$250

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

UNH : Are Bad Days Over ? (Cautious)UNH shares have moved above the 50-period moving average but are trading below the 200-period moving average.

For now, since the 200-period moving average is very high, a small trade can be tried by keeping the stop-loss level a little tight.

A few weak movements may pull the average down and the price may break the average.

Therefore, small position sizes are ideal.

NOTE : If we can maintain persistence on 376(Which will take a few days),

then we will look at the other gaps.

Risk/Reward Ratio : 2.39

Stop-Loss : 274.99

Take- Profit Level : 376.38

Regards.

UnitedHealth (UNH) Shares Plunge Following Earnings ReportUnitedHealth (UNH) Shares Plunge Following Earnings Report

Yesterday, prior to the opening of the main trading session, UnitedHealth released its quarterly results along with forward guidance. As a result, UNH shares dropped by over 7%, signalling deep disappointment among market participants. According to media reports:

→ Earnings per share came in at $4.08, missing analysts’ expectations of $4.48.

→ Revenue guidance was set at $445.5–448 billion, falling short of the anticipated $449.07 billion.

→ Concerns were further fuelled by rising costs and declining profitability, which the company attributed to the continued impact of Medicare funding cuts.

Consequently, the UNH share price dropped to its lowest level of 2025, last seen on 15 May.

Technical Analysis of UNH Stock Chart

In our end-of-May analysis, we updated the descending channel on the UNH stock chart and highlighted that following the recovery from the May low (marked by arrow 1), sellers could regain control. Since then:

→ Throughout June, the share price exhibited signs of supply-demand equilibrium around the psychological $300 level.

→ However, after an unsuccessful rally that formed peak A (which now resembles a bull trap), the balance shifted in favour of the bears. The price began to slide lower along the median line of the descending channel (illustrated by arrow 2).

This pattern was a red flag, particularly against the backdrop of a broadly rising equity market since the beginning of summer. Even if the bulls had hope, yesterday's candle could have completely extinguished it:

→ The session opened with a wide bearish gap.

→ During the day, bulls attempted a recovery, but failed — the candlestick closed at the daily low, leaving a long upper wick, a classic sign of selling pressure.

In this context, we could assume that:

→ Bears may seek to extend their advantage and test the year’s low;

→ The bearish gap area (highlighted in purple), reinforced by the descending channel’s median line, could act as resistance during any potential recovery.

At the same time, the $250 psychological level appears to be a strong support zone. This is backed by the 15 May bullish pin bar formed on record trading volumes — a potential sign of institutional interest in accumulating shares of this healthcare giant in anticipation of a long-term recovery.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

My UNH Thesis: Betting on a Healthcare Giant's Come BackThe healthcare sector has been in decline, which creates interesting opportunities. I recently talked about a few pharma plays - Eli Lilly, Novo Nordisk, and Pfizer.

Here's why I'm investing in NYSE:UNH :

UnitedHealth Group (UNH) has tanked ~50% in the past year, but the July 29 (VERY SOON) earnings could flip the script. As a historically dominant player, UNH is now undervalued amid sector weakness, offering massive upside if regulatory fears ease.

Here's my full bull case. 👇 FUNDAMENTAL ANALYSIS

Why the Sell-Off? A Perfect Storm of Bad News

UNH crushed the market for 15 straight years (2009-2023) with positive returns, predictable EPS growth, and 134% gains over the last decade.

But 2024 brought chaos:

Feb: Massive cyber attack caused a one-time EPS hit (non-recurring).

Ongoing: DOJ antitrust probe, criminal fraud investigation, rising Medicare costs, and Optum losses.

April: Disastrous Q1 earnings miss + lowered guidance.

Leadership drama: CEO death.

This erased gains (down 7% over 5 years), amplified by healthcare sector outflows—the biggest since 2020. But is this overblown? Signs point to yes. The markets almost always overreact to bad news.

Bullish Signals: Insiders Betting Big

The tide is turning:

Insider Buying Boom: $32M+ in 2024 (vs. $6.6M in 2019), including new CEO/CFO—highest in 15 years.

Congress Buying: Q2 2024 saw net purchases for the first time in 5 years (vs. historical selling).

DOJ Shift: Probe refocusing on pharmacy benefits (PBM) unit, dropping acquisition/monopoly scrutiny—implies no major findings. Great news!

Sector Tailwinds: Healthcare is one of 3 S&P sectors below historical valuations. Super investors (usually tech-obsessed) are piling in, despite the sector's -10% YTD vs. S&P's +13%.

Plus, UNH's dividend yield is at a record ~3% (vs. 1.5% avg), with 16%+ historical growth and 100%+ free cash flow conversion. Rare combo of yield + growth!

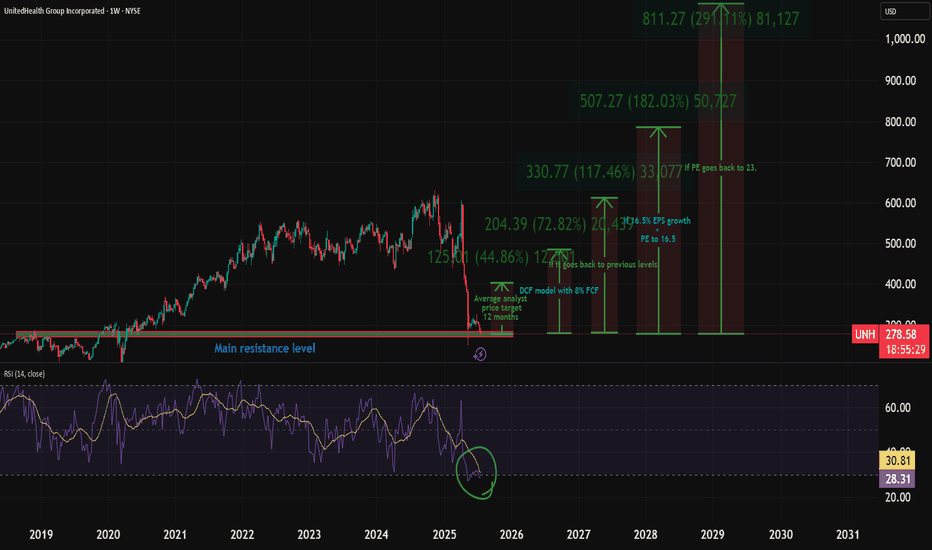

Valuation: Screaming Buy?

UNH trades at PE ~11.9 (vs. 10-year avg 23)—a steal.

Analysts project 16.7% EPS CAGR through 2029.

Conservative Scenario: 16.5% EPS growth + PE to 16.5 = $780/share by 2030 (173% total return, 18% CAGR ex-dividends).

Optimistic: PE back to 23 = $1,084/share (280% return).

Models confirm:

DCF (8% FCF growth): ~$484/share (70% upside).

DDM (7% div growth): ~$607/share (112% upside).

Blended Fair Value: ~$545/share (75-90% upside from ~$300). Buy below $436 for 20% safety margin.

Still, there is fear of DOJ uncertainty—investors hate unpredictability and that's why the stock is so low.

Key Catalyst: July 29 Earnings

This could be UNH's "most important report ever." Watch for:

Regulatory/legal updates (DOJ progress).

Full-year guidance revisions.

Metrics like medical loss ratio and PBM performance.

Positive news = potential rocket 🚀. Expectations are low (20 bearish EPS revisions vs. 0 bullish), so a beat could spark volatility... upward.

Risks: Not Without Bumps

Regulatory escalation (e.g., PBM issues) could tank it further.

Short-term headwinds: Medicare costs, sector selling.

Mitigants: DOJ de-risking, strong FCF buffer, insider confidence. Enter cautiously—size positions small.

TECHNICAL ANALYSIS

I also did a little technical analysis:

UNH price is at a resistance level

My EVaR indicator tells me we are in a low-risk area

RSI says the stock is oversold

I added the different price targets for better visualization

THE PLAN

My plan:

Later today, I will allocate 1% to 1.5% of my portfolio to the stock. If it drops, I will continue to DCA. The stock is already really beaten down, and I think a company this large cannot drop much more.

Quick note: I'm just sharing my journey - not financial advice! 😊

$UNH – Macro Outlook UpdateBack in April, I suggested the long-term uptrend from 2008 may have topped, shifting into a multi-year correction toward the 260–150 support zone. The decline unfolded faster than expected, with news-driven selling hitting the upper edge of that macro support — followed by a strong rebound.

Apr mind www.tradingview.com

Currently, price is consolidating constructively. As long as 282 holds, I favor a continuation higher into the 360–430 resistance zone where we’ll reassess the broader structure.

Daily chart

Macro chart

Thank you for your attention and I wish you successful trading and investing decisions!

UnitedHealth (UNH) Share Price ReboundsUnitedHealth (UNH) Share Price Rebounds

A month ago, in our analysis of the UNH chart, we:

→ highlighted that UnitedHealth shares had lost nearly 23% in value;

→ drew a descending channel and suggested that bearish pressure could continue, threatening the support level around $450, which had held since early 2022.

Since then, UNH’s stock price decisively broke below that level (as marked by the arrow), falling to around $250 — its lowest point since spring 2020 — before staging a sharp rebound. This steep price movement was driven by a series of fundamental developments, including:

→ the resignation of the CEO and news of a Department of Justice investigation into potential Medicare fraud;

→ UnitedHealth withdrawing its earnings guidance for the coming year;

→ political debates over the Medicaid programme as part of the 2025 budget negotiations;

→ President Trump’s directive to cut prescription drug prices.

Recent news that the new CEO and several top executives have bought tens of millions of dollars’ worth of UNH shares appears to have renewed investor confidence — the share price rose above the $300 mark yesterday.

Technical Analysis of UNH Share Chart

These latest developments justify an update to the descending channel configuration. Of particular note is the gradual decline with limited volatility — a sign that the price is moving along the channel's median line (highlighted on the chart).

In this setup:

→ the bounce from the $250 level points to the lower boundary of the channel;

→ traders may consider a scenario where the current recovery pushes UnitedHealth stock towards the median, after which supply pressure may return and offset the recent dominance of demand.

It’s also possible that the key psychological level of $300 could now act as support.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

UnitedHealth Group | UNH | Long at $323.00UnitedHealth Group NYSE:UNH currently has a P/E near 15x, steady rising revenue (2024 = $400+ billion), EPS of 6.24x, dividend of 2.2%, and earnings are forecast to grow by 10.8% per year. The stock, however, has plummeted recently due to negative news, rising healthcare costs, CEO changes, and suspension of 2025 outlook. Every company has bumps, but I view solid companies like NYSE:UNH as pure opportunities for long-term investment - especially with America's aging population.

From a technical analysis perspective, the stock price has entered my "crash" simple moving average zone (which currently extends down near $307.00). Personally, this is the zone I am starting a position due to the odds of a future bounce from here. However, I am very aware that there is an open price gap near $265.00 that may get filled this year or early next. I could see a bounce in my crash zone to bring in the bulls and then a drop to that level to heighten the fear. That is another area I plan to grab more shares and build a strong position. But, in case it doesn't extend that low, I have started a position at $223.00, with future investments near $307.00 and below. I doubt this will be a quick turnaround stock - patience is where money is made.

Targets (into 2028):

$375.00

$475.00

$580.00

UnitedHealth (UNH) Share Price PlummetsUnitedHealth (UNH) Share Price Plummets

UnitedHealth shares crashed by nearly 23% yesterday after the healthcare giant reported weaker-than-expected Q1 2025 results:

→ Earnings per share: actual = $7.20, expected = $7.29

→ Revenue: actual = $109.5bn, expected = $111.5bn

Technical Analysis of UNH Share Chart

As far back as a year ago, we highlighted key support around the $450 level. Yesterday’s negative news caused this support to once again demonstrate its strength by holding back further decline — but will it hold?

Taking the price action marked on the chart as a base, we can establish the structure of a descending channel (shown in red), with the price gapping sharply lower into the bottom half of this channel — and yesterday’s candle high (marked with an arrow) suggests that the median line has turned into resistance.

Yesterday’s candle closed near its lows, so it is reasonable to assume that bearish pressure may persist (with the aim of testing the lower boundary) — in which case, the $450 support zone, in place since early 2022, could be at risk.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

UNH - Took the GREEN PILL! 15% Move Inbound!NYSE:UNH 💊

H5_Swing Trade:

Playing small with one $560 Call heading into earnings. Fundamentally undervalued and beaten down stock since their CEO was murdered.

Good earnings and the fact they are a safety play make me really like this play.

H5 Trade and WCB look great too!

🎯$623

⏳Before March

Not financial advice

UNITEDHEALTH GROUP | THE BEAR'S CLAIM: $UNH PAYS THE PRICE Dec17UNITEDHEALTH GROUP | THE BEAR'S CLAIM: NYSE:UNH PAYS THE PRICE Dec17

UnitedHealth Group, NYSE:UNH , UNH

NYSE:UNH Trends:

NYSE:UNH Weekly Trend: Bearish

NYSE:UNH Daily Trend: Bearish

NYSE:UNH 4H Trend: Bearish

NYSE:UNH 1H Trend: Bearish

NYSE:UNH Price Target Areas:

NYSE:UNH BUY/LONG ZONE (GREEN): $488.75 - $514.75

NYSE:UNH DO NOT TRADE/DNT ZONE (WHITE): $480.00 - $488.75

NYSE:UNH SELL/SHORT ZONE (RED): $455.00 - $480.00

All indicators are pointing to bearish for $UNH. Looking at the monthly timeframe we can see there is a range that was respected between the levels of 480 up to 555. After price finally broke the level of 555 a new range began. 560 up to 615/620 area. Given the recent news and events; the stock has since seen a deep bearish trend. Momentum has taken price all the way back down to the previous range low of 480. Price currently rests on 480. Bears should seek continuation and target levels of 455/460, or even down to 415. Bulls should look for a reversal marked by breaks over 488.75 on the lower timeframes, or the 549 area for a higher frame reversal.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technicalindicators, supportandresistance, rangebreakout, rangebreakdown, rangetrading, chartpatterntrading, chartpatterns, unh, unitedhealth, unitedhealthgroup, NYSE:UNH , insurance, insuranceclaims, unhinsurance, unhclaims, unhdeductible, unhstock, unhprice, unhtarget, unhsetup, unhtrade, unhzone, medicare, unhanalysis, unitedhealthanalysis, unhtradeidea, unhidea, unhrecentevents,

UNH | UnitedHealth Group (UNH) | BearishNYSE:UNH

Technical Analysis of UnitedHealth Group (UNH)

Key Observations:

Current Price Action:

Price: $498.50

Recent Drop: -21.98 (-4.22%)

Support and Resistance Levels:

Immediate Support: $475.87 (Target Price 1)

Further Supports: $436.72 (Target Price 2)

Resistance: The price recently broke below previous support around $525-$530, confirming bearish momentum.

Trendlines:

The price has clearly broken below a key upward trendline.

The breakdown signals a shift from a bullish to a bearish trend, with lower highs (LH) and lower lows (LL) forming.

Relative Strength Index (RSI):

Current RSI: Below 30 (Oversold Zone).

The RSI indicates heavy selling pressure, suggesting the stock may be oversold, but bearish momentum remains intact.

Target Prices:

Target Price 1: $475.87

This level acts as immediate support where price could pause or consolidate.

Target Price 2: $436.72

If the price breaches the $475.87 level, the next key support lies at $436.72.

Summary:

UnitedHealth Group (UNH) is showing clear bearish signs, having broken below critical support and its upward trendline. The RSI indicates an oversold condition, but momentum remains downward. Key levels to monitor are $475.87 (Target 1) and $436.72 (Target 2). Any recovery will need to overcome resistance at $525-$530 for a trend reversal.

UNH Selloff Unreasonable - Still 15% ROI Short-TermSince my first NYSE:UNH idea a couple of days ago the price of this stock dropped significantly. If you've been part of the first idea you should've been able to lock in around 1.x% of return when using a tight stop-loss. Otherwise you've been stopped out with break-even. Nevertheless, the sell-off was not helpful and is completely exaggerating the situation at UNH since the company is not really effected by the current PBM debate.

"Deutsche Bank sees a potential divestiture as not having a significant impact on earnings, estimating the risk at likely less than $200M of the company’s roughly $30B+ operating earnings. Deutsche Bank noted, however, that CVS (CVS), Cigna (CI) and UnitedHealth (NYSE:UNH) 'could face additional risk from losing the ability to vertically integrate the PBM, fulfillment and manufacturing functions of biosimilars through organizations like Cordavis and Quallent.' Despite concerns about the potential breakup of their pharmacy businesses, Deutsche Bank maintained it's buy rating on UnitedHealth (UNH)."

From a technical standpoint we can see a confluence of support:

Weekly SMA200

Strong Trendline from March 2020

Horizontal Support at $480

UNH managed to bounce from the trendline intraday today. This could mean we're going to see a turnaround from here. If we break below the trendline on the daily chart this trade will be invalidated. Otherwise our target sits at $550.

UNH Bounce - Don't Miss Out On This 15% OpportunityNYSE:UNH dropped after the tragic death of UnitedHealthcare CEO (not UNH Group CEO) as well as public backlash. Nevertheless, as always in such situation, this has nothing to do with the stock itself. As price action traders we do not trade political or news events since those drops have an unimportant impact mid- to long-term.

UNH now sits on the support zone at around $550 which was previous resistance. We also filled the daily gap at around $568 completely. We touched the 0.236 Fib from the $273 bottom (from 2020) and the RSI is nearly oversold on the daily. This gives us a got chance for a bounce from this zone up to $600 - $620.

Support Levels:

$550

$528

Target/Resistance Levels:

$600

$622-628

UnitedHealth Group ($UNH) Faces Surge in Medical CostsUnitedHealth Group Inc. (NYSE: NYSE:UNH ), one of the largest health insurers in the United States, reported a 3% drop in share price following its Q3 2024 earnings report. The company's results highlighted an uptick in medical costs as it grapples with challenges in its insurance business, including lower government payments and persistently high healthcare demand. Let’s break down the key aspects driving the stock's recent performance.

Elevated Costs and Earnings Beat

UnitedHealth's Q3 2024 results showed a significant rise in its medical loss ratio (MLR)—the percentage of premiums used to cover medical costs. The MLR rose to 85.2%, exceeding both last year’s figure (82.3%) and analysts’ expectations of 84.2%. This surge in costs is attributed to an increase in healthcare services under Medicare plans, particularly for individuals aged 65 and older, as postponed procedures from the COVID-19 pandemic catch up. Additionally, turnover in Medicaid has left insurers with a sicker patient base, further elevating costs.

Despite these challenges, UnitedHealth delivered an adjusted profit of $7.15 per share, beating Wall Street estimates by 15 cents. The company's revenues hit $100.8 billion, surpassing the $99.28 billion expected by analysts, thanks to strong growth in its healthcare services businesses under Optum and insurance offerings under UnitedHealthcare.

Key highlights:

- Optum Health revenue grew by $2.1 billion, driven by the expansion of value-based care and in-home patient services.

- Optum Rx, the company’s pharmacy services division, saw revenue growth of $5.4 billion, fueled by new clients and expanded pharmacy offerings.

- Medicare and Medicaid pressures persisted, with the company facing government funding reductions and a sicker Medicaid population due to eligibility redeterminations.

While the overall financial performance was positive, the rise in medical costs and increased demand for healthcare services, particularly from Medicare and Medicaid plans, weighed on investor sentiment, contributing to the drop in stock price.

Technical Outlook: Bearish Signs Emerge

On the technical front, NYSE:UNH stock has entered a bearish trend following the earnings report, and it is currently down 3.54% in Tuesday’s pre-market trading. On Monday, the stock saw a 1.60% gain but quickly reversed as the negative aspects of the earnings report began to dominate market sentiment.

The stock has broken below its symmetrical triangle pattern, confirming a bearish continuation pattern. The Relative Strength Index (RSI) was 66 on Monday, indicating the stock was approaching overbought territory. However, the sharp decline in pre-market trading has relieved some of this pressure. If the bearish momentum continues, the RSI could dip below 50, signaling further downside potential.

Immediate support lies at $530, the base of the triangle pattern, where the stock may find some consolidation. The stock is currently hovering around its 50-day. A break below these levels could reinforce the bearish sentiment and signal further downside to come.

What Can Investors Expect?

From a fundamental perspective, UnitedHealth's revenue growth and earnings beat show that the company remains a leader in the healthcare sector, with its Optum businesses continuing to drive profitability. However, the elevated medical costs, particularly related to Medicare and Medicaid, could be a persistent headwind. Regulatory changes or adjustments in Medicaid enrollment could also add to volatility in the coming quarters.

On the technical side, the break below the triangle pattern is a bearish signal, and further downside toward the $530 support level seems likely if sentiment does not improve. Investors should watch for signs of consolidation at these levels or a potential breakdown, which could push the stock even lower.

Conclusion

UnitedHealth Group (NYSE: NYSE:UNH ) remains a strong company with a diverse portfolio spanning insurance and healthcare services. However, its near-term outlook is clouded by rising medical costs, Medicare funding challenges, and Medicaid enrollment fluctuations. Technically, the stock is in a bearish phase, but key support levels could provide opportunities for long-term investors if the stock consolidates or rebounds.

UNITED HEALTH forming a bottom.United Health (UNH) gave an excellent dip buy opportunity last time (March 29, see chart below), with the price even breaking above the long-term Resistance Zone eventually:

The price has since entered a Channel Up pattern with the price now below its 1D MA50 (blue trend-line), having already topped and attempting to form a new Higher Low at the bottom of the pattern.

Like the previous one in June, this bottoming process can take another 3 weeks, so we will time it accordingly and target 675.00 (+21.00% rise, similar to both previous Bullish Legs).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Earnings alert: Companies to watch for potential trades this weeAs we step into the second week of the Q1 earnings season, a roster of major financial players is gearing up to unveil their financial reports.

Expect updates from Goldman Sachs, Bank of America, Morgan Stanley, American Express, Blackstone, and Charles Schwab.

Additionally, non-financial companies like UnitedHealth, Taiwan Semiconductor Manufacturing, Netflix, P&G, J&J, and ASML Holding are also slated to release their earnings.

While bank stocks have been outperforming the broader S&P 500 Index in the past six months, the tide may be turning in the first quarter of this year. Despite JPMorgan's announcement of a modest 6% rise in profits on Friday, shares dropped over 5% following the bank's conservative full-year projections for net interest income. Meanwhile, Wells Fargo and Citigroup saw declines in profits.

On Wednesday, eyes will be on Discover Financial Services as it presents its results following the announcement of its acquisition by Capital One in February. And wrapping up the week is American Express, which is set to report after providing strong full-year guidance and increasing its dividend in the last quarter. Blackstone is expected to reveal a year-over-year increase in earnings driven by higher revenues.

Thursday brings Netflix's report, with the streaming giant aiming to maintain its momentum in subscriber growth. Netflix's management has recently expressed confidence in their growth strategy, emphasizing improvements across all aspects of their platform, the introduction of paid sharing, and the expansion of their advertising offerings.

Consumer product giants Johnson & Johnson and Procter & Gamble will disclose their earnings on Tuesday and Friday respectively, offering insights into whether increased prices are sustaining revenue growth.

Meanwhile, health insurer UnitedHealth Group is set to report on Tuesday amid rumors of an antitrust investigation.

UNH UnitedHealth Group Incorporated Options Ahead of EarningsIf you haven`t bought UNH before the previous earnings:

Then analyzing the options chain and the chart patterns of UNH UnitedHealth Group Incorporated prior to the earnings report this week,

I would consider purchasing the 440usd strike price at the money Puts with

an expiration date of 2024-4-19,

for a premium of approximately $10.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

UnitedHealth: Recovery? 🩹UnitedHealth shares have now dipped into the green Target Zone between $447.18 and $470.19. This is the price range in which we expect the low of the green wave (B) and thus a reversal. We therefore now expect a rise to above $495.87. At 40%, however, we think it is likely that the price will slip below the zone again and the low of the green wave alt.(B) will end somewhat lower.

UNITED HEALTH Time to buy again?Last time we looked into United Health (UNH) we gave a strong buy signal (October 03 2023, see chart below), which turned out to be very successful:

After getting rejected on Resistance 3, the stock started to decline structurally within a Channel Down. It is a pattern similar to the Channel Down of November 2022 - March 2023, which was again formed after UNH got rejected within the 2-year Resistance Zone, like it happened this time.

There is a high symmetry these past 2 years within the Resistance and Support Zones, so we expect the price to act accordingly. As a result, having already formed a 1D Death Cross, we expect the price to make one last Low towards the Support Zone (as long as the 1D MA50 holds as Resistance) and then rebound, which is what took place on March 10 2023, above the 0.618 Fibonacci retracement level.

As a result, we will time our buy accordingly and target $517.00 (Fib 0.618). An additional buy signal would be if the 1W RSI makes a Double Bottom, similar again to March 10 2023.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇