UPS

UPS BULLFLAG PT $178UPS just formed a Bull flag that if broken to the top should propel the stock to around $178. I do see the possibility of this consolidation to the lower end of the channel which would be $155. If that is broken, we can definitely see UPS work its way down the engulfing candle and find support with a bounce around $145. There is also a MASSIVE gap that needs to be filled around $124 and 134. Manage risk

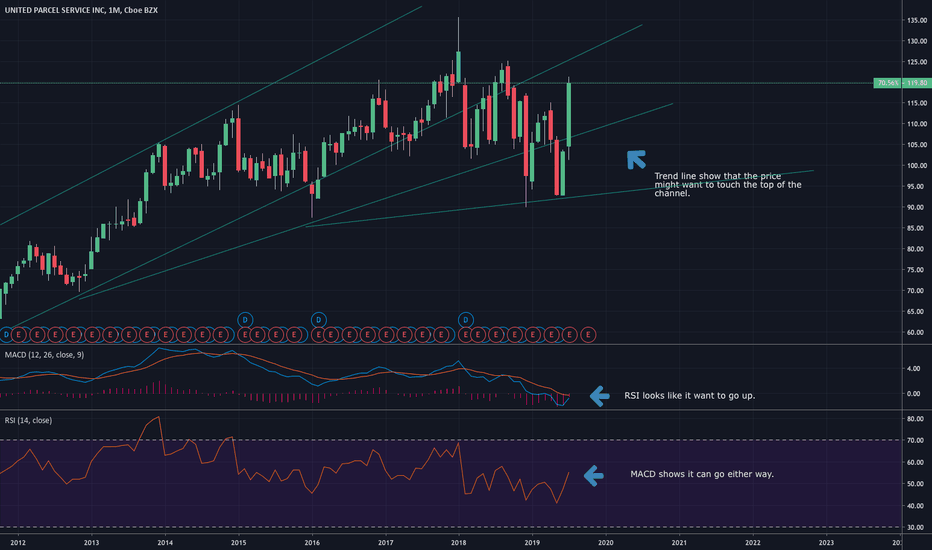

UPS a bit more patience

What we can see on this $UPS chart Divergence , RSI D1 over 81, Week ~79. One minus is what i see here alot of riangles wich confusing me...

I think everybody holding this stock until Dividend's day (ups and its friday) then weekend and after that sell off.

Everyone is now jumping on a $UPS rocket that is scheduled to fall .

Thanks for reading thats my opinion.

If you not greed or think same push Like button )

United Parcel Service $UPSAfter broke $103.8 out, hit the 100SMA and went back below buying point. It hold above 20SMA. RSI is still above the trend line so i would consider to be long after break out of $103.8 again.

12 months Consensus Price Target: $111

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx

UPS: BULLISH SIGNALSUPS price is moving up and it is likely to test the resistance level in the next days! This thought is highly supported by two indicators:

- MACD(12,26,9) -> MACD line > Signal line

- RSI 14 shows no indication of overbought conditions

High probability that a breakout will take place. However, my suggestion is to wait for the price to come back and test the resistance to ensure the resistance has become a support in order to avoid false breakout.

Be aware of a possible bounce back to the previous support! In that case GO SHORT.

Not a financial advise.

Enjoy your trade!

Daytrading RECAP 04/08/20 - 3 Longs & 1 Short for +1.6%!Hi traders,

Tom with another recap here.

*In my ID trades, I risk 1% of the account per trade and go for 2% (2:1 RRR ). Sometimes I adapt a little bit as you can see in the description.*

I switched to video recaps so you can see the charts in greater detail. Let me know if you like it!

Four trades today:

1) UPS - LONG @95.04, stopped out at 94.27 for a little under -1%

2) T - SHORT @29.62, closed half at 2:1 and the rest at B/E (messed that up). Total profit a bit over +1%

3) NVAX - LONG @16.75, closed half at 2:1 and let the rest run some more, closed just before 18 for a total of +2.5%!

4) PINS - LONG @16.9, the stock couldn't hold the pressure and collapsed into my SL @16.4 for -1%

Total PnL for the day: +1.6%

Total PnL for the week: +2.05%

In hindsight, I left money on the table with T and should've reversed PINS after it stopped me out and showed big pressure to the downside.

Mistakes are great teachers for your trading, learn to accept them and work with them!

Good trades and let me know how your Wednesday trading went!

Tom from FINEIGHT

UPS: Double Bottom and Buy OpportunityIf the price breaks the local swing high, a double bottom chart pattern will be confirmed. It will give us a buy signal based on the breakout.

RSI confirmed the price reversal from 102.00 support. MACD is bullish.

If the price moves back to the support zone, it will be possible to buy using reversal signals from the daily and hourly timeframes.

Disclaimer!

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market. But you must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.

UPS long Trend line playMissed the perfect entry as we gapped up. small position in already, will add on if we hold the current zone. If you have questions about the trendlines and horizontal area of interest (zones/colors/ meanings etc) you will have to DM me as it is too involved to go over in a comment. Happy to communicate though, just give me a little time.. Happy trading and stay green!