Metaverse 100% Growth Potential - Short TermMetaverse found the bottom at $0.46 after which strong growth has started. On the 17th of July ETP/USD has reached $2.2 high, which was 377$ growth in less than a month.

But while the high was reached, ETP has rejected the 88.6% Fibonacci retracement level, and price corrected down to $1.8 support area.

At this stage, for the uptrend to continue, price has to break above the $2.2 level. When/if that occurs, Metaverse should continue rising towards 61.8% Fibs, which is a $4 - strong psychological resistance.

On a downside, as long as daily close stays below $2.2 resistance a correctional wave down can be expected. The confirmation could be a break below the $1.66 level, which could result in a decline towards $0.9-1 area.

Uptrend-buy

OMX-30 Liveupdate!Nice Buy-Signal#RideTheLastWaveHey tradomaniacs,

quick another update for OMX-30!

Trend seems to continue in order to finish the last and 5th-Wave of the impuls-phase!

Type: Swing-trade

Buy-Limit: 1.632 (conservative)

Buy-Stop: 1.650 (aggresive)

Stop-Loss: 1.607

Target 1: 1.680 (Double-Top-Potential)

Target 2: 1.721 (ATH)

Trend-following-Strategy: Don`t use Take-Profits

Peace and good trades

Irasor

Trading2ez

Wanna see more? Don`t forget to follow me.

Any questions? Need education or signals? PM me. :-)

Metaverse Strong Growth Against BitcoinOn the 24th of June, Metaverse formed a double bottom at 7820 satoshis, after which price went up sharply, resulting in a 160% growth against the Bitcoin. Price has found the resistance at 20900 satoshis, where it has rejected the 38.2% Fibonacci retracement level.

But at the same time ETP/BTC broke above the descending channel and closed above the 200 Moving Average on the daily chart. This could mean the beginning of an uptrend, with the strong upside potential.

Still, the corrective move down could take place, especially after such a strong growth. ETP could decline towards 38.2% Fibonacci support at 15875 satoshis, and perhaps even lower, prior to the uptrend continuation.

There are two scenarios where investors could take advantage of the potential uptrend. Either wait a corrective wave down, the rejection of the Fibonacci support, or trade the breakout above the current resistance level.

A Great Opportunity to Buy EUR/GBP! Hello traders,

We can currently see price is in an uptrend, making HH and HL.

We are approaching diagonal resistance and that should take us higher continuing the trend.

Buy zone and Take profit zones are marked on the chart.

I wil update this trade soon.

If you find this post usefull dont forget to click like or follow me for more ;)

A great opportunity to go LONG on NZD/USD!Hello traders,

We can currently see price is in an uptrend, making HH and HL.

We are approaching diagonal resistance and that should take us higher continuing the trend.

Buy zone and Take profit zones are marked on the chart.

I wil update this trade soon.

If you find this post usefull dont forget to click like or follow me for more ;)

Mr.TTT

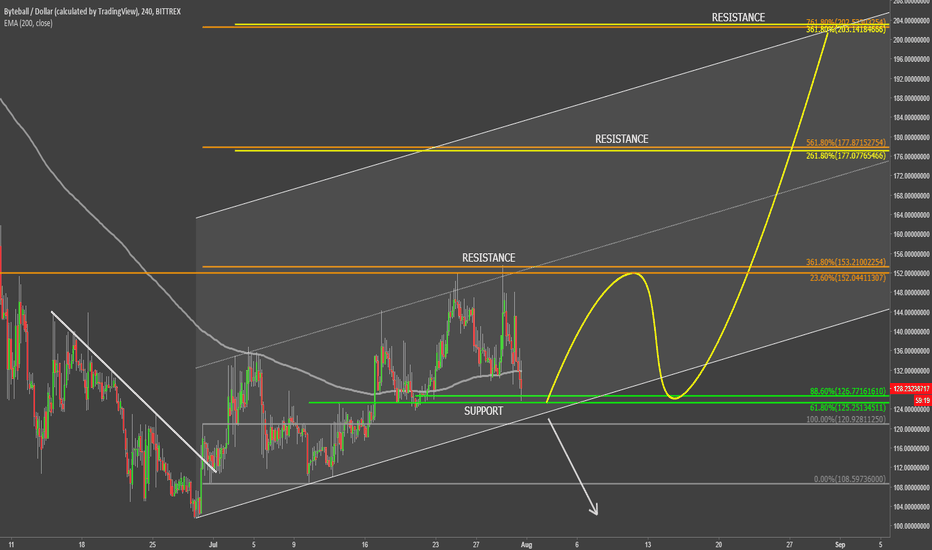

ByteBall at the Support - Uptrend Might ContinueAt the end of June Byteball has tested the low at $100, which is a strong psychological support. After bounce, price went up and broke above the downtrend trendline, corrected down, and went up again, this time breaking above the 200 Moving Average.

GBYTE/USD then bounced off strong resistance area at $150 and went down sharply. Currently it is trading at the $125 support, which could be the starting point for the uptrend continuation. It is worth mentioning that the 200 Moving Average is also acting as the support, as price still failed to break below with confidence.

If GBYTE stays above the $125 level, the uptrend is likely to continue, towards one of the Fibonacci resistance levels. First is at $177, and second is at $200 area, which is the next strong psychological resistance.

All-in-all, trend is bullish, but if the current support is broken, Byteball might once again move down towards the $100 area.

Bitcoin could be heading towards USD 9kFollowing the previous idea on Bitcoin, the 4/1 Gann Fan has been rejected, along with the 61.8% Fibonacci retracement level at $6170. BTC/USD started to move up and currently reached the 61.8% Fibs at $6550.

This is a very strong resistance for Bitcoin, because it is also corresponds with the 200 Moving Average. In order for the uptrend to begin, price has to break and close above both, $61.8% Fib resistance and the 200 Moving Average on a daily time-frame.

Break above should confirm Bitcoin bullish intention and could send the price up to the $8820 resistance, that is confirmed by two Fibonacci retracement levels and corresponds to the uptrend trendline.

But, if the current resistance will hold, the consolidation could take place. BTC/USD could be trapped between $6170 and $6550 for some time. In this case break above the resistance or below the support would determine further Bitcoin direction.

Bitcoin Fast Growth ScenarioOn the 29th of June, Bitcoin has formed a double bottom near $6k key psychological support. At the same time BTC/USD rejected the 4/1 Gann Fan, which also occurred back on the 6th of February, where BTC has rejected 2/1 Gann Fann trendline.

Recently, on the 27th of July, Bitcoin broke above the 200 Moving Average on the daily chart, which is a strong indication of the upside momentum being built. What is also very important is the break above the triangle pattern, which eventually might result in a fast growth.

Going along with the uptrend trendline and 561.8% Fibonacci retracement level, price could jump very soon, reaching $17700 by the end of September. This could be a potential growth of over 100% in less than two month.

Yes, this is a very optimistic scenario, but, it has it's probability which could and should be considered. Nevertheless, it is worth watching few resistance levels of the potential uptrend. First resistance is seen at $10.7k, and second $12.7k. Break above both would be required for the BTC to reached the final upside target at $17.7k.

On a downside, the Bitcoin currently found the support at 200 Moving Average, that has been rejected cleanly few days ago. While the price stays above the $7815, the fast uptrend would have a very high probability. Although break and close this level could result in a correction down prior to moving higher. And finally, only break and close below $5755 would invalidate bullish scenario would would extend the downtrend or a consolidation period.

Decentraland Established The UptrendSince 11th of July, Decentraland has been moving steadily upwards producing higher highs and higher lows. On the 17th of July price reached the high at $0.135, which has resulted in a 53% growth in less than a week.

Then price corrected won to $0.11, where MANA/USD has rejected cleanly 50% Fibonacci retracement level. Today MANA broke above the ascending channel, suggesting the continuation of the uptrend.

There are several resistance levels to watch. First 161.8% at $0.14, second 261.8% at $0.17, and the final upside target and strong resistance is at 361.8% Fibs, that is $0.2.

Basic Attention Token might outperform Bitcoin by 100%Following the previous idea on BAT , price has reached the upside target at 4717 satoshis, which is the 61.8% Fibonacci retracement level. The resistance has been broken along with the downtrend trendline, suggesting the continuation of the uptrend.

Now, the previous resistance at 4717 satoshis, become the support, which may or may not be tested again. But overall, the trend now is bullish and BAT/BTC should continue moving higher, towards one of the Fibonacci retracement levels applied to the 02.05-13.06 corrective wave down.

First resistance is seen at 161.8% Fibs, that is 7530 satoshis. Second resistance, could be the key level, located at 261.8% Fibs, that is 10k satoshis area. This is the potential upside target as it is not only the Fibs resistance but a strong psychological price.

On a downside, the worst case scenario at this point, is the correction down to the 3k satoshis support, and only break and close above it could invalidate bullish outlook. At the same time small corrective move down could be expected, but also price could continue moving higher without any corrections.

Quantstamp VS Bitcoin Next WaveQuantstamp found the bottom at 925 satoshis on the 29th of June. Then price went up sharply breaking above the 50 Moving Average and the downtrend trendline at the same time.

Price has reached the 1390 satoshis high, where Quantstamp has gained over 50% against the Bitcoin. The corrective wave down followed and price found the support at the downtrend trendline, which has been rejected cleanly.

Considering the recent price action, the next wave is expected to be up, and Quantstamp could be heading towards the 1540 satoshis support, where previously it found the resistance. If that resistance is broken, the next upside target is seen at 2150 satoshis level, that is 61.8% Fibonacci retracement level.

At the same time, the consolidation could be expected to take place, where price will continue ranging between 1000 and 1300 satoshis. And only break and close below the 925 satoshis could invalidate bullish outlook.

NEO vs Bitcoin Trending UpNEO has found the bottom at btc 0.0046 level, that has been tested on the 29th of June. Then price went up sharply and broke above the 50 Moving Average, while reaching the btc 0.0065 high.

On the current corrective wave down, price has found the support at the 50 Moving Average, 3/1 Gann Fan trendline as well as the 50% Fibonacci retracement level at btc 0.0055. This could be the starting point of the uptrend continuation and if support holds, price could go up to 61.8% Fibs at btc 0.0080, which corresponds to the Gann Fan trendline and the extended descending channel.

At the same time, if the current support is broken, corrective move down could be extended prior to the uptrend continuation, where NEO/BTC will move down to btc 0.0053 support level, that is 61.8% Fibs. The unlikely scenario is where NEO will break below the btc 0.0046 level, in this case the downtrend might continue.

BLOCKv VS Bitcoin Upside CorrectionBLOCKv has found the bottom at 256 satoshis, where RSI oscillator formed a bullish divergence. Price went up and broke above the downtrend trendline and the 50 Moving Average. On the small pullback, VEE/BTC rejected the Moving Average and produced a new higher high.

The higher highs and higher lows pattern currently presenting itself, suggesting the continuation of a short term uptrend and/or a correctional move upwards from the long term downtrend.

VEE could continue moving higher towards the key resistance at 483 satoshis. This is the very strong level and previously it has acted as the support as well as resistance on multiple occasions, not to mention that it does correspond to the 2/1 Gann Fan trendline.

Currently price is at 50% Fibs, that is 328 satoshis, and this could be the starting point of the uptrend continuation. Nevertheless, price still could decline and hit lower Fibonacci support level, prior to moving higher. But only break and close below the 256 satoshis could invalidate bullish outlook and result in a downtrend continuation.

Decentraland VS Bitcoin Uptrend ContinuesAfter Decentraland fond the bottom at 1150 satoshis, back on the 28th of May, price went up and broke above the downtrend trendline as well as the 200 Moving Average. On a correctional move down MANA/BTC rejected the 8/1 Gann Fan trendline for two consecutive times.

At the same time, since 6th of June, MANA has been trading above the Moving Average, and in fact found the strong support there, that is 1350 satoshis. Today price closed above th previous high, suggesting the continuation of the uptrend.

The strong resistance is seen at 2150 satoshis level, that is confirmed by two Fibonacci levels, mainly the 61.8% retracement. While the uptrend is likely to continue, daily break and close the already established support at 1300 satoshis area could invalidate the uptrend resulting in Decentraland moving towards 1000 satoshis psychological support.

Tron VS Bitcoin Uptrend AgainTron recently formed a bottom, hitting 612 satoshis low. At that point it rejected the 3/1 Gann Fan trendline, which has acted as the support. Yesterday, under the heavy volume, TRX/BTC broke above the 4/1 Gann Fan trendline as well as the 50 Moving Average, suggesting the beginning of an uptrend, or a corrective wave up.

Today price corrected back to the Moving Average and it seems found the support there, at 690 satoshis. It seems that current price is very attractive in terms of a buying opportunity and price should continue increasing.

The first strong resistance is at 64.8% Fibonacci retracement level, that is 860 satoshis, which corresponds to the 8/1 Gann Fan trendline. If that resistance is broken, Tron is likely to test 900-1000 satoshis area, that is 76.4% Fibs. Only break and close below 600 satoshis support could invalidate this scenario.

Internet Of People VS Bitcoin Reversal PotentialRecently Internet Of People has reached the low, hitting 11122 satoshis low. At the same time price failed to close below the 261.8% Fibonacci support, applied to the corrective wave up after the uptrend trendline breakout.

Today IOP/BTC started to rise and aready gained 23% since it reached the low on the 24th of June. Therefore, while/if the support is holding and the closing price stays above the 11122 satoshis, IOP is likely to outperform the Bitcoin in the short to medium term.

The confirmation could be the downtrend trendline breakout, after which price is expected to growth towards the 21k satoshis resistance area, previously acted as the support and resistance.

Viberate VS Bitcoin Near Psychological SupportOn the 24th of June, Viberate hit the low at 1080 satoshis. This is the 127.2% Fibonacci retracement level applied to the previous corrective wave up. At the same time this is the area of the key psychological support, that is 1000 satoshis.

Technically speaking, it might be a very attractive price for buyers, which could result in a trend reversal or a correctional move upwards against the Bitcoin. If daily close will remain above 1k satoshis, price could easily reach the strong resistance at 1615 satoshis, which previously was the key support. The confirmation could be daily break and close the 1260 satoshis resistance, where the descending channel has been rejected.

On the other hand, if VIB/BTC stays below the 1260 resistance and break to the new lows, the downtrend continuation could take place and the bullish outlook would be invalidated.

SpreadCoin Might Gain 50%SpreadCoin found the bottom at $0.23, that has been tested on the 13th of June. Since then price went up and today breaking above the 200 Moving Average, not to mention that price produce a new higher high.

This could be the beginning of a corrective wave up, or even a trend reversal. The very strong resistance is near $0.5 area, that is confirmed by two Fibonacci retracement levels applied through the two highs established on 30th of April and 23 of May. If the resistance will be reached, SPR/USD will gain over 50% and this could happen in a very near future.

The downside risk at this point is very low, however it SPR will go below already established support at $0.23, bears could once again begin to dominate this SpreadCoin.

ICON Could Have Formed Double BottomICON seem to have found the support at $1.85 area, that previously has been rejected twice, back in the beginning of April. At this support a Doji candle was formed on a daily chart and at the same time RSI has formed a bullish divergence.

This could be the point of a trend reversal, at the very early stage. Obviously it is too early to speak of an uptrend at this point, but it could be important to watch further price development.

Break above the downtrend trendline could be the confirmation of the change in trend, and perhaps result in the price reaching a new all-time high. But at the same time, daily break and close below the recently established low at $1.77 might invalidate such a bullish outlook and result in further decline.

AppCoins vs Bitcoin Bullish DivergenceAppCoins has been steadily moving down since the beginning of May. Price has decline from 8455, down to 3900 satoshis, loosing 54% to the Bitcoin. On the 27th of May, APPC/BTC found the support at 23.6% Fibonacci retrenchment level, applied to the uptrend trendline breakout point.

Today AppCoins is attempting to form a double bottom at the very same support area, around 4k satoshis, while forming a bullish divergence on the RSI oscillator. This could be a reversal time, where trend could change the direction, from down to up.

But APPC must stay above previous low established back in March, that is 3780 satoshis. If it breaks below, bullish outlook would be invalidated and downtrend continuation might take place.

Bitcoin Should Breakout SoonSince February, when Bitcoin found the low at $6k, price continues to consolidate within the triangle patter. Currently BTC/USD is trading very close to the uptrend trendline and the support level at 78.6% Fibonacci retracement level.

Could it be the turning point for BTC? Yes, it certainly could be. Current price seems very attractive and could provide a good buying opportunity for the medium to short term investors. While BTC stays above $6k, the probability of the uptrend remains very high. There are two resistance areas where the Bitcoin could be heading towards, first is $13k and second $18.5k. Both of them are confirmed by Fibonacci retracement levels.

Only if BTC will break and close below $7k, price could reach $6k support once again, which is a key support. Break below $6k should invalidate bullish outlook and might result in a decline towards $4k area.

BitcoinCash vs Bitcoin Uptrend EstablishedBitcoinCash found the bottom at btc 0.123 while forming a bullish divergence on the RSI oscillator. The following wave up resulted in a break above the downtrend trendline and the 50 Moving Average, suggesting the continuation of the already established uptrend.

The recent wave up resulted in a break above the btc 0.152 resistance level, confirming BCC/BTC bullish intentions. The potential move up might result in a growth towards btc 0.2, that is 38.2% Fibonacci retracement applied through the all-time high.

But this is only the first upside target and key resistance level. If Bitcoin Cash will break above, that should confirm further uptrend and could send price much higher. On the other hand, rejection could result in a corrective move down or an extended consolidation.

The risk of the downtrend will only become valid once/if price breaks below the btc 0.123. In that case BCC could go down towards btc 0.1 psychological support.

Etherparty (FUEL) Quadruple PotentialEtherparty currently trading near $0.05 support area, after it has rejected 61.8% Fibonacci at $0.0488. Price continues to consolidate without any major moves. However, while the support is holding the price is very likely to start moving higher.

The nearest upside target is where the upper trendline of the descending channel has been rejected previous, which is $0.1 area, that corresponds to the 23.6% Fibonacci retracement level. Break and close above it should trigger another wave upwards that could reach 50% Fibs at $0.21, that does correspond to the upper trendline of the extending descending channel.

Yet, it is possible FULE/USD will break below the $0.044 low, but only daily close lower could invalidate bullish outlook and send price down to the previous low at $0.006.