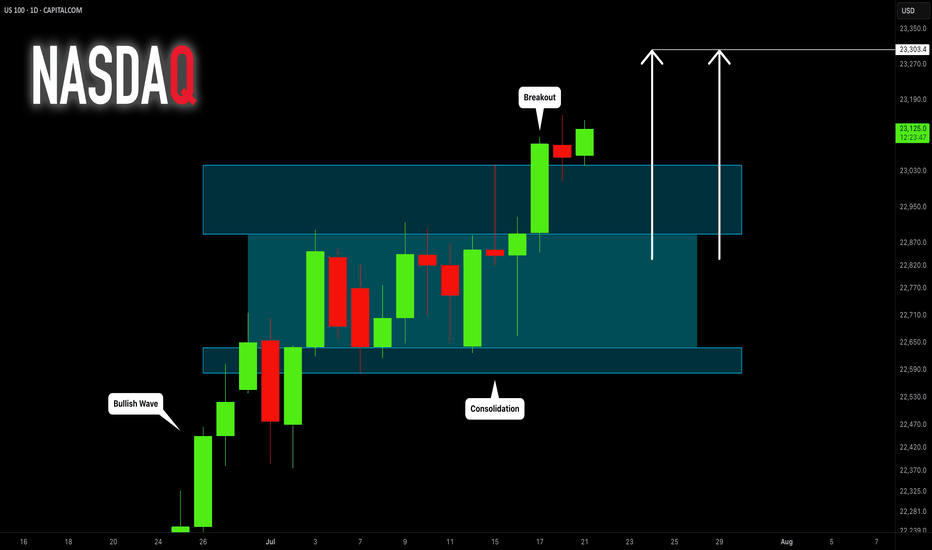

NASDAQ INDEX (US100): Bullish Continuation Confirmed

NASDAQ Index broke and closed above a resistance of a horizontal

parallel channel on a daily.

It confirms a bullish trend continuation and a highly probable growth

to the next strong resistance.

Goal - 23300

❤️Please, support my work with like, thank you!❤️

Us100signals

NASDAQ INDEX (US100): Time for Pullback

There is a high chance that US100 will retrace from the underlined

blue daily resistance.

I spotted a double top pattern on a 4h time frame after its test

and a nice bearish imbalance candle that was formed

during the NY session yesterday as confirmations.

Goal - 19590

❤️Please, support my work with like, thank you!❤️

NASDAQ INDEX (US100): Great Opportunity to Sell

NASDAQ Index formed a strong bearish pattern after a test of a key daily

resistance area.

I see a head & shoulders pattern on an hourly time frame

and a confirmed breakout of its horizontal neckline.

The index can continue decreasing.

Next support - 19240

❤️Please, support my work with like, thank you!❤️

NASDAQ INDEX (US100): Bullish Reversal Confirmed?!

I see 2 very strong bullish reversal confirmation on US100 on a daily.

First the market violated a resistance line of a falling channel.

Then, a neckline of a cup & handle pattern was broken.

Both breakouts indicate the strength of the buyers.

We can expect a growth at least to 20300 resistance.

❤️Please, support my work with like, thank you!❤️

NASDAQ INDEX (US100): Important Breakout

US100 formed a cup & handle pattern and successfully violated

its neckline on a daily.

With a high probability, the broken neckline turns into support now.

We can expect further growth.

Next resistances: 20550 / 20720

❤️Please, support my work with like, thank you!❤️

NASDAQ INDEX (US100): Potential Scenarios Ahead of FOMC

NASDAQ Index is currently consolidating within a horizontal range.

Most likely, the market participants are waiting for the FOMC tomorrow.

Depending on the reaction of the market to the boundaries of the range,

I see 2 potential scenarios.

Bullish Scenario

If the market breaks and closes above 19115 the resistance of the range,

with a high probability, a bullish rally will continue.

Bearish Scenario

If the Index breaks and closes below 18880 the support of the range,

it may initiate a correctional movement.

I think that US100 may keep being weak before the news release.

Let's see what direction the market will choose tomorrow.

❤️Please, support my work with like, thank you!❤️

Long position US100 We see that the Nasdaq index has left its upward channel and is correcting yesterday's movement, and we can follow it on the upward path.

US30 D1 - Short SignalUS30 D1

Big daily timeframe again here, you can see how much US30 has given back off the back of the dollar correction. That being said, we blitzed through 33600 resistance with no issues, the next area of correction/pivot may lay around 34000 whole number.

A nice area of D1 resistance and supply, 34000 whole number, and a solid 6R measure to see a 50% correction, from swing low to swing high.

NASDAQ Next MovePair : US100 Nasdaq

Description :

Rising Wedge as an Correction in Short Time Frame and Rejection from the Upper Trend Line

Impulse Correction

Rejection From Daily Resistance Level

Divergence

Break of Structure

Completed " 12345 " Impulsive Wave and " abc " Corrective Wave

Double Top

US100 ( High Probability SELL Setup SOON ) * Here we can see the Next Moves for US100 today,

* We're expecting the Mini Move ( PullBack ) before the continuation of the Down Trend,

* We're Using STF for a cClearer View of our Analysis, Therefore we can't predict the duration of the moves,

* We've got a Major Fundamental News today ( NFP ) at 1:30pm ( GMT + 00:00 ) London Time,

* Keep a close eye on Nasdaq100 ( US100 ) Today,

* Happy pip hunting traders.

* FX KILLA *

NAS100(US100) !! LONG !!Using the Supply and Demand strategy, we can clearly see that the price reached a strong demand area where the price rebounded strongly, in this case i would recommend waiting for confirmation from the 4h candle after wich we think about buying, the levels are shown in the chart.

GOOD LUCK FOR ALL.

US100 DAILY TIMEFRAMEUS100 might have a good sell after it break 11780 that is 0.382 on fibonacci target 12210 that is 0.618 on fibonnacci

after reaching historical level it reversed now breaking that resistance is good and its still have gap to fill

and its still bouncing between the channel

as on the weekly timeframe we have divergence on cci and %R

have confirmations before taking the trade when it brake see how its breaking and the candles

and do ur own risk management and secure profits always

nasdaq💰Fxone4all 💰

🔴 NASDAQ (short )

Sell limit : 15838 / 15870

🔸TARGET💰

🔹 15473

🔹15090

🔹14717

🛑 STOP LOSE : 16000

NASDAQ 4H Golden Cross aims at 16300 long-termMy most recent Nasdaq post was a buy signal on the 1D MA50:

Currently we have a buy continuation signal for the long-term towards the 1.5 Fibonacci extension (16300) with a potential short-term pull-back to add more longs on the 0.5 Fib retracement or the 1D MA100 (red trend-line). This is based on the May - June fractal whose pattern is so far following in great detail the current price action.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------