USDJPY falling, because of Treasury buying?Private foreigners have purchased just over half a trillion - yes, Trillion - LT USTs in the past six months (sorry, no #brettonwoods3)

Why such huge demand for safe, liquid US$ instruments? Not a whole lot of trust for the Fed's toolkit and use. © Jeff Snider

What is the reaction to buying UST's? The yields come lower. Interest rates come lower.

What does the Fed do? Follows the markets.

We're seeing a drop off in the US 10 Year Yield and this is also part of a wider yield curve inversion in the eurodollar market. Inversions signal troubles ahead, so anyone with money goes to the safest assets. Namely sovereign bonds and ultimately US sovereign debt.

The USDJPY has been tracking the move of US10Y and also either accelerated or decelerated depending on whats going on in the oil markets.

Japan is heavily dependent on importing energy, so a higher Oil price means the Japanese economy gets crushed and the yen drops. Oil prices are coming lower at present.

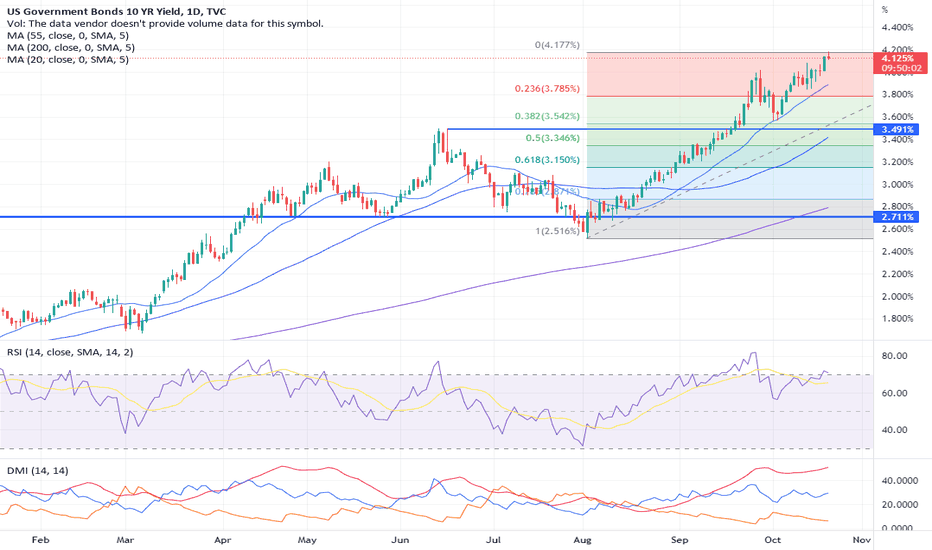

US10Y

US10Y Is more selling pressure ahead?The U.S. Government Bonds 10 YR Yield (US10Y) confirmed our huge Bearish Divergence spotted on our October 25 analysis and started the first pull-back since July:

The price is now below the 1D MA50 (blue trend-line) for the first time since August 19 and today is testing it as a Resistance. A double candle close above the 1D MA50, restores the bullish trend towards the October 21 High. Failure to establish two 1D candle closings above it, should most likely extend the selling pressure towards the 1D MA100 (green trend-line), which was where the pull-backs of March 07 and November 09 2021 found Support. A closing below it targets the final long-term Support of 1D MA200 (orange trend-line).

As you see on the chart, that still wouldn't change the long-term bullish trend on the US10Y as it would hit the bottom (Higher Lows trend-line) of the Channel Up (green). On the other hand a closing below the 1D MA200, would constitute a long-term trend change to bearish and target first the 1W MA100 (red trend-line).

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GOLD and Bond Yields. Are they starting to close the gap?Many may wonder what is the main driving force behind Gold's recent rally and a first answer would be the strong fall on the Dollar Index, since Gold is valued in USD. This is true but the basic driver leading Gold higher are the Bond Yields, with Bonds being an asset that is in direct competition with Gold, in the same safe haven category that at times is considered more attractive due to offering yields.

Bond yields shown in blue on this weekly chart have been rising non-stop since August 2020, which was Gold's technical market peak (excluding the most recent March 2020 which was fundamentally fueled by the Ukraine/ Russi war). Gold's November rise has been the strongest since that time as it is further assisted by the big drop on the US Dollar Index. This isn't yet a confirmed bearish reversal for the bond yields (US10Y) but is close to do so.

As you see historically, especially since 2012 (after Gold's previous cyclical top), we had periods that the gap between Gold and yields widened but was always closed. These two negatively correlated assets have diverged by a wide margin since August and it is highly likely that the recent Gold rally/ Yield pullback is the start of their convergence again.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

## Also DONATIONS through TradingView coins help our cause of increasing the daily ideas put here for free and reach out more traders like you. ##

2022-???? Bear Market to be labeled as: Bond Bust!Recession, Stagflation, Inflation, Dollar Strength, Russia/Ukraine War...how about labeling the current market turmoil what it really is; A Bond Bust!

As you can see from the monthly chart below, in Jan 2022 the US10YR Yield bullishly broke the neckline of an inverse H&S that formed between June 2019-Jan 2022; then in March of 2022 it broke up again from major downtrend line. (I wrote a post about this in March 2022 saying we were in "Unchartered Territory" and the US10YR must be watched).

If the Inverse H&S plays out it means we will see interest rates in the 7.5-8% range at a minimum in the near term. (Two things worth noting: 1. Nothing about this chart is bearish nor can you say it is showing any signs of reversing anytime soon when looking at it from a long term perspective. 2. Based upon charting theory-H&S patterns usually play out IF they are formed at tops or bottoms)

Most people think of bonds as a "relatively safe" investment vs. other types of investments so when you have the below loss on a "relatively safe" investment it should send out shock waves:

2022 YTD TLT LOSS: -34.12%

TLT High to Low during current bear market (Years 2000-2022): -48.89%

A 20 year US Bond ETF losing almost 50% within 31 months should be shocking AND, as stated above, yields are not showing any signs of reversing!

Here are the YTD Losses, as of Friday, in the US Indexes.

NDX: -30.08%

RUT: -19.29%

SPX: -19.04%

DJI: -10.99%

Would you have ever thought that TLT would outperform NDX in YTD losses during a bear market? Before 2022, I think 99.9% of traders would state this would be impossible. And yet...here we are with only two months left in 2022.

Now to the monthly charts of the DOW/DJI. I wanted to have a look at this chart since it has held up relatively well to see how the current monthly chart compares to other bear markets (Defined as a greater than 20% decline close to close). The green line on the charts is the 15 SMA...I also added some horizontal highs/lows based upon the high/lows of the last time price made an ATH and then closed below the 15 SMA and then back above it BEFORE a bear market formed. No two bear markets are the same so it's really about the relationship of the 15 SMA and the horizontal pink & red lines...what this analysis tells me is we will most likely test the March 2020 low at some point in time...we might come back up and re-test the ATH or go a little above it but statistically speaking if you look at the bear markets of the last 100 years in the DOW a new bull market is not us! Oct 2022 could however provide a temporary low! (Exceptions: 1917 & 1987 bear markets)

Key take aways:

1. The US10YR Yield; followed by the other common known Treasury Yields, should be the most discussed topic and how those charts affect money flows into different types of investments instead of all the other FUD out there! Remember: Money chases yields.

2. The chances of us re-visiting the Covid lows in the DOW are high given the above analysis.

3. NDX doesn't like high Treasury Yields as it's currently the weakest of the US Indexes and very weak compared to the DOW. Its history isn't as vast as the DOW so its anyone's guess as to how low it could go or how long it could take to make another ATH. It's not an Index I'm looking at buying anytime soon as Yields have made a clear signal that the 40 year downtrend has ended so we need to change our thinking in this new environment!

4. January seems to be a topping month while October seems to be a bottoming month however that is probably just a coincidence as this was not the case in the early 1900's.

There is a lot to take in above so I hope it makes sense after you think through it...I know it's not a quick read!

US10Y About to drop strongly after the 0.75% hike?The US10Y recently broke below the August Higher Lows trendline and remains below the 4H MA50 since October 25. The bearish divergence that RSI's Lower Lows suggested is identical to the one in April, May. The price patterns are very similar and this was a sell signal that dropped to the 1D MA50 and the Support of the previous Higher Low.

We have drawn these levels on the current pattern and that Support is at 3.567 while the 1D MA50 at 3.667. With the 1D RSI still on Lower Highs and Lower Lows and the 1W STOCH RSI on a Sell Cross, we expect the US10Y to hit at least the 1D MA50.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

## Also DONATIONS through TradingView coins help our cause of increasing the daily ideas put here for free and reach out more traders like you. ##

XAUUSD : THE REAL DEALMy sell condition was confirmed as Gold closed below the 4H MA50 (1,647.59 on XAUUSD), so I continue selling with 1,620 as my TP.

Needless to say, the price action this week evolves around Wednesday's Fed Rate Decision, with the markets taking a 'sell first, ask questions later approach', since buyers were unable to break above the 4H MA200 (1,664.76) as we discussed last week.

1D is bearish RSI # 41.716

MACD # -9.980

ADX # 32.831

and since we also failed to break above the 1D MA50 and the overall long-term trend remains bearish (as discussed last week), we can even see a Lower Low within 1,605 - 1,600.

The US10Y posted a green candle on Friday and seems to be recovering, while the DXY broke again above its 1D MA50.

This shows that the markets don't seem to expect that the Fed will diverge from their plan just yet.

All prices mentioned on my analysis are on XAUUSD.

$tnx entering sideways consolidation US10Y, aka $tnx is likely entering a phase of sideways consolidation before another leg up

Last time it came out of a bear market bottom, it took $tnx 11 years to clear the 4-5% area for good and begin its long term uptrend phase...

11 years that $spx used to compound gains of 180%

(long pertains to $spx) for yields perhaps long 3% is a good idea! but imo the easy money on yields has been made by now.

Inverted yields and odd weeksThis chart shows the periods with inverted 10y2y yields. Usually inversion doesn't lead to recession, like 2008. However the similarities with 2000 are striking. 3 Years ago we had a brief yield inversion, like in 1998. Then a second inversion occurred, bringing prices down with it. The same happens now. Half of the bubble burst occurred with yields inverted. Therefore it isn't necessary for yields to normalize for us to drop. We are in a bubble and it probably has burst.

And a less interesting part of the idea follows:

Yesterday some uninteresting-number-of-weeks candles closed. It was fun checking out where we are and how RSI reacts.

This has nothing to do with trading. I just love charts. I didn't bother with 1W chart because I consider it common.

In the following charts SPX is analyzed. I could post them in a new idea but got bored...

2W - we couldn't escape the ribbon, and RSI is flirting with its EMA. It is a tad lower than 50.

3W - RSI below its EMA and below 50.

4W - A bull trap on the price appears. But we are above the ribbon (for now?). RSI just barely above 50.

6W - A bullish engulfing or something? And then an inverted hammer appears.

Even though stochastic RSI reached the bottom, this doesn't mean that there is enough buildup to push RSI upwards. It takes two to dance/grow. Also EMA of RSI is helpful to me. RSI passing it provides me with an early signal of trend change.

9W - In this chart, the similarities to 2008 end. It resembles the .com bubble burst. It resembles the region just before the October 1998 rally. This one is less grim to the charts before. The candle however is a little mixed.

12W - Kinda bullish? I dunno... RSI made a higher low

18W - 2014-2022 stochastic RSI shows clear divergence. Stochastic producing lower highs, and with this candle it is confirmed.

36W - RSI and it's stochastic show a close similarity to September of 2000, the .com bubble burst.

Finally, I will add this DJI chart showing us where we are in history.

Let the drop commence I guess?

#XAUUSD THE TABLE NOW HAS TURNEDThe uptrend has taken a pause naturally as it is struggling to break above the 4H MA200 (1,668.71), having failed to close a candle above it.

This is a strong sign of (short-term at least) profit taking.

As mentioned yesterday, the 4H MA50 (1,648.31) is the short-term Support, there is also a Higher Lows trend-line involved (1,653.90) starting from the October 21 Low.

In any case, the 1D MA50 (my end target on this week's buy) is now even lower at 1,686.73, so I am moving the SL even higher in profit (1,653.80) in order to considerably limit the risk.

If either the 1D MA50 or the SL are hit, I will be in no rush to re-enter either with a Sell or a Buy ahead of today's ECB Rate Decision and U.S. GDP.

1D remains borderline neutral (RSI # 48.291, MACD # -10.580, ADX # 21.918) and only a break above the 1D MA100 (1,731.55) can reverse the trend into long-term bullish.

If we close today below the 4H MA50 (i.e. news are digested), I will sell (TP # 1,620).

US10Y Huge Bearish Divergence on RSI calls a drop!The U.S. Government Bonds 10YR Yield formed Lower Highs on its 1D RSI while the price action has been trading on Higher Highs. This is a major Bearish Divergence that technically calls for a price reversal to the downside.

What's even more interesting is that every time the same RSI Bearish Divergence has been formed in the past 12 months, the US10Y always pulled-back and hit its 1D MA50 (blue trend-line). This is currently at 3.563 (and rising).

A reversal on the bond yields can have a major impact on the financial markets, especially ahead of next week's Fed Rate Decision, as it is negatively correlated with stocks and Gold.

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XAUUSD CURRENT MAJOR LEVELSGold continues to replicate the price action of September 26-28, with the price now below the 4H MA50 (which is at 1,647.10 on XAUUSD) but is holding the 1,634.60 low. This makes Gold a buy opportunity on a 1 week basis (target the 1D MA50 at 1,680), but we need to take into consideration Thursday's heavy fundamentals (ECB Rate Decision and U.S. GDP) as the long-term trend remains bearish (1D RSI # 42.106, MACD # -16.530, ADX # 30.971) so I'll keep my stop tight on the above level. Only a break above the 1D MA100 (currently at 1,735.16) can reverse the trend to a bullish long-term sentiment. As mentioned these past few weeks, the US10Y is primarily dictating Gold's trend and its 1D RSI is showing a bearish divergence (which is bullish for Gold). A closing below 1,634.60 would be a sell break-out entry for me, targeting 1,620.

S&P 500 & US10YFundamental :

10/21/2022 | 19:24

US equities surged mid-day on speculation about the extent of monetary policy tightening (thus media speculation about the path of interest rates after November).

Treasury (bond markets) yields fell following a Wall Street Journal report that some Federal Reserve officials are no longer comfortable with the pace of interest rate hikes.

The Fed has raised its target funds rate by 300 basis points since it began tightening policy this year. The probability of the Fed raising rates in November by 75 basis points is over 92%, according to the CME's FedWatch tool.

“Hope that the Fed can temper or take their foot off the accelerator slightly helps the market,” said Andre Bakhos, managing member at Ingenium Analytics.

The US Dollar Index depreciated 0.8% to 112. The greenback weakened 2% against the Japanese yen to 147.27, falling from its highest level in about three decades.

10/21/2022 | 22:50

The S&P 500 index is up 4.7% weekly as positive third-quarter results drive strong gains, particularly in the energy, technology and materials sectors.

This week's advance was driven by quarterly earnings that beat analysts' average estimates. Even as companies report challenges such as inflation and supply chain issues, many show they have still managed to beat street consensus estimates.

That contributed to a relief rally after stocks fell in the weeks leading up to the results on worries about the impact of macro issues including inflation.

All 11 sectors of the S&P 500 rose this week, led by an 8.1% jump for energy, 6.5% for technology and 6.1% for materials. Other strong gains included consumer discretionary, up 5.6%, and communication services, up 5%. The smallest increase was recorded by utilities, up 1.9%.

10/21/2022 | 22:50

Wall Street ends higher driven by hopes of a slowdown in monetary tightening.

Some Fed officials have signaled their willingness to debate whether and how to signal a plan for a smaller rate hike in December, according to the WSJ.

San Francisco Regional Fed Chair Mary Daly said the Fed should avoid pushing the US economy into an "unprovoked downturn" by tightening monetary policy too much.

Stocks rise on Friday as the media report fuels optimism that the Fed's stance is easing.

Technics:

Range and MMA20/MMA50 broken on the rise this Friday 21st by 4 candlesticks (on a 4H vision) then rebound at the $3820.0 level.

The Average Directional Index is below 25 which indicates a slide in the price of the asset in the short term (ADX based on a MA of a 14-day range), but is in the process of increasing.

Bearish short-term momentum pointing to an upcoming temporization zone, an idea reinforced by a Stochastic indicator above 80 (indicating an overbought zone).

In addition, there is high Volume at levels below the new support line ($3730.0), although this volume is mostly representative of the buying force.

Money management:

1 position BUY on US10Y

1 position BUY on S&P 500

US 10Y yield convergence of resistance levels around 4.19/20We have a convergence of levels around the 4.19/4.20 zone of the chart, it is a long term double Fibonacci retracement and represents significant lows seen in 1998 and 2001.

Will be quite interested to see if the market pauses here in order to consolidate sharp gains that have been pretty relentless since August.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

Forecast US10YGood day everyone! Don't forget to put your thumbs up and write your comment if you like the idea

The bar for 10-year Treasuries has been broken.

The 10-year Treasury yield has broken the trend at 3.8%. In fact, this opens the way for growth to indicators in the range of 4.5-4.6%.

There are elections in November, and we need to show at least some effect from measures to combat inflation. This is the main task. Well, what's next? Let's assume that we managed to somehow stabilize the situation with inflation (actually or by manipulating statistics is another question) by achieving a target rate of around 4.5%. Let the economy go into recession. And, after some time, start the cycle of lowering the rate again and pulling the economy out of recession? The current rates were in 2008, and the values were 4.5% in 2007. And the Fed had enough of this "reserve" in reducing the rate for almost 14 years.

DISCLAIMER:

The opinion of the author may not coincide with yours! Keep this in mind and consider in your trading transactions before making a trading decision.

Gamble at your own risk - Global Financial Crisis of 2022/2023Do not pray to the false gods of guaranteed bailouts.

"The problem with all this is that it's their own policies that created the fragility, their own policies that created the dislocations and now we're relying on their policies to address the dislocations," Peter Boockvar of Bleakley Financial Group said. "It's all quite a messed-up world." -CNBC

Not everyone survives.

10 Year Treasury real yields showing a clear sign that liquidity is collapsing, the fastest rise since 2008.