US30 Rebounds from Key Support – Bulls Eyeing New HighsKey Support & Trendline Confluence:

The price recently bounced off the long-term ascending trendline, which has been a strong support level since late 2023.

The 38.2% Fibonacci retracement level ($40,205) provided additional confluence for a potential reversal.

Resistance Levels & Breakout Potential:

Immediate Resistance: $42,000 – A break above this level could confirm a bullish continuation.

Major Target: $45,065 – If momentum sustains, this all-time high could be tested soon.

Bullish Scenario:

A successful breakout above $42,000 could lead to an accelerated move toward $45,065 and beyond.

The trendline’s support indicates that bulls remain in control, and the recent rebound suggests renewed buying interest.

Risk Management & Confirmation:

Bullish confirmation: Sustained price action above $41,500 with strong volume.

Invalidation level: A breakdown below $40,000 could indicate a potential trend reversal.

Conclusion & Strategy:

Short-Term: Monitor price action around $42,000 for breakout confirmation.

Mid-Term: Expect a bullish move toward $45,000+ if the trendline holds.

Long-Term: If price breaks all-time highs, further upside potential is possible.

🚀 Bullish Confirmation Above $42,000 | ⚠️ Caution Below $40,000

US30

US30; Heikin Ashi Trade IdeaPEPPERSTONE:US30

In this video, I’ll be sharing my analysis of US30, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

US30 BULLS WILL DOMINATE THE MARKET|LONG

US30 SIGNAL

Trade Direction: long

Entry Level: 41,378.4

Target Level: 43,046.4

Stop Loss: 40,263.5

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DowJones The Week Ahead 17th March '25Dow INTRADAY bearish & oversold capped by resistance at 200 DMA

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Dow INTRADAY bearish & oversold capped by resistance at 41640Key Support and Resistance Levels

Resistance Level 1: 41640

Resistance Level 2: 41956

Resistance Level 3: 42450

Support Level 1: 40650

Support Level 2: 40080

Support Level 3: 39650

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

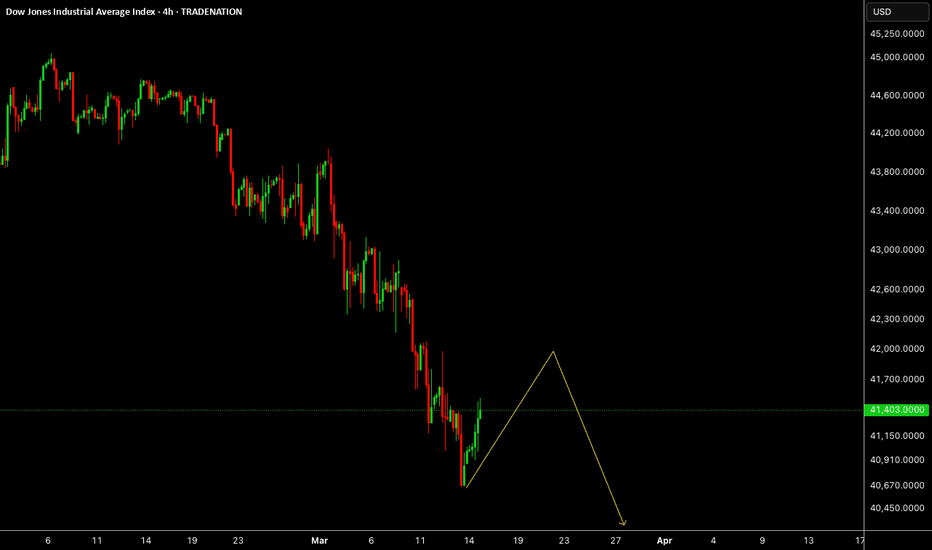

Us30 Reversal /Re entry 📝 US30 (Dow Jones) - Bearish Outlook | 1H Chart 📉

🔹 Market Bias: Bearish

🔹 Key Zones:

Sell Entry: 40,850 - 41,100 (Retracement to resistance)

Stop Loss (SL): Above 41,250 (Beyond liquidity grab zone)

Take Profit (TP):

TP1: 40,500 (First support)

TP2: 40,250 (Key demand zone)

TP3: 39,920 (Final target)

🔹 Analysis:

Price is trading below the 50 & 200 EMA → Downtrend intact 📉

Lower highs & lower lows → Bearish market structure

Potential fakeout before the drop, especially around high-impact news at 4 PM SAST ⚠️

🔹 News Event Consideration:

If data is weak → US30 likely continues dropping 📉

If data is strong → Possible short-term spike before reversal 🔄

🔹 Risk Management:

Be cautious of stop hunts & manipulation before the news.

If price breaks above 41,250 & holds, reconsider bearish bias.

🚀 Trade smart, manage risk, and stay updated on market sentiment!

#US30 #DowJones #StockMarket #TechnicalAnalysis #Trading #PriceAction #Forex #Indices

Dow Just crossed the infamous 200MA - Should we worry?The Dow Jones, continues to underperform international markets in 2025.

The Trump Administration is an unstable one which is causing such fear and uncertainty.

It seems like the very essence of policies, procedures and compliance are falling out with the ad hoc and sudden decisions being made by a small group of plutocrats.

Here is why the Dow Jones might remain to stay in trouble and for further downside to come.

Tariff Tensions:

Trump's ramping up tariffs on Canadian metals, and it's freaking out investors 😱📉

Recession Fears:

Mixed signals about a possible recession have everyone on edge 😬🔻

Tech Trouble:

Tech giants like Tesla are tanking, dragging the whole market down 🤖📉

Global Trade Chaos:

Uncertain trade policies are stirring global chaos and confusion 🌍🤯

Market Volatility:

Investor nerves are sky-high with volatility spiking, making everyone super cautious 😟📈

And the technicals speak for themselves.

The Price has broken below the M FOrmation and wait for it... The Infamous 200MA.

So the signs of downside are strong. WIll the US markets allow such downside to come, we'll have to see but as things stand - we have a bearish outlook with a target of 36,296.

What do you think?

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DOW JONES: Starting the final stage of 3year Bull Cycle.Dow Jones got oversold on its 1D technical outlook (RSI = 29.297, MACD = -550.130, ADX = 76.606) as it is currently testing its 1W MA50. This is a level that has been intact since November 2023 and is of high importance to the trend as it has a key cyclical attribute. The driving growth pattern of Dow since the 2009 bottom is a Channel Up and every time a Bull Cycle starts, the 1W MA50 is the first level of support, with every touch of it being the strongest buy opportunity. When the 3 year Bull Cycle is coming to an end, the 1W MA50 breaks and the index approaches the 1M MA50 during its Bear Cycle correction, which becomes the ultimate buy entry for the new long term 3 year Bull Cycle.

The current Cycle should starts getting completed technically after September 2025, so there is a high chance that the 1W MA50 holds here. The three Bull Cycles we've had so far had a fairly similar growth percentage, rising by +70.38% to +76.64%. If the +70.38% minimum range is followed on the current (4th) Bull Cycle, then we're aiming at 48,000 (TP) towards the end of the year. The 1M CCI seems to be printing the exact same build up to the Bear Cycle as in the past.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

US30 (Dow Jones) Buy Analysis: GTEUS30 has successfully pushed through an Inverse Fair Value Gap (IFVG) on the 1-hour timeframe, confirming bullish momentum. Price action suggests a continuation upward, with the next target being the top trendline around 41,950 - 42,000.

With CPI news scheduled for tomorrow morning, we can anticipate further volatility, but until then, US30 is likely to maintain its bullish structure. As long as price holds above the recent support zone around 41,500, the bias remains bullish towards the higher resistance levels.

Dow Jones Potential DownsidesHey Traders, in today's trading session we are monitoring US30 for a selling opportunity around 41900 zone, Dow Jones is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 41900 support and resistance area.

Trade safe, Joe.

Flat correction in DOW JonesA flat correction differs from a zigzag in that the sub wave sequence is 3-3-5, as shown in chart. Since the first actionary wave, wave A, lacks sufficient downward force to unfold into a full five waves as it does in a zigzag, the B wave reaction, not surprisingly, seems to inherit this lack of countertrend pressure and terminates near the start of wave A. Wave C, in turn, generally terminates just slightly beyond the end of wave A rather than significantly beyond as in zigzags.

S&P500 INDEX (US500): More Down

With a confirmed bearish breakout of a key daily horizontal support,

US500 index opens a potential for more drop.

Next key support is 5425.

It looks like the market is going to reach that soon.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Dow Jones: A Make-or-Break Buy Setup with Smart Money BackingDow Jones Industrial Average - Buy Setup

Technical: U.S. markets have struggled recently due to uncertainty over tariffs imposed by President Trump. While the S&P 500 and NASDAQ have broken key support levels, the Dow remains resilient, holding the critical 41,648 support. A break below would confirm a large double-top pattern, signaling a bearish outlook. This is a pivotal moment. The rebound from overnight lows is encouraging, but with the U.S. CPI release tomorrow, caution is warranted. While speculative, COT and seasonal data favour a short-term move higher.

Fundamental: The latest Commitment of Traders (COT) Report shows increasing long interest in the Dow, suggesting "smart money" accumulation.

Seasonal: Historically, from March 12 – May 2, the Dow has posted gains 84% of the time, averaging +3.68% over the past 25 years.

Setup:

Entry: 41,800 – 42,000

Stop Loss: 41,285 (below the Nov 2024 low at 41,648)

Target: 44,290

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DOW JONES Can the 1W MA50 hold and spark an end-of-year rally?Dow Jones (DJIA) has been trading within a Channel Up pattern since the late July 2023 High. The decline of the last 30 days can be technically seen as the Bearish Leg that will price its new Higher Low bottom.

The price isn't only close to the Channel's bottom but also the 1W MA50 (blue trend-line), a level that has been supporting since the October 30 2023 bullish break-out. As a result, a 1W MA50 hit will be a potential double support test, with the 1W RSI also printing a Bearish Leg similar to the one that led to the October 2023 bottom.

On the other hand, the ranged price action since the late November 2024 High, resembles the sideways volatility of the first half of 2024. Both were initiated after Higher High pricings at the top of the Channel Up. The rallies that led to those tops have been +21.00% and +23.72% respectively.

If there is a decreasing rate on each Bullish Leg, then the new one should be +17.30% (i.e. -3.30% less than the previous one), which falls marginally below the 1.5 Fibonacci extension, which is where the November 2024 High was priced.

As a result, as long as Dow is closing its 1W candles above the 1W MA50, the 2-year Channel Up is more likely to push upwards again for its new Bullish Leg, potentially targeting 48900 (+17.30%).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Dow Jones at the bottom of the trading rangeGiven the recent emotional decline in the Dow Jones and S&P500, the Dow Jones is expected to make an upward correction from the bottom of its confirmed trading range. The stop loss is equivalent to the closing of the 4-hour candle below today's last low, with a target of 43,500 in the final step.