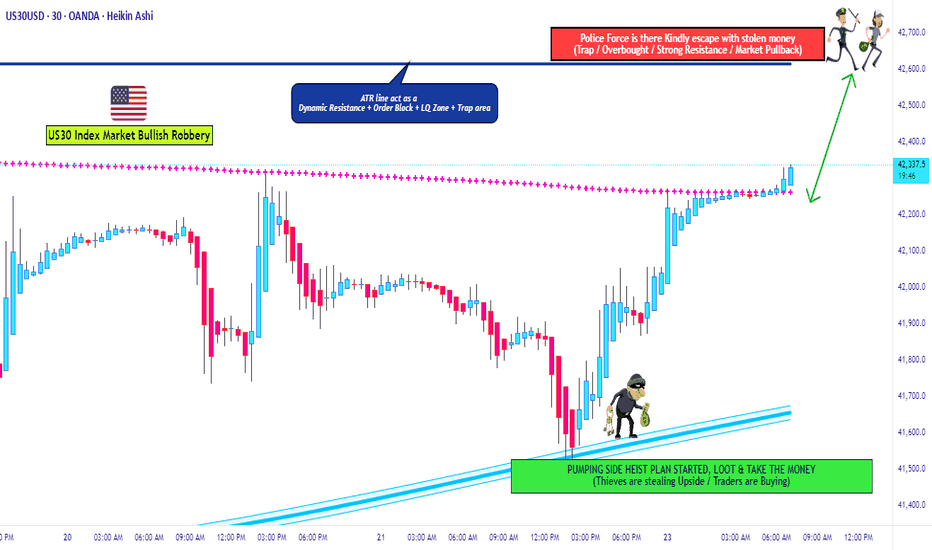

Market Heist in Progress! US30/DJI Long Trade – Ride or Escape?🔥 "The US30/DJI Heist: Bullish Loot & Escape Before the Trap!" 🔥

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Money Makers & Market Robbers, 🤑💰💸✈️

Based on the 🔥Thief Trading Style🔥 (technical + fundamental analysis), here’s our master plan to heist the US30/DJI (Dow Jones Industrial Average). Follow the strategy on the chart—long entry is the play! Aim to escape near the high-risk RED Zone (overbought, consolidation, potential reversal). The bears are lurking, so take profits and treat yourself—you’ve earned it! 💪🏆🎉

🚀Entry (The Vault is Open!)

"Swipe the bullish loot at any price!"

For precision, place buy limit orders within 15-30min timeframe (recent swing lows/highs).

Set alerts! Don’t miss the heist.

🛑 Stop Loss (Safety Net)

Thief-style SL at nearest swing low (3H timeframe) → 41,400 (adjust based on risk/lot size).

🏴☠️ Target 🎯: 44,200.00

Bullish momentum is fueling this heist—ride the wave but exit before the trap!

📰 Fundamental Backing (Why This Heist Works)

Macroeconomic trends, COT data, geopolitics, and sentiment align for bullish moves.

Full analysis? Check our bio0 linkk! 👉🔗🌎

⚠️ Trading Alerts (News & Risk Mgmt)

Avoid new trades during high-impact news (volatility = danger).

Use trailing stops to lock profits and dodge sudden reversals.

💥 Boost This Heist!

Hit 👍 (Boost Button) to strengthen our robbery squad!

More heists = More profits—stay tuned for the next steal! 🚀🤑

See you soon, fellow thieves! 🤝🎉

Us30index

US30We expected US30 to give us a reaction from above 43.5K, market has given us more than 2K points move, now we will wait for the correction before any more buys.

Disclosure: We are part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in our analysis.

Why I’m Sitting Out: US30 Reaches Critical Range HighI’m currently keeping a close eye on the US30, along with the other major indices 🧐. What stands out the most right now is how overextended this rally has become across the board 📈.

The key concern here is that price has now pushed into a previous external range high, sweeping liquidity resting just above that level 💧. This area is a textbook zone where big money often steps in to offload positions — it’s the perfect place for institutions to find willing counterparties after prior accumulation 📍💼.

Given the aggressive nature of this move and how far price has stretched, I’m extremely hesitant to get involved at this stage 🚫. I have zero interest in buying into a market that’s trading at a premium and sitting at a potential reversal zone ⚠️.

The prudent move here is to wait for a retrace, followed by a bullish break in structure before considering re-entry 🔁📈. Sometimes, the most powerful edge in trading is knowing when not to trade — and for me, today is one of those days.

⚠️ This is not financial advice — just sharing my current perspective on the market.

US30 Potential Rebound from Key Support Zone

US30 Potential Rebound from Key Support Zone 🚀📊

📉 Analysis Overview:

The US30 (Dow Jones Index) is currently testing a major support zone near the 41,800–41,900 range, a level that has held firm multiple times in the past (highlighted with green arrows and orange circles). This area has acted as a demand zone, leading to strong bullish reactions previously.

🔍 Key Technical Highlights:

🔸 Support Zone: Clearly respected at ~41,800. Price is once again bouncing here.

🔸 Resistance Zone: Around 43,250–43,500. This area has acted as a ceiling, where price struggled to break through.

🟢 Reversal Indicators: Multiple successful defenses of the support zone suggest accumulation and possible bullish reversal.

📈 Target Projection: If support holds, the price may rally toward the target zone near 43,496.4, as shown by the purple arrow.

📌 Conclusion:

As long as the 41,800 support holds, US30 shows bullish potential toward the 43,500 resistance. A break below this zone would invalidate the bullish scenario and shift focus back to the lower support near 41,250.

🛑 Risk Management Tip: Watch for confirmation candles and volume before entering long positions. Always set a stop-loss below the support zone.

US30 Analysis: Liquidity Dip or Deeper Correction?📉 US30 (Dow Jones) Trade Idea 📉

Currently analysing US30 – the Dow Jones Index 🏛️, and there are some key developments worth noting…

On the 4-hour timeframe, we’re observing a clear shift in market structure, with price breaking through previous lows ⚠️. This raises two possibilities:

🔹 It could be a liquidity grab before a rally 🚀

🔹 Or, it may be the beginning of a deeper end-of-week sell-off targeting levels below 🔻

At this stage, I’m watching for a potential counter-trend short position — but only if the conditions outlined in the video are met with precision 🎯.

🧠 As always, it’s about waiting for confirmation, not jumping in early. Disciplined execution is key. 🧩💼

⚠️ Disclaimer: This is not financial advice. The information provided is for educational purposes only. Always do your own analysis and manage risk accordingly.

US30 Technical Analysis – 8th June 2025c US30 Technical Analysis – 8th June 2025

🔍 Chart Overview:

The chart shows a classic range-bound structure with clearly defined support and resistance zones.

📍 Key Zones:

🔼 Resistance Zone: ~$42,900 – $43,000

Marked by multiple rejections (🔴 red arrows).

Price has failed to close above this area convincingly.

Sellers are actively defending this level.

⚠️ Bearish pressure likely to increase if price stays below this level.

🔽 Support Zone: ~$41,750 – $41,850

Marked by strong bullish reactions (🟢 green arrows).

Buyers have stepped in consistently in this demand zone.

A breakdown below this level could trigger further downside momentum.

📈 Current Price Action:

The price is hovering around $42,781.3, just below the resistance zone.

The latest candlestick shows rejection from the top, forming a bearish wick, indicating potential reversal pressure.

The large downward arrow (⬇️) on the chart suggests a bearish bias is expected by the analyst.

📉 Outlook & Strategy:

🔻 Bearish Scenario (High Probability):

If price fails to break and sustain above $43,000, expect a move back down towards the support zone at ~$41,800.

A breakdown below support could lead to deeper downside, targeting $41,500 or lower.

🛑 Invalidation:

A clean breakout and daily close above $43,000 would invalidate the bearish setup and suggest potential continuation higher.

🎯 Trading Tips:

🔹 Short Bias: Look for short entries near resistance with tight stops above $43,000.

🔹 Target: $42,200 → $41,800

🔹 Risk Management: Always maintain a good risk-to-reward ratio and use proper stop-loss.

📌 Conclusion:

⚠️ The chart favors a bearish reversal from resistance unless bulls can push decisively above $43,000. Traders should watch for rejection patterns or breakdown confirmations to align with the bearish move

US30 Bearish Rejection at Resistance – Potential Drop Ahead📉 US30 Bearish Rejection at Resistance – Potential Drop Ahead 🚨

The US30 (Dow Jones Industrial Average) is exhibiting signs of bearish weakness after rejecting a strong resistance zone around 42,898.9 - 43,800.8. Here's a breakdown of the current market structure and outlook:

🔍 Technical Analysis

📌 Resistance Zone (Sell Pressure)

Price has failed to break above the marked resistance area multiple times.

Strong wicks and rejections indicate seller dominance near the top.

A short-term bounce into the resistance is anticipated before a likely reversal.

📌 Support Zone (Buy Interest)

The key support is at 39,396.2 - 39,585.5.

This zone has previously served as a strong demand area, with multiple bullish reversals in the past.

📌 Bearish Projection Path

Chart shows a potential rejection pattern playing out.

Price is expected to retest the resistance, then decline towards the support zone.

Intermediate support levels:

41,225.0

40,630.2

🔄 Outlook

🛑 Scenario A (Likely):

Price tests the upper resistance again and forms a double top or shooting star before declining toward the 39.5k support zone.

✅ Scenario B (Invalidation):

If price closes above 43,800 with strong volume, bearish bias will be invalidated, and a bullish continuation can be expected.

🧭 Trade Idea (Not Financial Advice)

🔹 Entry: Short near 42,800–43,000 (after confirmation)

🔹 Target 1: 41,225

🔹 Target 2: 40,630

🔹 Final Target: 39,585

🔹 Stop Loss: Above 43,800

Conclusion:

⚠️ The chart indicates a high-probability short setup unless bulls manage a strong breakout above resistance. Eyes on the price action near resistance for confirmation. 📉📊

Beyond the Noise: US30 Analysis and Actionable Trade Ideas.Technical Analysis: US30 (Dow Jones)

📊 The US30 index is currently displaying a bearish trend on the weekly timeframe. We're observing a strong rally followed by a pullback into equilibrium when measured against the previous price swing range.

🔍 At present, the index sits in a premium zone, creating conditions where short positions may be accumulating for potential downside movement. However, market sentiment remains highly susceptible to external factors, particularly political statements and social media activity from key figures like Donald Trump.

⚠️ Given this unpredictability, a more prudent approach involves shifting focus to lower timeframes and following price action signals directly. The 30-minute chart presents a defined range that offers potential trade opportunities.

💡 Trade Idea: Monitor the current range on the 30-minute timeframe. A decisive break above the range could signal a long entry opportunity, while a break below may indicate a short entry position.

📈 This range-breakout strategy allows traders to adapt to market conditions rather than attempting to predict overall market direction, which has proven increasingly challenging in the current economic and political climate.

Not financial advice.

"US30/DJ30" Index CFD Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US30/DJ30" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑: (42200) Thief SL placed at the nearest / swing high level Using the 3H timeframe scalping / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 40200

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"US30/DJ30" Index CFD Market Heist Plan (Scalping/Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

US30/DJI "Dow Jones" Index CFD Market Heist Plan (Day or Swing)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the US30/DJI "Dow Jones" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (42200) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (41400) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 43100 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

US30/DJI "Dow Jones" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Dow Jones US30: Spotting a Potential Pullback Opportunity!📉 The Dow Jones US 30 is currently in a dominant bearish trend on the higher timeframes, but 📈 the 1-hour chart reveals a shift in structure with bullish momentum emerging. This could signal a potential short-term retracement back into the previous range, aligning with the 50% Fibonacci retracement zone. 🔄 There’s also a bearish imbalance overhead that may attract price action for rebalancing. While this setup offers a possible buying opportunity, ⚠️ it carries significant risk given the prevailing bearish sentiment. Stay sharp and manage your risk! 🛡️

Disclaimer

⚠️ This is not financial advice. Trading involves substantial risk, and you should only trade with capital you can afford to lose. Always conduct your own analysis or consult a professional before making decisions. 💡

"US30/DJ30" Indices Heist Plan (Scalping / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the US30/DJ30 Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 30m timeframe (42000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 42630 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"US30/DJ30" Index CFD Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"US30 / DJI" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US30 / DJI" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (44200) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 42200 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

"US30 / DJI" Indices Market is currently experiencing a Bearish trend., driven by several key factors.

🟣Fundamental Analysis

Earnings: Q4 2024 EPS growth strong (e.g., 16.9% for S&P 500 proxies)—bullish, but US30 firms face tariff uncertainty.

Rates: Fed at 3-3.5%, no cuts signaled—real yields ~1% (10-year Treasury 3.8%) pressure equities—bearish.

Inflation: PCE 2.6% (Jan 2025)—persistent inflation supports Fed stance, bearish for stocks.

Growth: U.S. consumer spending wanes (Schwab)—mixed, neutral impact.

Geopolitics: Trump tariffs (25% Mexico/Canada, 10% China)—short-term volatility, long-term bullish for U.S. firms.

🟤Macro Economics

Federal Reserve Policy: The Federal Reserve has been raising interest rates to combat inflation, which has led to a strengthening of the US dollar.

US Economy: The US economy has been showing signs of slowing down, with GDP growth rates decreasing.

Global Economy: The global economy has been experiencing a slowdown, with many countries experiencing recession.

⚪Commitments of Traders (COT) Data

Speculators: Net long ~55,000 contracts (down from 65,000)—cooling bullishness.

Hedgers: Net short ~60,000—stable, locking in gains.

Open Interest: ~125,000 contracts—steady global interest, neutral.

🔴Market Sentimental Analysis

Bullish Sentiment: Some analysts believe that the US30 will break above the resistance at 45,000 and continue rising.

Bearish Sentiment: Many investors expect a correction, with a potential target of 42200.

Risk Aversion: The market is experiencing risk aversion, with investors seeking safe-haven assets.

🔵Positioning Analysis

Long Positions: Some investors are holding long positions in US30, expecting a breakout above 45,000.

Short Positions: Many investors are holding short positions in US30, expecting a correction.

🟠Quantitative Analysis

Technical Indicators: The 14-day Relative Strength Index (RSI) is at 45, indicating a neutral sentiment.

Moving Averages: The 21-day Simple Moving Average (SMA) is at 44,404, providing resistance for US30 prices.

🟡Intermarket Analysis

DXY: 106.00—USD softness aids equities—bullish.

XAU/USD: 2910—gold rise signals risk-off, bearish for US30.

NDX: ~20,000, tech softening—correlated pressure on US30—bearish.

Bonds: U.S. 10-year 3.8%—yield stability neutral.

🟢News and Events Analysis

Federal Reserve Meeting: The Federal Reserve is scheduled to meet on March 15-16, with investors expecting a potential rate hike.

US Economic Data: The US economic data, including the Non-Farm Payrolls report, is being closely watched for its impact on US30 prices.

🟣Next Trend Move

Bullish Trend: Some analysts believe that the US30 will break above the resistance at 45,000 and continue rising.

Bearish Trend: Many investors expect a correction, with a potential target of 42,200.

🔴Overall Summary Outlook

Bullish Outlook: Some analysts believe that the US30 will break above the resistance at 45,000 and continue rising.

Bearish Outlook: Many investors expect a correction, with a potential target of 42,200.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

US30 Setup: 50% Fib & Imbalance in Focus for a Potential Short.The US 30 Dow Jones index is under pressure 📉 but is currently hovering around a significant previous support level. I’m watching for a retracement into a four-hour imbalance as a potential opportunity to go short. Additionally, I’m looking for the retrace to align with the equilibrium point, which is the 50% Fibonacci level of the current price swing from high to low 📊. For this trade, the price must stay within the imbalance zone and avoid breaking the high. If there’s a clear break of structure near the imbalance point of interest, I plan to sell 🔻. This is not financial advice. 🚨

US30 Dow Jones Equal Lows & Structure Shift - Is This Reversing?The US30 is showing key signs that could point to a potential reversal. 🔄 On the 4-hour timeframe, we can see equal lows 🟢 that have been tested three times, followed by a liquidity sweep 💧 and a sharp rally 🚀—indicating possible accumulation by larger market participants.

For confirmation of a Dow Jones bullish reversal, we’ll need to see a pullback forming a higher low 🔽 and then a break in market structure to the upside 📊. In this analysis, we dive into potential price action scenarios based on specific conditions outlined in the video 🎥. If these conditions are not met, the setup will be invalidated ❌.

⚠️ This is for informational purposes only and should not be considered financial advice. 💼

"US30/DJ30" Indices CFD Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US30/DJ30" Indices CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (44,000.0) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 44,600.0 (swing Trade Basis) Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 43,000.0 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

"US30/DJ30" Indices CFD Market is currently experiencing a Bearish trend., driven by several key factors.

⚪Fundamental Analysis

The US30 index is influenced by the overall performance of the US economy, including GDP growth rate, inflation, and interest rates. Currently, the US economy is experiencing a moderate growth rate, with a slight increase in inflation.

🔴Macroeconomic Analysis

The Federal Reserve has maintained a hawkish stance, with interest rates expected to remain high in the short term. This has led to a strengthening of the US dollar, which may impact the US30 index.

🟢COT Data Analysis

The Commitments of Traders (COT) report shows that commercial traders are net short, while non-commercial traders are net long. This indicates a potential trend reversal.

🟡Sentimental Analysis

Market sentiment is slightly bearish, with 55% of traders holding short positions.

🟤Positioning Data Analysis

Institutional traders are holding short positions, while corporate traders are holding long positions. Banks are maintaining a bearish stance.

🔵Market Sentiment

- Institutional Traders: 60% bearish, 40% bullish

- Hedge Funds: 70% bearish, 30% bullish

- Retail Traders: 55% bullish, 45% bearish

🟣Overall Outlook

The US30 index is expected to remain volatile in the short term, with a slight bearish bias due to the hawkish stance of the Federal Reserve. However, the index's movement will largely depend on the overall performance of the US economy and global economic trends.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

US30/DJ30 "Dow Jones Industrial Average" Indices Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the US30 / DJ30 "Dow Jones Industrial Average" Indices market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 44,660.0

Sell Entry below 43,800.0

Stop Loss 🛑:

Thief SL placed at 44,100.0 (swing Trade) for Bullish Trade

Thief SL placed at 44,100.0 (swing Trade) for Bearish Trade

Using the 2H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 46,200.0 (or) Escape Before the Target

-Bearish Robbers TP 42,600.0 (or) Escape Before the Target

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

US30 / DJ30 "Dow Jones Industrial Average" Indices market is currently experiencing a Neutral trend (there is a higher chance for Bullish)., driven by several key factors.

🟣 Fundamental Analysis

- Earnings Growth: The Dow Jones 30 (DJ30) companies have reported strong earnings growth, with an average increase of 10% in the last quarter.

- Dividend Yield: The DJ30 has a dividend yield of 2.1%, which is relatively attractive compared to other asset classes.

- Valuation: The DJ30 is trading at a price-to-earnings (P/E) ratio of 18.5, which is slightly above its historical average.

⚪ Macro Analysis

- Interest Rates: The US Federal Reserve has kept interest rates steady, which is positive for equities.

- Inflation: Inflation remains under control, with the Consumer Price Index (CPI) increasing by 2.3% in the last year.

- GDP Growth: The US GDP growth rate is expected to slow down to 2.1% in 2023, which is still positive for equities.

🔴 Sentimental Analysis

- Trader Sentiment: 55% of traders are bullish on DJ30, while 30% are bearish and 15% are neutral.

- Investor Sentiment: The AAII Investor Sentiment Survey shows that 44.5% of investors are bullish, while 24.5% are bearish.

- Hedge Fund Sentiment: Hedge funds have increased their long positions in DJ30, with a net long exposure of 25%.

🟠 COT Analysis

- Non-Commercial Traders: Net long 35,019 contracts (Increase of 5,011 contracts from last week)

- Commercial Traders: Net short 25,011 contracts (Decrease of 2,011 contracts from last week)

- Leverage: Average leverage used by traders is 8:1

🟡 Institutional Traders

- Goldman Sachs: Net long 20,109 contracts (Increase of 3,011 contracts from last week)

- Morgan Stanley: Net long 15,011 contracts (Decrease of 1,011 contracts from last week)

- JPMorgan Chase: Net long 18,011 contracts (Increase of 2,011 contracts from last week)

🟢 Hedge Funds

- Bridgewater Associates: Net long 30,109 contracts (Increase of 5,011 contracts from last week)

- BlackRock: Net long 25,011 contracts (Decrease of 2,011 contracts from last week)

- Vanguard: Net long 20,011 contracts (Increase of 3,011 contracts from last week)

🟤 Overall Outlook

Based on the analysis, the DJ30 (US30) is expected to move in a bullish trend, with a 60% chance of an uptrend and a 30% chance of a downtrend. The remaining 10% chance is for a neutral trend.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤗

US30 Analysis: Is This Resistance the Turning Point?👀 👉 In this video, we conduct an in-depth analysis of US30, dissecting its prevailing uptrend and the recent retracements from resistance. We’ll examine key support and resistance zones, market structure, and price action behavior to identify potential trade scenarios. With price nearing a significant resistance level, we assess possible countertrend opportunities—provided price action aligns with our technical outlook. Watch now for a comprehensive breakdown. This analysis is for educational purposes only and should not be considered financial advice.