S&P500 Vast Support from previous High. New 2 year Bull started.The S&P500 / US500 has reached a bottom and is rebounding.

The rebound is taking place just over the 1week MA200 but also the key pivot line that was previously a Cycle High and now turned Support.

We have seen this another 2 times in the last 10 years and both time caused a massive rally.

This puts an end to the tariff war correction and based on the chart starts a new 2 year Bull Cycle.

Minimum rise before was +58%. Target 7600.

Follow us, like the idea and leave a comment below!!

Us500

S&P INTRADAY oversold bounce backUS stock futures dropped and the dollar weakened as concerns grew that the trade war could cause lasting economic damage. This came despite a surge in European and Asian equities, which followed a major rally on Wall Street after President Trump unexpectedly paused most of his tariffs. The move lifted global risk sentiment temporarily, but also isolated China as the primary target of Trump’s trade offensive, limiting Beijing’s options for near-term de-escalation. In response, Chinese leaders are meeting today to consider additional economic stimulus.

Meanwhile, U.S. Treasuries gained as investors sought safety following a volatile session. The Federal Reserve, for its part, signalled it plans to keep interest rates steady, aiming to prevent tariff-driven inflation even if the labour market weakens. Officials have publicly downplayed the need for rate cuts, choosing to prioritize stability over pre-emptive easing.

Key Support and Resistance Levels

Resistance Level 1: 5509

Resistance Level 2: 5660

Resistance Level 3: 5787

Support Level 1: 4815

Support Level 2: 4700

Support Level 3: 4585

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US500 Historical Rallies & Pullbacks with a Potential ProjectionI’ve observed the US500’s performance over the years, marking rallies with a blue line and pullbacks with a yellow line. Looking at the chart, a systematic repetition of these movements emerges, which, at first glance, seems to follow a recognizable pattern.

Specifically, I’ve cloned the blue line from the rally that started on 03/23/2020 and ended on 12/20/2021, now represented by a green line, to hypothesize a potential future rally. This clone is based on the duration of previous pullbacks:

The first pullback, before the 2020 rally, began on 02/20/2020 and ended on 03/23/2020.

The second pullback, the current one, started on 02/17/2025 and might conclude around 04/07/2025, potentially paving the way for a new rally.

the angle of those pullbacks is almost identic

This "snapshot" observation suggests we could be nearing a turning point. Of course, this is just a hypothesis based on historical patterns, and I encourage cross-referencing it with other indicators or analyses. What are your thoughts?

DOW JONES INDEX (US30): Bearish More From Resistance

It looks like US30 is returning to a bearish trend again.

I see a strong bearish sentiment after a test of a key daily resistance.

The price formed an inverted cup and handle pattern and we see

a strong bearish imbalance with London session opening.

Goal - 39.685

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

S&P500: Trump's 90-day tariff pause just saved the day??S&P500 is having so far a +9.50% rise from today's low as even though Trump announced a 125% raise to China tariffs, he lowered and paused tariffs for 90 days to all countries that contacted the U.S. for negotiation. The 1D technical outlook is about to get neutral (RSI = 42.537, MACD = -181.510, ADX = 39.036) as the rebound is taking place at the HL bottom of the Bullish Megaphone, while the 1W MA200 stayed intact.

A similar Megaphone was last seen during the previous 2018 Trade War and was completed with the COVID crash that started an abnormal rally to new ATH to correct the equally abnormal crash. Needless to say, it was based on quick rate cuts but the situation isn't all that different today. Trump's stance towards negotiating, coupled with highly anticipated rate cuts, can deliver an equally abnormal rally now.

The previous HH of the Bullish Megaphone hit the 2.0 Fibonacci extension. This time if the rally extends to the end of the year, targeting the 1.5 - 1.618 Fibonacci Zone would be considered fair (TP = 6,900).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Has SPX formed a bottom?SPX500USD - 24h expiry

Price action looks to be forming a bottom.

A Doji style candle has been posted from the base.

Setbacks should be limited to yesterday's low.

We look to buy dips.

Risk/Reward would be poor to call a buy from current levels.

We look to Buy at 4900.5 (stop at 4767.5)

Our profit targets will be 5295.5 and 5365.5

Resistance: 5219.6 / 5350.0 / 5500.0

Support: 5100.0 / 5000.0 / 4812.2

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

S&P INTRADAY oversold bounce backTrump threatened a 50% import tax on China, adding confusion over his global tariffs. China promised to hit back and moved to support its markets.

Stocks bounced slightly as investors looked for bargains, but uncertainty around U.S. trade policy remains. U.S. Treasuries rose after falling on Monday.

Wall Street is getting more cautious. BlackRock downgraded U.S. stocks, and Goldman Sachs warned the selloff could turn into a longer bear market.

Key Support and Resistance Levels

Resistance Level 1: 5273

Resistance Level 2: 5379

Resistance Level 3: 5510

Support Level 1: 4815

Support Level 2: 4700

Support Level 3: 4585

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

S&P500 Dead Cat Bounce or V-shaped Recovery?The S&P500 index (SPX) saw a remarkable turnaround yesterday after the Wall Street opening. The early futures sell-off came very close to the 1W MA200 (orange trend-line), which has been the ultimate Support level since the March 2009 Housing Crisis bottom (the last major Bear Cycle).

It supported the 2022 Inflation Crisis, the 2018 U.S. - China Trade War, the 2015 E.U./ Oil Crisis and 2011 correction. It only broke during the irregularity of the March 2020 COVID flash crash.

Note that the 1W RSI hitting 27.30 has only happened during the COVID crash and the actual March 2009 Housing Crisis Bottom. At the same time, the index reached the All Time High (ATH) trend-line (dashed0 of the High before the 2022 Inflation Crisis (previous correction phase). As this chart shows, previous ATH trend-lines have never been broken during the correction phases that followed them.

In any case, the million dollar question is of course this: Was yesterday a Dead Cat Bounce inside the new Bear Cycle or we are ahead of a V-shaped recovery? Well technically it depends on the 1W MA200 (the market needs 1W candles to close above it) while fundamentally if depends on potential trade deals and of course the Fed (the market needs rate cut assurances).

If this is a V-shaped Recovery indeed, there is no reason not to expect the market to follow all previous rebounds of 1W MA200 corrections that weren't Bear Cycles (Bear Cycles on this chart are 2008 and 2022).

As you can see, all rebounds have been sharp, indeed V-shaped recoveries, ranging from 20 to 27 weeks (140 - 189 days) until they broke their previous High. So this indicates that technically, SPX should make new ATH by October 13 2025 the latest (and September 02 earliest). Of course this is just a projection, this time we have no COVID shutdowns, no Grexits or Brexits, no Oil crises, it is all due to one fact, the tariffs and if deals are reached and the Fed delivers the much needed rat cuts, the recovery may be even faster, as sharp as the correction has been.

The facts are on the historic data on the chart. The conclusions are yours.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bulls are not of the woods, not by far1. What happened yesterday?

In my weekend analysis covering US indices , I mentioned that US500 (SP500) could drop and test the ascending trend line starting back at the pandemic low. This line is confluent with the horizontal support level given by January 2022 ATH, offering a good opportunity for traders to open long positions.

Indeed, at least on CFDs and futures, this trend line was touched, and the price rebounded strongly from there.

2. Key Question:

Will we have a full V-shape recovery, or will the price drop back below 5k in the coming sessions?

3. Why I expect a continuation of the correction:

🔸 Strong Resistance: The US500 has established a robust ceiling around the 5350-5400 zone(also a gap there)

🔸 Lack of Building Momentum on Support: There's no clear indication that this resistance will be broken anytime soon with the lack of accumulation under 5k

🔸 Potential for Further Decline: Given the current market structure, a drop below 5k remains a realistic possibility in the upcoming sessions.

4. Trading Plan:

🎯 My Strategy: Playing the range.

✅ Buy near the 4800 support.

✅ Sell into the resistance zone between 5350 and 5400.

5. Conclusion:

I’m watching for market confirmations and will continue applying this range strategy until there’s a clear directional change. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

S&P INTRADAY futures point to lower open Global stocks sold off sharply on Monday as investors rushed into safe-haven assets, driven by growing concerns over U.S. President Donald Trump’s tariffs. The market reaction is forcing Wall Street analysts to dial back their bullish outlook on U.S. equities.

Despite the market turmoil, Trump and his team downplayed fears of inflation and recession, remaining confident that strong economic growth lies ahead.

In response, China’s policymakers met over the weekend to discuss potential steps to support the economy, including speeding up planned stimulus measures, according to sources.

Meanwhile, traders are now expecting the Federal Reserve to cut interest rates this year, with some even betting on an emergency rate cut before the Fed’s next scheduled meeting, as recession fears mount.

Oil prices dropped for a third day, with Saudi Arabia cutting the price of its main crude grade by the most in over two years, adding to the bearish sentiment.

Key Support and Resistance Levels

Resistance Level 1: 5273

Resistance Level 2: 5379

Resistance Level 3: 5510

Support Level 1: 4815

Support Level 2: 4700

Support Level 3: 4585

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Institutional Demand: SP500 longsHey,

Trump’s April 2025 tariffs triggered a global market crash, with the Dow plunging and the Nasdaq entering a bear market. China retaliated, raising recession fears. News warns of rising unemployment, inflation, and a major economic slowdown.

So what does this mean for us as traders and investors?

Volatility equals opportunity.

The S&P 500 is approaching a strong demand zone and trendline. I’m not a fan of trying to catch the exact bottom — just have a consistent plan to scale in, buy once at the zone or do it in chunks. But with prices this low, it’s a great time to consider adding more. Data shows, every major crash has rebounded sooner than expected for the past 100 years.

Great opportunities where fear makes people miss it.

Kind regards,

Max

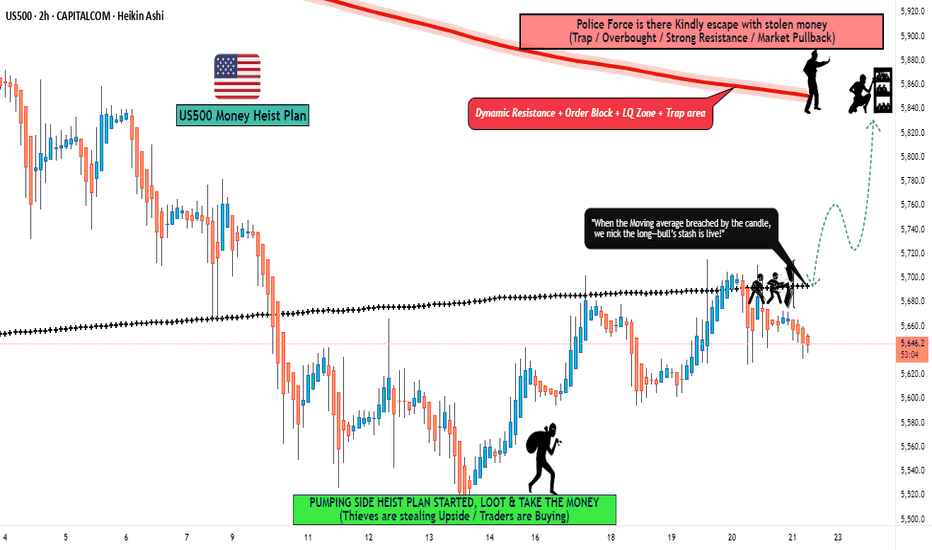

"SPX500/US500" Index CFD Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "SPX500 / US500" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑: (5730) Thief SL placed at the nearest / swing high level Using the 8H timeframe swing / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 5300 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"SPX500 / US500" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"US500 / SPX500" Index CFD Market Heist Plan (Day or Swing)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US500 / SPX500" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (5700) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 2H timeframe (5600) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 5850 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"US500 / SPX500" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Ethereum TA 25.4.5Hello everyone, I hope you are doing well. Ethereum on the 4-hour timeframe got rejected after hitting a strong order block and started forming new lows. Given the current chart conditions, we have two order blocks in the high price area and we expect the price to return to these levels. If we see a short setup, we will enter a short position with a target of 1750. For now, I am not suggesting a long position and will wait until the pullback on the chart is complete.

⚠️ This Analysis will be updated ...

👤 Sadegh Ahmadi: GPTradersHub

📅 25.Apr.5

⚠️(DYOR)

❤️ If you apperciate my work , Please like and comment , It Keeps me motivated to do better

Bitcoin TA 25.4.5Hello friends, I hope you are doing well. In this daily timeframe, we have an order block that has caused a price level to break. Inside this daily order block, there is a hidden order block that can be observed in the 4-hour timeframe, which has the potential to push the price down to $74,000. We are waiting for the price to reach this order block as indicated in the chart, and then we will look for a trigger in the 15-minute and 5-minute timeframes to set up a short position with a target of $74,000. This is my roadmap. If there are any changes, I will definitely inform you.

⚠️ This Analysis will be updated ...

👤 Sadegh Ahmadi: @GPTradersHub

📅 25.Apr.5

⚠️(DYOR)

❤️ If you apperciate my work , Please like and comment , It Keeps me motivated to do better

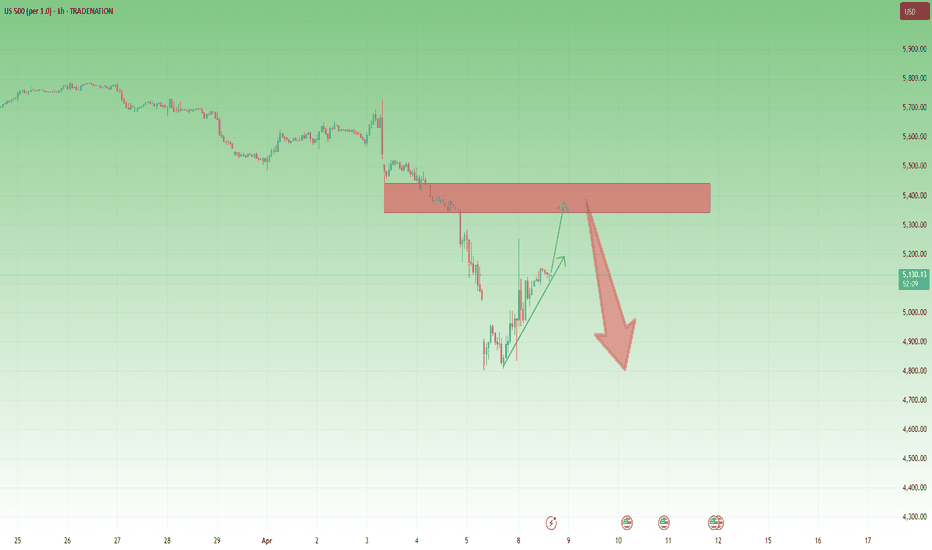

S&P 500 to tank to 5,100 pointsPEPPERSTONE:US500

The S&P 500 broke below critical support after Trump announce massive tariffs on everyone, worst than expected. Volume is increasing to the downside, and it looks like the next wave down has already started.

Wave C is supposed to be equal or larger than wave A, and reach the next critical support, which will lead us to 5,100 points in the next couple of weeks.

I heard that net tariffs on China are 54%, does than means that iPhones are going to rise in price 54%?

Maybe it will be reconsidered later, and the market will bounce in the future, but not likely in the short term.

Good luck to you

Hank Tough - Long ride down to 4,514 for US500Even with better than expect numbers with NFP.

The matter remains that the world is not on great terms with MAGAs Tariff plan. Tariffs are in an indirect way a threat when it comes to trade wars.

Because, there'll need to be reciprocals and larger measures to make up for the mess.

Apparently, the calculations of the tariffs was to make up for the trade deficit, but it means that there'll need to ACTUALLY be the same amount or more of exports - which we know won't happen as there are two types of goods.

Elastic - Where the price and demand and supply changes.

Inelastic - where they a don't change much.

Right now there is a LARGE Inverse Cup and Handle forming on the daily with the price below 20 and 200 - showing strong downside to come.

So, we can expect looking at the pattern to continue to 4,514.

'Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Thoughts?

S&P500 down -4.84%, worst day since 2020 COVID crash! GAME OVER?The S&P500 (SPX) had yesterday its worst 1D closing (-4.84%) in exactly 5 years since the COVID flash crash started on March 11 2020 (-4.89%). Not even during the 2022 Inflation Crisis did the index post such strong losses in a day.

Obviously amidst the market panic, the question inside everyone's minds is this: 'Are we in a Bear Market?'. The only way to view this is by looking at SPX's historic price action and on this analysis we are doing so by examining the price action on he 1W time-frame since the 2008 Housing Crisis.

As you can see, starting from the Inflation Crisis bottom in March 2009, we've had 4 major market corrections (excluding the March 2020 COVID flash crash which was a Black Swan event). All of them made contact with the 1W MA200 (orange trend-line) and immediately rebounded to start a new Bull Cycle. Those Bull Cycles typically lasted for around 3 years and peaked at (or a little after) the red vertical lines, which is the distance measured from the October 15 2007 High to the May 07 2011 High, the first two Cycle Highs of the dataset that we use as the basis to time the Cycles on this model.

The Sine Waves (dotted) are used to illustrate the Cycle Tops (not bottoms), so are the Time Cycles (dashed). This helps at giving a sense of the whole Cycle trend and more importantly when the time to sell may be coming ahead of a potential Cycle Top.

This model shows that the earliest that the current Cycle should peak is the week of August 11 2025. If it comes a little later (as with the cases of October 01 2018 and June 01 2015), then it could be within November - December 2025.

The shortest correction to the 1W MA200 has been in 2011, which only lasted 22 weeks (154 days). The longest is the whole 2008 Housing Crisis (73 weeks, 511 days). All other three 1W MA200 corrections have lasted for less than a year.

On another note, the 1W RSI just hit the 34.50 level. Since the 2009 bottom, the market has only hit that level 5 times. All produces immediate sharp rebounds. The December 17 2018, March 16 2020 and August 15 2011 RSI tests have been bottoms while May 09 2022 and August 24 2015 bottomed later but still produced sharp bear market rallies before the eventual bottom.

Uncertainty is obviously high but these are the facts and the hard technical data. Game over for stocks or this is a wonderful long-term buy opportunity? The conclusions are yours.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

S&P 500 Down 3% – Divergence AppearsThe S&P 500 (SPX) continues to show a strong bearish bias and is approaching the 5,300-point level in the short term. Selling pressure remains steady as post-“Liberation Day” uncertainty persists, with markets concerned that the recently announced tariffs could significantly impact the U.S. economic outlook. As a result, this could severely limit the performance of equity indices like the S&P 500.

Bearish Channel

Since February 20, the SPX index has maintained consistent downward momentum, establishing a new bearish channel in the short term. The index has now broken below the key 5,400-point support level. However, the speed of the recent declines may have created an imbalance in market forces, which could pave the way for a bullish correction in upcoming sessions.

Divergence in Indicators

MACD: Both the MACD line and the signal line have shown higher lows in recent trading sessions, which contrasts with the lower lows in the SPX price, indicating a bullish divergence.

RSI: The RSI is showing a similar pattern, with the line forming higher lows while price continues to make lower lows. Additionally, the RSI is now approaching the 30 level, which is typically considered the oversold zone.

These divergence and oversold signals suggest that bearish momentum has accelerated sharply, potentially signaling short-term exhaustion. As the balance between buyers and sellers begins to stabilize, this may be an early indication that upward corrections could occur in the next few sessions.

Key Levels:

5,780 points – Distant resistance: This level aligns with the 200-period moving average. A return to this zone could mark the start of a new bullish phase, posing a threat to the current bearish channel.

5,530 points – Near resistance: This area corresponds to neutral levels seen in recent weeks. It may become a target zone for potential corrective upward moves.

5,388 points – Key support zone: This level matches the lowest prices since September 2024 and is where the price is currently consolidating. If the index breaks decisively below this level, it could lead to a more extended bearish channel in the short term.

By Julian Pineda, CFA – Market Analyst

S&P500 6th time in 14 years that this buy signal flashes.S&P500 is sinking under its MA50 (1w) and is headed straight to the next support level, the MA100 (1w).

Last time it touched this level was in October 30th 2023 and that's alone a great buy signal.

It's the RSI (1w) you should be paying attention to as it is approaching the 33.00 level, which since August 2011 it has given 5 buy signals that all touched the MA100 (1w).

Obviously in 2022 we had a bear market, March 2020 was the COVID Black Swan and December 2018 the peak of the U.S.-China trade wars.

Trading Plan:

1. Buy on the MA100 (1w).

Targets:

1. 6500.

Tips:

1. This is a long term trade and it is all about your approach to risk. If you can handle unexpected dips below the MA100 (1w), then you will be greatly rewarded by the end of 2025.

Please like, follow and comment!!

US500: Trend Shift - Potential Break of Key Support LevelsThis analysis focuses on the US500 chart, a representation of the S&P 500 index, a key indicator of the US stock market's performance. The chart displays price action over a 4-hour timeframe, offering a medium-term perspective. The analysis aims to identify potential support levels and assess the likelihood of further bearish movement.

2. Key Findings and Supporting Evidence:

Bearish Trend: The chart clearly shows a prevailing downtrend. The price has been making lower highs and lower lows, signifying strong selling pressure.

Breakdown of Rising Wedge: A rising wedge pattern, often considered a bearish reversal pattern, is visible between March 11th and March 27th. The subsequent breakdown from this wedge has confirmed the bearish sentiment and suggests a continuation of the downtrend.

Potential Support Levels: The chart highlights three potential support levels:

5500 (Current Level): The price is currently hovering around this level. A break below this level could trigger further selling.

5504.2 (First Target): This level is marked as the first potential target for the bearish move.

5441.3 (Second Target): This level represents a more significant support and a deeper potential target.

Trading Strategy Indication: The chart suggests a potential short-selling opportunity, with entry around the current level (5500) and targets at the identified support levels. The stop-loss is placed above the recent high to manage risk.

High Volatility: The sharp price swings and the length of the red (bearish) candles indicate high volatility, suggesting strong momentum behind the downtrend.

3. Relevant Data and Statistics (Inferred):

Timeframe: 4-hour chart.

Index: US500 (S&P 500 equivalent).

Recent High: Approximately 5800.

Recent Low: Approximately 5486.7.

Potential Support Levels: 5500, 5504.2, 5441.3.

4. Discussion of Implications and Potential Future Trends:

Market Sentiment: The breakdown from the rising wedge and the continued bearish momentum suggest a shift in market sentiment towards increased pessimism.

Economic Factors: The downtrend could be influenced by various economic factors, such as rising interest rates, inflation concerns, or geopolitical uncertainties.

Risk Management: Traders should exercise caution and implement proper risk management strategies, including stop-loss orders, due to the high volatility.

Potential for Rebound: While the current trend is bearish, it's essential to acknowledge the possibility of a rebound or consolidation at the support levels.

S&P INTRADAY bearish below 5636President Donald Trump imposed the highest U.S. tariffs in a century, aiming to reshape the global economy. This move triggered threats of retaliation and a sharp market selloff worldwide. Stock markets reacted quickly and negatively. U.S. equity futures dropped as investors worried about corporate earnings. European and Asian stocks also declined. The dollar fell to a five-month low, while investors sought safety in Treasury bonds, and the yen strengthened.

Key Support and Resistance Levels

Resistance Level 1: 5636

Resistance Level 2: 5713

Resistance Level 3: 5790

Support Level 1: 5413

Support Level 2: 5262

Support Level 3: 5200

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.