"US500/SPX500" Index Market Money Heist Plan (Day / Scalping)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US500 / SPX500" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (5500) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (5200) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 5750 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸"US500/SPX500" Index CFD Market Heist Plan (Day / Scalping Trade) is currently experiencing a bullishness🐂.., driven by several key factors.👆👆👆

📰🗞️Get & Read the Fundamental, Macro economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis,Positioning and future trend targets with Overall Score...... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Us500breakout

"SPX500/US500" Index Market Money Heist Plan (Day / Scalping)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "SPX500/US500" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Blue MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (5400) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (5100) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 5800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"SPX500/US500" Index Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets & Overall outlook score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

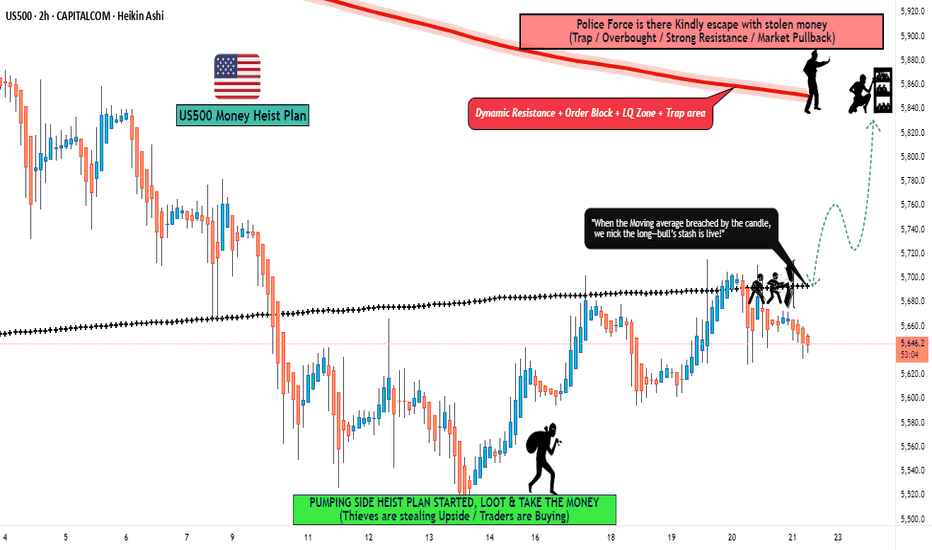

"US500 / SPX500" Index CFD Market Heist Plan (Day or Swing)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US500 / SPX500" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (5700) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 2H timeframe (5600) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 5850 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"US500 / SPX500" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"US500 / S&P 500" Index Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the "US500 / S&P 500" Index market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade after the Red MA line Breakout,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 3H period, the recent / nearest low or high level.

Goal 🎯: 63,00.00

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

US500 Long Term SELLING Trading IdeaHello Traders

In This Chart GBPJPY HOURLY Forex Forecast By FOREX PLANET

today GBPJPY analysis 👆

🟢This Chart includes_ (GBPJPY market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

US500 Next MovePair : US500

Description :

Rising Wedge as an Corrective Pattern in Long Time Frame with the Breakout of the Lower Trend Line and Retracement

Divergence

Break of Structure

Bullish Channel in Short Time Frame as an Corrective Pattern

Completed " 12345 " Impulsive and " ABC " Corrective Wave

US500 Index Next MovePair : US500 Index

Description :

Flag Pattern

Divergence

Bullish Channel in Short Time Frame as an Corrective Pattern

Break of Structure will Complete its Retest at S / R Level

Completed " ABC " Corrective Pattern

Impulse Correction Impulse

S&P 500 Weekly AnalysisS&P 500 on the daily chart. The market is still under the control of the bears. This mean that we have to look for selling opportunities more than the buy once. Let us see how the market will move on Monday.

US Market Technicals Ahead (7 June – 11 June 2021)Investors will keep a close eye on Thursday’s U.S. consumer price data amid concerns that rising inflation could prompt the Federal Reserve to begin pulling back on stimulus. The consumer price report for May will probably show the inflation rate rising to 4.6 percent, the highest since September 2008 and well above the Federal Reserve’s target of about 2 percent.

Meme stocks look likely to continue to grip investors’ attention after a wild ride last week. Markets will also be monitoring the progress of President Joe Biden’s proposed $1.7 trillion infrastructure plan, which has already boosted the industrials and materials sectors this year, leaving many industrials and materials stocks vulnerable to a selloff if a large spending bill in Washington fails to materialize.

Elsewhere, the European Central Bank (ECB) is to meet on Thursday and may discuss tapering stimulus.

Here’s what you need to know to start your week.

S&P500 (US Market)

The benchmark index ($SPX) kicked off the 2nd half of 2021 on a positive note, gaining +0.55% (+23 points) during the week.

$SPX remains less than a percentage point away from recapturing its all time high level of 4,245 level. The past two weeks of low market volatility have seen $SPX trading in a range less than 36 points, the lowest since April 2021.

In the meanwhile, $SPX continues to reflect a minor bearish divergence within its falling price volatility along with daily trading volume on its up-days as highlighted since last week. The immediate support to watch for $SPX is now at 4,150, a breakdown to the lowest price level traded over the past two weeks.

Inflation threat

All eyes will be on the latest CPI data on Thursday, after a much stronger than expected inflation number sparked a selloff last month, as many worried rising price pressures could force the Fed to begin unwinding stimulus soon.

Friday’s jobs report indicated that while jobs growth picked up from the previous month wage growth also accelerated. This could bolster the argument that higher inflation may persist rather than being transitory, as is currently viewed by the Fed.

The inflation reading is one of the last major pieces of economic data ahead of the next Fed meeting on June 15-16 and Fed officials will be in their traditional blackout period during the coming week ahead of that meeting.

The economic calendar also features Thursday’s figures on initial jobless claims, which fell below 400,000 in last week’s release for the first time since the start of the pandemic.

Meme stock frenzy

The wild ride for meme stocks looks set to continue, after AMC ($AMC) shares ended last week with gains of more than 80% despite falling more than 6% on Friday.

AMC has been at the center of a fresh wave of buying by retail investors who hyped the stock in forums such as Reddit’s WallStreetBets, breathing new life into a phenomenon that began with January’s more than 1,600% gain in GameStop ($GME).

AMC, which was on the brink of bankruptcy not long ago, on Thursday completed its second share offering in three days, cashing in on a nearly 400% surge in its share price since mid-May.

But most analysts say that the scale of the rally is out of line with AMC’s fundamentals and high valuations on the meme stock names are unlikely to last.

There are no actively managed stock funds among AMC’S 20 largest shareholders, according to Refinitiv data, leaving open the risk that a shift in retail investor opinion could quickly sink its shares.

Infrastructure deal

Market participants will be closely following negotiations between Democrats and Republicans in Washington over President Joe Biden’s proposed $1.7 trillion infrastructure deal.

Transportation Secretary Pete Buttigieg had said the White House sees Monday – when Congress returns from a one-week break – as a critical date to see progress in talks.

Expectations of government spending on infrastructure have already boosted value stocks this year, particularly the industrials and materials sectors, which have both gained around 20% since the start of the year, against a 12.5% gain for the S&P 500.

Those large gains may leave many industrials and materials stocks vulnerable to a selloff if a large spending bill in Washington fails to materialize.

ECB dilemma

The ECB meets on Thursday and will release its updated growth forecasts for 2021 and 2022.

Policymakers will debate whether to prolong their support for the euro zone recovery through emergency stimulus, a decision that will hinge on how strong they believe the region’s economic recovery is.

Recent dovish comments by several ECB policymakers have highlighted the risks of premature tightening. Any indication from ECB head Christine Lagarde that the debate on tapering is getting underway could push euro zone bond yields still higher and undermine the economic recovery in the bloc.

US Market Technicals Ahead (3 May – 7 May 2021)As markets enter into the month of May, investors will turn to the US jobs report due this Friday, which will probably point to an acceleration in the labor market recovery. Appearances by Federal Reserve officials and other data, including PMIs for indications on the health of the U.S. economy will also be closely watched, as the reopening continues

On the corporate front, the first-quarter earnings season continues, with reports to watch including Pfizer ($PFE), General Motors ($GM), PayPal ($PYPL), Uber ($UBER), and Berkshire Hathaway ($BRK)

Here is what you need to know to start your week.

S&P500 (US Market)

The benchmark index ($SPX) squeezed out a gain of, +0.34% (+14.1 points), with price action remaining flat and muted as cautioned previously. The current ATR-14 range of $SPX is trading at its lowest of the year at 40 points/day, an almost 50% shave off from the Year to Date peak of 71 points per day (March 2021).

With $SPX daily price action transiting into a consolidation phase at its high, along with sessional volume well remaining below its 50 days average range for the 4th consecutive week, it is worth to note that the number of US equities trading above its individual 100 Day Moving Average have declined to only 66%.

At such juncture, it is of utmost importance for market participant to remain prudent with their risk exposure on the long side of the market. The immediate support to watch for $SPX remains at 4,110 level, a minor classical support level.

Bumper job gains expected

The U.S. economy is expected to have notched up another strong month of jobs growth in April with Friday’s nonfarm payrolls report expected to show 978,000 jobs created, after 916,000 jobs were added in March – the largest increase since last August. The unemployment rate is expected to tick down to 5.7% from 6%.

Data late last week showed that economic growth accelerated in the first quarter, putting the economy on track for what is expected to be the strongest performance this year in nearly four decades.

Unprecedented fiscal stimulus and easing anxiety over the pandemic, with all adult Americans now eligible for vaccination, have resulted in a faster economic rebound in the U.S. compared to the rest of the world.

Earnings

Earnings are rebounding from last year’s pandemic-fueled lows, with results now in from more than half of the S&P 500 companies.

Dozens more companies are due to report in the coming week, with vaccine makers Pfizer ($PFE) reporting Tuesday, followed by Moderna ($MRNA) on Thursday.

Travel related earnings to watch include results from Hilton Worldwide Holdings Inc ($HLT) and Caesars Entertainment ($CZR), while some consumer brands are also on the schedule, including Anheuser Busch Inbev ($ABI) and Estee Lauder ($EL).

Some other notable earnings include General Motors ($GM), Uber ($UBER), ViacomCBS ($VIAC), DraftKings Inc ($DKNG) and Beyond Meat ($BYND).

Earnings are raising some fresh questions in the debate over growth versus value. After a decade of steadily under-performing the overall market, value has been a favorite reopening bet and investors will be watching to see if this trend continues.

Fed Chairman speaks

Fed Chairman Jerome Powell is speaking on Monday, but he is not expected to offer any fresh insights on the economy during his appearance to discuss community development at an online conference hosted by the National Community Reinvestment Coalition.

Last week Powell said the “time is not yet” to talk about tapering the Fed’s $120 billion monthly pace of bond buying.

US Market Technicals Ahead (12 Apr – 16 Apr 2021)Price volatility is expected to pick up this week. First-quarter earnings season gets underway with updates expected from major banks such as JPMorgan Chase ($JPM), Citigroup ($C) and Wells Fargo ($WFC). While results are expected to be fairly strong, most will be watching to see what companies say about the outlook for the current quarter and the rest of the year, given expectations for faster economic growth.

On the economic data front, U.S. consumer price inflation (Tuesday) and retail sales (Thursday) will be the biggest data points of the week.

Global financial markets will also pay close attention to comments from a Fed Chair Jerome Powell at the Economic Club of Washington on Wednesday, for additional insight into the outlook for monetary policy in the months ahead.

Elsewhere, in Asia, China will become the first major economy to report first-quarter growth data when it publishes highly anticipated GDP numbers.

Here is what you need to know to start your week.

S&P500 (US Market)

The benchmark index ($SPX) furthered its ascend with a gain of +2.12% (+85.5 points) for the week, establishing an all time high closing of 4,122 level. This was aligned with our weekly market analysis highlighted last week.

It is important to note that the past week of daily incremental price action on $SPX has reflected a clear Bearish Divergence with its transactional volume. A price retracement upon a eutrophic rally beyond the structure of a technical trend channel is always imminent on such scenario. However, the hypothesis of a short term correction for $SPX would remain healthy and strong for the bullish sentiment of the index.

With price volatility expected to pick up this week due to the series of major economic events, the immediate support to watch for $SPX is at 4,030 level, a trendline resistance turned support level.

U.S. 1Q Earnings Season Kicks Off

The first quarter earnings season on Wall Street will kick off in the coming week, with banking giants JPMorgan Chase ($JPM), Goldman Sachs ($GS), and Wells Fargo ($WFC) all set to release their latest quarterly results on Wednesday.

Earnings from Bank of America ($BAC), Citigroup ($C), and Blackrock ($BLK) are then due on Thursday, followed by Morgan Stanley ($MS) on Friday.

Overall, Q1 earnings are expected to have jumped nearly 25% year-over-year, according to Refinitiv. That would be the biggest quarterly gain since 3Q 2018, when tax cuts under former President Donald Trump drove a surge in profit growth.

Financials are expected to show one of the biggest earnings gains, up 75.6% year-on-year, while materials are seen up 45.4%.

U.S. Consumer Price Inflation (CPI)

CPI is expected to have risen 0.5% last month and 2.5% over the prior year, according to estimates. If confirmed, it would mark the fastest increase in eight months.

Excluding the cost of food and fuel, core inflation is projected to climb 0.2% from a month earlier and 1.6% on a year-over-year basis, a tad faster than the 1.3% increase registered in February.

Rising inflation expectations helped spark a first-quarter selloff in Treasuries that drove yields to pre-pandemic highs in recent sessions.

U.S. Retail Sales

The consensus forecast is that the report will show retail sales jumped 5.5%, rebounding from February’s steep decline of 3%, which was the biggest drop since April 2020.

Excluding the automobile sector, sales are expected to rise 4.8%, snapping back from a drop of 2.7% in the preceding month.

Fed Speakers

A number of Fed speeches will get market attention in the week ahead, as traders watch for further clues on interest rates.

Topping the agenda will be remarks from Fed Chair Jerome Powell who will be speaking on Wednesday at an Economic Club of Washington event.

The Fed chair has reiterated lately that any emergence of inflation should be temporary and that the central bank will keep its accommodative policies in place for a long time.

China 1Q Gross Domestic Product (GDP)

China will post its first quarter gross domestic product (GDP) on Friday morning.

The data is expected to show the world’s second-largest economy grew 18.8% in the first three months of 2021 when compared to the year-ago period, accelerating from the previous quarter’s 6.5% pace.

Besides the GDP report, the Asian nation will also publish data on March trade balance, industrial production, retail sales, unemployment, and fixed asset investment.

China’s economy has shown signs of improvement in recent months, with activity rebounding to pre-pandemic levels thanks to a resurgence in global manufacturing and a sharp recovery in domestic spending.