BTC/USD - weekly Analytics + Altcoins 09.08.2021In our opinion, bitcoin has been in the rising trend since the false breakout of 20.07.2021. The local correction from 01.08.2021 to 05.08.2021 finished with the impulse growth, which indicates the future rise of the quotes. Globally, the next target lies in the area of 48.000 dollars, after its overcoming the road to conquer the mark of 58.000 dollars will open.

We consider TRON and HIVE as the most perspective coins for development of a steady growing trend. (the idea is confirmed by local growth impulses)

USD-BTC

S&P 500 - Standard & Poor's 500 IndexThis will be my final analysis on the Standard & Poor's 500 Index until the market bottoms out.

I urge all investors that have extreme long exposure to exit the market due to economic uncertainties and political agendas

Vaccinations leading to a 3rd wave has created an economic situation we have never experienced before.

Markets are currently topped out and in an extremely overbought territory!

Most stocks are in bearish momentum

If anyone is looking for trading assistance you can contact

maverickassociates.wixsite.com

DogeCoin - Elon Musk you have been used!Hello everyone,

Dogecoin is going to cost a lot of people a lot of money. But what really happened? Elon was the pawn in an evil game here - Believe it or not! He is a bit clumsy himself and will have realised his mistake!

The largest crypto exchange in the world starts leveraged trading with Dogecoin. Elon Musk is so nice and makes a gift to the whales! The two events coinciding here should hardly be a coincidence! He posts per Doge and makes the coin known. What profit was possible for the whales here is probably equivalent to a trade of the century. As they say - that was a noBrainer!

Billions in capital from ordinary citizens are now being destroyed here! And this with the help of a man who takes himself a bit too seriously on Twitter and doesn't think about the consequences of his actions ... unbelievable!

Unfortunately, no all-clear can be given from a chart perspective. The most important support has fallen and the downward trend is likely to continue. My target price is about 0.1 cent.

This assessment will only change if the zone around 0.3 cent can be broken upwards with volume. Honestly, I wish it to everyone who is invested here!

Please pay attention to our risk note! I am not an investment advisor and this analysis only reflects my personal opinion and is not a call to individual action!

If you want to support my work I'm happy about a like & follow 🙏

Best regards & success!

Max from ChartDigger

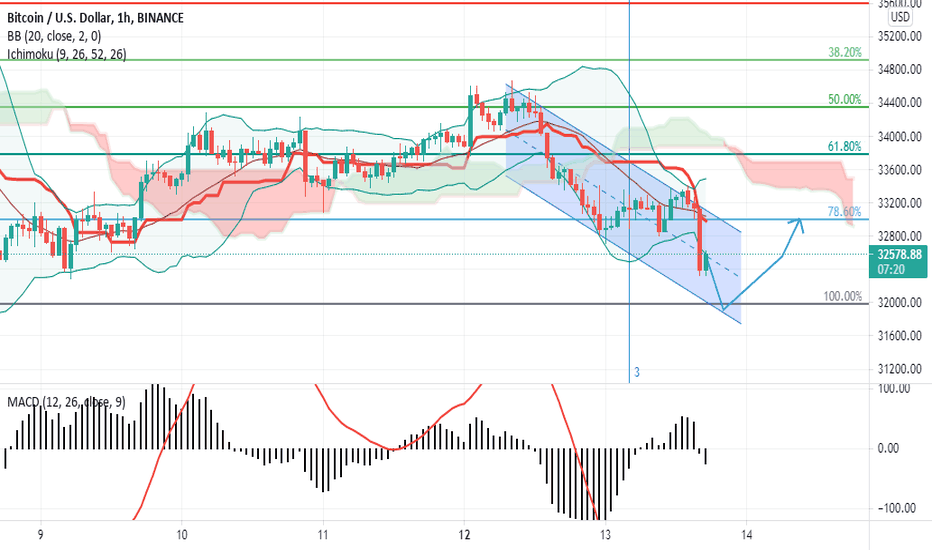

BITCOIN blows the trumpet - NO ONE wants to hear that!!!Hello everyone,

I know no one wants to hear this, but it's time to come clean to all the MOON boys who are making promises and keeping you happy. What does the chart tell us, what is more likely and what are the possible scenarios for bitcoin?

First - anyone who has been following me for a while knows I am currently perma-bear on bitcoin. My short analysis has hit the mark and so far I have no reason to doubt that this assessment will continue. To rule out conflicts of interest immediately - I am flat on crypto - and with good reason! I trade stocks and that's currently a lot more fun than the coins. Anyone who is interested can have a look at my other analyses!

Even in the current mood of the end of time, Bitcoin can clearly hold on to formations that are now becoming clearer in the chart. We are talking about the trumpet 📣

"The Trumpet (Broadening Formation) is a relatively rarely occurring chart formation. Basically, it is a triangle open to the right, whose boundary lines run further and further apart at the top and bottom. The angle at which the upper and lower boundary lines diverge can be arbitrary. Normally, however, the formation is symmetrical. This means that the boundary and support lines diverge at the same angle. There is no favoured direction of breakout. The trumpet can occur both as a trend continuation formation and as a reversal formation (top formation)."

What this means to me is clear. A definite statement cannot yet be made. Nevertheless, a clear tendency can be seen here and it doesn't look so great. The price remains weak, continues to fall and recoveries are more of a homeopathic nature! A breakout on the downside is therefore currently much more likely for me. The problem here is that if the formation breaks out to the downside and the price cannot be intercepted, the crypto market will probably be trapped in a long-term and tough crypto winter for good!

The only possible remedy: the price must leave the formation to the upside, or be caught vigorously at shot target 3 on a breakout to the downside! Honestly, I wish it to everyone who is invested here!!!

Please pay attention to our risk note! I am not an investment advisor and this analysis only reflects my personal opinion and is not a call to individual action!

If you want to support my work I'm happy about a like & follow 🙏

Best regards & success!

Max from ChartDigger

Matic Is not feeling so goodGlobal trend is pushing too much pressure on Bitcoin right now, hence BTC would pressure other alts.

What's happening right now:

Signs of retracing/crash:

1. CFDs on Gold are falling hard (looks still bearish)

2. SPY is aiming to 100

3. Silver is similar to Gold, both of them were signals weeks before big crashes on the market

4. Housing bubble is again insane right now (not only in the US)

Gen-Z should work for 30 years straight just to buy a house without paying mortgages and being slaves to the banks

5. Gov. Bonds are falling

6. Commodities are falling too

Plus, Matic is still sitting on massive gains, a lot of people still believe in bullish trend reversal

My goal: 0.52 - 50% , 0.31 - 25% , 0.22 - 25%

Be careful and don't be greedy, it's just my POV on things.

Inverse head and shoulders on the 1 hourWe seem to be forming an inverse head and shoulders on the 1-hour timeframe after hitting the strong support area around 0.78/0.80 earlier and being rejected by the 0.89 resistance.

We have also backtested the break back into the large triangle and should see some upside here.

RSI is moving nicely around mid-40s and MACD can cross trigger line at any time.

As we know if BTC moves so will XRP so although the technicals show a possible move up to a target area of 0.98 it could also be halted at the resistance areas before that at 0.9 and then 0.95.

All depends on if we break the neckline and with what RSI, volume and what BTC does. If we break the neckline and possibly confirm then we can safely enter a long trade.

Not financial advice, just calling what I see.

Any constructive criticism appreciated.

Ripple, XRP, SEC and the FUD of the century - My final idea.

SEC's price suppression on XRP is coming to an end as it is rumoured that SEC employees and whales have already bought as much as they could at low prices.

Earlier this year the defence case for the San Francisco firm had looked dead in the water with maximum FUD, haters clapped and weak hands sold, according to crypto observers.

The SEC file its lawsuit a few days before Christmas 2020, claiming its founders were selling it's product, imagine that? a company selling products is something unheard about until now. They also stated its founders were getting rich, something unheard also.

Now, six months on and after series of bruising battles, it appears the odds are now with Ripple Hodlers.

/////

Dear TradingViewers, so this is my last and final idea, it was fun while it lasted but my humour is not for everyone and I keep getting banned in here, thanks for everyone's likes and comments, all the best.

Bitcoin Expected higher prices - check out why!Dear traders,

Here is a new update for Bitcoin on the 2 hour chart.

As you can see, my previous head shoulder formation came true exactly. Also the small head shoulder formation in the descending trend channel have been perfectly met (target1).

How is Bitcoin doing now and what can we expect.

Currently we are in the process of forming a mini inverted HS with the neckline of the turquoise H-S at 52627 as the target.

Important is to be constantly alert for the formation of a new structure, patterns, divergences etc.

So for the moment I am LONG on BTC until 52627.

The reasons for this position:

1 We see a positive divergence in the RSI (4 hours chart)

2. The falling trend channel has been broken.

3. The targets of the 2 previous HS formations have been met exactly.

A rebound to the previous important key level at 52627 is thus very possible.

Please note these are hypotheses, my personal view. Everyone has their own view on the charts and that is perfect. That's why there are bulls and bears. The balance in the market.

I don't see the price going higher than 55000 before we can expect another wave down.

Important: If the price of Bitcoin drops UNDER 46000 then the older lower target will come back into view! So keep that in mind!

A closing price of the day candle below 46000 is bearish and continuation of the downtrend!

A closing price above 55000 is a possible scenario towards the old all time high, a double top or higher targets after breakout above the All time high

Traders, this is my personal view on Bitcoin, No trading advice. Always do your own research before trading and at least use stops and money management to limit your risk.

If you guys appreciate my work it will be a motivation for me if julle give a thumbs up and follow me for updates.

I wish you lots of profits and above all safe trading!

BITCOIN - BTC - VERY IMPORTANT LEVELS TO KEEP IN MIND!Hello Traders,

I have created a comprehensive roadmap on this 8 hour chart from Bitcoin with targets and support for the short to medium term.

Scroll down or up the price scale onthe right for all support and resistance levels.

Below is the description but be sure to remember the very important levels. 64651 and 51724 (ultimate 47674. Bitcoin drives the entire Crypto market so always consider these in your decisions.

These are in my opinion the 3 most important scenarios that are going to happen and completely depend on which horizontal support or resistance is broken. Is Bitcoin going to make new all time highs or are we going to go into a deeper correction. So it all depends on what happens next in the short term.

A Breakout Above 64651 is Bullish for the medium term and a breakout below 51724 medium term Bearish. A breakout below Support 4 at 47674 almost certainly leads to much lower price targets.

Scenario 1:

The 1st target at 60678 is broken by BTC and immediately validates the inverse head shoulder pattern. 1st target is then 68953 USD but ONLY if resistance 64651 (the old all time high) is broken! Next, the upside targets are then:

Target 2 64,651 USD

Target 3 68,953 USD

Target 4 74,750 USD

Target 5 82,627 USD

Target 6 104,623 USD

Scenario 2:

Bitcoin stays between 60678 and 51724/ So this is a sideways trend. We can then easily move between these 2 levels for a longer period of time and profit from sideway market techniques.

Keep in mind that if we don't get above the old all time high we can therefore also get a double top which is extremely bearish.

Scenario 3:

Bitcoin breaks the important support level 2 at 51724 after which we immediately set a lower low.

This then also immediately confirms the right shoulder of a much larger head shoulder pattern (see previous analysis of Bitcoin) and we see the following targets to the downside coming into view.

Support 3 49,592 USD

Support 4 47,674 USD

Support 5 44,477 USD

Support 6 40,640 USD

Ultimate Support 7 29,557 USD

Bitcoin is the king of crypto currencies. If it drops slowly or stabilize then the ALTS can go much higher. Does Bitcoin fall fast then the whole market goes down. If Bitcoin rises faster and more aggressively then the ALTS could face a correction.

You can come back each time when you want to easily see where we are in this roadmap.

This is purely my own outlook on Bitcoin and therefore no trading advice. Definitely always do your own research when trading!