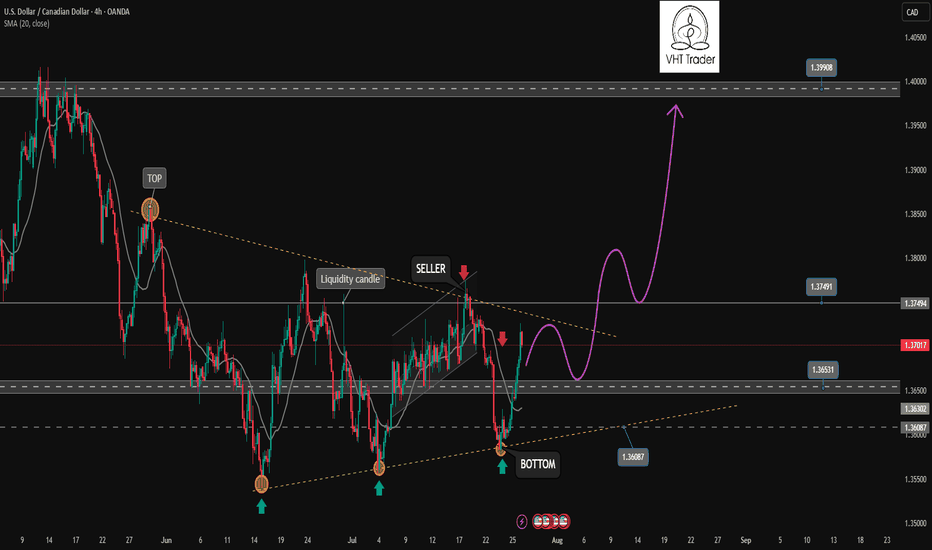

USDCAD Prepaing to Gilde Down ??USDCAD has been struglling to move up, All the monthly and Bi-Monthly analysis show down including D1. Check your support and resistances and open positions accordingly. Wait for Price Again to preform and see the strong breakouts.

Disclaimer:

The content presented in this IMAGE is intended solely for educational and informational purposes. It does not constitute financial, investment, or trading advice.

Trading foreign exchange (Forex) on margin involves a high level of risk and may not be suitable for all investors. The use of leverage can work both for and against you. Before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience, and risk tolerance.

There is a possibility that you may incur a loss of some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be fully aware of all the risks associated with foreign exchange trading, and seek advice from a licensed and independent financial advisor if you have any doubts.

Past performance is not indicative of future results. Always trade responsibly.

Usdcadanalysis

USD/CAD Bullish Bias Supported by COT Data and Seasonal Trends🗓 Monthly Chart Overview

• Price Inefficiency Zone: There's a clear imbalance between 1.40165 and 1.41248, suggesting a potential magnet for price. A retracement to at least the 50% level of this inefficiency could be expected.

• Bullish Structure: Price has formed a bullish order block and is currently retracing, which often precedes a continuation move upward.

• This setup hints at accumulation before a bullish expansion.

📆 Weekly Chart Insights

• Inefficiency Filled: Price has filled previous inefficiencies, showing healthy market structure.

• Liquidity Behavior: We've seen price sweep lows, then begin sweeping highs, while respecting bullish blocks—a strong indication of a shift in directional intent.

• This behavior supports the idea that USD/CAD is preparing for a bullish continuation.

📅 Daily Chart Momentum

• Aggressive Breakout: After a period of consolidation, price broke out aggressively to the upside, confirming bullish momentum.

• Structure: The daily chart maintains a bullish structure, reinforcing the higher timeframe bias.

💹 Commitment of Traders (COT) Data

• USD Positioning: The U.S. Dollar is showing net buying interest, supporting strength.

• CAD Positioning: The Canadian Dollar is net bearish on average when compared to last year’s data.

• This divergence in sentiment adds confluence to a bullish USD/CAD bias.

📊 Seasonal Trends

• Historically, USD/CAD tends to rise from August through November, with September, October, and especially November being the most bullish months.

• This seasonal tendency aligns with the current technical and fundamental setup.

🏦 Macro Considerations

• Interest Rates: Keep a close eye on central bank rate decisions and forward guidance, as they can significantly impact USD/CAD volatility and direction.

🔍 Summary

USD/CAD shows strong bullish potential across monthly, weekly, and daily timeframes. Technical structure, COT data, and seasonal trends all point toward a continuation to the upside. A revisit to the inefficiency zone around 1.4060–1.4120 could be a key target in the coming months.

USDCAD BEARISH ZONE COMESUP Current Technical Landscape

Market Sentiment & Drivers

The USD/CAD has risen modestly following Canada’s weak jobs data showing a −40.8 k drop in employment, raising expectations of dovish Bank of Canada policy and fueling a weaker Loonie.

Meanwhile, signals of a more dovish Fed—especially after Trump’s appointed governor tone—have added further downward pressure on the USD.

Key Levels & Technical Indicators

ActionForex (Intraday):

4H MACD has crossed above its signal, neutralizing bias for now.

Break below 1.3720 could target a deeper fall back to 1.3538 — the recent corrective low.

Break above 1.3809 would invalidate that bearish view and suggest a retest of 1.3878.

ActionForex (Weekly):

The pair hovered around 1.3720 last week with a neutral weekly bias.

A downside break could confirm continuation of the corrective decline toward 1.3538.

A bullish breakout beyond 1.3809 could lead to a retest of 1.3878 and possibly higher.

StockTA (as of July 28):

Overall sentiment remains bearish (score: −0.26), particularly in the short-term (−0.48).

Key resistance cluster around 1.47 to 1.45, with multiple levels noted between 1.47 and 1.37.

Support appears near 1.36, based on their analysis.

Marketscreener (latest in July):

Short-term trend: Neutral; Mid-term trend: Bearish; Long-term trend: Neutral.

Short-term resistance: 1.3733, support: 1.3571.

Mid-term resistance: 1.3978, support: 1.3571.

Long-term resistance: 1.4524, support: 1.3490.

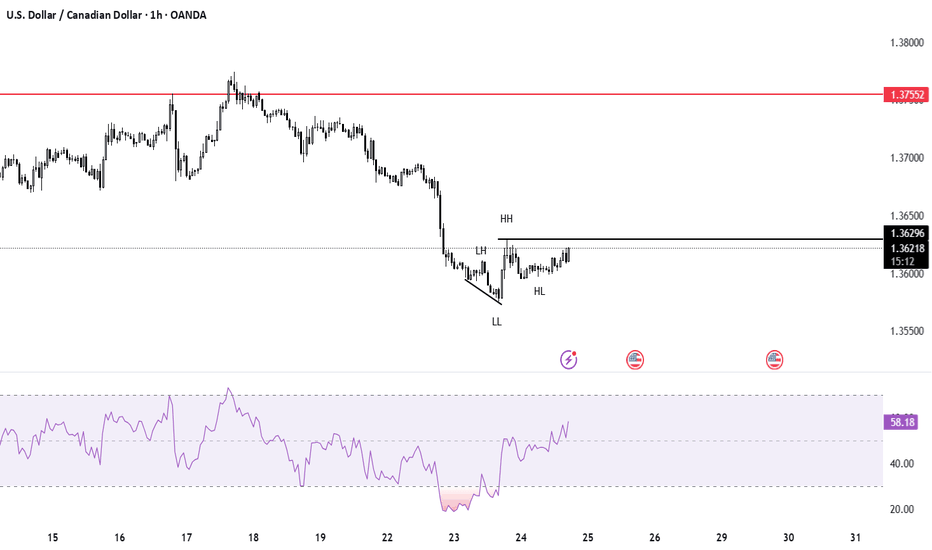

Interpretation: Bearish Zone “Coming Up”

The phrase “bearish zone comes up” likely refers to the pair approaching a key resistance area where bearish reversal pressure is increasing. Currently:

1.3720–1.3809 is a critical near-term range. A failure to break above 1.3809 may invite renewed downside toward 1.3538.

Medium-term resistance clusters between 1.37 and 1.40 are also zones where bearish setups may form.

Broader resistance around 1.45–1.47 remains the major structural ceiling, although this lies further out unless the bias shifts.

Strategy Considerations

Bearish setup: Wait for rejection near 1.38, ideally with confirmation (e.g. bearish candle, MACD crossover). A break below 1.3720 could accelerate retest of 1.3538.

Bullish invalidation: A sustained move above 1.3809 could negate the immediate bearish bias, opening targets back toward 1.3878 and beyond.

USDCAD drop to order block?Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDCAD(20250808)Today's AnalysisMarket News:

① Trump nominated Stephen Milan, Chairman of the White House Council of Economic Advisers, to serve on the Federal Reserve Board, with a term ending January 31, 2026.

② Waller is reportedly a leading candidate for the next Fed Chair.

③ U.S. Treasury Secretary Bensont stated that the interview process for the Fed Chair has begun.

④ Bostic stated that the July jobs report did change the Fed's outlook on its employment goals.

Technical Analysis:

Today's Buy/Sell Levels:

1.3746

Support and Resistance Levels:

1.3798

1.3778

1.3766

1.3726

1.3713

1.3694

Trading Strategy:

If the price breaks above 1.3746, consider a buy entry, with the first target price being 1.3766. If the price breaks below 1.3726, consider a sell entry, with the first target price being 1.3713.

USDCAD - Big Picture and MomentumBig Picture and Momentum

USD/CAD is trading comfortably above the 50-day EMA (~1.3728) and above the 9-day EMA, indicating continued bullish momentum. The 14-day RSI is above the 50 level, confirming the positive market sentiment.

Key Support and Resistance

Resistance: 1.3770–1.3798 range is the current target, a break of which could open the way to the January high around 1.4016.

Support:

50-day EMA (~1.3728) is the first line of defense.

Next is the 9-day EMA (~1.3679).

A further weakening could see a decline to 1.3560, and a strong correction could see a decline to the February 2024 lows (~1.3420).

Market Behavior Scenarios

Bullish scenario: holding above EMA with RSI > 50 creates good conditions for a move up to 1.3770-1.3800, and then to 1.4016, with increasing momentum.

Bearish scenario: falling below EMA, especially below 1.3679, can lead to a deeper decline - to 1.3560 and then to 1.3420.

Recommendations for traders

Long position: can be considered for entry when holding above 1.3728, with a target of 1.3770-1.3800, and a stop just below the EMA.

Short position: justified when falling below 1.3728-1.3679, with a target of 1.3560, and a stop just above the EMA level.

USD/CAD(20250806)Today's AnalysisMarket News:

The US non-manufacturing PMI fell to 50.1 in July from 50.8 in June, below the expected 51.5. The ISM New Orders Index fell to 50.3 in July from 51.3 in June, with export orders contracting for the fourth time in five months.

Technical Analysis:

Today's Buy/Sell Levels:

1.3781

Support and Resistance Levels:

1.3828

1.3810

1.3799

1.3763

1.3751

1.3734

Trading Strategy:

On a breakout above 1.3781, consider a buy entry, with the first target at 1.3799. On a breakout above 1.3763, consider a sell entry, with the first target at 1.3751.

USD CAD Where Are We Heading DEEP ANALYSIS Hi Trading Fam

So with USD CAD this is what we are seeing:

Bearish:

If we stay under 1.38 then a drop down to the 1.37 range

Bullish:

If we can close above the high at 1.38 then we have levels of 1.3840 , and 1.3980 that could be hit

Trade Smarter Live Better

Kris

Watching Retracement Levels for Potential USDCAD Entry📈 The USDCAD remains firmly in a bullish trend following a sharp pullback on the 4-hour timeframe. Price continues to print higher highs and higher lows, showing sustained upward momentum. I’m watching for a retracement back into equilibrium of the previous price swing — if price dips and then breaks structure to the upside, I’ll be eyeing a potential long entry 🔍📊 (not financial advice).

USDCAD Daily AnalysisUSDCAD has recently completed a clean 5-wave Elliott Wave decline, reaching a significant low at 1.3540 on June 16, 2025. This low marks the end of the bearish cycle, followed by an accumulation phase. During this phase, price formed a triple bottom pattern, confirming strong demand around the 1.3540–1.3560 zone.

The breakout above the neckline confirms this reversal pattern, and price is now retesting the previous resistance zone (1.3750–1.3770), which has turned into support.

The pair is also trading above the 21-period EMA, reinforcing the bullish momentum.

Elliott Wave & Structure Outlook

Elliott Wave count shows a completed 1–5 bearish wave, followed by a corrective bullish structure in progress.

Wave A of the corrective move has likely completed, and Wave B retracement is underway.

A continuation toward Wave C is expected, targeting the 1.4180–1.4300 resistance area, aligning with prior major supply zones.

Trade Plan

Buy Entry Zone: 1.3750 – 1.3700

Stop Loss: 1.3560 (below structure support and trendline)

Take Profit Targets:

🎯 TP1: 1.4000

🎯 TP2: 1.4180

🎯 TP3: 1.4300

USDCAD has shifted from a prolonged bearish trend into a bullish corrective phase. A successful retest of the breakout zone offers a high-probability long trade setup. Breakout and continuation toward 1.4180–1.4300 aligns with wave theory and technical resistance zones.

USD/CAD Daily - Triple Bottom Breakout PatternUSD/CAD Daily – Triple Bottom Breakout

The USD/CAD pair on the 1D chart has formed a Triple Bottom pattern, a classic bullish reversal setup after a downtrend. This pattern suggests that sellers were unable to push the price below the established support zone on three separate occasions, signaling strong buying interest.

🔍 Chart Highlights:

Three distinct lows at a consistent support level

Strong bounce after each test of support, confirming bullish defense

Neckline (resistance line) successfully broken, indicating a breakout

Price target projected from the height of the pattern added to the breakout level

📈 Pattern: Triple Bottom

📍 Breakout Level (Neckline): Around 1.37800

🎯 Target: Approx. 1.42000

🛑 Invalidation: A daily close back below the neckline

This breakout may indicate the beginning of a bullish trend continuation, with momentum favoring the bulls as long as price holds above the neckline.

USD/CAD Rises to 2-Month HighUSD/CAD Rises to 2-Month High

Today, the USD/CAD exchange rate briefly exceeded the 1.3870 mark – the highest level seen this summer. In less than ten days, the US dollar has strengthened by over 2% against the Canadian dollar.

Why Is USD/CAD Rising?

Given that both the Federal Reserve and the Bank of Canada left interest rates unchanged on Wednesday (as expected), the primary driver behind the pair’s recent rally appears to be US President Donald Trump's decision to impose tariffs on several countries – including Canada:

→ Despite efforts by Prime Minister of Canada Mark Carney to reach an agreement with Trump, no deal was achieved;

→ Canadian goods exported to the US will now be subject to a 35% tariff;

→ The tariffs take effect from 1 August;

→ Goods compliant with the United States-Mexico-Canada Agreement (USMCA) are exempt.

Media analysts note that the tariffs are likely to increase pressure on the Canadian economy, as approximately 75% of the country's exports are destined for the United States.

USD/CAD Technical Analysis

At the end of July, the price formed a steep ascending channel (A-B), with bullish momentum confirmed by a decisive breakout above the 1.3790 resistance level, as illustrated by the arrow:

→ the pullback before the breakout was relatively shallow;

→ the bullish breakout was marked by a long bullish candlestick with a close near the session high;

→ following the breakout, the price confidently consolidated above 1.3790.

Provided that the fundamental backdrop does not undergo a major shift, bulls might attempt to maintain control in the market. However, the likelihood of a correction is also increasing, as the RSI indicator has entered extreme overbought territory.

Should USD/CAD show signs of a correction after its steep ascent, support might be found at:

→ line C, drawn parallel to the A-B channel at a distance of its width;

→ the previously mentioned 1.3790 level, which now acts as a support following the breakout.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USDCAD SELLUSD/CAD rallies further, approaches 1.3900 on higher levies to Canada

The US Dollar keeps marching higher, as the Canadian Dollar struggles after Trump decided to increase tariffs to Canada to 35% from the previous 25%, escalating the trading tension with one of its main trading partners. The US President justified his decision on Canada’s alleged reluctance to cooperate on curbing the traffic of fentanyl and other drugs across the US border

The year will be politically marked by Trump’s return to the White House. A Republican government is seen as positive for financial markets, but Trump’s pledge to cut taxes and impose tariffs on foreign goods and services may introduce uncertainty to both the political and economic landscape.

Canada’s political crisis peaked in late 2024 with a no-confidence vote against Prime Minister Justin Trudeau, leading to snap elections and a weakened Liberal minority government. Policy uncertainty and economic challenges dominate 2025’s outlook, raising concerns over market stability and investor confidence.

The BoC is set to continue easing interest rates through 2025, at least at a faster pace than the Fed is expected to, which could apply pressure on CAD’s already-rising rate differential.

SUPPORT 1.38444

SUPPORT 1.38039

SUPPORT 1.37621

RESISTANCE 1.38889

RESISTANCE 1.39049

USD/CAD Breaks Triangle: Bullish Target in SightHello guys!

USD/CAD has broken out of a clear triangle formation, signaling strong bullish momentum. The breakout above the top line of the triangle, supported by earlier bullish divergence, confirms that buyers are now in control.

Triangle breakout confirmed

Strong bullish impulse post-breakout

Retest of the broken trendline expected

Target: 1.38791

A clean retest of the breakout level could provide another entry opportunity before price reaches the target zone highlighted in blue.

Trade deal thread could pump USDCAD?USDCAD as with the bounce off the monthly support level, current is a strong uptrend.4H perspective, price is trading above 10ema since the cross over of 20ema and 10ema price is pushing back to the upside. With trade deal thread, including upcoming GDP on CAD could pump this price back to the resistance ?

As 10ema has not been tested since cross over, we may see the price to back to the upside with respecting the 10ema.

Buying on EMA is a high probability trade setup.

Uptrend is coming. Opportunity for buyers✏️ OANDA:USDCAD is trading close to the upper boundary of the triangle pattern. There is a high possibility that the current bullish momentum will break the upper boundary and form an uptrend for the USDCAD pair. The important price zone for the sellers at the moment is 1.075. If the buyers are strong enough to push the price above 1.075, the sellers will only be really interested in the price zone of 1.340, the high of the pair in May.

📉 Key Levels

Buy trigger: Reject and Trading above 1.365

BUY DCA Break 1.375

Target: 1.400

Leave your comments on the idea. I am happy to read your views.

USD/ CAD Are We Heading to $1.46 Territory Watch OUT Afternoon Trading Family

Based on what we are seeing is a nice bullish run up to the following levels :

Levels To Watch For:

1) $1.39

2) $1.41

3) $1.43

4) $1.46

However be aware if we for whatever reason we sink back into the 1.35 territory then we could see a drop down to 1.34

Trade Smarter Live Better

Kris

USD/CAD(20250730)Today's AnalysisMarket News:

According to a Reuters/Ipsos poll, Trump's approval rating has fallen to 40%, the lowest level since his second term.

Technical Analysis:

Today's Buy/Sell Levels:

1.3762

Support and Resistance Levels:

1.3820

1.3798

1.3784

1.3739

1.3725

1.3704

Trading Strategy:

If the price breaks above 1.3784, consider a buy entry, with the first target price at 1.3798. If the price breaks below 1.3762, consider a sell entry, with the first target price at 1.3739.

USDCAD: a long positionHello guys.

Divergence:

A bullish RSI divergence is noted, price made lower lows while RSI formed higher lows, signaling a potential bullish reversal.

Price Action:

Price has bounced strongly from around the 1.3570–1.3580 zone and is now approaching a descending trendline resistance.

Trade Setup:

Entry: 1.3718

Stop Loss: Below the breakout candle, near 1.3686

Take Profit: Around 1.3782

Risk-to-Reward: 1:3

USD/CAD Institutional Buy Zone – Thief Trading Alert!🔥 USD/CAD "LOONIE BANK HEIST" 🔥 – THIEF TRADING STYLE (BULLISH SNIPER PLAN)

💸 ATTENTION: Market Robbers & Profit Pirates!

"Steal Like a Pro – Escape Before the Cops Arrive!"

🎯 MASTER TRADE PLAN (Based on Thief Trading Tactics):

Entry Zone (Pullback Heist):

📌 Pullback-1: Market Maker Trap Zone (1.35400+) – Wait for retest!

📌 Pullback-2: Institutional Buy Zone (1.33500+) – Confirm bullish momentum!

"Patience = Perfect Heist Timing. Don’t rush—ambush the trend!"

🎯 Profit Target: 1.38100 (or escape earlier if momentum fades).

🛑 Stop Loss (Escape Route): Nearest 4H Swing Low (wick/close) – Adjust based on risk & lot size!

🚨 SCALPERS’ WARNING:

"Only snipe LONG! Big pockets? Strike now. Small stack? Join swing robbers & trail your SL!"

📉 WHY THIS HEIST? (Bullish Triggers):

Technical + Fundamental alignment (COT, Macro, Sentiment).

Overbought but institutional demand holding strong.

"Bears are trapped—time to rob their stops!"

⚠️ CRITICAL ALERT:

News = Volatility = Police Ambush!

Avoid new trades during high-impact news.

Trailing SL = Your Getaway Car! Lock profits before reversals.

💥 BOOST THIS HEIST!

"Hit 👍, 🔔 Follow, and 🚀 Boost to fuel our next robbery! Let’s drain the banks together!"

🔮 NEXT HEIST COMING SOON… Stay tuned, partner! 🎭💰

USDCAD SELLUSD/CAD rallies to 1.3680 as the market focuses on a hawkish Fed

The US Dollar extends its recovery for the second consecutive day, supported by strong US data. Upbeat US business activity and Jobless Claims support the Fed's "wait and see" rhetoric. In Canada, the weak Retail Sales data keep hopes for a BoC rate cut alive.

The year will be politically marked by Trump’s return to the White House. A Republican government is seen as positive for financial markets, but Trump’s pledge to cut taxes and impose tariffs on foreign goods and services may introduce uncertainty to both the political and economic landscape.

Canada’s political crisis peaked in late 2024 with a no-confidence vote against Prime Minister Justin Trudeau, leading to snap elections and a weakened Liberal minority government. Policy uncertainty and economic challenges dominate 2025’s outlook, raising concerns over market stability and investor confidence.

The BoC is set to continue easing interest rates through 2025, at least at a faster pace than the Fed is expected to, which could apply pressure on CAD’s already-rising rate differential.

SUPPORT 1.36991

SUPPORT 1.36739

SUPPORT 1.36495

RESISTANCE 1.37346

RESISTANCE 1.37455