Usdcadanalysis

#USDCAD: Two Big Target Accumulating of 800+ Pips! **USDCAD **

Following the US President’s decision to impose a 25% tariff rate on Canada, the USD/CAD exchange rate experienced a significant surge, reaching approximately 1.49. However, as the market has stabilised, we anticipate a gradual decline in the exchange rate, which may help bridge the liquidity gap.

Two prominent red lines serve as potential entry and stop-loss points. Additionally, two designated targets are set as swing take-profit areas.

We appreciate your unwavering support. Should you have any inquiries regarding the strategy or any trading-related questions, please do not hesitate to provide feedback.

Team Setupsfx_

USD/CAD 1H – Bearish Setup with SBR & DBD Zone | Trendline BreakKey Zones:

🔵 Entry Point (Sell):

Around 1.41300–1.41500 (Supply Zone: SBR + DBD zone)

Price is expected to pull back here before dropping

This is the ideal place to look for bearish confirmation

🟦 Supply Zone (Resistance)

🔴 Stop Loss:

Just above 1.41804

If price hits this, the bearish idea is invalidated

⚠️ Protection zone

🟡 Demand Zone (Support):

1.40000–1.40500

Price may bounce here temporarily

Watch for consolidation or breakout

🟢 Take Profit / Target Point:

1.39320

This is the final target for the short position

Potential -1.36% move / 192.7 pips

💰 Profit zone

Visual Summary with Dots:

🔵 Sell Entry: Around 1.41400

🔴 Stop Loss: Above 1.41800

🟢 Take Profit: At 1.39320

USDCAD Trendline Breakout Ready for a Long SellHello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

USDCAD Downtrend Hinges on This SupportFenzoFx—USD/CAD is trading bearishly and failed to form a new higher high above the 1.4297 resistance. A new bearish wave could be triggered if selling pressure drives the price below the 1.4143 support level.

In this scenario, the next bearish target will likely be 1.4028. Please note that the bearish outlook should be invalidated if USD/CAD exceeds 1.4297.

>>> Trade USDCAT at FenzoFx Decentralized Forex Broker

USD/CAD Bearish Setup: Trendline Rejection & Supply Zone Trade📉 Trendline & Market Structure

🔵 Descending Trendline: The price has respected this trendline multiple times (🔴 red dots mark rejection points). This confirms a bearish structure.

📦 Supply Zone (Sell Area)

🟦 Blue Zone (Supply Zone): This is a strong resistance area where sellers may push the price down.

🚀 Price Rejected Here: Market reaction suggests potential bearish momentum.

⚠️ Stop Loss & Target 🎯

❌ Stop Loss (1.42308): If the price breaks above, the bearish setup is invalid.

🎯 Target (1.40437): Marked with a blue arrow 📉 indicating a downward move.

✅ Trade Plan

🔽 Sell Entry: Inside the supply zone

🛑 Stop Loss: Above the supply zone

🎯 Take Profit: At the lower blue level

This setup suggests a high-risk reward ratio favoring short positions. 📊 Keep an eye on the trendline and market reaction!

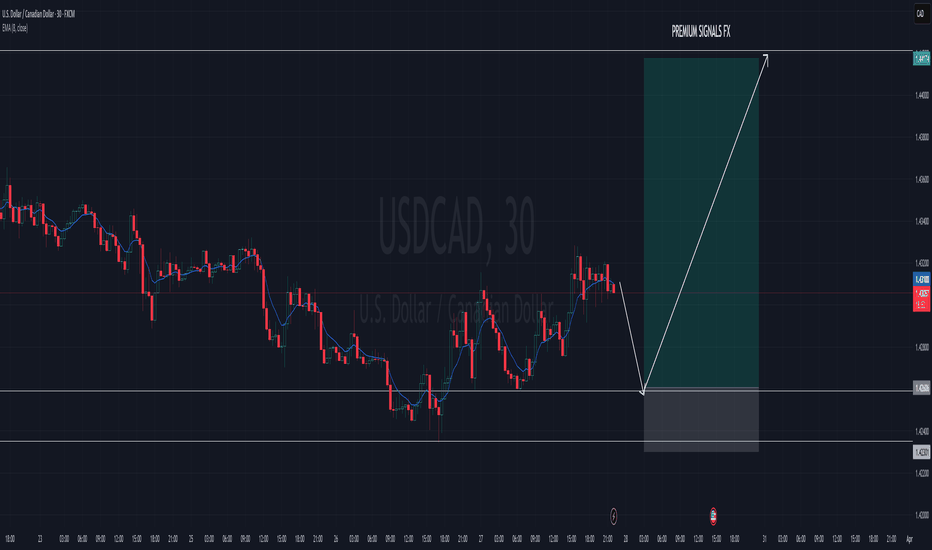

USD/CAD Rejection Trade Setup – Short from Supply Zone with RisiTimeframe: 30 Minutes (M30)

Indicators:

EMA 30 (Red): 1.41932

EMA 200 (Blue): 1.42196

🧠 Trade Setup: Potential Short Opportunity

📍 Current Price: 1.42252

📌 Key Levels:

Entry Point (Supply Zone): 1.42582

Strong resistance zone, overlapping with EMA 200 and a previous consolidation zone.

Price has entered a rising wedge pattern—a potential bearish reversal signal.

Stop Loss: 1.42987

Placed just above the supply zone to avoid premature exit due to a false breakout.

Take Profit (EA Target Point): 1.40379

Aligns with previous demand zone, solid support level.

⚖️ Risk-to-Reward Breakdown:

Risk: ~335 pips

Reward: ~2047 pips

R:R Ratio: ~1:6 — Excellent risk-to-reward ratio for a swing short.

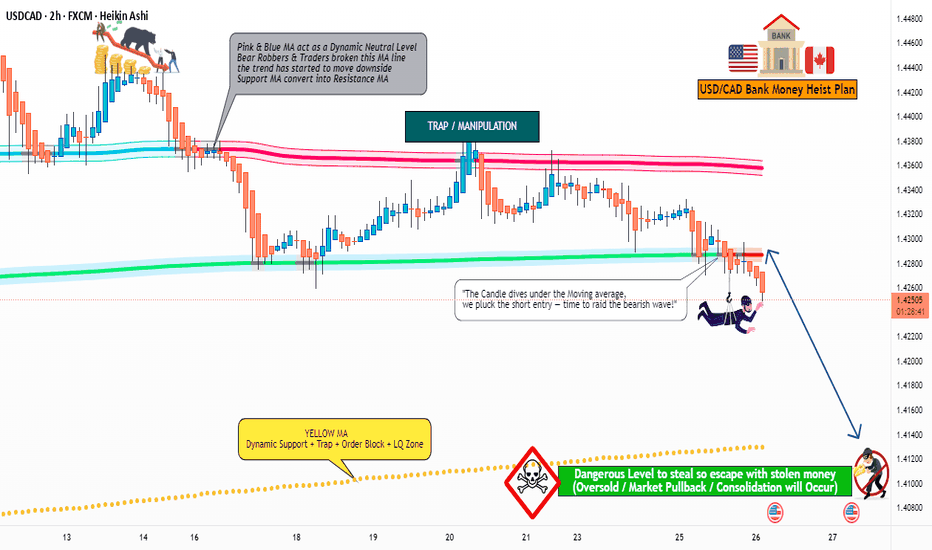

USD/CAD "The Loonie" Forex Bank Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CAD "The Loonie" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑: Thief SL placed at 1.43600 (scalping / Day Trade Basis) Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.41300 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

USD/CAD "The Loonie" Forex Bank Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/CAD "The Loonie" Forex Bank (Swing Trade) Heist Plan 🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CAD "The Loonie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on! profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or swing low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (1.44500) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Primary Target - 1.41500 (or) Escape Before the Target

🏴☠️Secondary Target - 1.39500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

USD/CAD "The Loonie" Forex Bank Heist Plan (Swing Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend...

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/CAD Bullish Trade Setup: Key Support, Entry, and Target AnalThis chart is a technical analysis of the USD/CAD currency pair on a 3-hour timeframe. Here’s a breakdown of the key elements:

Key Observations:

1. Exponential Moving Averages (EMAs):

200 EMA (Blue Line) at 1.43318 – A long-term trend indicator.

30 EMA (Red Line) at 1.43135 – A short-term trend indicator.

The price is currently trading above both EMAs, suggesting a bullish bias.

2. Support and Resistance Levels:

A support zone (purple box) around 1.43010 to 1.43141 has been identified, which the price is expected to respect.

The target level (EA TARGET POINT) is set at 1.44511, indicating a bullish price movement expectation.

3. Entry, Stop Loss & Take Profit:

Entry Point: Near the 1.43318 level (current price area).

Stop Loss: Placed below the supp

Market Analysis: USD/CAD DipsMarket Analysis: USD/CAD Dips

USD/CAD declined and now consolidates below the 1.4350 level.

Important Takeaways for USD/CAD Analysis Today

- USD/CAD started a fresh decline after it failed to clear the 1.4415 resistance.

- There was a break below a major bullish trend line

USD/CAD Technical Analysis

On the hourly chart of USD/CAD at FXOpen, the pair climbed toward the 1.4420 resistance zone before the bears appeared. The US Dollar formed a swing high near 1.4415 and recently declined below the 1.4350 support against the Canadian Dollar.

There was also a close below the 50-hour simple moving average and 1.4310. There was a break below a major bullish trend line with support at 1.4310.

The bulls are now active near the 1.4300 level. The pair is now consolidating losses below the 23.6% Fib retracement level of the downward move from the 1.4415 swing high to the 1.4288 low. If there is a fresh increase, the pair could face resistance near the 1.4330 level.

The next key resistance on the USD/CAD chart is near the 1.4350 level and the 50% Fib retracement level of the downward move from the 1.4415 swing high to the 1.4288 low.

If there is an upside break above 1.4350, the pair could rise toward the 1.4400 resistance. The next major resistance is near the 1.4415 zone, above which it could rise steadily toward the 1.4450 resistance zone.

Immediate support is near the 1.4290 level. The first major support is near 1.4260. A close below the 1.4260 level might trigger a strong decline. In the stated case, USD/CAD might test 1.4240. Any more losses may possibly open the doors for a drop toward the 1.4400 support.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USD/CAD Pulls Back After Hitting 1.4400FenzoFx— The USD/CAD pair hit 1.4400 but lost momentum, pulling back from resistance. Technically, USD/CAD may dip toward the 50-period SMA near 1.4330 before resuming its uptrend.

However, if USD/CAD drops below 1.4330, the bearish momentum may extend to the 1.4250 support, invalidating the bullish outlook.

USDCAD -Weekly Forecast,Technical Analysis & Trading Ideas

Technical analysis is on the chart!

No description needed!

OANDA:USDCAD

________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

It looks like a wedge!If you're not a chartist, then see it as a liquidity grab at the marked red dot.

We probably still have another 100 pips of leverage left, maybe more!

Remember that a crowded area is a liquidity-starved area.

Don't forget that patience pays off!

Apply your own strategy to find the entry, or here's a little setup; that's what I'm waiting for.

Keep It Simple!

Don't forget to follow me.

USD/CAD Bearish Trade Setup – Resistance Rejection & Target ProjUSD/CAD Bearish Trade Setup – Key Resistance & Target Projection

Analysis:

Timeframe: 30-minute chart

Current Price: 1.43248

Indicators:

EMA (200, Blue): 1.43024 (Key Dynamic Support)

EMA (30, Red): 1.43142 (Short-term trend)

Resistance Zone (Supply Area): 1.43300 - 1.43450

Support Level (Rejection Zone): 1.43085 - 1.43024

Trade Setup:

Entry Zone: Around the rejection level near 1.43142

Stop Loss: 1.43435 (Above the resistance zone)

Take Profit Target: 1.42355 (EA Target Point)

Projection:

Price is expected to reject the resistance zone, drop below the 200 EMA, and test the lower target at 1.42355.

If price confirms rejection at resistance, a short (sell) opportunity is valid.

A break above the stop-loss level could invalidate the bearish bias.

Conclusion:

Bearish momentum is anticipated if price respects the resistance zone.

Confirmation from price action (candlestick patterns) will strengthen the trade setup.