USD/CAD "The Loonie" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CAD "The Loonie" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Yellow MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (1.40200) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (1.42500) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.39000 (or) Escape Before the Target

💰💵💸USD/CAD "The Loonie" Forex Market Heist Plan (Swing/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Usdcadshort

USDCAD and USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDCAD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USD/CAD "The Loonie" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CAD "The Loonie" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Pink MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (1.40500) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.36000 (or) Escape Before the Target

USD/CAD "The Loonie" Forex Market Heist Plan (Day / Swing Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

#USDCAD: Two Big Target Accumulating of 800+ Pips! **USDCAD **

Following the US President’s decision to impose a 25% tariff rate on Canada, the USD/CAD exchange rate experienced a significant surge, reaching approximately 1.49. However, as the market has stabilised, we anticipate a gradual decline in the exchange rate, which may help bridge the liquidity gap.

Two prominent red lines serve as potential entry and stop-loss points. Additionally, two designated targets are set as swing take-profit areas.

We appreciate your unwavering support. Should you have any inquiries regarding the strategy or any trading-related questions, please do not hesitate to provide feedback.

Team Setupsfx_

USD/CAD(20250411)Today's AnalysisMarket news:

The annual rate of the US CPI in March was 2.4%, a six-month low, lower than the market expectation of 2.6%. The market almost fully priced in the Fed's interest rate cut in June. Trump said inflation has fallen.

Technical analysis:

Today's buying and selling boundaries:

1.4013

Support and resistance levels:

1.4170

1.4112

1.4073

1.3952

1.3914

1.3855

Trading strategy:

If the price breaks through 1.4013, consider buying, the first target price is 1.4073

If the price breaks through 1.3952, consider selling, the first target price is 1.3914

USDCAD Trendline Breakout Ready for a Long SellHello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Potential Sell (1H Scalp)Here's my 3 point confluence analysis.. I could be wrong so any additional tips on the comments are welcomed

1. USDCAD was on a small uptrend until it broke the trendline then consolidated sideways.

2. After breaking the trendline a reversal pin bar has formed indicating a downward but this wasn't enough to support the idea

3. after a sell order block formed followed by two FVG I'm confident that it set to move the previous low or to the discount area.

--------------------------------------------

Entry strategy (Enter on Pullback)

--------------------------------------------

Since the stochastics indicator on the hourly is showing it is oversold my TRADE ENTRY is a pull back into the red oderblock & wait for stochastic indicator to be overbought to enter or a rejection of the orderblock

note: the trade could just keep going down without doing a pullback

USD/CAD Rejection Trade Setup – Short from Supply Zone with RisiTimeframe: 30 Minutes (M30)

Indicators:

EMA 30 (Red): 1.41932

EMA 200 (Blue): 1.42196

🧠 Trade Setup: Potential Short Opportunity

📍 Current Price: 1.42252

📌 Key Levels:

Entry Point (Supply Zone): 1.42582

Strong resistance zone, overlapping with EMA 200 and a previous consolidation zone.

Price has entered a rising wedge pattern—a potential bearish reversal signal.

Stop Loss: 1.42987

Placed just above the supply zone to avoid premature exit due to a false breakout.

Take Profit (EA Target Point): 1.40379

Aligns with previous demand zone, solid support level.

⚖️ Risk-to-Reward Breakdown:

Risk: ~335 pips

Reward: ~2047 pips

R:R Ratio: ~1:6 — Excellent risk-to-reward ratio for a swing short.

USD/CAD "The Loonie" Forex Bank (Swing Trade) Heist Plan 🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CAD "The Loonie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on! profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or swing low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (1.44500) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Primary Target - 1.41500 (or) Escape Before the Target

🏴☠️Secondary Target - 1.39500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

USD/CAD "The Loonie" Forex Bank Heist Plan (Swing Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend...

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/CAD Bullish Trade Setup: Key Support, Entry, and Target AnalThis chart is a technical analysis of the USD/CAD currency pair on a 3-hour timeframe. Here’s a breakdown of the key elements:

Key Observations:

1. Exponential Moving Averages (EMAs):

200 EMA (Blue Line) at 1.43318 – A long-term trend indicator.

30 EMA (Red Line) at 1.43135 – A short-term trend indicator.

The price is currently trading above both EMAs, suggesting a bullish bias.

2. Support and Resistance Levels:

A support zone (purple box) around 1.43010 to 1.43141 has been identified, which the price is expected to respect.

The target level (EA TARGET POINT) is set at 1.44511, indicating a bullish price movement expectation.

3. Entry, Stop Loss & Take Profit:

Entry Point: Near the 1.43318 level (current price area).

Stop Loss: Placed below the supp

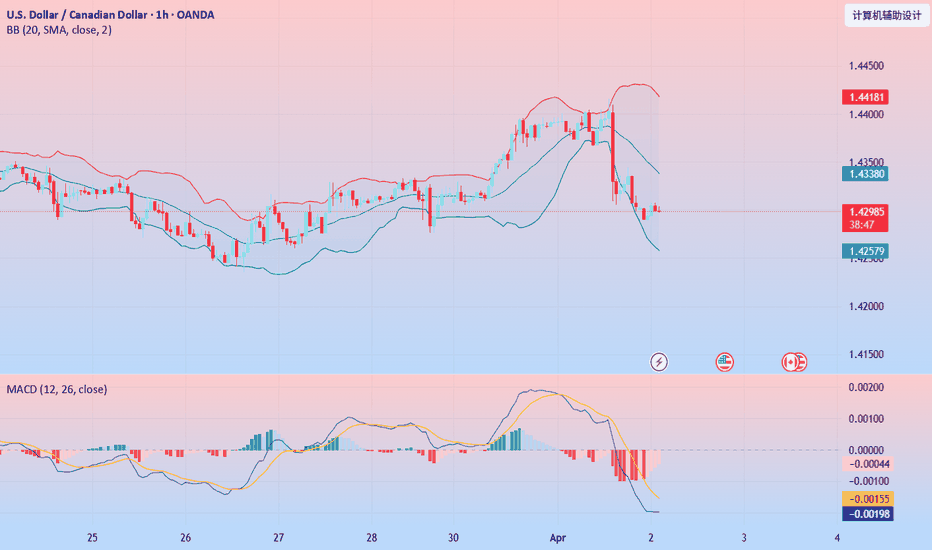

USD/CAD(20250402)Today's AnalysisToday's buying and selling boundaries:

1.4337

Support and resistance levels

1.4454

1.4410

1.4382

1.4293

1.4265

1.4221

Trading strategy:

If the price breaks through 1.4337, consider buying, the first target price is 1.4382

If the price breaks through 1.4293, consider selling, the first target price is 1.4265

USD/CAD Bearish Trade Setup – Resistance Rejection & Target ProjUSD/CAD Bearish Trade Setup – Key Resistance & Target Projection

Analysis:

Timeframe: 30-minute chart

Current Price: 1.43248

Indicators:

EMA (200, Blue): 1.43024 (Key Dynamic Support)

EMA (30, Red): 1.43142 (Short-term trend)

Resistance Zone (Supply Area): 1.43300 - 1.43450

Support Level (Rejection Zone): 1.43085 - 1.43024

Trade Setup:

Entry Zone: Around the rejection level near 1.43142

Stop Loss: 1.43435 (Above the resistance zone)

Take Profit Target: 1.42355 (EA Target Point)

Projection:

Price is expected to reject the resistance zone, drop below the 200 EMA, and test the lower target at 1.42355.

If price confirms rejection at resistance, a short (sell) opportunity is valid.

A break above the stop-loss level could invalidate the bearish bias.

Conclusion:

Bearish momentum is anticipated if price respects the resistance zone.

Confirmation from price action (candlestick patterns) will strengthen the trade setup.

#USDCAD 4HUSDCAD (4H Timeframe) Analysis

Market Structure:

The price is currently trading within a well-defined downtrend channel and has reached the upper boundary, which is acting as strong resistance. Previous price action suggests that sellers have been active at this level, leading to potential bearish pressure.

Forecast:

A sell opportunity may arise if the price fails to break above the channel resistance and shows signs of rejection. If the resistance holds, further downside movement is expected within the channel structure.

Key Levels to Watch:

- Entry Zone: Consider selling near the channel resistance upon confirmation of bearish rejection.

- Risk Management:

- Stop Loss: Placed above the channel resistance to manage risk.

- Take Profit: Target lower levels within the channel, aligning with previous support zones.

Market Sentiment:

As long as the price remains within the downtrend channel and respects the resistance, the bearish trend is likely to continue. However, a breakout above the resistance may shift the market sentiment toward bullish movement.

USD/CAD Bullish Setup: Key Support Holding for Potential Upside This chart represents a technical analysis of the USD/CAD currency pair on the 1-hour timeframe. Here's a breakdown of the key elements:

Key Indicators & Levels:

Exponential Moving Averages (EMA):

200 EMA (Blue Line): 1.43906 (Long-term trend indicator)

30 EMA (Red Line): 1.43859 (Short-term trend indicator)

Support & Resistance Zones:

Support Zone (Purple Area, Lower): Around 1.43658

Resistance Zone (Purple Area, Upper): Around 1.44500

Trade Setup:

Entry Point: Near 1.43753 (Current Price)

Stop Loss: Below 1.43658 (Red zone at 1.43158)

Take Profit Target: 1.45425 - 1.45433 (Blue zone)

Potential Trade Direction:

The price is expected to bounce from the support zone and move upwards.

A break above the resistance zone (~1.44500) would confirm bullish momentum.

The projected target is 1.45425 - 1.45433.

Conclusion:

Bullish Outlook: If the price respects the support zone and breaks above 1.44500.

Bearish Risk: If the price falls below 1.43658, the setup would be invalid.

EMA Perspective: The price is fluctuating around the 200 EMA, suggesting a potential trend shift.

Would you like a more detailed breakdown or any additional insights