Trade deal thread could pump USDCAD?USDCAD as with the bounce off the monthly support level, current is a strong uptrend.4H perspective, price is trading above 10ema since the cross over of 20ema and 10ema price is pushing back to the upside. With trade deal thread, including upcoming GDP on CAD could pump this price back to the resistance ?

As 10ema has not been tested since cross over, we may see the price to back to the upside with respecting the 10ema.

Buying on EMA is a high probability trade setup.

Usdcadsignal

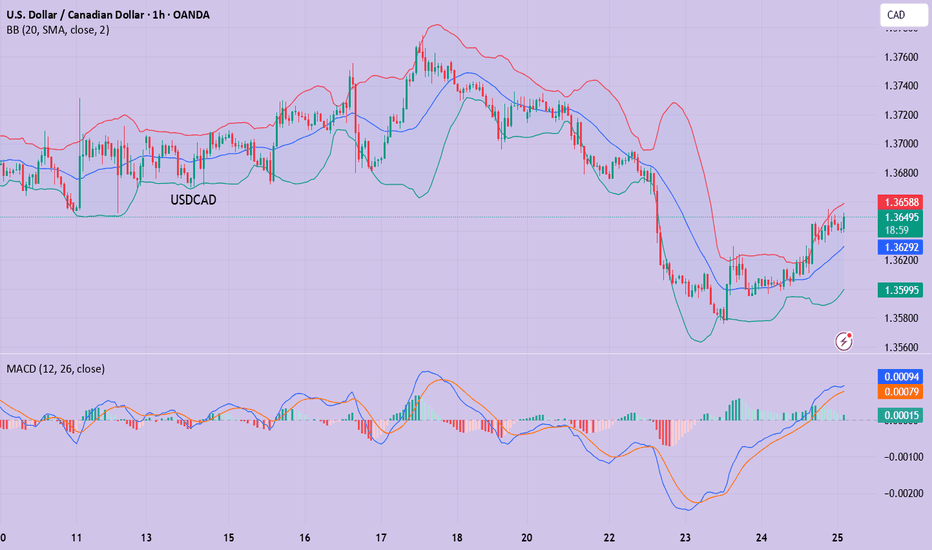

USDCAD: a long positionHello guys.

Divergence:

A bullish RSI divergence is noted, price made lower lows while RSI formed higher lows, signaling a potential bullish reversal.

Price Action:

Price has bounced strongly from around the 1.3570–1.3580 zone and is now approaching a descending trendline resistance.

Trade Setup:

Entry: 1.3718

Stop Loss: Below the breakout candle, near 1.3686

Take Profit: Around 1.3782

Risk-to-Reward: 1:3

USD/CAD(20250725)Today's AnalysisMarket news:

The European Central Bank announced that it would maintain the three key interest rates unchanged, reiterated data dependence, warned that the external environment is highly uncertain, and President Lagarde did not rule out the possibility of future rate hikes. Traders reduced their bets on ECB rate cuts.

Technical analysis:

Today's buying and selling boundaries:

1.3626

Support and resistance levels:

1.3689

1.3666

1.3651

1.3602

1.3587

1.3563

Trading strategy:

If the price breaks through 1.3651, consider buying, with the first target price of 1.3666

If the price breaks through 1.3626, consider selling, with the first target price of 1.3602

#USDCAD: 1000+ Pips Big Bullish Move With Three TargetsThe USDCAD is currently in a bearish trend since the day has dropped significantly and is still falling. We anticipate the price to drop slightly more before it reaches our entry zone. There are two entry points, and you can choose either one that aligns with your views. There are three targets, and you can set take profit targets that suit you best.

Good luck and trade safely.

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

#USDCAD: Two Major Buying Zones, Patience Pays! As previously analysed, USDCAD is expected to decline towards our predetermined entry point. We anticipate a bearish US Dollar for the remainder of the week, which will ultimately lead USDCAD to reach the entry zone. Three distinct target areas exist, collectively worth over 1100 pips. Each entry point, stop loss, and take profit is clearly defined.

We wish you the best of luck and safe trading.

Thank you for your support.

If you wish to assist us, we encourage you to consider the following actions:

- Like our ideas

- Provide comments on our ideas

- Share our ideas

Kind Regards,

Team Setupsfx_

Much Love ❤️🚀

USDCAD possible bullish reversal for 1.3960#usdcad weekly key reversal bar, made a new low, closed off the high, early indication for reversal. It's better to wait for correction 61.8 fib level, 79.0 fib level and 79.0 fib level to reduce/secure drawdwon i.e. 1.3622-1.3585 is the area of interest for long trade. stop loss below key reversal bar i.e. 1.3520. target level: 1.3960

USD/CAD(20250618)Today's AnalysisMarket news:

World Gold Council: 95% of central banks expect gold reserves to rise in the next 12 months.

Technical analysis:

Today's buying and selling boundaries:

1.3642

Support and resistance levels:

1.3778

1.3727

1.3694

1.3590

1.3557

1.3506

Trading strategy:

If the price breaks through 1.3694, consider buying, the first target price is 1.3727

If the price breaks through 1.3642, consider selling, the first target price is 1.3590

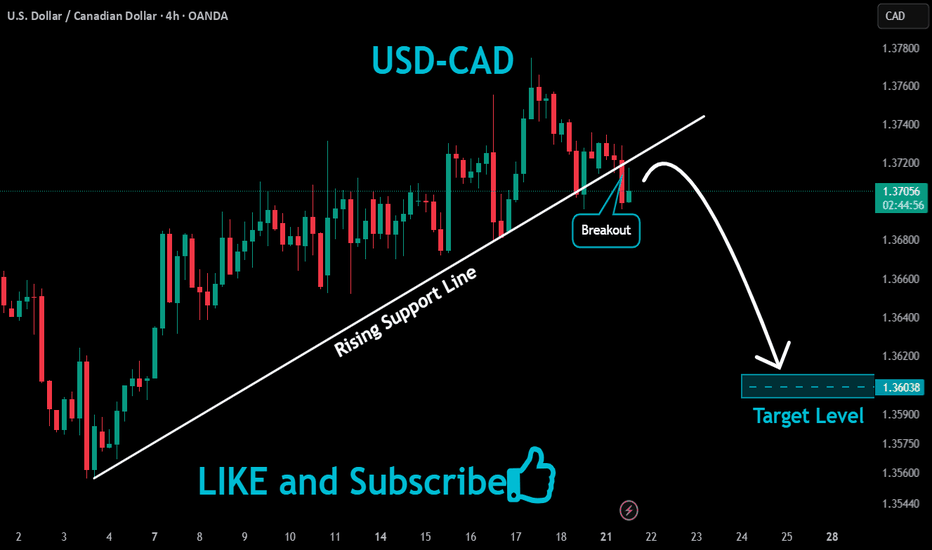

USDCAD Bearish Bias: Beware Liquidity Traps & Reversal Risks.I'm currently keeping a close eye on USDCAD, which has been in a strong bearish trend. 📉

In this video, I explain how the market is unfolding across both the higher and lower timeframes, and why it’s critical to watch them in conjunction. On the lower timeframes, we often see a clean sequence of lower highs and lower lows, as the algos set up a seemingly a smooth trend. But traders should be cautious ⚠️

Why? Because on the higher timeframes, the market can easily pull back, triggering a liquidity hunt. This is often when the algorithm targets stop orders above recent highs, before resuming the trend 🧠💥

While my bias remains bearish, I'm also aware of the risk that the market could shift gears unexpectedly to run stops and shake out weak hands. This concept is fully broken down in the video — with examples of how to spot these traps and prepare accordingly 🎯

USDCAD Hits Support as Fed-Hawkish & BoC Cuts! Big Bounce ComingUSDCAD ( OANDA:USDCAD ) is trading at the Potential Reversal Zone(PRZ) and near the important Support line and Support lines .

In terms of Elliott Wave theory , it seems that USDCAD has managed to complete 5 main down waves and we can expect more up waves .

Also, we can see the Regular Divergence(RD+) between Consecutive Valleys .

I expect USDCAD to rise to at least 1.37860 CAD.

Fundamental View:

The Bank of Canada initiated its rate-cutting cycle , while the Federal Reserve remains firm with no immediate plans to ease.

Strong NFP data on Friday reinforced USD ( TVC:DXY ) strength .

Oil prices( BLACKBULL:BRENT ) may offer temporary support to CAD , but macro divergences clearly favor the dollar .

Note: Stop Loss(SL)= 1.36110 CAD

U.S Dollar/Canadian Dollar Analyze (USDCAD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

#USDCAD: 500+ Pips Big Buy Opportunity!Dear Traders

Hope you are doing great, we have a great buying opportunity on USDCAD, our first entry is in profit of 250+ pips, however, we expect price to grow steadily after reconfirming the same area. USDCAD tends to reconfirm the order block area many times before a big bull move. Good luck.

USD/CAD(20250516)Today's AnalysisMarket news:

Fed Chairman Powell: The Fed is adjusting its overall policy-making framework. Zero interest rate is no longer a basic situation. The wording of underemployment and average inflation rate needs to be reconsidered. PCE is expected to drop to 2.2% in April.

Technical analysis:

Today's buying and selling boundaries:

1.3972

Support and resistance levels:

1.4020

1.4002

1.3990

1.3953

1.3941

1.3923

Trading strategy:

If the price breaks through 1.3972, consider buying, the first target price is 1.3990

If the price breaks through 1.3953, consider selling, the first target price is 1.3941

Canadians Are DustedEssentially they have given their nation to communism and will suffer the consequences of poor economic performance especially when compared to the US. Over the long term CAD has only gotten weaker, and if you go back to 2007-2008 you see a massive dollar rally.

Due to future economic turmoil I see again the dollar outperforming similar to 07-08 and making new all time highs. We have already seen a retracement of all the gains USD made against CAD this year, in my opinion was expedited due to Trumps tariff tweets, now we shall begin the trend towards new highs.

While that is the macro view, my short term trade is that USD will see buys to 1.40. Only at that level is the potential for further downside possible. But till then we will see price move towards 1.40 after a retracement to 1.383

Note my chart is inverted

Just to be clear, first we will see shorts to 1.383, then we will see buys to 1.40. So a retracement then a continuation of the bullish dollar.

Bearish Pressure Builds on USDCAD - 1D to 15m Sell Setup!Currently eyeing USDCAD 👀 — the pair has been under consistent downward pressure 📉. Volatility remains elevated ⚡, so be prepared for potential sharp moves.

The daily timeframe shows a clear bearish structure, aligning with my short bias 🐻. I’ve drilled down to the 4H, 1H, and 15min charts to refine my entry 🎯.

The 15-minute chart began showing signs of bearish momentum, and I’ve taken a short position based on that lower-timeframe confirmation ⏱️🔥.

As always, not financial advice – just sharing my view and execution logic 💼⚠️.

USD/CAD(20250429)Today's AnalysisMarket news:

The U.S. Treasury Department raised its second quarter debt forecast to $514 billion. U.S. Treasury Secretary: The "X Day" for the debt ceiling issue will be announced soon.

Technical analysis:

Today's buying and selling boundaries:

1.3845

Support and resistance levels:

1.3921

1.3892

1.3874

1.3816

1.3798

1.3769

Trading strategy:

If the price breaks through 1.3845, consider buying, the first target price is 1.3874

If the price breaks through 1.3816, consider selling, the first target price is 1.3798

USDCAD accumulation phase for long 1.4050-60usdcad stopped making further lower low in daily time frame. 23rd April daily candle made a higher low, indication for strength for coming days. demand zone for long is 1.3840-3800, stop loss: 1.3780, target: 1.4050-50. even weekly trend is down. reversal/counter trend trade. use lower risk please.

usdcad buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

USD/CAD(20250424)Today's AnalysisMarket News:

The United States hit a 16-month low in April. The total number of new home sales in the United States in March was an annualized to a new high since September 2024.

Technical analysis:

Today's buying and selling boundaries:

1.3861

Support and resistance levels:

1.3966

1.3927

1.3901

1.3820

1.3794

1.3755

Trading strategy:

If the price breaks through 1.3901, consider buying, the first target price is 1.3927

If the price breaks through 1.3861, consider selling, the first target price is 1.3820

USD/CAD "The Loonie" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CAD "The Loonie" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Yellow MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (1.40200) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (1.42500) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.39000 (or) Escape Before the Target

💰💵💸USD/CAD "The Loonie" Forex Market Heist Plan (Swing/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩