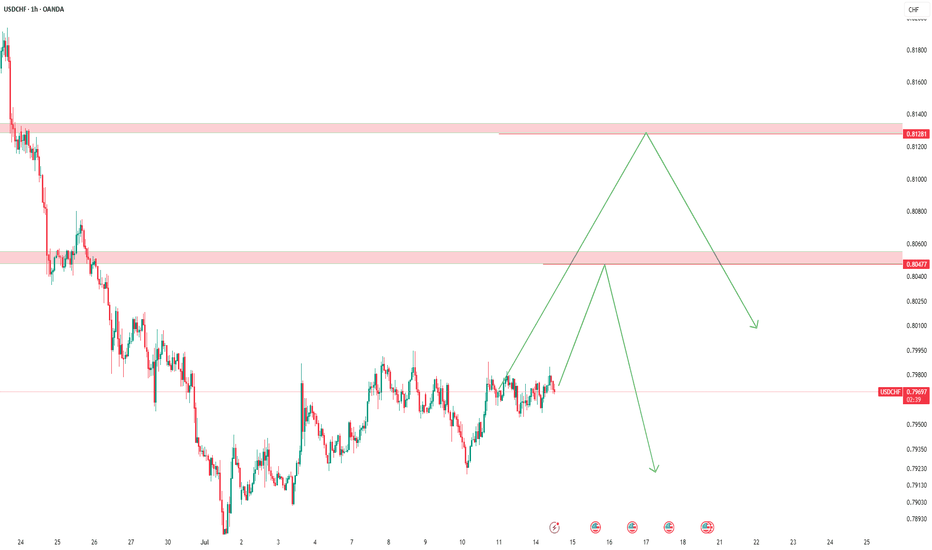

USDCHF - Looking To Buy Pullbacks In The Short TermH1 - We have a clean bullish trend with the price creating a series of higher highs, higher lows structure.

This strong bullish momentum is followed by a pullback.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Usdchfidea

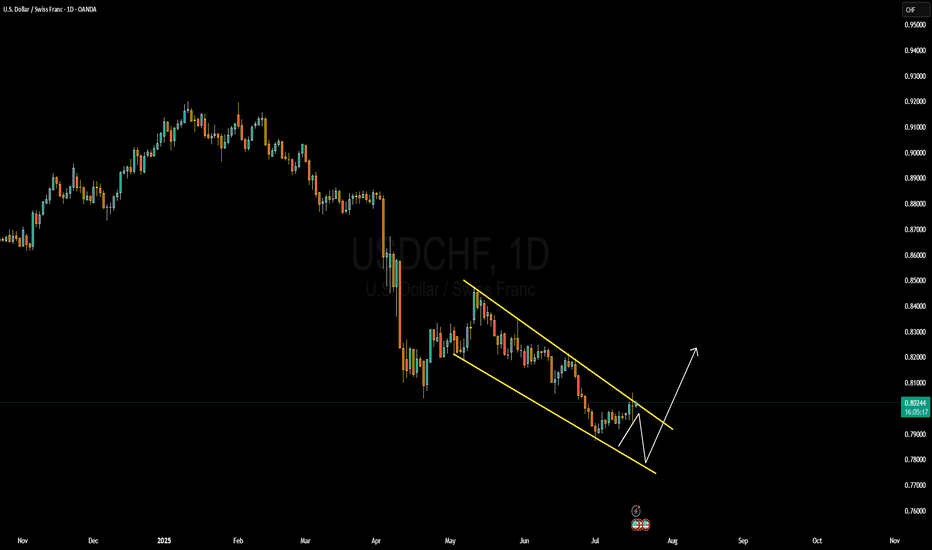

Liquidity Grab Complete? Why USDCHF Could Be Heading South📉 USDCHF remains firmly in a downtrend on both the weekly (1W) and daily (1D) timeframes. The recent bullish retracement is now confronting a critical resistance zone 🔒 — defined by a descending trendline and a daily order block between 0.8150–0.8200.

🧱 Price action at this level shows clear signs of rejection, aligning with a bear flag formation, which could pave the way for continued downside toward the 0.7800–0.7600 region.

📊 Fundamentally, the Swiss Franc (CHF) continues to gain strength, supported by Switzerland’s stable economic outlook and ongoing safe-haven demand. Meanwhile, the US Dollar faces headwinds from dovish Fed expectations and rising political uncertainty in the US 🇺🇸.

🔮 From a Wyckoff/ICT perspective, this upward move appears to be a liquidity grab into a premium zone, with smart money likely distributing positions before initiating a new markdown phase. A sell bias is favored below 0.8200, with downside targets set at 0.8000 and beyond.

📅 Keep a close eye on this week’s US NFP and Swiss CPI releases — both could inject fresh volatility into the pair.

Market Analysis: USD/CHF Consolidates GainsMarket Analysis: USD/CHF Consolidates Gains

USD/CHF is rising and might aim for a move toward the 0.8120 resistance.

Important Takeaways for USD/CHF Analysis Today

- USD/CHF is showing positive signs above the 0.8040 resistance zone.

- There is a connecting bullish trend line forming with support at 0.7990 on the hourly chart.

USD/CHF Technical Analysis

On the hourly chart of USD/CHF at FXOpen, the pair started a decent increase from the 0.7910 support. The US Dollar climbed above the 0.8000 resistance zone against the Swiss Franc.

The bulls were able to pump the pair above the 50-hour simple moving average and 0.8040. A high was formed at 0.8079 and the pair is now consolidating gains above the 23.6% Fib retracement level of the upward move from the 0.7911 swing low to the 0.8079 high.

There is also a connecting bullish trend line forming with support at 0.7990. On the upside, the pair is now facing resistance near 0.8080. The main resistance is now near 0.8120.

If there is a clear break above the 0.8120 resistance zone and the RSI remains above 50, the pair could start another increase. In the stated case, it could test 0.8200. If there is a downside correction, the pair might test the 0.7990 level.

The first major support on the USD/CHF chart is near the 0.7950 level and the 76.4% Fib retracement level.

The next key support is near 0.7910. A downside break below 0.7910 might spark bearish moves. Any more losses may possibly open the doors for a move towards the 0.7850 level in the near term.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

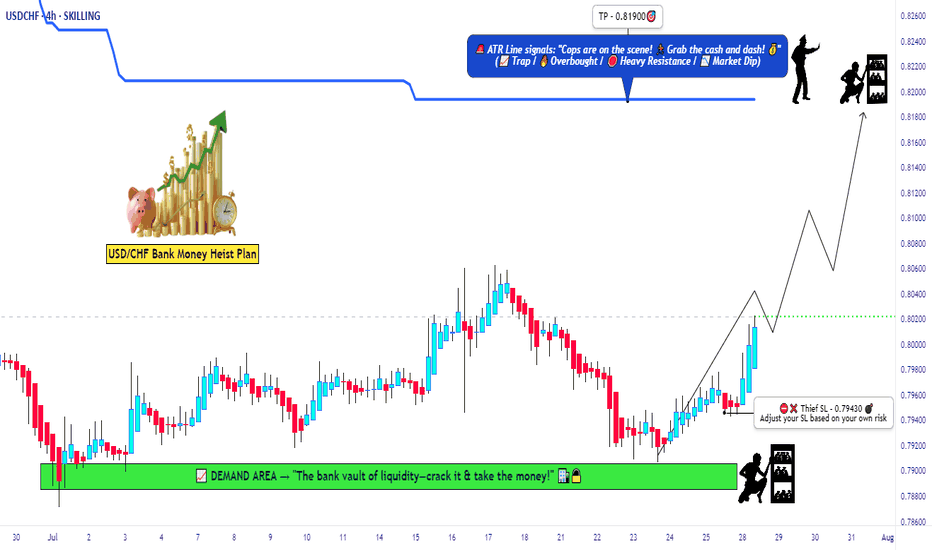

USD/CHF Swissie Heist Plan: Rob the Trend, Ride the Bull!🔐💰 USD/CHF Swissie Forex Heist 💰🔐

“Rob the Trend, Escape the Trap – Thief Style Day/Swing Master Plan”

🌎 Hola! Hello! Ola! Marhaba! Bonjour! Hallo!

Dear Market Looters, Swing Snipers & Scalping Shadows, 🕶️💼💸

Welcome to another elite Thief Trading Operation, targeting the USD/CHF "SWISSIE" vault with precision. Based on sharp technical blueprints & macroeconomic footprints, we're not just trading – we're executing a Forex Bank Heist.

This robbery mission is based on our day/swing Thief strategy – perfect for those who plan, act smart, and love stacking pips like bricks of cash. 💵🧱

💹 Mission Brief (Trade Setup):

🎯 Entry Point – Open the Vault:

Swipe the Bullish Loot!

Price is prepped for an upside raid – jump in at any live price OR set smart Buy Limit orders near the 15m/30m recent pullback zones (last swing low/high).

Use DCA / Layering for better entries, thief-style.

🧠 Thief Logic: Let the market come to you. Pullbacks are entry doors – robbers don’t rush into traps.

🛑 Stop Loss – Exit Strategy If Caught:

📍 Primary SL: Below recent swing low on the 4H chart (around 0.79430)

📍 Adjust based on lot size, risk, and number of stacked entries.

This SL isn’t your leash – it’s your getaway route in case the plan backfires.

🏴☠️ Profit Target – Escape Before the Cops Arrive:

🎯 Target Zone: 0.81900

(Or dip out earlier if the vault cracks fast – Robbers exit before alarms trigger!)

📌 Trailing SL recommended as we climb up the electric red zone.

🔥 Swissie Heist Conditions:

📈 USD/CHF showing upward bias based on:

Momentum shift

Reversal zone bounce

Strong USD sentiment & macro factors

✅ COT positioning

✅ Intermarket correlations

✅ Sentiment & Quant data

➡️ Do your fundamental recon 🔎

⚔️ Scalpers – Here's Your Mini-Mission:

Only play LONGS. No counter-robbing.

💸 Big bags? Enter with aggression.

💼 Small stack? Follow the swing crew.

💾 Always trail your SL – protect the stash.

🚨 News Alert – Avoid Laser Alarms:

🗓️ During high-volatility releases:

⚠️ No new trades

⚠️ Use trailing SLs

⚠️ Watch for spikes & fakeouts – the vault traps amateurs

💣 Community Boost Request:

If this plan helps you loot the market:

💥 Smash that Boost Button 💥

Let’s strengthen the Thief Army 💼

The more we grow, the faster we move, and the deeper we steal. Every like = one more bulletproof trade.

#TradeLikeAThief 🏆🚨💰

📌 Legal Escape Note:

This chart is a strategic overview, not personalized advice.

Always use your judgment, manage risk, and review updated data before executing trades.

📌 Market is dynamic – so keep your eyes sharp, your plan tighter, and your strategy ruthless.

🕶️ Stay dangerous. Stay profitable.

See you soon for the next Forex Vault Hit.

Until then – Lock. Load. Loot.

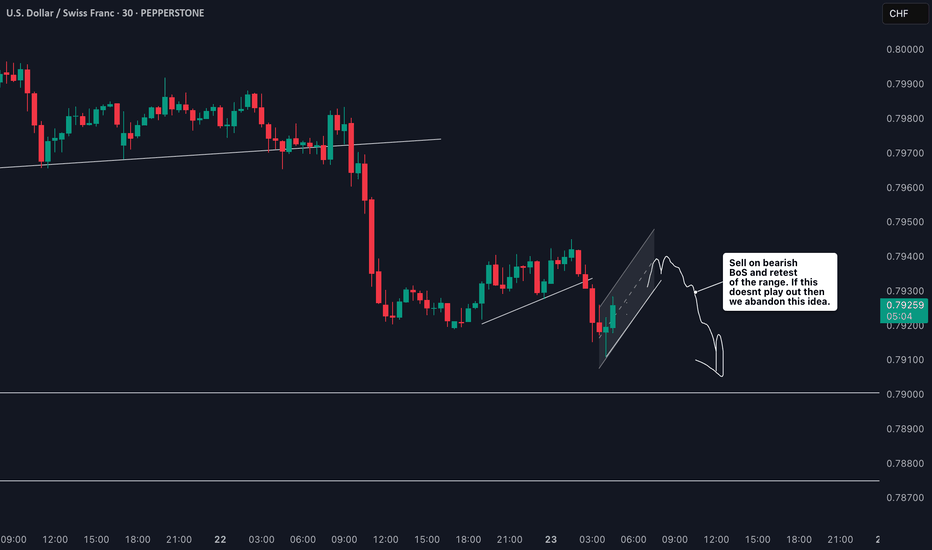

Is USDCHF Ready to Drop? Short Setup Explained📉 USDCHF Trade Idea Breakdown

Taking a close look at USDCHF, we’re currently in a clear downtrend 🔻. Price is under pressure on the higher timeframes, but on the lower timeframes (15m & 30m), we’re seeing a pullback 🌀.

What I’m watching for now is a rejection at resistance 🔄 followed by a bearish break in market structure ⛔️. If that confirms, I’ll be looking to take a short entry with targets set at the two previous lows marked out in the video 🎯📉.

Stop loss placement would be just above the recent swing high for risk management 🛑.

As always — this is not financial advice ⚠️.

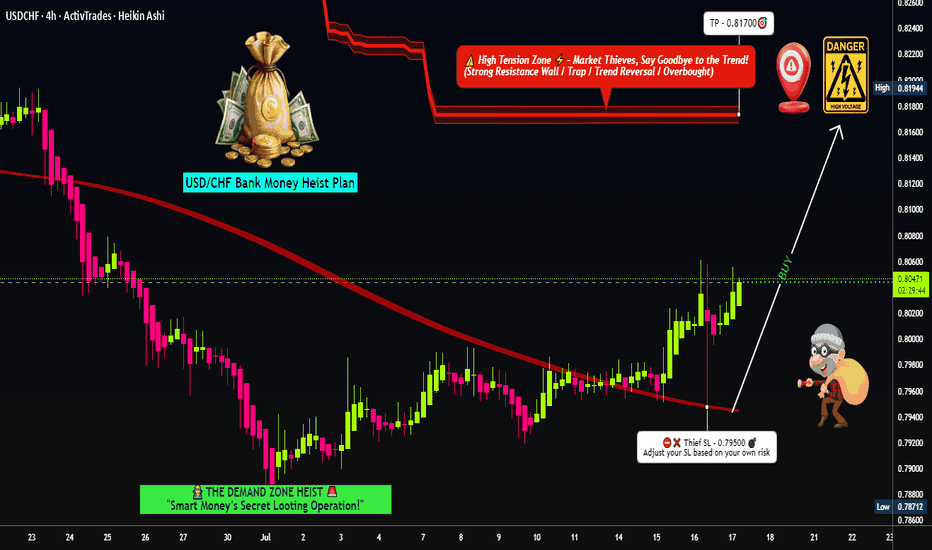

USD/CHF Swissie Heist Plan: Rob the Trend, Ride the Bull!🔐💰 USD/CHF Swissie Forex Heist 💰🔐

“Rob the Trend, Escape the Trap – Thief Style Day/Swing Master Plan”

🌎 Hola! Hello! Ola! Marhaba! Bonjour! Hallo!

Dear Market Looters, Swing Snipers & Scalping Shadows, 🕶️💼💸

Welcome to another elite Thief Trading Operation, targeting the USD/CHF "SWISSIE" vault with precision. Based on sharp technical blueprints & macroeconomic footprints, we're not just trading – we're executing a Forex Bank Heist.

This robbery mission is based on our day/swing Thief strategy – perfect for those who plan, act smart, and love stacking pips like bricks of cash. 💵🧱

💹 Mission Brief (Trade Setup):

🎯 Entry Point – Open the Vault:

Swipe the Bullish Loot!

Price is prepped for an upside raid – jump in at any live price OR set smart Buy Limit orders near the 15m/30m recent pullback zones (last swing low/high).

Use DCA / Layering for better entries, thief-style.

🧠 Thief Logic: Let the market come to you. Pullbacks are entry doors – robbers don’t rush into traps.

🛑 Stop Loss – Exit Strategy If Caught:

📍 Primary SL: Below recent swing low on the 4H chart (around 0.79500)

📍 Adjust based on lot size, risk, and number of stacked entries.

This SL isn’t your leash – it’s your getaway route in case the plan backfires.

🏴☠️ Profit Target – Escape Before the Cops Arrive:

🎯 Target Zone: 0.81700

(Or dip out earlier if the vault cracks fast – Robbers exit before alarms trigger!)

📌 Trailing SL recommended as we climb up the electric red zone.

🔥 Swissie Heist Conditions:

📈 USD/CHF showing upward bias based on:

Momentum shift

Reversal zone bounce

Strong USD sentiment & macro factors

✅ COT positioning

✅ Intermarket correlations

✅ Sentiment & Quant data

➡️ Do your fundamental recon 🔎

⚔️ Scalpers – Here's Your Mini-Mission:

Only play LONGS. No counter-robbing.

💸 Big bags? Enter with aggression.

💼 Small stack? Follow the swing crew.

💾 Always trail your SL – protect the stash.

🚨 News Alert – Avoid Laser Alarms:

🗓️ During high-volatility releases:

⚠️ No new trades

⚠️ Use trailing SLs

⚠️ Watch for spikes & fakeouts – the vault traps amateurs

💣 Community Boost Request:

If this plan helps you loot the market:

💥 Smash that Boost Button 💥

Let’s strengthen the Thief Army 💼

The more we grow, the faster we move, and the deeper we steal. Every like = one more bulletproof trade.

#TradeLikeAThief 🏆🚨💰

📌 Legal Escape Note:

This chart is a strategic overview, not personalized advice.

Always use your judgment, manage risk, and review updated data before executing trades.

📌 Market is dynamic – so keep your eyes sharp, your plan tighter, and your strategy ruthless.

🕶️ Stay dangerous. Stay profitable.

See you soon for the next Forex Vault Hit.

Until then – Lock. Load. Loot.

USDCHF – Two Levels, One PlanWe’re watching two key resistance zones for a potential short.

If the first level holds and gives a signal, we’ll short from there.

If that level breaks, we may switch to a short-term buy up to the next level.

Once price reaches the second resistance, we’ll be ready for another sell opportunity.

No predictions — just following the flow.

USDCHF Forming Descending ChannelUSDCHF is currently moving within a well-defined descending channel on the daily timeframe. The structure has been respecting this pattern for several months, and we are now approaching a potential breakout zone. Price recently tapped the midline of the channel and showed early signs of bullish rejection. I'm closely monitoring this pair as it builds momentum for a possible bullish reversal, either from a deeper retest at the lower channel boundary or directly breaking above the upper trendline.

On the fundamental side, today's shift in sentiment around the US dollar is quite clear. After a series of weaker US inflation reports and growing market anticipation of a Fed rate cut, USD has come under pressure. However, the Swiss franc is also showing signs of weakness, especially after the Swiss National Bank became the first major central bank to cut interest rates earlier this year and is likely to remain dovish through the remainder of 2025. This monetary policy divergence creates space for USDCHF to rally as investors price in a potential stabilization or rebound in the dollar.

Risk sentiment also plays a role here. With global equities slightly pulling back and geopolitical tensions simmering, safe haven demand is mixed. While CHF typically benefits in risk-off environments, the lack of recent SNB hawkishness gives USDCHF bulls a clearer edge, especially if US data stabilizes or improves.

Technically, I’m anticipating a potential false break to the downside before a sharp bullish wave toward 0.8300 and beyond. Momentum indicators are flattening, and with volume starting to pick up on bullish candles, this setup has potential. I’ll be looking to add further confirmation as price approaches the lower trendline or breaks out with clean structure. Keep a close eye — this setup could turn into a strong profit opportunity in the coming days.

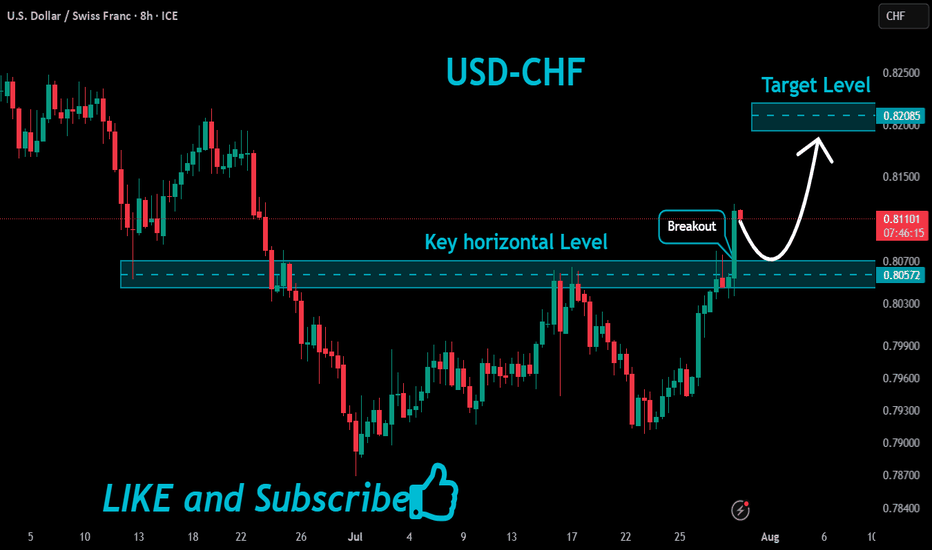

USD/CHF Breakout Done , Long Setup Valid To Get 100 Pips !Here is my opinion on USD/CHF , We have a clear breakout and the price now above my support area , i`m waiting the price to go back to retest it and then give me any bullish price action and i will enter a buy trade , the reason for cancel this idea , if we have a daily closure again below my area.

USDCHF – Reversal Setup Building Above 0.79 SupportUSDCHF has broken out of its steep downward channel and is now forming a potential bullish reversal base above the key support zone at 0.7940–0.7870. Price action suggests momentum could be shifting in favor of the bulls, with upside targets sitting at 0.8100 (Fibonacci 38.2%) and 0.8210 (previous resistance and 61.8% retracement).

🔍 Technical Structure:

Clean descending channel now broken.

Price holding above May–June lows, forming a potential higher low.

First target: 0.8100 zone.

Final target: 0.8210 resistance.

Stop: Below 0.7870 structure low.

🧠 Fundamentals:

USD Outlook: Bullish tilt as Fed members push back against early cuts. Markets eye July 11 CPI, which could confirm inflation stickiness and reinforce USD strength.

CHF Outlook: Weak bias, as the SNB has turned more dovish. With safe-haven demand easing and growth outlook softening, CHF is losing favor across the board.

Global sentiment: Risk appetite improving as geopolitical concerns (e.g., Strait of Hormuz, Iran) temporarily ease—removing upward pressure on CHF.

⚠️ Risk Factors:

A surprise drop in U.S. CPI this week could shift USDCHF sharply lower.

Renewed geopolitical tensions may revive CHF demand suddenly.

Fed speak and yields must remain supportive for this structure to play out.

🔁 Asset Dynamics:

USDCHF tends to lag behind DXY and USDJPY. Watch those pairs for confirmation. It can also follow moves in US10Y yields and react inversely to Gold volatility (safe-haven flow shifts).

✅ Trade Bias: Bullish

TP1: 0.8100

TP2: 0.8210

SL: Below 0.7870

Event to Watch: 🇺🇸 U.S. CPI – July 11

📌 If CPI confirms sticky inflation, USDCHF could rally toward the upper retracement zones quickly. Watch for confirmation candles near breakout.

USDCHF continues bullish recovery. Opportunity for BUY signal✏️#USDCHF is showing bullish recovery. The price is trading in a triangle pattern in the recovery phase. The 1.79500 area is an important support zone that is driving the pair's upside. 0.80700 is the immediate Target for a BUY signal.

📈Key Level

SUPPORT 0.79500

RESISTANCE 0.80700

BUY now at support 0.79500

Target: 0.80700

SELL Trigger: Break support 0.79500

Leave your comments on the idea. I am happy to read your views.

Setupsfx_ | USDCHF: A Big Major Swing Sell In Making 760+ Pips The USDCHF pair has dropped significantly since our last update. We anticipate another drop before price may reverse. DXY is also dropping and may continue to decline. There’s a major swing target that will take time to complete successfully. Use risk management according to your own risk tolerance.

Thank you for your continued support!

Team Setupsfx_

USD/CHF SWISSY Forex Heist Plan | Thief-Style Buy Setup🔥💰 "Forex Bank Heist: Thief Trading Blueprint for USD/CHF SWISSY 💵💸" 💣🚨

"Steal Pips, Not Dreams. Trade Like a Robber, Think Like a Mastermind." 🕶️💼

🌟 Hello World! Bonjour! Ola! Hallo! Marhaba! 🌟

Welcome, all Money Makers, Market Hustlers & Chart Robbers 🕵️♂️🤑🚁

Let’s gear up for our latest USD/CHF "Swissy" Forex Bank Heist, crafted using our high-level Thief Trading Style—a bold fusion of technical know-how, street-smart price action, and strategic risk maneuvers.

💎 HEIST PLAN SUMMARY

This trade is locked, loaded, and ready to target the vault using a Bullish Breakout / Pullback strategy.

We are eyeing the SWISSY with laser focus, watching closely for price action to retest key support zones, then blast through resistance to secure our escape route.

Let’s not get caught in the police trap zone (aka overbought resistance with fakeouts and bearish ambushes). Keep those trailing stops tight and your loot tighter. 🏃♂️💨

🎯 ENTRY STRATEGY — “The Vault is Open!” 📈

💰 Buy Limit Orders near recent swing low or pullback zone (15M–30M timeframe).

💣 Use DCA (Dollar-Cost Averaging) or Layered Entry strategy to spread risk and improve entry points.

🏹 Entry range: Monitor consolidation for the perfect dip-snatch setup.

🛑 STOP LOSS — “Fallback Safe House” 🚨

📍 Place SL just below recent swing low using 2H timeframe (e.g., 0.79200).

💡 Adjust based on position size, number of entries, and personal risk.

🏴☠️ TARGET ZONE — “The Getaway” 🎯

🎯 TP Level: 0.80700

🚁 Or escape early if momentum weakens—profit is profit.

💹 Scalpers: Ride only the bullish getaway car. Use Trailing SLs to ride and protect gains.

📊 MARKET STATUS — "SWISSY Watchtower" 🕵️

The market is currently neutral, but pressure is building. Expect a bullish breakout if macro & technicals align.

💡 Smart Robbers read the full blueprint:

→ Macro Outlook

→ COT Reports

→ Sentiment Analysis

→ Intermarket Trends

→ Seasonality & Institutional Flow

📰 TRADING ALERT — “Dodge the Sirens” 🚓

🚨 Avoid opening new trades during high-impact news events

💼 Use Trailing Stop-Loss to lock in profits

🧠 Plan your risk and exit BEFORE the bullets (candles) start flying

❤️ BOOST THE CREW! 💥

If this plan helps you pull clean profits, show love and Boost the chart 🔥📈

Your support fuels more strategies and keeps the crew funded 💼💵

Stay sharp, stay ruthless, and always trade like a Thief in the Charts 🎩🕶️

📌 Disclaimer

This strategy is educational and should not be considered investment advice.

Always trade based on your own analysis, risk profile, and market research.

🗓️ Stay tuned for the next Forex Heist Blueprint — we rob charts, not wallets.

📡 Tap follow. Boost the crew. Profit like a pro.

#USDCHF: Will USD Breakthrough The Strong Bearish Downtrend? The USDCHF currency pair has experienced significant volatility due to the ongoing trade dispute between the United States and China, which has led to a substantial decline in the DXY index. Consequently, CHF and JPY have emerged as the most stable currencies in the market.

Despite the USDCHF currency pair reversing its bullish trend, we anticipate a potential reversal back to a bearish position. We believe this reversal may be a temporary trap, and the currency pair is likely to regain its bullish position in the future.

There are two potential areas where the USDCHF currency pair could reverse from its current trend. The first area is relatively early, and if the USDCHF currency pair crosses a specific region, we may have a second safe option that could provide greater stability.

We extend our best wishes and best of luck in your trading endeavours. Your unwavering support is greatly appreciated.

If you wish to contribute, here are several ways you can assist us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_🚀❤️

#USDCHF: 878+ PIPS Swing Buy In Making! Good Luck! Dear Traders,

OANDA:USDCHF

Price has been dropping since we had a change of character, there are many factors that are helping in USDCHF to drop. The mainly the first reason is CHF dominance in the market, CHF has been bullish ever since Gold continued the bullish trend, CHF, AUD and GOLD all of these three are positively correlated. Other fundamental reason is the blooming fear of recession in the US Market, on Friday we saw indices and stocks drop record high similarly to the first announcement of covid lockdown. USD index saw sharp drop due to this and it is likely that price will continue to do that on dxy index.

USDCHF: DXY Likely to remain bearish in long term! The USDCHF pair is likely to remain bearish in the coming days as DXY doesn’t show any bullish momentum. However, we expect DXY to be bullish in the short term, which will help the price reach our designated selling zone. Once the price reaches this zone and shows a reversal sign in a smaller timeframe, you can consider entering or taking any decision.

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_🚀❤️

USD/CHF Slips LowerUSD/CHF Slips Lower

USD/CHF declined and now struggling below the 0.8000 resistance.

Important Takeaways for USD/CHF Analysis Today

- USD/CHF declined below the 0.8000 and 0.7950 support levels.

- There is a key bearish trend line forming with resistance near 0.7920 on the hourly chart at FXOpen.

USD/CHF Technical Analysis

On the hourly chart of USD/CHF at FXOpen, the pair started a fresh decline from well above the 0.8080 zone. The US Dollar dropped below the 0.8000 support to move into a negative zone against the Swiss Franc.

The bears pushed the pair below the 50-hour simple moving average and 0.7940. Finally, the bulls appeared near the 0.7870 level. A low was formed near 0.7872 and the pair is now consolidating losses.

There was a minor increase above the 23.6% Fib retracement level of the downward move from the 0.8080 swing high to the 0.7872 low. On the upside, the pair could face resistance near the 0.7920 level. There is also a key bearish trend line forming with resistance near 0.7920.

The next major resistance is near the 0.7940 level, above which the pair could test the 0.7975 level. It is close to the 50% Fib retracement level of the downward move from the 0.8080 swing high to the 0.7872 low.

If there is a clear break above the 0.7975 resistance zone, the pair could start another increase. In the stated case, it could even surpass 0.8030.

On the downside, immediate support on the USD/CHF chart is 0.7870. The first major support is near the 0.7850 level. The next major support is near 0.7800. Any more losses may possibly open the doors for a move toward the 0.7720 level in the coming days.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USD/CHF Exchange Rate Falls to Multi-Year LowUSD/CHF Exchange Rate Falls to Multi-Year Low

According to the chart, the USD/CHF exchange rate has settled below the key psychological level of 0.8000. The rate hasn’t been this low since the financial crisis of 2008.

On one hand, the drop in USD/CHF is driven by weakness in the US dollar. The US dollar index has fallen to its lowest level in over three years, largely due to the conflicting trade policies pursued by the Trump administration. On the other hand, geopolitical instability has increased the appeal of the Swiss franc as a so-called safe-haven asset.

Technical Analysis of the USD/CHF Chart

Since mid-May, price fluctuations have formed a downward channel (marked in red), and by the end of June the rate had stabilised around the psychological threshold of 0.8000 (indicated by an arrow) — right at the median of the channel.

However, this balance between supply and demand proved temporary, tipping in favour of sellers. As a result, we now see a decline in USD/CHF along a steep trajectory (marked in black), potentially targeting the lower boundary of the red channel — which suggests a possible move down to 0.7800 USD per franc. Along this path, support may come from the 1.618 Fibonacci extension level (0.7875); note how the 0.8055 level previously acted as support (marked with a blue arrow).

The RSI indicator confirms strong selling pressure — but will the bearish trend continue?

Much will depend on the broader fundamental context. As reported by the Wall Street Journal, the sharp strengthening of the franc against the dollar is causing growing concern at the Swiss National Bank (SNB), as an overly strong franc harms Swiss exporters. This suggests that the current market sentiment could shift dramatically if the SNB issues any relevant statements.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

How to Trade USDCHF 's Downtrend with Precision📉 Market Breakdown: USDCHF Under Pressure

Currently keeping a close watch on USDCHF 💵🇨🇭 — the pair has been in a strong, sustained bearish trend 🔻, and the overall pressure remains clearly to the downside.

My bias is firmly bearish 📊, but I’m not rushing in. Instead, I’m patiently waiting for an optimal entry 🎯 — one that offers the right balance of confluence, structure, and reduced risk 🧠🛡️.

🎥 In today’s video, we dive into:

✅ Market structure

✅ Price action

✅ The prevailing trend

✅ Entry zones with minimized risk

I also walk you through my personal entry strategy and trading plan 📋, it's not just an idea drop.

📌 Disclaimer: This is not financial advice — the content is for educational purposes only.

USDCHF..SHORT📌 USDCHF – Multi-Scenario Setup

This pair has two key levels: one short-term, the other long-term.

If price reaches the first level and shows solid bearish reaction, I’ll enter a short.

If that level breaks and confirms, I’ll go long—but manage the long aggressively, since I’ll look to exit around the higher level.

If the price pushes beyond even the second zone, I’ll be ready to buy again.

❗️I’m never upset by a loss or a broken level.

The market leads—I follow.

Claiming “it must drop from here” or “it has to rise” is wishful thinking, not trading.

✅ Stay calm, stay flexible, and stay prepared for every scenario.

USDCHF Analysis – "Dollar Trying to Break Free from Downtrend"USDCHF is breaking out from a multi-week descending channel.

Structure shows a potential trend reversal from the June 12th low.

First bullish leg may target the 23.6% Fib level at 0.8266, followed by an extended move toward 0.8355.

Key resistance: 0.8266 and 0.8355 (Fib levels)

Stop loss: around 0.8093–0.8056 zone (previous support and breakout base)

Structure Bias: Bullish breakout after prolonged downtrend – confirmation depends on sustained move above 0.8200

📊 Current Bias: Cautiously Bullish

🧩 Key Fundamentals Driving USDCHF

USD Side (Mildly Bearish to Neutral):

FOMC held rates, Dot Plot showed only one cut expected for 2025, but Powell’s tone was less hawkish.

US Retail Sales soft, and PPI/CPI showed signs of inflation cooling.

Recent risk-off sentiment (Middle East, oil spikes, equity volatility) supports the USD.

Trump commentary and 2025 election anticipation bring long-term uncertainty.

CHF Side (Strong but potentially weakening):

SNB held rates steady, with cautious tone—no urgency to hike again.

Safe-haven flows still support CHF, but waning inflation and stronger global equity market might reduce CHF appeal.

SNB has hinted at FX intervention readiness, which could weaken CHF if necessary.

⚠️ Risks That May Reverse or Accelerate Trend

False breakout risk if 0.82 fails to hold → deeper pullback toward 0.8090

Stronger CHF demand on geopolitical fear (Israel–Iran, Ukraine)

Unexpectedly weak US data this week or renewed Fed dovish talk

🗓️ Important News to Watch

US: Core PCE, GDP revision (June 27), jobless claims

CHF: Swiss CPI, SNB FX intervention chatter

Risk sentiment: Iran/Israel tensions, equity volatility, Trump Fed commentary

🏁 Which Asset Might Lead the Broader Move?

USDCHF could mirror sentiment across CHF pairs—if risk-on resumes and CHF weakens across the board (EURCHF, NZDCHF also rallying), USDCHF may accelerate higher.