USDCHF - another opportunityTeam, this week, we done many trades with USDCHF and very successfully,

Tomorrow RATE announce and NO change.

that mean the USD will like moving strong against most currencies,

We found opportunity to RE-ENTER the USDCHF again

Target base on the chart.

TARGET 1 - reduce 30% volume

TARGET 2 - reduce another 50%

Target 3 - close the remaining

Please follow it accordingly. Do NOT forget to bring trail stop loss to BE once target 1 meet.

Usdchflong

USDCHF LONG FORECAST Q2 W19 D6 Y25USDCHF LONG FORECAST Q2 W19 D6 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USDCHF STRONG BULLIDH (UPTREND) SCENARIOTrade Setup: BUY

Entry Zone (Buy Price Range):

Between 0.81500 – 0.82500 (ideal pullback or breakout entry range depending on current price action)

Stop Loss (Risk Management):

0.80500

Below recent swing low and key support zone

Take Profit Targets:

Target 1: 0.83700 (near-term resistance or Fibonacci level)

Final Target: 0.85800 (major resistance / long-term objective)

Trade Management Plan:

1. After Entry:

Monitor price action at 0.83000–0.83700.

Consider partial profits at Target 1 and move stop to break even.

2. If Target 1 Hits:

Lock profits and trail stop loss below higher lows for continuation to 0.85800.

3. Exit Plan:

Exit completely if price breaks below 0.80500 with strong bearish momentum.

USDCHF LONG FORECAST Q2 W18 D1 Y25USDCHF LONG FORECAST Q2 W18 D1 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USDCHF LONG FORECAST Q2 W18 D30 Y25USDCHF LONG FORECAST Q2 W18 D30 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USDCHF LONG FORECAST Q2 W18 D29 Y25USDCHF LONG FORECAST Q2 W18 D29 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USDCHF I Intraday Long Opportunity from Support Welcome back! Let me know your thoughts in the comments!

** USDCHF Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

USDCHF possible bullish reversal for 08470 & 0.8530#usdchf weekly bar is a key reversal bar, made a new low, closed towards high. market liquidity sweep below the previous double bottom. weekly key reversal bar is an early indication for bullish reversal. trend is quite bearish. better to wait for correction i.e. 61.8fib level, 70.0fib level and 79.0fib level as well. stop loss below the key reversal bar. Initial take profit level is 0.8470, next one is 0.8525-30.

USDCHF LONG FORECAST Q2 W17 D25 Y25USDCHF LONG FORECAST Q2 W17 D25 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block

✅Intraday bearish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USDCHF - Expecting Bullish Continuation In The Short TermH1 - Strong bullish momentum followed by a pullback

No opposite signs

Expecting further continuation higher until the two Fibonacci support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCHF LONG FORECAST Q2 W17 D23 Y25USDCHF LONG FORECAST Q2 W17 D23 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Trade confluences

- Weekly order block rejection

- Weekly imbalance to be filled

- Daily bullish close

- 4H 50 EMA supporting long position

- Intraday breaks of structure

- 15’ order block created

- Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USDCHF LONG FORECAST Q2 W17 D22 Y25USDCHF LONG FORECAST Q2 W17 D22 Y25

Summary

- Weekly order block

- Daily order block

- Price is currently bearish

Requirements

- Wait for a comprehensive bullish turn around in price action

- 15' break of structure

USDCHF LONG FORECAST Q2 W17 D22 Y25

FRGNT X

IG - JCFRGNT

USD/CHF At Interesting Area To Buy To Get 250 Pips m Agree ?Here is my analysis on USD/CHF , The price finally find a support to can go up from it , we have D Confirmation and also 4H Confirmations , so i think we can enter a buy trade when the price go back to retest the support and new 1h Up Trendline , and we will targeting 200 Pips .

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

USDCHF LongHi guys,

Hope everyone is still enjoying the lovely big profits we earned on gold, BTC, and EURUSD. We are yet to hit a stop loss this year, which is good.

Anyway, here is our long signal for EUR USD. Wait for the 5 minute candle to close above, and respect the entry.

USD CHF Buy 🦇

📊Entry: 0.81733

⚠️Sl: 0.81531

✔️TP1: 0.81938

✔️TP2: 0.82199

✔️TP3: 0.82530

✔️TP4: 0.82868

Hope you earn lots of profit. Please drop me a comment if you follow the signal

Best wishes

Sarah ETAforex

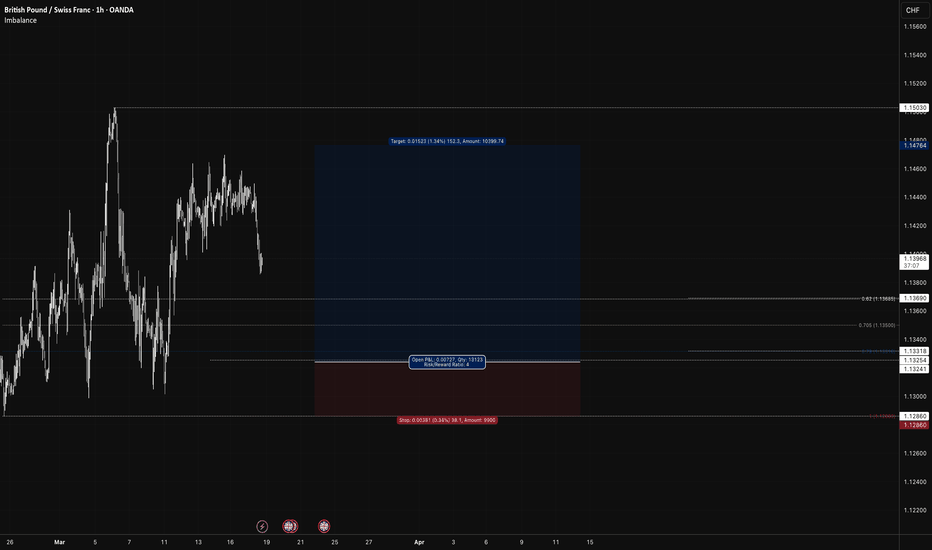

USD/CHF (Long)USD/CHF

Daily:

Price > 200EMA

Swing Period 10

Swing Low: 1.10884

Swing Low: 1.15030

Volume Imbalance: 3 Candles

Daily Order Block: 1.12253 / 1.11294

H4:

Price > 200EMA

Swing Period: 7

Swing High: 1.15030

Swing Low: 1.12860

Volume Imbalance: 2 Candles

H4 Order Block: 1.13452 / 1.13089

H1:

Swing Period: 5

Swing High: 1.15030

Swing Low: 1.12860

Volume Imbalance: 25 Candles

H1 Order Block: 1.13452 / 1.13089

Model 1:

Entry Price: 1.13241

Stop Loss: 1.12860

TP1: 1.14003 @ 1:2 / 50%

TP2: 1.14383 @ 1:3 / 25%

SL: Breakeven

TP3: 1.14764 @ 1:4 / 25%

Model 2:

Entry Price: 1.13690 - 1.13318

Entry Trigger: 9EMA X 21EMA

SL: Above recent swing low

TP1: 1:2

SL: Trailing 9EMA

USD/CHF Market Analysis – Potential Bullish ReversalThe USD/CHF pair is currently in a downtrend, as indicated by the overall bearish price action. However, the chart suggests a potential reversal scenario.

Price is approaching a key H4 demand zone, which previously acted as strong support. If this level holds, a bullish move could be anticipated. The projected market structure indicates a possible pullback before a continuation upwards, aligning with the larger trend shift.

Traders should monitor price reaction within the demand zone, as a break below could indicate further downside continuation, while a strong rejection may confirm a bullish reversal.

USD/CHF: Bearish Continuation Towards Key SupportUSD/CHF has maintained a strong bearish trend, forming a series of lower highs and lower lows. The chart highlights a **Deep Crab** harmonic pattern, which previously triggered a corrective move before resuming its overall downtrend.

Currently, price action is trading near **0.8767**, approaching a key support zone at **0.8722** (HOP level). The recent rejection from the **H4 supply zone** around **0.8920** further confirms bearish momentum, suggesting sellers remain in control.

**Key Considerations:**

- A breakdown below **0.8722** could accelerate further downside, extending losses towards lower psychological levels.

- A potential pullback may occur if buyers step in at support, but the overall bearish structure remains intact unless a significant reversal signal appears.

**Conclusion:** USD/CHF remains under bearish pressure, with a high probability of further declines. Traders should monitor price action at support for potential continuation or reversal signals before committing to new positions.

USDCHF at Key Support Zone – Potential Rebound to 0.89000OANDA:USDCHF has reached a significant support zone, marked by prior price reactions and strong buying interest. This area has previously acted as a key demand zone, increasing the likelihood of a bullish bounce if buyers step in.

If the price confirms support within this zone through bullish price action—such as long lower wicks or bullish engulfing candles—we could see a reversal toward 0.89000, a logical target based on previous market structure and price behavior.

However, if the price breaks below this support zone and sustains, the bullish outlook would be invalidated, potentially leading to further downside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!