AUDUSD 0.7300 is the next destination for Aussie bulls ?AUD/USD continues to recover and has made back the losses from the outside day to the downside on Thursday,

Bulls have to break above 0.7180 resistance to travel to 0.7220 and ultimately to 0.7300 to the upside.

Support is at 0.7150, 0.7120 and 0.7100 figure.

USDCNH

Adding upside exposure on a correction=> Here we have a very interesting playing field ... an unsurprising result with the political mess.

=> Today we are continuing to overlook the macro and focus on technicals as we have macro updates and expectations coming in our end of year reports.

=> So lets get started....

=> As with the rest of USD pairs this has been corrective since October and anything towards 6.74 should been seen as an opportunity to re-engage in adding upside exposure.

=> We eventually see potential in this continuing towards 7.00 and a break here will unlock the ladder for 7.10 and give scope up to 7.21.

=> We recommend buying dips as they will be competitive and don't see room for a pullback much lower than 6.78-6.74.

=> Best of luck for those in Yuan pairs and those sidelined looking to add dollar exposure.

USDCNH- Trend Continuation of downward movementIt has been a roller coaster ride from the top , this trade idea is trend continuation trade from the top. Now USDCNH is forming a nice flag and will break down soon . For those who like to take risk , can enter sell with reasonable risk , otherwise wait for it to break the trend line and join the sell. Hope this helps. Don't forget to moon up the likes and your comment will be welcome

USDCNH: buying opportunityOn the hourly chart of USDCNH, the price has finished the 1-5 Elliott structure with strong impulse wave (A), I expect the price to start correcting to local Fibo levels in the nearst future. There we would find an optimal long signal. I will keep you posted! What are your thought on USDCNH?

Going Down SoonLove this pair, been riding this thing for a long time, go out when it retraced and now I'm ready to get back in. Watching price action, we should see it stop at this resistance zone, I don't see it going very high up into the zone, but watch price action and when you see bearish momentum in shorter time frames look to get in. There is also bearish divergence on the 4hr, pretty sure this will be going down here for a long while, ride this one down to 6.26 level.

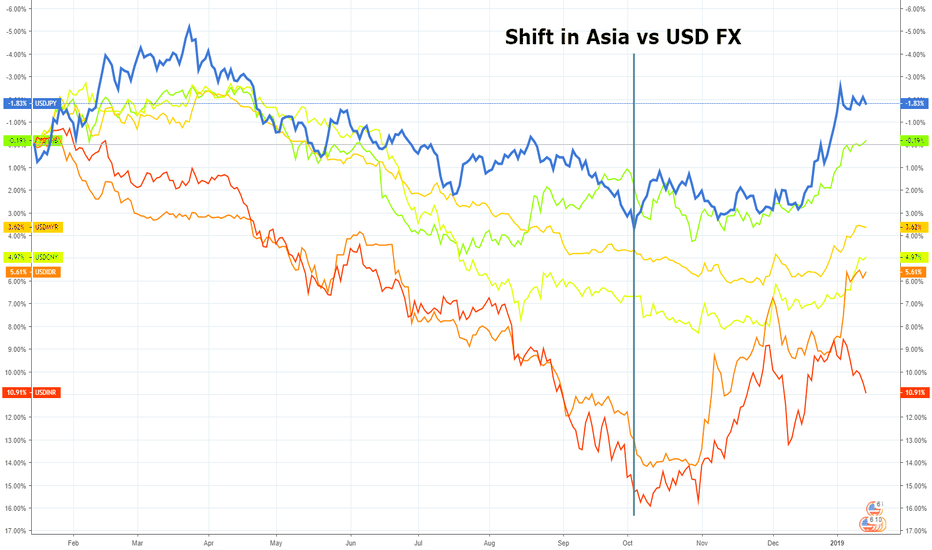

Asia Forex: Comparison chart vs USDFor the purposes of taking a broader view of movements in forex markets...

Chart: 1-year performance of JPY, THB, MYR, CNY, IDR, INR vs the USD (inverted)

Since October, there has been a marked improvement in the performance of Asian currencies. The change means Asian currencies have paired losses over the last 12 months, with the yen and Tai bot entering the black.

A relief rally or turning point for Asia FX?

USDCNH ShortDespite the People’s Bank of China (PBOC) has announced to cut its Reserve Require Ratio (RRR) by 100bps on Friday, however it looks like a no brainier to me to short the USDCNH now with a SL around 6.98. I know some banks has immediately improved its USDCNY target price to above 7.1 after the news, however the chart seems to be showing the opposite and it just do not make sense for China to allow its currency to further depreciate when they have USD 1.3 trillion external debt and are already in credit crunch.

Yuan sharp reversalThis morning we saw another one sharp reversal of Yuan to growth.

In the previous month, the People's Bank of China actively engaged in interventions in the foreign exchange market and spent on it more $34 bln, protecting national currency from disordrly decline, although it did not interfere USDCNH’s from crawling up.

In November, we have already seen a couple of sharp kickbacks of the pair associated with good news from China, but the scale of the decline suggests that it was also the intervention of the PBC.

However, such interventions do not fundamentally change the sentiment in the markets, and the moment of growth should be a quick return to the fundamental trend.