USDILS

The 31.7% contraction in the US economy for Q2 2020The pair will continue to move lower in the following days after it broke down from a major support line. The 31.7% contraction in the US economy for Q2 2020 weakens the US position as a mediator between the Jews and the Arabs. This month, Israel and the UAE announced that they will be neutralizing their diplomatic ties. This agreement could be a game-changer in the middle east as the Arab League remains committed to boycotting Israeli trades. In the middle of this deal was the United States, which continues to stir global power balance. However, the devastating impact of COVID-19 in the country’s economy might force the US to abandon its ambition in the middle east. Israel’s term sharing politicians, Benjamin Netanyahu and Benny Gantz are at odds over the country’s annual budget. The disagreement between the two (2) could send the country into another snap election, the fourth of its kind in less than two (2) years.

The Israeli shekel looks to extend one of its best ralliesThe Israeli shekel looks to extend one of its best rallies in a while against the US dollars. Bearish investors are slowly but steadily driving the pair towards its support level. It’s believed that prices would hit their lowest ranges since June 2011, an impressive feat for the Israeli shekel. Looking at it, the shekel has successfully erased its losses against the US dollar from the beginning of the coronavirus pandemic. However, the situation looks like it’s getting dire and some experts are now saying that it could have a reversal anytime soon, perhaps once it reaches that support. With the number of cases continuing to rise, the government of Israel said last week that it will be mandating new restrictions that will include closing business and even beaches on weekends just to contain the spread. According to reports, the closure is going to be costly for the government and should strike approximately 800 million shekels from its still-recovering economy.

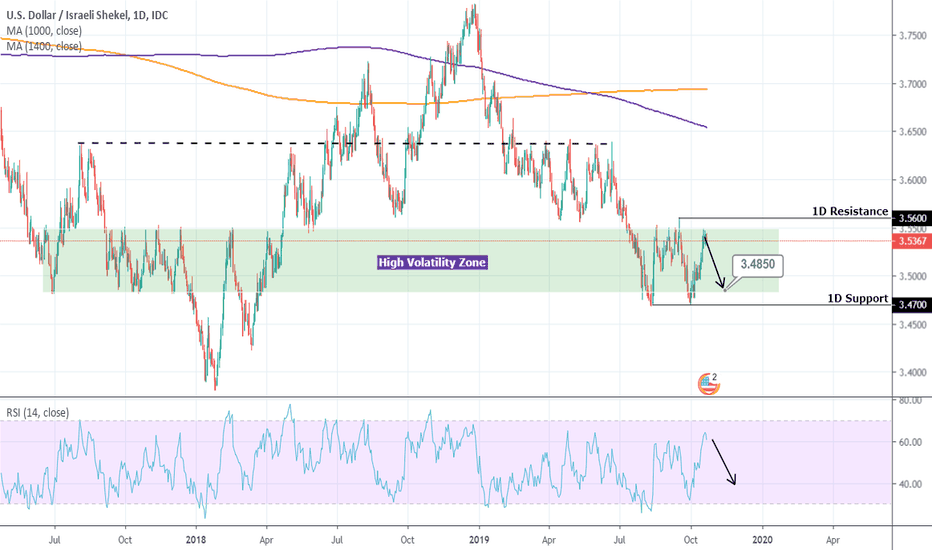

USD/ILS REVERSAL LONG SET UP (EXOTIC PAIR)TITLE: USD/ILS REVERSAL LONG SET UP

Asset : EXOTIC

Type : BUY Limit Order

Time Frame : MONTHLY

Entry 1 $3.4278

Entry 2 $3.3930

Sl $3.3610

Tp.1 $3.4678

Tp.2 $3.4930

Tp.3 $3.56478

tp.4 $3.6890

tp.5 $4.000

MavRich

•Why

We believe that the majority have big dreams and goals,and if given the right opportunities mixed with inspiring ambition you can do amazing things, like becoming doctors, lawyers, business owners, or

master the art of trading.

We understand that goals can be financially limited and we are here to help! We are a company determined on exceeding expectations,breaking the barriers hindering financial freedom,and making for a better tomorrow today-not for us but for the commonwealth

•How

Here at MavRich we take advantage of every opportunity given,we invest in all markets such as forex,crypto,and stocks. We are defying the very

meaning of efficiency by being able to send you a variety of consistent quality trades that you can input right through your phone! We work day and night

marking up charts,staying up to date on latest news, and backtesting to ensure you maximize your profits!!

Every trade that we send is Backed by our teachers who have thousands of hours of wall street experience

So what are these markets?

Forex or Foreign exchange is a world market where

one currency is being traded for another,however

Cryptocurrency is an exchange which uses cryptographic functions to conduct financial transactions, and trading the stock market involves

buying and selling shares of individual companies.

•What we do

We help the majority achieve financial freedom

We have the right tools and a variety of programs

designed to best suit you on your road to trading

success.

We go above and beyond to make sure classes

are easily accessible,no matter where you are such as are

The shekel remains strong and determined against the US dollarDespite the struggling Israeli economy, the shekel remains strong and determined against the US dollar. The pair is bound to hit its support in the first half of June. Bearish investors are brushing off the concerns about Israel’s economy and are focused on taking advantage of the broader weakness of the greenback. Although this week was full of concerning news about the country’s economy. Local reports say that the country’s economy contracted at 7.1% in the first devastating quarter of 2020. The economic fall out surprised the local market as the Bank of Israel previously said that it expects the economy to shrink by 4.5%, and the 7.1% fall is interestingly bigger than projections. Moreover, the Bank of Israel also optimistically said that it sees the economy growing by 6.8% by next year after the coronavirus pandemic. However, USD/ILS investors still note that it’s smaller than previous forecasts of 8.7% growth just last month.

ridethepig | ILS Market Commentary 2020.04.29The first 3.50 test triggered development from the Bank of Israel, it shows how quickly the zone can be protected and the tables are turned. Intervention is clear, smelling it a mile off here and makes the short-term opportunity towards the highs an attractive option. When the CB like Israels comes out to say that the currency has gone too far and they wont hesitate to step in... you know the swing that follows from that will illustrate the use of fundamentals in particularly striking fashion.

The attack on EM FX raises the stakes; because we have the second iteration of the virus to come in the Southern Hemisphere and another leg lower to track in Global Equities. We can keep an ear to the ground on local Israeli politics, without any surprises a leg back towards the top in the range looks imminent. Will look to dial back below 3.50.

Thanks as usual for keeping the likes, comments, charts, questions and etc coming!

The Israel’s stock market continues to close higherAs Israel’s stock market continues to close higher, the odds will continue to favor bearish investors. The USD/ILS trading pair is mainly driven by the positivity in the Israeli market and the negativity in the United States economy. The Israeli shekel is bound to recover its major losses against the US dollar from earlier this year, maintaining its commendable performance. However, it’s also feared that further appreciation from the Israeli shekel might prompt the country’s central bank to interfere. But despite those concerns, the pair remains on track to crash back to its support area. Moreover, experts from Israel warns that the outlook of the country and the economy is still vague thanks to the ongoing pandemic, with some experts saying that this dilemma is truly unique in history. However, bearish investors are hoping that the Israeli government has finally learned from previous economic hurdles like the 2008-2009 economic crisis.

USD/ILS will break down from a key support lineThe pair will break down from a key support line, sending the pair lower towards a downtrend support line. A demonstration happened in Israel despite the coronavirus outbreak. The rally calls for the incumbent prime minister, Benjamin Netanyahu, to resign. In recent months, the Israeli government came under pressure after Netanyahu failed to form a coalition government. This led to the 2 major parties to agree on a term sharing agreement. Netanyahu will end his 11-year run as the country’s prime minister. Yesterday, April 20, Netanyahu and his rival, Speaker of the Knesset Benny Gantz, agreed to form a unity government. This will end Israel’s year-long political crisis. In other news, Israel has still one of the lowest coronavirus related deaths. Meanwhile, the US is nearing the 800,000 mark of coronavirus cases and 45,000 deaths. Unemployment in the country is also surging, which will lead to the US economy and the US dollar to fall.

The Israeli shekelAfter the Israeli shekel rebounded yesterday, bulls immediately stepped on their gas pedals to prevent the Israeli shekel from dragging the pair downwards again. Looking at it, the 50-day moving average is still below the 200-day moving average, suggesting that bulls haven’t actually prevailed yet. Although, it’s also worth noting that the two MAs are now close to intersecting wherein traders of the US dollar are hoping the 50-day MA rises above the 200-day MA. The announcement of the US Federal Reserve earlier this week, on Tuesday, set the tone for the greenback. According to reports, the Fed will reinstate a funding center or facility used during the financial crisis back in 2008. The facility will help to directly provide credit to businesses and houses that are in great need. And just recently, it was just reported that the Ban of Israel made a loan that is worth billions of shekels to support the country during this pandemic.

USD/ILS will break out from a “Falling Wedge” patternThe pair will break out from a “Falling Wedge” pattern resistance line, sending the pair higher towards a major resistance line. The US-Israel relationship is under pressure following the rise of Bernie Sanders, a Democratic 2020 US presidential candidate. Sanders, unlike other candidates, has been vocal about his concern on Israel and its leadership. He skipped the American Israel Public Committee (AIPAC) conference yesterday, March 02. The meeting coincides with Israel’s election for prime minister. In a span of 12 months, Israel voted three (3) times for one of the country’s top positions. This was amid the failure of the incumbent prime minister to form a coalition government. Benjamin Netanyahu has been Israel’s prime minister since 2009. He previously held the same position from 1996 to 1999, making him the longest serving PM in the country. He was the key for a strong US-Israel alliance.

USD/ILS will continue to move lower in the following daysThe pair will continue to move lower in the following days toward its January 2018 low. Palestinian leader Mahmoud Abbas cut all its ties with the United States and Israel. This was after he rejected the peace plan presented by the two (2) countries. The conflict between the Arab and Jewish country started 53 years ago. This was after Israeli’s occupation of the West Bank, Gaza Strip, and the Golan Heights. On the peace plan was the agreement of Palestinian demilitarization. The continuous support of America to Israel, politically and economically, is an advantage for the Jews and the Israeli Shekel. In other news, the US is set to report its Consumer Price Index (CPI) report today, February 13. On the recent report, US CPI month-over-month (MoM) advanced 0.1%, below the forecast and previous record of 0.2%. The Consumer Price Index will determine the figures for inflation, which is important for monetary policies created by the Fed.

USDILS: Rising Wedge within a Channel Up. Buy opportunity.The pair is trading on a Rising Wedge within a wider 1D Channel Up (RSI = 59.015, MACD = 0.014) and the neutral Highs/Lows (0.0000) indicate that it is close to pricing a Higher Low. The long's obvious TP is the Wedge's Resistance at 3.7900 but if it breaks we will extend the buying to 3.8200.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Planning a short on the US Dollar vs Israeli ShekelI have been looking at this for a week or so and it is getting close to short area. You can see the trendline I have at the top there. Have an alert set on that, once it crosses that price it is in extended area, will look for it to turn there and pull back. Long term this will head to 4.

Can be played with BTC and massive margin @ bit.ly

........

........

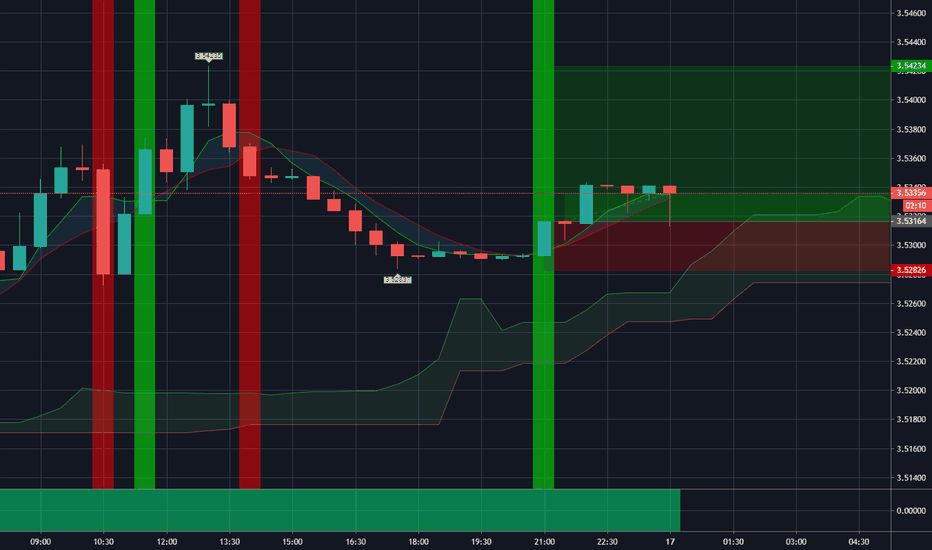

USD/ILS 1H Chart: Pair waits bullish confirmationUpside risks dominated the USD/ILS exchange rate after the pair reversed from the lower boundary of a long-term ascending channel located at 3.5758.

The rate is trading near the upper boundary of a short-term ascending channel. Given that the currency pair is supported by the 55-, 100– and 200-hour SMAs, it is likely that a breakout from the junior channel occurs during the following trading sessions. A potential upside target is the monthly R2 at 3.6912.

By the large, it is expected that the exchange rate continues its increase until the Fibonacci 0.00% at the 3.7177 mark.