INR has made a major top against USDFall of INR against the USD began in early 1970s, or perhaps late 1960s--we don't know for sure for lack of trading data. Since then, it has depreciated against the USD in crystal-clear 5 legs, or waves according to Elliott Wave Theory (EWT). To validate EWT, there occurred a gigantic gap of 9.23% in July 1991 where third wave is supposed to be--a hallmark of third waves. Furthermore, there's even a divergence between Price and Elliott Wave Oscillator (5/35 MACD) on the Monthly chart--typical of fifth waves.

So, what's next then? Considering the time frame of the entire price move till date, I would say that a bear wave of Supercycle degree has just ended and we are looking at a 10-15 year advance in Indian Rupee against the US Dollar . In support of my forecast, INR has just posted a beautiful, unambiguous 5-wave advance in the shape of an expanding diagonal--hallmark of first waves--from 87.972 to 83.7625.

If I'm right, price should retreat a bit toward the classic 61.8% level at 86.3396, and then fall hard--and I mean very hard, with a gap--toward the levels below 80, followed by another pause and a small retreat, and another fall, thereby completing a set of 5 distinct waves . Should price follow the path of my forecast to that point, we would have a definite confirmation on hand that a Supercycle bear wave has indeed ended.

The final target of this Supercycle bull wave of INR vs. USD? It's too early and too far ahead to hazard a guess, but as per EWT principles, it should be somewhere close to 44. Yes. 1$ = ₹44. I hope I live to see that day. It's going to take a while, till 2040 perhaps, but we'll get there alright.

USDINR

Indian market cannot go bullish until RUPEE becomes strong !a lot of analysts saying Dollar is going to week vs rupees but seeing technical chart, dollar is traded above 50 EMA and never come to touch since October. currently Dollar completed Symmetrical Pattern showing any upcoming momentum may happen, either bullish or bearish is just could say after seeing breakout/breakdown this pattern. To gain strength in Rupee it is required to give USDINR 50EMA breakdown or bearish crossover. Till then the rupee will remain weak and Indian stock market also.

USD is facing a Trendline resistance Vs INRUSD is facing a trendline resistance Vs Indian Rupee. Support zone currently for USD is near 87.06 followed by 86.82. Below this level we have the Mother line support for USD. This mother line support is at 86.55. If that is broken by the slide in USD 86.36 or 86.13 levels. Final support for USD will be at 85.65 before it hits Father line at 85.02. Resistances for USD are at 87.41, 87.55 and 87.76 before it can hit all recent high of 87.97. Shadow of the candle right now for USD is negative. Huge volatility in USD on either sides can be expected as Trump Tariff announcements continue for few months.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

USDINR Best sell signal you can find.The USDINR pair has been rising parabolically since the late September 2024 bottom. This rise has however most likely come to an end as the 1W RSI hit the top of its 16-year Resistance Zone.

This Zone has been holding since the October 2008 High and as you can see, it has offered 7 excellent sell signals. Most of those times, the rejection hit at least the 1W MA50 (blue trend-line), so if you are looking for a long-term short trade, you can consider this.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

INRUSD - Indian Rupee Collapse UPDATEMy initial post on INRUSD was back on Sept 2022 more than 2 years ago.

My update is more of the same going forward. INR will continue to collapse despite its nominal economic growth.

When the economy is very small relative to its population, the growth rate doesn't matter as if a major economy like the US has similar growth. It's like comparing apples to oranges. But I certainly understand how people can be misled. That's why I am trying to explain it to you here today.

USDINR The 2-year Rising Wedge is holding.The USDINR pair continues to respect the Rising Wedge that we mentioned more than 2 months ago (July 24, see chart below), giving us both excellent buy and sell signals:

This 2-year Rising Wedge pattern is approaching its top (Higher Highs trend-line) once more so we're preparing for a sell signal again. The confirmation to sell within this pattern is given when the 1W RSI breaks above its MA line (yellow trend-line).

Our Target is 83.7500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Can Inflation Shift the Fed’s Rate Path? This week’s inflation data could be decisive for traders as markets weigh whether the Fed will cut rates by 25 or 50 basis points. Last week’s jobs report did not sway the market from its current consensus.

The US economy added 142,000 jobs in August 2024, falling short of the expected 160,000, based on the latest NFP data. According to the CME FedWatch Tool, the likelihood of a 25-bps rate cut climbed to 73%, while expectations for a 50-bps cut dropped to 27%.

Attention now turns to inflation, with consumer prices expected to fall to 2.6%—the lowest since March 2021—and producer prices anticipated to rise 0.2% month-over-month.

Key USD pairs to watch this week include EUR/USD, with the ECB's upcoming interest rate decision in focus. Additionally, pairs impacted by inflation data releases from Mexico, Brazil, Russia, and India could see significant movement.

Year long wedge- Chart patterns dont tell the whole storyIndian Rupee is on year long wedge formation

But its not strictly a technical pattern because INR is in dirty float meaning Central Bank manages its levels. Therefore the chart does not reflect the market participants view

Can't trade this kinda managed chart patterns

USDINR Bullish break-out signalThe USDINR pair broke this week above Resistance 1 (83.700), the long lasting level since the week of March 18 and following a strong rebound on the 1W MA50 (blue trend-line), the break-out should technically lead higher.

The long-term pattern remains a Rising Wedge and we expect at least a symmetrical +1.29% Bullish Leg to price the Higher High, similar to the March High. Our Target is 84.000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

India's inflation data in focus as Modi meets Putin As Indian Prime Minister Narendra Modi engages with Russian President Vladimir Putin in Moscow, the focus back home will shift to the latest inflation figures.

India has faced significant pressure from Western nations to distance itself from Russia following the invasion of Ukraine. However, New Delhi has maintained its ties with Moscow. A key factor in this enduring relationship is energy cooperation, which has played a pivotal role in stabilizing fuel prices and, consequently, inflation in India.

In May 2024, India's annual consumer inflation rate eased to 4.75%, down slightly from 4.83% in April. Projections for the upcoming data suggest a minor decrease to 4.70%.

However, Reuters reports indicate a different trend. According to a poll of 54 economists, inflation in India likely edged up in June, breaking a five-month streak of declines. This increase is attributed to a surge in vegetable prices, driven by extreme weather conditions damaging crops. The poll forecasts inflation rising to 4.80% year-on-year in June, up from 4.75% in May. Food prices, which constitute around half of the overall Consumer Price Index (CPI) basket, are a significant factor in this anticipated rise.

For the exact date and time of these major economic events, import the BlackBull Markets Economic Calendar to receive alerts directly in your email inbox.

The USD/INR potentially maintains its bullish bias, staying above the key 100-day Exponential Moving Average (EMA) on the daily chart. Upside targets include 83.65, the upper boundary of its trading range. On the downside, the 100-day EMA at 83.40 serves as an initial support level for the pair.

USDINR Bearish unless it breaks that Resistance.The USDINR pair has been trading within a long-term Rising Wedge pattern since the November 11 2022 Low. The 1W MA50 (red trend-line) has been supporting all the way and in fact has made contact with the price and held on 3 occasions, with the most recent being on June 03.

We are currently bearish as the price remains within the Rising Wedge, targeting its bottom (Higher Lows trend-line) at 83.2150. If however the pair manages to close a 1D candle above Resistance 1 (83.7000), we will take the small loss and open a buy, targeting the Higher Highs at 84.000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Trials and Elections: 3 Market-adjacent events to watch Trump and Hunter Biden Trials

Former U.S. President Donald Trump was convicted last week on all counts of falsifying business records. Trump faces sentencing in one month’s time on July 11. Each of the 34 felony counts could result in up to four years in prison, although first-time offenders (or ex-presidents) like Trump are rarely incarcerated.

Meanwhile, a jury was sworn in on Monday for a (show?) trial of Hunter Biden, son of President Joe Biden, on gun charges.

Mexican Election

The Mexican peso continues to fall sharply towards 18.0 per USD, its lowest since October 2023, following results indicating a supermajority win for the Moderna party and its allies in Congress. Claudia Sheinbaum, the Moderna party candidate, won the presidential election by a significant margin.

As noted in Reuters, "The peso is underperforming amid growing concerns that the governing coalition's supermajority in the lower house might lead to the implementation of non-market-friendly policies,".

Indian Election

The Indian rupee plunged past 83.5 per USD, nearing its record-low of 83.7 from April. This movement erased the sharp rally triggered by early vote tallies, as updated counts indicated that incumbent PM Narendra Modi’s Bharatiya Janata Party is likely to secure a much narrower victory than anticipated.

Amidst the election turmoil in the world's largest democracy, the Reserve Bank of India's (RBI) monetary policy decision is also expected this week. In April 2024, the RBI maintained its benchmark repo rate at 6.5% for the seventh consecutive meeting.

Indian Rupee Faces Headwinds But May Outperform in BondsThe Indian rupee is currently facing pressure due to a combination of factors:

* **Weakening Chinese Yuan:** The decline in the Chinese yuan, a key regional currency, is putting downward pressure on the rupee.

* **Potential Portfolio Outflows:** Upcoming elections in India are raising concerns about political stability, which could lead foreign investors to withdraw their money from the Indian stock market, further weakening the rupee.

The Reserve Bank of India (RBI) is likely intervening to support the rupee, but the currency remains near its all-time low.

**Opposition Viewpoint**

Congress candidate Anand Sharma blames the current government's policies for the rupee's depreciation and the wider economic slowdown.

**Brighter Spots for Rupee Bonds**

Despite the short-term challenges, there are positive signs for rupee-denominated bonds:

* **Stronger Macroeconomic Fundamentals:** India's improving economic fundamentals could make rupee bonds more attractive to foreign investors.

* **Market Infrastructure Improvements:** Advancements in India's financial markets are making it easier for foreign investors to enter and exit the bond market.

* **Central Bank Reserves:** The RBI's healthy foreign exchange reserves provide a buffer against external shocks.

* **Inclusion in Global Indices:** The upcoming inclusion of Indian bonds in global indices like JP Morgan and Bloomberg is expected to attract significant foreign inflows.

**Potential Outperformance vs. US Bonds**

Analysts believe rupee bonds could outperform US bonds due to:

* **Potentially Lower Rupee Yields:** Rupee bond yields might fall as US rates decline, making them more attractive to investors seeking higher returns.

**Challenges Remain**

The main risk to this optimistic outlook is a potential rise in global oil prices due to geopolitical tensions.

**Overall**

The Indian rupee is facing near-term headwinds, but the long-term outlook for rupee-denominated bonds appears promising. Stronger economic fundamentals, improved market infrastructure, and inclusion in global indices could attract foreign investments and lead to outperformance compared to US bonds.

USD/INR Long (Buy)

Enter At: 83.6198

T.P_1: 83.8357

T.P_2: 84.2813

T.P_3: 84.8017

T.P_4: 85.4276

T.P_5: 85.7789

T.P_6: 86.1611

T.P_7: 86.4859

T.P_8: 86.8564

T.P_9: 87.5423

T.P_10: 87.9545

T.P_11: 88.6104

T.P_12: 89.0118

T.P_13: 89.4886

T.P_14: 89.8233

T.P_15: 90.6218

T.P_16: 91.3954

S.L: 80.4441

USDINR Sell opportunity to the 1D MA50The USDINR pair made a direct hit on our 82.700 Target, which we set on our last analysis (January 10, see chart below):

Right now we see the price pulling back within a Channel Down. This is a standard pattern within the long-term Rising Wedge pattern, which as you see out of 7 Bearish Legs all broke below the 1D MA50 (blue trend-line) and only 1 managed to make just a hit-and-rebound.

As a result we are going for a moderate sell Target at 83.100 and then we will reverse to buying, targeting Resistance 1 at 83.700.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

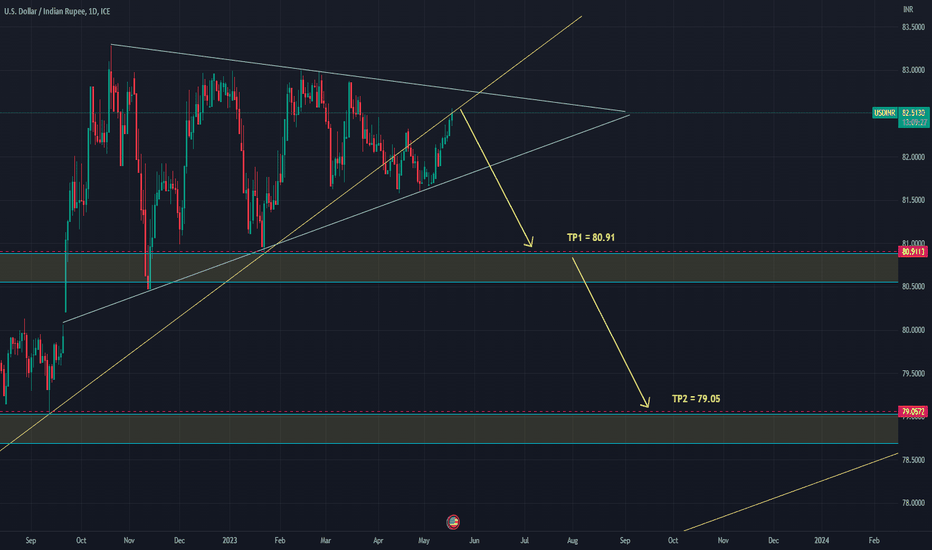

USD/INR sale nowHi everyone! USD/INR pair long was in one range, thereby a narisova a triangle. Now the price drew already 2/3 triangles. Therefore it is possible to expect it breakdown in the nearest future. I expect breakdown of a triangle down. Now the price is close to the upper bound of a triangle therefore the entrance to the transaction is safe. Stop loss can be delivered above a triangle, that is on breakdown up. I consider that the price as a result all the same will achieve the designated objectives (even at breakdown up and leaving up to 88). Technical indicators nap week and monthly schedules showed a turn long ago. So, I sold at the current price 82.53 with the purposes:

TP1 = 80.91

TP2 = 79.05

Information provided is only educational and should not be used to take action in the market.

USDINR Still bearish but we move our target a little higher.This is an update to our November 27 2023 idea on the USDINR pair where we issued a sell signal exactly at the top (Higher Highs trend-line) of the 1 year Rising Wedge pattern:

Our 82.600 Target hasn't yet been hit but due to the slower than expected decline, we have to modify our target and move it a little higher to 82.700, which marks a projected contact with the 1W MA50 (blue trend-line).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Decoding USDINR with Elliott Waves: A Comprehensive AnalysisDecoding USDINR with Elliott Waves: A Comprehensive Analysis

Weekly Perspective:

Daily Perspective:

4 Hourly Perspective:

Hourly Perspective:

Current Stage: Inside iv of (c) of 2 of ((1)) of wave V of wave (III).

Current Bias: Presently showing a bearish inclination on the hourly chart.

Future Outlook: Post the completion of wave (c) of 2 , a potential swing towards the north is anticipated.

Invalidation Level: Post starting journey towards north Strictly set at the recent swing low of (c) of 2, serving as a critical point for the bearish bias. If breached, it might prompt a re-evaluation of wave counts on the hourly time frame.

Elliott Wave Concept:

Elliott Wave Theory proposes that market prices unfold in specific patterns, providing insights into potential future price movements.

It identifies waves of various degrees, each with its own subdivisions, illustrating the cyclical nature of market psychology.

Corrections, labeled as 2 or (b), are temporary pauses in the prevailing trend before the larger trend resumes.

Validation of Elliott Wave counts often comes from adhering to strict rules and guidelines, including confirmation of trend reversals and respecting key invalidation levels.

Conclusion:

The USDINR pair, as per Elliott Wave analysis, is currently navigating a complex pattern with bearish signals on the hourly chart. However, the prospect of an upcoming swing towards the north is plausible post the completion of wave 2. Traders are advised to closely monitor the invalidation level as it holds the key to potential shifts in the Elliott Wave counts.

I am not Sebi registered analyst. My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing. I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

USDINR- forex- daily analysis1 DEC- Analysis:

Currency

Price is consolidating at the top

USDINR opens:

side: if it gives breakout buy(100)

gapup: buy (100)

gapdown: if opens near previous day reversal + immediate breaks 5 min high then buy(100)

if it cosolidate in first half after gapdown then we can sell in second half after 11:30 am (100)

USDINR Neutral but needs a medium-term pull-back.The USDINR pair has been practically ranged around the 1D MA50 (blue trend-line) since September but on a long-term perspective, close to the top (Higher Highs trend-line) of the Rising Wedge. This calls for a technical medium-term pull-back, especially with the Bearish Divergence on the 1D RSI, which is trading within a Channel Down. Our target is the 1D MA200 (orange trend-line) at the bottom of the Wedge at 82.600.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇