Indian Rupee - USDINR - Is it all over?I reviewed the this chart first in Sept 2020. At that time, I was looking at top to form in USD/INR. Since then, the price made wild moves but still on the looks of it, it's not clear if the top is in place. However, the most important trigger that made me think and do a detailed analysis on this is the break of this trend line. You will notice the trend line from 1980 which acted as a support in 2011, 2018 and in 2020 is now broken.

After analysing the move 2008 until the all time highs, it seems that the top is place.

Another way to confirm is to look at the type of pattern that is forming when the prices fell from all time highs. On the looks of it, it seems the fall is in-line with the correct pattern and doesn't violates any rule or guidelines in place.

So if the analysis is correct, then what can be expected?

price should fall at least to Rs. 69.5 to Rs 71.xx levels to begin with. This fall should be sharp and fast.

Post that, there could be more bearish potential but it could be too early to call for it.

Finally if the prices falls below Rs. 68.32 on a closing basis, then it will be confirmed that the long term top is in place and price could put Rs.62.5

I will continue to track it and see how it performs over the next few weeks.

FX_IDC:USDINR

USDINR

It is time to buy USD/INRHi everyone! Now USD/INR pair reached the trend line on the week chart. Technical indicators indicate the need of a turn. I consider that in the nearest future we will be able to observe strengthening of dollar. Purchase has the low level of risk since SL can be placed below the trend line at once (everyone chooses itself).

Bought on 72.79

TP1 = 73.59

TP2 = 74.79

SL = 72.38

Information provided is only educational and should not be used to take action in the market.

USDINR ::: SHORTL O N G T E R M S I P T R A D E

DATE: 20 MAY 2021

INSTRUMENT: USDINR

TREND: SELL

TIME FRAME: DAY

CMP: 73.160

SELL BELOW: 73.118

STOP LOSS: 73.30

TGT 01: 73

TGT 02: 72.84

TGT 03: 72.70

TGT 04: 72.323

TGT 05: 72.70

DISCLAIMER:

We are not S E B I registered analysts. Please consult your personal financial advisor before investing. We are not responsible for your profits/losses whatsoever.

Leave a comment that is helpful or encouraging. Let's master the markets together.

USDINR - Reaching solid support zoneThe current structure of USDINR is still weak and is probably moving towards 72.65 levels.

The current chart shows two technical possibilities that suggest goos support zone in the 72-73 range.

At First, there is trendline support, that the prices broke in April 2021, and the same trendline would now act as a support.

Secondly, there is also a harmonic pattern probability whose support also coincides with the trendline support.

So keep your eyes on price action, and be ready to take advantage of solid support.

If you are trading this, you are trading at your own risk

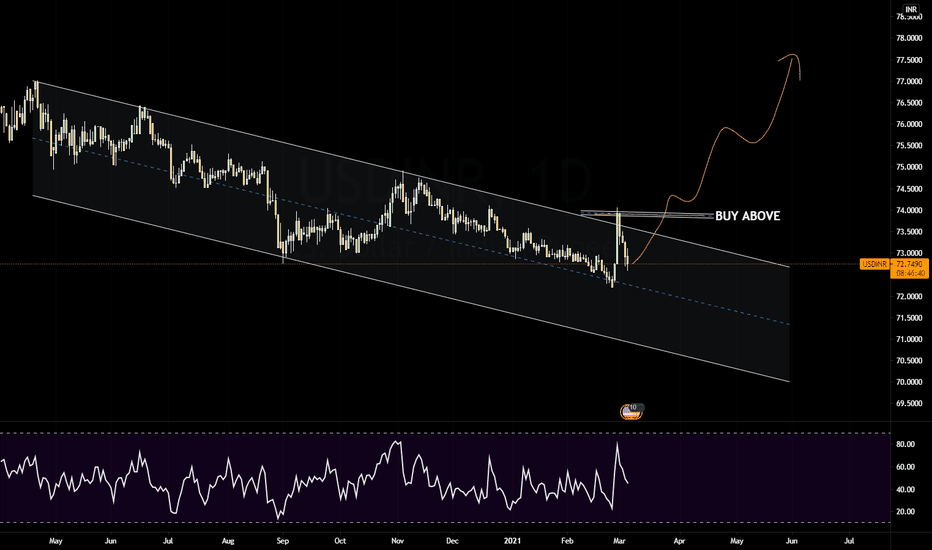

USD/INR long, 30 of aprilHi everyone! USD/INR pair moves to the lower line of an upside channel. However, I consider that shortly there will be a movement up to the level of the last top. Now it is necessary to watch closely overcoming the red line noted on the chart. Careful traders should wait for this confirmation of the idea.

Bought on 74.01

TP = 75.56

SL = 73.16

Information provided is only educational and should not be used to take action in the market.

USDINR ::: SHORT07 MAY 2021

INSTRUMENT: USDINR

TREND: SELL

TIME FRAME: DAY

CMP: 73.54

SELL BELOW: 73.424

STOP LOSS: 73.752

TGT 01: 73.298

TGT 02: 73.196

TGT 03: 73.058

DISCLAIMER:

We are not S E B I registered analyst. Please consult your personal financial advisor before investing. We are not responsible for your profits/losses whatsoever.

USDINR 75 CE 07 MAY 2021DATE: 29.4.21

Very high-risk trade

INSTRUMENT: USDINR

75.00 CE 07 MAY 21.

CMP.0525

BUY ABOVE: .0635

SL:.0400

TGT 01: .0705

TGT 02: .0878

TGT 03: .1050

RISK DISCLAIMER:

We are not SEBI registered analysts. Please consult your personal financial advisor before investing. We are not responsible for your profits/losses whatsoever.

USD/INR longHi everyone! USD/INR pair on the day chart moves in an upside channel and now reached its lower line. Technical indicators indicate oversold pairs therefore I expect continuation of the ascending movement to level 1.618 on Fibonacci.

Bought on 74.38

TP = 76.68

SL = 74.088

Information provided is only educational and should not be used to take action in the market.

USDINR ::: SHORTRISK DISCLOSURE

Futures and options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Trade with risk capital only. The past performance of any trading strategy or methodology is not necessarily indicative of future results. Past performance is no guarantee of future results and should not be interpreted as a forecast of future performance. We make no promise as to the performance of the account and while the investment objective is major capital appreciation over time no representation is being made or implied that any account will or is likely to achieve profit. The value of your investments can decrease as well as increase and, as such, funds invested should constitute risk capital. The risk of loss in trading commodities and options can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. You should carefully consider whether your financial condition permits you to participate in futures trading. In so doing, you should be aware that futures and options trading can quickly lead to large losses as well as gains. Such trading losses can sharply reduce the value of your investment. All information provided on these pages is for fair use. Normal copyright protections apply to all commercial use of any documents or information. We are not responsible for any loss due to inaccuracies in the information provided. Nothing presented here should be construed as investment advice or recommendations.

USD/INR FX EXOTICS PAIR LONG TERM BUY MY PRICE PREDICTION FOR USD-INR IS 78.550 – MID JULY 2021 AND 80.555 BY JAN 2022 (LONG TERM BUY IDEA)

CURRENT MARKET IS ON A STRONG UPTREND. IN THE SHORT TERM THE CURRENT UP TREND MAY BREAK AT 74.650 WHICH 50% OF THE FIB LEVELS AND GO DOWN TO 73.330 WHERE THE ORDER BLOCK IS & FROM THE WE CAN EXPECT A LONG TERM BUY ENTRY OPPORTUNITY

POSSIBLE BUY OPPORTUNITY IS AT 73.130 – 74.140

INSTITUTIONAL ORDER BLOCK LEVELS ARE 72.755 – 73.350 – 77.420

RED DOWN ARROWS INDICATE POTENTIAL SELL OPPORTUNITIES.

GREEN UP ARROWS INDICATE POTENTIAL BUY OPPORTUNITIES.

MY ANALYSIS > SRT, PRICE ACTION, INSTITUTIONAL ORDER BLOCKS AND FIB RETRACEMENT

USD/INRUSD/INR in pole and flag likely to fail due to movementum in Indian stock market and price action

USD INR PAIR CONTAINING BULLISH RALLY The bullish pattern breakout formation

You can enter on 1 hours candle restreesment

Also take trade in half quantity it will sustain above levels

Also we can see new high soon .

Best off luck

Disclaimer- Take it as educational purposes not for trading tips or calls

USD/INR short: section fast transactionsHi everyone! On the week chart USD/INR pair moves in an upside channel towards its lower bound. And also now the price overcame the important trend line down and tested it from below. Now some indicators indicate continuation of the movement down. Therefore I expect price movement down at least to two following supports (my purposes).

Short on 73.3470

TP1 = 72.76

TP2 = 72.52

Information provided is only educational and should not be used to take action in the market.

This section is intended for short-term speculation. Be ready to leave a position at any time.

Bullish Pin Bar on 4H candle for USDINRthe pair looks bullish with its aggresive rise with increased volume, We can see crossing of 73.80 in coming week.

USDINR at key support reversal to happenOn monthly chart USDINR is at key support and has higher chance of reversing up to 75 in coming months. The support is from 20 Month moving average and trendline from 2012 low. hence for long term traders better be on the buy side as dollar is also seen strengthening in coming months.

27th January Forecast & LevelsIntraday Levels for 27th January, 2021

Dashed lines and boxes represent turning points.